Welcome back to the Wolf of Harcourt Street Newsletter.

Last Friday was the last day of June, and also wrapped up the second quarter of the year. This week, the finance teams will have been busy closing the books, finalising the results and get everything ready to share with the market starting at the end of this month.

Before all of the mayhem kicks off, I wanted to share a heads-up on what I’ll be paying attention to this earnings season. I'll be keeping a close eye on both the financial and the non-financial indicators that can impact a company's performance.

Financial Snapshot

In the table below, I have pulled together a financial snapshot of the revenue and adjusted EPS consensus estimates for 10 stocks in my portfolio that I am most interested in this earnings season. The stock market is a forward looking mechanism and these estimates represent what the market has priced in today. Generally speaking, any deviations from these expectations will cause a fluctuation in the stock price.

The consensus estimates have been extracted from Koyfin which is the tool that I use to screen and analyse stocks. In my opinion, it is the most comprehensive financial data and visualisation tool that makes the research process so much easier for investors. If you would like to try it for yourself, you can click here to sign up and receive a 10% discount.

Key Performance Indicators

Microsoft

What? Azure revenue growth.

Why? Azure growth is a good gauge for the potential performance of cloud-based stocks.

MercadoLibre

What? Gross Merchandise Volume (GMV).

Why? Last quarter MELI reaccelerated GMV growth. How has this trend developed.

Amazon

What? AWS revenue growth.

Why? Useful metric that can be used to compare performance to other Hyperscalers to determine overall market positioning.

Airbnb

What? Nights and Experiences Booked.

Why? Predictor of future demand and revenue.

What? Family daily active people (FDAP).

Why? This will be the last quarter before the impact of Threads (Zuck’s Twitter) will be reported.

Datadog

What? Dollar Based Net Retention Rate (DBNRR).

Why? Can the DBNRR of +130% for the past three years be sustained.

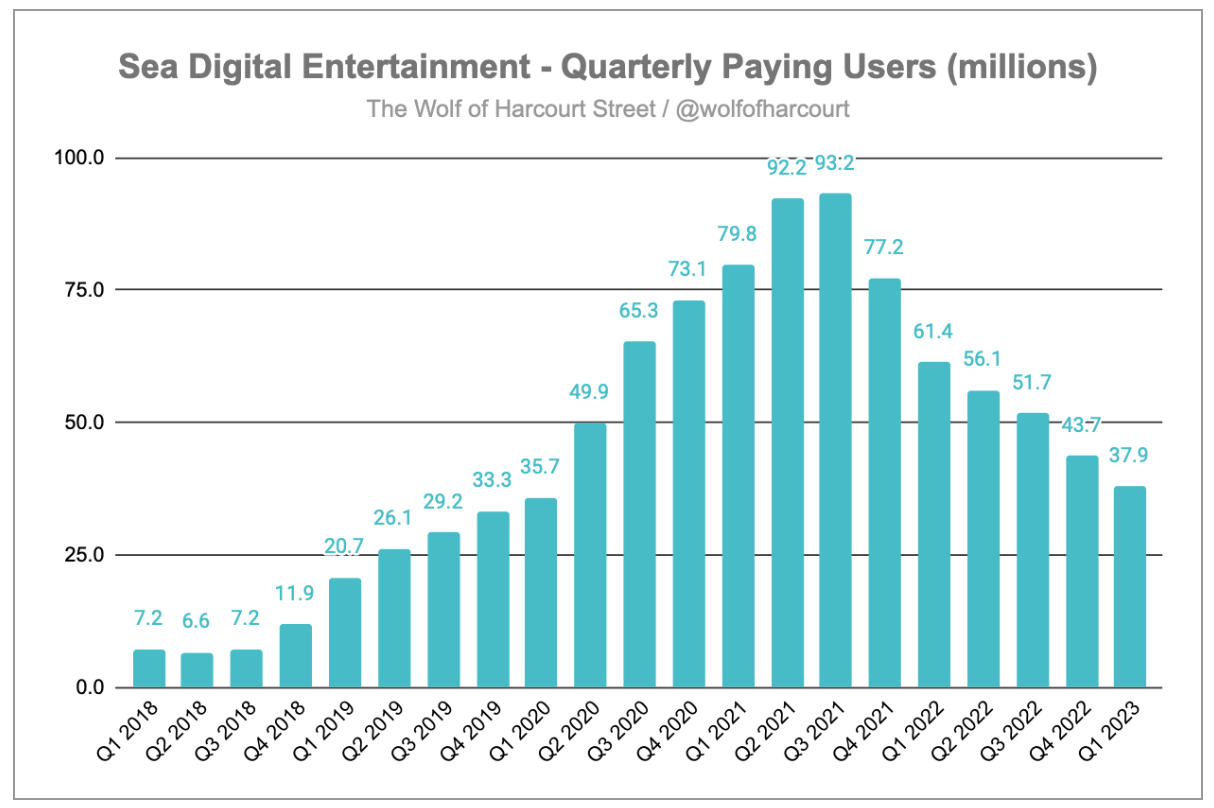

Sea Limited

What? Digital Entertainment Quarterly Paying Users.

Why? Has the trend worsened or steadied.

Square

What? Gross Payment Volume (GPV).

Why? Is Cash App GPV continuing to outpace Square ecosystem GPV.

Paypal

What? Total Payment Volume (TPV).

Why? Was the reaccelerating growth in TPV last quarter a once or can it be sustained.

Cloudflare

What? Customers with $100K+ Annual Recurring Revenue.

Why? More large customers diversifies current revenue concentration.

What are some of the stocks and metrics that you have your eye on this earnings season?

Hit subscribe below if you have not already done so in order to receive the latest content straight to your inbox each week.

If you enjoy today’s edition, then feel free to share as it, it really helps.

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Will be interesting to see how the market responds to Azure vs AWS results. Expectations should be much higher for Azure with how Microsoft is priced right now

I don't think Garena performance matters much with Sea at these prices. Shopee and DFS growth has turned gaming into an optionality more than a necessity imo.