Rather than a full investment thesis, this post serves as a 'Quick Pitch' for a new stock I’ve recently added to the portfolio.

Contents

Introduction

Moat Analysis

KPI & Financial Snapshot

Growth Opportunity

Risks

Valuation

Investment Outlook

1. Introduction

Rubrik is a company that helps organizations keep their data safe and easy to recover if something goes wrong, such as a cyberattack or accidental deletion. In simple terms, Rubrik provides secure backup and recovery solutions, ensuring that files, databases, and entire systems can be quickly restored to their previous state. The company was founded in 2014 and went public via an IPO in April 2024.

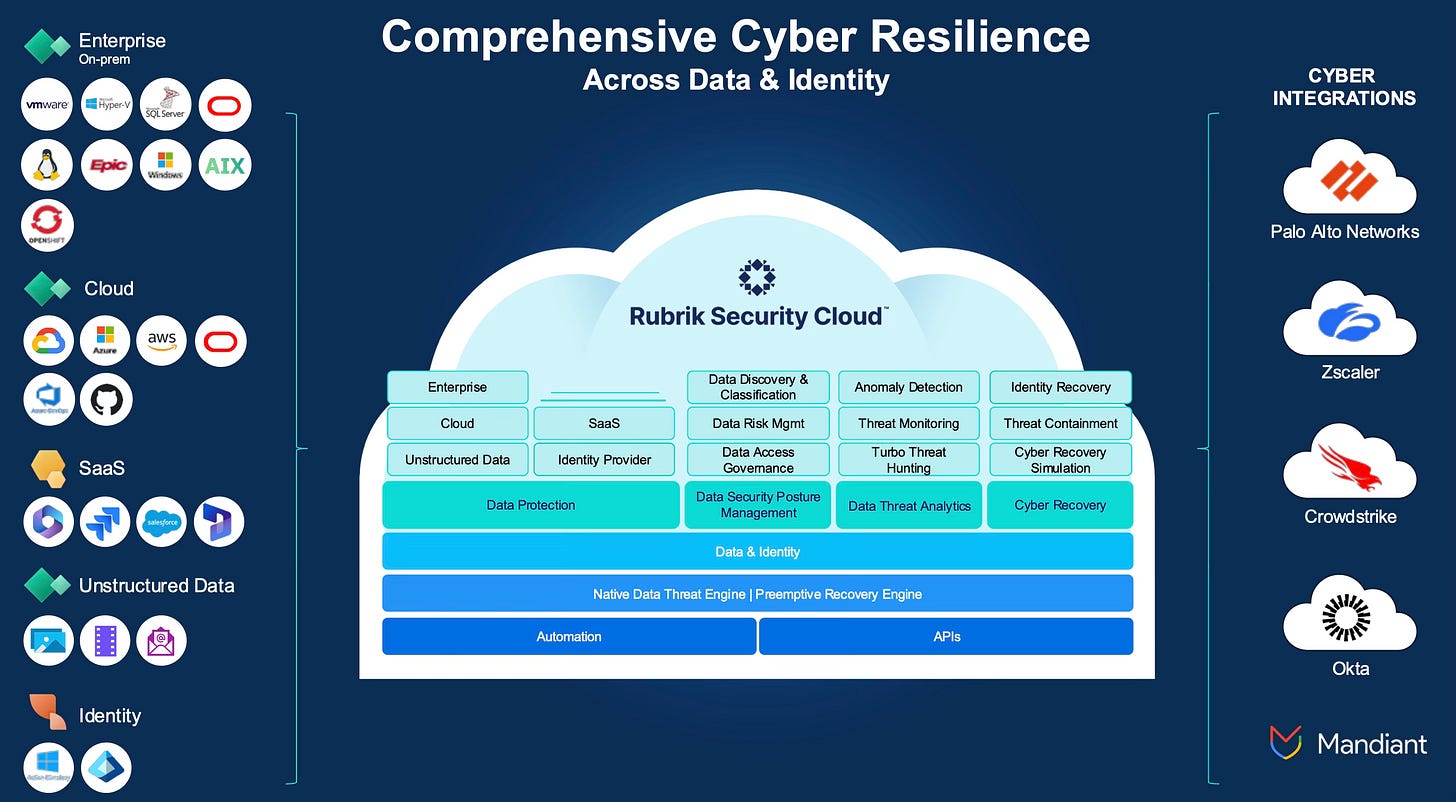

Rubrik operates as a Software-as-a-Service (SaaS) data security and management company built around its flagship Rubrik Security Cloud (RSC) platform.

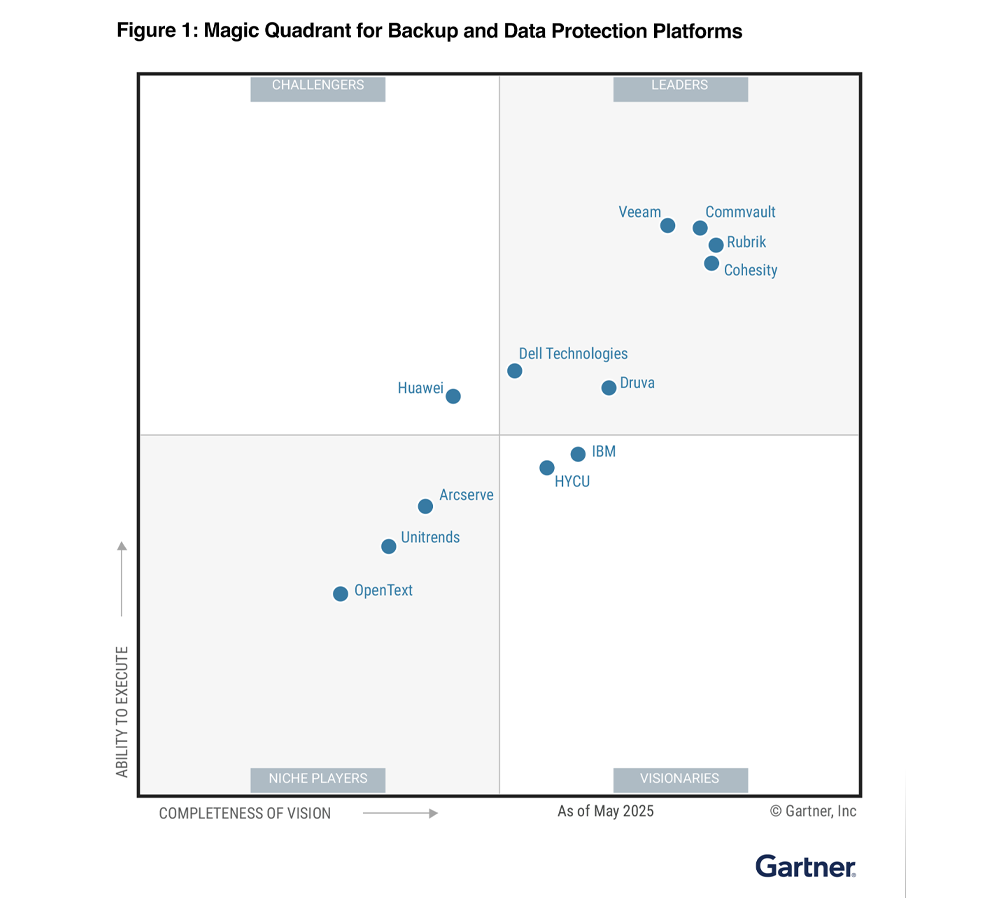

It has evolved from traditional backup and recovery into a comprehensive cyber resilience provider, positioning itself as “securing the world’s data.” Rubrik is recognised as a Gartner Magic Quadrant Leader for six consecutive years, reflecting its strong market position.

The platform helps organizations build resilience against cyberattacks, ransomware, malicious insiders, and operational disruptions. Built on a Zero Trust Data Security model, Rubrik leverages machine learning to safeguard information while enabling fast recovery.

What Rubrik Offers

Backup and Recovery: Automatically saves copies of data and makes recovery quick and simple.

Protection from Cyber Threats: Enables recovery from ransomware or hacking without paying attackers.

Works Everywhere: Supports data across on-premise systems, the cloud, or hybrid environments, all managed through a single dashboard.

Automation and Ease of Use: Automates complex workflows, reducing manual effort.

Fast Recovery: Restores files or systems almost instantly, minimizing downtime.

Security: Encrypts data, ensures backups remain unchanged, and supports compliance requirements.

Think of Rubrik as both a secure digital vault and a rewind button for critical data.

How Rubrik Enables Recovery After a Cyberattack

Pre-Attack Preparation: Rubrik continuously backs up and scans data, creating “snapshots.” It proactively scans for threats, tags sensitive files, and monitors access to reduce risks.

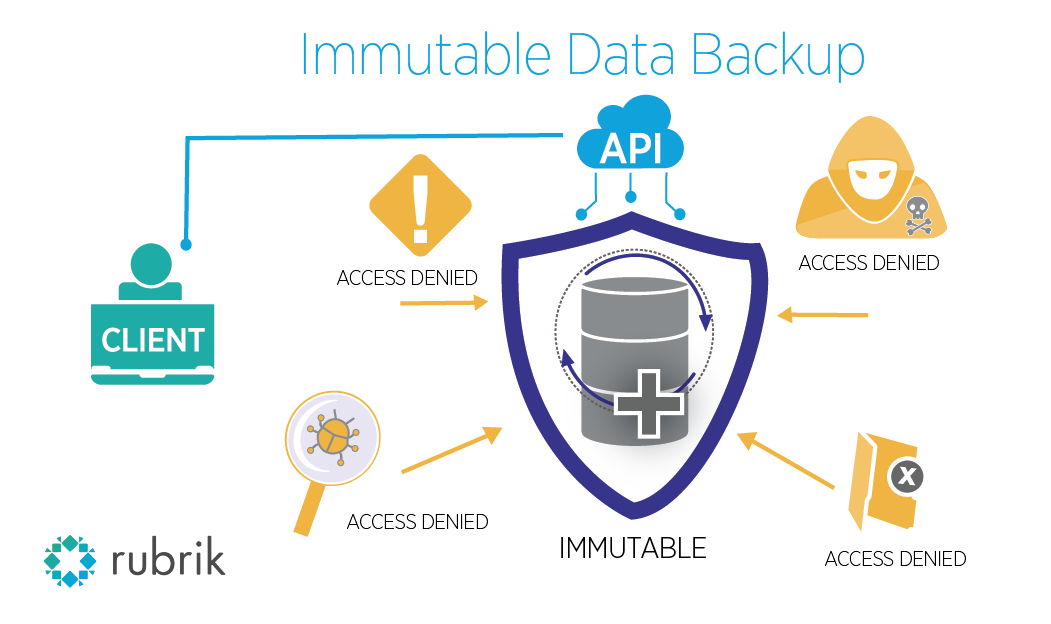

Cyberattack Occurs: If data is compromised, Rubrik’s immutability ensures backups cannot be altered by attackers, preserving clean copies.

Identify Clean Recovery Points: The Preemptive Recovery Engine pinpoints safe, uninfected backups created before the attack.

Restore Data: With just a few clicks, Rubrik restores data from these clean backups. Recovery time is reduced from weeks to hours or days. IT teams can also test data in a secure “sandbox” to confirm recovery is safe.

Business Back Online: Once confirmed, Rubrik streamlines the workflow through automation, restoring files, applications, and systems with minimal disruption. Businesses resume normal operations without paying ransom.

Post-Attack Insights: Rubrik continuously analyzes risks and provides insights to strengthen defenses for the future.

In essence, Rubrik acts as an organisation’s “undo button” after a cyberattack, rapidly restoring data and enabling a secure, confident recovery.

2. Moat Analysis

Rubrik is still in the growth phase of its business, meaning its competitive position is developing. Strong moats typically emerge over time. Below is a summary of key moat components and their trajectory.

1. Switching Costs

Rubrik benefits from moderate but growing switching costs driven by platform integration and data dependencies. Its API-first architecture and unified management interface embed the platform deeply into workflows, making migration complex.

Technical features such as the immutable file system, proprietary data deduplication, and zero trust security architecture add further switching friction. Customer feedback highlights substantial implementation investment, though Rubrik’s fast deployment can make competitors easier to trial.

2. Network Effects

Rubrik benefits from network effects through threat intelligence, ecosystem development, and partner integrations.

Threat analytics improve as more organisations deploy the platform. The platform learns collectively, enhancing security for all customers.

Ecosystem integrations with partners like Microsoft Azure, Pure Storage, and major cloud providers increase stickiness and expand platform value.

Multi-cloud architecture supports AWS, Azure, and Google Cloud, positioning Rubrik well as enterprises adopt hybrid and multi-cloud strategies.

These dynamics create a virtuous cycle, strengthening security and platform value as adoption grows.

3. Cost Advantages

Rubrik positions itself as a premium provider, with cost advantages rooted in total cost of ownership (TCO) reduction rather than low upfront pricing. Forrester case studies show 30–50% TCO savings via license consolidation, reduced admin/support, and lower data centre costs.

Rubrik’s advantage lies in delivering meaningful TCO reductions for enterprises consolidating and automating resilience workflows. For large, complex environments, savings could be in millions of dollars, making the premium pricing a net financial benefit. For smaller setups, however, costs may outweigh benefits.

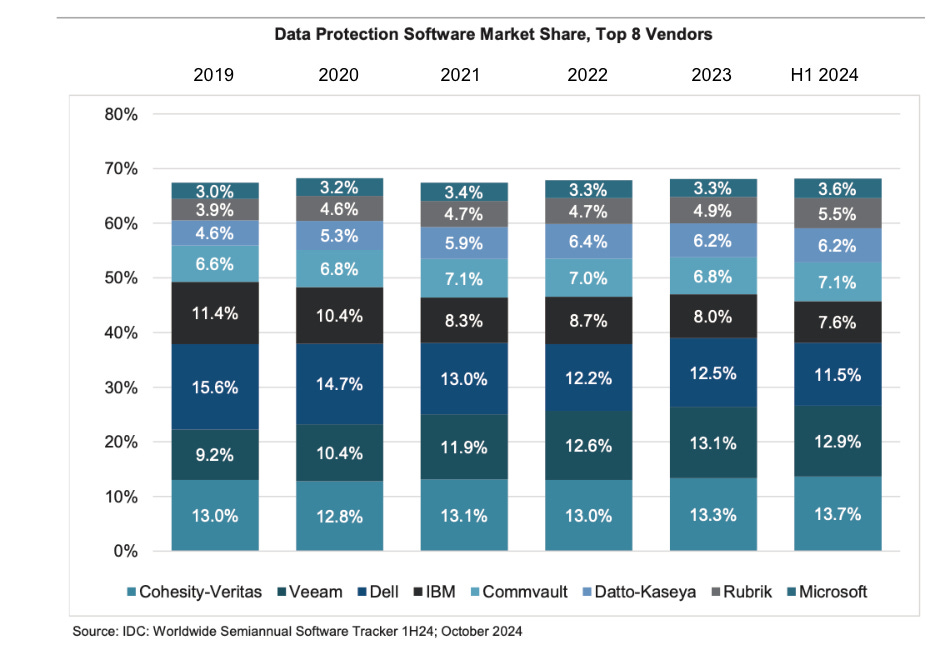

4. Efficient Scale

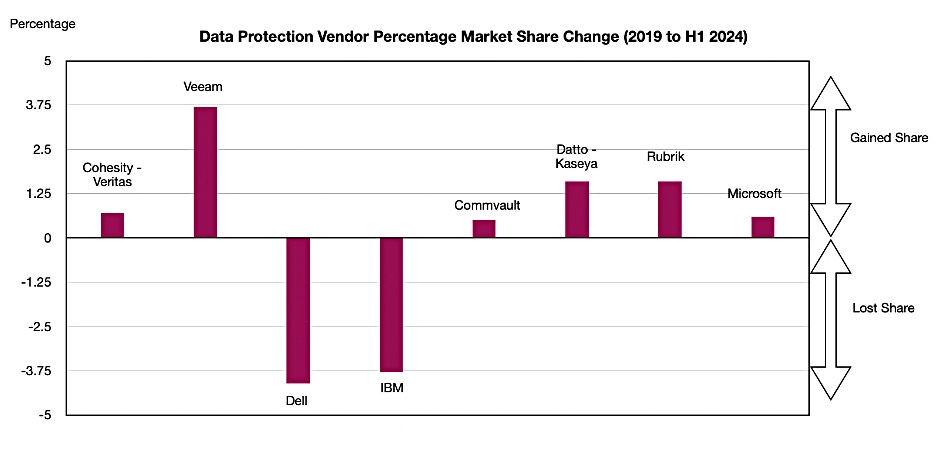

Rubrik operates in a large, growing market but has not yet reached the scale required for durable competitive positioning. The market remains fragmented with Cohesity-Veritas and Veeam holding larger shares. Rubrik’s scale advantage is therefore limited, although its growth trajectory points to significant potential.

3. KPI & Financial Snapshot

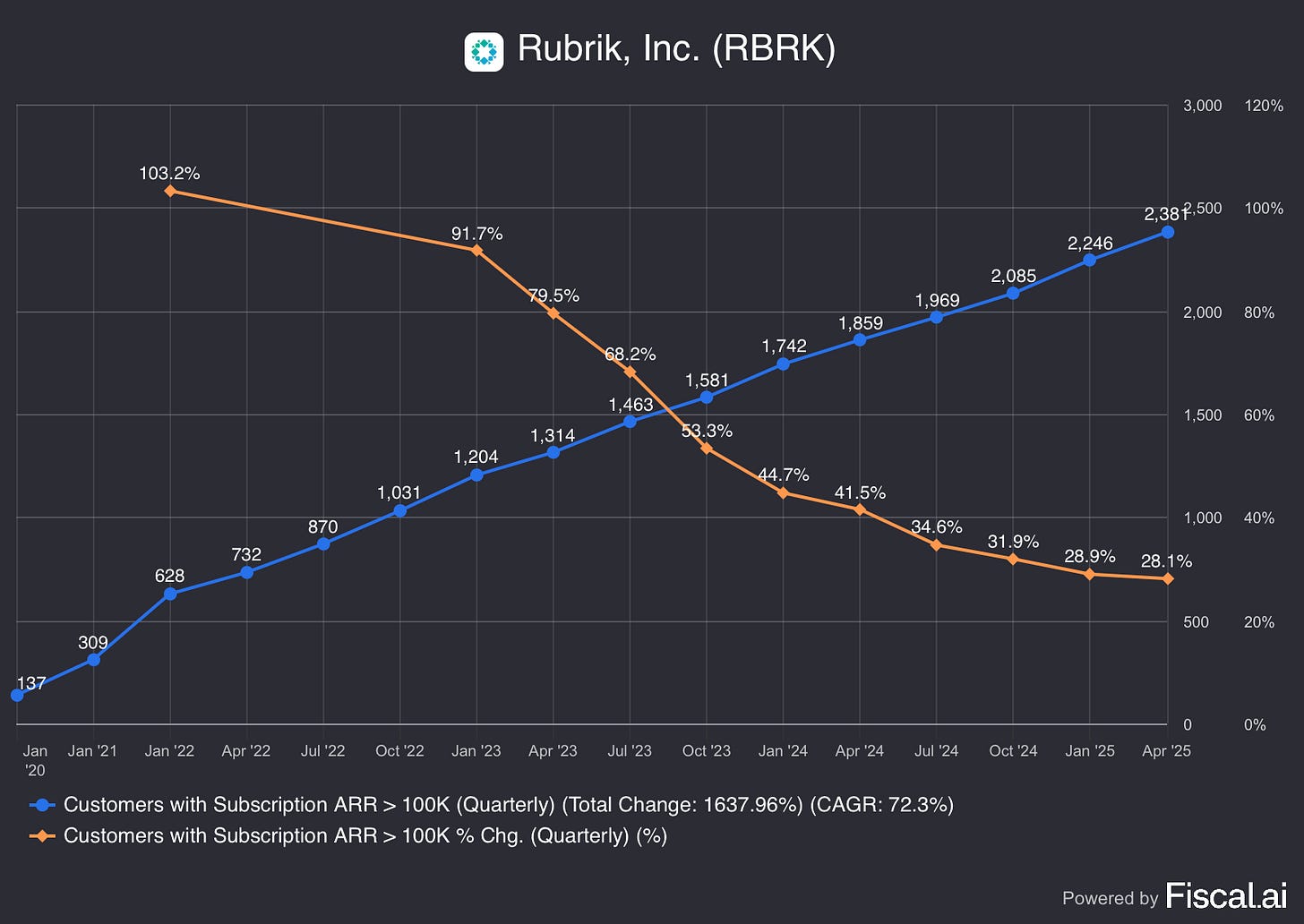

Customers with $100K+ in Subscription ARR

Rubrik tracks the number of customers generating at least $100,000 in annual recurring subscription revenue (ARR), a key metric reflecting its ability to land and expand large enterprise clients. These clients are critical for sustained revenue growth in the competitive cybersecurity and data protection market.

As of Q1 FY 2026, Rubrik reported 2,391 customers with $100K+ in Subscription ARR, up 29% YoY. Customers at this level are more likely to expand platform usage, adopt additional modules such as cloud security or anomaly detection, and renew at higher rates. Sustained growth in this KPI demonstrates Rubrik’s relevance and traction among enterprises with stringent data security requirements, where deal sizes, multi-year commitments, and switching costs are higher.

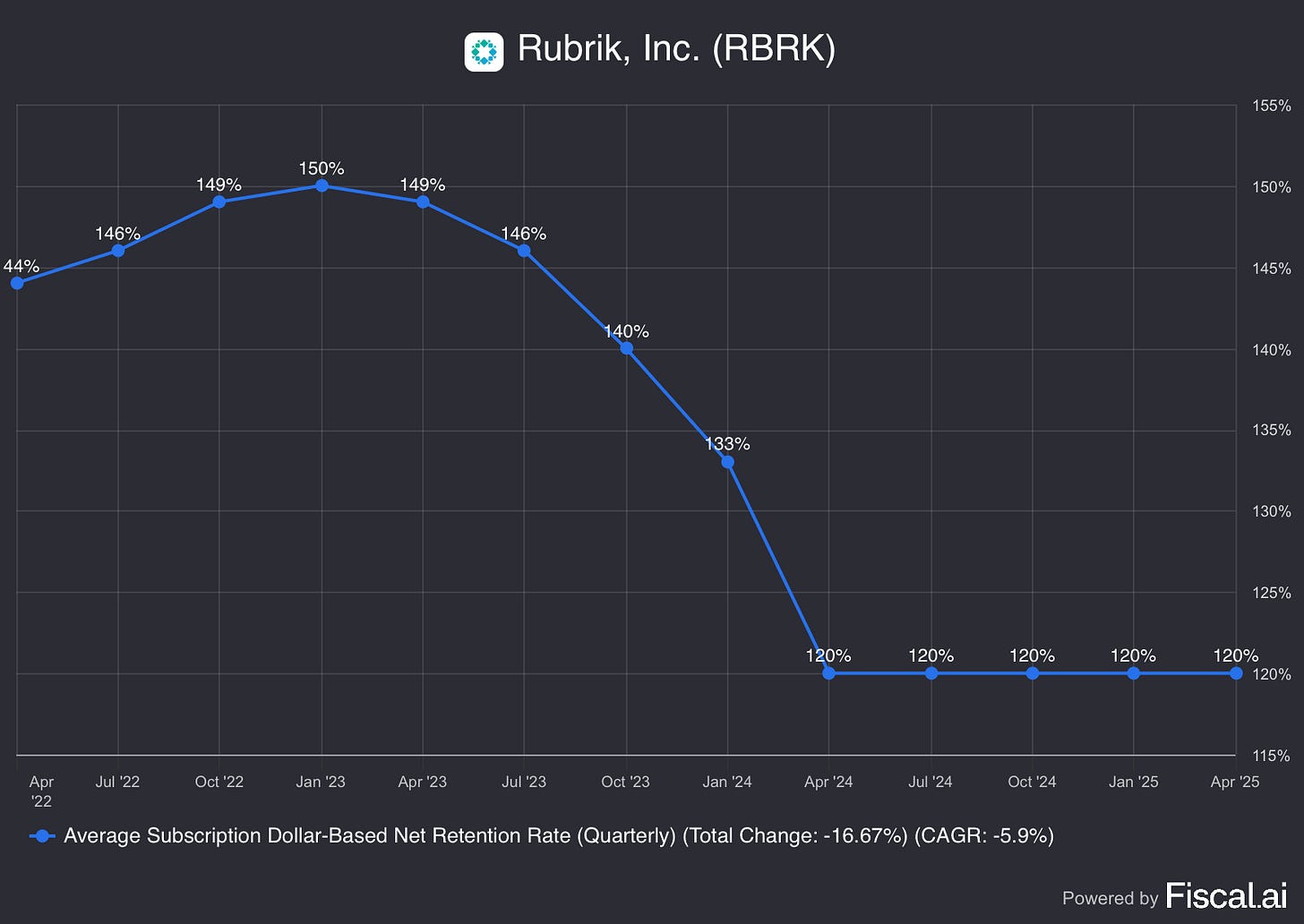

Average Subscription Dollar-Based Net Retention Rate

Rubrik’s NRR consistently exceeds 120%, signalling strong upsell, retention, and expansion within its subscription base. In enterprise SaaS, an NRR above 120% is considered world-class and reflects effective cross-selling, upselling, and limited churn.

The company grows its footprint by:

Increasing the volume of data protected within existing applications

Securing additional applications for customers

Adding more security functionality to existing deployments

In Q1 FY 2026, adoption of additional security functionality contributed over 30% to subscription NRR. High NRR allows more efficient sales spending, as each landed customer becomes increasingly valuable over time. Maintaining 120%+ NRR will become more challenging as net new customer growth slows, requiring continued product innovation and strong customer success.

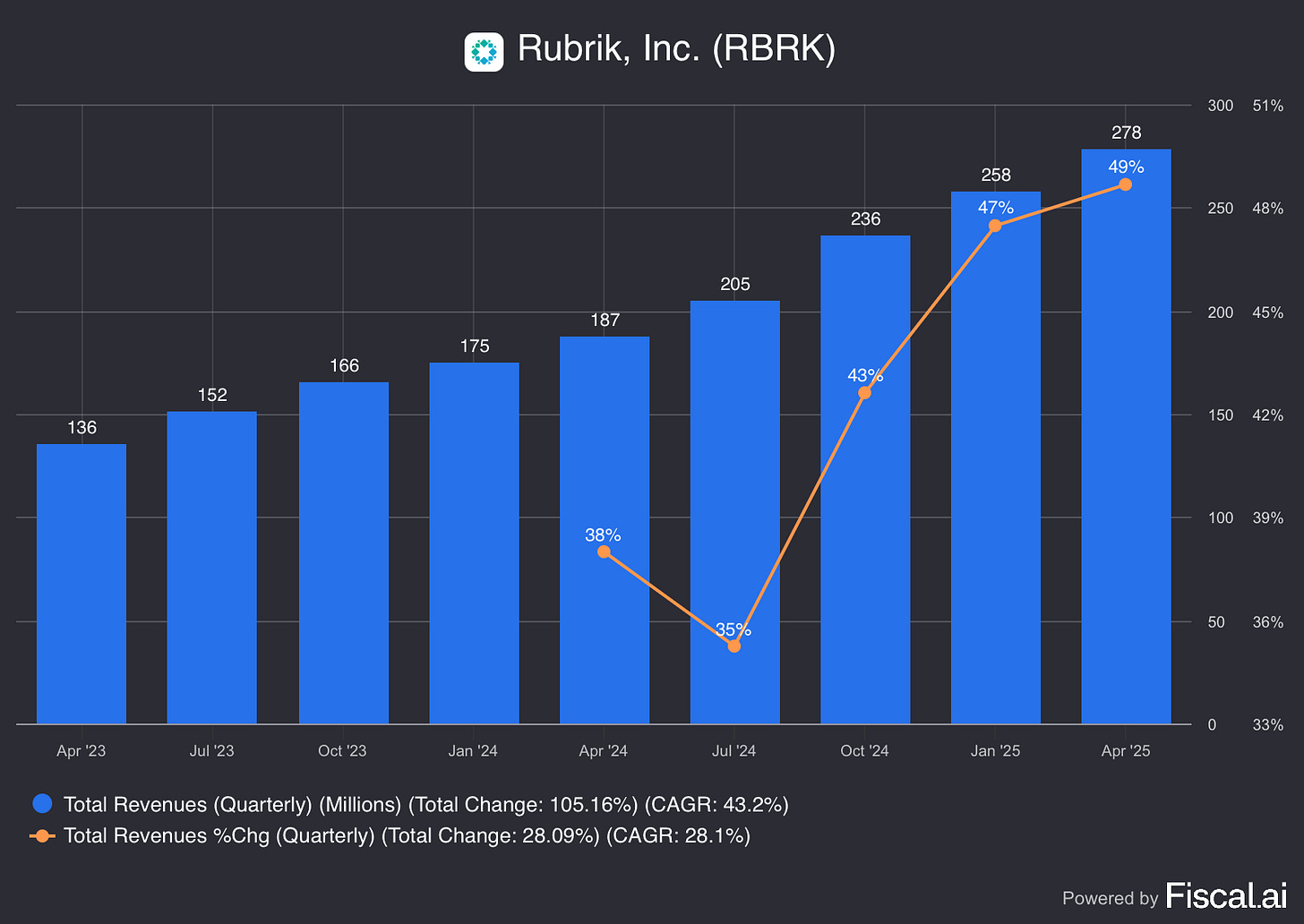

Revenue

Rubrik’s revenue comes primarily from subscription sales tied to the RSC platform and related solutions, including term-based licenses and standalone SaaS products such as Anomaly Detection and Sensitive Data Monitoring. Subscription revenue represents 95% of total revenue, with professional services, installation, training, consulting, and technical support, making up the remainder.

In Q1 FY 2026, total revenue reached $278 million, up 49% YoY and marking the third consecutive quarter of growth acceleration. Subscription revenue grew 54% to $266 million, while legacy maintenance revenue fell from $6 million to $2 million, reflecting a successful transition from older models.

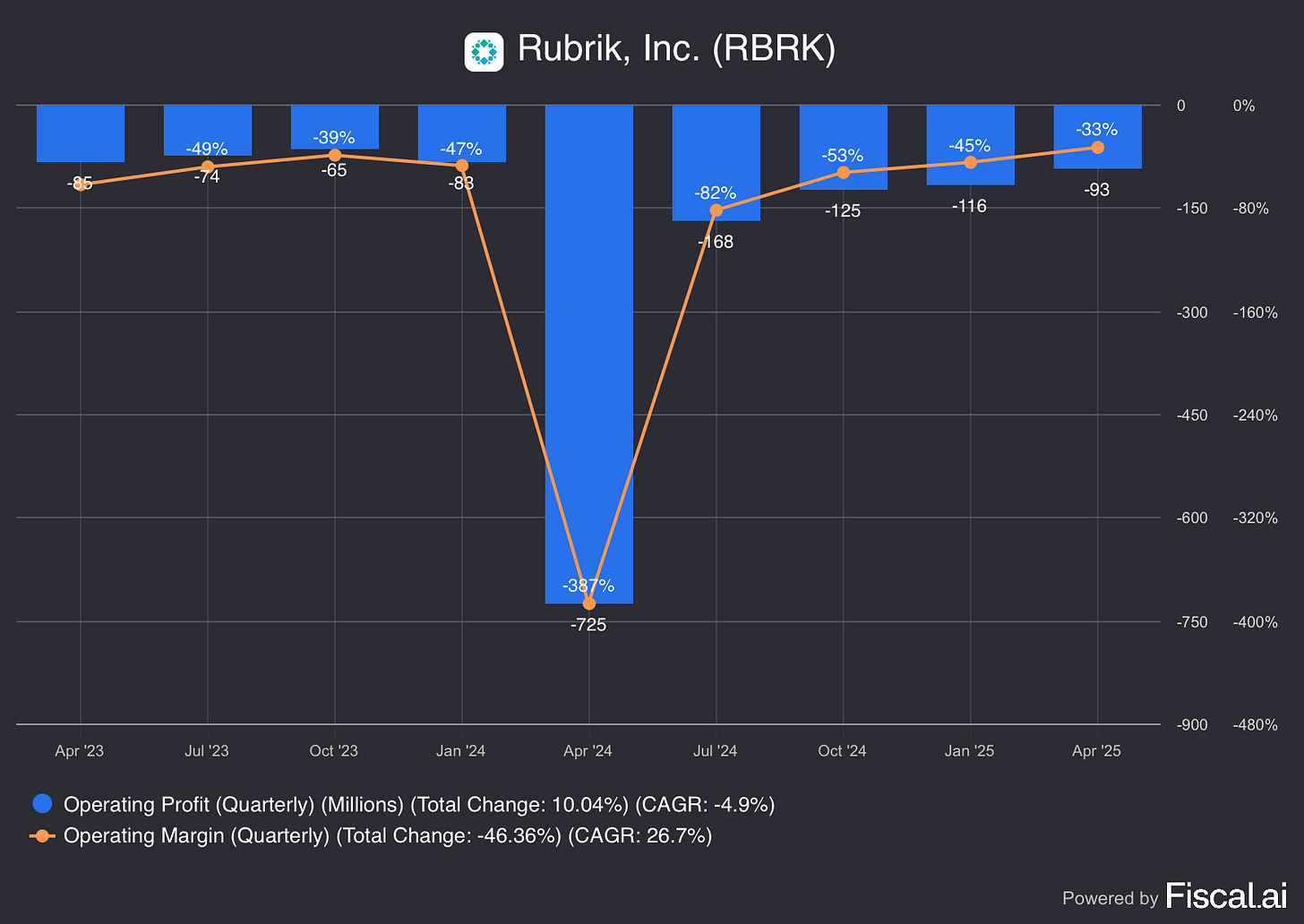

Operating Margin

Rubrik’s operating margin remains negative as investments in growth outpace current revenue. In Q1 FY 2026, the operating loss was $93 million, representing a -33% margin, down from -387% in Q1 FY 2025, when high IPO-related stock-based compensation inflated expenses.

The negative margin reflects aggressive sales and marketing spend (61% of revenue) and R&D (29% of revenue), despite a healthy gross margin of 78%. Rubrik’s operating loss is therefore a function of strategic investments in product development, innovation, and market expansion.

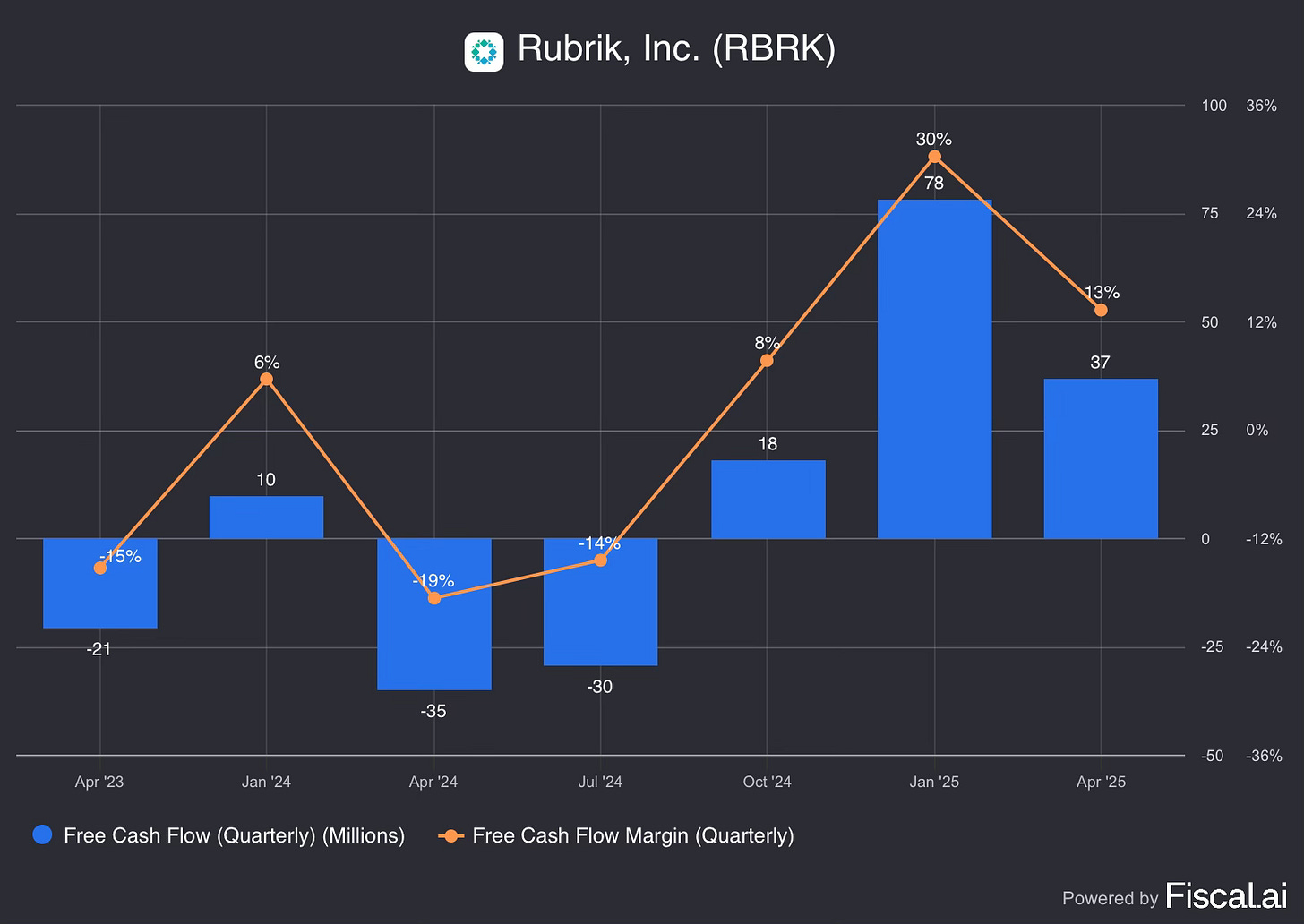

Free Cash Flow

Despite the negative operating margin, Rubrik generated $33 million in positive free cash flow in Q1 FY 2026, a 13% FCF margin. This improvement reflects better operational efficiency, with the Subscription ARR Contribution Margin rising from -11% to +8% YoY.

The discrepancy between operating margin and FCF largely stems from stock-based compensation (SBC), which currently represents 26% of revenue. SBC serves two purposes: attracting and retaining top talent in a competitive sector, and conserving cash while investing heavily in growth. IPO-related equity award vesting also contributes temporarily to the expense but is expected to moderate as the company scales.

Looking ahead, while post-IPO SBC levels will remain a factor, Rubrik’s FCF margin is expected to expand, and operating margin should turn positive once SBC stabilises.

4. Growth Opportunity

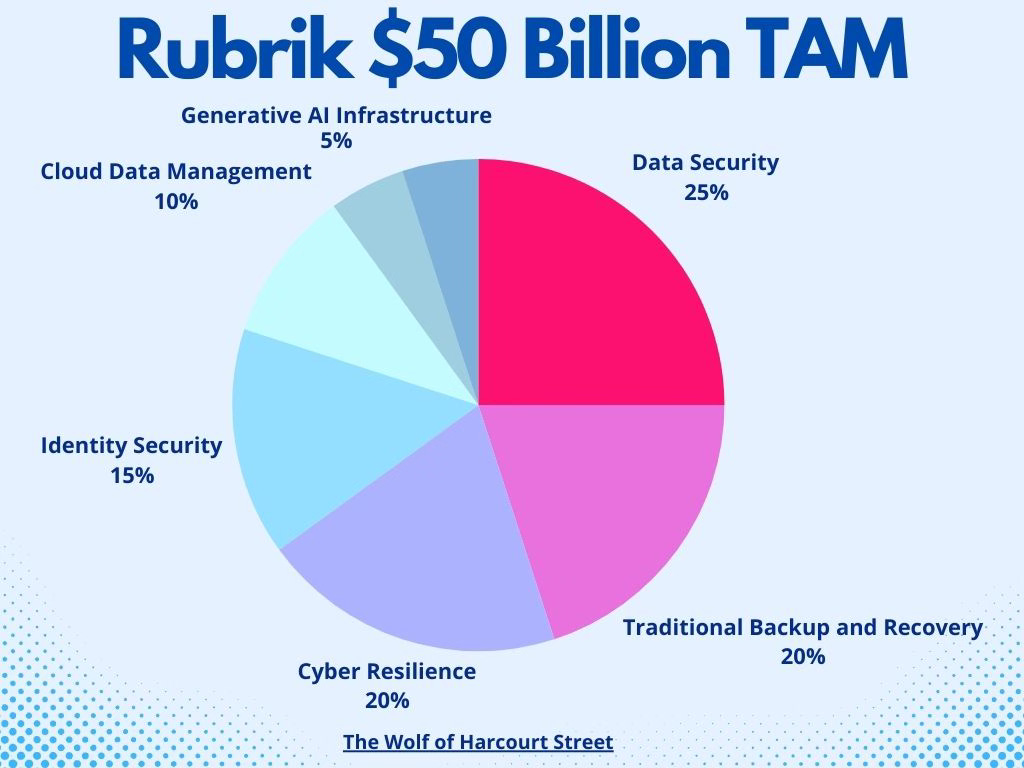

1. $50 Billion Market

The traditional backup market is $10 billion and growing, while Rubrik’s broader data security and cyber resilience TAM reaches $50 billion. With an ARR of $1.2 billion (2% of TAM), there is significant room to capture market share as spending shifts from legacy backup to integrated platforms.

Rubrik focuses on cyber resilience, now a top priority for CIOs and CISOs, consistently winning deals against legacy and next-gen competitors. Recent examples include a U.S. pharmacy company replacing a legacy vendor and a Japanese industrial firm consolidating multiple cloud backups under Rubrik, citing threat mitigation and cost savings.

The Identity Recovery solution cuts hybrid cloud recovery times from weeks to under an hour, combining identity and data security in one platform. Long-term initiatives like Rubrik Annapurna aim to accelerate secure, scalable GenAI adoption, leveraging Rubrik’s platform to manage and secure business data simultaneously.

Rising ransomware costs, tightening regulations (NIS2, DORA), and expanding cloud/SaaS footprints drive demand for platforms that secure hybrid, multicloud, and Microsoft 365 environments, positioning Rubrik at the intersection of data, security, and AI.

2. Isolated from Risk of In-Housing

While some software vendors face substitution from in-house AI, Rubrik is structurally insulated. Backup relies on immutable, offsite, air-gapped copies, making third-party platforms a necessity for security and compliance (ISO 27040, NIST SP 800-209, NIS2).

Hybrid enterprise workloads across on-premises, multicloud, and SaaS platforms make in-house backup replication complex. Rubrik’s connectors, policy engines, and compliance reporting cannot easily be replicated internally, and independence is critical.

Attackers target both production and backup data. Rubrik’s immutable file system, zero-trust design, and SaaS control plane ensure isolated recovery, restoring trust with regulators and boards. Backup is subtractive risk management, requiring independence, while AI tools are additive. Even with internal AI, enterprises still need trusted third-party backup, which Rubrik provides, integrating AI/ML for detection without substitution risk.

5. Risks

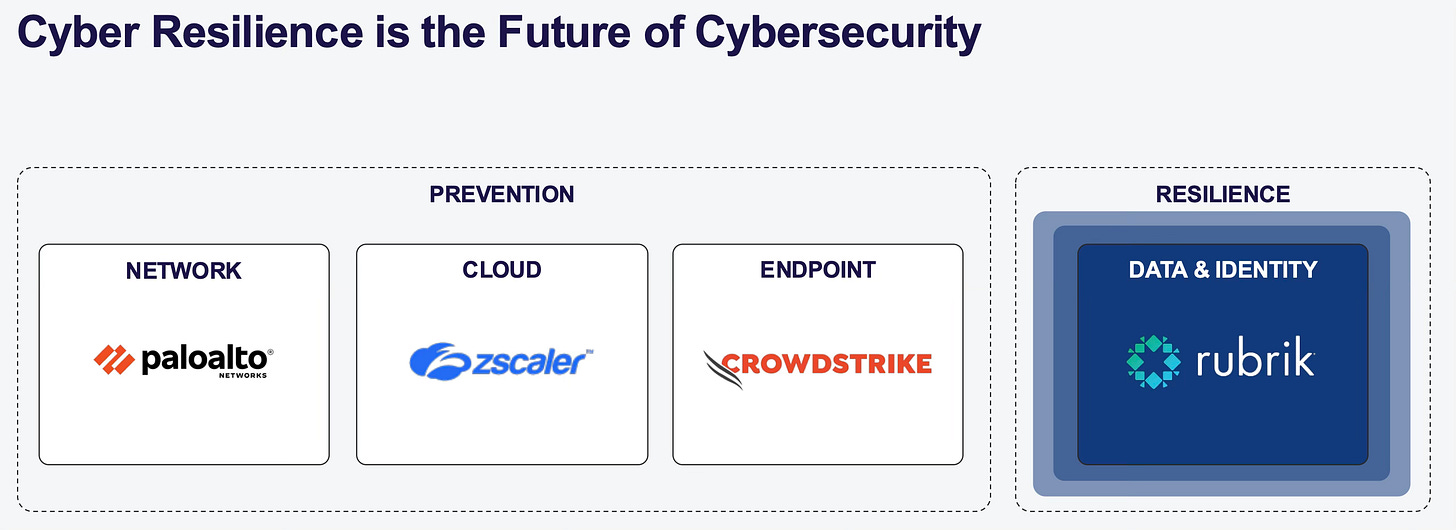

1. Competition from incumbents and hyperscalers

The backup and data protection market is crowded, with both legacy vendors (Veritas, Dell, Commvault, Veeam) and newer challengers. Cohesity-Veritas holds the largest data protection market share. Many of these players are repositioning around cyber resilience, immutability, and cloud workloads, the same themes driving Rubrik’s growth. Consolidation among incumbents (e.g., Cohesity’s acquisition of Veritas) adds competitive pressure, as larger combined entities can leverage broader resources for R&D, sales, and channel reach.

At the same time, hyperscalers continue expanding their native backup and recovery capabilities. Leveraging massive infrastructure scale, deep pockets, integrated cloud services, and embedded AI, their offerings are attractive to cloud-first customers. While enterprises still value a third-party control plane for independence and regulatory compliance, pricing pressure or bundled offerings from these giants could slow Rubrik’s share gains, particularly if customers are tempted by “good enough” solutions integrated into their existing cloud environments.

2. Execution risk in scaling growth, profitability, and security

Rubrik has expanded beyond core data protection into adjacent areas such as cyber resilience, AI-driven security, and SaaS data protection. While diversification opens growth opportunities, it also increases complexity in product development, go-to-market execution, and customer success management. Scaling sales and marketing while maintaining deal quality remains a challenge. Early issues in co-selling with partners like Microsoft, where flooding partners with all opportunities initially diluted focus and credibility, illustrate this risk.

Despite rapid revenue and ARR growth, Rubrik still faces profitability pressure due to significant spending on R&D, sales and marketing, and strategic acquisitions. If sales efficiency declines, renewals slow, or operating leverage takes longer than expected, financial performance could be impacted. If Rubrik needs to raises capital, the combination of fresh issuance and heavy SBC could significantly dilute shareholders and weigh on returns.

In addition, any security incident involving Rubrik’s SaaS platform would be especially damaging, given the company’s central value proposition of trust and cyber resilience. Customers rely on the platform to ensure the integrity, availability, and rapid recoverability of critical data. A relevant example is CrowdStrike in July 2024, when a faulty software update to its Falcon endpoint detection and response agent caused recurring system crashes and “blue screen of death” errors across millions of Windows systems globally. While not a breach or cyberattack, this incident highlighted the substantial risks cybersecurity providers face when their own platforms fail.

6. Valuation

Comparable Multiples

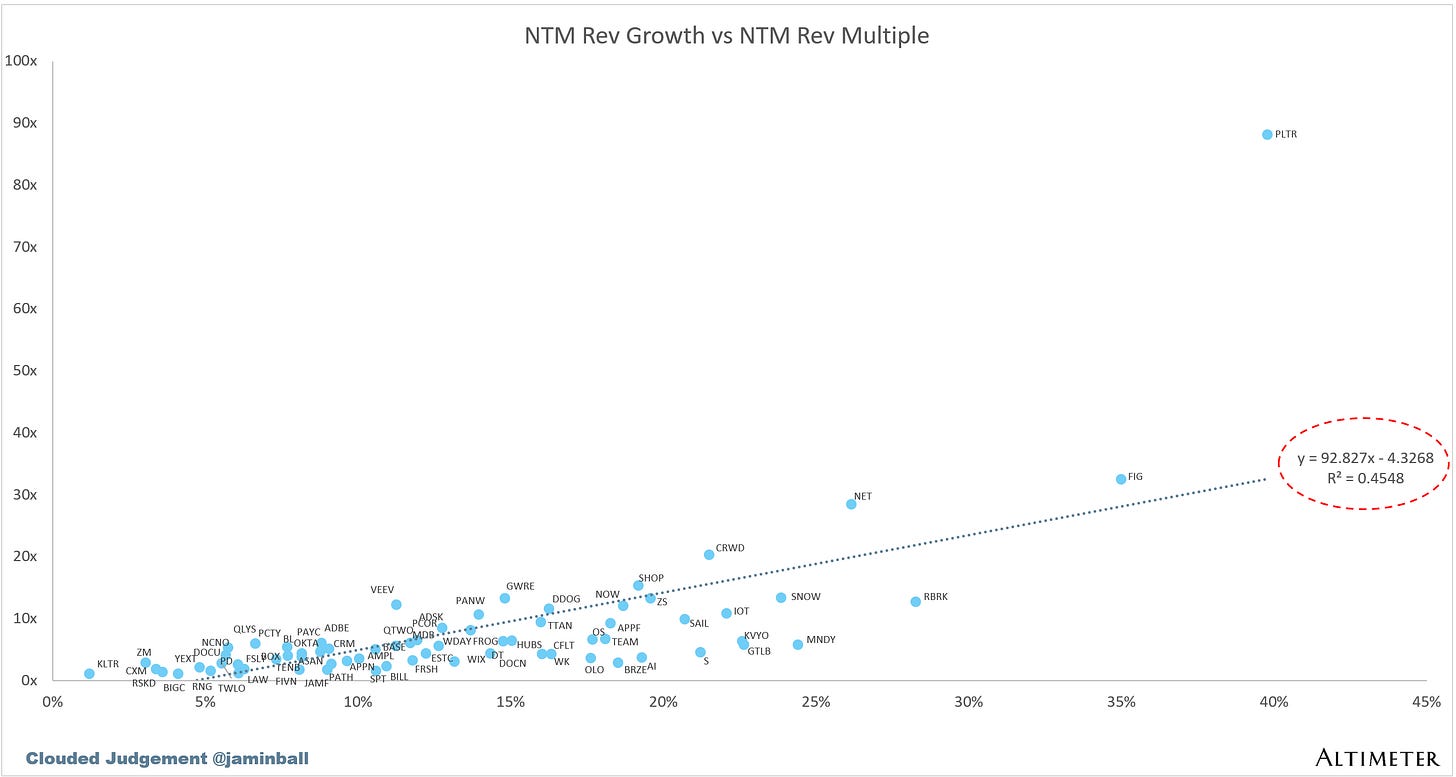

Since Rubrik is not yet GAAP-profitable, I have compared its next twelve months (NTM) revenue versus NTM revenue multiple against a broad set of software peers. In the chart below (sourced from the

newsletter), you can see that Rubrik trades below the peer group mean. The bottom-right corner of this chart is the “sweet spot”, as it represents higher growth at a lower multiple. Only two companies are growing faster than Rubrik, yet both command significantly higher multiples.Notably, CrowdStrike (CRWD) and Zscaler (ZS), while not direct competitors, operate within the broader cybersecurity industry. Both are growing slower than Rubrik yet trade at far higher multiples. This highlights the current market focus on prevention in cybersecurity. As attacks become more frequent, resilience will emerge as a critical theme, positioning Rubrik as a potential beneficiary.

Reverse DCF

Although Rubrik is not yet GAAP-profitable, it has turned free cash flow (FCF) positive. Reverse-engineering its current share price of $83.97 (a $16 billion market cap) suggests the market is pricing in 37% annual growth over the next decade. At first glance, this seems aggressive, but a breakdown provides more context.

Rubrik’s trailing twelve months (TTM) FCF is $103 million, representing a 10% FCF margin. Given that Rubrik has only been FCF positive for three quarters, it is reasonable to expect this margin to double or even triple over the next 10 years. For comparison, CrowdStrike already delivers a 26% FCF margin while growing above 20%, and Palo Alto Networks generates a 34% margin.

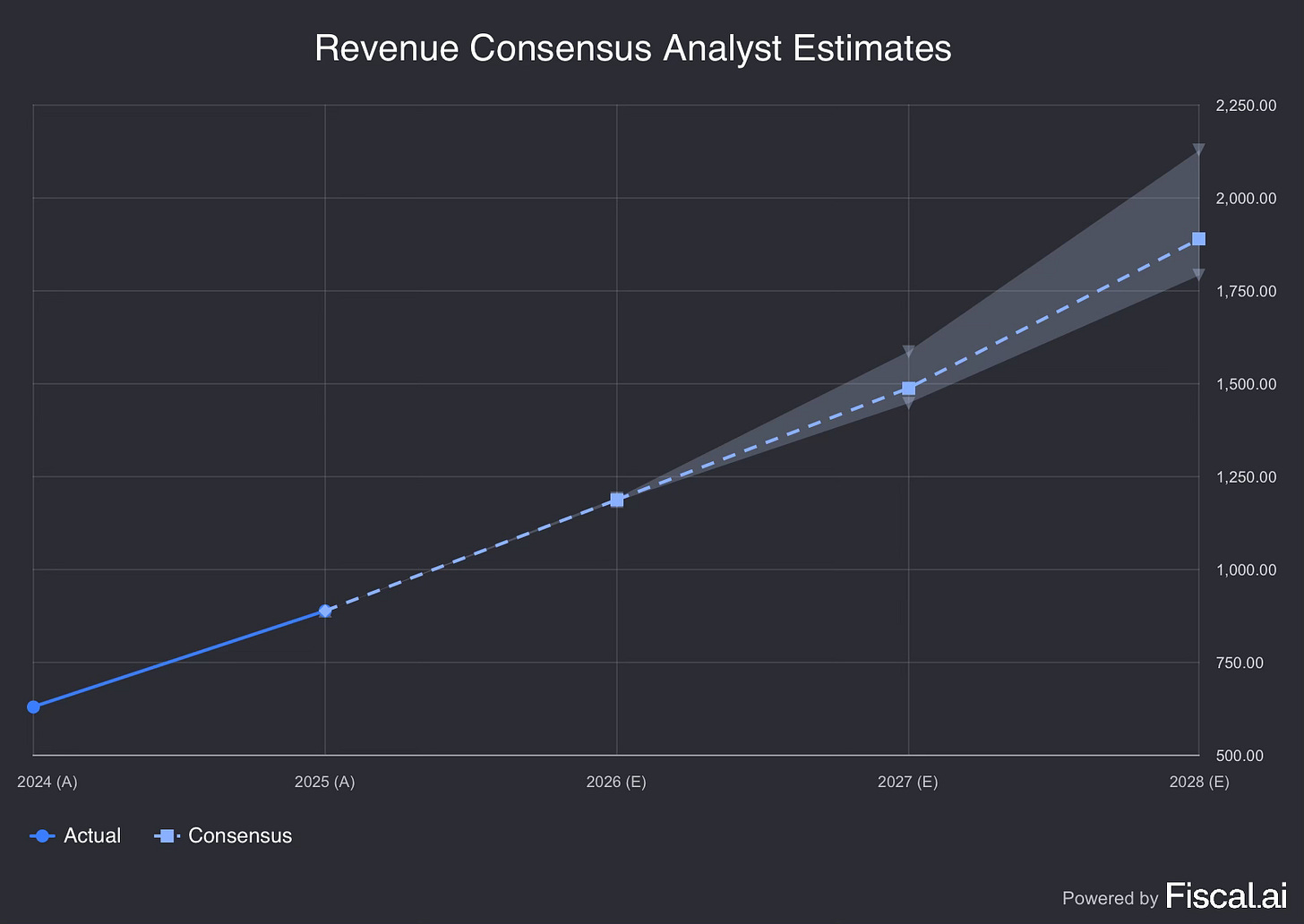

Revenue growth is the second factor. Wall Street expects Rubrik to reach $1.89 billion in revenue by FY 2028, implying a 29% CAGR over the next three years. While Rubrik is not cheap, its valuation looks more reasonable when factoring in both its explosive growth and the operating leverage it will achieve as it scales and matures.

7. Investment Outlook

Behind every great company is a great founder and leadership team, and Rubrik’s leadership meets this standard. CEO and co-founder Bipul Sinha brings more than 20 years of experience building billion-dollar tech companies. Before Rubrik, he worked as a venture capitalist backing firms like Nutanix and Hootsuite. His mix of engineering experience at Oracle, business acumen, and market vision has enabled Rubrik to anticipate industry trends and stay ahead of competitors.

Rubrik’s culture is another strength. One example is its practice of open board meetings, which fosters radical transparency and collective problem-solving. This alignment of employees with mission and strategy is rare among startups. CEO Bipul Sinha owns 6% of the company, and together with co-founders they hold 18%. This skin in the game ensures management incentives are aligned with shareholders. Strategic backing from Microsoft, which invested in 2021, has also provided Rubrik with technical synergy, distribution advantages, and market validation that have accelerated adoption.

Rubrik sits at the intersection of cybersecurity and data protection, addressing a $50 billion TAM. While cybersecurity today focuses heavily on prevention, rising ransomware threats (often powered by AI agents that never sleep) make breaches inevitable. Enterprises are increasingly shifting to cyber resilience, where Rubrik’s “undo button” for cyberattacks is mission-critical. Its role as a trusted third-party recovery provider also protects it from in-housing risk. Although Rubrik positions itself as a premium product, its value proposition significantly lowers TCO compared to incumbents, fuelling market share gains that should continue as it scales.

While the stock is not cheap and trades at a premium, Rubrik offers unique exposure to the resilience niche of cybersecurity, an area still under appreciated by markets. Its multi-product strategy expands TAM and demonstrates optionality in the model. Though Rubrik’s moat is still developing, signs of durable competitive advantages are emerging in the form of switching costs, network effects, and cost advantages. With strong founder-led leadership and strategic support from Microsoft, Rubrik combines vision and execution strength that position it to be a long-term winner.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Hey Wolf,

As you know I appreciate your thoughts and analysis. So apologies in advance for the somewhat critical tilt of this question which is this; How is this company different from some of the other popular software companies from a few years ago that have been absolutely murdered on a total return basis? Specifically, I'm thinking of Confluent, Elastic, Gitlab and a few others. that were darlings of the SaaS world that have continued to grow top-lines at a fast rate, but which have failed to perform on the open market.

I'm comparing Confluent specifically to Rubrik now. They both operate at a similar scale (~$1 billion LTM revenues) with similar 75% gross margins, are similarly losing about ($400-500 million per year in GAAP OP, with about 25% of sales in SBC, meaning that they are FCF profitable but with significant ongoing dilution. From a qualitative perspective, both are selling mission-critical software with a similar land-and-expand operating model increasingly to enterprise clients with a large proportion of revenues coming from clients with >100k in ARR and with similarly large DNBRs. TAM is similar too with CFLT estimating it at $50 billion as well. Lastly, they both operate in industries with seemingly long-term tailwinds in place (data mobility, and security).

The only difference I see here is that Rubrik is growing at a faster pace (+20% y/y in MRQ for CFLT vs. +50% y/y for RBRK) but that also appears to be accounted for in the valuation discrepancies (CFLT trades at 4.1x NTM Sales vs. 12.9x for RBRK). Is the thought here that RBRK's superior growth rate translates into operating leverage at a higher pace? Enough to offset the significant dilution and the potential for multiple compression?

Great read, and l love the format