Sea: +100% revenue growth for thirteen quarters

Sea Limited Q3 2021 Earnings Analysis

Today, I analyse the Q3 2021 earnings report of Sea Limited (Ticker: SE), which was released before the bell on 16 November 2021.

In this report, I will cover the following:

Key Highlights

Wall Street Expectations

Digital Entertainment

E-commerce

Digital Financial Services

Income Statement

Balance Sheet

Cash Flow

Guidance

Conclusion

1. Key Highlights

Revenue: $2.69 billion +122% year-over-year (YoY)

Digital Entertainment: $1.10 billion +92% YoY

E-commerce: $1.31 billion +168% YoY

Sale of goods: $0.28 billion +82% YoY

Gross Profit: $1.01 billion +148% YoY

Digital Entertainment: $785 million +110% YoY

E-commerce: $211 million +576% YoY

Sale of goods: $13 million +505% YoY

Net Loss: $425 million compared to a loss of $571 million YoY

Adjusted EBITDA: $121 million compared to a loss of $165 million YoY

2. Wall Street Expectations

Revenue: $2.47 billion (beat by 9%)

Adjusted Earnings per Share: -0.63 (miss by 33%)

Source: CML

3. Digital Entertainment

At the end of Q3 2021, quarterly active users (QAUs) reached 729.0 million, an increase of 27.4% YoY. Quarterly paying users grew by 42.7% YoY to 93.2 million and represented 12.8% of QAUs for the third quarter compared to 11.4% for the same period in 2020.

Average bookings per user were $1.7, in line with that for the third quarter of 2020. Overall bookings were $1.2 billion, up 29% YoY.

The key driver in user growth here was once again the global hit game, Free Fire, which continued to see strong user engagement, and ranked second globally by average monthly active users for all mobile games on Google Play in the third quarter of 2021, according to App Annie.

4. E-commerce

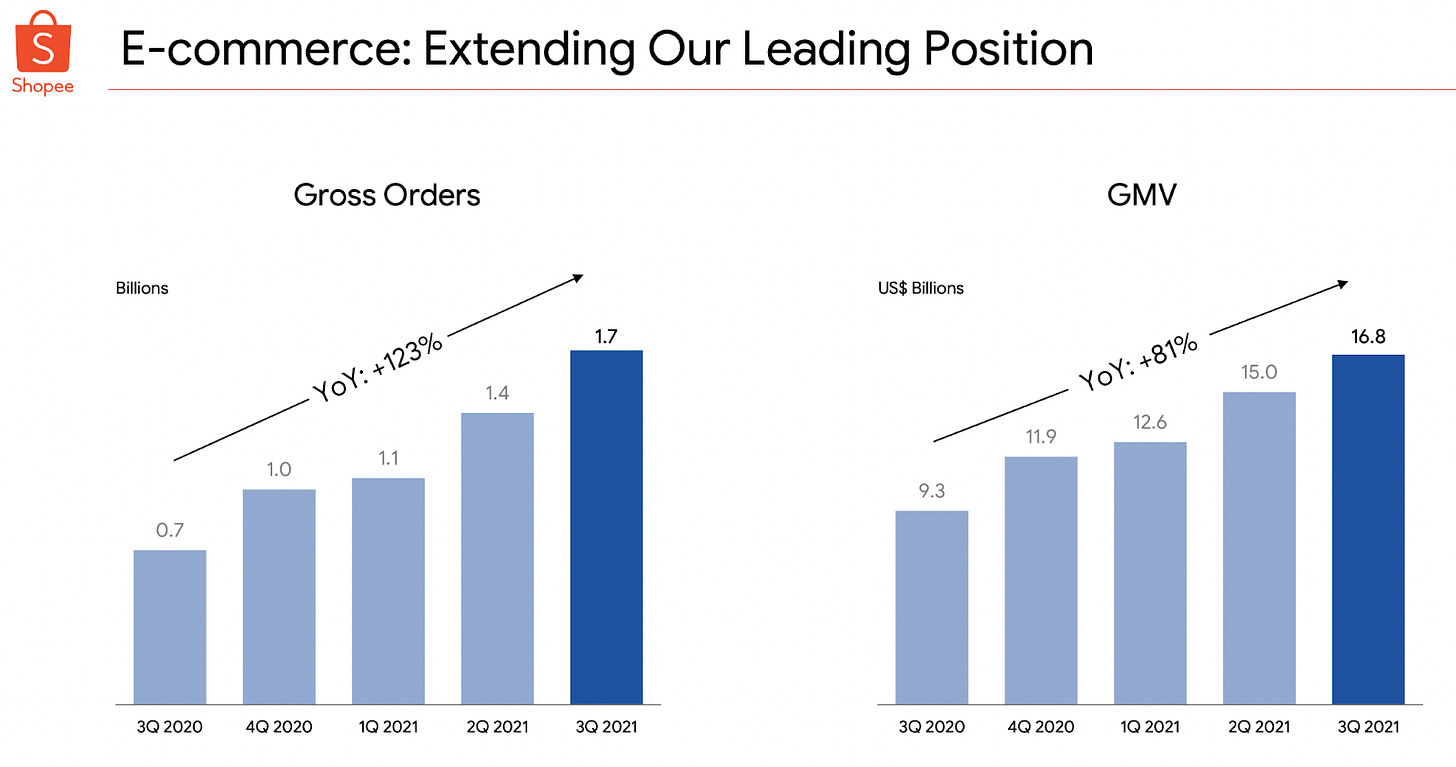

Gross orders totalled 1.7 billion, an increase of 123.2% YoY. This represents nine consecutive quarters of triple digit YoY order growth. Gross merchandise value (GMV) was $16.8 billion, an increase of 80.6% YoY.

Globally, Shopee was the top-ranked app in the Shopping category on Google Play by total time spent in app and ranked second by downloads and average monthly active users in the third quarter of 2021, according to App Annie.

In Southeast Asia and in Taiwan respectively, Shopee continued to rank first in the Shopping category by average monthly active users and total time spent in app for the third quarter of 2021, according to App Annie. In Indonesia specifically, Shopee also ranked first by these metrics.

In Brazil, where Shopee was launched in late 2019, it continued to rank first in the Shopping category by downloads and total time spent in app and continued to rank second by average monthly active users for the third quarter of 2021, according to App Annie.

5. Digital Financial Services

Mobile wallet total payment volume was $4.6 billion for the third quarter of 2021, an increase of 111% YoY. In addition, quarterly paying users for mobile wallet services increased to 39.3 million in the third quarter. The company continues to see strong growth in the adoption of SeaMoney’s offerings.

6. Income Statement

During the quarter, Sea grew its top line by 122% YoY. If we round up the 99% revenue growth in Q3 2020 to 100%, Sea has reported 13 consecutive quarters of +100% revenue growth dating as far back as Q3 2018. This is pretty astounding when you take a step back and think about it. The company has been doubling revenue each quarter YoY for more than three years. Gross profit is following a similar growth trajectory and increased by 147%, with gross margin also improving from 34% to 38% YoY.

E-commerce is the fastest growing area of the business, growing almost twice as fast as Digital Entertainment and Sale of Goods during the quarter. For the very first time, E-commerce revenue has surpassed Digital Entertainment revenue to become the largest segment.

The increase in gross margin from 34% to 38% is a result of an increase in gross margins in all areas of the business.

Why are margins improving?

Digital Entertainment margins improved due to higher contributions from self-developed games. The Garnea platform distributes video games from game publishers meaning that Sea can advantage its own titles.

E-commerce margins improved due to increased marketplace take rate. The implied take rate during Q3 2021 was 7.1% compared to 5.0% at Q3 2020.

Not so long ago (Q2 2020 to be exact), both E-commerce and Sale of Goods were reporting negative gross margins. This improvement is a very healthy trend.

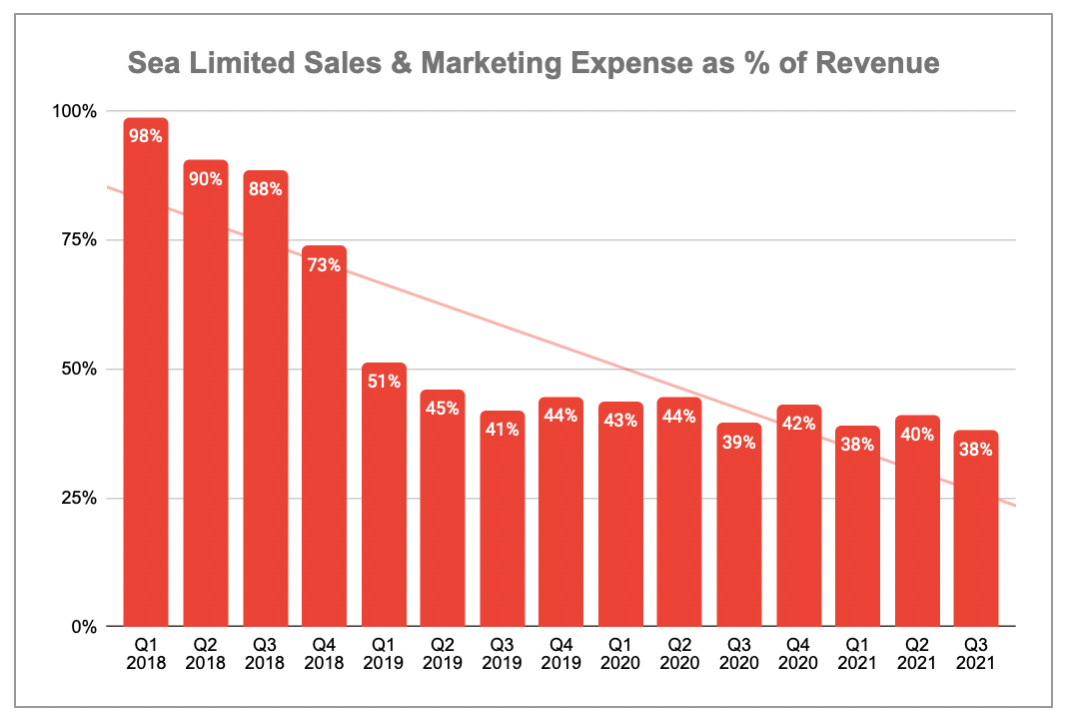

Operating expenses increased by 106% to $1.47 billion during the quarter. The main driver here was sales and marketing expenses, which increased by 114% to $1.01 billion due to the ramping up of marketing incentives and online marketing efforts that management said was a strategic decision. The level of spending on sales and marketing expenses is an area I pay particular attention to. One of the key risks that I originally associated with Sea was its cash burn related to sales and marketing expenses. At one stage Sea was spending 98% of its revenue on sales and marketing expenses alone, which arguably meant that it was subsidising sales. The trend is moving in the right direction.

7. Balance Sheet

Observations

Over $11.1 billion in cash and cash equivalents up from $6.2 billion at Q4 2020

Total Liabilities as percent of Total Assets is 58% down from 67% at Q4 2020

Current Assets to Current Liabilities ratio of 2.49 up from 1.93 at Q4 2020

Goodwill balance making up less than 3% of total assets, which relates to a number of acquisitions. The increase since Q4 2020 is a result of the acquisition of Indonesian lender Bank BKE in Q1 2021

Long-term debt (convertible notes) has increased by almost $1.7 billion during 2021

8. Cash Flow

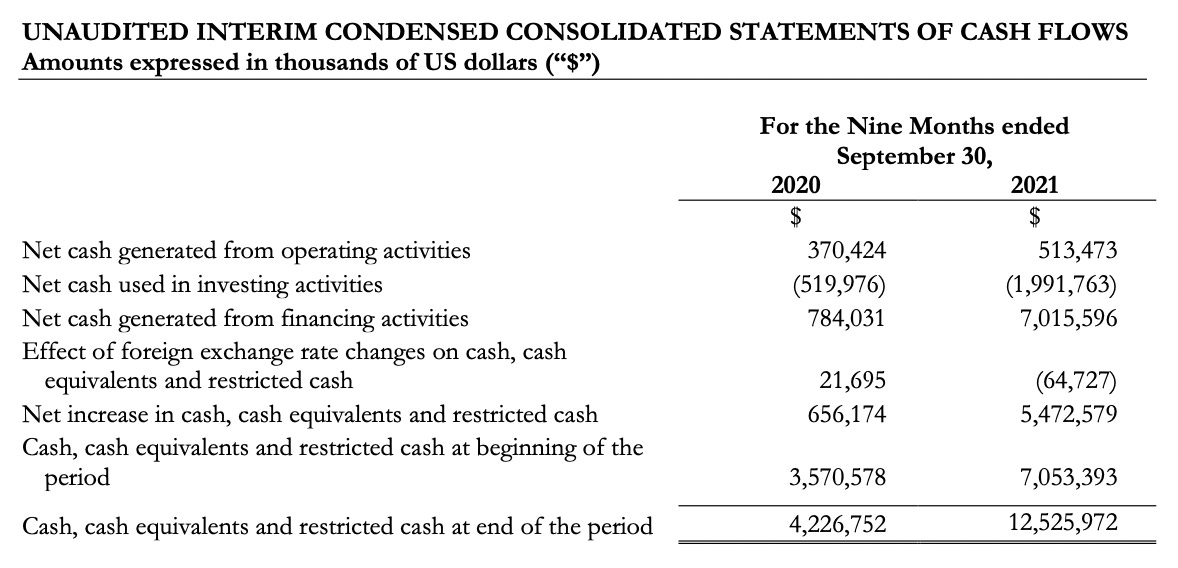

Unfortunately, the reduced version of the cash flow statement means that the level of analysis here is limited. This is a bugbear of many analysts.

What we do know is that Sea’s operating cash flow is improving. At Q3, year-to-date (YTD) cash flow from operations improved by 39%, from $370 million to $513 million.

Sea’s YTD investing cash flow resulted in a deficit of $1.99 billion compared to a deficit of $520 million YoY.

Sea’s YTD financing cash flow resulted in a surplus of almost $7 billion compared to a surplus of $0.8 billion YoY. From the balance sheet, we can infer that this is a result of the increase in additional paid-in capital from the stock offering in September.

Without a granular cash flow statement we are unable to determine the free cash flow that Sea generated.

9. Guidance

For the second time this year management raised the guidance for E-commerce for the full year of 2021. E-commerce revenue is expected to be between $5.0 billion and $5.2 billion, representing growth of 135% from 2020 at the midpoint of the revised guidance. The previous guidance was between $4.7 billion and $4.9 billion.

Guidance for Digital Entertainment remains unchanged, ranging $4.5 billion to $4.7 billion for the full year of 2021, representing growth of 122% from 2020 at the midpoint.

10. Conclusion

This was a very good quarter from Sea in my book. Looking at the top line, Sea beat estimates and also raised forward guidance. When looking under the hood, gross margins improved across all three segments, and key operating metrics such as QAUs and GMV continue to grow. On Tuesday, 16 November, the day earnings were released, Sea closed the session down almost 4%.

Rating: 4 out of 5. Exceeds expectations.

Disclosure: The author holds a long position in Sea Limited.

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Hit the subscribe button below if you have not already done so in order to receive the latest content straight to your inbox each week. By hitting the archive button you can view all of my previous newsletters on the website.

Happy investing

Wolf of Harcourt Street

Disclaimer: I am not a financial adviser and I am not here to give specific financial advice. The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. The information is based on personal opinion and experience, it should not be considered professional financial investment advice. There is no substitute for doing your own due diligence and building your own conviction when it comes to investing.

Sea's operations and financials look great. Yet, as you said, the share price declined 4% on the earnings announcement. None of what you wrote tells us what the share price should be. How would you come up with a valuation that you think is justifiable?