Executive Summary

E-commerce experienced significant growth, with gross orders rising 40% YoY to 2.5 billion and GMV reaching $23.3 billion, a 29% increase YoY. The implied marketplace take rate improved to 10.7%, up from previous quarters, indicating that Shopee is successfully increasing its revenue share even as GMV and orders grow rapidly.

Digital Entertainment quarterly active users reached 648 million, a 21% YoY increase, marking the highest level since Q4 2021. The quarterly paying user ratio also improved from 7.9% to 8.1% YoY, leading to a 22% increase in quarterly paying users, reaching 52.5 million, the highest since Q2 2022. Bookings reached $536.8 million, with a 21% YoY and 5% QoQ growth, marking the fourth consecutive quarter of positive trends. Average bookings per user slightly increased from $0.81 to $0.83 YoY.

Digital Financial Service's loans principal outstanding reached $3.5 billion by the end of Q2 2024, reflecting a 40% YoY growth and an 8% QoQ increase. The number of active users for consumer and SME loans grew by 58% YoY and 14% QoQ, reaching 21 million. Despite rapid growth, Sea Money maintained a stable non-performing loan ratio at 1.3% of the total loan principal outstanding in Q2 2024, indicating strong risk management practices.

Total revenue grew by 23% YoY for the second consecutive quarter, reaching $3.81 billion. This growth was primarily driven by the e-commerce business, which saw a 30% YoY increase in revenue to $3.0 billion. Digital Financial Services also contributed with a 21% YoY increase in revenue, reaching $519 million. The gross margin remained stable on a QoQ basis at 42% but decreased YoY from 47% due to business mix shift declines in gross margin across all segments.

Operating expenses rose 29% YoY, primarily driven by a 57% increase in S&M expenses. S&M expenses constituted 20% of revenue in Q2 2024, up from 16% in Q2 2023 but down from 21% in Q1 2024. The heavy S&M investments made in 2023 are now showing effectiveness with each additional dollar in spend generating more revenue.

Digital Entertainment, despite declining as a share of total revenue, generated $303 million in OCF in Q2 2024. Digital Financial Services also began contributing significantly to OCF, representing 37% of OCF despite only 15% of total revenue. Shopee is nearing breakeven in terms of OCF and is expected to be positive in the latter half of 2024.

Contents

Financial Highlights

Wall Street Expectations

E-commerce

Digital Entertainment

Digital Financial Services

Financial Analysis

Guidance

Conclusion

1. Key Highlights

Revenue: $3.81 billion +23% year-over-year (YoY)

Digital Entertainment: $436 million -18% YoY

E-commerce: $3.03 billion +30% YoY

Sale of goods: $343 million +41% YoY

Gross Profit: $1.58 billion +9% YoY

Net Income: $90 million -76% YoY

Adjusted EBITDA: $448 million -12% YoY

2. Wall Street Expectations

Revenue: $3.72 billion (beat by 2%)

Earnings per Share: 0.19 (miss by 26%)

3. E-commerce

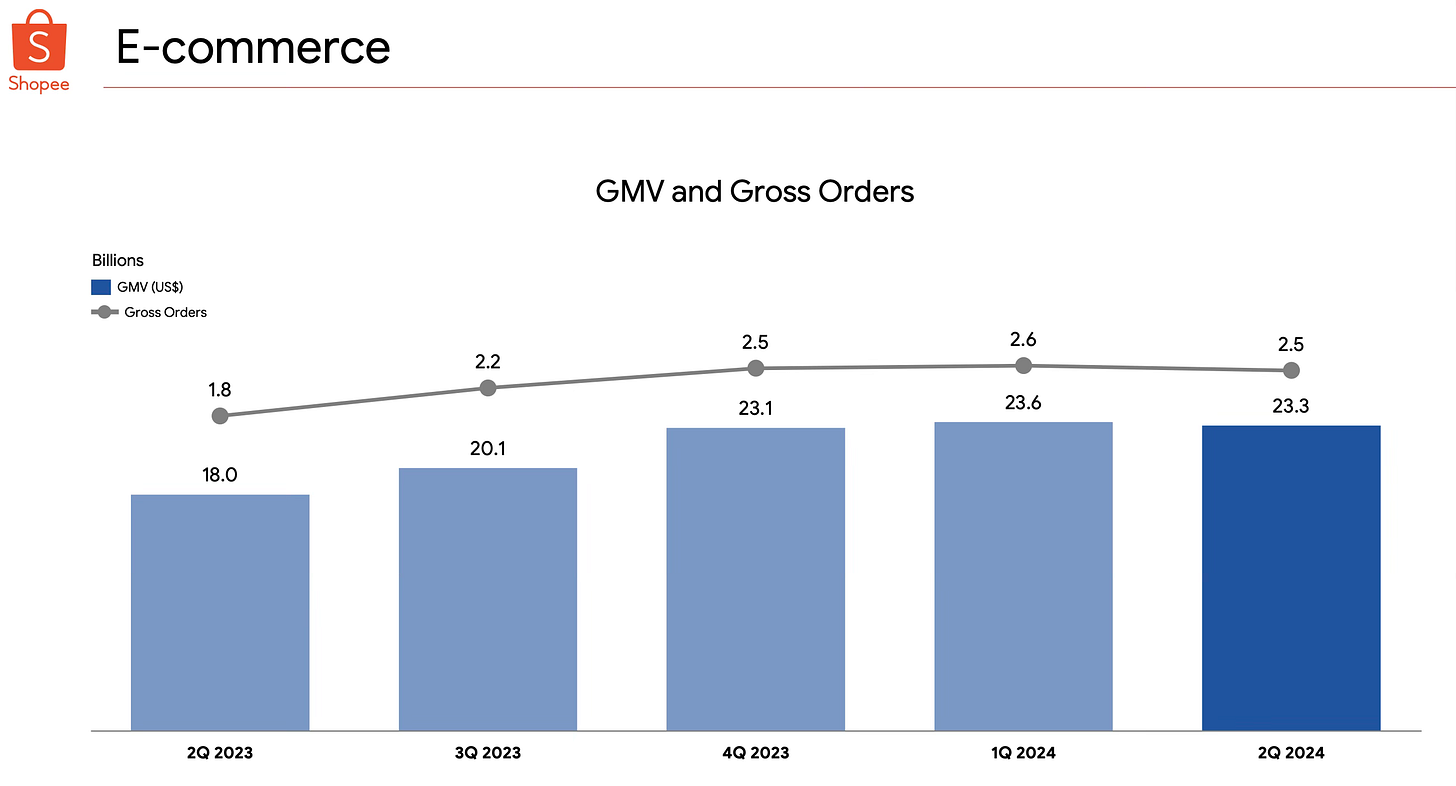

Shopee achieved a significant rise in gross orders, totalling 2.5 billion, reflecting a 40% YoY increase.

Gross Merchandise Volume (GMV) for the quarter amounted to $23.3 billion, representing growth of 29% YoY.

Based on the GMV of $23.3 billion and marketplace revenue of $2.5 billion, the implied marketplace take rate is 10.7% which is up from 10.6% in Q2 2023 and 10.2% in Q1 2024. It is once again positive to see that the increasing take rate is being achieved while GMV and Gross Orders grow significantly faster than a year ago.

Shopee is focusing on increasing its ad take rate, which is currently below the industry average. Improvements in onboarding features, ad algorithms, and the introduction of Live Ads on Shopee Live have boosted ad revenue. In the second quarter of 2024, the number of sellers paying for ads increased by over 20% YoY, with a notable adoption in Indonesia, where 1 in 4 active streamers paid for Live Ads in June 2024.

Investments in logistics, particularly through SPX Express, have enhanced delivery speed and reduced costs. In the second quarter of 2024, over 70% of SPX Express orders in Asia were delivered within three days, with the cost per order decreasing by 8%. The introduction of a "Change of Mind" returns feature has lead to increased customer satisfaction, higher basket sizes, and greater user loyalty. Data-driven technological improvements have led to faster resolution of return and refund cases, with over 50% of such cases in Asia being resolved within one day.

4. Digital Entertainment

At the end of Q2 2024, quarterly active users (QAUs) reached 648 million, a 21% increase YoY and the highest level since Q4 2021. Additionally, the quarterly paying user ratio rose from 7.9% to 8.1% YoY, leading to a 22% increase in quarterly paying users (QPUs), which grew from 43.1 million a year ago to 52.5 million in the second quarter of 2024.

This rise in the quarterly paying user ratio resulted in a 7% quarter-over-quarter (QoQ) increase in QPUs, from 48.9 million to 52.5 million. The number of QPUs is now at its highest since Q2 2022, marking the second consecutive quarter of QoQ growth.

Garena's bookings reached $536.8 million, reflecting a 21% YoY and 5% QoQ growth. This is the fourth consecutive quarter of positive trends in gross bookings. Average bookings per user increased slightly YoY from $0.81 to $0.83.

Free Fire remains the main driver of bookings growth, demonstrating its status as an evergreen franchise with a highly engaged user base. It maintained over 100 million daily active users (DAUs) throughout Q2 2024 and was the most downloaded mobile game globally during this period, according to Sensor Tower. The company plans to expand its gaming portfolio by launching "Need for Speed: Mobile" in Taiwan, Hong Kong, and Macau later this year, in partnership with Tencent and Electronic Arts.

5. Digital Financial Services

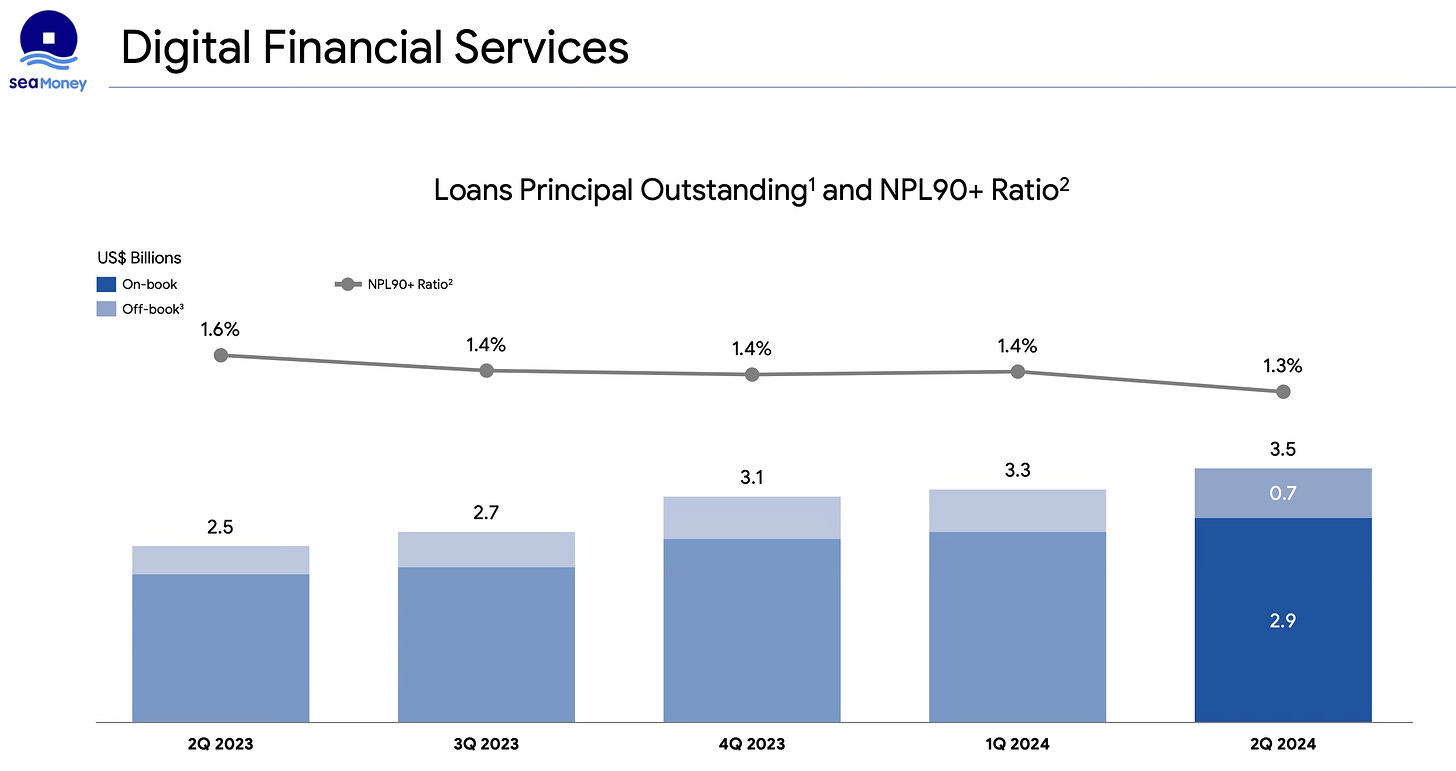

Sea Money's loans principal outstanding reached $3.5 billion by the end of Q2 2024, reflecting a 40% YoY growth and an 8% QoQ increase. The number of active users for consumer and SME loans grew significantly by 58% YoY and 14% QoQ, reaching 21 million.

Despite the rapid growth, the company maintained a stable non-performing loan (NPL90+) ratio at 1.3% of the total loan principal outstanding in Q2 2024, indicating effective risk management.

The consumer and SME credit business remains a key driver of revenue and profit. The On-Shopee segment saw efficient customer acquisition, with over 4 million first-time borrowers in Q2 2024, more than doubling from the previous year. The Off-Shopee segment expanded credit use cases, particularly in Indonesia, where they partnered with over 1,000 merchants to offer SPayLater loans for mobile phones, becoming the first player to provide instant credit approval at scale in this category.

6. Financial Analysis

Revenue

Total revenue grew by 23% YoY for the second consecutive quarter, reaching $3.81 billion. This growth was driven primarily by its e-commerce business and digital financial services.

E-commerce achieved revenue of $3.0 billion, representing a 30% YoY increase. Core marketplace revenue grew by 41% YoY, while value-added services saw a 16% YoY increase.

Digital Entertainment experienced a 17% decline in revenue, falling to $436 million. This decrease was mainly due to lower recognition of accumulated deferred revenue from previous quarters, despite an increase in bookings during the quarter.

Digital Financial Services saw revenue increase by 21% YoY, reaching $519 million, largely due to growth in both the consumer and SME credit businesses.

Gross Margin

The gross margin remained consistent QoQ at 42% but declined YoY from 47%. This shift is due to two main factors. First, the business mix has changed significantly over the past twelve months. The Digital Entertainment division, which historically had a gross margin exceeding 70%, decreased from 17% of total revenue in Q2 2023 to just 11% in Q2 2024. E-commerce now represents 80% of revenue, up from 75% a year ago.

Second, the gross margin for all three segments declined. Digital Entertainment fell from 70% to 68%, e-commerce from 46% to 42%, and the sale of goods from 10% to 7%.

Operating Margin

Operating expenses increased 29% YoY, reaching $1.5 billion. The main driver behind this rise was Sales and Marketing (S&M) expenses, which surged 57% YoY to $775 million. In Q2 2024, Sea allocated 20% of its revenue to S&M expenses, up from 16% in Q2 2023 but down from 21% in Q1 2024.

The effectiveness of the heavy S&M investments made in 2023 is becoming evident. In Q2 2024, S&M expenses increased by $5 million compared to the previous quarter, while revenue grew by $73 million. This indicates an effective use of resources, with a small increase in spending resulting in substantial revenue growth. In contrast, Q2 2023 saw S&M expenses rise by $93 million, but revenue increased by only $55 million. This earlier period reflects a less optimal return on investment, with a larger increase in expenses yielding a smaller revenue gain.

The Q2 2024 figures show a much higher return on S&M spend, with each additional dollar in spend generating more revenue. The company has likely refined its investment strategies, targeting more effectively and utilising channels that yield better results.

Sea reported an operating profit of $83 million for Q2, compared to $284 million YoY. The company achieved a net profit of $80 million and is essentially operating at breakeven as it focuses on growth initiatives.

Cash Flow Analysis

Despite operating at breakeven, Sea generated operating cash flow (OCF) of over $1 billion for the first half of 2024, an impressive figure given the company's 23% top-line growth.

Using Q2 2024 Adjusted EBITDA as a proxy for OCF reveals several key insights:

Despite a decline in Digital Entertainment's share of total revenue, it still recorded $303 million in OCF. On an annualized basis, this would exceed $1.2 billion in OCF.

Digital Financial Services is also generating OCF, contributing 37% of total OCF while comprising only 15% of total revenue.

E-commerce is nearing breakeven on an OCF basis and is expected to achieve positive OCF in the second half of 2024.

7. Guidance

While management do not provide formal financial guidance, they did reveal that they expect Shopee to achieve adjusted EBITDA positivity starting in the third quarter of 2024. They also revised its full-year guidance upward, now projecting that Shopee's gross merchandise value (GMV) will grow by mid-20% for 2024.

In advance of the Q2 2024 earnings report, Wall Street analysts projected a revenue growth of 17% for 2024 and an adjusted EPS of 1.94. I anticipate analysts will revise these estimates upwards particularly given the management guidance around EBITDA and GMV.

8. Conclusion

On the conference call, management noted that the e-commerce sector is becoming more stable, with a reduction in aggressive competition. They also highlighted potential for further increases in take rates, driven by commissions, fees, and advertising revenue. This is not something you typically hear during a price war and reaffirms my belief that Shopee is the dominant market leader in Southeast Asia.

The company aims to enhance pricing, user experience, and content supply to gain market share and improve unit economics. Unit economics for live streaming are improving, with profitability in some markets. In Brazil, the company has achieved positive contribution margins due to reduced shipping costs and an improved user experience. This is particularly noteworthy, given MercadoLibre’s dominance in Brazil.

The company is working on several initiatives to enhance the efficiency and cost structure of SPX. These include:

Scaling operations: Increasing the number of hubs (900 new hubs in Q2, including mobile hubs) to improve coverage and reduce costs.

Automation: Implementing automation solutions in sorting centers and hubs to boost productivity.

Technology enhancements: Deploying better sorting and routing technology, especially for last-mile delivery, tailored to market complexities.

Operational efficiency: Focusing on optimizing the "ops clock," which involves streamlining processes from order pickup to final delivery to improve overall logistics performance.

This was another strong quarter for Sea, with particularly encouraging guidance around EBITDA and GMV growth. As a shareholder, it's satisfying to see the thesis I predicted in 2023, when the stock was at a low, playing out as expected. The market opportunity remains vast, and Sea, as the dominant force in the region, is well-positioned for continued growth. I'm not concerned about whether Sea posts an adjusted EPS of $0.10, $0.15, or $0.20 in the short term. Instead, I want to see continued >20% growth by reinvesting its profits in future growth opportunities that can be achieved at breakeven.

Based on the forward EV/Sales multiple of 2.5 and with 80% of revenue now coming from e-commerce, the current valuation suggests that all of Sea’s value is attributed solely to e-commerce, with no value assigned to Digital Entertainment. This is despite Digital Entertainment operating at a $1.2 billion EBITDA run rate.

Rating: 3 out of 5. Meets expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com