Executive Summary

E-commerce GMV reached $25.1 billion, growing 29% YoY, with a 24% YoY increase in gross orders. Shopee continues to dominate e-commerce in Asia, with a 20% YoY growth in monthly active buyers. Brazil also showed significant growth, with a nearly 40% increase in active buyers. Shopee enhanced monetisation by raising commission rates, benefiting from market rationalisation, and boosting ad revenue through better ad tools, which led to a 10% increase in ad-paying sellers and a 25% YoY growth in ad revenue per seller.

Digital Entertainment quarterly active users reached 629 million, growing 16% YoY, and the number of paying users increased by 24%. Garena's gross bookings grew by 24% YoY, with a 4% QoQ increase, marking the fifth consecutive quarter of positive growth.

Digital Financial Service's loan business has grown significantly, with outstanding loan principal increasing by 73% YoY and 30% QoQ, reaching $4.6 billion. The company added 4 million new borrowers, growing its active loan user base to 24 million. Its "low-and-grow" strategy, which starts users with small loans and increases credit limits based on repayment history, has kept non-performing loans stable at 1.2%.

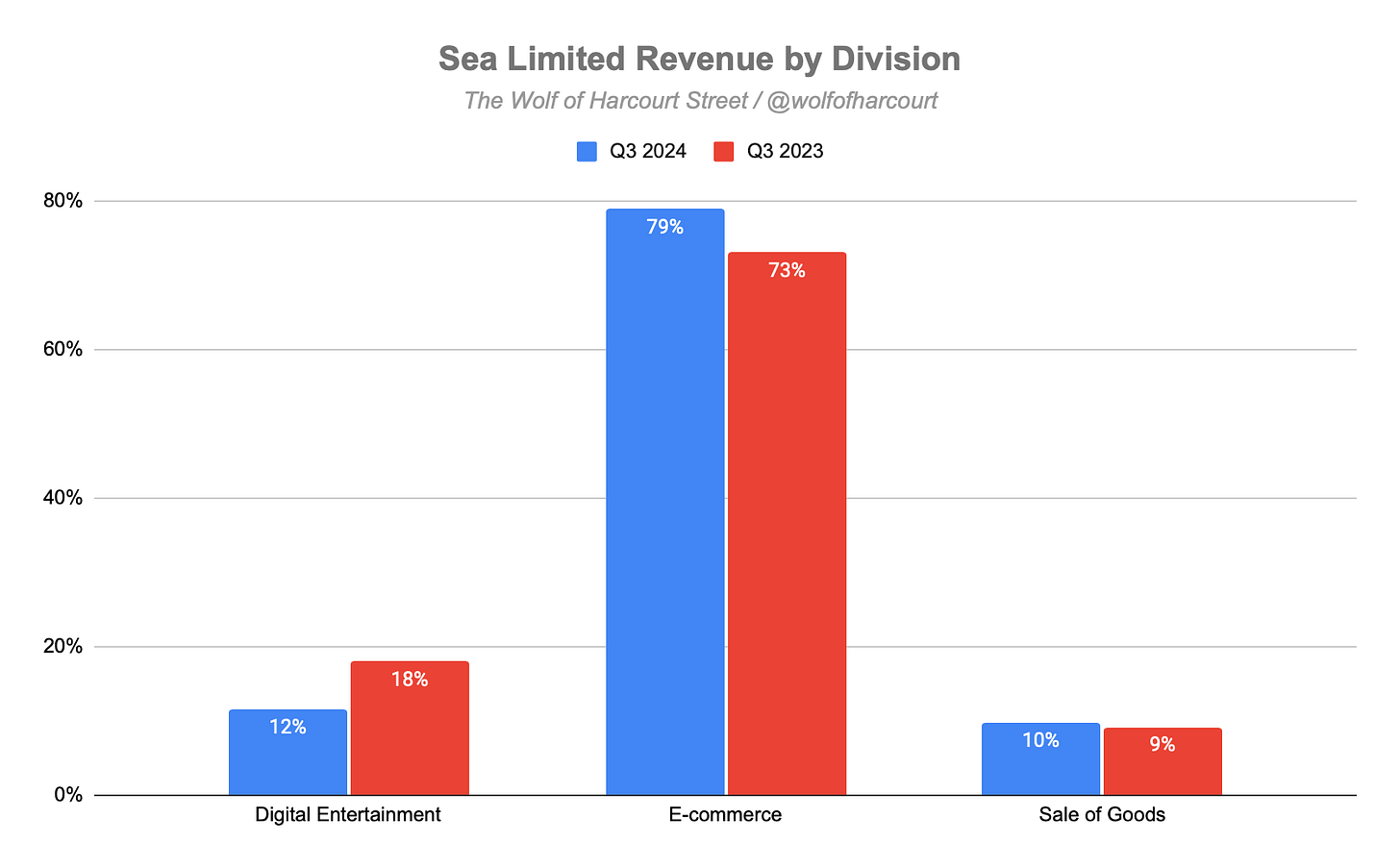

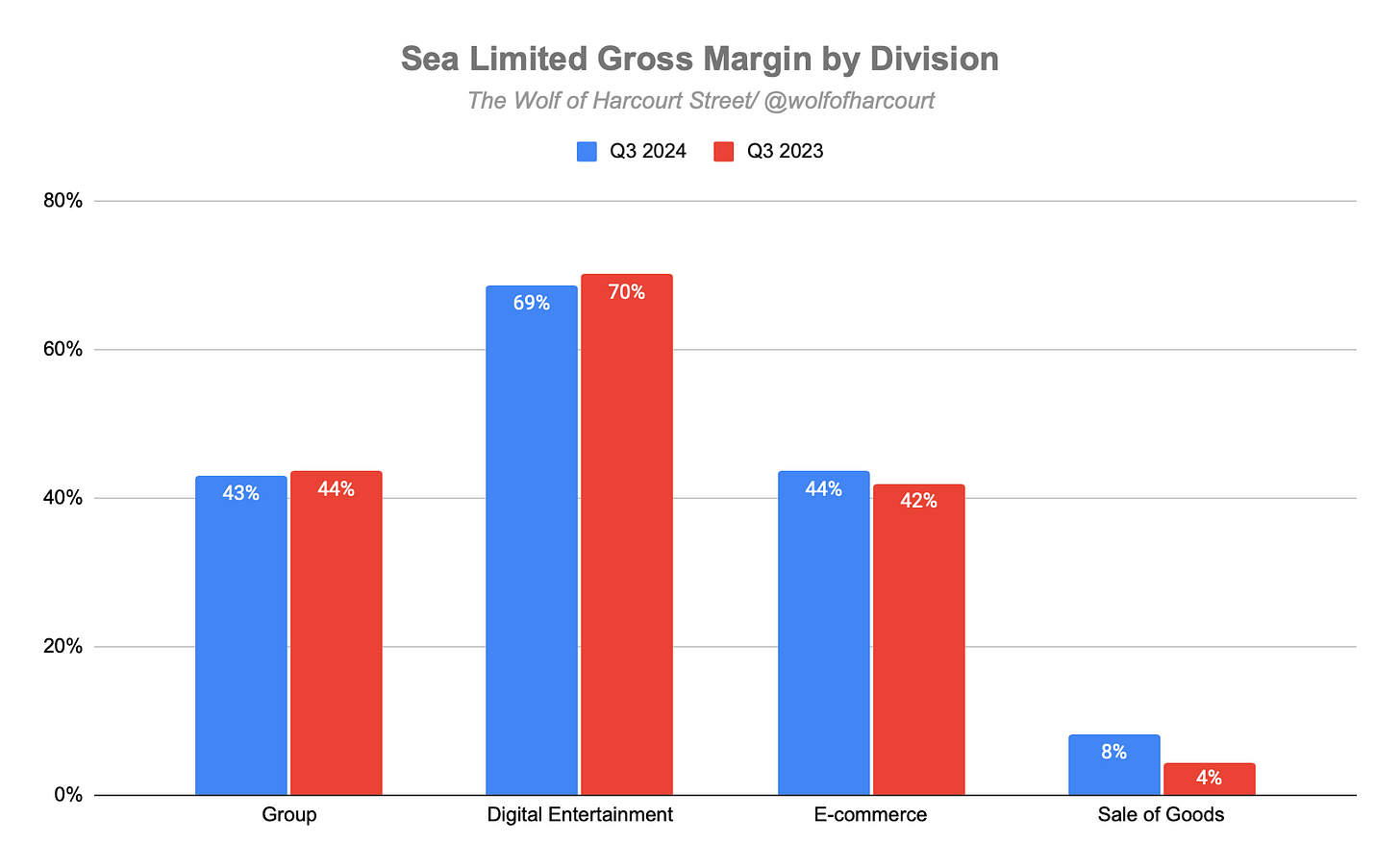

Total revenue grew by 31% YoY reaching $4.33 billion, driven mainly by e-commerce and digital financial services. The gross margin stayed stable at 43%, slightly down from 44% YoY, reflecting a shift in the business mix. E-commerce and other services now accounts for 79% of total revenue, up from 73% a year ago, while Digital Entertainment's share dropped to 12% from 18%, impacting the overall margin.

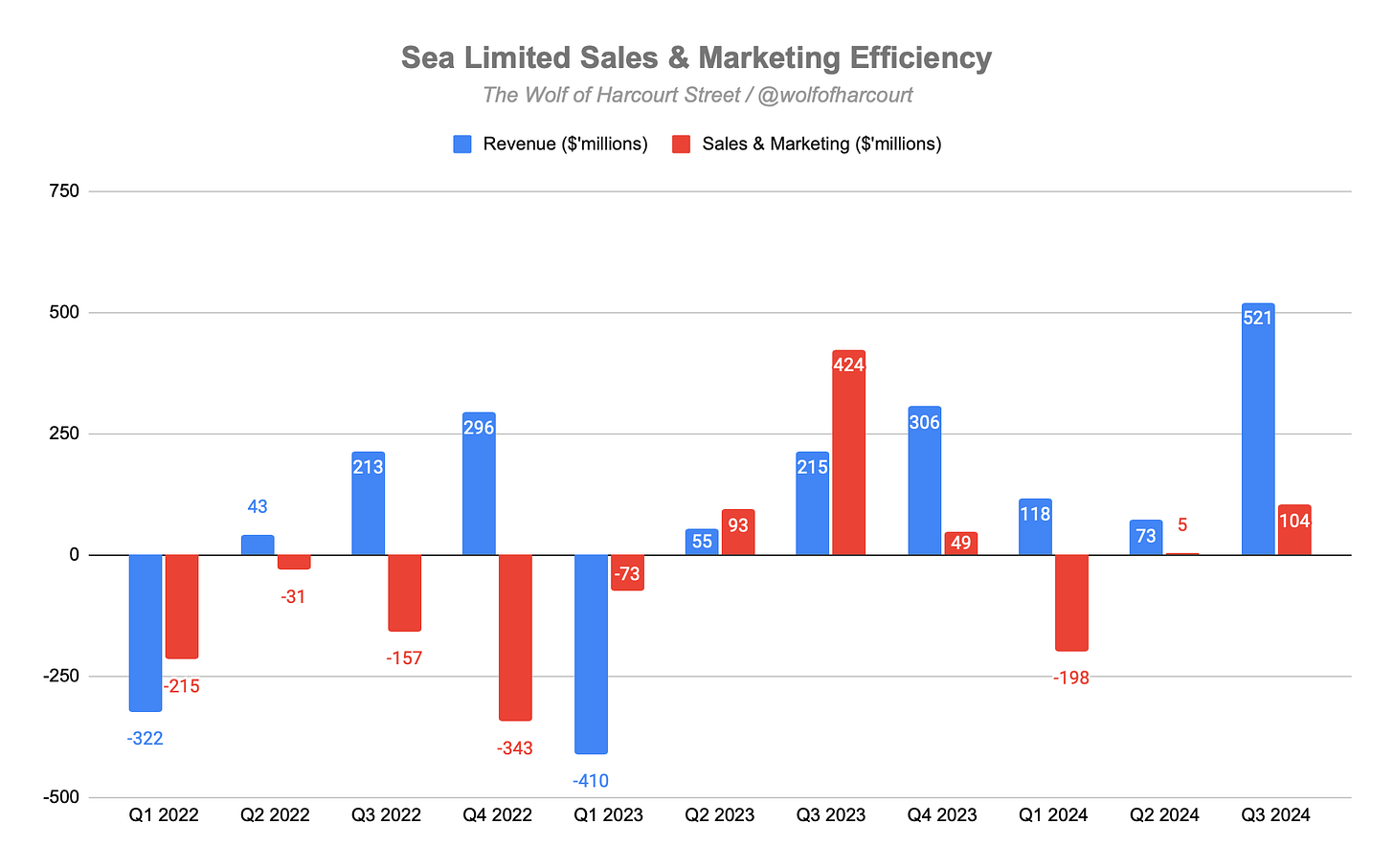

The operating margin improved significantly to 5%, driven by a reduction in Sales and Marketing expenses as a percentage of revenue. While S&M expenses grew in absolute terms sequentially, they generated a much higher return on investment compared to the previous year, reflecting the effectiveness of Sea's targeted and efficient investment strategies. Sea Money's growth in loans led to a 48% increase in provisions for credit losses, which will need ongoing monitoring despite the stable non-performing loan ratio.

Contents

Financial Highlights

Wall Street Expectations

E-commerce

Digital Entertainment

Digital Financial Services

Financial Analysis

Guidance

Conclusion

1. Financial Highlights

Revenue: $4.33 billion +31% year-over-year (YoY)

Digital Entertainment: $498 million -16% YoY

E-commerce: $3.41 billion +41% YoY

Sale of goods: $418 million +39% YoY

Operating Income: $202 million +259% YoY

Net Income: $153 million +207% YoY

Adjusted EBITDA: $521 million +1,378% YoY

2. Wall Street Expectations

Revenue: $4.08 billion (beat by 6%)

Earnings per Share: 0.24 (in line)

3. E-commerce

Gross Merchandise Volume (GMV) for the quarter reached $25.1 billion, reflecting a 29% YoY growth, with gross orders totalling 2.5 billion, up 24% YoY. Shopee's GMV run rate now exceeds $100 billion for the first time.

Shopee maintains strong market leadership across Asia, achieving over 20% YoY growth in monthly active buyers in Q3. Brazil also showed strong growth, with active buyers increasing by nearly 40%.

With GMV at $25.1 billion and marketplace revenue of $2.8 billion, the implied marketplace take rate is 11.2%, up from 9.5% in Q3 2023 and 10.7% in Q2 2024. This is a significant improvement, especially given the rapid growth in GMV and gross orders over the past few quarters. How has Shopee achieved this?

Shopee has increased monetization through higher commission rates, benefiting from market rationalization in Southeast Asia, and through ad revenue growth. Improvements in ad tools and technology increased ad-paying sellers by 10% and ad revenue per seller by 25% YoY. The ad take rate improved by more than 30 basis points compared to last year.

Updates on Shopee’s operational priorities include:

Price Competitiveness: A Qualtrics survey named Shopee the top platform for competitive pricing in both Asia and Brazil.

Service Quality: SPX Express, Shopee’s logistics arm, offers cost-effective, fast delivery. In Asia, half of SPX Express orders are delivered within two days, with cost per order improving quarter-on-quarter (QoQ).

Content Ecosystem: Live streaming on Shopee has become a significant engagement driver, particularly in Indonesia, with over 50% growth in daily unique streamers and 15% growth in live-streaming buyers QoQ. Collaborations like YouTube integration, allowing in-video purchases, are expanding to other Southeast Asian markets.

In Brazil, Shopee achieved its first breakeven quarter, showing improved unit economics with larger basket sizes and high engagement from newer user cohorts. Despite Mercado Libre's dominance, Shopee was named Brazil’s top e-commerce site by the Folha Top-of-Mind Award, and its monthly active buyers grew 40% YoY while Mercado Libre's GMV growth slowed sequentially.

4. Digital Entertainment

Quarterly active users (QAUs) reached 629 million, growing 16% YoY, with the quarterly paying user ratio rising from 7.5% to 8.0% YoY. Quarterly paying users (QPUs) increased by 24% YoY, from 40.5 million to 50.2 million.

After eight quarters of YoY declines in QPUs, this cohort has now grown by over 22% for three consecutive quarters, indicating stabilisation.

Garena’s bookings reached $556.5 million, reflecting a 24% YoY and 4% QoQ growth. This is the fifth consecutive quarter of positive trends in gross bookings, with average bookings per user up 8% YoY from $0.82 to $0.89. Free Fire remains a key driver, attracting over 100 million daily active users, up 25% YoY. It was the #1 most downloaded mobile game globally, with new user downloads also rising by 25%.

Expanding User Base: Growth extended into regions like North Africa, where Garena has increased in-game events and local campaigns.

Localized Content and Engagement: A major esports tournament in Morocco set attendance and social media records, while Garena’s frequent updates and region-specific content, like a viral collaboration with Thailand’s Moo Deng pygmy hippo, keep engagement high.

New Game Launches: Garena launched Need for Speed Mobile in Taiwan, Hong Kong, and Macau, quickly becoming the top downloaded racing game. It is also partnering with Tencent to bring Delta Force to multiple global markets.

Remarkably, Free Fire, launched in 2017, continues to grow its user base steadily.

5. Digital Financial Services

Sea Money's outstanding loan principal reached $4.6 billion, up 73% YoY and more than 30% QoQ. The business scaled rapidly, adding 4 million new borrowers and reaching 24 million active loan users, marking a 60% YoY and 14% QoQ increase.

Using Shopee’s data for risk assessment, Sea Money has diversified funding through asset-backed lending and retail deposits from digital banks. New users start with small credit limits and short tenures through SPayLater on Shopee. Users with a strong repayment history can access larger loans with longer terms. This “low-and-grow” strategy, reminiscent of Nubank, has kept the 90-day non-performing loan (NPL) ratio stable at 1.2%. Average loans outstanding per user remain under $200, with short loan tenures.

The focus on off-Shopee loans, especially in Indonesia, has expanded credit use cases. Off-Shopee loans now make up over half the loan book there. Larger offline purchases, such as mobile phones, are a popular use case and will be expanded to other markets.

6. Financial Analysis

Revenue

Total revenue growth accelerated in 2024, increasing by 31% YoY to reach $4.33 billion, marking the fastest growth rate since Q1 2022. This was primarily driven by growth in GMV within e-commerce and digital financial services.

E-commerce revenue totaled $3.2 billion, with marketplace revenue up 43% and core marketplace revenue (from transaction fees and ads) rising 49%.

Digital Entertainment revenue declined by 16% to $498 million. This drop was due to lower recognition of accumulated deferred revenue from prior quarters, despite a rise in bookings during the period.

Revenue from Digital Financial Services grew by 38% YoY to $616 million, fuelled by growth in both consumer and SME credit businesses.

Gross Margin

The gross margin remained relatively stable at 43%, down slightly from 44% YoY but up from 42% QoQ. The YoY change mainly reflects shifts in the business mix.

Over the past twelve months, the Digital Entertainment division, which traditionally enjoyed a gross margin exceeding 70%, has reduced its share of total revenue from 18% in Q3 2023 to just 12% in Q3 2024. In contrast, e-commerce now constitutes 79% of revenue, up from 73% a year ago.

While e-commerce and Sale of Goods gross margins improved YoY, the overall gross margin saw a marginal decline due to the updated business mix.

Operating Margin

Operating income grew by 259% YoY, from -$128 million to $202 million, improving the operating margin from -4% to 5%.

Operating expenses rose 6% YoY, reaching $1.66 billion. Sales and Marketing (S&M) expenses, the most significant operating expense, comprised over half of the total. Notably, S&M expenses decreased by 4% YoY to $879 million, with S&M as a percentage of revenue dropping from 28% in Q3 2023 to 20%.

The effectiveness of 2023’s substantial S&M investments is becoming increasingly apparent in 2024. While S&M expenses rose by $104 million QoQ, revenue increased by $521 million—nearly a 5x return. In contrast, Q3 2023 saw a $424 million increase in S&M, yet revenue only rose by $215 million.

This quarter's figures show a record return on S&M spending, with each additional dollar generating significantly more revenue. Sea’s refined investment strategies, including improvements in ad tech that attract more sellers to paid ads and enhancements to SPX Express for better coverage and faster delivery, underscore their more targeted and efficient approach.

If S&M wasn’t the main driver of the increase in operating expenses, then what was?

Sea Money’s loans grew by 73% during the quarter, which led to a 48% increase in the provision for credit losses, totaling $212 million. The allowance for credit losses is calculated based on historical lifetime credit loss experience and adjusted for forward-looking factors specific to the receivable and economic environment. This increase is not due to a rise in non-performing loans (NPLs), as the NPL ratio remained stable at 1.2%. This ratio will be important to monitor in upcoming quarters.

Cash Flow Analysis

Sea generated over $2.2 billion in operating cash flow (OCF) in the first nine months of 2024, with over $1 billion generated in Q3 alone—likely due to the scaling of the credit business, which may inflate these figures. A full assessment will require the end-of-year cash flow statement.

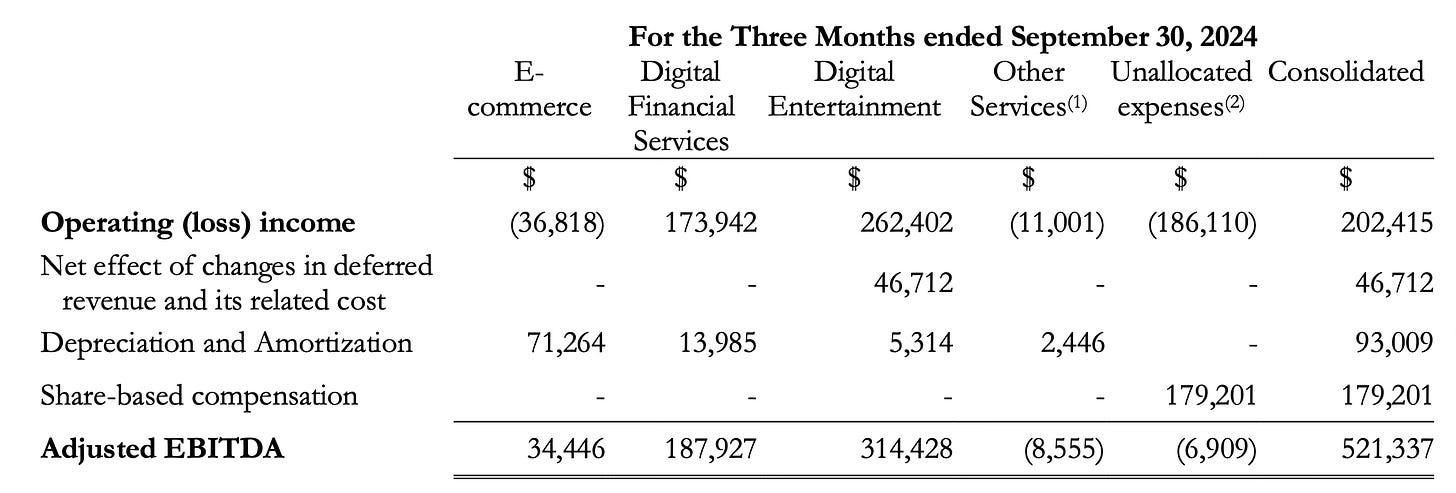

Using Q3 2024 Adjusted EBITDA as a proxy for OCF provides several insights:

Despite the continued decline in Digital Entertainment’s share of total revenue, it still generated $314 million in OCF, equating to over $1.2 billion on an annualized basis.

Digital Financial Services contributed 36% of total OCF, despite representing only 14% of total revenue.

E-commerce achieved breakeven on an OCF basis for the first time, as management forecasted last quarter.

For the first time, all three divisions are now profitable.

7. Guidance

Although management does not provide formal financial guidance, they disclosed that Shopee is on track for mid-20% YoY GMV growth and expect Free Fire’s full-year bookings to grow by over 30% YoY.

Ahead of the Q3 2024 earnings report, Wall Street analysts projected revenue of $16.02 billion (a 22% YoY increase) and an adjusted EPS of 1.93 for 2024. Given Sea’s 26% revenue growth year-to-date, it is likely analysts will revise these estimates upward.

8. Conclusion

This was an excellent quarter, with Sea experiencing high growth across all three divisions:

Shopee: Shopee is on track to achieve mid-20% GMV growth in 2024. With relatively low e-commerce penetration in many of its markets, Shopee is well-positioned for sustained growth as e-commerce adoption accelerates.

SeaMoney: SeaMoney’s loan book grew by over 70% this quarter while maintaining a stable NPL ratio. Strong synergies with Shopee’s user base and proprietary data provide unique advantages. Given the significant underserved demand, SeaMoney is well-positioned to expand its credit and financial services across the region.

Garena: Garena’s full-year bookings for Free Fire are expected to grow by over 30%. By expanding into new regions, adding localised content, and launching fresh titles, Garena is enhancing user engagement and market growth for its gaming portfolio.

Sea has undergone a remarkable transformation—from a high-growth, cash-burning company during the pandemic to a cost-cutting, profit-focused operation in 2023 with slower growth. Now, CEO Forrest Li has achieved what many thought impossible, returning the company to high growth while improving profitability. He deserves significant credit for this accomplishment.

The growth of Sea's advertising platform, which boosts the take rate, has aligned with my previous predictions. In the conference call, management attributed the improved ad take rate to several strategic initiatives:

Algorithm and System Revamp: Technical upgrades to the ad system have enhanced ad placement relevance, improving ad conversion rates and delivering better ROI for sellers.

Traffic Utilization Optimization: Improved algorithms provide more flexibility in balancing ads with organic results, increasing ad efficiency.

Seller Experience Enhancement: Updates to the ad interface have simplified adoption for sellers, expanding the seller base and increasing the range of ad-targetable products.

Management anticipates continued improvements over the coming quarters as these technological enhancements are rolled out across regions.

Another highlight in the report is the expanding logistics capabilities of SPX across Asia and Brazil, where SPX delivers over 50% and 70% of orders, respectively. Coverage is expected to grow in the coming quarters, and alongside this expansion, there is a strong focus on reducing costs and improving delivery quality. SPX has established a competitive advantage by driving efficiency across the logistics value chain:

First Mile: Cost efficiency improvements include optimized product pickup from sellers and enhanced seller readiness through better management of sellers and the fleet.

Sorting Centers: Increased automation and productivity-linked worker compensation have raised sorting efficiency.

Line Haul: Truck usage optimization is enhancing line-haul efficiency.

Last Mile: Innovations such as mobile last-mile hubs in remote areas and rider efficiency improvements, including route sequencing technology that accounts for traffic and user behaviour, allow riders to deliver more orders per trip.

In the broader picture, Shopee and SeaMoney increasingly resemble Mercado Libre’s Marketplace and Mercado Crédito. The e-commerce user base drives demand for fintech services, which in turn fuels greater e-commerce growth. SeaMoney’s growth, particularly through increased Shopee user penetration with products like SPayLater, creates a powerful flywheel effect.

Rating: 4 out of 5. Exceeds expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Thank you v much. Great work

Thanks for the update! Very strong results indeed.

Looks like there is a typo in the summary: gross orders growth is 24% yoy, not 40%.

What is a bit concerning is the yoy growth in G&A. I hope they don't become complacent again on the back of strong results and will not engage in excessive spending.

Also, 90+ NPLs may be non-meaningful given the short duration of the loans ("several months"). I'm not sure why they are not disclosing say 30+ NPLs. In addition to that, given the 70%+ yoy loan book growth, 90+ NPLs should naturally go down as there are lots of "fresh" loans that haven't had a chance to become non-performing yet.