Welcome back to The Wolf of Harcourt Newsletter!

Today, I analyse the Q4 2022 earnings report of Sea Limited (Ticker: SE), which was released on 7 March 2023.

In this report, I will cover the following:

Key Highlights

Wall Street Expectations

Digital Entertainment

E-commerce

Digital Financial Services

Income Statement

Balance Sheet

Cash Flow

Guidance

Conclusion

1. Key Highlights

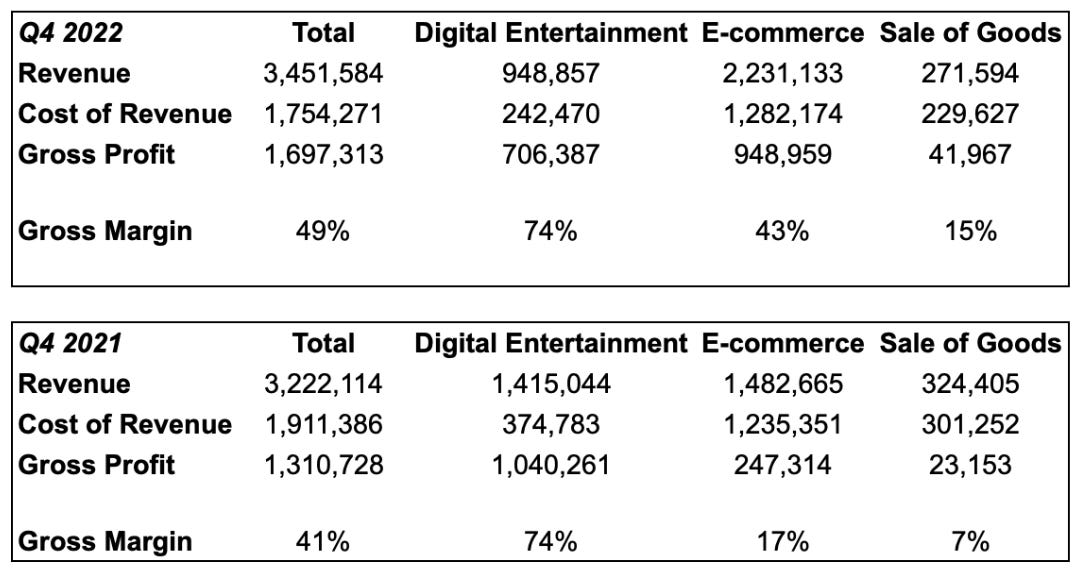

Revenue: $3.45 billion +7% year-over-year (YoY)

Digital Entertainment: $949 million -33% YoY

E-commerce: $2.23 billion +51% YoY

Sale of goods: $272 million -16% YoY

Gross Profit: $1.70 billion +30% YoY

Digital Entertainment: $706 million -32% YoY

E-commerce: $949 million +284% YoY

Sale of goods: $42 million +81% YoY

Net Income: $423 million compared to a loss of $616 million YoY

Adjusted EBITDA: $486 million compared to a loss of $492 million YoY

2. Wall Street Expectations

Revenue: $3.03 billion (beat by 14%)

Adjusted Earnings per Share: -0.75 (beat by 267%)

Source: Zachs

3. Digital Entertainment

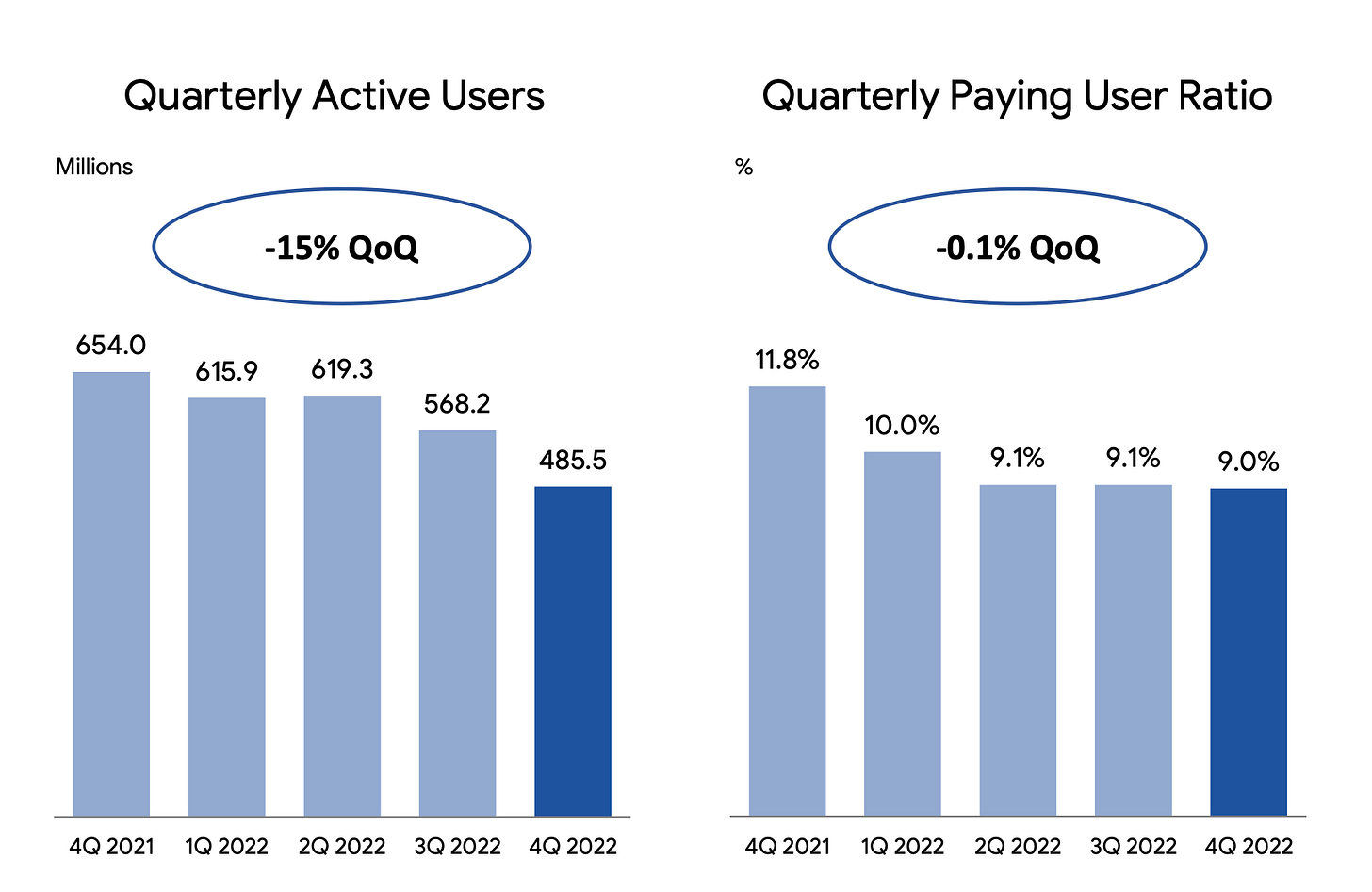

At the end of Q4 2024, quarterly active users (QAUs) reached 485.5 million, a decrease of 26% YoY. The quarterly paying user ratio also decreased from 11.8% to 9.0% YoY. What this ultimately means is that quarterly paying users fell by 43% from 77.2 million a year ago to 43.7 million for the fourth quarter of 2022. As you will see below, Sea changed the earnings disclosure so this had to be worked out independently.

Management have stated that ongoing moderation in user engagement and monetization is driving the weak performance. A significant driver of this has been the decision by the Indian government to ban the global hit game, Free Fire, in 2022 (Source).

4. E-commerce

Gross orders totalled 1.7 billion, an decrease of 1% YoY. Gross merchandise value (GMV) was $18 billion, a decrease of 1% YoY or an increase of 8% on a foreign exchange neutral basis (FXN). From Q1 2023, management will transition from quarterly to annual disclosure of these operating metrics.

App Annie reveals Shopee listed as the number one online shopping platform in Indonesia throughout 2022, with the highest number of downloads on Google Play and the Apple Store and active users monthly.

Moreover, SimilarWeb's data showed that the e-commerce platform Shopee had the highest number of visitors, with around 181 million per month, on average, in the last three months (October-December 2022).

Shopee continues to be the market leading platform for live selling in Southeast Asia.

5. Digital Financial Services

Management have really scaled back the disclosures related to Sea Money with no information provided related to mobile wallet total payment volume or quarterly paying users for mobile wallet services. This is frustrating as an investor. What we do know is that revenue for Digital Financial Services was $380 million for Q4 2022, up 93% YoY.

Sea Money is a highly synergistic part of the digital ecosystem. On the conference call management stated that:

Our mobile wallet has resulted in lower transaction costs and more stimulus transaction experience on Shopee. Shopee has allowed the mobile wallet to grow its user base and build user habits more efficiently. With Shopee, our credit business is able to leverage a large captive user base, a highly relevant use case with significant scale and the wealth of user insights for more effective underwriting.

Management also disclosed a change in loan write-off period in a certain market from 180 days to 120 days in the fourth quarter based on their assessment of historical credit losses. As a result, the non-performing loans past due by more than 90 days as a percentage of total gross loans receivable declined from less than 4% in the third quarter of 2022 to less than 2%. Without this change in write-off period, the ratio would be about 5%.

6. Income Statement

During the quarter, Sea grew its top line by 7% YoY. This is far removed from the 14 consecutive quarters of +100% revenue growth achieved at the end of 2022. This should not be a surprise to investors as CEO Forrest Li stated the intention to pivot to efficiency and profitability rather than growth at any cost.

Despite revenue only increasing by 7%, gross profit increased by 38% with gross margin improving from 41% to 49% YoY.

E-commerce continues to contribute the majority of revenue of the business. In fact, Digital Entertainment and Sale of Goods both experienced revenue declining during the quarter.

The increase in gross margin from 41% to 49% is a result of an increase in gross margins in all areas of the business (technically Digital Entertainment remained flat).

Why are margins improving?

E-commerce margins improved due to increased marketplace take rate. The implied take rate during Q4 2022 was 10.0% compared to 7.1% at Q4 2021. I expect Shopee to continue to exercise pricing power. They jacked up commission rates again as recently as January (Source). Management also cited cost efficiencies that contributed to the gross margin improvement. The short answer to the above is simply pricing power and economies of scale.

Operating expenses decreased by 23% to $1.35 billion during the quarter. The main driver here was sales and marketing expenses, which decreased by 61% to 474 million due to the efforts to optimize operating costs and achieving higher cost efficiencies. One of the key risks that I originally associated with Sea was its cash burn related to sales and marketing expenses. At one stage Sea was spending 98% of its revenue on sales and marketing expenses alone, which arguably meant that it was subsidising sales. The trend is moving in the right direction but faster than most anticipated so what else is contributing to it?

Management have been focusing on core business areas, streamlining operations, and deprioritising non-core initiatives. During 2022, Sea pulled out of a number of countries in Latin America including Argentina, Chile, Colombia and Mexico (Source). Even more recently, the company has pulled out of France, Spain and Poland in Europe (Source). Entering new markets incurs even more sales & marking expense than maintaining an existing presence. Pulling out of existing markets and not entering new markets (which Sea had been doing aggressively up until 2022) has contributed to the expedited sales & marketing expense ratio downward trend.

The walk from an operating loss of $442 million during Q4 2021 to an operating income of $343 million during Q4 2022 can be summarised as follows:

~$293m gross margin benefit due to pricing power and economies of scale

~$510m operating margin benefit due to reduction in sales & marketing on non-core initiatives

7. Balance Sheet

Observations

Over $7.5 billion in cash and cash equivalents down from $10.8 billion at Q4 2021.

Deferred revenue has decreased by over $1 billion to $1.54 billion. This relates to cash received upfront for revenue related to future periods and lines up with the overall slowdown in revenue growth.

Total Liabilities as percent of Total Assets is 66% up from 60% at Q4 2021.

Goodwill balance making up over 1% of total assets, which relates to a number of acquisitions. The decrease since Q4 2021 is a result of goodwill impairment due to strategic decisions to dispose of or shut down certain historical investments for the digital entertainment business.

Long-term debt (convertible notes) has decreased by 4% during 2022.

8. Cash Flow

Unfortunately, the reduced version of the cash flow statement means that the level of analysis here is limited.

What we do know is that Sea’s operating cash flow is improving. At Q4, quarter-to-date (QTD) cash flow from operations improved from -$305 million to +$320 million.

Sea’s QTD investing cash flow resulted in a surplus of $51 million compared to a deficit of $1.78 billion YoY.

Sea’s QTD financing cash flow resulted in a deficit of almost $514 million compared to a surplus of $386 million YoY.

Without a granular cash flow statement we are unable to determine the free cash flow that Sea generated.

9. Guidance

For the first time (that I can ascertain), management did not give any future guidance. When asked about the outlook for 2023, management said:

We’re aware of weakness - continued weakness in online physical consumptions by users across various markets, and in particular, some of the markets like Malaysia, as we previously also shared before, remain relatively -- in terms of year-on-year comparison, probably particularly relatively slow. And - but of course, previously, during COVID, some of these markets also happened to enjoy the strongest and the most spectacular growth during the COVID. So, it remains a tough comparison

Wall Street analysts are currently predicting revenue growth of 8.7% and earnings growth of 110.1% in 2023 (Source). However, I expect the earnings estimate to get revised upwards once the Q4 2022 surprise results have been fully digested.

10. Conclusion

Coming into this quarter, expectations for both the top line and bottom line were low. The speed of this turnaround to profitability in the space of one quarter is nothing short of phenomenal. Most analysts did not expect Sea to hit profitability until Q2 2023 at the earliest.

Digital Entertainment is still very profitable with a 42% operating margin. The decline in growth stemming from users and monetisation is a concern. Bookings which are an indicator of future demand declined 18% YoY suggesting the slowdown will continue into 2023.

E-commerce did the majority of the heavy lifting this quarter achieving an operating margin of 5% compared to -59% YoY. Over the next number of quarters we will really find out how strong of a moat Shopee possess. Are the network effects sufficiently strong such that merchants are prepared to take the commission rate increases on the chin or was this quarter simply a black swan event to the detriment of future growth and profitability?

Digital Financial Services remains the bright spot when it comes to revenue growth and I expect this to continue into 2023. Despite only accounting for 11% of total revenue during the quarter, this area posted a very health operating margin of 16%. Close attention should be paid to the credit losses going forward especially after the accounting change this quarter.

Finally, my two cents is that rather than trying to reach more people, Sea is seeking to make its current ones repeated buyers. This allows for a decrease in sales & marketing expenses on user acquisition. Once a consumer grows used to using one solution, you no longer have to advertise to them as heavily as before and their lifetime value increases.

Rating: 4 out of 5. Exceeds expectations.

Disclosure: The author holds a long position in Sea Limited.

Hit subscribe below if you have not already done so in order to receive the latest content straight to your inbox each week.

If you enjoy today’s edition, then feel free to share as it, it really helps.

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com