Sea: From Growth to Profit to Growth again?

Sea Limited (SE) Q2 2023 Earnings Analysis

Executive Summary

Digital Entertainment quarterly active users increased by 11% QoQ, and the quarterly paying user ratio improved from 7.7% to 7.9% QoQ. As a result, quarterly paying users increased by 14% to 43.1 million. Average bookings per user declined from $0.90 to $0.90 QoQ. All of these factors resulted in the segment revenue declining 2% QoQ.

E-commerce revenue increased 32% YoY driven by higher transaction-based fees and advertising revenue. The resulting increase in take rates has flowed directly to the bottom line resulting in segment gross margin expansion from 24% to 46%. On a sequential basis, revenue increased 2% QoQ suggesting that the YoY increase is entirely due to price increases rather than higher volumes.

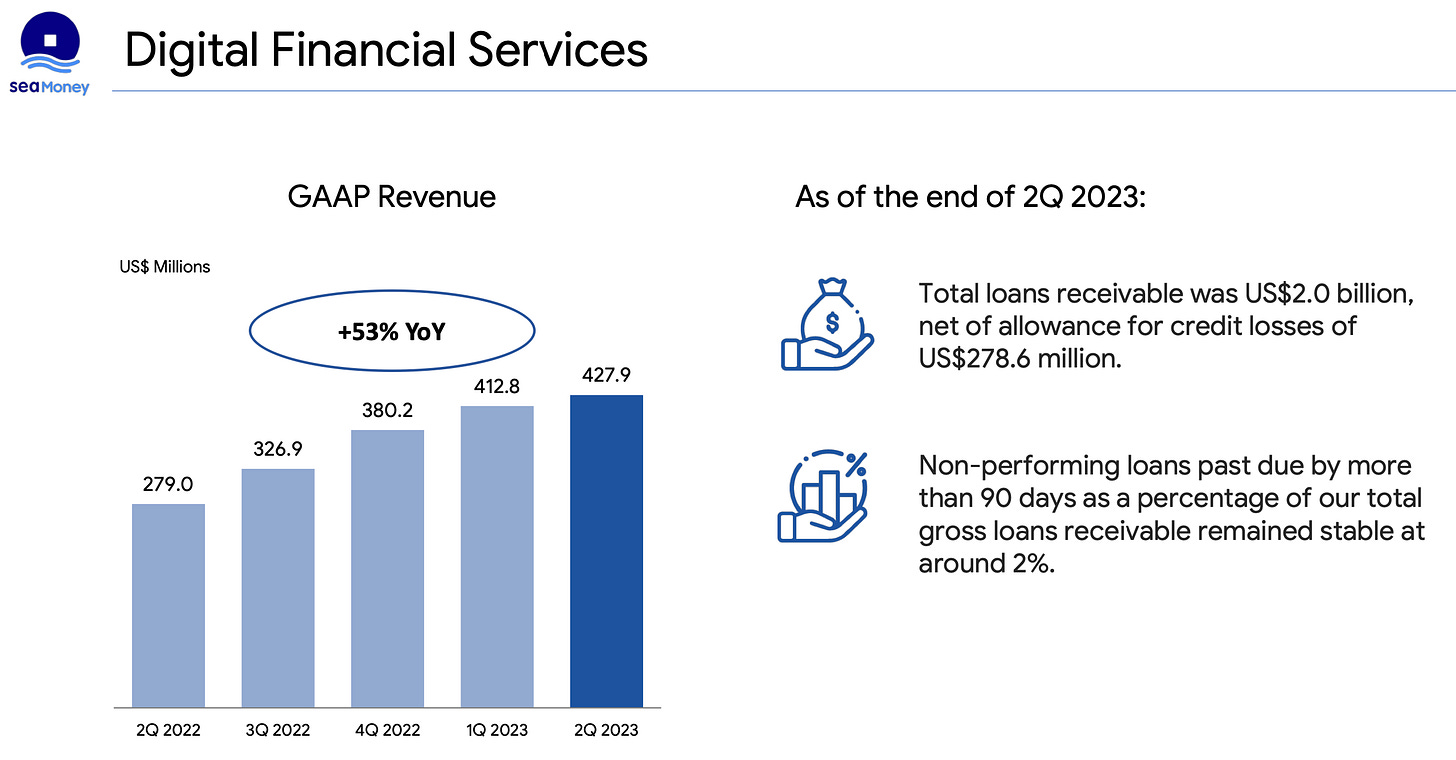

Digital Financial Services revenue reached $428 million, growing 53% YoY benefiting from the company's ability to tap into market demand and effectively offer financial services and products. The increasing synergy between SeaMoney and Shopee ecosystems is evident in their performance. SeaMoney maintained a low level of non-performing loans past due by more than 90 days, at around 2%.

Contents

Financial Highlights

Wall Street Expectations

Digital Entertainment

E-commerce

Digital Financial Services

Financial Analysis

Guidance

Conclusion

1. Key Highlights

Revenue: $3.10 billion +5% year-over-year (YoY)

Digital Entertainment: $529 million -41% YoY

E-commerce: $2.32 billion +32% YoY

Sale of goods: $244 million -15% YoY

Gross Profit: $1.45 billion +33% YoY

Net Income: $331 million compared to a loss of $931 million YoY

Adjusted EBITDA: $510 million compared to a loss of $506 million YoY

2. Wall Street Expectations

Revenue: $3.25 billion (miss by 5%)

Earnings per Share: 0.46 (beat by 17%)

3. Digital Entertainment

At the end of Q2 2023, quarterly active users (QAUs) reached 544.5 million, a decrease of 12% YoY. The quarterly paying user ratio also decreased from 9.0% to 7.9% YoY. What this ultimately means is that quarterly paying users (QPUs) fell by 23% from 56.1 million a year ago to 43 million for the second quarter of 2023. The total user base and paid user base both continue to shrink YoY.

The quarter-over-quarter trends are more positive with QAUs increasing 11% and the quarterly paying user ratio increasing from 7.7% to 7.9%. Based on this we can conclude that the management actions mentioned last quarter which included optimising various aspects of gameplay and game mechanics based on user feedback are paying off.

Another driver of this recovery has been the emergence of Garena Free Fire as the most downloaded title in June 2023, thanks in part to a crossover event with Spider-Man to celebrate the release of Spider-Man: Across the Spiderverse on June 2 (Source: Sensor Tower). The game achieved almost 19 million downloads, and proved to be a particular success in India, which accounted for 27.9% of downloads. This was followed by Indonesia with 12.7% and Vietnam with 8.1%. On the conference call, management noted that there had been growth in bookings for Free Fire for the first time in seven quarters.

QPUs is the single most important metric when looking at Digital Entertainment. Free users don’t pay the bills as I keep pounding the table about each quarter. The increase in QAUs and the quarterly paying user ratio has resulted in QPUs increasing by 14% from 37.9 million to 43 million QoQ.

You might think that Digital Entertainment is a legitimate turnaround. Later in this report, you will learn why this is not the case.

4. E-commerce

During Q2 2023, revenue increased by 21% YoY, reaching $2.1 billion. Core marketplace revenue grew by 38% to $1.2 billion, driven by higher transaction-based fees and advertising revenue. Adjusted EBITDA improved significantly, with a positive value of $150 million, compared to a loss of $648 million in the previous year.

Shopee's positive financial performance was attributed to increased monetization and improved operating cost efficiency. In the Asian market, they achieved an adjusted EBITDA of $204 million, a substantial improvement from a loss of $316 million in the same period last year. Adjusted EBITDA losses in other markets also narrowed considerably, reaching $54 million compared to $332 million previously. Brazil showed a significant improvement in contribution margin loss per order, improving by 83% YoY to $0.24, thanks to enhanced monetisation and higher efficiency in sales and marketing expenses.

On the conference call management noted that efforts have been concentrated on enhancing cost efficiency and user experience. Notably, they improved logistics efficiency, expanded their network, and introduced digital enhancements for order scheduling and tracking, resulting in a better delivery experience and lower costs. This operational advantage serves as a key competitive edge in their eyes.

They also bolstered user engagement, particularly through live streaming, which witnessed remarkable participation and satisfaction. The Shopee Affiliate Program has been instrumental in attracting more buyers, leading to tangible growth in GMV and revenue. They've successfully drawn in new users, including those from harder-to-reach areas, achieving a 10% increase in buyer net promoter score.

They continue to enhance seller support through upgraded services, training opportunities, and a broader product assortment. This comprehensive approach has contributed to their position as the first profitable e-commerce marketplace in Southeast Asia, priming them for long-term growth. As they turn towards reinvesting for growth again, early indications are positive, with over 10% growth in gross orders driven by active buyers and purchase frequency.

5. Digital Financial Services

SeaMoney's performance in the second quarter of 2023 showed significant growth once again. Revenue reached $428 million, a 53% increase compared to the previous year. The adjusted EBITDA improved to $137 million, a substantial improvement from a loss of $112 million in the same period of 2022. This strong performance was attributed substantial growth in its features and product offerings. The synergy between SeaMoney and Shopee ecosystems is becoming increasingly evident, providing mutual benefits and opportunities for expansion.

SeaMoney's progress is leading to improved access to financial services and products for underserved segments within its markets. This emphasis on inclusivity aligns with broader goals of providing financial opportunities to a wider population.

SeaMoney maintained a healthy risk profile, with non-performing loans past due by more than 90 days at a relatively low level of around 2%. SeaMoney's ongoing efforts to refine risk policies related to customer credit and selection underscore their commitment to responsible lending. The company's approach to diversify funding sources by engaging with third parties for credit business supports sustainable growth while managing risks effectively.

The user-friendly UI and UX design of SeaMoney's bank app have led to high user ratings of 4.8 stars on both Apple and Google app stores. This positive reception underlines the effectiveness of their design choices and efforts to create a seamless user experience.

6. Financial Analysis

Sea grew revenue by 5% YoY driven by the improved monetization in e-commerce and digital financial services businesses. The revenue trend is more worrying for two other reasons:

Wall Street analysts had expected revenue growth of 10%

Sequentially revenue only increased 2% QoQ

Koyfin is the tool that I use to screen and analyse stocks. In my opinion, it is the most comprehensive financial data and visualisation tool that makes the research process so much easier for investors. If you would like to try it for yourself, follow the link below to receive a 10% discount.

Despite revenue only increasing by 5%, gross profit increased by 33% with gross margin improving from 37% to 47% YoY.

E-commerce continues to contribute the majority of revenue of the business. Digital Entertainment and Sale of Goods both experienced revenue declining during the quarter.

Despite the increase in QPUs during the quarter, Digital Entertainment revenue still declined 2% QoQ (Q1 2023: $540 million). How is this possible if there are more paying users? The answer is because average bookings per user have declined from $0.90 in Q1 2023 to $0.80 in Q2 2023. While the number of paying users has increased, the quality has continued to decrease.

Similarly, while E-commerce revenue increased by 32% YoY, it only increased 2% QoQ. My theory is that the YoY revenue increase is entirely driven by price increases rather than volume increases. This will not be sustainable in the long-term if accurate. What’s more, management decided to stop disclosing Gross Orders and Gross Gross merchandise value at the start of this year. Makes you wonder.

The increase in gross margin from 37% to 47% is a result of the E-commerce gross margin almost doubling from 24% to 46%. Sale of Goods gross margin increased modestly but Digital Entertainment gross margin remained relatively steady at 70%.

E-commerce margins improved due to increased monetization and greater cost efficiencies.

Operating expenses decreased by 39% to $1.17 billion during the quarter. The main driver here was sales and marketing expenses, which decreased by 49% to 494 million due to the continued efforts to optimise operating costs and achieving higher cost efficiencies.

Provision for credit losses increased 37% to $153 million driven by expansion to a broader user base and the growth of the loan book.

The walk from an operating loss of $837 million during Q2 2022 to an operating income of $284 million during Q2 2023 can be summarised as follows:

~$304m gross margin benefit primarily due to higher transaction-based fees and advertising

~$640m operating margin benefit primarily due to continued cost optimisation and efficiencies

~$177m goodwill impairment benefit due to nil impairment in Q2 2023

Cash Flow Analysis

Sea’s operating cash flow is showing rapid improvement. At Q2, year-to-date (YTD) cash flow from operations improved from -$1.21 billion to +$1.2 billion. This represents an operating cash flow margin of 20% which is really impressive considering the focus on profitability is less than one year old.

One item of interest in the operating cash flow statement is share based compensation (SBC) which decreased 2% YoY to $180 million. Last year, management shifted from cash bonuses to SBC due to the focus on profitability. It is positive to see the SBC remain relatively consistent YoY.

Sea’s YTD investing cash flow resulted in a deficit of $2.87 billion compared to a deficit of $2.08 billion YoY.

Sea’s YTD financing cash flow resulted in a surplus of almost $59 million compared to a surplus of $142 million YoY.

Not only has Sea posted two quarters in a row of positive FCF but last twelve months (LTM) FCF is also positive for the very first time. Sea is therefore self-sufficient with no requirement for external sources of funding.

7. Guidance

Management did not give any future guidance. Wall Street analysts are predicting revenue growth of 5.6% for 2023 and EPS of 1.19. After the Q1 earnings report, Wall Street analysts had expected 8.2% revenue growth for 2023 resulting in a significant downgrade.

8. Conclusion

The positives.

Operating margins for all segments have improved enormously, swinging negative to positive for E-commerce and Digital Financial Services.

Secondly, Sea is now entirely self sufficient as evidenced by the FCF trends.

The negatives.

The underlying E-commerce business is now a worry. This segment only grew 2% QoQ. There is now a real concern that the revenue growth is almost entirely due to price increases and not volume increases which is not sustainable. We have seen the Sales & Marketing budget slashed and growth grind to a halt. Does Shopee have an underlying competitive advantage when it comes to fulfillment or was the Sales & Marketing budget simply subsidising sales?

Despite the increase in QAUs and QPUs, Digital Entertainment is still in trouble. Management have tried to draw attention to the fact that QAUs and the quarterly paying user ratio have increased QoQ. On the face of it this is good but under the hood revenue has still decreased QoQ because the paying users are spending even less. You can have all of the active users in the world but if the paying users and spend per user moves in the wrong direction these active users are worthless.

On the conference call CEO Forres Li said:

“We have started, and will continue, to ramp up our investments in growing the e-commerce business across our markets. Such investments will have impact on our bottom-line and may result in losses for Shopee and our group as a whole in certain periods”

I contrast this profit versus growth yo-yo approach from Sea with the consistent profitable growth approach from MercadoLibre.

After this quarter, I come away with a lot more questions rather than answers.

Rating: 2 out of 5. Not meeting expectations.

Disclosure: The author holds a long position in Sea Limited.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com