Executive Summary

Digital Entertainment revenue decreased by 15% YoY. Quarterly active users reached 594.7 million, growing by 21% YoY, while quarterly paid users increased by 29% YoY to 48.8 million. The increase in the quarterly paying user ratio contributed to the highest number of quarterly paying users since Q3 2022. Garena's bookings experienced continued positive trends, reaching $512 million, with Free Fire showing a resurgence.

E-commerce revenue growth accelerated to 33% YoY, driven by higher transaction-based fees and advertising revenue. Gross orders reached 2.6 billion, a 56% YoY rise. Gross Merchandise Volume for the quarter was $23.6 billion, showing a 36% YoY increase and the fastest growth in two years. Despite the growth in GMV and orders, the consistent take rate of 10% YoY indicates positive customer satisfaction and stable revenue generation.

Digital Financial Services revenue reached $499 million, growing by 21% YoY, driven by growth in both user acquisition and loan volume. Active users for loans surged by 42% YoY to over 18 million, with the total loan principal reaching $3.3 billion, reflecting a 29% YoY growth. Notably, loans not tied to Shopee now represent over 40% of the total loans, indicating expansion opportunities beyond the Shopee platform.

The gross margin remained consistent on a quarterly basis at 42% but dropped YoY due to changes in the business mix and declines in gross margin across all segments. The Digital Entertainment division, historically high-margin, decreased in revenue share, while e-commerce became a larger portion of total revenue.

Operating expenses increased by 15% YoY, driven primarily by a significant rise in Sales and Marketing expenses. However, there has been a reduction in Sales and Marketing expenses QoQ, attributed to better user engagement from previous investments in live streaming. Despite recording a Q1 operating profit, the company reported a net loss primarily due to income tax expenses. Despite operating at breakeven, Sea recorded operating cash flow of $468 million with Shopee approaching positive cash flow faster than most anticipated.

Contents

Financial Highlights

Wall Street Expectations

Digital Entertainment

E-commerce

Digital Financial Services

Financial Analysis

Guidance

Conclusion

1. Key Highlights

Revenue: $3.73 billion +23% year-over-year (YoY)

Digital Entertainment: $458 million -15% YoY

E-commerce: $2.95 billion +31% YoY

Sale of goods: $326 million +35% YoY

Gross Profit: $1.55 billion +10% YoY

Net Loss: $23 million vs net income of $87 million YoY

Adjusted EBITDA: $401 million -21% YoY

2. Wall Street Expectations

Revenue: $3.62 billion (beat by 3%)

Earnings per Share: 0.03 (miss compared to (0.04))

3. Digital Entertainment

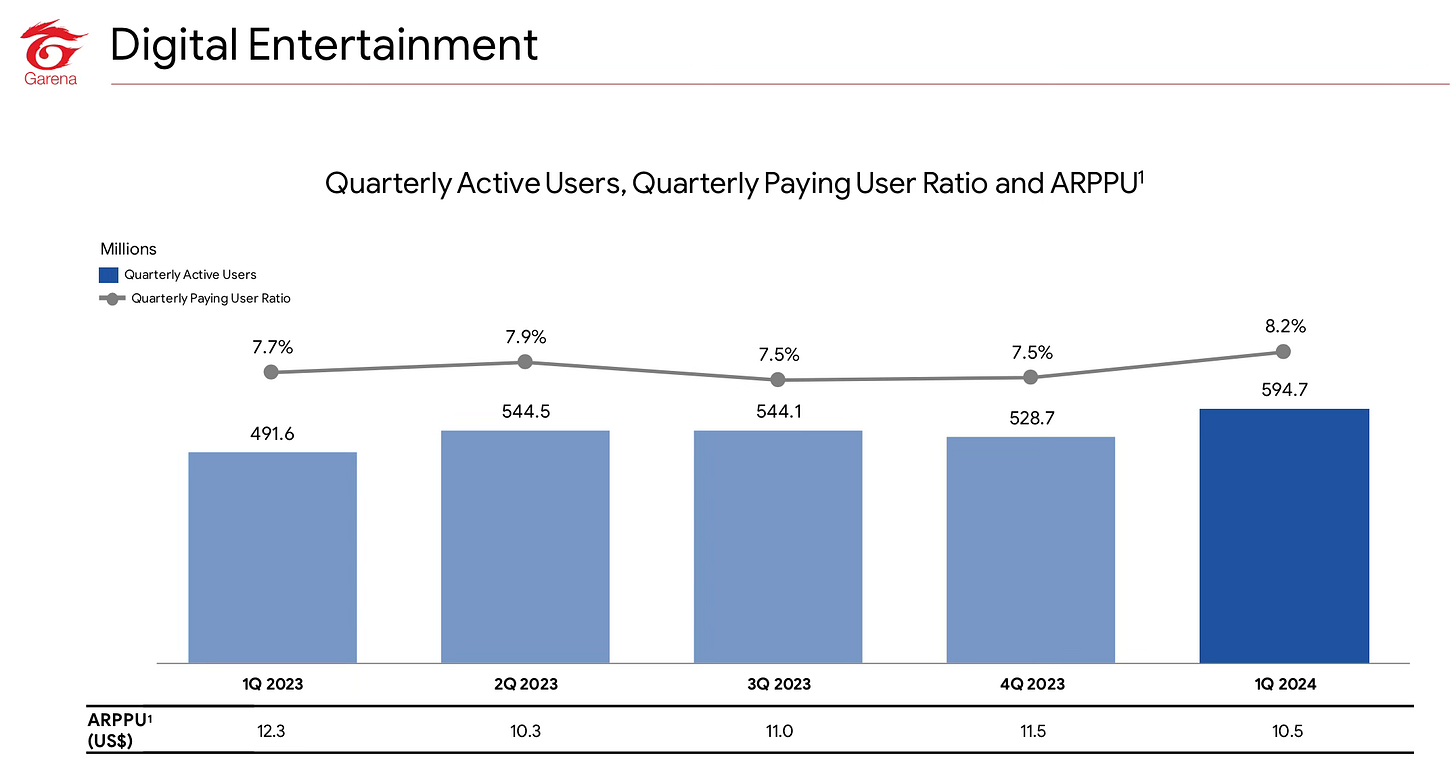

At the end of Q1 2024, quarterly active users (QAUs) reached 594.7 million, growing 21% year-over-year (YoY). Additionally, the quarterly paying user ratio increased from 7.7% to 8.2% YoY. This ultimately led to a 29% increase in quarterly paying users (QPUs), rising from 37.9 million a year ago to 48.8 million in the first quarter of 2024. Both the total user base and the paid user base grew for the first time since Q4 2021.

QPUs is the most crucial metric when appraising Digital Entertainment. The increase in the quarterly paying user ratio resulted in a 23% QoQ increase in QPUs, rising from 39.7 million to 48.8 million. The number of QPUs is the highest it has been since Q3 2022. Last quarter, I concluded that the bottom was in for QPUs, and this has proved exactly the case.

Garena's bookings reached $512 million, reflecting an increase of 11% YoY and 12% QoQ. This marks the third consecutive quarter of positive trends in gross bookings. Average bookings per user were flat QoQ at $0.86 but declined by 9% from $0.94 YoY.

Q1 2024 could be termed the resurgence of Free Fire, as average Monthly Active Users (MAU) increased by 24% YoY, maintaining its status as one of the largest mobile games globally by user scale. The game's continuous appeal to new users is highlighted by it being the most downloaded mobile game worldwide during this period, according to Sensor Tower. Key strategies contributing to sustained player engagement include the frequent introduction of new play modes, redesigns, and content updates. Notable updates include the successful "Chaos" version in January 2024, which allowed player voting for key events, and the "Mechadrake" version in April 2024, introducing a cooperative mode against a mechanical monster alongside the traditional PvP gameplay.

On the conference call, management confirmed that they are expecting double-digit growth for the year. After an initial decline in gaming activity post-COVID, there has been a resurgence in gamer engagement.

4. E-commerce

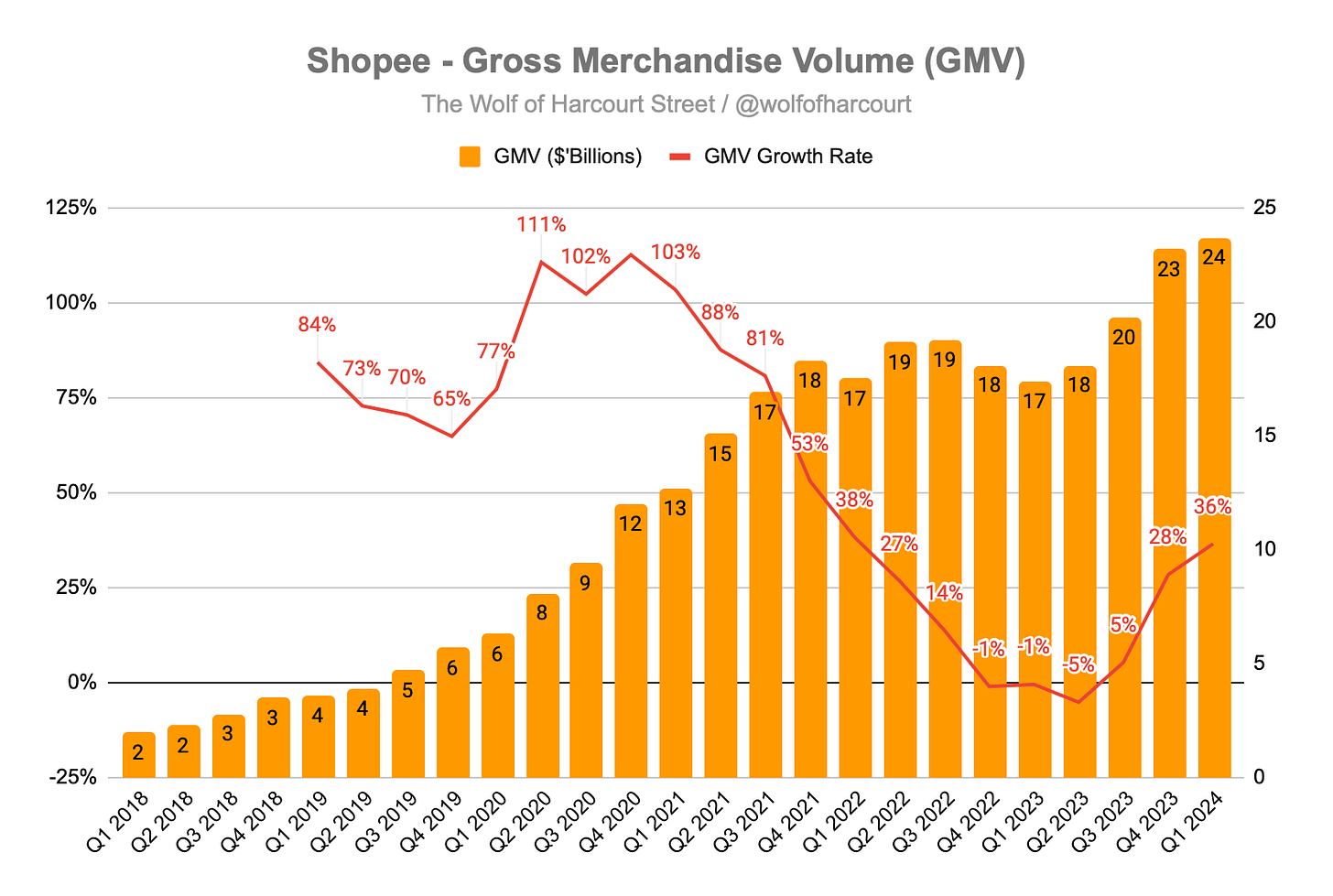

Shopee witnessed a substantial rise in gross orders, totaling 2.6 billion, reflecting a 57% YoY increase. Additionally, Gross Merchandise Volume (GMV) for the quarter amounted to $23.6 billion, showing a 36% YoY increase. The GMV growth experienced in the quarter was the fastest growth in two years.

After transitioning to annual disclosure of GMV and Gross Orders at the end of 2022, management reverted to disclosing these metrics again in Q3 2023. This quarter, they also disclosed the GMV for Q1 and Q2 2023, which had not previously been disclosed. At the time, I cynically questioned if this decision was made to mask poor underlying performance. This skepticism was validated as GMV declined by 1% and 5% respectively during these periods. While it is reassuring to see a U-shaped recovery to growth, I can’t help but feel a breach of trust by management due to the lack of transparency during this period. Management needs to own the metric and not withhold it when it doesn't suit their narrative. Rant over.

Based on a GMV of $23.6 billion and marketplace revenue of $2.4 billion, the implied take rate is 10.2%, which is consistent with Q4 2023 and Q1 2023. The fact that the take rate has remained consistent YoY while GMV and Gross Orders have grown significantly is a positive sign of customer satisfaction.

Q1 marked the highest ever quarterly performance in terms of orders and GMV. Looking ahead, management focused on three operational priorities for 2024:

Enhance price competitiveness

Strengthen its content ecosystem

Improve service quality for buyers

The company’s logistics capabilities, particularly through SPX Express, are proving to be a key differentiator. Approximately 70% of SPX Express orders in Asia are delivered within three days, with significant cost reductions per order: 15% in Asia and 23% in Brazil YoY. The return-and-refund process has been streamlined, with Shopee directly managing it. This has led to a 30% YoY decrease in resolution times, with about 45% of cases resolved within one day. It is clear that investments in logistics infrastructure are already paying off.

By managing their logistics in-house rather than relying on third-party logistics (3PL), the company achieves better unit economics due to several strategic advantages. These advantages include retaining the margin typically taken by 3PLs, improved capital expenditure planning through better business forecasting, enhanced day-to-day operational efficiency through precise short-term volume forecasts, the ability to optimize seller behaviors to streamline logistics, and leveraging technology for supply chain optimization. Additionally, the company can integrate new consumer services cost-effectively by controlling end-to-end planning across the marketplace.

In response to an analyst's question on the conference call, management revealed that the long-term competitive advantage for Shopee is focused on three areas:

Cost Efficiency: Emphasizing lowering the cost to serve buyers and sellers.

Price Competitiveness: Ensuring product prices on the platform are better than competitors by working closely with sellers and the supply chain.

Service Quality: Improving delivery, returns, and customer service to enhance the overall user experience.

5. Digital Financial Services

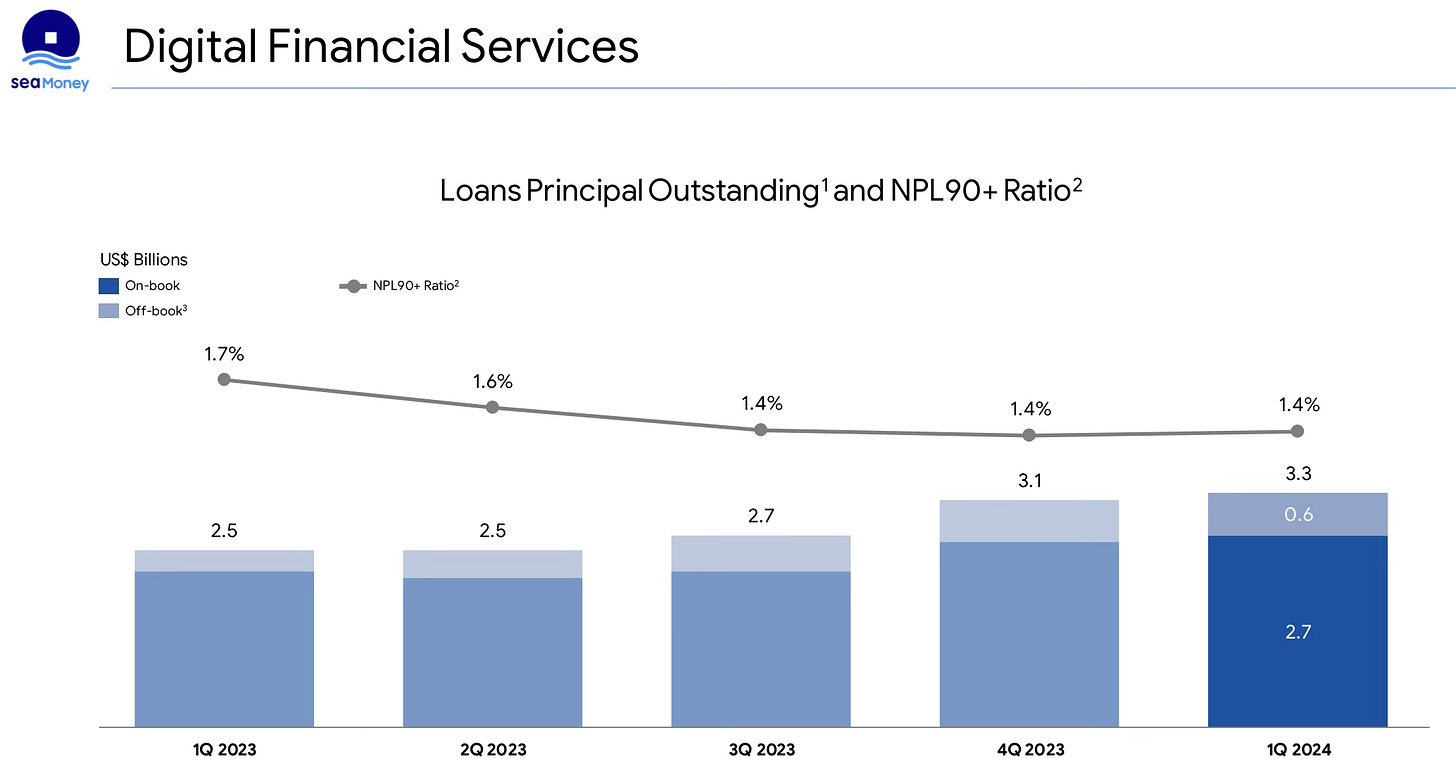

SeaMoney continues to experience growth in both user acquisition and loan volume. In 1Q 2024, the number of active users for these loans rose by 42% YoY to over 18 million, and the total principal of these loans reached $3.3 billion, marking a 29% YoY and 5% QoQ growth.

Notably, loans not tied to Shopee now constitute over 40% of the total loans, highlighting growth opportunities beyond Shopee. SeaMoney's prudent risk management is evidenced by the stable non-performing loan (NPL) ratio of 1.4%, achieved by continuously refining risk models with more user data across different markets. This approach ensures business growth while maintaining robust risk control.

6. Financial Analysis

Revenue

Sea’s total revenue grew by 23% in Q1 2024, reaching $3.73 billion compared to $3.04 billion in the same quarter of 2023. This was the fastest quarter of revenue growth since Q2 2022.

Digital Entertainment saw a decline in revenue of 15%, falling to $458 million from $540 million in Q1 2023. This decrease was primarily due to lower recognition of accumulated deferred revenue from previous quarters, despite an increase in bookings during the first quarter of 2024.

E-commerce achieved revenue of $2.75 billion, representing a 33% YoY growth. Core marketplace revenue, driven by transaction-based fees and advertising revenues, saw a significant 47% YoY increase. Value-added services revenue, mainly related to logistics services, experienced growth of 8% YoY.

Digital Financial Services, which was surpassed by e-commerce as the fastest-growing area, increased revenue by 21% YoY, reaching $499 million. This growth was primarily attributed to the expansion in both the consumer and SME credit businesses.

Gross Margin

The gross margin remained consistent on a QoQ basis at 42% but dropped YoY from 47%. There are two primary reasons for this shift. Firstly, the business mix has undergone significant changes over the past twelve months. The Digital Entertainment division, historically boasting a gross margin exceeding 70%, decreased from 18% of total revenue in Q1 2023 to just 12% in Q1 2024. E-commerce now constitutes 79% of revenue, up from 74% one year ago.

Secondly, the gross margin for all three segments declined. Digital Entertainment slid from 68% to 66%, e-commerce from 45% to 42%, and the sale of goods more than halved from 13% to 5%.

Operating Margin

Operating expenses experienced a 15% YoY increase, amounting to $1.48 billion. The primary driver behind this rise was Sales and Marketing (S&M) expenses, which surged by 92% YoY, reaching $770 million. In Q1 2024, Sea allocated 21% of its revenue to S&M expenses, up from 13% in Q1 2023. However, this is a significant decrease from the 27% of revenue allocated to S&M expenses in Q4 2023.

During the conference call, management revealed that S&M expenses have been reduced QoQ due to the benefits from previous investments resulting in better user engagement (UE) from live streaming. Live streaming volumes are growing, with significant improvements in UE across various markets. The company expects continued improvement in UE for live streaming in future quarters. This trend of reduced spending is expected to continue, although month-to-month fluctuations may occur due to reasons like foreign exchange variations. Regarding the overall S&M strategy, management noted that various products are in early stages with significant growth potential. Marketing spend is strategic and depends on customer acquisition costs, user engagement, and new product launches.

After several quarters, we can now assess the efficiency of the S&M investments made in 2023. In Q1 2024, S&M expenses decreased by $198 million compared to the previous quarter, while revenue increased by $118 million. This contrasts with Q3 2023, during which S&M expenses increased by $424 million, but revenue only increased by $215 million. Sea invested in growth throughout 2023 to develop its logistics infrastructure, and it is now reaping the benefits of this investment.

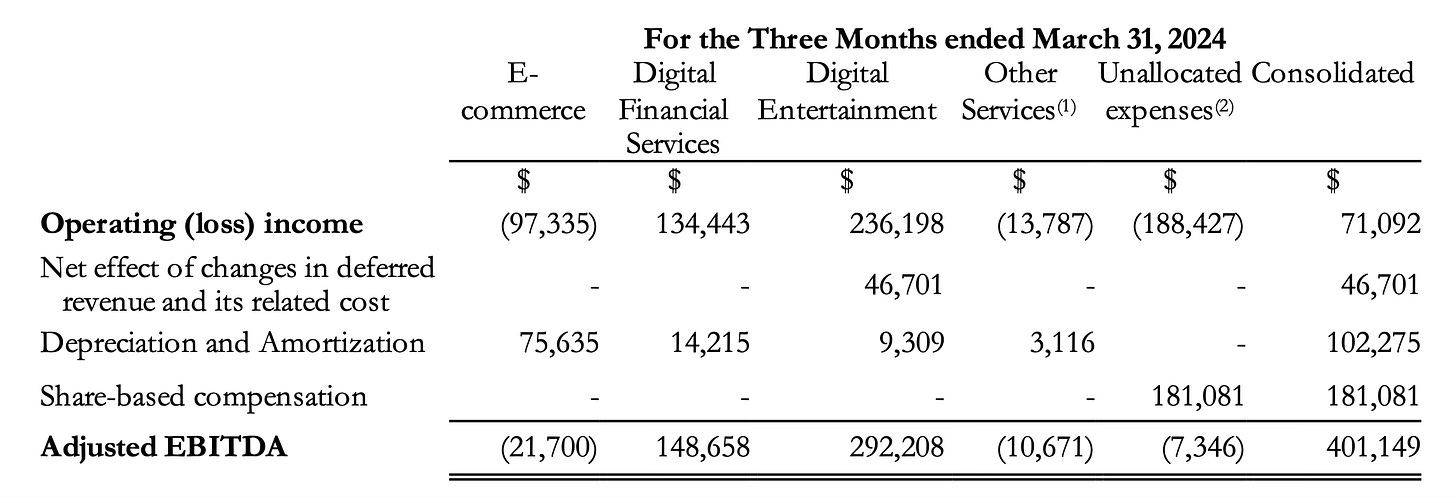

Sea recorded a Q1 operating profit of $71 million compared to $125 million YoY. The company reported a net loss of $23 million, primarily due to $79 million in income tax expenses.

Cash Flow Analysis

Despite essentially operating at breakeven during the quarter, Sea still recorded operating cash flow (OCF) of $468 million while growing revenue +20%. It is important to frame this in the context of profitable growth. In Q1 2023, Sea recorded $606 million in OCF but only grew revenue by 5%.

If we take Adjusted EBITDA as a proxy for OCF, two things immediately stand out.

Despite Digital Entertainment being referred to as a "melting ice cube," it recorded almost $300 million in OCF. On an annualized basis, this would exceed $1 billion in OCF. This is a significant return for an area expected to return to double-digit growth in 2024.

Shopee is nearly at breakeven on an OCF basis and is expected to be positive later in 2024, possibly as early as mid-2024. This is much quicker than the market had expected, as most analysts anticipated Shopee to continue burning cash in 2024.

7. Guidance

Management did not provide specific financial guidance, but it's worth tracking how the Wall Street consensus estimates have changed. Following the Q4 2023 earnings report, analysts projected a revenue growth of 15% for 2024 and an adjusted EPS of 1.77. However, prior to the Q1 earnings report, analysts revised these estimates upward to 17% revenue growth and an adjusted EPS of 1.67. I anticipate analysts will further adjust these estimates upward once they have fully digested the Q1 results.

8. Conclusion

This quarter marked one of Sea's best performances in several years. Regular subscribers will recall my anticipation of this inflection point and a return to growth, which was indeed materialised this quarter. The company reported substantial growth across all fronts while maintaining positive cash flow. While anyone can achieve growth by burning money, Sea has demonstrated that the infrastructure investments made in 2023 are yielding tangible competitive advantages.

Garena, once the cash cow, experienced a concerning decline, but the tide is now turning. Not only did total users increase, but so did user engagement, particularly among paid users. This uptick is expected to drive revenue growth in the upcoming quarters, supported by robust bookings growth. Despite being previously dismissed as a dead business by many, Garena is now poised to generate $1 billion in cash flow in 2024.

Shopee, despite operating at breakeven, achieved an impressive 36% growth in GMV. However, the take rate remains at just 10%, indicating an under-monetized advertising platform. There is significant potential to increase the ad take rate, as evidenced by comparable platforms in other markets.

We also see there's a meaningful room on the ad take rate that we can look at. I think I shared this in the previous call as well that we believe that our ad take rate is still slightly lower than the peers that we see in other markets. So there is some meaningful room there.

If Shopee could increase the take rate by an additional 2% from advertising, it could result in an extra $470 million in high-margin advertising revenue. Amazon and MercadoLibre offer a guide as to how this could play out.

SeaMoney continues to produce +20% growth while producing strong profit and cash flow with the credit businesses, particularly Shopee PayLater (SPL), being a significant contributor. SPL is growing alongside Shopee and achieving better penetration over time. The fly wheel effect.

Rating: 4 out of 5. Exceeds expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Thanks for the great update on Sea!

Good stuff Wolf, thanks for the work on $SE.

What do you think of Tiktok, Temu and the likes impacting Shopee future? I am considered an old dog now, my family uses Shopee for many years so sticking to the UI UX but wonder what make younger generations choose one over the other?

Thoughts on slowing growth on SeaMoney?