Executive Summary

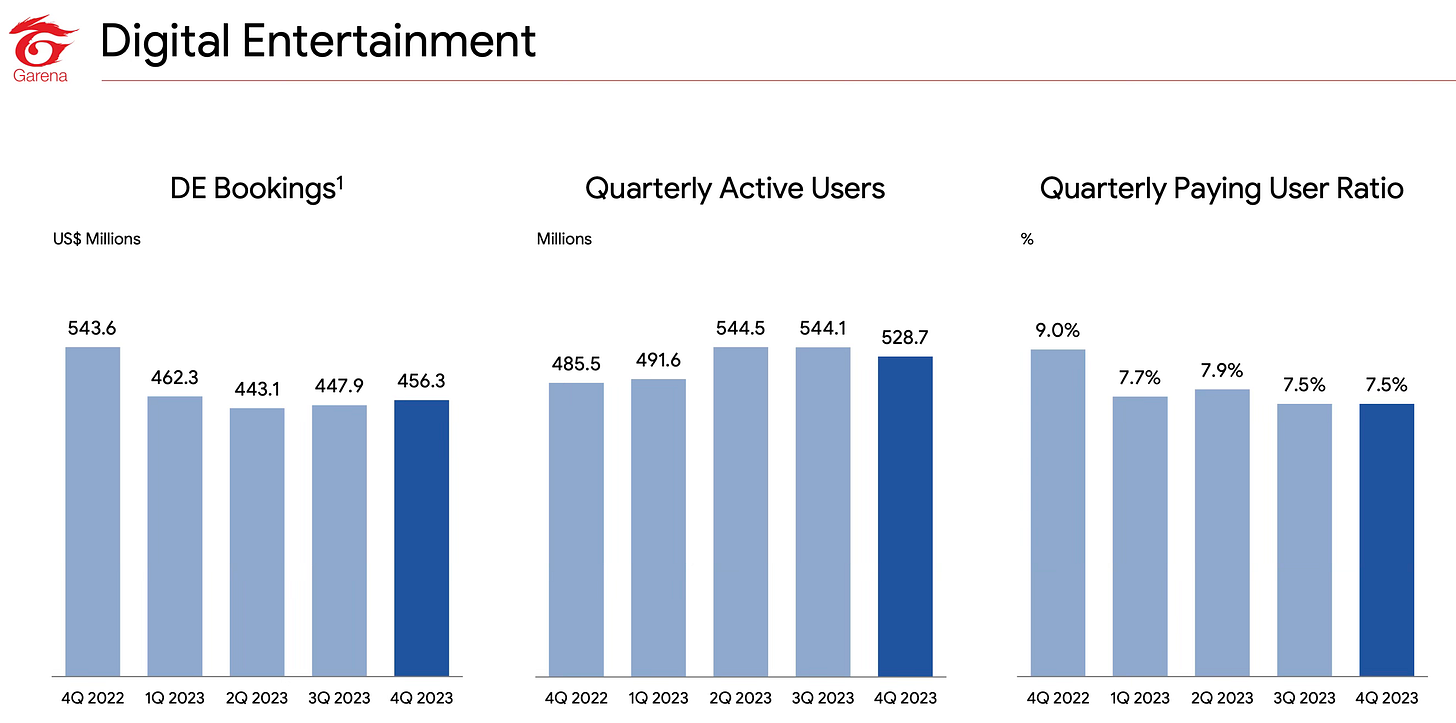

Digital Entertainment revenue decreased 46% YoY. Quarterly active users increased by 8% YoY but the quarterly paying user ratio deteriorated from 9%% to 7.5% YoY. As a result, quarterly paying users decreased by 9% to 39.7 million. However, average bookings per user grew 5% to $0.86 along with 2% bookings growth QoQ.

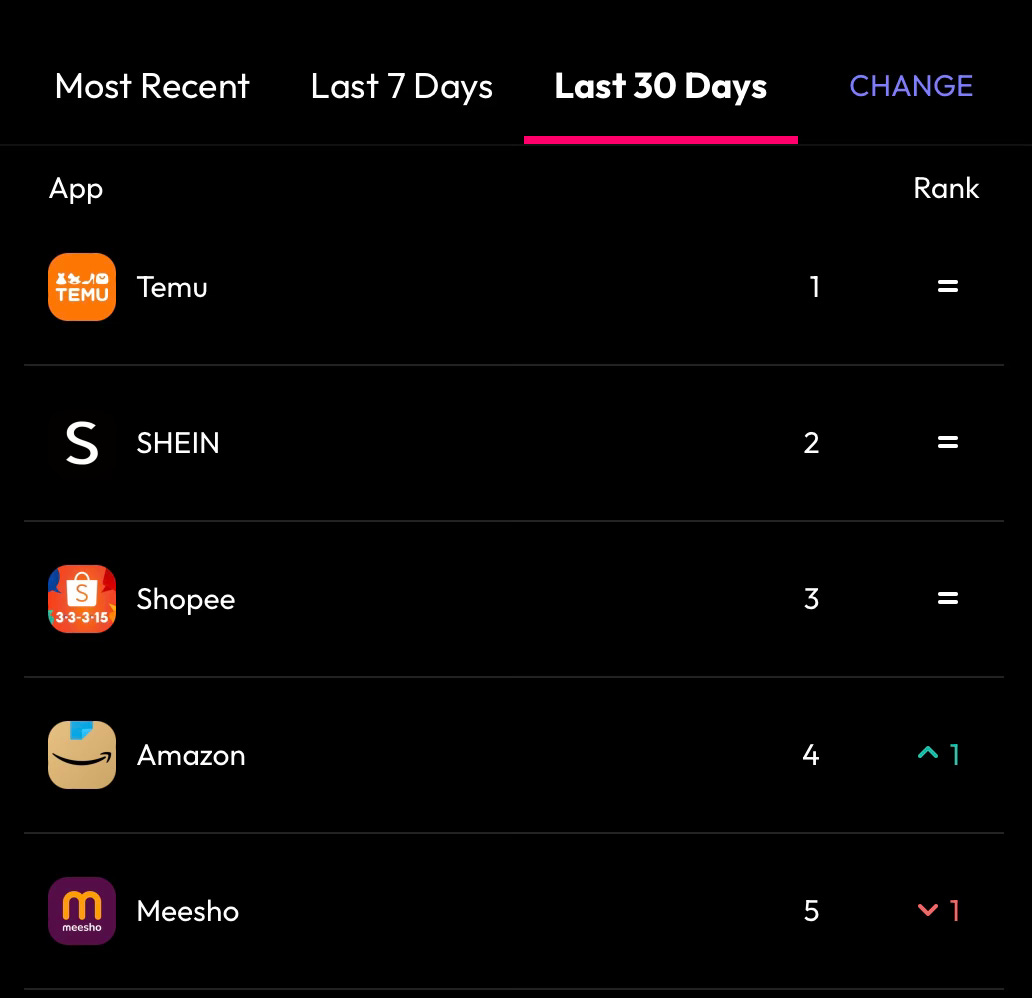

E-commerce revenue growth accelerated to 23% YoY driven by higher transaction-based fees and advertising revenue. Gross orders reached 2.5 billion, a 46% YoY increase, and a 13% QoQ rise. Gross Merchandise Volume (GMV) for the quarter was $23.1 billion, showing a 29% YoY increase and a 15% QoQ rise. The implied take rate remained consistent at 10% compared to the prior year period.

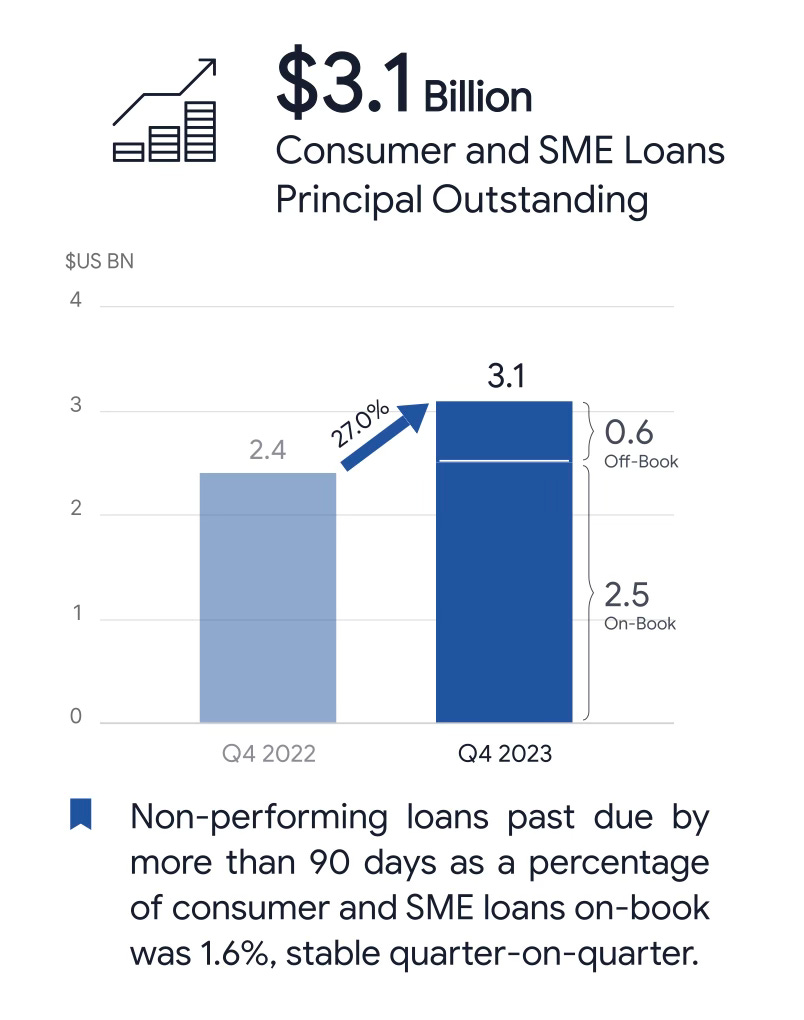

Digital Financial Services revenue reached $472 million, growing 24% YoY driven by successful consumer and SME credit operation. The consumer and SME loan principal reached $3.1 billion, with active users exceeding 16 million, marking a 27% and 28% YoY increase, respectively.

The gross margin contracted from 49% to 42%, mainly due to changes in the business mix, with Digital Entertainment's weight dropping from 27% to 14%. In addition, all segments experienced a decline in gross margin. The reduction in Digital Entertainment's margin is attributed to a decreasing number of QPUs, impacting revenue-generating activities. The e-commerce margin drop was influenced by factors like product mix, cost pressures, and market dynamics.

Substantial investment in logistics included opening five new sorting centers and 385 first- and last-mile hubs, resulting in a 12% YoY decrease in logistics cost per order in Asia. Notable improvements in delivery speed were observed in Indonesia with more than half of Java orders delivered within two days. Despite incurring a net loss of $110 million, Sea achieved an impressive operating cash flow of $279 million, reflecting strategic reinvestment from digital entertainment and financial services divisions into e-commerce infrastructure.

Contents

Financial Highlights

Wall Street Expectations

Digital Entertainment

E-commerce

Digital Financial Services

Financial Analysis

Guidance

Conclusion

1. Key Highlights

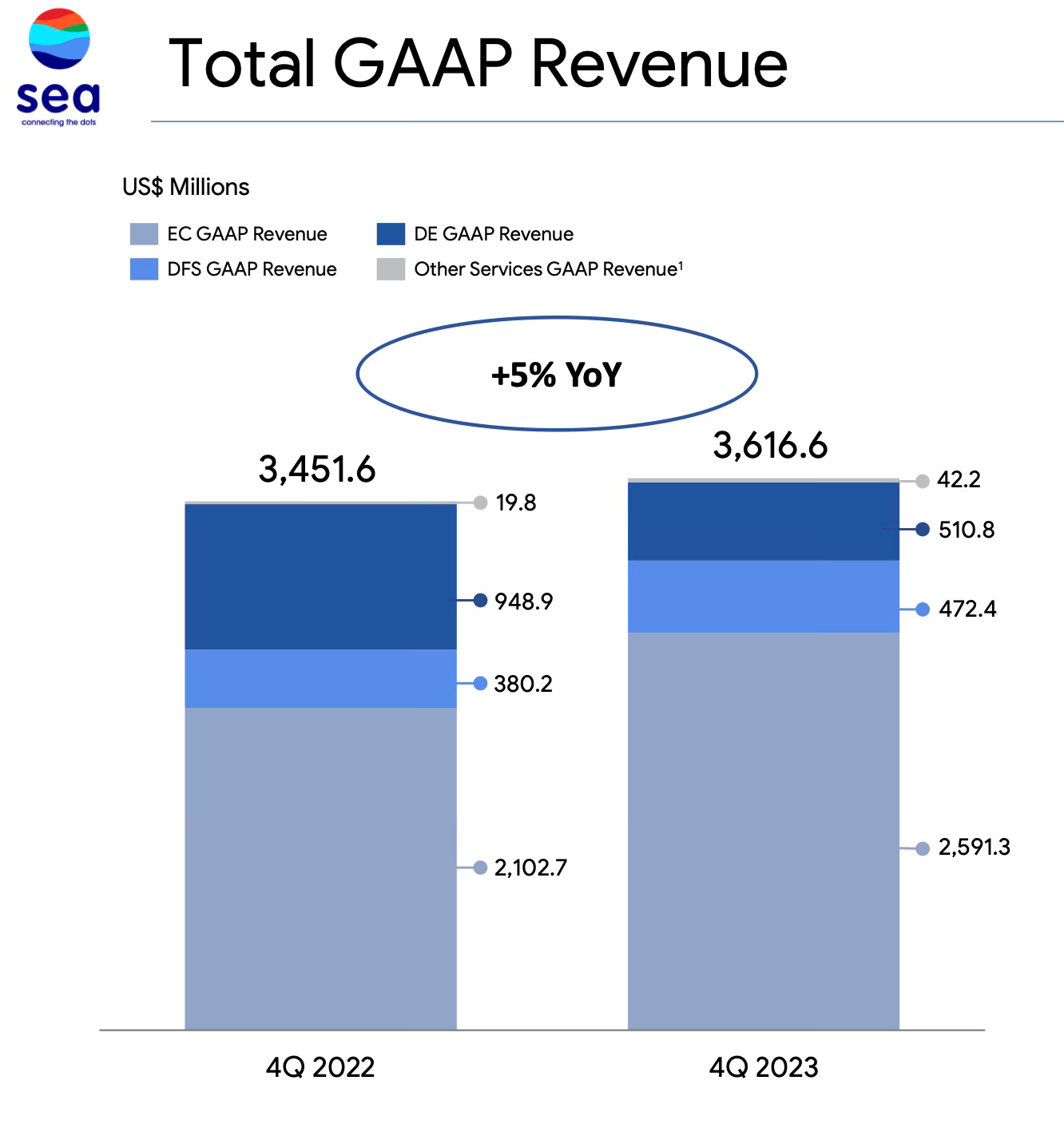

Revenue: $3.62 billion +5% year-over-year (YoY)

Digital Entertainment: $511 million -46% YoY

E-commerce: $2.77 billion +24% YoY

Sale of goods: $335 million +23% YoY

Gross Profit: $2.09 billion +19% YoY

Net Loss: $112 million -126% YoY

Adjusted EBITDA: $127 million -74% YoY

2. Wall Street Expectations

Revenue: $3.55 billion (beat by 2%)

Earnings per Share: (0.28) (beat by 32%)

3. Digital Entertainment

At the end of Q4 2023, quarterly active users (QAUs) reached 528.7 million, marking an 8% YoY increase. However, the quarterly paying user ratio decreased from 9.0% to 7.5% YoY. Ultimately, this led to a 9% decline in quarterly paying users (QPUs), dropping from 43.7 million a year ago to 39.7 million for the fourth quarter of 2023. Although the total user base grew for the first time since Q4 2021, the paid user base continued to shrink YoY.

Regarding Digital Entertainment, QPUs emerge as the most crucial metric. As I've emphasized for some time, free users don't contribute to the financial health of the platform. The decrease in the quarterly paying user ratio resulted in a 2% QoQ decline in QPUs, falling from 40.5 million to 39.7 million. Despite this decline, the number of QPUs remains above the low reported in Q1. The data now suggests that the bottom is in for QPUs, and Q1 2024 should see the first quarter of growth since Q4 2021.

In Q4, Garena's bookings reached $456 million, reflecting a 2% QoQ increase. Average bookings per user also rose by 5% to $0.86. This marks the second consecutive quarter of positive trends in gross bookings and average bookings per user.

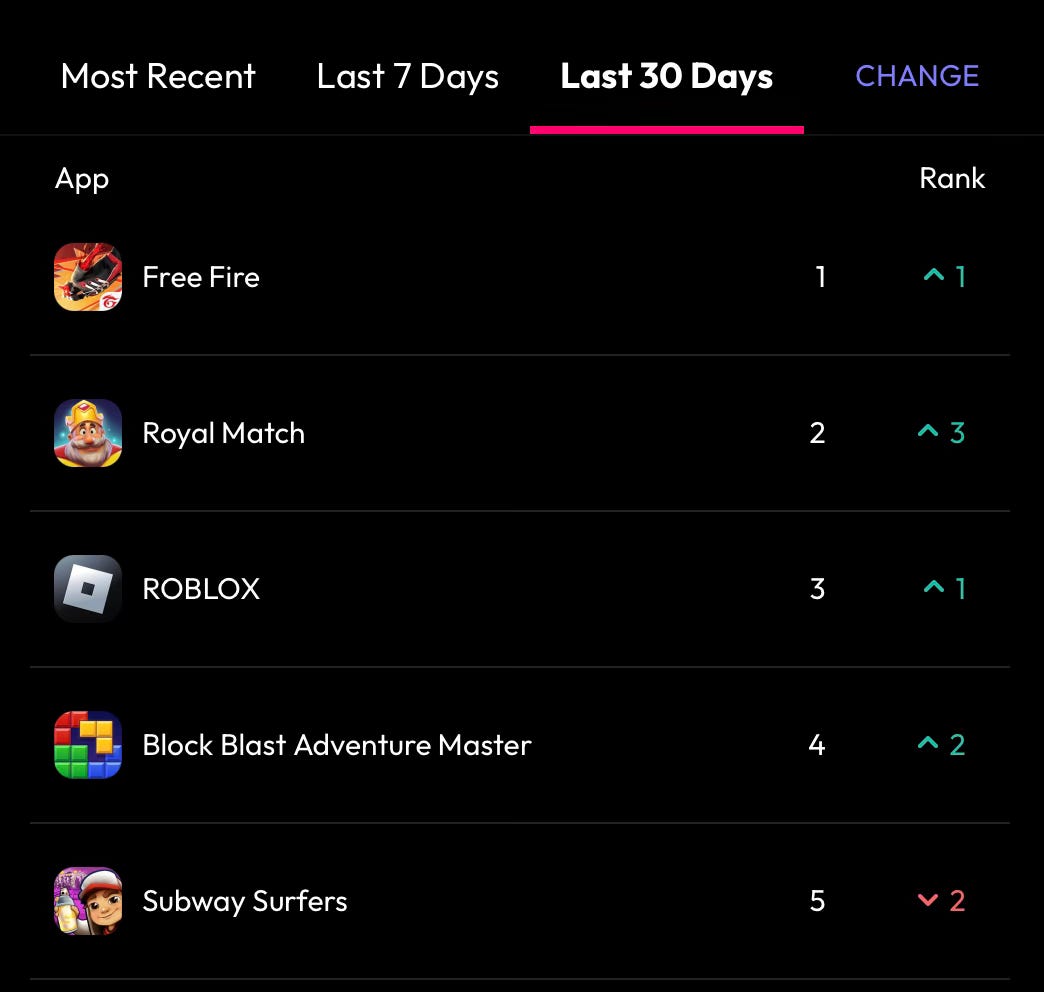

Garena's success in digital entertainment, particularly with Free Fire, is attributed to continuous efforts to enhance game experiences, introduce localized content, and foster collaborations. Notably, partnerships with Lamborghini and JKT48 have contributed to improved user acquisition and retention trends.

Free Fire, recognized as the most downloaded mobile game globally in 2023, sustained positive trends into 2024, achieving over 100 million peak daily active users in February. With this momentum, Garena anticipates double-digit year-on-year growth in both the user base and bookings for Free Fire in 2024. Garena's success with Free Fire is attributed to continuous efforts to enhance game experiences, introduce localized content, and foster collaborations. Notably, partnerships with Lamborghini and JKT48 have contributed to improved user acquisition and retention trends.

Free Fire recently won the Best Shooter Game at Sensor Tower APAC Awards 2023 and is set to participate in the Esports World Cup in November in Brazil. Seven years since its launch, Free Fire continues to attract a dedicated global player base, maintaining its momentum as it heads into 2024.

4. E-commerce

Shopee witnessed a substantial rise in gross orders, totaling 2.5 billion, reflecting a 46% YoY increase and a 13% QoQ growth. Additionally, Gross Merchandise Volume (GMV) for the quarter amounted to $23.1 billion, showing a 29% YoY increase and a 15% QoQ rise.

After transitioning to annual disclosure of GMV and Gross Orders at the end of 2022, management chose to reveal these metrics again in Q3. The acceleration of growth both YoY and QoQ is a very positive upward trend.

Based on a GMV of $23.1 billion and marketplace revenue of $2.3 billion, the implied take rate is 10%, which is consistent with Q4 2022 but up from 9.5% in Q3 2023. The fact that the take rate has remained consistent YoY but GMV and Gross Orders have grown significantly is a positive sign of customer satisfaction.

On the conference call, management focused on three operational priorities:

Enhancing service quality for buyers.

Improving the competitiveness of product listings.

Strengthening the content ecosystem.

Notable logistics advancements include the opening of five new sorting centers and 385 new first- and last-mile hubs, leading to a 12% YoY decrease in logistics cost per order in Asia. In Indonesia, more than half of Java orders were delivered within two days in December 2023, showcasing improvements in delivery speed. Shopee's e-commerce logistics network is deemed highly intensive and efficient, serving as a strong competitive advantage.

Livestreaming e-commerce, comprising around 15% of physical order volume in Southeast Asia, witnessed improved unit economics. Shopee Brazil demonstrated strong performance, with a nearly 90% YoY improvement in contribution margin loss per order, attributed to user monetization and cost efficiency enhancements.

5. Digital Financial Services

SeaMoney's digital financial services segment has undergone significant growth, propelled by the success of its consumer and SME credit business. The credit business, which commenced in 2019 with SPayLater consumption loans, has broadened to encompass cash loan services for Shopee buyers and sellers. The Shopee ecosystem has bestowed a unique advantage, facilitating SeaMoney in swiftly attaining critical scale and profitability.

As of December 31, 2023, the outstanding principal for consumer and SME loans reached $3.1 billion, reflecting a 27% YoY increase. The active users in the fourth quarter surpassed 16 million, showing 28% YoY growth.

Looking ahead to 2024, SeaMoney plans to invest further in user acquisition for its credit business, both on and off the Shopee platform, while maintaining a prudent approach to risk management. Beyond the credit business, SeaMoney is expanding its digital banking and insurance services to tap into future opportunities in the digital financial services segment.

6. Financial Analysis

Revenue

Sea’s total revenue grew by 5% in Q4 2023 reaching $3.62 billion compared to $3.45 billion in the same quarter of 2022.

Notably, Digital Entertainment saw a decline in revenue to $511 million from $949 million in Q4 2022, primarily due to a moderation in user monetization observed earlier.

E-commerce achieved revenue of $2.59 billion, representing a 23% YoY growth. Core marketplace revenue, driven by transaction-based fees and advertising revenues, saw a significant 41% YoY increase. However, value-added services revenue, mainly related to logistics services, experienced a 5% YoY decline due to higher revenue net-off against shipping subsidies.

Digital Financial Services was the fastest-growing area, increasing revenue by 24% YoY, reaching $472 million, primarily attributed to growth in both the consumer and SME credit business.

Gross Margin

The gross margin contracted materially, dropping from 49% in Q4 2022 to 42% in Q4 2023. There are two primary reasons for this shift. Firstly, the business mix underwent significant changes over the past twelve months. The Digital Entertainment division, historically boasting a gross margin exceeding 70%, decreased from 27% of total revenue in Q4 2022 to just 14% in Q3 2023. E-commerce now constitutes 77% of revenue, up from 65% one year ago.

Secondly, the gross margin for all three segments declined. Digital entertainment slid from 74% to 68%, e-commerce from 43% to 41%, and the sale of goods was halved from 15% to 8%.

The reduction in the Digital Entertainment gross margin may be attributed to the decreasing number of QPUs despite an increase in QAUs. A lower paying user ratio suggests that a smaller percentage of the total user base engages in revenue-generating activities, impacting the gross margin. The revenue generated from paying users may not be sufficient to offset the costs associated with providing additional user services, resulting in a decline in the gross margin.

The slight drop in e-commerce margin could be explained by various factors, including product mix, cost pressures, and market dynamics.

Operating Margin

Operating expenses (OpEx) experienced a 16% YoY increase, amounting to $1.58 billion. The primary factor behind this rise was Sales and Marketing (S&M) expenses, which surged by 104% YoY, reaching $967 million. In Q4 2023, Sea allocated 27% of its revenue to S&M expenses, up from 14% in Q4 2022. However, this is down marginally from the 28% of revenue it allocated to S&M expenses in Q3 2023.

These financial moves indicate that Sea has entered a growth phase, marked by substantial investments in its infrastructure. Earlier commentary revealed the opening of five new sorting centers and 385 first- and last-mile hubs, resulting in a significant achievement: half of all orders in Indonesia were delivered within two days. This strategic investment is viewed as a means to establish a lasting competitive advantage.

In addition to investing in physical infrastructure, Sea has dedicated considerable time and effort to technical revamps of their ad platform. Any increased efficiency in this area will directly impact the bottom line. Management believes that compared to global peers, they have sizable room to grow here. I immediately think of the high-margin ad business of Amazon and MercadoLibre when considering what the future might look like for Sea.

And we have done quite a few technical revamps in the past few months, and this will be deployed and fine-tuned in the coming quarter, which will enable us to further grow our ad take rate

The increase in S&M expenses during the quarter resulted in an operating loss of $57 million compared to a profit of $343 million in Q4 2022.

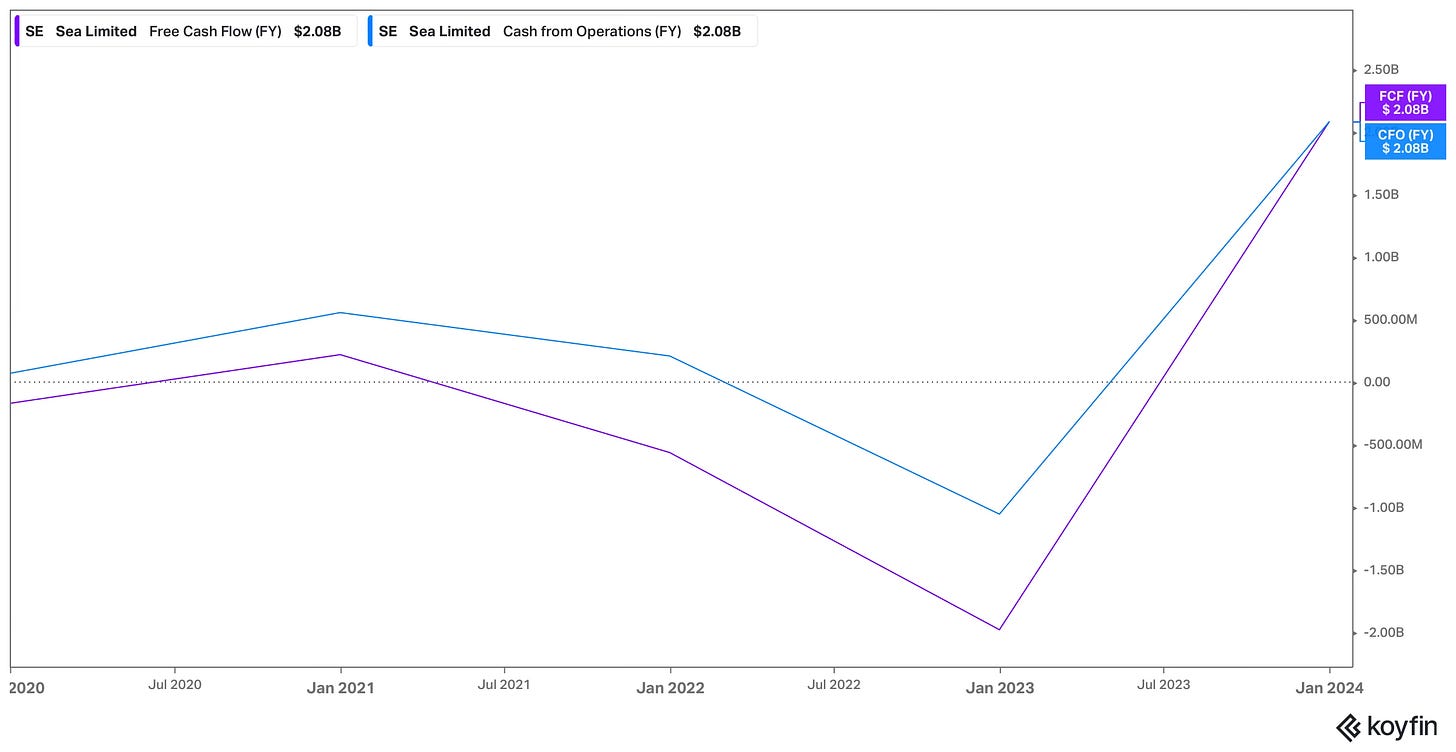

Cash Flow Analysis

Sea’s operating cash flow rapidly improved in 2023. At the end of 2023, cash flow from operations improved from -$1.06 billion to $2.08 billion. This represents an operating cash flow margin of 16%, which is impressive considering the heavy investment over the past two quarters.

Equally impressive is that despite incurring a net loss of $112 million in Q4, Sea still achieved operating cash flow of $279 million. This means that Sea reinvested the cash generated from the digital entertainment and digital financial service divisions back into building out the e-commerce infrastructure.

7. Guidance

While management did not provide specific financial guidance, they did reveal during the conference call that they anticipate high teens growth in GMV for the full year, along with positive adjusted EBITDA in the second half of the year. The positive adjusted EBITDA in the second half of the year came as a surprise to me, I was expecting it to be negative for 2024.

Wall Street analysts predict revenue growth of 15% for 2024 and adjusted EPS of 1.77. Sea is now entering periods of notably lower comparatives, meaning that we can expect a return to double-digit growth for the first time since Q3 2022.

8. Conclusion

2023 marked the first full year of annual profit for Sea since its IPO in 2017. This achievement was made possible by improving the operating margins of all three segments. Most of this work was completed in the first two quarters of the year as management tightened its belt before returning to growth mode in the second half.

It costs money to build a moat, and Sea is actively doing just that. While margins were compromised in Q4 compared to one year ago, I believe this is the best course of action for the long run. During the conference call, management emphasized:

the most important thing is, with this, we are able to sustain our market leadership while building up all the competitive moat that we've been building over the past years

We are already starting to see the fruits of this labor, including faster delivery times and increased coverage. Simultaneously, Shopee is expanding premium services such as next-day delivery and introducing new features, including return-on-spot services. It was pleasantly surprising to learn that Shopee aims to break even in the second half of 2024 while increasing market share through further emphasis on price competitiveness, service quality, and live streaming. Over the past few quarters, Sea has gained market share, particularly in Indonesia.

During last month’s earnings review, I noted that the quarter of reckoning for Sea is almost upon it. This quarter, we got it. The company grew faster than Wall Street expected and incurred fewer losses in doing so. However, the real highlights are the improvement in KPIs such as GMV and Gross Orders. On top of this, we now have tangible evidence of competitive advantages being built as part of infrastructure investment, resulting in faster delivery times and increased coverage.

Rating: 3 out of 5. Meets expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

I just saw this piece earlier along with some others about SEA on Seeking Alpha and linked to them for today's post: https://emergingmarketskeptic.substack.com/p/emerging-markets-week-march-18-2024