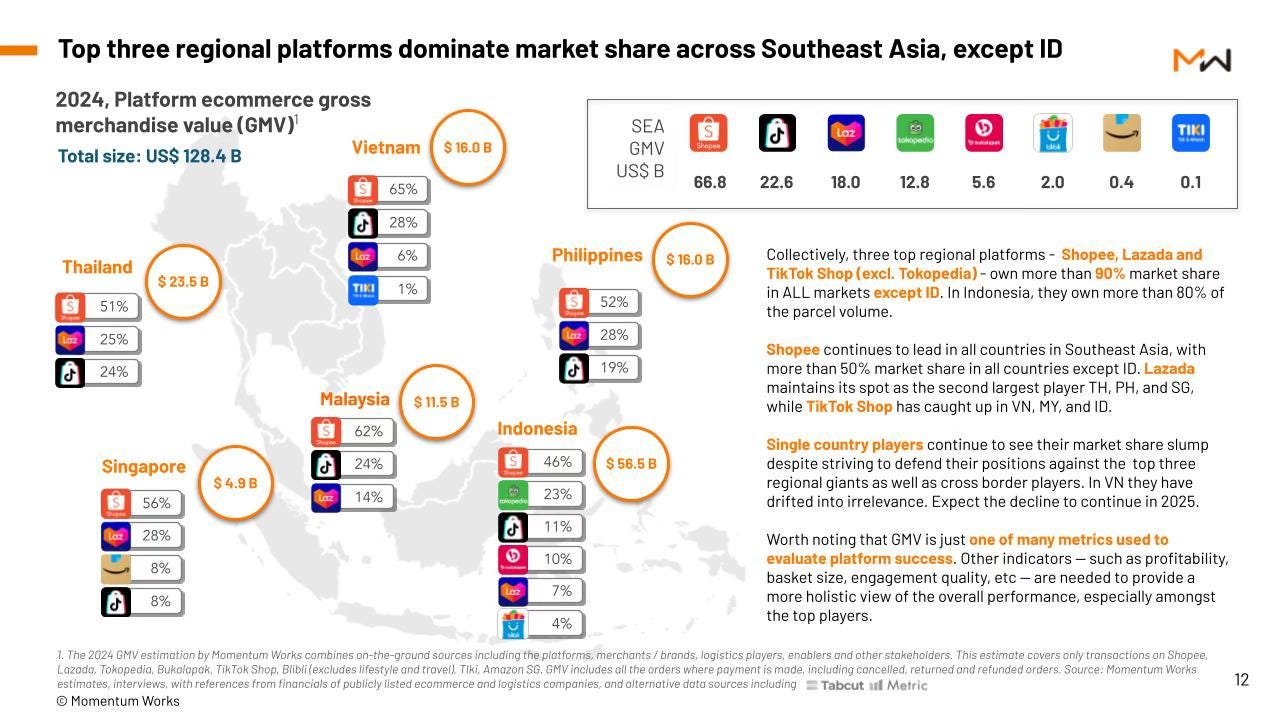

Southeast Asia platform e‑commerce gross merchandise volume (GMV) grew by 12% in 2024 to reach $128.4 billion. This growth was driven by continued internet adoption and rising consumer spending, led by Indonesia’s $56 billion market (44% of GMV). Thailand and Malaysia were the fastest-growing markets (~22% and 19% YoY, respectively).

Southeast Asia shipped 43.6 million e-commerce parcels daily in 2024, nearing U.S. volumes, demonstrating the region's enormous scale and continued growth. Who are the dominant players, and what does it mean for investors?

This article draws on data from the Ecommerce in Southeast Asia 2025 report by Momentum Works.

Shopee’s Widening Moat

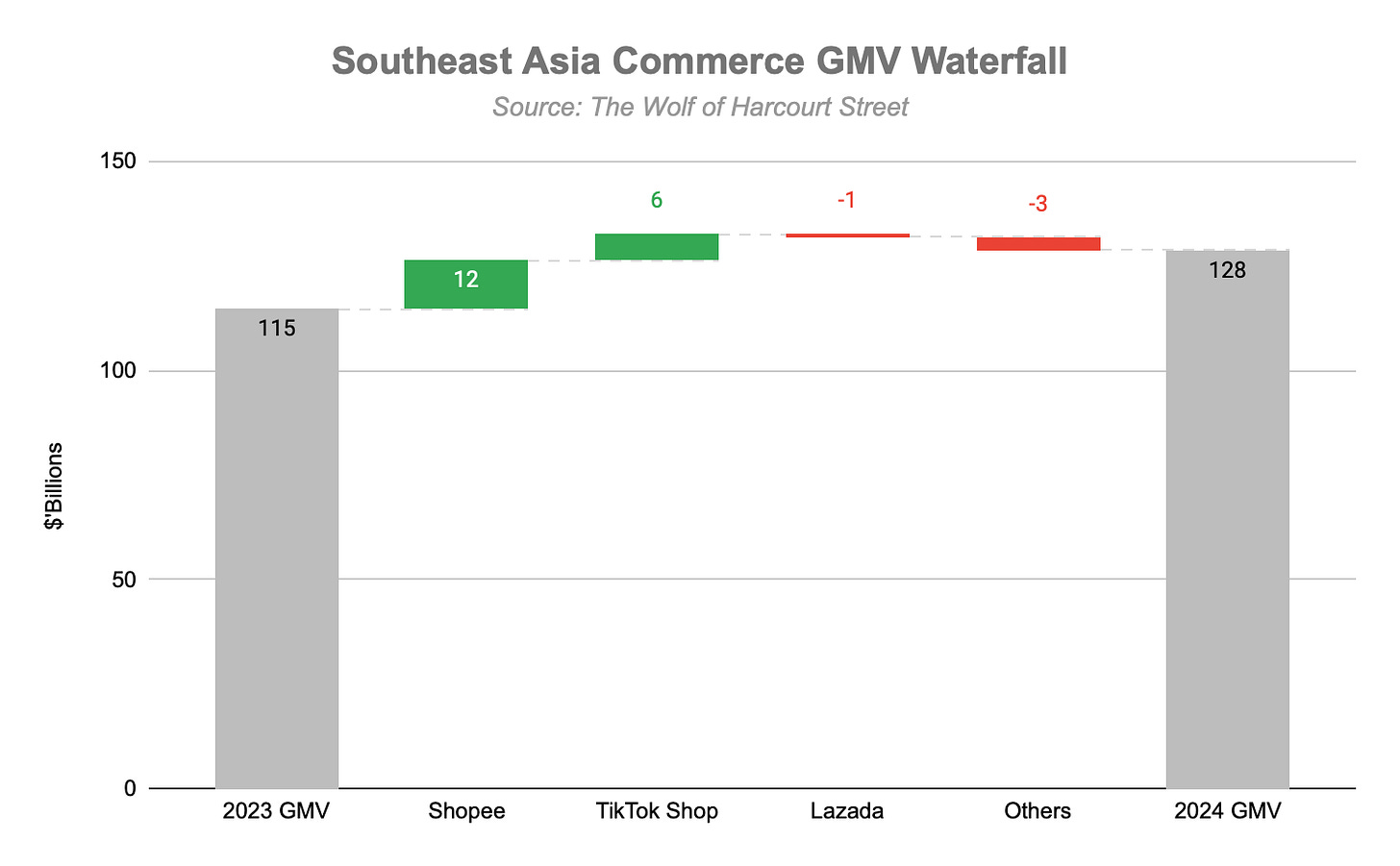

Shopee’s lead is growing. The platform commanded 52% of Southeast Asia e‑commerce GMV in 2024 (up from 48% in 2023), reaching $66.8 billion. While growth has moderated since the pandemic, Sea Limited (Shopee’s parent company) is guiding for ~20–25% GMV growth in 2025 with improving margins.

Shopee’s edge lies in scale and disciplined execution. The company has moved away from aggressive price wars to focus on unit economics. For example, after years of subsidies, both Shopee and TikTok are now automating ad buys and cutting unprofitable programs. This focus on ROI has helped Shopee post positive EBITDA for two consecutive years.

Several factors reinforce Shopee’s position:

Scale & Ecosystem: Shopee benefits from a massive, young user base and a broad catalog, from consumer goods to live commerce. It integrates Monee (digital payments, credit, insurance) directly into the platform. In Q1 2025, Monee’s loan book grew 60% YoY, feeding credit into Shopee purchases and driving loyalty.

Innovations: Shopee keeps users engaged with live streaming, in-app games, and mobile top-ups. Logistics have also improved through infrastructure investments like in-house warehouses and Shopee Mall guaranteed shipping, boosting service levels and monetization.

Brands & Marketplace: Shopee has evolved from a low-cost focus to offering more local and international brands. While maintaining its broad marketplace, it also curates premium sellers for Shopee Mall, increasing its take-rate through ads and value-added services.

These factors together give Shopee both scale advantages and improving unit economics. In 2024, Shopee grew GMV by 28% (including regions beyond Southeast Asia), breaking $100 billion while turning profitable. Shopee has built a durable moat in user engagement and monetisation, putting it in a strong position to harvest Southeast Asia’s digital growth.

Competitor Snapshot – TikTok, Lazada, Others

TikTok Shop

TikTok Shop has rapidly gained ground. Its Southeast Asia GMV quadrupled in two years to reach $22.6 billion in 2024. After acquiring Tokopedia in December 2023 and merging Indonesian operations, TikTok is now pursuing disciplined expansion. Instead of relying on subsidies, it’s emphasising ROI, positioning social commerce as a discovery engine for sellers.

Momentum works estimate the TikTok/Tokopedia combo now commands around 28% of Southeast Asia’s platform GMV. Its growth, especially among Gen Z, means Shopee cannot afford complacency.

Lazada

Once a regional leader, Lazada (owned by Alibaba), has ceded ground to Shopee but is stabilising. Its GMV growth has been modest, and its market share is smaller, but 2024 marked its first full-year of profitability. The CEO has repositioned the brand to focus on high-quality assortments, AI-driven logistics, and premium sellers, moving away from direct competition with Shopee in the value segment. As a result, Lazada is carving a niche in higher-end goods, while Shopee dominates low-cost C2C and SME sectors.

Other Players

The rest of the field is fragmented. Local champions like Bukalapak, Blibli, and Tiki hold share in home markets, but none present a regional threat. Western players like Amazon remain marginal outside Singapore. In total, Shopee, TikTok, and Lazada account for over 80% of Southeast Asia’s platform GMV.

Shopee’s rivals are investing to stay relevant. TikTok is the wild card, if it can turn its social audience into regular shoppers, it may narrow the gap. But for now, Shopee’s lead in scale and profitability remains firm. Of the $14 billion GMV added in 2024 across the region, Shopee accounted for $12 billion.

A Long Runway of Growth

Despite slower growth in 2024, the Southeast Asia e‑commerce opportunity is far from saturated. Penetration was just 12.8% of retail in 2024, leaving billions in offline spending up for grabs. Momentum forecasts that AI and data tools could unlock an additional $130 billion in GMV by 2030, improving search, logistics, and personalisation.

Live-streaming and video shopping already account for 20% of platform GMV and are still growing. Rising incomes and internet access, especially in Vietnam, Thailand, and the Philippines, continue to add new shoppers.

Brands accounted for less than 30% of Southeast Asia’s platform e-commerce GMV, compared to over 50% in China, underscoring the untapped potential for brand-driven growth. Chinese consumer brands, learning from past missteps, are re-entering the region with improved products and localised strategies, gaining traction across key categories.

For Sea Limited, the challenge is converting this momentum into sustained profitability. Management is targeting ~20% GMV growth in 2025 with better margins, and Q1 2025 results (+21.5% YoY) suggest solid demand. Meanwhile, its SeaMoney and digital entertainment arms offer both cushioning and cross-sell potential.

Still, competition is fierce. Shopee must fend off TikTok’s social allure and Lazada’s premium positioning, all while carefully managing costs. But so far, Shopee’s ecosystem, data, and ingrained habits have proven resilient.

The Bottom Line

Shopee entered 2025 as Southeast Asia’s #1 e‑commerce platform by volume, with a widening lead. It has achieved this through a combination of scale, infrastructure investment, and smarter monetization. With total GMV still rising and digital penetration far from mature, Shopee appears well-positioned for profitable growth.

Importantly, Sea Limited is no longer burning cash to gain share. Instead, it is transforming Shopee into a high-volume, margin-expanding platform, a promising trajectory for long-term shareholders.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Would you open a position at this levels?

What metrics do you use best to assess their value. Ebitda? Similar like meli they have a credit portfolio.

What's the story with Shopee in South America? It launched an assault on a market dominated by MercadoLibre and was making ground. Then it scaled back. I'm not sure why. What happened. What are its plans beyond Asia?