In this report, I will cover the following:

Overview

Customers

Capitalisation

Revenue and Margins

Valuation Multiples

Balance Sheet and Cash Flow

Stock Price History

Competitors

Management and Ownership

Risks

Opportunities

Investment Strategy

Shopify Inc.

Ticker: $SHOP

Sector: Technology

Market Cap: $183.4 billion

1. Overview

Shopify is a global commerce company, providing tools to start, grow, market, and manage a retail business of any size. Shopify’s platform and services are engineered for reliability while delivering a better shopping experience for buyers everywhere.

In an era where social media, cloud computing, mobile devices, and data analytics are creating new possibilities for commerce, Shopify provides value by offering merchants a multi-channel front end and a single integrated back end. Shopify also enables merchants to build their own brand, leverage mobile technology, and handle massive traffic spikes with flexible infrastructure.

Shopify is designed to help merchants own their brand, develop a direct relationship with their buyers, and make their buyer experience memorable and distinctive. In a world where buyers have more choices than ever before, a merchant’s brand is increasingly important. The Shopify platform is designed to allow a merchant to keep their brand present in every interaction to help build buyer loyalty and competitive advantage. There is a strong possibility that you have used shopify without even realising.

As ecommerce expands as a percentage of overall retail transactions, a trend that accelerated in 2020 as the global COVID- 19 pandemic necessitated physically distanced commerce, buyers expect to be able to transact anywhere, anytime, on any device through an experience that is simple, seamless, and secure. As transactions over mobile devices represent the majority of transactions across online stores powered by Shopify, the mobile experience is a merchant’s primary and most important interaction with online buyers. Shopify has focused on enabling mobile commerce, and the Shopify platform includes a mobile-optimized checkout system, designed to enable merchants’ buyers to more easily buy products over mobile websites.

The business model has two revenue streams: a recurring subscription component that Shopify calls subscription solutions, and a merchant success-based component called merchant solutions.

Subscription Solutions

Shopify generates subscription solutions revenue primarily through the sale of subscriptions to the platform, including variable platform fees, as well as through the sale of subscriptions to the Point-of-Sale ("POS") Pro offering, the sale of themes, the sale of apps, and the registration of domain names. There are a few tiers to Shopify’s subscription service. At the low end are the Shopify Lite ($9 per month), Basic Shopify ($29 per month), Shopify ($79 per month), and Advanced Shopify ($299 per month) tiers. There are differences between these four tiers in terms of their features and functionality as seen below.

Merchant Solutions

Shopify offers a variety of merchant solutions to augment those provided through a subscription to address the broad array of functionality merchants commonly require, including accepting payments, shipping and fulfillment, and securing working capital. Shopify believes that offering merchant solutions creates additional value for merchants, saving them time and money by making additional functionality available within a single centralized commerce platform, and creates additional value for Shopify by increasing merchants’ use of our platform.

2. Customers

At the end of Q1 2021, Shopify had more than 107 million registered users, including buyers using Shop Pay as well as the Shop App, of which more than 24 million were Monthly Active Users. The user list includes some massive brands including PepsiCo, Red Bull and Tesla. At the end of March 2021, the million-plus businesses that operate on this platform have generated $319 billion in global economic activity. At the end of March 2021, Shop Pay had facilitated over $24 billion in cumulative Gross Merchandise Value (“GMV”) since its launch in 2017.

Shopify’s partner ecosystem continued to expand, as approximately 45,800 partners referred a merchant to Shopify over the past 12 months, up 73% compared with 26,400 over the 12 months ended March 31, 2020.

GMV for the first quarter was $37.3 billion, an increase of $19.9 billion, with growth accelerating to 114% over the first quarter of 2020. Gross Payments Volume ("GPV") grew to $17.3 billion, which accounted for 46% of GMV processed in the quarter, versus $7.3 billion, or 42%, for the first quarter of 2020.

According to Shopify visitor statistics, the marketplace had over 58 million visits between January and December 2020. Visitors from the US are the most prominent bunch on the platform, with 40% of visits originating from there, considering only desktop users. Canada (6%), the UK (5%), Australia (4%), and India (3%) follow. You can click here and see the Shopify analytics in real-time.

Shopify users in 2021 spend an average of 3 minutes and 27 seconds during their visit to a Shopify store. 44% of those visits come from direct sources, 24% come from referrals, and searches account for 27%. Traffic from social media platforms is only at 3%.

Shopify stats show that the majority of the traffic that Shopify receives comes from mobile devices. This is excellent news for Shopify merchants, as 90% of consumers make purchasing decisions from their mobile device, according to mobile marketing statistics. One of the other big contributors to Shopify’s traffic are search engines, which are responsible for 29% of Shopify’s visits.

More than half of shoppers who buy from Shopify stores end up making at least one other purchase. More specifically, the average shopper buys 3.8 times from the same store.

3. Capitalisation

Shopify went public on the 20th May 2015 through an IPO raising an initial $131 million valuing the company at $1.3 billion. Today the market market cap is $183 billion meaning if you had invested at the IPO date you would have a 100-bagger (over 140x your initial investment) in 6 years. Despite this performance the company is still very much a growth stock.

4. Revenue and Margins

Shopify has been growing revenues at an extraordinary rate over the past couple of years whilst also maintaining its gross margins. During its most recent financial results for Q1 2021:

Revenue was $988.6 million, an increase of 110% year-over-year.

Subscription solutions revenue was $320.7 million, an increase of 71% year-over-year.

Merchant solutions revenue was $668.9 million, an increase of 137% year-over-year.

Gross margin was 57% in Q1 2021 compared to 55% in Q1 2020. The key driver here is the Subscription solutions gross margin which is 82% compared to the 44% gross margin on the Merchant solutions.

This level of growth and margins is not a once off as Shopify has a demonstrated track record when we look back over the last 2 years.

Shopfiy is already profitable on the bottom line after posting Income from operations of $118.9m in Q1 2021 compared to a loss of $73.2 million year-over-year. During Q1 2021, Shopify also recorded a $1.3 billion unrealised gain on their equity investment in Affirm as a result of its IPO in January 2021 but is not included in the Income from operations.

5. Valuation Multiples

Shopify very much lives up to the characteristics of a growth stock and trades at high valuation multiples. Below are some of the key valuation metrics that I have identified. I have included the PE ratio and while Shopify is profitable, this is not the focus for the business at this time.

While the Price/Sales valuation multiple is rich, it has essentially remained relatively flat over the past 12 months whilst the market cap has increased by 50%.

6. Balance Sheet and Cash Flow

Commentary

Over $2.7 billion in cash and cash equivalents

Total Liabilities as % of Total Assets is 16%

Current Assets to Current Liabilities ratio of 17.1

Goodwill balance making up just under 3% of total assets which primarily relates to the acquisition of 6 River Systems in Q4 2019

Free cash flow for Q1 2021 was +$131 million compared with -$102 million year-over-year

7. Stock Price History

The share price had been trending sideways before the first explosion in 2019 followed by another parabolic run as Covid-19 hit in 2020. The stock hit its most recent all time high in June 2021.

8. Competitors

WooCommerce currently has the largest ecommerce platform market share in the USA, with more than one in four online businesses using it to power their stores. Coming in second, the Shopify market share stands at 23 percent.

As the two largest ecommerce platforms, WooCommerce and Shopify’s combined market shares in the USA make up 49 percent. In other words, nearly one out of every two online shops in the USA use one of these two leading ecommerce platforms to sell their merchandise.

Third on the list of the leading ecommerce platforms in the USA is Wix Stores, which has 17 percent of the total market share. This is followed by Squarespace with 11 percent of the ecommerce platform market share in the USA.

The other leading ecommerce platforms used by online businesses in the USA include Ecwid and OpenCart, both with much smaller market shares.

As of June 2021, there are over 1.6 million online stores in the USA that use WooCommerce as their ecommerce platform.

Globally, WooCommerce has the largest e-commerce market share at over 28% and Squarespace is second at over 17%, Shopify is firmly positioned in third at almost 11%. This puts them far ahead of all other contenders like MonsterCommerce, WixStores and Magento.

9. Management and Ownership

Tobi Lütke is the founder and Chief Executive Officer of Shopify. In 2004, Tobi began building software to launch an online snowboard store called Snowdevil. It quickly became obvious that the software was more valuable than the snowboards, so Tobi and his founding team launched the Shopify platform in 2006. He has served as CEO since 2008 at the company's headquarters in Ottawa, Canada. Prior to that, Lütke acted as Chief Technology Officer between September 2004 and April 2008.

Tobi Lütke appears to be well received at Shopify with an 91% approval rating on Glassdoor with the company overall scoring 4.2 out of 5 by its own employees.

In Tobi Lütke, Shopify meets my criteria of being led by a visionary founder.

10. Risks

1. Rapid growth may not be sustainable

Shopify generates revenues through the sale of subscriptions to its platform and the sale of additional solutions to it’s merchants. The subscription plans typically have a one-month term, although a small percentage of merchants have annual or multi-year subscription terms. Merchants have no obligation to renew their subscriptions after their subscription term expires. As a result, even though the number of merchants using the platform has grown rapidly in recent years, and in particular in 2020 in connection with the shift to online commerce accelerated by the COVID-19 pandemic and related restrictions and lockdowns, there can be no assurance that we will be able to retain these merchants.

New merchants joining the platform may also decide not to continue or renew their subscription. For example, the restrictions imposed in response to the COVID-19 pandemic accelerated a shift from physical commerce to online or multi-channel commerce, which contributed to growth in the use of the platform in 2020. As the COVID-19 pandemic abates and these restrictions are lifted, commerce may shift away from online purchases and merchant's online stores may experience decreases in transaction volume, which would negatively affect Shopify growth and business, financial condition, and operating results.

2. Competition

Shopify faces competition in various aspects of their business as demonstrated earlier and we can expect such competition to intensify in the future, as existing and new competitors introduce new services or enhance existing services and as the business continues to evolve. Many competitors have longer operating histories, larger customer bases, greater brand recognition, greater experience and more extensive commercial relationships in certain jurisdictions, and greater financial, technical, marketing, and other resources than Shopify does. New or existing competitors may be able to develop products and services better received by merchants or may be able to respond more quickly and effectively than Shopify can to new or changing opportunities, technologies, regulations or merchant requirements. In addition, some larger competitors may be able to leverage a larger installed customer base and distribution network to adopt more aggressive pricing policies and offer more attractive sales terms, which could cause Shopify to lose potential sales or to sell their solutions at lower prices.

For example, many large technology platforms have started to impose restrictions on the ability of other parties to access or use data from their customers and users. Google and Apple have announced changes to the ways that third parties can use web browsers to obtain user information and Apple has announced similar changes to iOS 14 that will impact how applications and third parties can access user information. These increasingly restrictive practices could affect Shopify merchants' ability to sell or market their offerings, which could affect the demand for our platform and lead to the loss of current or prospective merchants or other business relationships.

11. Opportunities

1. Large and expanding addressable market

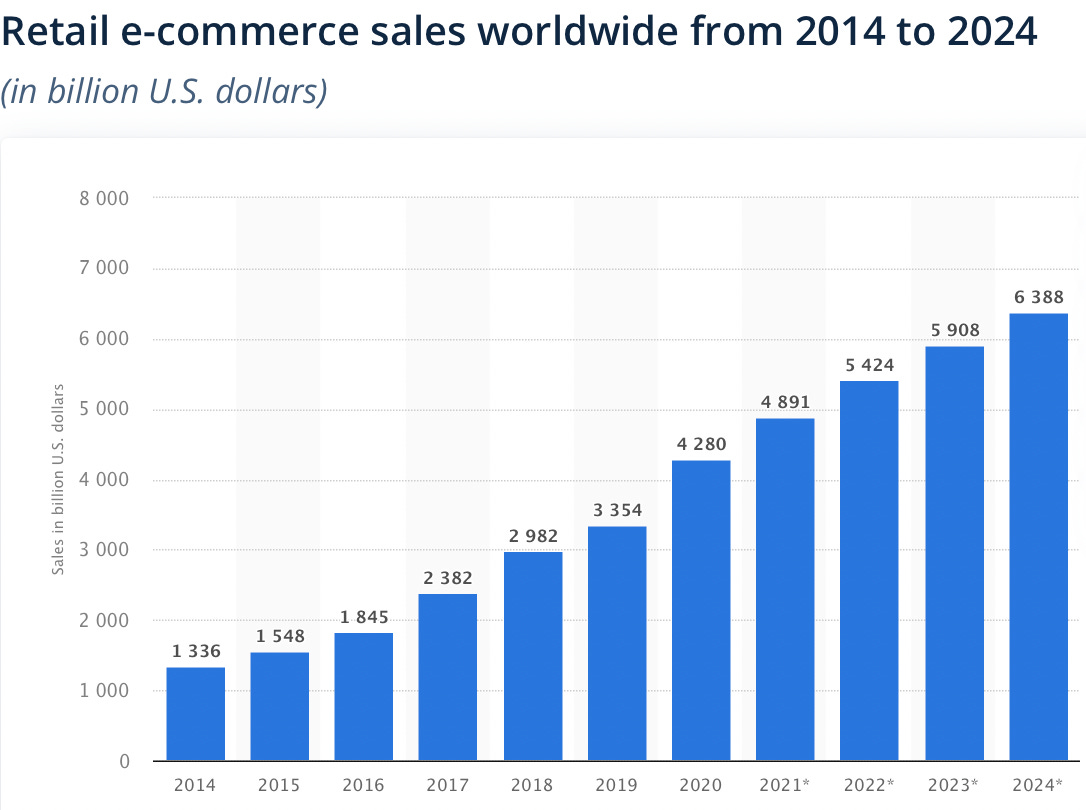

Ecommerce has been the fastest-growing channel over the last decade, with the crisis accelerating such shifts. Statistica projects that half of the absolute value growth for the global retail sector over the 2020-2025 period will be digital. That equates to $1.4 trillion in absolute value growth as more goods are sold online. To put that projected ecommerce growth in context, that would be roughly the size of the total value of products sold across all retail channels just five years ago.

China and the US will account for 55% of that value growth in e-commerce opportunities, which is to be expected from the largest e-commerce markets globally. From a percentage growth perspective, Latin America, an emerging e-commerce region, saw e-commerce adoption accelerated due to the crisis as more consumers shopped online to obtain necessities.

Retailers and consumer brands now compete on their digital capabilities. Many in the industry have accepted this reality. Of those working at retailers and consumer brands, 68% expect consumers will judge them more on their digital prowess post-pandemic, according to a survey fielded by Euromonitor International in November 2020. Being evaluated on their digital resume means that retailers and consumer brands who were not investing in new technologies or adopting a digital-first mindset pre-crisis, have fallen further behind their peers. An ecommerce offering is no longer an option, it is a requirement and thats where Shopify comes in.

2. Innovative Management

Tobi Lütke is an exceptional entrepreneur and businessman. Shopify’s founding story stems from the fact that the first Shopify store was his own as we mentioned earlier. Shopify was created because Lütke saw a big problem that needed fixing and is a sign of the entrepreneurial drive and innovative mindset of the company leader.

This innovative mindset can be demonstrated by the below timeline since 2014:

2014 – Shopify introduces Shopify Plus

2015 – Shopify enables merchants to sell products on Facebook and Twitter, launches Shopify Shipping and provides integration with Amazon.com offerings

2016 – Shopify launches Shopify Capital, Shopify’s merchants become one of the first to be able to accept Apple Pay and Google Pay for web orders on mobile and Shopify becomes the first ecommerce platform to integrate with Facebook’s Messenger service

2017 – Shopify improves Shopify Payments by introducing Shopify Pay, a feature to streamline the mobile checkout process

2018 – Shopify makes selling on Instagram available, introduces the Locations feature that enables merchants to manage inventory across multiple locations and launches a fraud protection feature on Shopify Payments

2019 – Shopify introduces a feature allow merchants to sell in multiple currencies and get paid in their local currency, launches Shopify Studios, a full-service TV and film content production house and introduces a language-translation feature for merchants to reach international shoppers

2020 – Shopify opens a R&D centre in Canada to trial new fulfillment and robotics technologies, partners with fintech company Affirm to launch a “buy now, pay later” product called Shop Pay Installments and announces Shopify Balance to improve the cash flow of merchants

Take a breath now! Shopify’s commitment to innovation and helping its merchants to sell better is a key competitive advantage.

12. Investment Strategy

Shopify is driven by its mission to “make commerce better for everyone, so businesses can focus on what they do best: building and selling their products”. Helping its merchants to sell better is central to everything that Shopify do. The company is operating in the large and growing market of ecommerce and could potentially expand its market opportunity in the future because of its keen ability to innovate. The company also has a rock solid balance sheet.

Shopify currently trades at a premium valuation with the expectation that it will continue to grow at a rapid rate for many years. With such a loft valuation comes with it share price volatility. Any bumps along the road will no doubt cause a fall in the share price in the short term.

Ultimately, Shopify is a company that is perfectly aligned with the customers that it serves. Shopify remains focused on empowering merchants instead of chasing revenue and this shows up in the numbers. For every $1 of Shopify’s revenue, its merchants generate $40.82. You can talk the talk but Shopify really does walk the walk when it comes to its mission statement. I believe that this is a 1 trillion dollar company in the making.

Disclosure: The author holds a long position in Shopify.

Hit the subscribe button below if you have not already done so in order to receive the latest content straight to your inbox each week. By hitting the archive button you can view all of my previous newsletters on the website.

Happy investing

Wolf of Harcourt Street

Disclaimer: I am not a financial adviser and I am not here to give specific financial advice. The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. The information is based on personal opinion and experience, it should not be considered professional financial investment advice. There is no substitute for doing your own due diligence and building your own conviction when it comes to investing.