Today, I analyse the Q3 2021 earnings report of Square, Inc (Ticker: SQ), which was released on 4 November 2021.

In this report, I will cover the following:

Key Highlights

Wall Street Expectations

Seller Ecosystem

Cash App Ecosystem

Income Statement

Balance Sheet

Cash Flow

Guidance

Conclusions

1. Key Highlights

Revenue: $3.84 billion +27% year-over-year (YoY)

Seller Ecosystem: $1.39 billion +44% YoY

Cash App Ecosystem: $2.39 billion +16% YoY

Gross Profit: $1.13 billion +43% YoY

Seller Ecosystem: $606 million +48% YoY

Cash App Ecosystem: $512 million +33% YoY

Net Income: $0.1 million down from $35.5 million YoY

Adjusted EBITDA: $233 million up from $181 million YoY

2. Wall Street Expectations

Revenue: $4.42 billion (miss by 13%)

Gross Profit: $1.15 billion (miss by 2%)

Earnings per Share: 0.38 (miss by 2%)

Gross Payment Volume: $45.5 billion (in line)

Souce: Zach

3. Seller Ecosystem

During the quarter, Seller Gross Payment Volume (GPV) amounted to $41.7 billion. This represented an increase of 45% YoY and 23% on a two-year CAGR. Management observed the following trends:

Products: Card-present GPV was up 55% YoY, and up 21% on a two-year CAGR basis. Card-not-present GPV was up 29% year over year and 26% on a two-year CAGR basis.

Geographies: Growth in the U.S. market was relatively consistent with the second quarter on a two-year CAGR basis. International markets achieved strong Seller GPV growth year over year during the third quarter.

Mid-marker sellers now make up the largest cohort and are growing gross profit nearly twice as fast as the overall Seller business on a two-year CAGR basis.

4. Cash App Ecosystem

During the quarter, Cash App GPV amounted to $3.7 billion, up 27% YoY and up 134% on a two-year CAGR.

In October, Cash App expanded its offerings to families by serving teens in the U.S., a completely new demographic. Through authorization from a parent or guardian, individuals between 13 and 17 years of age can now use Cash App for peer-to-peer payments, Cash Card and related rewards through Boost, and banking tools like Direct Deposit. This teen audience represents approximately 20 million individuals in the U.S alone.

Square also launched Cash App Pay during the quarter, a simple and mobile-friendly way for Cash App customers to pay at Square sellers across online and in-person channels.

Bitcoin transactions were down sharply during this quarter as less volatile pricing impacted the demand. However, on the conference call CFO Amrita Ahuja noted “strength” in volume during October.

The area between red lines marks the Bitcoin price movement during the quarter. This data supports the less volatile pricing during the quarter but it also gives a signal as to the increased volume that can be expected in Q4 one month in.

5. Income Statement

Square grew its top line by 27% YoY. More importantly gross profit increased by 43% with gross margin also improving from 26% to 29% YoY.

Gross Profit rather than Revenue is a far more important performance indicator for Square because Bitcoin distorts the view (Square records the full Bitcoin transaction amount as revenue rather than the 2% fee it charges for the transaction). Square missed the revenue consensus estimate by 13% but only missed the gross profit estimate by 2% meaning that the revenue miss was entirely due to Bitcoin revenue which is very low margin.

As you can see below, Bitcoin related revenue slowed considerably YoY whilst subscription and service-based revenue was the fastest growing area of the business.

Subscription and service-based revenue growth should be keenly observed as it has got the juiciest gross margin. The increase in gross margin can be explained by the increase in relative weight of subscription and service-based revenue and the decrease in relative weight of Bitcoin revenue. Subscription and services-based revenue has increased from 15% during Q3 2020 to 18% during Q3 2021 whilst Bitcoin revenue has decreased from 54% during Q3 2020 to 47% during Q3 2021.

Operating expenses increased by 49% to $1.11 billion during the quarter. Note that this increase was 6% greater than the increase in gross profit.

The main driver here was product development costs which increased by 61% to $366.6 million. This increase included headcount and personnel costs related to engineering, data science, and design teams.

Sales and marketing expenses amounted to $408m representing 36% of gross profit during the quarter, down from 43% at Q3 2020. Costs here relate to growth in headcount as well as increased sales and marketing spend for the Seller ecosystem as many geographies exited lockdown and instore purchases resumed.

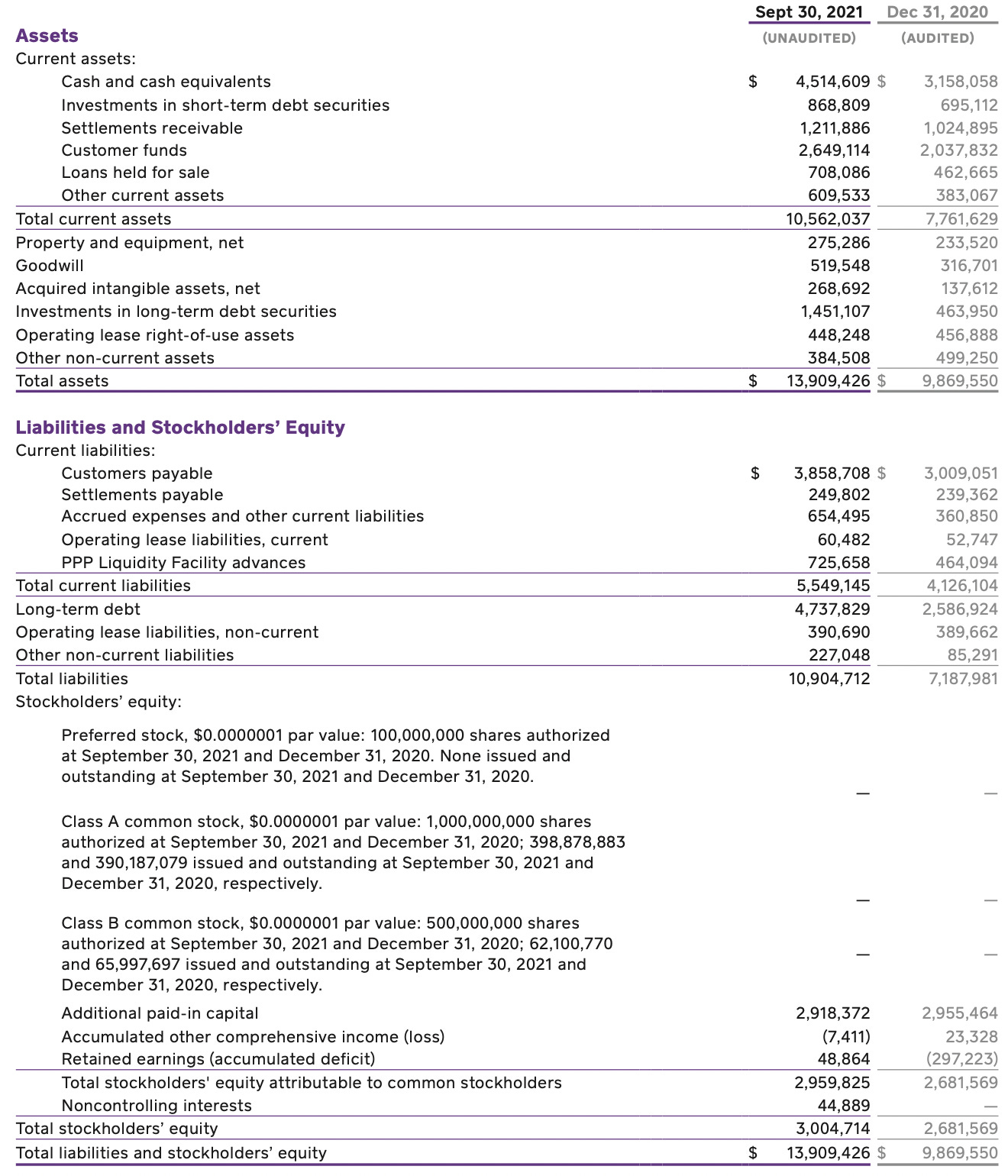

6. Balance Sheet

Observations

Over $4.5 billion in cash and cash equivalents up from $3.2 billion at Q4 2020

Total Liabilities as percent of Total Assets is 78% up from 73% at Q4 2020

Current Assets to Current Liabilities ratio of 1.90 up from 1.88 at Q4 2020

Goodwill balance making up less than 4% of total assets which relates to a number of acquisitions. The balance has increased during 2021 by $202m primarily as a result of the acquisition of TIDAL

Long-term debt has increased by over $1.2 billion during 2021

7. Cash Flow

Square’s operational cash flow is improving. At Q3, year to date (YTD) cash flow from operations improved by 157% from $261 million to $673 million.

Square’s YTD investing cash flow resulted in a deficit of $1.27 billion compared to a deficit of $532 billion YoY. The key driver here is the significant investment in marketable debt securities which ties in with the increase we see on the balance sheet.

Square’s YTD financing cash flow resulted in a surplus of almost $2 billion compared to a surplus of $1.33 billion YoY. The key driver here is the issuance of unsecured notes which again ties in with the increase in debt we see on the balance sheet.

Overall, Square produced YTD free cash flow of $575 million compared to $175 million YoY. This is a healthy trend.

8. Guidance

Seller GPV is expected to be up 42% YoY in October, and the two-year CAGR is expected to be up 24%.

Cash App gross profit growth is expected to be 35% YoY in October and on a two-year CAGR is expected to be up 90%.

For the fourth quarter of 2021, management expects non-GAAP product development, sales and marketing, and general and administrative expenses to increase by approximately $115 million compared to the third quarter of 2021.

9. Conclusion

A very middle of the road quarter from Square. The company has set its own high standards and when it doesn’t hit those heights it can feel a little underwhelming. On Friday, 5 November, the day after earnings were released, Square closed the session down 4%.

The growth story with Square is still very much intact. Gross profit continues to grow by at least 40% and this trend is expected to continue into the coming quarters. Additionally, it was announced on the conference call that the acquisition of “buy now pay later” company Afterpay is expected to close in Q1 2022. Further to this, CEO, Jack Dorsey announced that the company is ramping up investment in crypto-related products and services, launching a business unit that will include a platform for decentralized-finance (DeFi), services and more Bitcoin-related products.

Rating: 3 out of 5. Meets expectations.

Disclosure: The author holds a long position in Square.

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Hit the subscribe button below if you have not already done so in order to receive the latest content straight to your inbox each week. By hitting the archive button you can view all of my previous newsletters on the website.

Happy investing

Wolf of Harcourt Street

Disclaimer: I am not a financial adviser and I am not here to give specific financial advice. The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. The information is based on personal opinion and experience, it should not be considered professional financial investment advice. There is no substitute for doing your own due diligence and building your own conviction when it comes to investing.