In this report, I will cover the following:

Overview

Customers

Capitalisation

Revenue and Margins

Valuation Multiples

Balance Sheet and Cash Flow

Stock Price History

Competitors

Management and Ownership

Risks

Opportunities

Investment Strategy

Square, Inc.

Ticker: $SQ

Sector: Technology

Market Cap: $89.8 billion

1. Overview

Square, Inc can be best described as a commerce ecosystem. The Company enables its sellers to start, run and grow their businesses. It combines software with hardware to enable sellers to turn mobile devices and computing devices into payments and point-of-sale solutions. The tools help sellers make informed decisions through the use of analytics and reporting. The company can be viewed as two significant ecosystems namely the Seller Ecosystem and the Cash App Ecosystem.

Seller Ecosystem

Once a seller downloads the Square Point of Sale mobile application, they can take their first payment. With its offering, a seller can accept payments in person via magnetic stripe (a swipe), Europay, MasterCard, and Visa (a dip), or Near Field Communication (a tap); or online via Square Invoices, Square Virtual Terminal, or the seller's Website. Once on its system, sellers gain access to technology and features, such as reporting and analytics, next-day settlements, digital receipts, payment dispute management and chargeback protection, and Payment Card Industry (PCI) compliance.

Cash App Ecosystem

On the consumer (buyer) side, Cash App offers individuals access to a way to send and receive money. The Cash App also includes Square Cash Card, which not only operates as a debit card but also allows people to trade bitcoin and stocks. This ecosystem seeks to build a similar ecosystem of services for individuals, providing financial access to all and allowing anyone to send, spend and save money all from one app.

2. Customers

Seller Ecosystem

During the first quarter of 2021, Seller Gross Payment Volume (GPV) was up 20% year over year. Seller GPV consists of the total monetary amount of all card payments processed by sellers using Square, net of refunds, and does not include GPV from the Cash App ecosystem. Mid- market Seller GPV grew 43% year over year, more than 2x the growth of total Seller GPV.

Square’s point-of-sale software has attracted new and larger sellers to Square. In the first quarter of 2021, more than half of Square for Restaurants and Square for Retail sellers onboarded were new to Square. Restaurants and retailers value the cohesion of Square’s ecosystem to help them manage their businesses efficiently, and have adopted more than three products on average. These sellers have used more of the broader ecosystem and generated gross profit of more than 5x greater compared to the average seller.

Cash App Ecosystem

At the end of 2020, Cash App reached more than 36 million monthly transacting active customers, up more than 50% year over year. Peer-to-peer payments are a primary driver of customer acquisition for Cash App. In 2020, customers sent funds to more individuals and more frequently, driving a nearly 50% increase in peer-to-peer transactions sent per customer compared to the prior year. These network effects have complemented paid marketing campaigns, allowing Square to maintain a ridiculously low acquisition cost of fewer than $5 in 2020 for a new transacting active customer.

In 2020, customer adoption beyond peer to peer increased across all of Square products compared to the prior year. New customers adopted products like Cash Card and bitcoin within their first month at a higher rate. Boost which allows Square to personalise rewards for customers in real time has been a powerful tool to drive Cash Card adoption and increase customer engagement. At the end of 2020, new Cash Card customers adopted Boost at a higher rate, and Boost actives spent approximately 2x more than other Cash Card customers.

Lastly, you can’t speak about Cash App customers without mentioning Bitcoin. In 2020, more than three million customers purchased or sold bitcoin on Cash App, and, in January 2021 more than one million customers purchased bitcoin for the first time. Bitcoin has helped increase gross profit per active customer and engagement in the broader ecosystem as bitcoin actives use other products, such as Cash App and direct, more frequently compared to the average Cash App customer.

3. Capitalisation

Square went public on the 19th November 2015 through an IPO raising an initial $243 million valuing the company at $2.9 billion. Today the market market cap is $89.7 billion meaning if you had invested at the IPO date you would have over 30x your initial investment in less than 6 years. Despite this performance the company is still very much a growth stock.

4. Revenue and Margins

Square has been growing revenues at a phenomenal rate over the past couple of years. During its most recent financial results for Q1 2021:

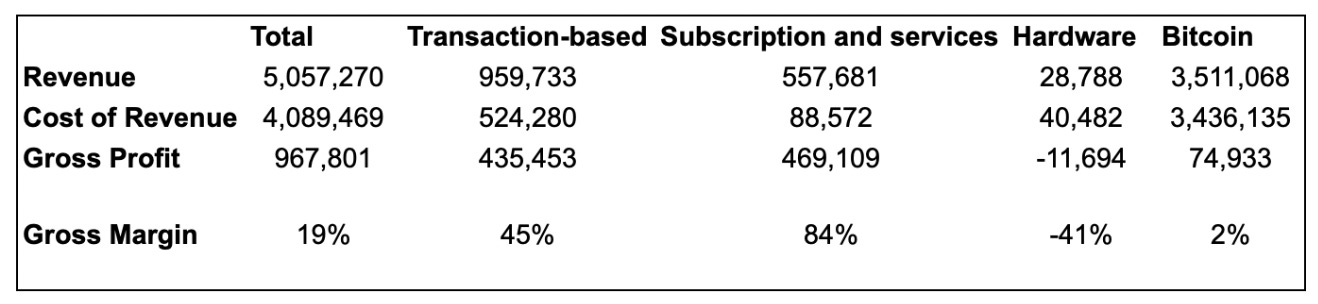

Revenue was $5.057 billion, an increase of 266% year-over-year.

Transaction-based revenue was $960 million, an increase of 27% year-over-year.

Subscription and services-based revenue was $558 million, an increase of 88% year-over-year.

Hardware revenue was $29 million, an increase of 39% year-over-year.

Bitcoin revenue was $3.511 billion, an increase of 1047% year-over-year.

At this point it is important to point out the accounting treatment for Bitcoin revenue is distorting revenue. Square recognises the full value of Bitcoin transactions on Cash App as revenue, and then records the cost of acquiring the Bitcoin prior to transferring the cryptocurrency to customers’ accounts as cost of revenue. Therefore, revenue is not a meaningful indicator for performance and gross profit is more important.

Gross margin was 19% in Q1 2021 compared to 31% in Q1 2020 which is distorted by the Bitcoin revenue. More importantly, gross profit increased by 79% to $964 million in Q1 2021 up from $597 million in Q1 2020.

Below we can see how the Q1 2021 revenues and gross profit are split between ecosystem and revenue stream.

5. Valuation Multiples

Square is a growth stock and by its nature trades at high valuation multiples. Below are some of the key valuation metrics that I have identified. I have included the PE ratio and while Square is profitable, this is not the focus for the business at this time.

As a result of the recent market correction, the Price/Sales multiple is now at pre-pandemic levels (albeit not directly comparable given the increased weighting to Bitcoin revenue at present). As a comparative, PayPal valuation multiples are as follows:

Price/Sales 12.31

Price/Book 14.53

Price/Earnings 54.85

If I had released this investment thesis a week or two earlier I would be stating that Square commands a very rich valuation. However, based on todays valuation I believe that Square offers an attractive risk/reward opportunity for new investors with a long-term horizon.

6. Balance Sheet and Cash Flow

Commentary

Over $3 billion in cash and cash equivalents

Total Liabilities as % of Total Assets is 80%

Current Assets to Current Liabilities ratio of 1.68

Goodwill balance making up less than 3% of total assets which relates to a number of acquisitions, most notably the acquisition of Weebly, the website-building company in 2018. Readers can expect this amount to increase in 2021 with the acquisition of TIDAL

Free cash flow for Q1 was negative $132 million however Square did report positive free cash flow of $243 million for 2020

7. Stock Price History

The share price had been moving along nicely for the first couple of years after it’s IPO before really taking off over the past year hitting an all time high in February 2021.

8. Competitors

The payments and fintech market is one that attracts lots of would-be competitors.

Seller Competitors

Adyen growing payments company with global operations headquartered in the Netherlands

Stripe provides a payment gateway to application developers and competes with developer tools offered by Square

Shopify, Big Commerce, Wix are direct competitors when it comes to e-commerce building

Cash App Competitors

Paypal’s Venmo stands as a direct and the most serious competitor to Cash App considering PayPal’s massive user base. At the end of 2020, Venmo has 52 million users while Cash App has 36 million but is growing faster.

The competition between Cash App and Venmo is a really fascinating one. If you are interested in reading a bit more into it, I recommend the Venmo vs Cash App paper by Maximillian Friedrich from Ark Invest.

Other competitors include Revolut and N26 which are more commonly used here in Europe.

9. Management and Ownership

Square was founded in 2009 by Jack Dorsey and Jim McKelvey. The original inspiration for Square occurred to Dorsey in 2009 when McKelvey was unable to complete a $2,000 sale of his glass faucets and fittings because he could not accept credit cards.

Jack Dorsey is the current CEO and Chairman of Square. He is also the CEO of Twitter which he also cofounded. McKelvey served as Chairman until 2010 and today he sits on the Board of Directors.

Jack Dorsey appears to be well received at Square with a 92% approval rating on Glassdoor with the company overall scoring 4.3 out of 5 by its own employees.

In Jack Dorsey, Square meets my criteria of being led by a visionary founder. One of the main criticisms of Dorsey is his double hatting as CEO of both Square and Twitter. I personally don’t have any issue with this so far from a Square perspective as the company is executing well but the same could not be said for Twitter over the past number of years.

10. Risks

1. “Jack” of All Trades

A key part of Square’s strategy and success has been to add more and more services on its platform. Not only has this provided more convenience for customers, it has expanded the total addressable market.

However, there is a risk to this strategy as it inherently increases the complexity of the company. The services span into very diverse categories like invoices, deposits, inventory, appointments, website hosting, marketing, employee management, business loans. All of these are in highly competitive markets.

Further to this, the acquisition of TIDAL which is a global music and entertainment platform has many investors wondering how this fits in with the long-term vision.

Lastly, Jack Dorsey is the CEO of two publicly traded companies. There is a risk that he takes his eye off the ball with Square and turns more attention to Twitter.

2. Competition

As I have discussed above, Square faces intense competition in both its Seller and Cash App ecosystems. Many of the competitors are well resourced with plenty of financial muscle. Square’s ability to build great products that are easy to use will play a big part in how the company can grow Cash App.

Further to this, I expect the Big Tech most notably Apple and Facebook to really zone in on payments in the future and provide even stiffer competition.

11. Opportunities

1. Large Addressable Markets

Square believes that its Seller ecosystem has a $85 billion market opportunity in the US alone. Square derives the market opportunity for each category in the Seller ecosystem by applying a typical revenue or take rate to the relevant volume of business activities in each category.

Square believes that the Cash App ecosystem has a market opportunity that’s more than $60 billion in the USA. The figures for the various market opportunities are based on the potential take rate in each activity and the overall volume of transactions that are happening in the USA ($4 trillion in peer-to-peer sending, $2 trillion in spending, and $3 trillion in investing).

For context, Square’s total revenue in Q1 2021 was ‘just’ $5 billion as you might recall. An annualised revenue figure of roughly $20 billion will still only represent less than 14% of Square’s overall market opportunity of more than $145 billion in the USA alone.

This market also excludes the potential for international expansion, new products, and new use cases. Square is highly innovative and its total addressable market has increased over time.

2. War on Cash

Covid-19 has created a fear of touching cash and has accelerated the shift towards digital payment methods. Square solutions mean that customers can swipe their cards, push them into the chip reader or tap without ever making contact with the Square dongle. The staff operating the dongle never even has to touch the credit or debit card, making it a completely touchless transaction.

According to Forbes, Gen Z will make up approximately 31% of the global population in 2021. This shift in the population will have huge significance because it indicates that the majority of the world’s population by 2021 will be a tech-savvy or tech-exposed generation increasing the demand for digital payment systems.

Mobile-point-of-sale (mPOS) is a revolutionary technology as it frees merchants from their bricks-and-mortar locations and in-store payments. It empowers merchants to go to various places like concerts, trade shows, food trucks, and many other places where they can seamlessly accept payments from their customers. According to Global Market Insights, mPOS will have a CAGR of 19% (approx.) between 2020 to 2026.

Digital wallets are making the idea of carrying around a physical wallet almost novel. A digital wallet refers to a software, electronic device, or online service that allows individuals or businesses to make electronic transactions. According to Juniper Research, total spend through digital wallets will exceed $10 trillion in 2025, up from $5.5 trillion in 2020.

3. Reopening Play

Square's seller ecosystem consists of various hardware and software solutions designed to empower merchants, and the ecosystem has expanded rapidly in recent years. Square Online allows sellers to easily build a digital storefront that syncs with their in-store inventory (or menu) and point-of-sale system, enabling merchants to manage their physical and online presence from one dashboard.

During the pandemic Square launched Online Checkout, a solution that helps clients rapidly shift to e-commerce without building a full digital storefront. Online Checkout allows sellers to easily add a checkout link to emails, blogs, or social media, giving them a digital presence immediately. Square's expanding seller ecosystem ranging from point-of-sale software to digital commerce solutions extends far beyond enabling merchants to accept digital payments. Increasingly, Square offers end-to-end solutions that allow sellers to manage and grow all aspects of their business.

Brick-and-mortar stores were Square's legacy customer base, the majority of which were forced to shut during the past year. As physical stores including restaurants, barbershops and beauty salons begin to reopen Square will be facilitating much of this pent up economic demand.

12. Investment Strategy

Square operates in a space where there is likely to be multiple winners. In my opinion, Cash App is going to be one of them. Current revenue is so small compared to its current total addressable market, which will likely expand further in the future. Jack Dorsey is a visionary CEO who has cultivated a culture of constant innovation. With a high level of recurring revenue from subscriptions as well as repeat customer-use, Square makes for a fascinating investment case over the next decade.

Disclosure: The author holds a long position in Square.

Hit the subscribe button below if you have not already done so in order to receive the latest content straight to your inbox each week. By hitting the archive button you can view all of my previous newsletters on the website.

Happy investing

Wolf of Harcourt Street

Disclaimer: I am not a financial adviser and I am not here to give specific financial advice. The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. The information is based on personal opinion and experience, it should not be considered professional financial investment advice. There is no substitute for doing your own due diligence and building your own conviction when it comes to investing.

Very detailed analysis on one of the most exciting tech companies in my view. Square‘s business model is extremely scalable. I don’t like they include Bitcoin revenues resp it’s important to exclude it to get an accurate growth potential picture.

Again, very good read.

Cheers