In recent editions, I shared a Due Diligence Checklist to help with opening a position in a stock and explored When To Sell a Stock. Somewhere in the middle we have got an existing stock in our portfolio. We have determined that we don’t want to sell it but should we add more?

In this edition, I examine some of the scenarios that indicate when to add to a stock position. We are assuming that you have performed full due diligence when opening a position in the stock and that the initial investment thesis has not changed.

This article is written from the perspective of a long term investor. Short term investors or traders might approach this question from a completely different angle.

1. Dollar Cost Average

One of the easiest and simplest methods to add to a stock position is to simply dollar cost average. This method involves investing at periodic intervals in an effort to reduce the impact of volatility in the market on the purchase price.

For example, we might decide that we want to invest $1,000 in Apple stock and we are able to commit to investing $200 per month. In this instance, we would purchase $200 worth of Apple stock on the same day we get paid each month until we reach $1,000 invested.

This strategy removes much of the detailed work required in attempting to time the market. Per the below graphic we can see that the average price we pay ends up being smoothed out over the period we have committed to invest.

2. Valuation Multiples Improve

Another method to add to a stock is when the valuation metrics improve. This approach might seem counterintuitive but when the share price goes up, the stock can be better value. Valuation multiples are essentially a range of indicators that can be used to value a stock. Check out the post titled Valuation Multiples if you are not familiar with this concept or would like a refresher.

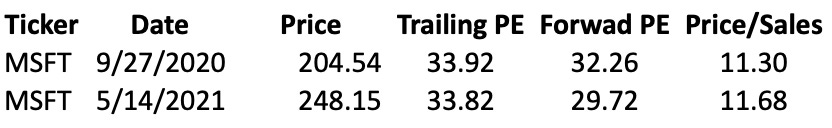

When you first invest in a stock you take note of the key information such as the purchase price, PE ratio, Price/Sales etc

In the scenario above we can see that whilst the Microsoft share price has risen during this period by over 20% you could argue that the company is actually a better investment now because both the trailing and forward PE ratios are lower.

The goal here is to add at better value points:

PE down

P/S down

Dividend yield up if you are a dividend investor

3. Moving Averages

A moving average is a stock indicator that is used in technical analysis. The moving average smooths out price data by creating a constantly updated average price. The average is taken over a specific period for example, 5 days, 50 days, 200 days, or any period you like.

By looking at the moving average direction we can get a sense as to what direction the price is moving. If the moving average is moving up, then this means that the price has been moving up recently and if the moving average is moving down, then the price has been moving down.

In the above chart from Trading View, I have pulled in the share price for Sea Limited mapped to the 50, 100 and 200 day moving averages. The blue line represents the 50 day moving average of $234.50, the green line green line is the 100 day moving average of $232.76 and the current share price is $216.69 which means that the stock is currently trading below both the 50 and 100 day moving averages.

Moving averages are a great way to gain a deeper insight into what is going on with an individual stock in terms or trading activity and volume. Put simply, it makes seeing the trend easier. I have previously written a detailed post on moving averages on EngineerMyFreedom.com which you can check out here if you would like to read more about the concept.

4. Advanced Technical Indicators

The most advanced method in determining when to add to a position is from analysing technical indicators. This is often an area more utilised by traders but it can still be a useful tool for the long-term investor.

One of the most widely regarded bullish signals is the cup with a handle price pattern. The cup is in the shape of a "u" and the handle has a slight downward drift with the right-hand side of the pattern typically experiencing lower trading volume.

The above chart shows the Cloudflare breakout from a cup with a handle pivot back in October 2020.

If you are looking to learn more about this area, How to Make Money in Stocks by William J. O’Neill is an essential read.

Hit the subscribe button below if you have not already done so in order to receive the latest content straight to your inbox each week. By hitting the archive button you can view all of my previous newsletters on the website.

Happy investing

Wolf of Harcourt Street

Disclaimer: I am not a financial adviser and I am not here to give specific financial advice. The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. The information is based on personal opinion and experience, it should not be considered professional financial investment advice. There is no substitute for doing your own due diligence and building your own conviction when it comes to investing.