Last week I published a Due Diligence Checklist that could be used as a guide in performing research on a particular stock. So now you did your research and you bought a stock that could become a big winner. Now what?

One of the biggest problems that investors have, particularly growth investors, is determining the proper time to sell. It is a lot easier to be objective when you're deciding what to buy. However, when it comes time to selling, it can be difficult to separate emotions from your decision making.

This article is written from the perspective of a long term investor. Short term investors or traders might approach this question from a completely different angle.

In an ideal world the answer to the question “when should I sell?” is never.

Exceptional businesses often command an exceptional price for a reason. In my view, the price of the stock increasing alone is not a reason to sell. Did you expect the price to go up before you bought it? If you didn’t then why did you buy it!

If a company is growing and executing well it does not make any sense to me to sell. At various stages the likes of Amazon, Apple and Netflix looked over valued. If you purchased any of these names over the past decade and had sold because you thought it was overvalued you could have missed out on potential life changing returns.

Obviously this is an ideal situation and unfortunately things don’t always turn out like this. Having a disciplined set of rules around when to sell mitigates the risk of selling excellence.

1. Initial Investment Thesis Has Changed

Before you make any investment you should understand the why. Journaling your thoughts is a great way to keep a record of why you invested in a particular stock. I write a detailed investment thesis on every stock I invest in which is something that I have started to share.

Once you have the initial investment thesis laid out it is then very easy to check how the company is performing down the line compared to the thesis. If the thesis has not changed despite the stock price having significantly increased or decreased then there is no reason. However, if the thesis has now changed then you might need to consider selling the stock. For example, has the growth significantly slowed down? Have the risks you identified come to fruition such as regulatory changes that directly impact the company?

Additionally, did you make an error in your initial investment thesis? Perhaps you made an error in an assumption and now you realise that the business is simply not a suitable investment.

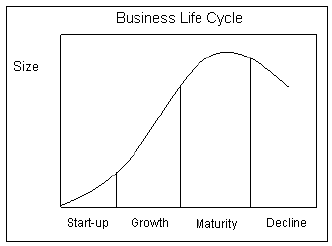

2. Business Life Cycle Change

There are four main stages of the business life cycle: Start-up, Growth, Maturity and Decline. Growth investors by the very nature invest in companies that are in the start-up or growth stages. A legitimate reason to sell a growth stock is because despite having performed really well over the years, has reached the maturity stage of its life cycle. When a company reaches the maturity or decline stages it typically has exhausted all growth avenues and begins to distribute its earrings through a dividend.

3. Takeover

Mergers and acquisitions happen regularly in the corporate world. Big fish eats little fish. If you are invested in a growth stock and it is the subject of a much larger company this might be a reason for you to sell. When an acquisition is announced, the stock price of the company being acquired typically rises to a level that is close to the agreed-upon price.

For example, Slack Technologies recently agreed to be acquired by Salesforce in a cash-and-stock deal. The Slack shareholders will receive Salesforce shares in exchange for their Slack shares. Slack is very much a growth company whilst Salesforce is more mature in terms of the business life cycle. Slack shareholders might not want to become Salesforce investors and decide to sell their Slack shares.

4. Financial Needs Outside Of Investing

Stocks are assets and there are times when people need to cash in on them. When you first started to invest your investment goals might have been to buy a house, travel the world, or put your children through college. Based on your own individual situation you might cash in on some of your stocks to realise some of these financial needs.

The key point here is that you are selling to withdraw cash from your brokerage account and are not simply selling to invest in another stock.

5. Change to your Investment Strategy

Your investment strategy should determine what stocks are in your portfolio. A personal investment strategy is something that I encourage every investor to have. If your investment strategy changes then by effect some of the stocks in your portfolio might not fit with the strategy and will need to be sold.

For example, I recently made A Change to My Investing Strategy. As a result of this I sold a couple of stocks because they were no longer aligned to my investing strategy. While the initial investment thesis had not changed, I sold the stocks because they were not positively contributing towards my end goals.

6. Tax Benefit

Depending on your jurisdiction, there might be a tax benefit in selling a stock at a particular time to reduce your tax liability. In Ireland, the Capital Gains Tax threshold is quite low so some investors might try to utilise strategies such as the annual exemption or tax loss harvesting. If you are interested in learning more about the tax consequences of investing you can check out the Let’s Talk About Tax Series that I have written.

Final Words

There is no right or wrong answer when it comes to when to sell. The most important thing is to have a set of rules or principles that you can refer to when making the decision. Removing the emotions from the decision and acting on the facts will ultimately lead to better decision-making. Don’t be that guy or girl who sold the next Netflix too early because you thought it couldn’t go any higher!

Hit the subscribe button below if you have not already done so in order to receive the latest content straight to your inbox each week. By hitting the archive button you can view all of my previous newsletters on the website.

Happy investing

Wolf of Harcourt Street

Disclaimer: I am not a financial adviser and I am not here to give specific financial advice. The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. The information is based on personal opinion and experience, it should not be considered professional financial investment advice. There is no substitute for doing your own due diligence and building your own conviction when it comes to investing.