Why Professional Money Managers tend to be Worse at Selling Stocks

A Feedback Loop to Improve Sell Decisions

Welcome to the hundreds of new subscribers who have joined since the viral Datadog, Inc. Investment Thesis

The monthly deep dive is determined by a Twitter poll, so follow me to participate in the decision-making process. Democracy rules!

To suggest stocks for future coverage, send me an email or DM on Twitter, and I'll add them to upcoming polls.

Did you know that professional money managers tend to be worse at selling stocks than buying them?

Research by academics and data firm Inalytics which looked at more than 4 million trades by almost 800 portfolios over a five-year period, found that each buy decision by a professional portfolio manager yielded an average of 1.2% over the next year, but a sell decision led to an average loss of 0.7% per year. The researchers suggest the reason for this is that managers invest more time researching purchases, which may be easier to make, and tend to sell without enough information. The full paper can be found here.

As investors, deciding when to sell a stock is one of the hardest decisions we face. After selling a stock, we often stop following it completely, leading to missed opportunities to learn from our actions and improve our decision-making process. Given the research suggesting that sell decisions result in poorer returns comparatively, how can we improve this skill set?

The concept of a feedback loop is relevant to evaluating the outcome of selling a stock. Without reviewing the outcome of the decision, there is no way to determine whether it was a good or bad decision. By not taking the time to assess the outcome, you miss out on the opportunity to learn from your actions and adjust your decision-making process accordingly. This creates a potential negative feedback loop where you continue to make the same mistakes and miss out on opportunities to improve your performance. Therefore, it is crucial to review the outcome of selling a stock to inform future decisions and create a positive feedback loop that helps us make better choices in the future

This week’s edition includes a review of the sales from my portfolio in 2021. I discuss the reasons for selling at the time, the stock's performance since then, and my current reflections after a couple of years.

Snapshot

Out of the six positions I sold in 2021, only two are marginally higher. Four of them have dropped by 40% or more.

Realty Income (O)

Rationale

I sold the stock as part of a broader shift in my investment strategy to focus on stocks with higher potential for capital appreciation, rather than income generation, due to the tax treatment in Ireland (discussed previously).

Current Reflection

My decision to sell the stock was based solely on a strategic shift and not a reflection of my personal views towards the stock. My stance remains unchanged.

Walmart (WMT)

Rationale

The reasons for selling here were similar to Realty Income. Despite a low dividend yield, I perceived limited potential for capital appreciation based on the valuation and anticipated earnings growth.

Current Reflection

I sold the stock when its P/E ratio was 33, which is high for a low-margin, low-growth business. Today, the stock trades at a P/E of 35, but my view on Walmart remains unchanged. The valuation and expected earnings growth continue to indicate low potential for capital appreciation, justifying my decision to sell.

Futu (FUTU)

Rationale

I decided to sell Futu for two reasons. Firstly, the turbulence in China at the time was something that concerned me and since I already had exposure to China via Nio, I deemed it sufficient. Secondly, I was concerned with the detachment between the Futu share price action and the fundamentals. At the time of sale the position was up 125% in my portfolio and I had only held it for nine months.

Current Reflection

Futu’s growth has ground to a halt in 2022, only growing by 2%. When I sold the stock it was trading at a P/E ratio of 50. The share price has been cut in half and the current P/E of 19 appears far more reasonable. Revenue and earnings are expected to growth by 15% and 20% respectively in 2023. Ultimately, I feel that investing brokerages are simply a race to zero and that over the long-term margins will continue to become squeezed. Given the added China risk I would be hesitant to reenter this stock.

GAN Limited (GAN)

Rationale

GAN was 1% weighting in my portfolio and having a position this small was never going to move the needle unless I increased its weight which I was not prepared to do. GAN announced a share repurchase program which felt like a strange decision to me at the time. My view was that the company should be focusing on growth initiatives and not share buy backs given the stage in its business life cycle.

Current Reflection

I had a lucky escape as the stock has completely capitulated since. A perceived “growth” stock authorising a share repurchase program when the market was at an all time high was a big red flag for me. The decision has turned out to be an incredibly poor use of capital by management. I would not touch this stock with a barge pole.

Paysafe (PSFE)

Rationale

The earnings that Paysafe reported during Q3 2021 were by far the worst of all the companies that I held at the time. They managed to miss the revenue estimate handsomely, increasing revenue by only 2% in a booming digital payments industry in addition to lowering already light forward guidance. The company was not delivering on any of the shiny promises it made before its SPAC merger and was losing clients.

Current Reflection

Another lucky escape. Similar to GAN, I feel like if anything I did not get out of this stock fast enough at the time. I was giving management the benefit of the doubt for too long. This “growth” stock grew revenue by a whole 1% in 2022. I would continue to avoid.

Disney (DIS)

Rationale

Of all the stocks that I sold during 2021, this decision definitely felt the toughest at the time. The Q3 2021 results were not what I was hoping for. Revenue came in just under estimates but the Disney+ subscriber growth slow down was what really caught my attention. At the end of the quarter there were 118.1 million subscribers, quite a bit below the estimate of 124 million. Only 2.1 million new subscribers were added in the quarter. This was the lowest number of new subscribers in a single quarter since Disney+ was launched two years earlier. Average Revenue per User also declined.

I had no doubt that Disney would be around for decades to come due to its world class brands and intellectual property. However, I had little faith in CEO Bob Chapek getting the most out of Disney+ which was the plan laid out by former CEO Bob Iger. Ultimately, I sold because I felt that shareholder returns could plod along for the next few quarters or years. The P/E ratio at the time was 140.

Current Reflection

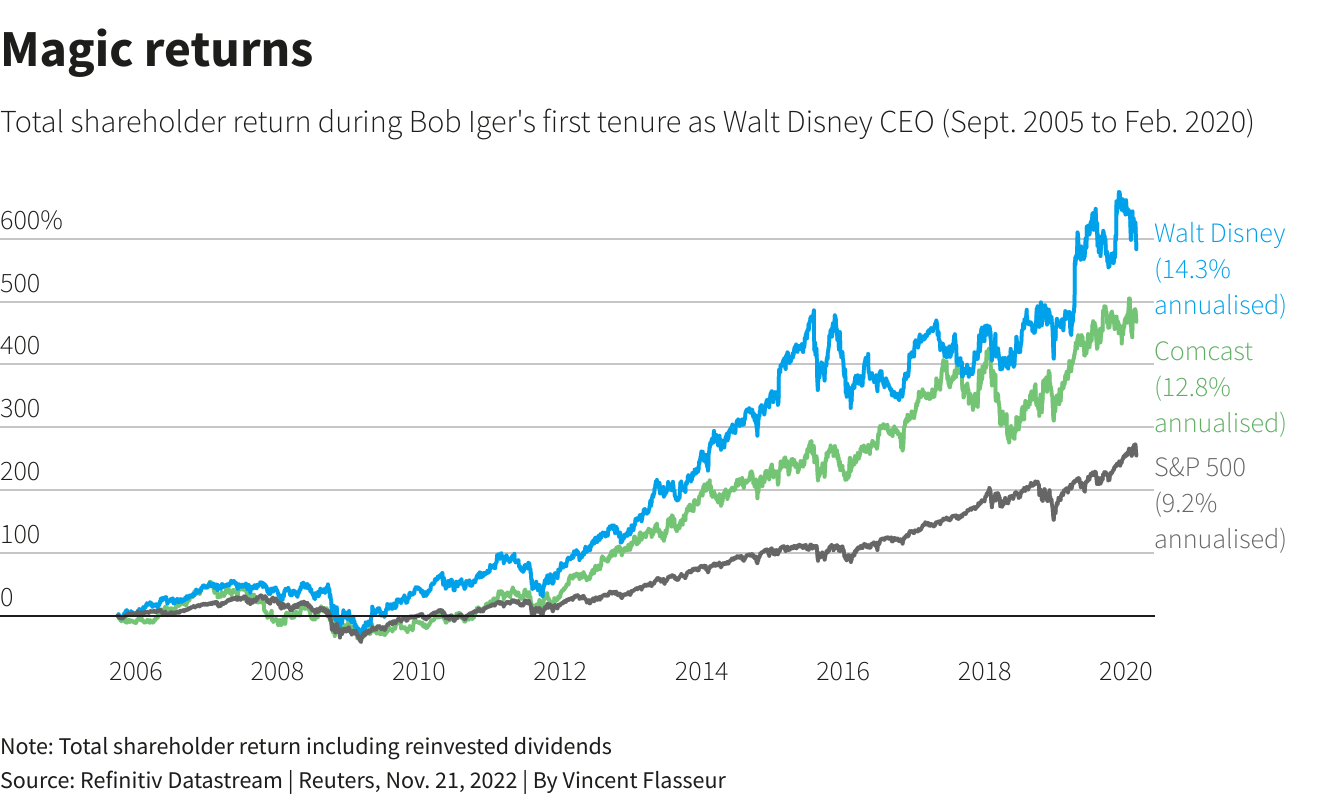

I wasn’t the only one who felt that Bob Chapek was not up to it. In November 2022, the Disney Board fired Bob Chapel and announced that Bob Iger would be returning.

During Q4 2022, Disney+ subscribers declined 1% quarter-on-quarter and the company’s streaming losses have continued to grow to over $1 billion in a single quarter.

This was a tough decision but I feel like the decision has been vindicated so far. Having said that, this is a stock that I would not rule out revisiting in the future if Bob Iger manages to turn the ship around given. His previous track record speaks for itself.

Concluding Remarks

As a long-term investor, I believe that the time horizon for investment decisions should be at least ten years and not two. Nonetheless, I felt that this was a very worthwhile exercise on my part.

Speaking candidly, Paysafe and GAN should never have entered my portfolio in the first place. I let SPAC mania take hold and my due diligence suffered as a result. Subsequently, I have enforced a rule whereby a stock must trade on the public markets for at least six months before it is eligible for inclusion in my portfolio.

Writing this piece and sharing my reflections has been a great way for me to remind myself of the learnings on my journey so far. I strongly encourage you to perform a similar exercise based on your own decisions.

Successful investing is a continuous cycle of actions, reflections, and learnings.

Hit subscribe below if you have not already done so in order to receive the latest content straight to your inbox each week.

If you enjoy today’s edition, then feel free to share as it, it really helps.

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Great reflections here. It appears that anything you sold in 2021 turned out well. :) It will be interesting though to do the same exercise next year including both 2021 and 2022 sales.