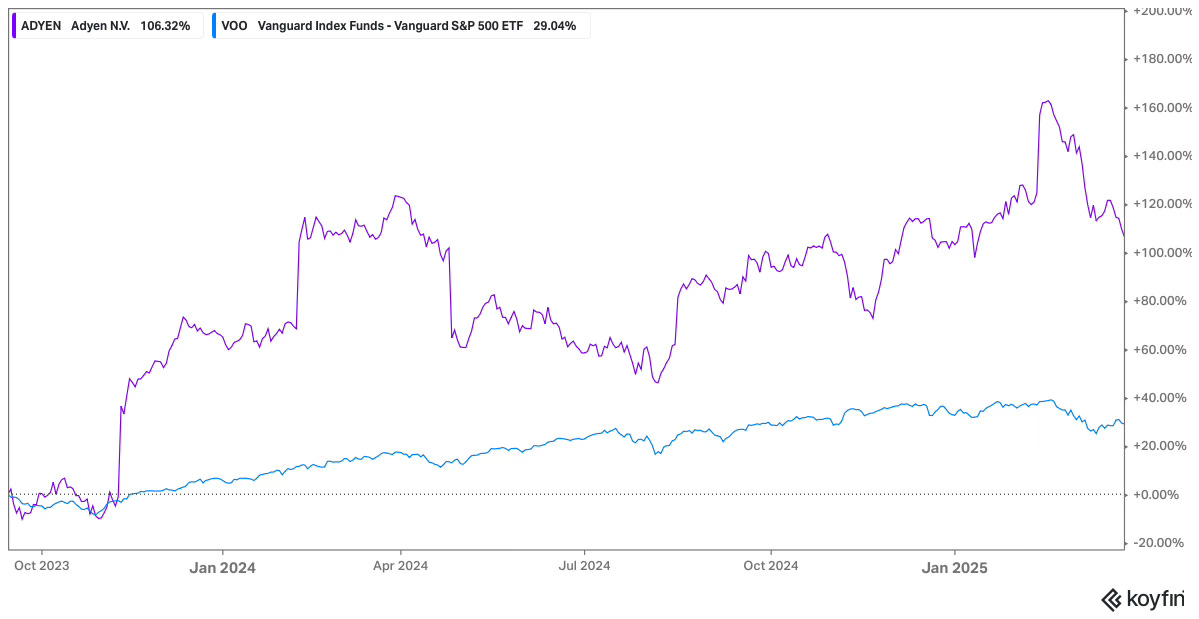

Adyen’s stock is up +106% since I first pitched it in August 2023, significantly outperforming the market’s return of +29% over the same period.

After the stock price has more than doubled, what is Adyen’s fair value today?

In this update, I present a revised financial model and fair value assessment. The starting point for this analysis is the 2024 financial results. I have already shared a detailed H2 2024 earnings analysis, which can be accessed via the link below.

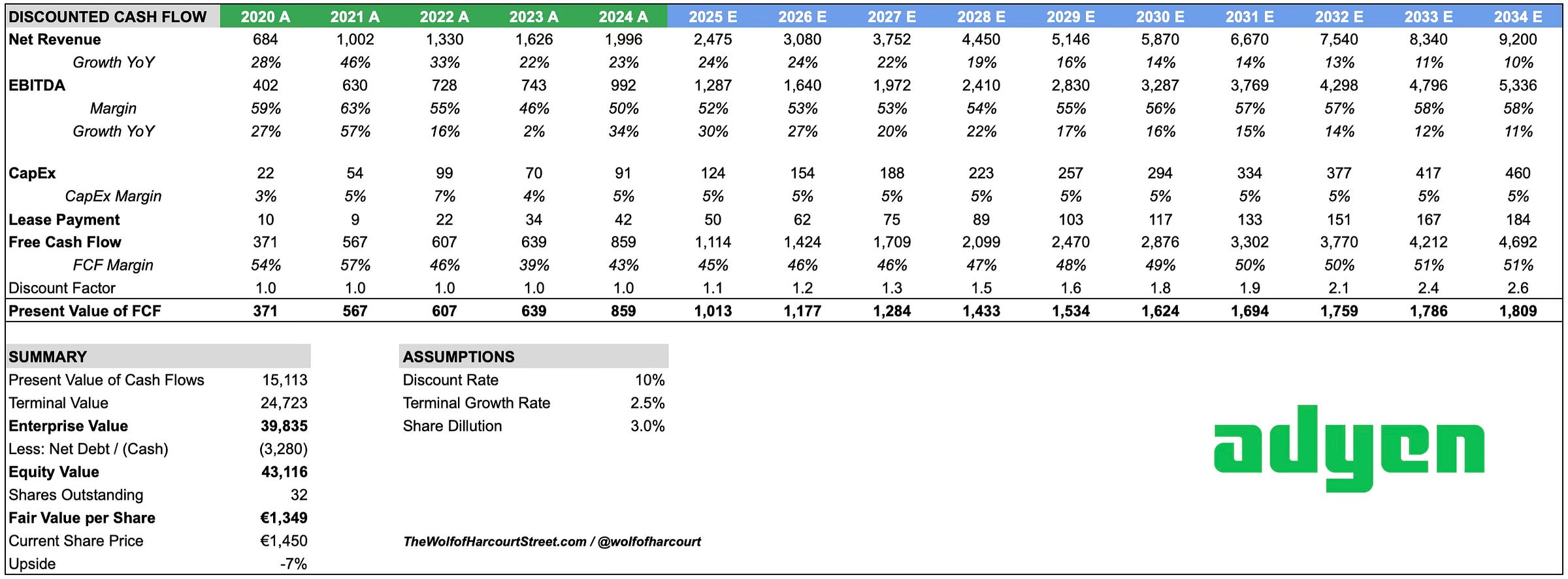

Discounted Cash Flow Analysis

Future cash flows have been projected over ten years using a 10% discount rate. Previous models were based on a five-year period, which resulted in most of the value being attributed to the terminal component. To reduce reliance on this assumption, I have extended the projection period. A terminal growth rate of 2.5% has been applied, reflecting Adyen’s ability to benefit directly from inflation. Adyen's revenue is a function of the payment volume it processes multiplied by its take rate.

A 16% revenue CAGR is projected from 2024 to 2034, assuming >20% revenue growth for the next three years before gradually decelerating as the revenue base scales. This growth will be driven by sustained momentum in the global payment processing market, which is projected to expand from $144.1 billion in 2024 to $914.9 billion in 2034, with embedded finance and cross-border transactions as key growth drivers. For context, between 2018 and 2024, Adyen’s revenue grew at a 32% CAGR.

The EBITDA margin is forecast to reach 52% in 2025, before expanding to 58% by year 10, driven by operating leverage. In H2 2024, Adyen achieved an EBITDA margin of 53%, while management currently guides for an EBITDA margin above 50% in 2026. This analysis assumes Adyen will not reach the 60%+ EBITDA margins seen in 2021.

The Capital Expenditure (CapEx) margin has been set at 5% over the entire forecast period, consistent with management guidance. Adyen’s historical CapEx margin over the past seven years has also averaged 5%. As a result, the Free Cash Flow (FCF) margin is projected at 45% in 2025, increasing to 51% by 2034. It is worth noting that Adyen achieved an FCF margin above 50% between 2018 and 2021 before it declined in 2022.

Maximum share dilution has been projected at 3%. Historically, Adyen has issued relatively little share-based compensation, partly due to the 20% bonus cap in the Netherlands. However, this is set to increase as Adyen expands into the U.S. For example, the newly appointed Chief Technology Officer, Tom Adams, receives an amount equivalent to 100% of his base salary as share-based compensation, compared to 46% for his predecessor.

Based on these assumptions, Adyen’s fair value is approximately €1,349 per share, indicating a potential downside of -7% compared to the share price of €1,450 on 27 March 2025.

Conclusion

The analysis suggests that Adyen is currently trading near fair value. Adyen is a high-quality business, and its current valuation reflects this, even using conservative assumptions.

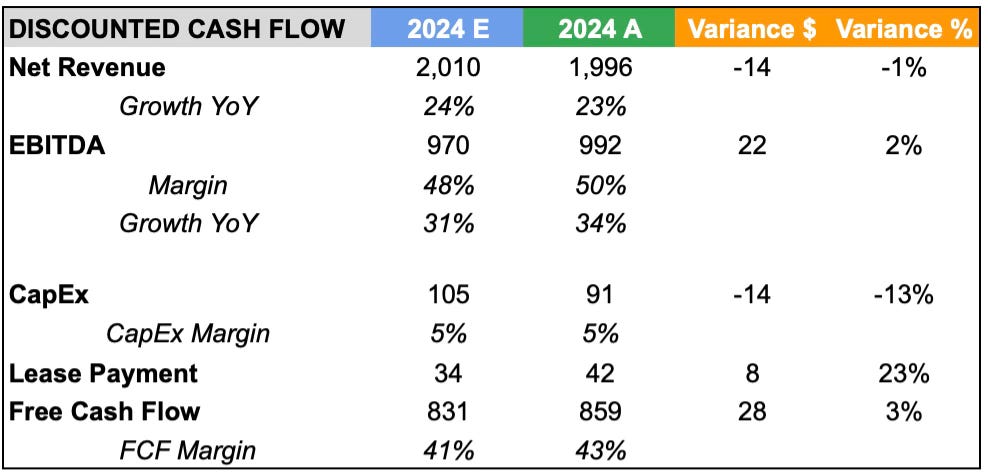

In the table below, I have revisited my assumptions from last year’s valuation exercise. While net revenue growth was slightly below my estimate, Adyen exceeded expectations on FCF margin.

While I have no plans to sell Adyen, and it remains a firm hold due to the underlying business quality, the opportunity to deploy new capital into the stock today is less appealing than it was in 2023 and parts of 2024.

The reason I am comfortable holding Adyen is the optionality within the business and the secular growth tailwinds driving it. If the company continues to gain market share and maintains the pace of new partnerships seen in 2024, it could continue to exceed expectations, just as it did last year.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Love this company and their execution, but indeed it’s too high to get a good price

Thanks for this. Not really surprising most of the undervaluation is gone at this price.