Adyen: Volume acceleration validates long-term strategy

Adyen H2 2023 Earnings Analysis

Executive Summary

Adyen's Processed Volume for H2 2023 reached €554.1 billion, showcasing accelerated growth of 29% YoY. The expansion of existing customer relationships drove over 80% of this growth, emphasizing the significance of customer retention for Adyen's success. Despite a decreased take rate of 16.3 basis points (compared to 17.3 in H1 2023 and 17.1 in H2 2022), Adyen's land-and-expand business model, featuring a tiered pricing structure, contributed to the sustained five-year compounded annual growth rate of 44% in Processed Volume.

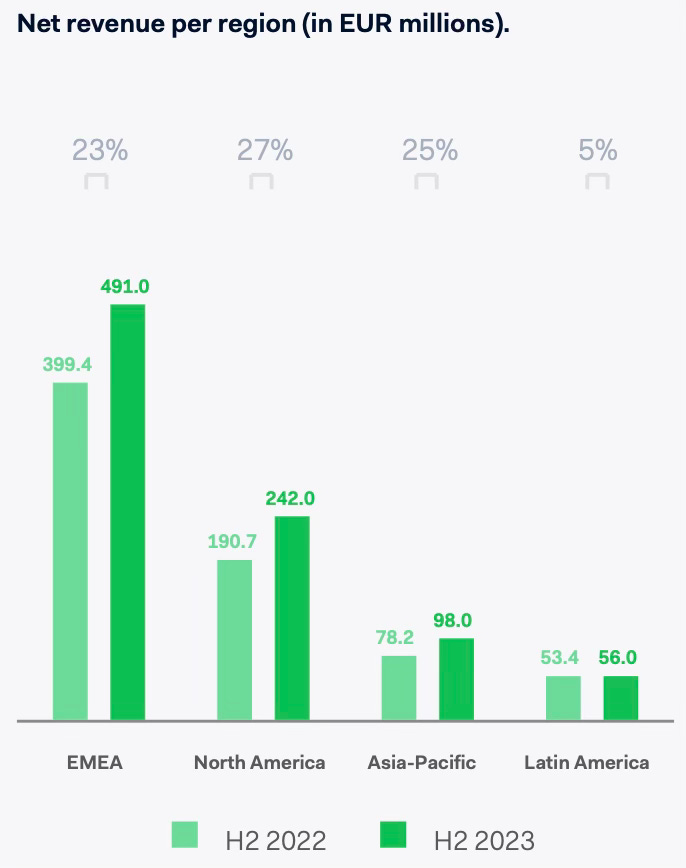

Adyen achieved a 23% YoY growth in net revenue, reaching €887 million in H2 2023. The success is attributed to the land-and-expand commercial strategy, fostering long-term partnerships and evidenced by increased payment volume at a lower take rate. Notably, North America saw the fastest growth at 27% YoY, marking a standout performance in the competitive region.

Adyen’s operating expenses were driven by global team expansion, with 313 new hires, resulting in an improved but still elevated OpEx ratio of 57%. Adyen plans to moderate hiring in 2024 for improved operating leverage. Adyen's counter-cyclical team-building strategy contrasts with peers like PayPal.

Notable client wins include partnerships with S Group, OBI, Straumur, Oracle, BILL, Klarna, and True Alliance. Additionally, Adyen's strategic move to acquire a UK banking license expands its global and financial service capabilities. The company's focus on North America, with strategic investments in open banking and alternative payment methods, has proven to be successful.

Contents

Financial Highlights

Wall Street Expectations

Business Activity

Financial Analysis

Guidance

Conclusion

1. Key Highlights

Revenue: €887 million +23% year-over-year (YoY)

Operating Income: €378.5 million +13% YoY

Net Income: €416.1 million +48% YoY

2. Wall Street Expectations

Revenue: €879 million (beat by 1%).

EBITDA: €401 million (beat by 5%)

3. Business Activity

Processed Volume

Adyen reported a Processed Volume (PV) of €554.1 billion in H2 2023, reflecting a 29% YoY increase. This growth is primarily attributed to the expansion of existing customer relationships on the platform. Over 80% of the growth came from these strong customer relationships, and there was minimal volume churn (less than 1%). This highlights the importance of retaining and nurturing existing customers as a key driver of Adyen's growth, aligning with the company's historical growth patterns. With accelerated growth in H2, Adyen has maintained a staggering PV five-year compounded annual growth rate (CAGR) of 44%.

The Digital segment, the largest one, experienced faster growth in H2 driven by the ramp-up of existing customers. In the second half of 2023, Digital volumes reached €338.4 billion, accounting for 62% of the total processed volume and growing at a rate of 28% YoY, up from 23% in H1 2023. This is significant because Adyen attributed the slowdown in H1 to competitive pricing in North America, suggesting that the company has overcome this obstacle.

The Unified Commerce segment continued to grow globally, reaching €144.2 billion in H2 2023, with significant YoY growth of 29%. Unified Commerce volumes made up 26% of the total processed volume. Despite a broader slowdown in retail, Adyen processed record volumes during Q4’s peak shopping season.

The Platforms segment saw volumes of €61.5 billion in H2 2023, constituting 12% of the total processed volume and growing at a more modest rate of 11% YoY.

Take Rate

Adyen’s take rate decreased from the last period, landing at 16.3 basis points, compared to 17.3 basis points in H1 2023 and 17.1 basis points in H2 2022. This trend is a natural outcome of Adyen’s tiered pricing model, which extracts more value from its customers through its land-and-expand business model.

4. Financial Analysis

Adyen's net revenue grew by 23% YoY to €887 million in H2 2023. Management has attributed the majority of net revenue growth to the success of its land-and-expand commercial track record, which continues to shape meaningful and long-term partnerships. This is corroborated by the increased processed volume at a lower take rate observed earlier. Adyen has grown net revenue at a five-year compounded annual growth rate (CAGR) of 34%.

Adyen’s net revenue contributions continued to diversify, with EMEA contributing 55%, followed by North America at 27%, APAC at 11%, and LATAM at 7% in H2 2023.

North America was the fastest-growing region, up 27% YoY, followed by APAC with 25% YoY growth, EMEA with 23% YoY growth, and LATAM with 5% YoY growth in H2 2023. The performance of Adyen in the hotly contested North America region is one of the standout highlights from the earnings report.

Operating expenses amounted to €491.3 million in H2 2023, representing an 8% increase from the first half of the same year and a significant 27% YoY rise. The higher expenses were primarily attributed to investments in expanding the global team to support the company's growth and scaling efforts. Despite the increased expenses, the Operating Expense (OpEx) ratio improved compared to the first half of 2023, decreasing from 62% to 57%. However, it remained higher than the second half of 2022 when the ratio was 54%.

The majority of the operating expense increase was driven by employee benefits, which reached €308.1 million in H2 2023, reflecting a 39% YoY increase. This rise was fueled by the continued expansion of the Adyen team, with 313 new hires in H2, bringing the total number of full-time employees to 4,196 by the end of the year. The company plans to moderate hiring in the coming years to enhance operating leverage, with the impact expected to be visible in financials starting in 2024.

Sales and marketing expenses in H2 2023 totaled €25.6 million, representing an 18% YoY decrease. The company focused on optimizing lead generation activities, marketing formats, media distribution channels, and production, resulting in increased effectiveness and profitability while reducing costs. This strategic approach aims to achieve a more impactful and cost-efficient marketing strategy for the organization.

In the second half of 2023, Adyen experienced a 14% increase in EBITDA, reaching €423.0 million compared to €372.0 million in the same period in 2022. This growth was primarily attributed to team expansion, which slowed down as the company concluded its accelerated investment initiative. However, the EBITDA figure was negatively impacted by €17.0 million due to inventory write-offs. The company faced supply chain challenges during the COVID period and ordered backup terminals with non-optimal specifications to meet demand, resulting in overstock and subsequent write-offs. Despite these challenges, the EBITDA margin improved to 48% in H2 2023 from 43% in H1 2023. The company's counter-cyclical team-building strategy over the past two years is in stark contrast to peers such as PayPal, who have recently begun initiating layoffs.

Adyen generated finance income, reaching nearly €153 million in H2 2023, reflecting a remarkable 450% YoY increase. This finance income played a crucial role in contributing to Adyen's overall net income of €416 million. The growth is attributed to higher interest rates not only on Adyen's own cash deposits but also on the cash deposits it manages for merchants, showcasing the company's ability to capitalise on favourable financial conditions and maximise income from its financial operations.

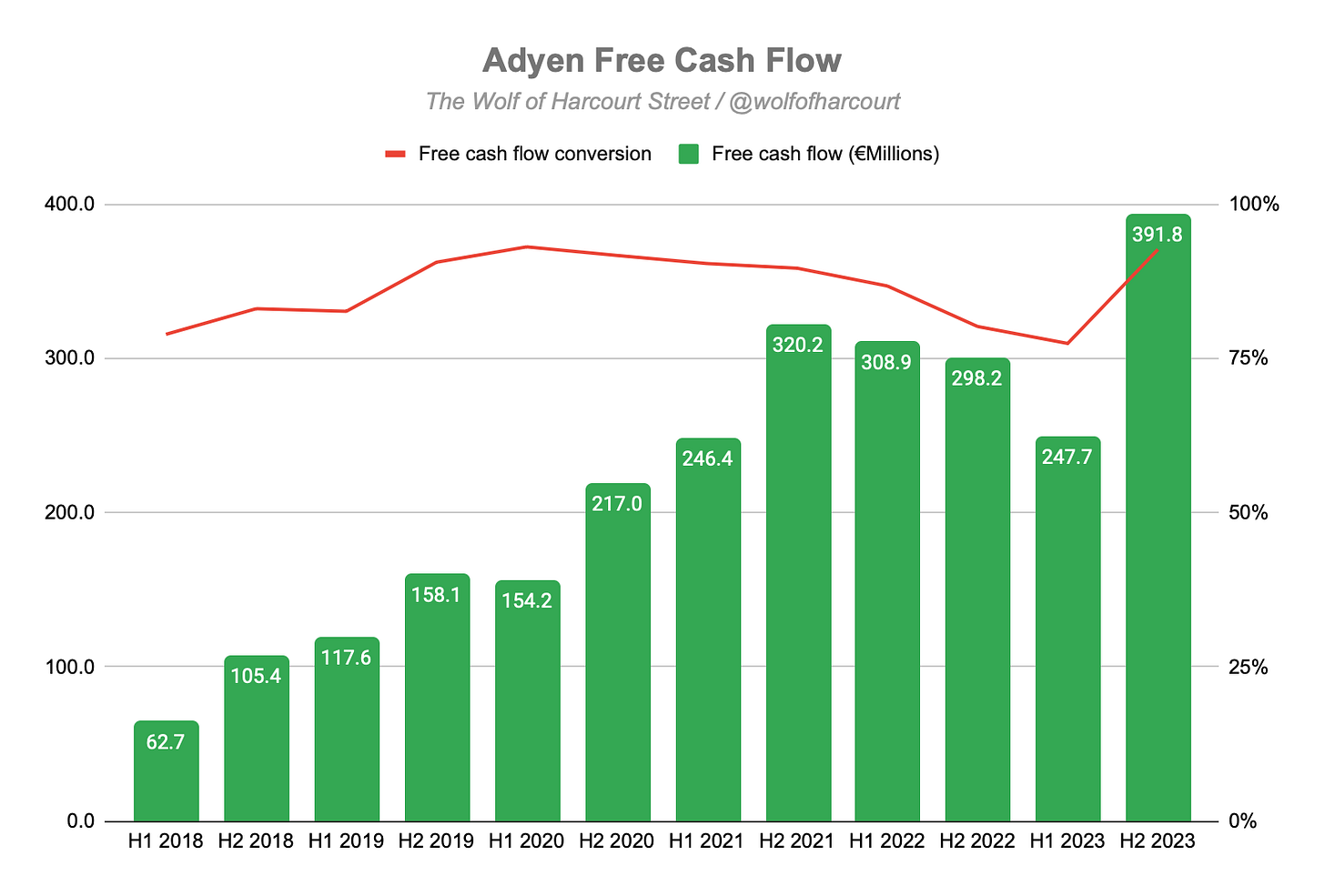

Cash Flow

Adyen reported free cash flow of €391.8 million in H2 2023, marking a 31% increase compared to the previous year, primarily attributed to decreased CapEx. The CapEx investment amounted to €13.7 million, constituting 2% of net revenue, down from 7.6% in H1 2023. The company front-loaded its data center infrastructure investments in the first half of the year, and this period was able to yield results below expectations. The free cash flow conversion ratio increased to 93%, up from 80% in H2 2022.

5. Guidance

Management reported no significant business developments in the second half of 2023 that would prompt a change in its guidance. Therefore, the established financial objectives, including achieving net revenue growth in the low to high twenties percent until 2026, improving EBITDA margin to above 50% in 2026, and maintaining a sustainable capital expenditure level of up to 5% of net revenue, remain unchanged.

6. Conclusion

This was a really good report from Adyen. The company accelerated processed volume and revenue growth while improving profitability. However, it should not come as a surprise to anyone, as this had been clearly signposted by management during the H1 2023 report, as well as during the investor day in November 2023. The market's reaction to Adyen’s H1 2023 results has led to a deliberate shift from management towards enriching their investor communications, and this should be viewed as a very positive development.

Notable client wins during the period included:

SS Group (Finland’s largest retail group) - processing their portfolio of large-format grocery stores, restaurants, hotels, and service stations.

OBI (German multinational home improvement brand) - providing dual support through both POS capabilities and Adyen for Platforms (AfP) solutions.

Straumur (subsidiary of Kvika Bank) - a financial services customer turning to Adyen’s technology to round out their offerings and meet advancing consumer expectations.

Oracle (multinational technology company) - a partnership to provide a complete payments solution called Oracle Payments.

BILL (leading financial operations platform for SMBs) - delivering advanced acquiring and issuing experiences for BILL’s accounts payable and accounts receivable solutions.

Klarna (global payments network and shopping assistant) - selecting Adyen to act as one of their acquirers on behalf of their different customer offerings.

True Alliance - robust fraud protection has brought fraud rates under 0.5%, contributing to estimated annual cost savings of up to AUD 1.4 million.

In H2 2023, Adyen also acquired a UK banking license to be able to successfully obtain direct access to the Bank of England's centralized clearing and real-time payment rail (the Faster Payments Services). This expands Adyen’s global and financial service capabilities

Personally, what caught my eye most was Adyen's performance in North America. The region, traditionally dominated by card payments, is experiencing increased complexity with the emergence of new payment methods, digital wallets, and regulatory changes. The dynamic environment is seen as fertile ground for innovation, and the company's strategic investments in its US branch license and alternative payment methods, such as open banking, aim to help North American customers stay ahead, optimize costs, and streamline processes. This strategy has proven successful, as North America was the fastest-growing region in the second half of the year, attributed to market share and volume growth with major digital customers.

When I shared my Adyen Investment Thesis on 14 September 2023, the stock traded at €700. At the time of writing, the stock is trading at €1,436, meaning that the investment has returned 105% in less than 5 months. While I am not a short-term investor, I am extremely satisfied with this result and plan to hold my Adyen shares for many years. I am a strong believer that finding good businesses with low expectations will lead to outperformance over the long term.

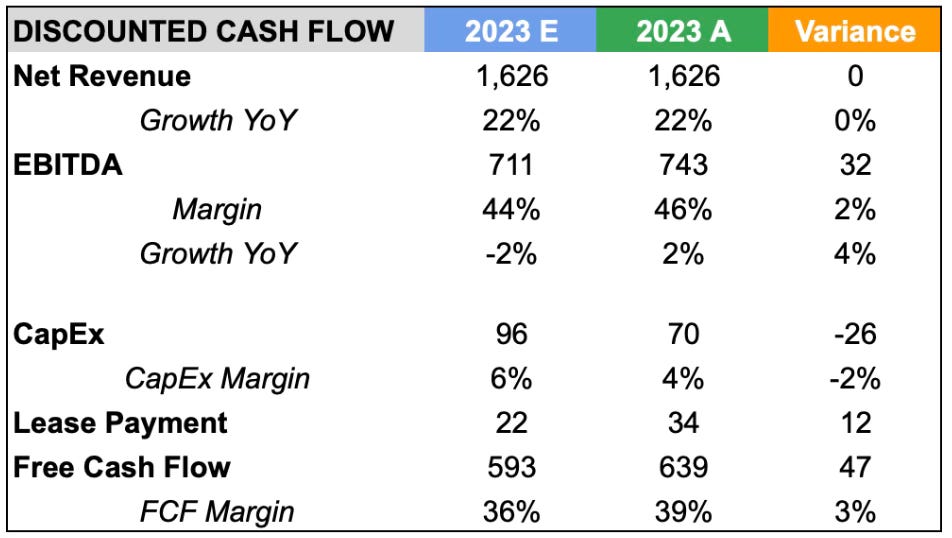

In light of this, let's revisit the assumptions I made in September and compare them to the actual results posted by Adyen. I was spot on with the revenue estimate, and Adyen managed to surpass the EBITA and Free Cash Flow by 2% and 3% respectively. Adyen was a textbook example of a good company with low expectations.

The full Adyen investment thesis is linked below for new subscribers or anyone that missed it.

Rating: 4 out of 5 exceeds expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Thanks for the detailed update! That finance income though. What a win...