Executive Summary

Adyen reported €626 billion in processed volume for H2 2024, growing 22% YoY, with a 40% CAGR over six years. Excluding a single large-volume customer (likely Cash App), process volume growth was stronger at 28% YoY. Adyen’s take rate held steady at 16.2 bps, rising from 14.7 bps in H1 2024 due to lower Cash App volumes. Over time, take rates are expected to decline as Adyen scales via its tiered pricing model.

Adyen’s net revenue surpassed €1 billion for the first time, reaching €1,083 million (+22% YoY), driven by existing customers and new business wins. EMEA remained the largest region (58% of revenue) and reclaimed the top spot as the fastest-growing region (+27% YoY), its highest rate since H1 2022. North America grew +21% YoY, Asia-Pacific +12% YoY, while Latin America declined 1% YoY due to FX headwinds but saw +12% underlying growth.

Adyen’s operating income surged 36% YoY to €514 million, with operating margin improving from 43% to 47%, the highest growth since H2 2021. Employee benefits, the main operating expense, rose 15% YoY to €354 million, while headcount growth slowed to 4% YoY after rapid hiring in 2022-2023. Notably, 43% of new hires were in North America. After a temporary decline, average monthly revenue per FTE rebounded to €42K in H2 2024, the highest since H2 2021, reflecting improved productivity. Despite rising talent costs, average monthly cost per FTE remained flat at €12K in H2 2024.

Adyen's FCF grew 27% YoY to €499 million, with an 88% FCF conversion ratio, while CapEx remained low at €49M (5% of net revenue), a level the company aims to maintain. Despite reporting €9.95 billion in cash, the net cash balance is €3.28 billion. Looking ahead to 2025, management expects net revenue growth to accelerate slightly, increased hiring, and EBITDA margin expansion as revenue outpaces costs.

Contents

Financial Highlights

Wall Street Expectations

Business Activity

Financial Analysis

Guidance

Conclusion

1. Financial Highlights

Revenue: €1,083 million (+22% YoY)

Operating Income: €514 million (+36% YoY)

Net Income: €516 million (+24% YoY)

2. Wall Street Expectations

Revenue: €1,075 million (beat by 1%)

EBITDA: €541 million (beat by 5%)

3. Business Activity

Processed Volume

Adyen reported Processed Volume (PV) of €626 billion in H2 2024, reflecting 22% YoY growth. Over the past six years, Adyen has compounded PV at a CAGR of 40%.

Notably, volume growth this period was impacted by a single large-volume customer, believed to be Cash App, which had limited impact on net revenue—a factor we will explore later in the report. Excluding this customer, processed volume grew 28% YoY.

Digital

The Digital segment remained the largest contributor, reaching €383.5 billion in H2 (+13% YoY) and €783.4 billion for FY 2024 (+29% YoY). Growth accelerated in H2, driven by the digital content & subscriptions and delivery & mobility verticals.

Adyen continues to lead in digital payments by leveraging AI-powered solutions, particularly Adyen Uplift, which optimizes transactions, improves risk-based intelligence, and maximizes revenue. The company analyzes €1 trillion in payment data to provide tailored payment configuration recommendations.

Following the 2023 Durbin Amendment revision, Adyen’s network-agnostic AI routing lowers costs while maintaining high approval rates. Enterprises benefit from automatic network selection based on success rates and scheme fees, requiring no additional coding. The Uplift product lowered total payment costs by up to 5% for pilot customers in the U.S.

Unified Commerce

The Unified Commerce segment grew strongly to €194.2 billion in H2 (+35% YoY) and €334.8 billion for FY 2024 (+32% YoY), benefiting from diversification beyond luxury and small-format retail.

Today’s consumers demand payment flexibility, with 55% abandoning purchases if their preferred payment method is unavailable. Businesses are shifting from fragmented legacy systems to integrated payment solutions, and companies that connected their backend systems saw a 47% increase in sales.

Adyen’s Unified Commerce solution connects in-person, online, and mobile payments through a single tech stack. Despite digital growth, 80% of transactions still occur in person, which is why Adyen launched the SFO1 terminal, enhancing branding, marketing, and payment functions.

Platforms

The Platforms segment saw the fastest growth, reaching €88.5 billion in H2 (+44% YoY) and €167.6 billion for FY 2024 (+51% YoY). Excluding eBay, growth was even higher—+58% in H2 and +70% for FY 2024.

The number of platform business customers increased by 57k YoY to 145k.

The number of transacting platform terminals rose by 82k YoY to 204k.

Adyen for Platforms (AfP) integrates Digital and Unified Commerce capabilities, enabling platforms and marketplaces to process payments across online, in-person, and mobile channels. AfP also facilitates embedded financial products (EFPs), driving customer stickiness and revenue growth.

SaaS platforms, particularly those integrating in-person payments, represent a key growth opportunity.

Take Rate

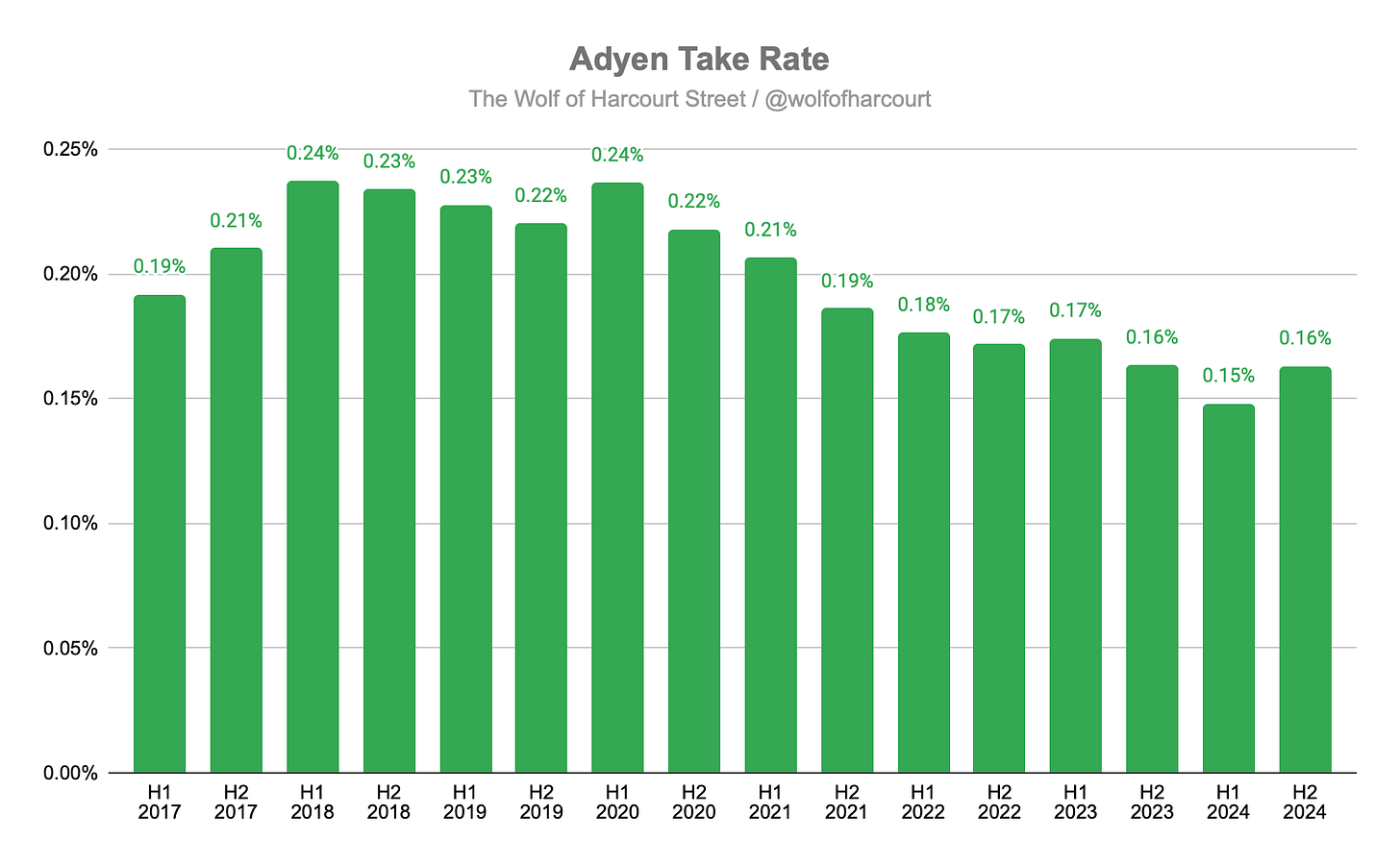

Adyen’s take rate remained stable at 16.2 basis points in H2 2024, consistent with H2 2023 but materially higher than 14.7 basis points in H1 2024.

The sequential increase is due to a reduction in Cash App volumes, which, while significant in processed volume, come with a much lower take rate.

Over time, Adyen’s overall take rate is expected to decline gradually due to its tiered pricing model, which extracts more value from customers through a land-and-expand business approach.

4. Financial Analysis

Revenue

Adyen’s net revenue surpassed €1 billion for the first time, reaching €1,083 million, a 22% YoY increase. Growth was primarily driven by existing customers, with Adyen expanding its share of wallet and winning new business by differentiating its offering.

Net revenue distribution by region remained stable YoY:

EMEA: 58% (largest contributor)

North America: 27%

Asia-Pacific: 10%

Latin America: 5%

Despite being the largest region, EMEA reclaimed the top spot as the fastest-growing region, accelerating to +27% YoY—the highest rate since H1 2022.

North America: +21% YoY

Asia-Pacific: +12% YoY

Latin America: declined 1% YoY due to material FX headwinds (but grew +12% on an underlying basis).

The accelerated growth in EMEA and continued momentum in emerging regions such as North America highlight that Adyen is still early in realizing its market opportunity.

Operating Margin

Operating income surged 36% YoY to €514 million, the fastest growth since H2 2021, as the operating margin improved from 43% to 47%.

The main operating expense, employee benefits, increased 15% YoY to €354 million.

Adyen expanded its global team by 111 net new hires in H2. However, after doubling headcount in 2022-2023, the FTE growth slowed to just 4% YoY. Of these new hires, 43% were in North America.

Rapid hiring in previous years caused average monthly revenue per FTE to drop to €32k in H1 2023, as new employees required time to ramp up. Over the past 18 months, this metric rebounded to €42k in H2 2024, the highest since H2 2021, indicating that new hires are now contributing positively.

While average monthly cost per FTE had been rising due to higher talent costs in North America, it remained flat sequentially at €12k in H2 2024.

EBITDA

EBITDA rose 35% YoY to €569 million in H2 2024, up from €423 million in H2 2023. The EBITDA margin expanded from 48% to 53%, the highest since H1 2022, benefiting from operating leverage as hiring slowed while revenue growth remained strong.

Net Income

Net income increased 24% YoY to €516 million, aided by higher finance income, which rose 13% to €173 million.

This increase was driven by a 20% rise in average deposits held in central banks and other banks, allowing Adyen to earn more interest income on the cash it holds on behalf of merchants.

Cash Flow Analysis

Free cash flow (FCF) grew 27% YoY to €499 million, with an FCF conversion ratio of 88%.

Capital expenditures (CapEx) totaled €49 million, representing 5% of net revenue, in line with H1. Adyen intends to maintain CapEx at or below 5% of net revenue going forward.

Adyen reported €9.95 billion in cash and cash equivalents on its balance sheet. However, this figure is misleading as it includes cash held on behalf of merchants.

On a net basis, Adyen holds €3.28 billion in cash, up from €2.35 billion at the end of 2023.

As Adyen’s cash pile continues to grow, questions are emerging around its capital allocation strategy, given its low CapEx requirements.

Given Adyen’s historical reluctance toward acquisitions in favour of a unified payments solution, could we see share buybacks or even a dividend announcement in the future? On the conference call, we received a clear response:

“We see a lot of advantage to having a very strong balance sheet as we're trying to roll out our financial product suite. The confidence that our customers have in us as a partner to help them roll out these types of products is really key in ultimately being able to get these, yes, growing and becoming a much more significant part of our overall business. So we still see that as the best use of cash today.”

- Ethan Tandowsky, CFO

5. Guidance

Similar to the trend observed in 2024, management expects a slight acceleration in net revenue growth in 2025. They also plan to increase headcount at a higher rate than in 2024. However, the EBITDA margin is expected to expand further in 2025, as revenue growth outpaces cost increases.

Looking at Adyen’s long-term guidance, management reported no significant business developments in the second half of 2024 that would prompt a revision.

6. Conclusion

This is one of the most satisfying earnings reports I have read as a shareholder, for several reasons.

First, it has been exactly 17 months since I released my initial Adyen investment thesis. At that time, when Adyen was trading at €700, the prevailing market sentiment was that payments were a race to zero and Adyen had no moat. Fast forward to today: the stock has returned +160%, profit margins have hit a three-year high, and revenue continues to grow at a strong pace.

Second, this is a perfect example of investing in a management team you truly believe in and trust. When margins compressed in 2023, it was due to Adyen’s counter-cyclical hiring strategy. In 2020 and 2021, while most technology firms were rapidly expanding their workforce, Adyen held off to avoid overpaying. Then, in 2022 and 2023, as those same firms were initiating layoffs, Adyen ramped up hiring—zigging when others zagged. Some believed this margin compression was permanent, but others, like myself, trusted the approach.

At the same time, PayPal-owned Braintree began aggressively cutting prices below cost to gain volume—sacrificing profitability in the process. Adyen held firm on its pricing and refused to engage in a price war. A new CEO later, and Braintree has had to reverse course, with growth falling from 30% in 2023 to just 2% in Q4 2024. For context, Adyen grew volumes 10 times faster. I think it’s obvious which strategy has won out.

There are two key takeaways from this investment thesis:

Invest in good companies with low expectations.

Back in 2023, expectations were on the floor, and Adyen was priced as if it were in terminal decline. Low expectations help reduce risk, as the market doesn’t expect much from the business or fears an imminent earnings collapse. We've seen countless examples of this in recent years—Meta being one of them.Find management teams with honesty and integrity—and let them do their job.

Adyen’s management team is best in class. As investors, we often overestimate our influence and how much we truly know. Great management teams sacrifice short-term profitability for long-term success—as was the case with Adyen.

And the best part? The best is yet to come.

Adyen’s founders set out to power every payment. Today, their technology is becoming the backbone of seamless transactions—whether online, in-person, or anywhere in between. The runway ahead remains clear.

We invest for decades, not days.

Rating: 4 out of 5. Exceeds expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com