Executive Summary

Adyen processed €649 billion in volume during H1 2025, up 5% YoY and representing a 32% CAGR over the past four years. Growth was held back by a single large-volume customer, likely Cash App, which had little impact on net revenue. Excluding this customer, volume growth was 23%, and the effect should phase out in future periods. The take rate rose from 14.7 bps to 16.8 bps, reflecting a shift in merchant mix after reduced Cash App volumes, which carry lower rates.

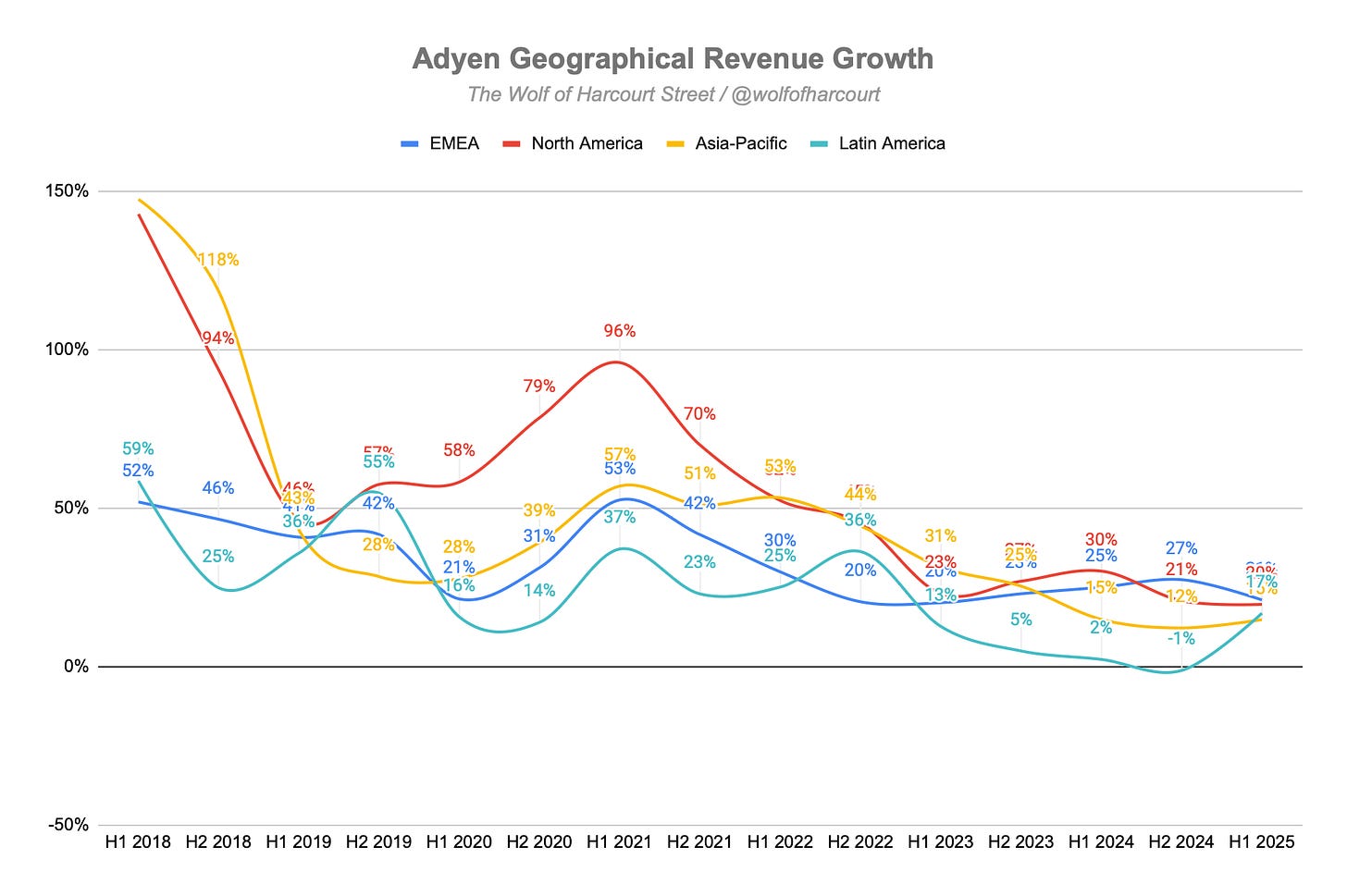

Net revenue rose 20% YoY to €1,093 million (21% on a constant currency basis), marking Adyen’s slowest growth since going public. The increase was mainly driven by higher wallet share among existing customers, consistent with its land-and-expand strategy. Regional revenue distribution remained stable: EMEA contributed 58% (+21%), North America 27% (+20%, impacted by U.S. tariff changes and a weaker dollar), Asia-Pacific 10% (+15% from growth in Japan and India), and Latin America 5% (+17%, its fastest since H1 2022, supported by wallet share gains in Brazil and Mexico and local product rollouts such as PIX).

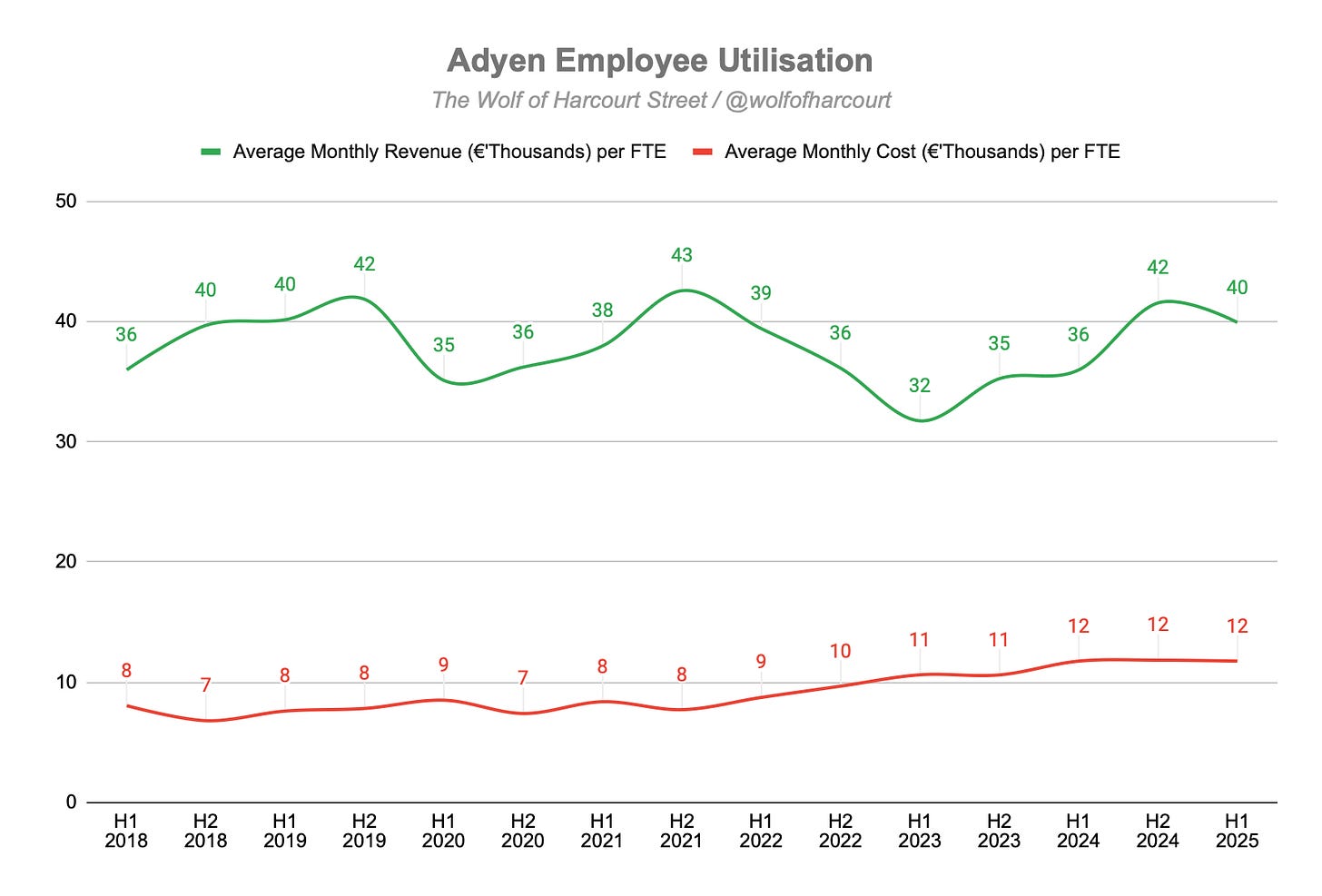

Adyen delivered strong profitability gains in H1 2025, with operating income rising 29% YoY to €483 million and operating margin improving from 41% to 44%, outpacing net revenue growth. Employee benefits, the largest expense, increased 8% to €376 million as the company added 223 hires (+8% YoY). Average monthly revenue per FTE dipped to €40k (from €42k in H2 2024) after a rebound last year, while average monthly cost per FTE has held steady at €12k for 18 months.

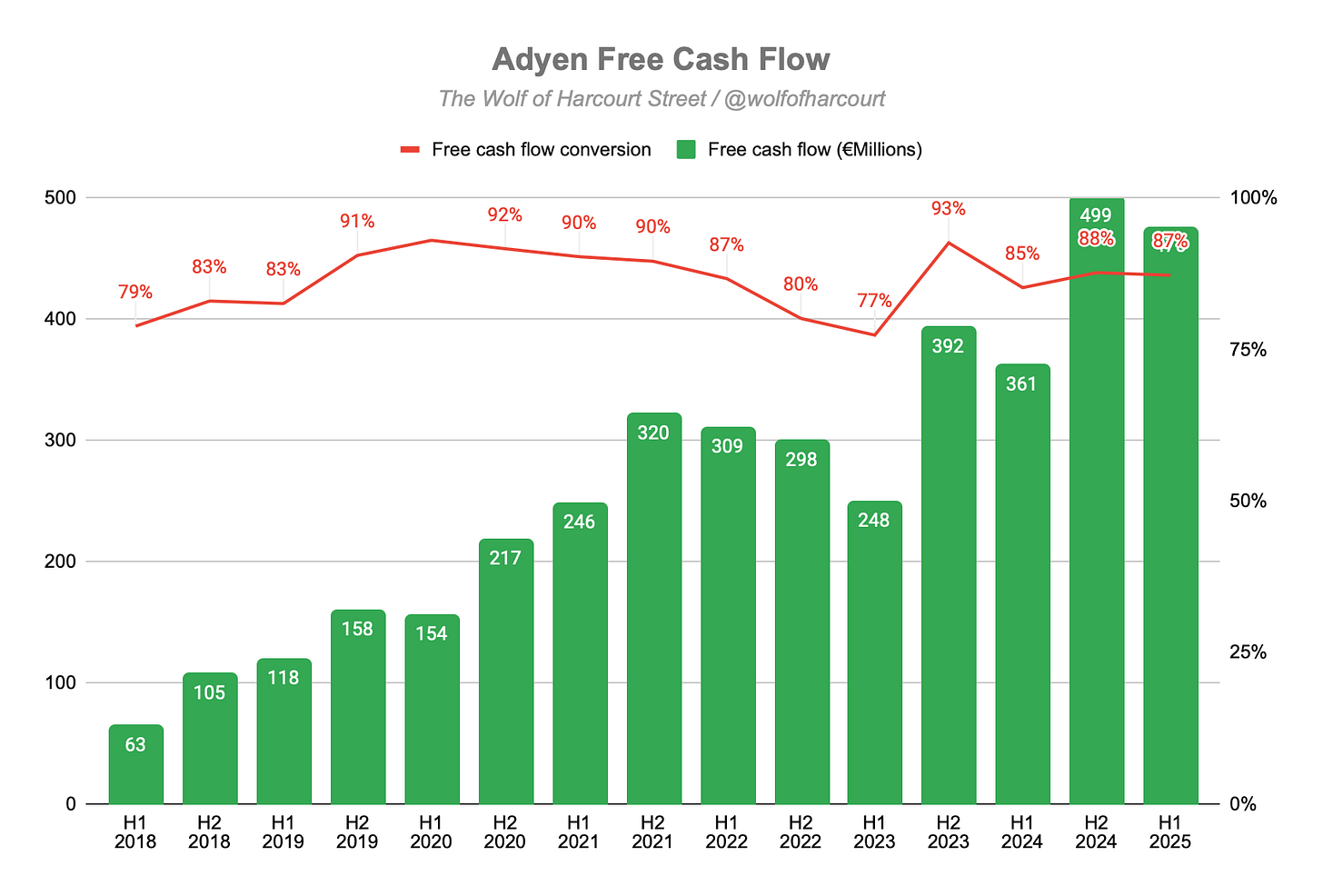

Free cash flow rose 32% YoY to €475 million, with conversion improving to 87%. Adyen holds €12.5 billion in cash and equivalents, though this includes merchant funds, leaving €3.8 billion in net cash, up from €3.3 billion a year ago. With deposit rates at 2%, the large cash position raises questions about capital allocation, especially given Adyen’s asset-light model, preference for in-house development, and low likelihood of acquisitions. While management says the strong balance sheet supports long-term growth in financial products, there is a case for returning capital to shareholders via buybacks or dividends, which could offer higher returns than current interest income.

Adyen tempered its 2025 outlook after lower-than-expected market volume growth in H1, now expecting full-year net revenue growth to match H1 levels on a constant currency basis rather than accelerate. Management noted a 2% Q2 drag from APAC merchants trading into the U.S., an effect likely to persist through H2. Despite this, Adyen reaffirmed its 2026 midterm guidance of low-to-high 20s growth, will maintain its hiring pace to support long-term expansion, and still targets an EBITDA margin above 50% in 2026, though 2025 margin gains will be more modest than in 2024.

Contents

Financial Highlights

Wall Street Expectations

Business Activity

Financial Analysis

Guidance

Conclusion

1. Financial Highlights

Revenue: €1,093 million (+20% YoY)

Operating Income: €483 million (+29% YoY)

Net Income: €481 million (+17% YoY)

2. Wall Street Expectations

Revenue: €1,105 million (miss by 1%)

EBITDA: €547 million (miss by 1%)

3. Business Activity

Processed Volume

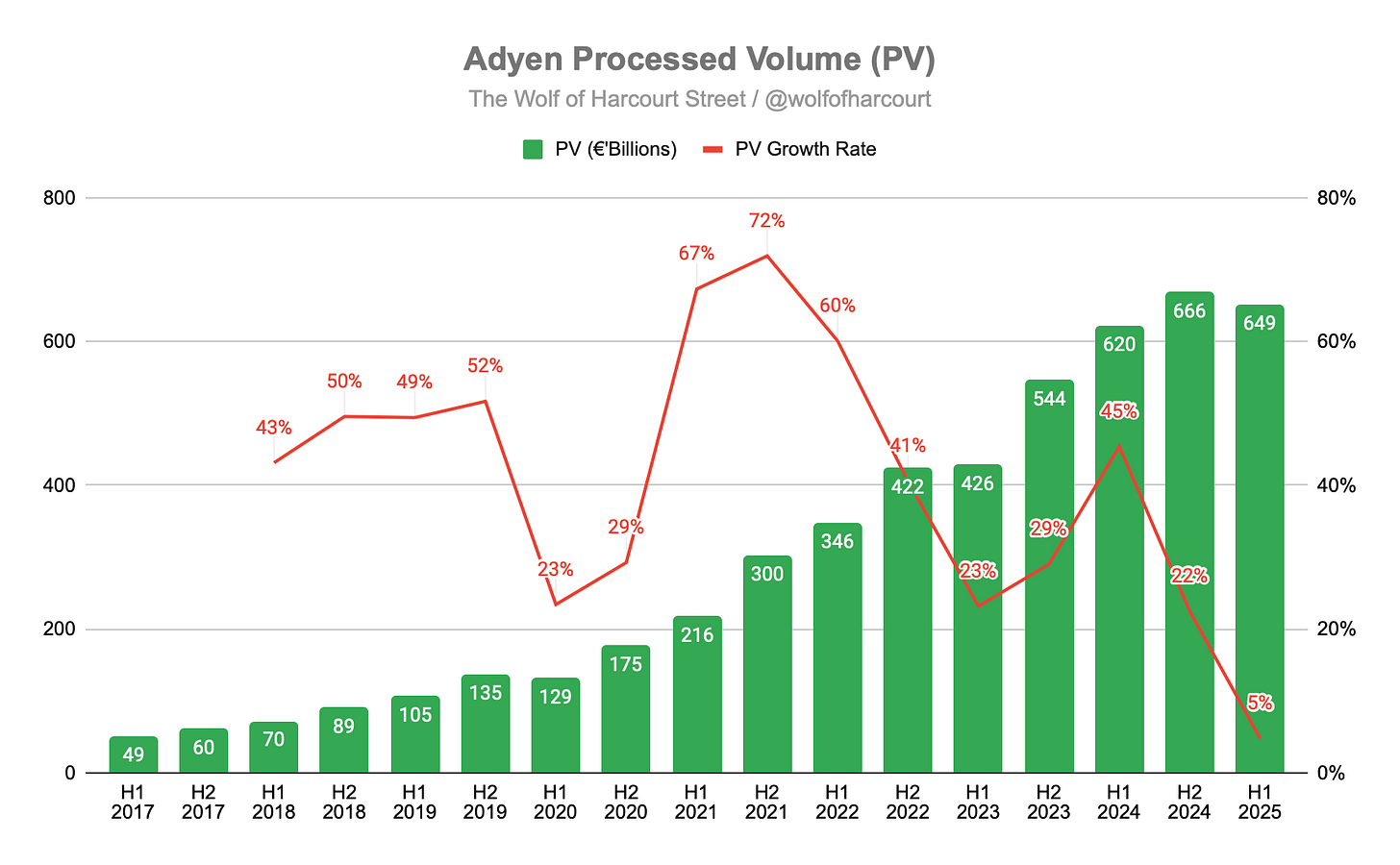

Adyen reported Processed Volume (PV) of €649 billion in H1 2025, up 5% YoY. Over the past four years, PV has compounded at a 32% CAGR.

Similar to H2 2024, growth was dampened by a single large-volume customer, believed to be Cash App, which had minimal impact on net revenue. Excluding this customer, PV growth was +23% YoY. While the actual reported results matter most, this is important context for future growth, since this effect will be lapped in coming periods.

Digital

PV for the Digital segment declined 9% YoY to €364 billion, primarily due to the same large-volume customer. Excluding this impact, Digital PV grew +18% YoY.

Management highlighted that growth was also affected by changes to U.S. tariffs, which weighed on online retail, particularly for large-volume merchants headquartered in APAC. However, momentum in the U.S. Digital customer base remained strong, especially in content, subscriptions, and on-demand verticals like delivery and mobility.

U.S. debit volumes more than doubled YoY, supported by Intelligent Payment Routing (IPR) and direct connections to local debit networks. IPR reduced debit transaction costs by an average of 20% in H1 and improved authorization rates by +89 basis points.

Adyen Uplift, the AI-driven optimization suite, is now fully embedded in Digital. Nearly all customers use its Optimize module, while 68% of enterprise merchants in the 2025 cohort adopted the Protect module from day one.

Digital is also becoming more diversified, with growth in sectors undergoing digital transformation such as insurance. Adyen now serves six of the world’s top ten P&C insurers and over 60 insurance customers globally, with new partnerships including Clearcover and Axa Partners. Clearcover, for example, saw authorisation rates rise +24% since partnering with Adyen.

Unified Commerce

Unified Commerce PV grew +35% YoY to €190 billion, making it Adyen’s fastest-growing segment. This reflects increasing demand for seamless cross-channel experiences as merchants replace legacy systems with modern infrastructure.

Adyen’s unified platform, actionable data, and scalable tools enable merchants to adapt quickly and expand confidently, even in uncertain macro conditions.

Adyen now supports 591 Unified Commerce customers across multiple regions, up by 51 from H1 2024.

451 customers process at scale across channels (>€10 million on both POS and e-commerce, with >€50 million total volume over the past 12 months), up by 94 YoY.

Active Unified Commerce terminals reached 402,000, an increase of 110,000 YoY.

Retail remains a key strength, with notable customers including Arhaus, Vans, North Face, and Kering. Momentum is also strong in hospitality, F&B, and entertainment, with recent partnerships including JOE & THE JUICE, HEYTEA, and ATG Entertainment.

Platforms

Platforms PV rose +20% YoY to €95 billion. Excluding eBay, PV growth was +59% YoY.

32 platform customers now process over €1 billion annually, up from 22 a year ago.

Active business customers on Platforms grew to 193,000 from 104,000 in H1 2024.

Transacting terminals increased to 255,000, up 89,000 YoY.

Platforms are expanding beyond payments, embedding financial products like issuing and working capital to deepen relationships and open new revenue streams. Adoption is particularly strong in issuing, with customer count nearly doubling YoY and processed volume surpassing €2 billion.

A standout case is Fresha, a global beauty and wellness platform. Fresha embedded payments into its platform, creating a new revenue stream and driving deeper engagement. Over 30,000 account holders now use its embedded payments (up 10% in six months), leading to a 12% increase in processed volume from €137 million in January 2025 to €153 million in June 2025. This represents just 23% of Fresha’s customer base, indicating significant runway. Fresha has also launched working capital via Adyen Capital, helping SMBs access financing and positioning itself as a financial partner.

On a personal note, the barbers I go to use Fresha, and I have been paying directly through the platform at checkout without taking out my card or phone. Only recently did I realise that Adyen powers it in the background.

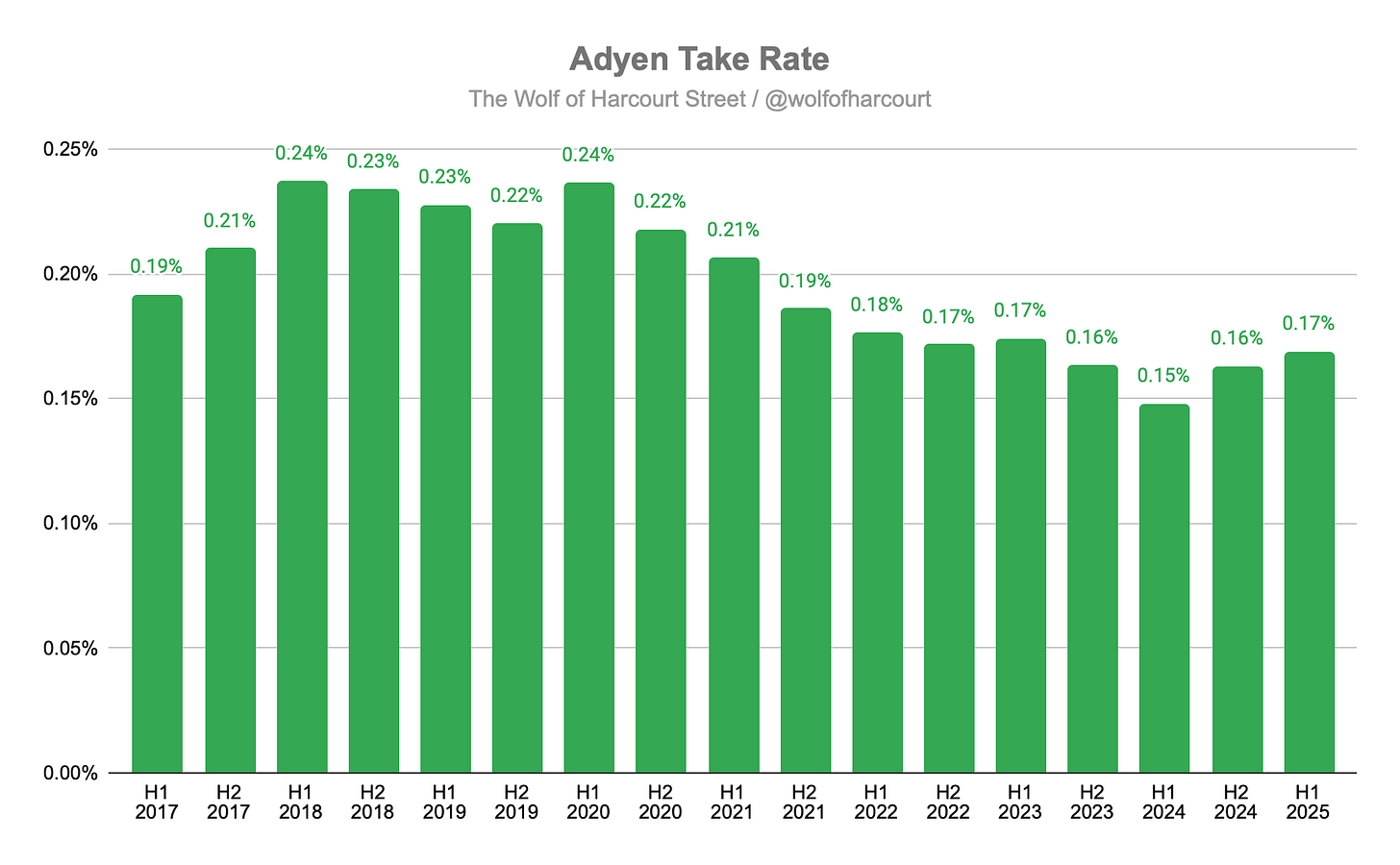

Take Rate

Adyen’s take rate increased from 14.7 bps in H1 2024 to 16.8 bps in H1 2025, driven by a shift in merchant mix following reduced Cash App volumes, which carry a lower take rate.

Over the long term, the take rate is expected to gradually decline due to Adyen’s tiered pricing model, which captures more value through a land-and-expand approach rather than maximising rates upfront.

4. Financial Analysis

Revenue

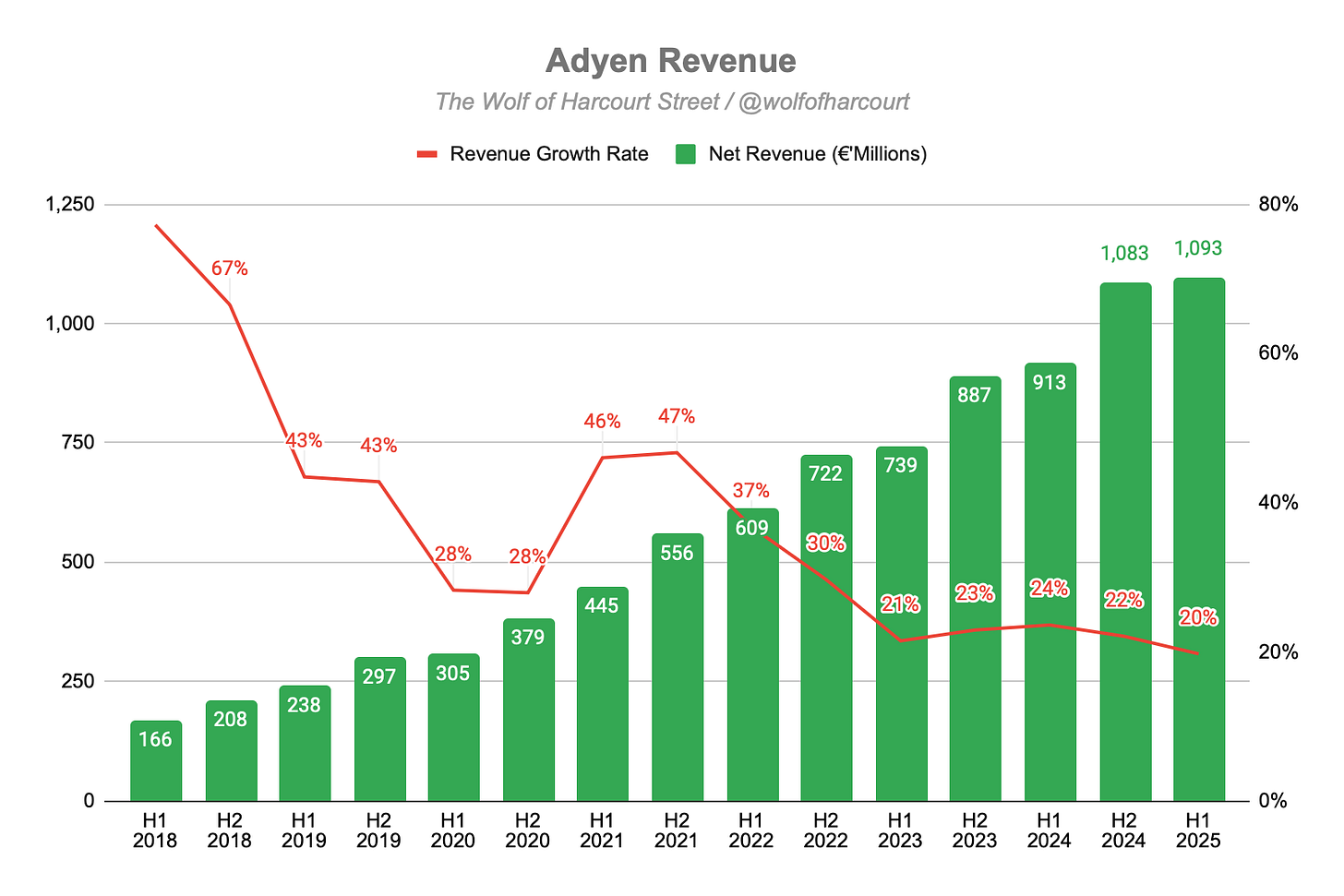

Net revenue reached €1,093 million, up 20% YoY (21% on a constant currency basis). This marks the slowest growth since Adyen became a publicly listed company. Growth was primarily driven by increased share of wallet with existing customers, in line with Adyen’s land-and-expand business model. Notably, net revenue includes €6 million of net interest income, up 136% YoY, mainly related to the Accounts product within the Financial Products suite. While not material today, this could become more significant over time.

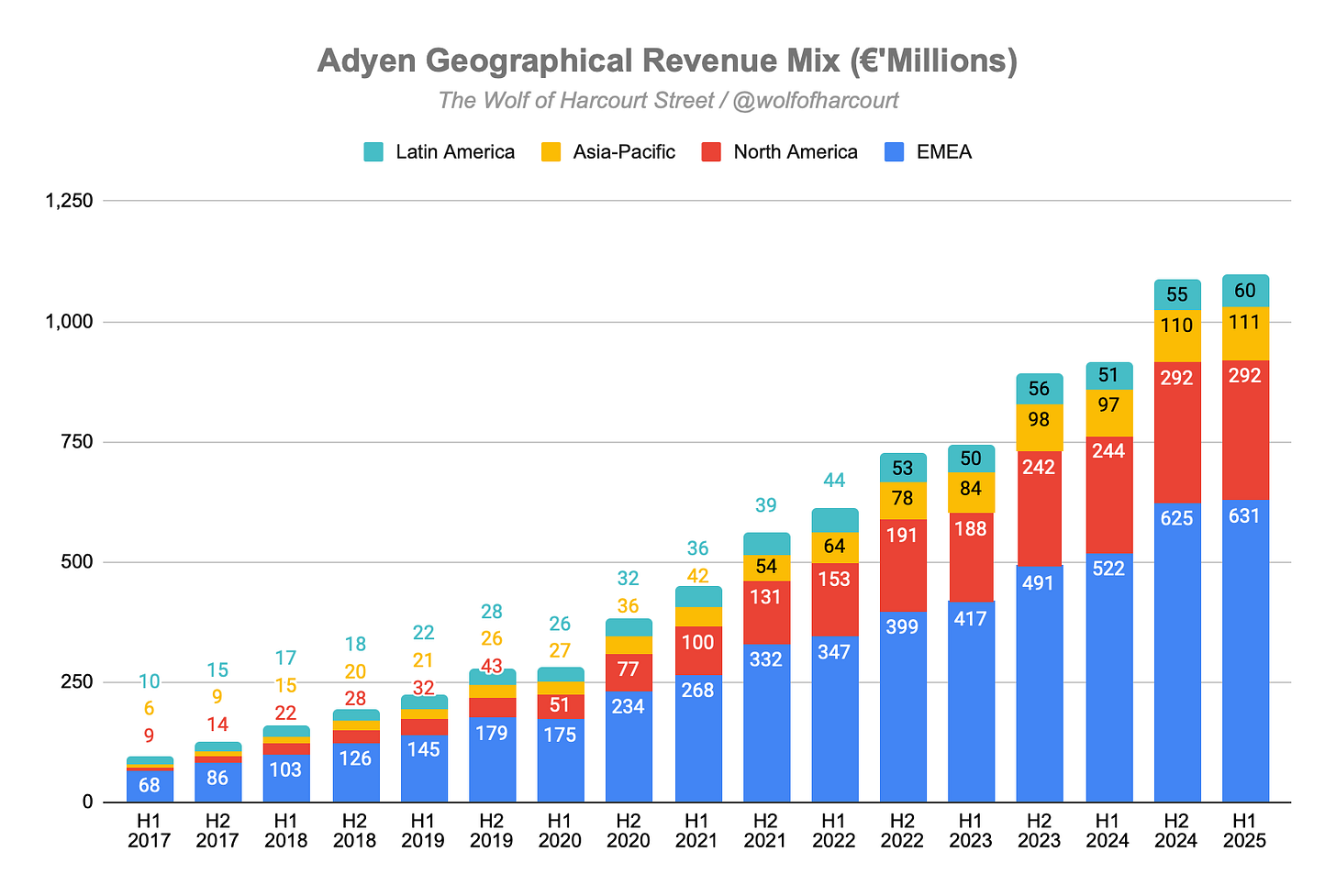

Net revenue distribution by region remained stable YoY:

EMEA: 58% (largest contributor, +21% YoY)

North America: 27% (+20% YoY, moderated by U.S. tariff changes and a weaker dollar)

Asia-Pacific: 10% (+15% YoY, driven by deeper relationships in Japan and India)

Latin America: 5% (+17% YoY, fastest since H1 2022, supported by wallet share gains in Brazil and Mexico and local product investments such as PIX)

Operating Margin

Operating income increased 29% YoY to €483 million, outpacing net revenue growth. Operating margin improved from 41% to 44%.

Employee benefits, the largest operating expense, rose 8% YoY to €376 million. Adyen added 223 net new hires in H1 (+8% YoY), accelerating from 4% in H2 2024. Management stated hiring remains closely aligned with strategic priorities, particularly financial products, tech, and commercial functions, and expects a similar hiring pace in H2 2025.

Rapid hiring in prior years pushed average monthly revenue per FTE to a record low in H1 2023, as new hires required time to ramp up. This metric rebounded in H2 2024 but declined again in H1 2025 to €40k (up from €36k in H1 2024). Average monthly cost per FTE, which had been rising due to higher North American talent costs, has held steady at €12k for the past 18 months.

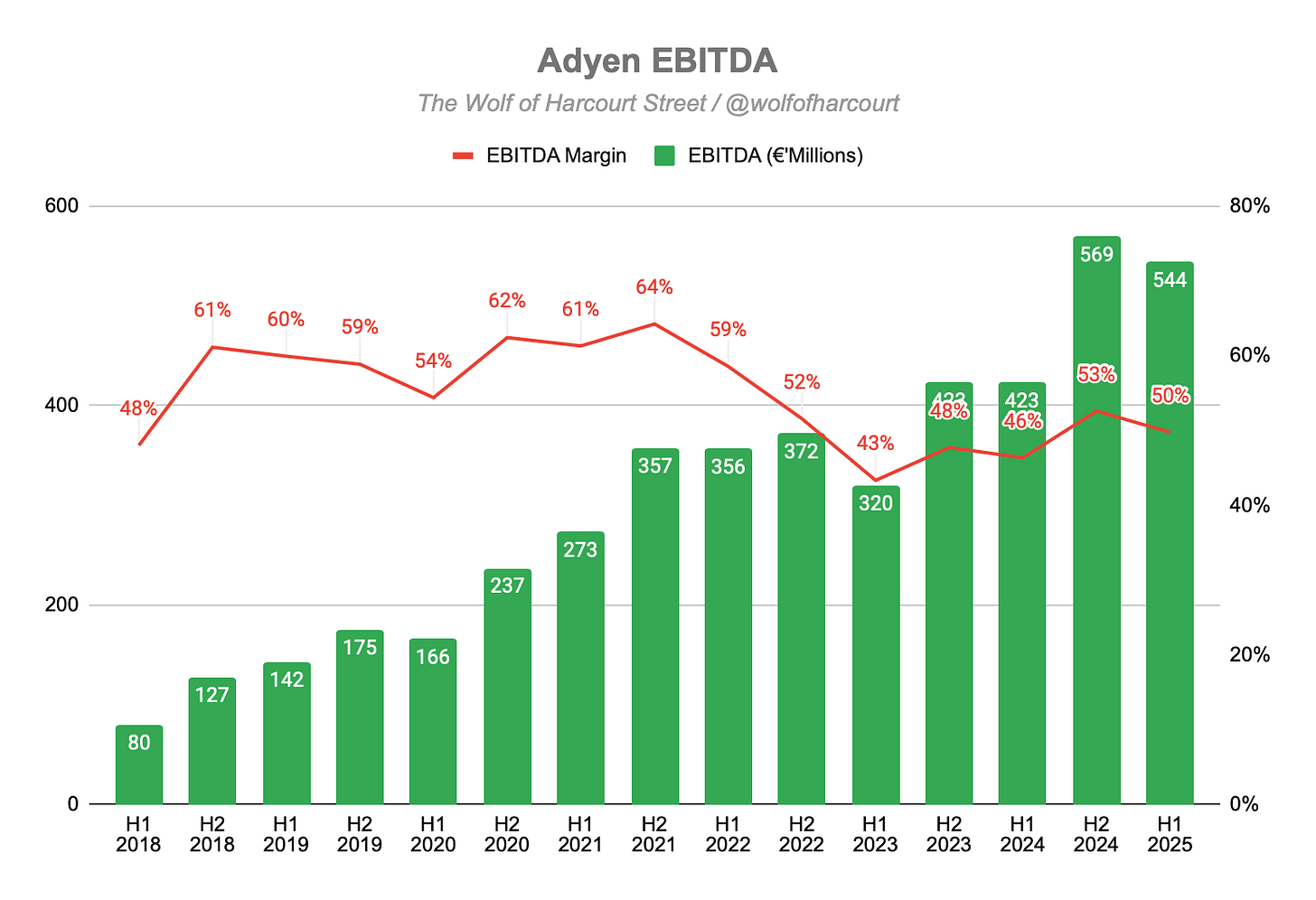

EBITDA

EBITDA rose 28% YoY to €544 million. The EBITDA margin expanded from 46% to 50%, benefiting from operating leverage despite the faster hiring pace.

Net Income

Net income increased 17% YoY to €481 million. This was achieved despite a 22% YoY drop in finance income to €139 million, driven by a steady reduction in the ECB interest rate, which fell to 2% in June 2025 (from 3.75% in June 2024).

Cash Flow Analysis

Free cash flow (FCF) grew 32% YoY to €475 million, with FCF conversion improving to 87% from 85% a year earlier.

Capital expenditures (CapEx) totaled €47 million (4% of net revenue), consistent with Adyen’s long-term target of keeping CapEx at or below 5% of net revenue.

Adyen reported €12.5 billion in cash and cash equivalents, up €3.6 billion YoY. However, this includes merchant funds. On a net basis, Adyen holds €3.8 billion in cash (up from €3.3 billion YoY).

With deposit interest rates now at 2%, holding such a large cash balance is becoming a questionable capital allocation decision. Adyen’s asset-light model grows mainly through headcount investments, and acquisitions are unlikely given their preference for building a unified payments platform in-house. While management views the strong balance sheet as essential for scaling the financial products suite, I believe the company should now consider a buyback or dividend, both of which would likely generate better returns than 2%.

On the conference call, CFO Ethan Tandowsky reiterated management’s position:

“In terms of the cash position, I think what's really key for us is continuing to drive the growth that we expect over a number of years, as I mentioned earlier, I think the flexibility that the strength of our balance sheet brings is still the best use of cash to help drive that growth, and that's going to continue to be our focus.”

- Ethan Tandowsky, CFO

5. Guidance

Following lower-than-expected market volume growth in the first half of 2025, Adyen now considers the previously anticipated slight acceleration in annual net revenue growth for 2025 unlikely. The company expects this trend of slower market volume growth to persist through the remainder of the year, with full-year net revenue growth projected to be broadly in line with H1 2025 on a constant currency basis.

On the conference call, management disclosed that the APAC merchants trading into the U.S. subset of customers reduced growth by approximately 2% in Q2 compared with what it would have been otherwise. This impact, concentrated in the latter part of the half, is expected to continue through H2 2025.

Adyen reiterated its midterm guidance for 2026, pointing to low-to-high 20s growth. It also plans to maintain its hiring pace in H2 2025 at similar levels to H1, signaling sustained investment in its team. This deliberate hiring aligns with expectations for EBITDA margin expansion in 2025, albeit at a more moderate pace than in 2024. The long-term objective remains an EBITDA margin above 50% in 2026, leveraging the operating efficiency built into the business model.

6. Conclusion

This was a rather underwhelming report from Adyen. While the minor miss on revenue and EBITDA versus market expectations was, in my view, irrelevant, the lowered guidance for the remainder of the year clearly disappointed investors.

Adyen had anticipated a slight acceleration in annual net revenue growth for 2025, assuming stable market volume growth. However, weaker-than-expected market volume growth in H1 has made this acceleration unlikely. The consolation is that the drivers behind this guidance change were external factors, namely macroeconomic volatility, U.S. tariffs, and currency headwinds.

Cash App also added noise this quarter. PV growth appeared weak, but the revenue impact was more about a low take rate, and management’s focus remains firmly on net revenue.

There were positives. The fundamentals remain strong, with Adyen continuing to increase share of wallet with existing customers, and the 2025 cohort tracking well ahead of prior years. The accelerated hiring pace suggests confidence in the company’s future prospects.

The value proposition to merchants was also reinforced through case studies:

Nord Security: 10% increase in conversion, 41% drop in fraud rates, and 35% reduction in manual risk rules via Adyen Uplift.

The market reaction was, frankly, puzzling. Algorithmic trading seems to have driven knee-jerk selling before the data was fully digested. The initial sell-off was likely due to lowered short-term guidance, while the recovery followed management’s quantification of the APAC tariff impact and reaffirmation of medium-term guidance.

Coming into this report, I felt Adyen was somewhat overvalued, having last valued it around €1,350 in my Adyen: 2025 Financial Model and Valuation Update analysis a couple of months ago, versus the then-price of about €1,450. Initially, the stock dropped 20% to €1,175 before rebounding 17% to €1,390. Given the reduced 2025 guidance, the stock now trades at or just above fair value.

When a stock carries a premium valuation ahead of earnings, any lowering of guidance almost inevitably leads to multiple compression. That said, I do not believe this update undermines the long-term investment thesis.

Rating: 2 out of 5. Below expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Still searching for the share price rebound...