Executive Summary

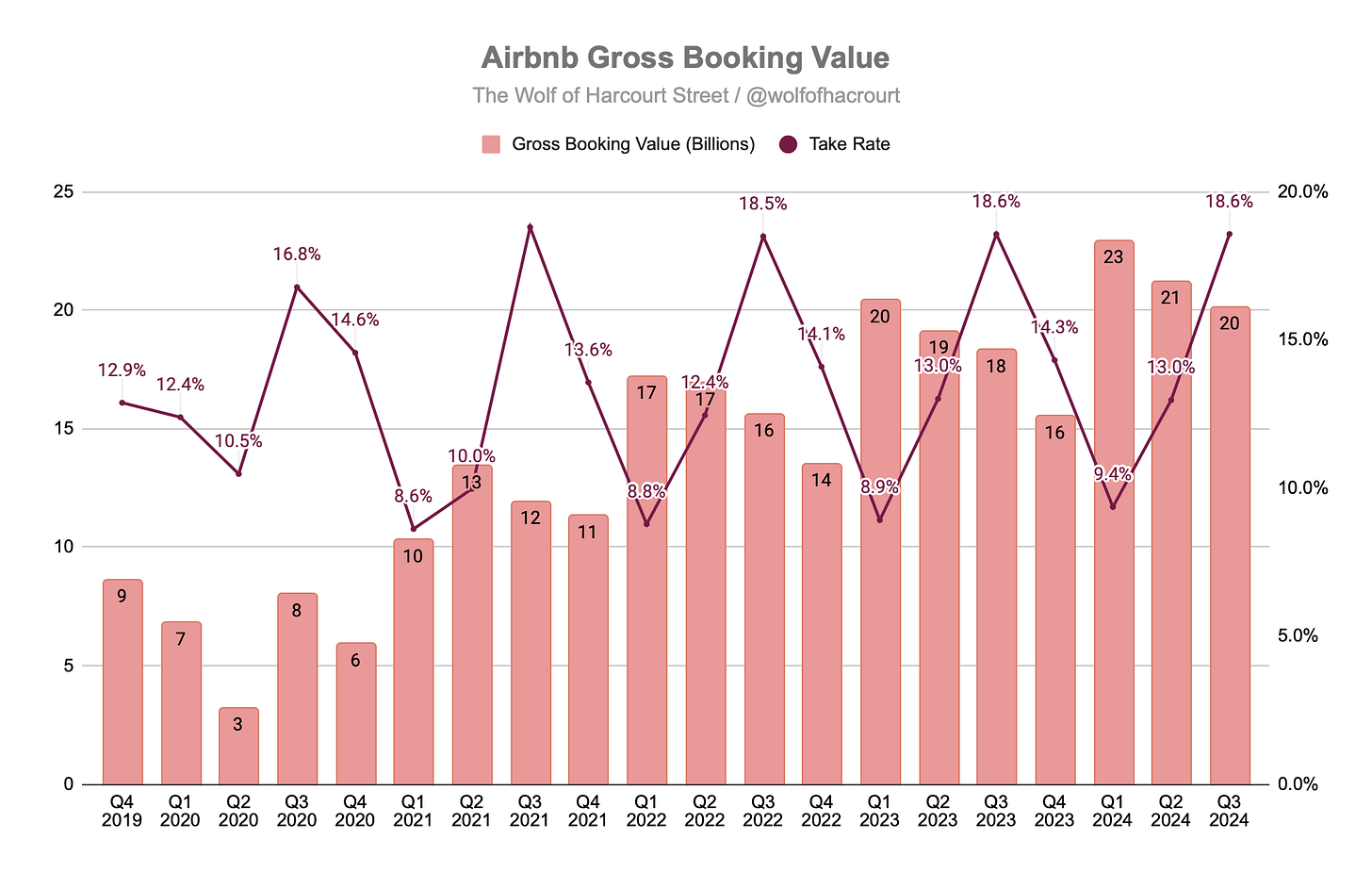

Nights and Experiences Booked grew 8% YoY, with a strong recovery to double-digit growth by quarter-end. Gross Booking Value reached $20.1 billion (up 10% YoY) due to increased bookings and a 1% rise in the Average Daily Rate to $164, largely stable across regions with modest price increases and shifts in booking mix. The take rate remained steady at 18.6%, as added revenue from cross-currency fees balanced out investments in customer service enhancements for guests and hosts.

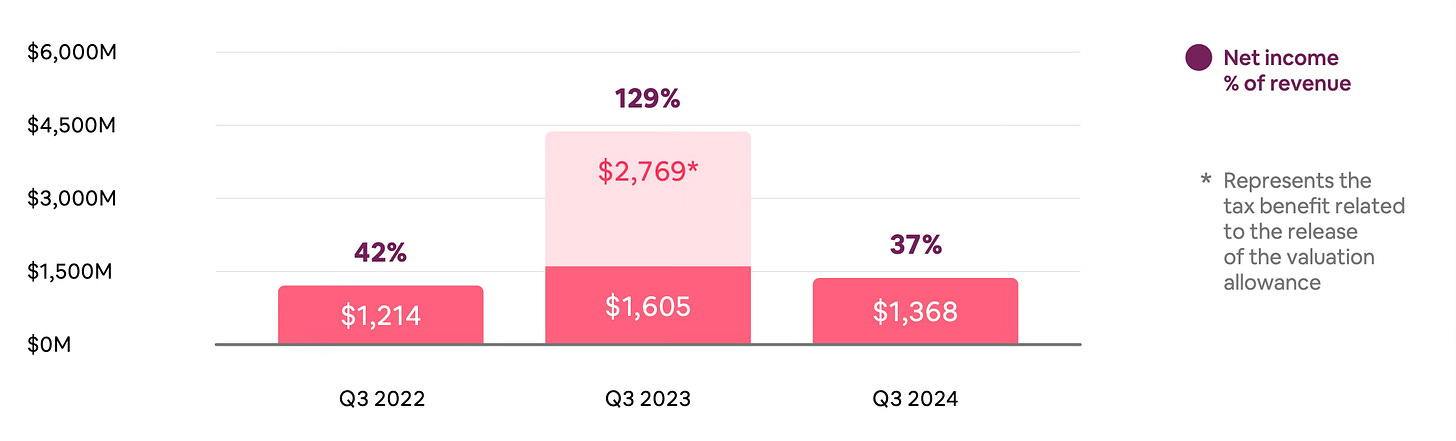

Airbnb’s revenue reached a record $3.73 billion, up 10% YoY, driven by a strong increase in bookings and a modest rise in Average Daily Rate. Operating income was $1.53 billion with a margin of 41%, down from 44% in Q3 2023. This decrease was mainly due to a 28% YoY increase in sales and marketing expenses, which focused on expanding bookings in under-penetrated regions. Net income was $1.37 billion, with a 37% margin. The margin decline was primarily due to a one-time tax benefit in the prior year and non-cash tax expenses in the current period.

Airbnb generated $1.1 billion in FCF in Q3 2024, down from $1.3 billion in Q3 2023 due to a $163 million IRS payment. Over the past twelve months, FCF reached $4.1 billion with a 38% margin. Airbnb used its strong FCF to repurchase $1.1 billion in stock during Q3 2024, totalling $3.3 billion in buybacks over the last twelve months, reducing the diluted share count from 681 million to 665 million.

Management forecasts Q4 revenue of $2.39-$2.44 billion, implying 9% YoY growth at the midpoint. Adjusted for one-time Q4 2023 gift card benefits, Q4 2024 growth would be about 2% higher. CEO Brian Chesky shared plans to diversify beyond vacation rentals, aiming to introduce 1–2 new ventures each year with $1 billion revenue potential. These ventures include a revamped Airbnb Experiences launching in May to foster frequent, loyalty-driven use, targeting both travellers and locals with unique, accessible activities.

Contents

Financial Highlights

Wall Street Expectations

Business Activity

Financial Analysis

Guidance

Conclusion

1. Financial Highlights

Revenue: $3.73 billion +10% year-over-year (YoY)

Net Income: $1.37 billion -69% YoY

Free Cash Flow: $1.07 billion -18% YoY

2. Wall Street Expectations

Revenue: $3.72 billion (in line)

Earnings per Share: 2.15 (miss by 1%)

3. Business Activity

Nights and Experiences Booked

Nights and Experiences Booked rose by 8% YoY, with bookings gaining momentum throughout the quarter and returning to double-digit growth by the end. Airbnb’s app strategy played a significant role in this growth, with app bookings increasing 18% YoY and now accounting for 58% of total nights booked, up from 53% last year. Additionally, there was continued growth in first-time bookers, particularly among younger travelers, suggesting successful user acquisition and engagement with new audiences.

North America: Q3 2024 showed YoY growth in Nights and Experiences Booked, especially in non-urban destinations and for larger groups. Growth was led by short-term stays and entire home bookings, which outpaced long-term stays and Airbnb rooms.

EMEA: Growth in Nights and Experiences Booked slightly accelerated, supported by the Paris 2024 Olympics. Non-urban destinations saw the highest growth, with Airbnb hosting nearly 700,000 guests during the Games and a 35% increase in Paris listings.

Latin America: Nights and Experiences Booked grew 15% YoY, with domestic travel remaining strong (+21%). This region saw the highest growth in active listings, along with Asia Pacific, both experiencing notable YoY booking growth.

Asia Pacific: Nights and Experiences Booked grew 19% YoY, remaining steady with the previous quarter. Cross-border travel to the region increased by 23%, and there was a gradual recovery in outbound travel from China.

Gross Booking Value and Take Rate

Gross Booking Value (GBV) reached $20.1 billion, a 10% YoY increase, driven by growth in Nights and Experiences Booked and a modest rise in Average Daily Rate (ADR). ADR rose to $164, a 1% increase YoY (2% excluding FX impacts), with stable or positive trends across all regions due to price increases and shifts in booking mix.

Regional breakdowns showed that North America's ADR grew by 3% (1% excluding FX and mix shift), while EMEA saw a 6% increase (3% excluding FX and mix shift), reflecting price appreciation in both regions.

The implied take rate remained flat YoY at 18.6%, as additional revenue from cross-currency service fees was offset by increased investments in customer service aimed at enhancing guest and host experiences.

Strategic Updates

Making Hosting Mainstream: With over 8 million active listings, Airbnb aims to make hosting as popular as traveling on the platform. A new Co-Host Network helps hosts find local, experienced co-hosts to manage listings and bookings.

Perfecting the Core Service: Airbnb has introduced over 535 new features and upgrades over the past three years, improving the platform for both hosts and guests. The 2024 Winter Release added 50+ guest-focused upgrades, including personalized search filters and listing recommendations. Additionally, Airbnb removed 300,000 listings that didn’t meet quality standards, addressing guest concerns about listing quality.

Expanding Beyond the Core: Airbnb is focusing on under-penetrated expansion markets, where growth in nights booked has been more than double that of core markets. This strategy will help Airbnb expand internationally, with plans to extend services beyond accommodations in the coming year.

4. Financial Analysis

Revenue

Airbnb's revenue reached $3.73 billion, a 10% increase from the prior year and a new quarterly record. This growth was driven by a strong increase in Nights and Experiences Booked, alongside a modest rise in ADR.

Operating Margin

Airbnb reported an operating income of $1.53 billion in Q3 2024, with an operating margin of 41%, down from 44% in Q3 2023. This margin compression was primarily due to a 28% YoY increase in sales and marketing expenses, which outpaced revenue growth. Investments were concentrated in global markets and performance marketing. According to management, this marketing approach accelerated booking growth in under-penetrated regions like low-penetration states in middle America, showcasing effective audience targeting and channel optimization.

Net Margin

Net income was $1.37 billion, yielding a 37% net income margin. The decrease from Q3 2023 was mainly due to a one-time deferred tax asset benefit in the prior year and non-cash tax expenses this year.

A key contributor to Airbnb’s net income is interest income. The company saw an 8% increase in interest income, rising from $192 million in Q3 2023 to $207 million in Q3 2024. 15% of Airbnb’s net income came from interest income.

Cash Flow Analysis

Airbnb generated $1.1 billion in operating and free cash flow (FCF). YoY FCF declined from $1.3 billion in Q3 2023, primarily due to a $163 million IRS payment related to a prior matter. Over the past twelve months, FCF reached $4.1 billion, with an FCF margin of 38%. As the Merchant of Record, Airbnb experiences seasonal fluctuations in free cash flow. Cash inflows are high in Q1 due to booking collections but lower in Q3 when hosts are paid for completed stays.

This strong FCF allowed Airbnb to repurchase $1.1 billion of stock in Q3 2024, with a trailing twelve-month total of $3.3 billion in buybacks. This reduced the diluted share count from 681 million in Q3 2023 to 665 million in Q3 2024.

5. Guidance

Management expects Q4 revenue between $2.39 billion and $2.44 billion, implying 9% growth at the midpoint. ADR is projected to increase modestly due to higher demand for larger, premium listings and a small FX benefit. Adjusted for one-time gift card benefits in Q4 2023, Q4 2024 revenue growth would be about 2% higher. Demand is strong across core and expansion markets, with growth in both short- and long-lead-time bookings. Nights and Experiences Booked are expected to surpass Q3 2024 growth.

For 2024, the Adjusted EBITDA Margin is projected at 35.5%, with Free Cash Flow Margin exceeding this level. SBC expenses are expected to rise 25% YoY, outpacing headcount growth due to changing RSU accounting, though they should align more closely with headcount growth beyond 2024 as older RSUs vest.

6. Conclusion

Airbnb reported a solid quarter, achieving 10% revenue growth, just above the forecasted 9%. Although net income appears to have declined sharply, this was expected, given the prior year’s artificially inflated figures due to a one-time tax benefit.

Despite earlier concerns about weaker U.S. demand, this quarter's outlook is more positive. Booking lead times, initially shorter, normalized by September, suggesting stable booking trends across all major regions by quarter-end. Increased marketing spend, particularly in global expansion markets, is expected to continue into Q4, slightly compressing margins compared to last year.

Airbnb also achieved milestones with over 2 billion guest arrivals and nearly 500 million annual room nights booked, aiming to attract more hotel-style travelers by emphasizing quality, affordability, and usability. CEO Brian Chesky shared ambitions to expand beyond vacation rentals, with plans to introduce 1–2 new business ventures annually, each targeting $1 billion in incremental revenue. Upcoming offerings include a reimagined Airbnb Experiences launching next May, with further expansions into travel-adjacent sectors anticipated.

To foster frequent use, Airbnb is enhancing Experiences to encourage monthly or even weekly engagement. Initially aimed at travelers, these experiences are designed to appeal locally, offering unique activities to users in their hometowns. Inspired by Apple’s approach with the iPod, Airbnb aims to cultivate frequent, loyalty-driven use across travel and local activities.

Rating: 3 out of 5. Meets expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com