Executive Summary

Nights and Experiences Booked grew by 9.5% YoY, driven by growth across all regions and a substantial increase in app downloads and usage, particularly in the U.S. Mobile bookings now account for 54% of all nights booked, indicating a shift towards mobile usage. Gross Booking Value experienced a 12% increase YoY, reaching $22.9 billion. This growth was mainly driven by more Nights and Experiences Booked, alongside a 3% rise in Average Daily Rate to $173.

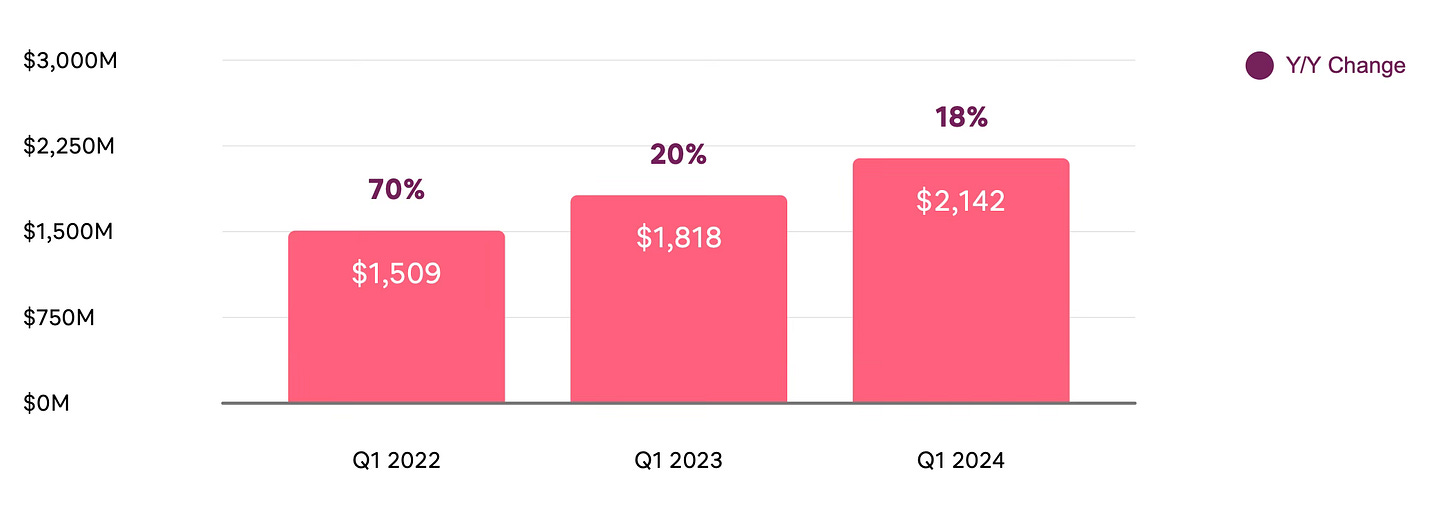

Airbnb saw an 18% increase in revenue from the previous year, reaching $2.14 billion. This growth was driven by an increase in Nights and Experiences Booked, a slight rise in ADRs, and the seasonal impact of Easter. Net income more than doubled to $264 million in Q1 2024, with the net income margin rising to 12% from 6% the previous year. This improvement is partly due to a shift in marketing spend, focusing more on Q2 2024 in addition to a 125% increase in interest income.

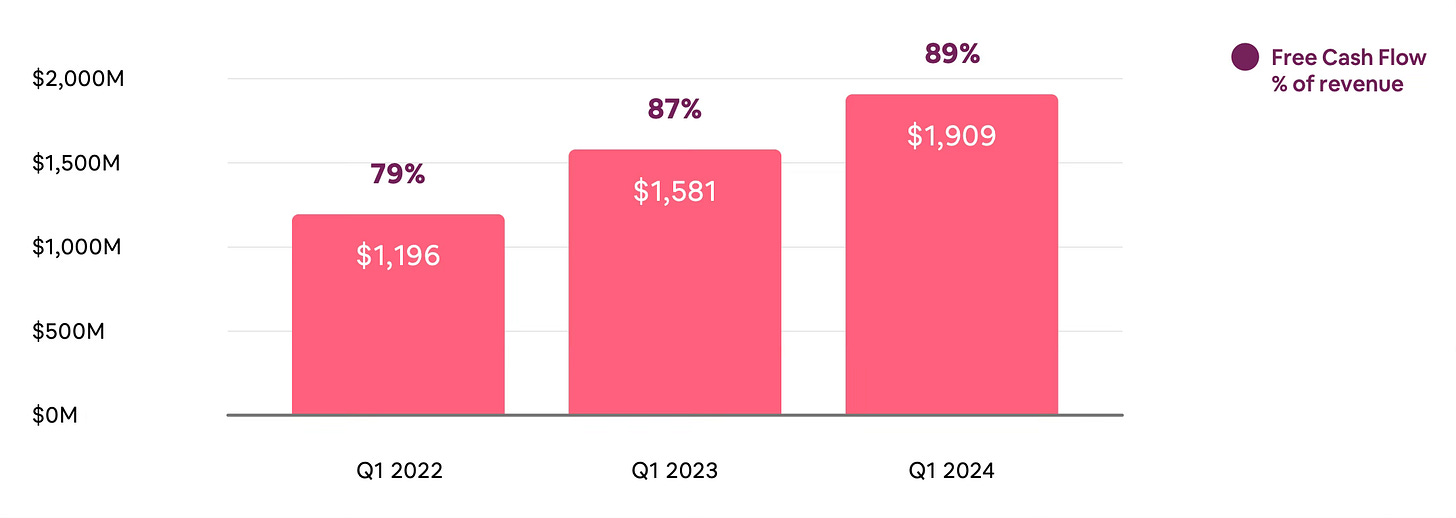

Airbnb achieved a record-breaking first quarter in 2024 with over $1.9 billion in free cash flow, resulting in a FCF margin of 89%. This exceptional performance is attributed to Airbnb's business model, where it collects cash upfront for bookings but recognizes revenue later, when the stays occur.

The Q2 revenue guidance appears light initially due to the timing of the Easter holiday in 2024, which shifted some revenue from Q2 to Q1. Despite this, Airbnb's projected H1 2024 revenue is $4.85 billion, representing a 13% increase YoY and surpassing Wall Street's estimate of $4.80 billion. Although Airbnb's stock dropped by 8% following the earnings release, this reaction is attributed to investors focusing on the perceived weak guidance for a single quarter rather than the overall strong performance and growth.

Contents

Financial Highlights

Wall Street Expectations

Business Activity

Financial Analysis

Guidance

Conclusion

1. Financial Highlights

Revenue: $2.14 billion +18% year-over-year (YoY)

Net Income: $264 million +126% YoY

Free Cash Flow: $1.9 billion +21% YoY

2. Wall Street Expectations

Revenue: $2.06 billion (beat by 4%)

Earnings per Share: 0.23 (beat by 78%)

3. Business Activity

Nights and Experiences Booked

In Q1, Nights and Experiences Booked increased by 9.5% YoY, driven by growth across all regions, despite facing a hard comparison with Q1 2023. A notable aspect of the growth was the substantial increase in app downloads and usage. In the U.S., app downloads grew by 60%, contributing to a 21% increase in nights booked through the mobile app globally. Mobile bookings now account for 54% of all nights booked, indicating a shift towards mobile usage.

North America: Domestic travel remained stable, with strong growth in non-urban and larger group travel. Nights booked for groups of over five people increased 15% compared to Q1 2023, marking the fourth consecutive quarter of growth in this segment.

EMEA: Similar to North America, there is strength in non-urban and larger group travel, with nights booked for groups of over five people increasing 12% compared to Q1 2023. There is an expectation of a strong backlog of bookings for the upcoming Olympics in the summer.

Latin America: There was significant growth, with Nights and Experiences Booked up 19% in Q1 2024 compared to Q1 2023. Cross-border nights booked for trips within Latin America increased by 30%. This region presents major growth opportunities with strong demand.

Asia Pacific: There was an increase of 21% year-over-year in Nights and Experiences Booked, with a significant improvement in cross-border travel, which rose 28% year-over-year. The recovery in outbound China travel was also notable, with nights booked on an origin basis in China increasing nearly 80% year-over-year.

Gross Booking Value and Take Rate

GBV increased by 12% YoY in Q1 2024 to $22.9 billion. This growth was driven primarily by an increase in Nights and Experiences Booked, as well as a modest increase in Average Daily Rate (ADR), which rose 3% YoY to $173. Excluding the impact of foreign exchange (FX), ADR increased by 2% across all regions due to price appreciation.

Regional breakdowns showed that ADR in North America increased by 3% YoY but remained flat when excluding the impact of FX and mix shift. The growth in short-term stays and entire homes surpassed long-term stays and Airbnb rooms, affecting the mix shift. In EMEA, ADR increased by 7% YoY, or 4% when excluding FX and mix shift, indicating stronger performance in these markets. Overall, the growth in GBV and ADR suggests robust business performance across regions.

The implied take rate for Q1 2024 increased notably compared to Q1 2023, reaching 9.4%. This increase was primarily due to the timing of Easter occurring in Q1 2024 rather than in Q2, as it did in 2023, and to a lesser extent, the occurrence of Leap Day in February. Additionally, the company updated its terms of service to allow charging a fee for cross-currency bookings starting April 1, 2024. This fee is being tested and only affects about 20% of their GBV, indicating a shift in pricing strategy but with a limited impact on the majority of transactions.

Product Releases

On 1st May, Airbnb launched "Icons" as a new category of extraordinary experiences hosted by famous figures in various fields, such as music, film, and sports. These experiences, including stays at notable locations like the Disney and Pixar's Up house, aim to enhance Airbnb's brand by reaching new audiences and diversifying its offerings beyond travel accommodations. Additionally, Airbnb is launching new features tailored for group trips, such as shared wishlists, a redesigned Messages tab, and trip invitations, to make planning group trips more convenient and engaging for users. These updates align with Airbnb's goal of strengthening its brand relevance and appeal to different market segments while also expanding its services and user experience.

4. Financial Analysis

Revenue

In Q1 2024, Airbnb's revenue reached $2.14 billion, which marked an 18% increase from the previous year. This growth was primarily driven by a rise in the number of Nights and Experiences Booked, a slight uptick in ADRs, and the seasonal influence of Easter. The company also benefited from favorable currency exchange rates, as roughly half of its revenue was in non-USD currencies, while a smaller portion of its operating expenses was.

Airbnb's revenue is calculated by applying its take rate to its GBV, and the increase in the take rate during the quarter allowed its revenue growth to surpass the growth in GBV.

Margins

Airbnb reported an operating income of $101 million in Q1 2024, indicating an operating margin of 5%, which is a notable improvement from 0% in the same quarter of 2023. The change in operating income is partially attributed to changes in marketing spend: while in 2023 marketing spend was concentrated more in the first half of the year, in 2024 the allocation remains more towards the first half, with a heavier focus in Q2 compared to Q1.

Airbnb's net income more than doubled to $264 million in Q1 2024 and the net income margin increasing from 6% to 12% compared to the same period in 2023. A key factor in this growth was Airbnb's ability to capitalize on higher interest rates. The company saw a 125% increase in interest income, rising from $146 million in Q1 2023 to $293 million in Q1 2024. This boost in interest income came from Airbnb's role as the Merchant of Record, allowing the company to hold cash from customer bookings and invest it in short-term US Treasury bills. This strategic financial move leveraged the rising interest rates to generate additional income before paying hosts.

Cash Flow Analysis

Airbnb generated over $1.9 billion of free cash flow (FCF) in Q1 2024, resulting in a FCF margin of 89% and the highest first quarter ever.

Airbnb's exceptionally high FCF in Q1 is due to the company's business model of collecting cash upfront when customers book their stays. This inflow of cash occurs in Q1 as travelers book trips for upcoming months, particularly for spring and summer vacations. Although Airbnb collects cash in Q1, it does not recognize the bookings as revenue immediately, as revenue is recognized when the stays occur later in the year (often in Q2 or Q3). Since Airbnb is the Merchant of Record, it holds onto the collected cash until the services are provided, after which it pays out the appropriate amount to the hosts. This cycle leads to seasonal fluctuations in free cash flow, with high inflows in Q1 due to bookings and potentially lower free cash flow in Q3 due to payments to hosts for completed stays.

On a training twelve month basis, Airbnb’s FCF margin is 41% which is a more accurate representation of the underlying business performance.

5. Guidance

Management expects Q2 2024 revenue to be between $2.68 billion and $2.74 billion, representing a YoY growth of 8% to 10%. However, this growth faces a headwind due to the timing of the Easter holiday, the inclusion of Leap Day in Q1 2024, and changes in foreign exchange rates. Despite these challenges, demand for travel is strong ahead of major summer events like the Olympics and Euro Cup, suggesting potential for accelerated growth in Q3 2024.

In terms of operational metrics, the company anticipates the growth rate of nights booked in Q2 2024 to be stable compared to Q1 2024, while ADR should increase modestly compared to Q2 2023.

Adjusted EBITDA for Q2 2024 is expected to be flat to up on a nominal basis, but down on an Adjusted EBITDA Margin basis due to the Easter timing, one-time payment processing benefits in Q2 2023, and higher marketing expenses.

For the full year, the company maintains its prior guidance, aiming to grow Adjusted EBITDA nominally and achieve an Adjusted EBITDA Margin of at least 35%, allowing for investments in growth opportunities.

6. Conclusion

Let's first address the Q2 revenue guidance, which appears rather light on initial inspection. Due to the timing of the Easter holiday in 2024, some revenue from Q2 was pulled forward into Q1. This is evident from the fact that Q1 revenue beat analysts' expectations by 4%. Last quarter, management had guided for 13% revenue growth in Q1 but achieved 18%.

If we look at the first half of the year based on Q1 actuals and Q2 guidance, Airbnb is projected to report H1 2024 revenue of $4.85 billion compared to $4.30 billion in H1 2023, representing an increase of 13% YoY. Furthermore, Wall Street's estimate for H1 2024 revenue was $4.80 billion, which means that the projected H1 revenue is actually higher.

After the earnings release, Airbnb's stock sold off by 8% based on the perceived weak guidance. This demonstrates how fickle investors can be when they focus on a single quarter rather than considering the bigger picture.

The analysis I shared in March suggested that Airbnb was undervalued by as much as 18%. This margin has increased even further after the earnings reaction. There was nothing in the earnings report to contradict any of my assumptions; in fact, Airbnb is on track to grow revenue faster in 2024 than I had estimated. The full analysis is linked below for anyone who missed it.

Rating: 3 out of 5. Meets expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

thanks very much for this important udpdate!