Datadog: 2024 Financial Model and Valuation Update

What is the Fair Value of Datadog?

Almost 18 months ago, I released my initial investment thesis on Datadog (DDOG), which included a comprehensive analysis of the business, a 5-year projected P&L, and a discounted cash flow valuation. At the time, my analysis indicated that the company was trading below its fair value, and since then, the stock has returned +61%. The full report is linked below.

In this update, I present a revised financial model and fair value assessment. Before diving into the updated financials, let's review Datadog's performance in the first half of 2024.

Business Activity

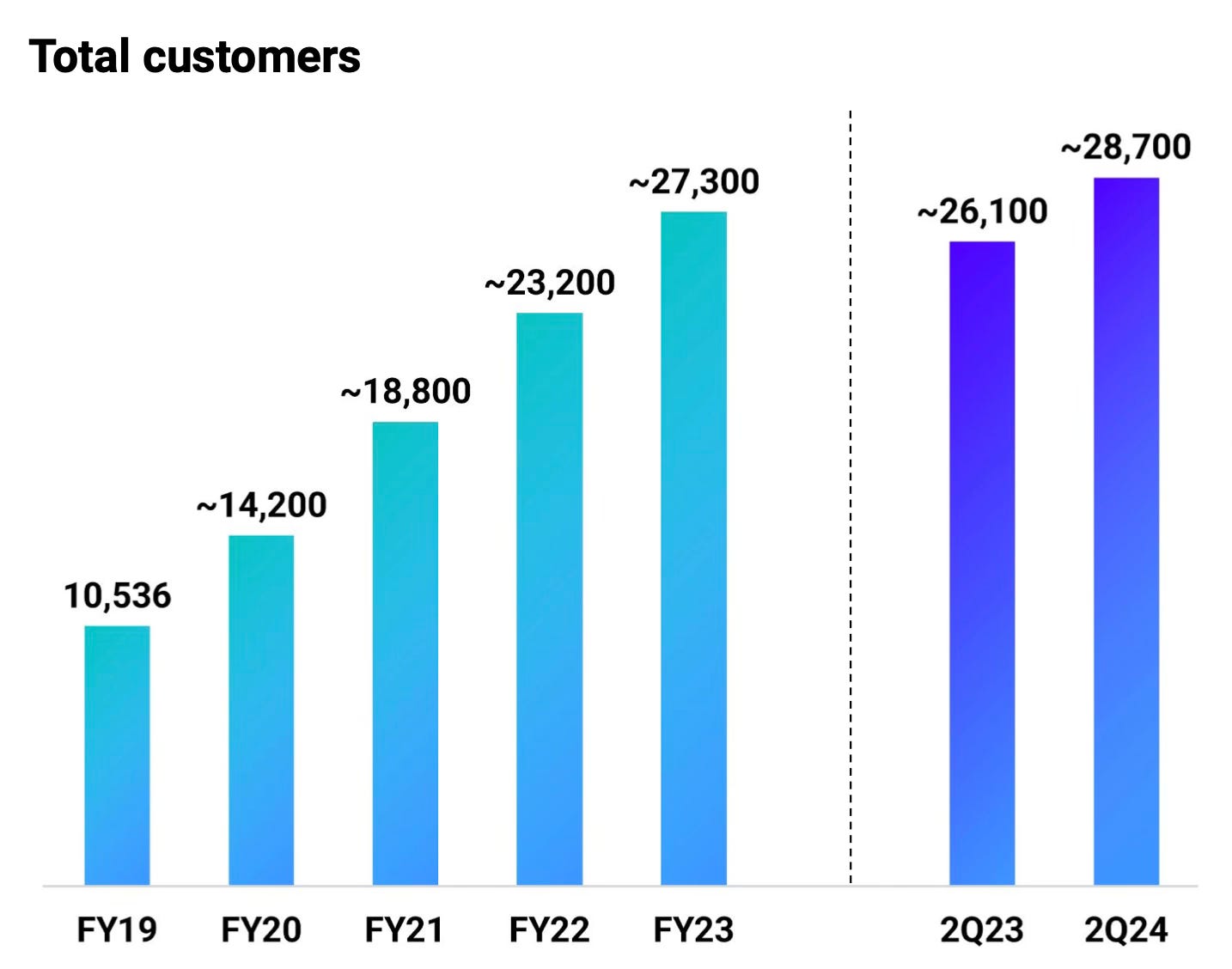

Total Customers

Datadog ended Q2 2024 with 28,700 customers, representing a 10% year-over-year (YoY) increase.

Annual Reoccurring Revenue (ARR)

Datadog’s ARR base continues to grow, with customers contributing $100K+ in ARR increasing by 13% to 3,390. However, growth has decelerated over the past three years.

A significant portion of the company's ARR comes from a small subset of high-value customers. Customers with ARR of $100,000 or more, representing about 12% of the total customer base, account for 87% of the company's ARR.

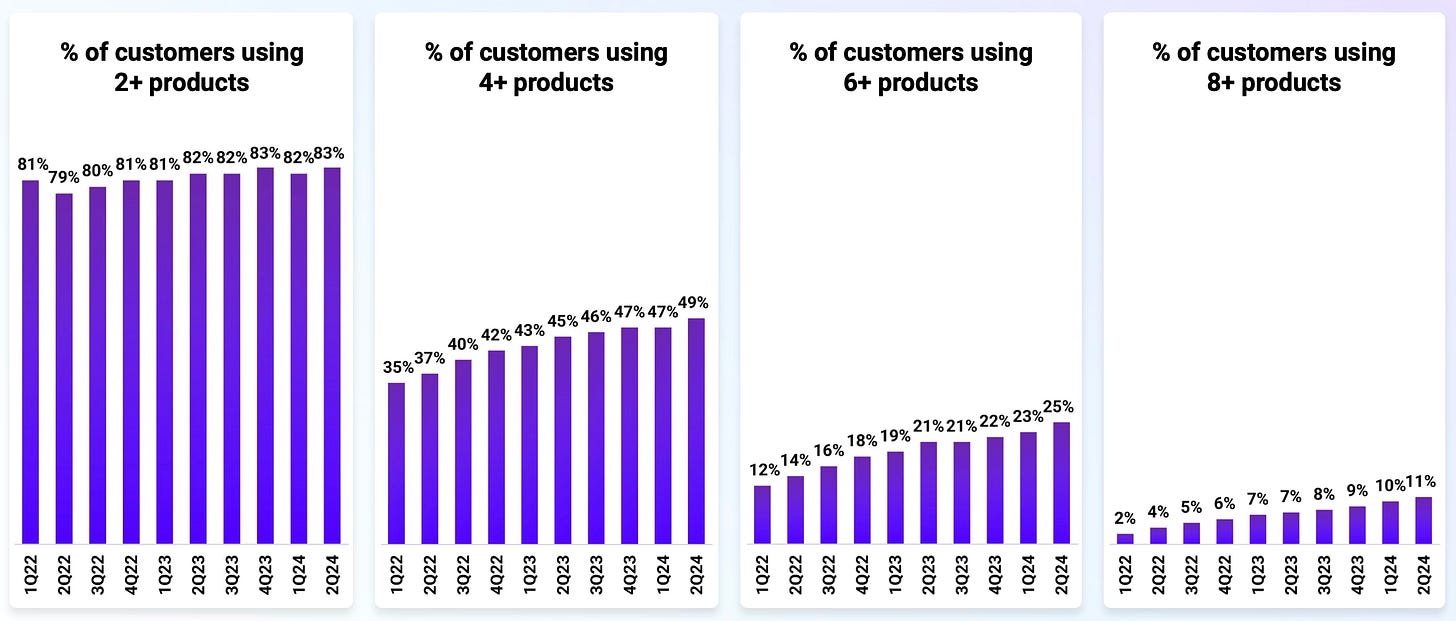

Platform Adoption

Datadog's platform adoption is driven by its successful ‘Land and Expand’ model, as more customers continue to adopt multiple products. By the end of Q2 2024, 83% of customers were using two or more products, up slightly from 82% the previous year.

Further along the spectrum:

49% of customers now use four or more products, up from 45% a year ago.

25% of customers use six or more products, compared to 21% last year.

11% of customers are using eight or more products, a notable increase from 7% the previous year.

Customer Retention Rate

Datadog’s dollar-based net retention rate (DBNRR) was in the mid-110% range in Q2 2024, consistent with the last few quarters. Management noted an upward trend when viewed quarterly, as this is a trailing 12-month measure.

A DBNRR in the mid-110% range indicates that Datadog is effectively generating more revenue from its existing customers, with customers, on average, spending 10-15% more than they did the previous year.

Financial Analysis

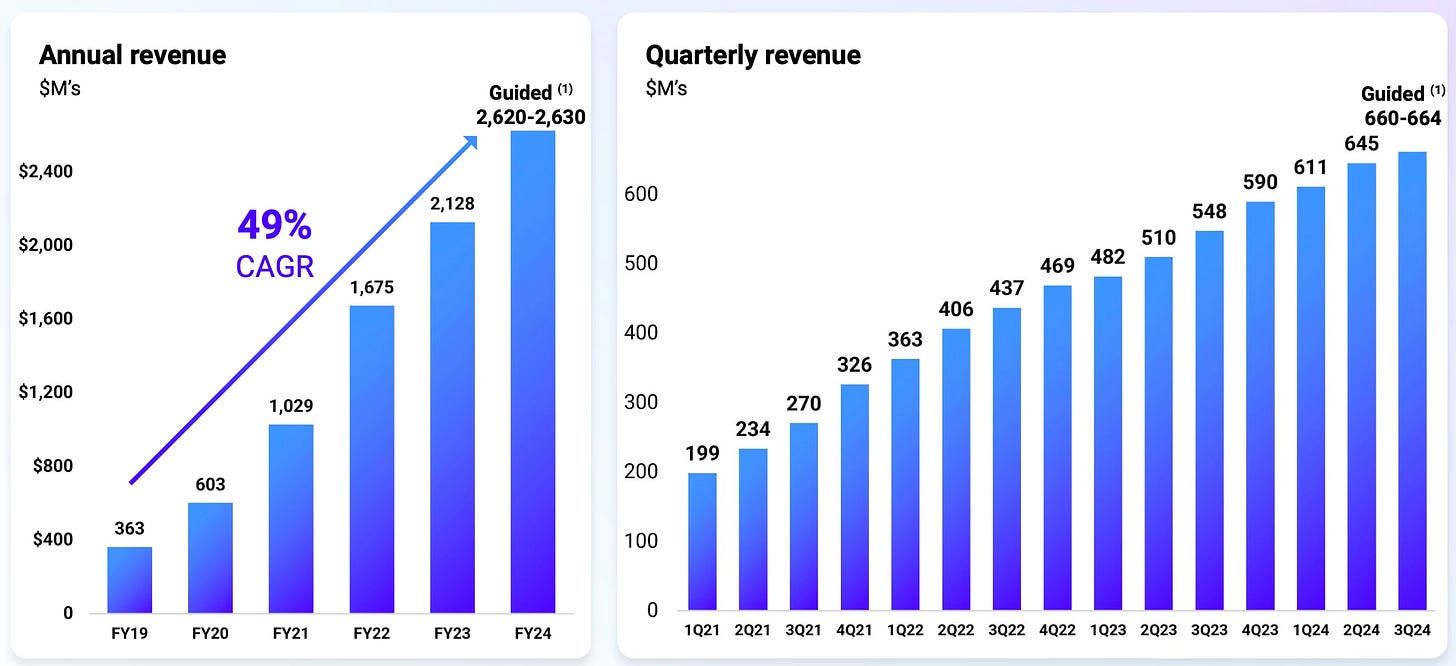

Revenue

Datadog's impressive growth and expanding customer portfolio have led to substantial revenue increases in recent years. This trend continued in Q1 and Q2 2024, with revenue growing 27% YoY, up from 25% at the end of 2023.

Management noted higher usage growth from existing customers in Q2 2024 compared to Q2 2023, and usage growth in the first half of 2024 exceeded that of the same period in 2023. Datadog’s core products continue to see increased customer penetration and usage, while newer offerings in observability, cloud security, and cloud service management are steadily growing.

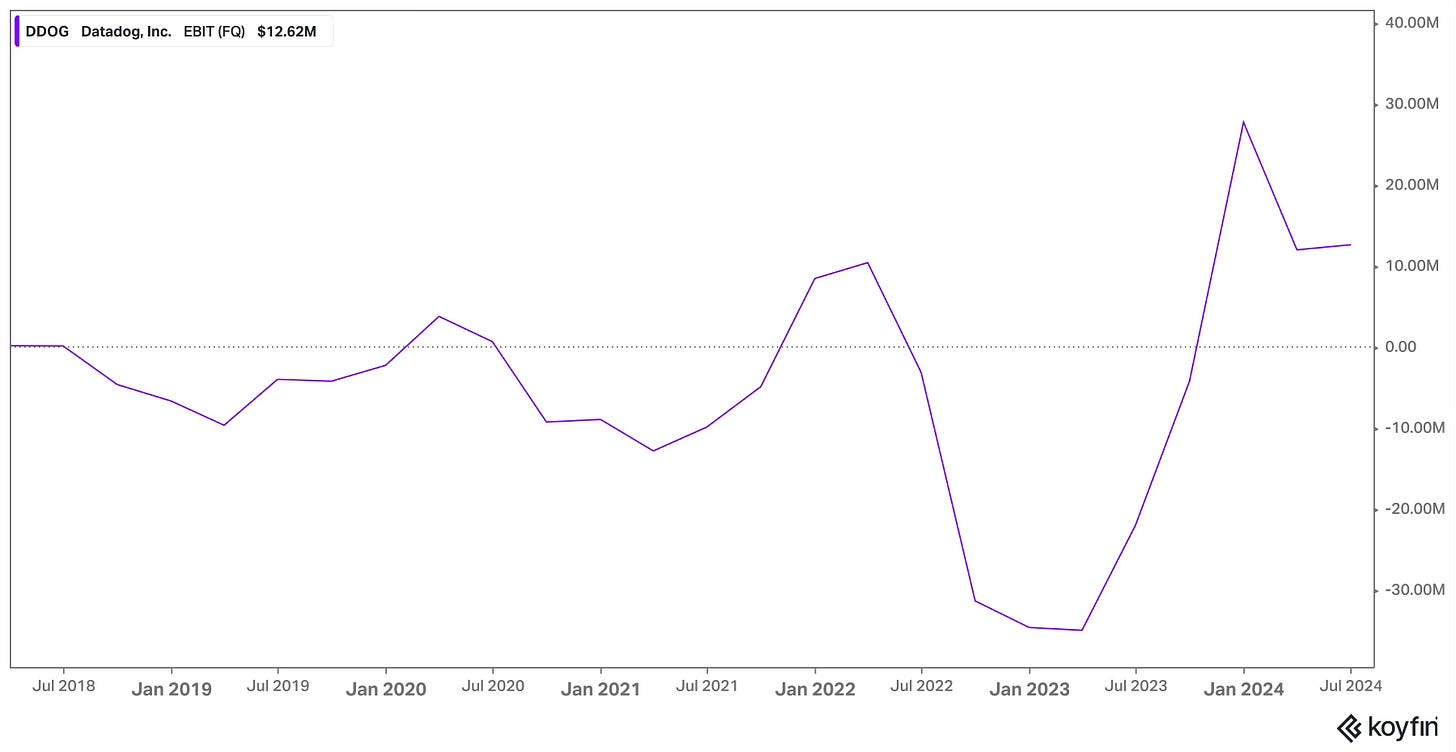

Profitability

On a GAAP basis, Datadog is barely profitable, recording an operating profit of $13 million in Q2 2024, resulting in a 2% GAAP operating margin. On a Non-GAAP basis, operating income was $158 million, translating to a 24% Non-GAAP operating margin. The primary adjustment made by the company is the exclusion of significant stock-based compensation (SBC) expenses, which will be discussed later in the report.

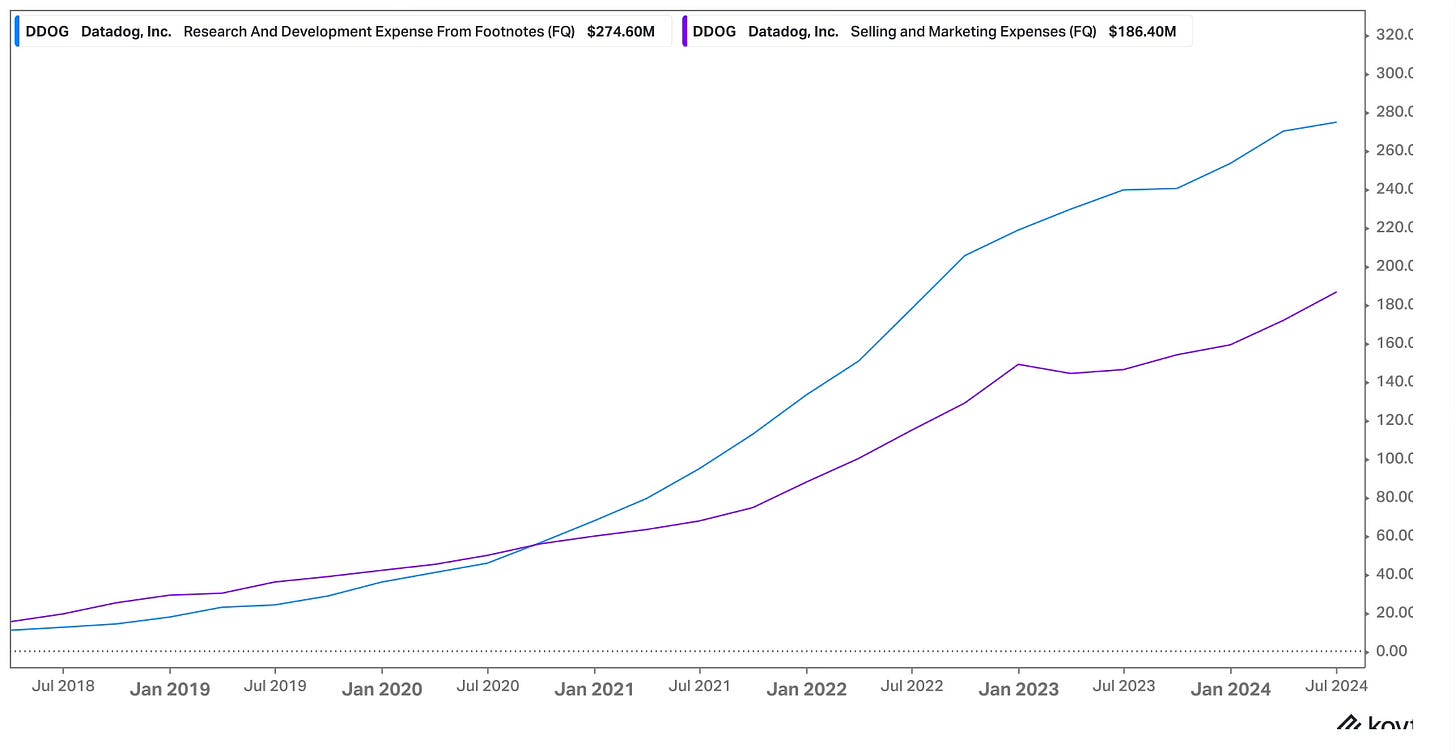

Datadog invests heavily in research and development (R&D) to maintain its market leadership. R&D expenses represent the largest portion of its operating costs, increasing from 27% of revenue in 2017 to 43% in Q2 2024. This highlights Datadog’s commitment to innovation and its focus on staying ahead of the curve by continuously developing new products and features.

Sales & Marketing (S&M) expenses, however, have been trending downward, falling from 45% of revenue in 2018 to 29% in Q2 2024. The simultaneous decrease in S&M expenses and increase in R&D expenses suggests that Datadog’s products are gaining market traction organically. Instead of spending heavily on acquiring customers, Datadog is investing its gross profit into R&D to enhance its offerings for existing and prospective customers.

Free Cash Flow

Datadog’s free cash flow margin was 28% in 2023 and remained at 28% in Q2 2024 on a trailing twelve months basis. A significant contributor to the divergence between free cash flow and GAAP operating margins is SBC expenses. In Q2 2024, Datadog incurred $270 million in SBC expenses, up 17% from Q2 2023.

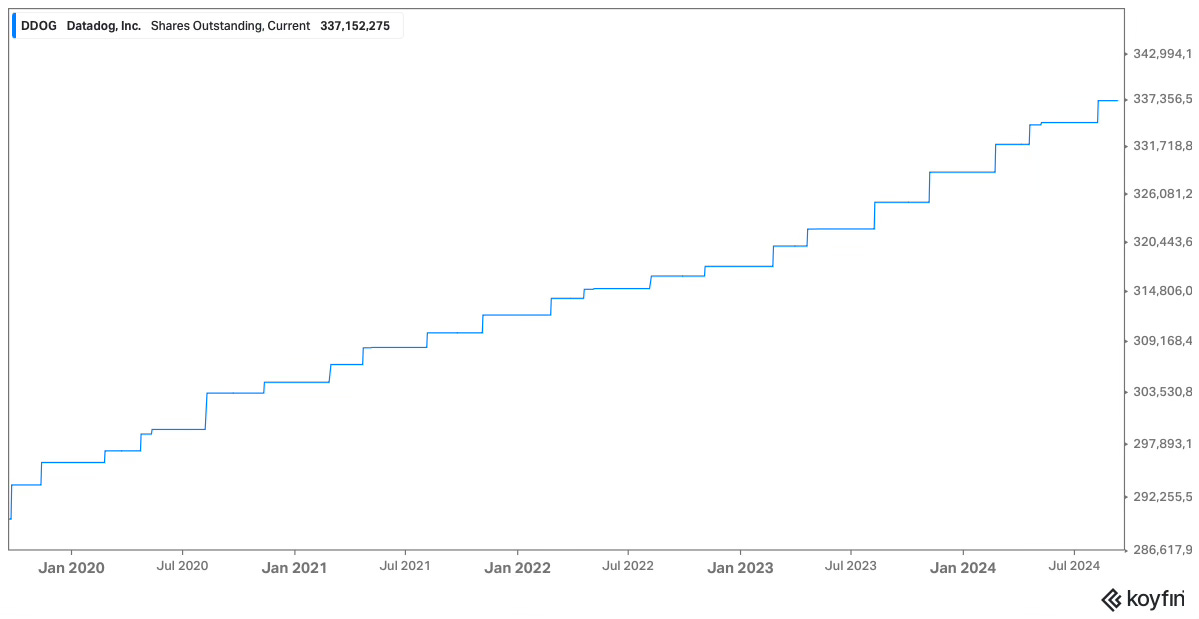

While SBC contributes to strong free cash flow margins, it has resulted in notable shareholder dilution, amounting to 3.5% in 2023 alone.

Discounted Cash Flow Analysis

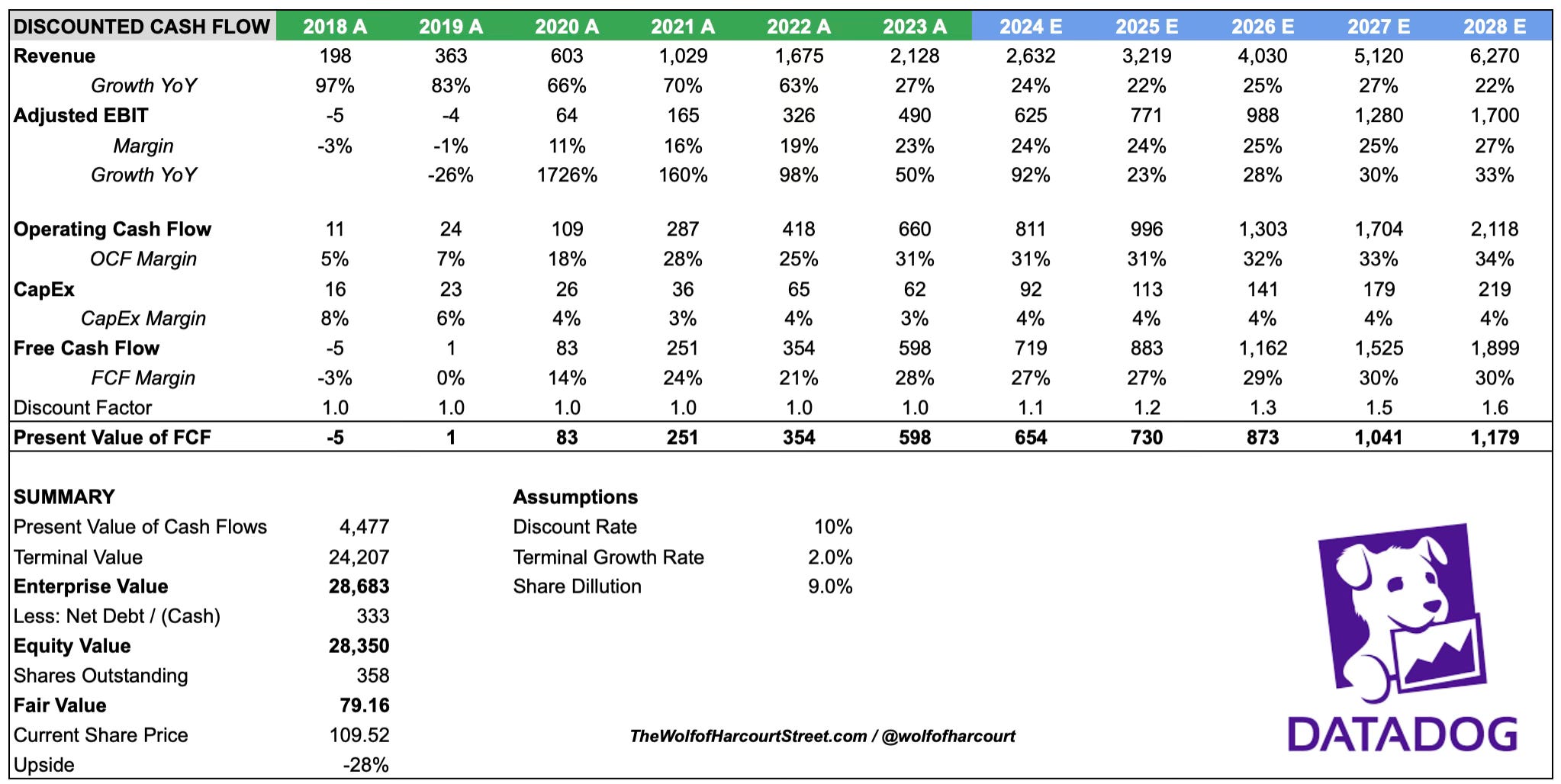

Future cash flows have been projected over five years using a discount rate of 10%. A terminal growth rate of 2% has been assumed, which is at the lower end of the range given the terminal risk associated with fast-paced technology companies.

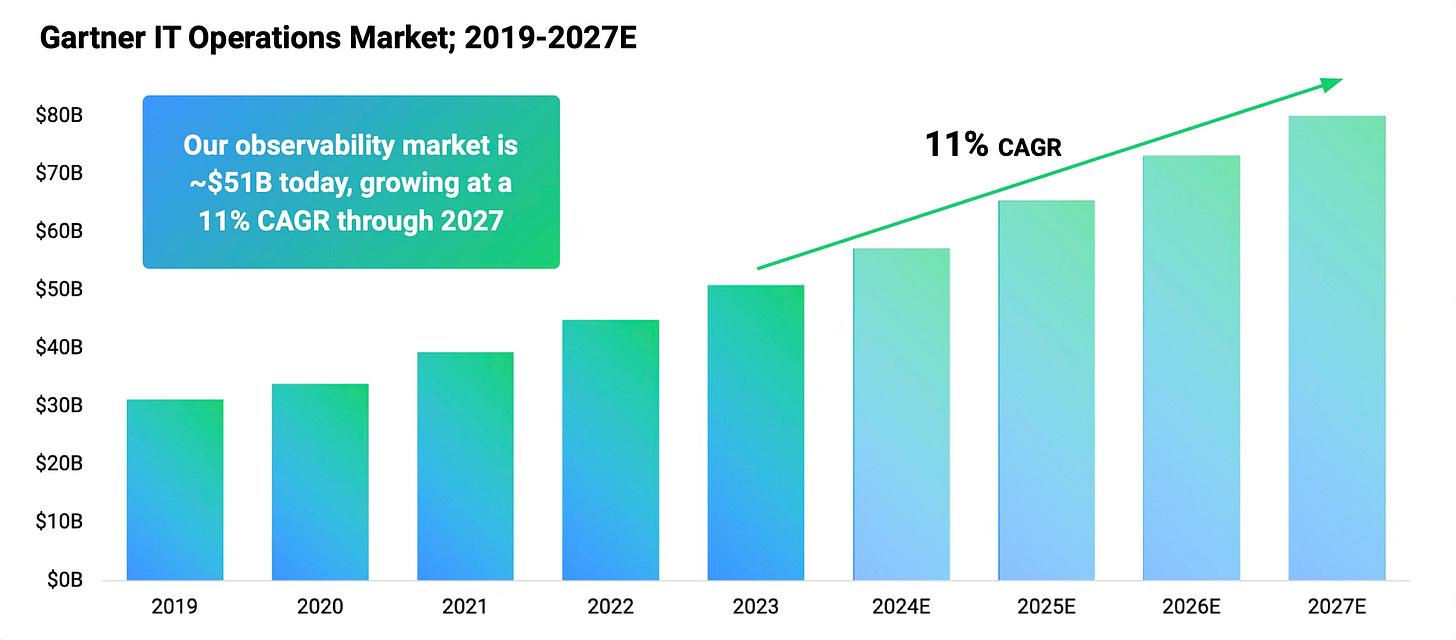

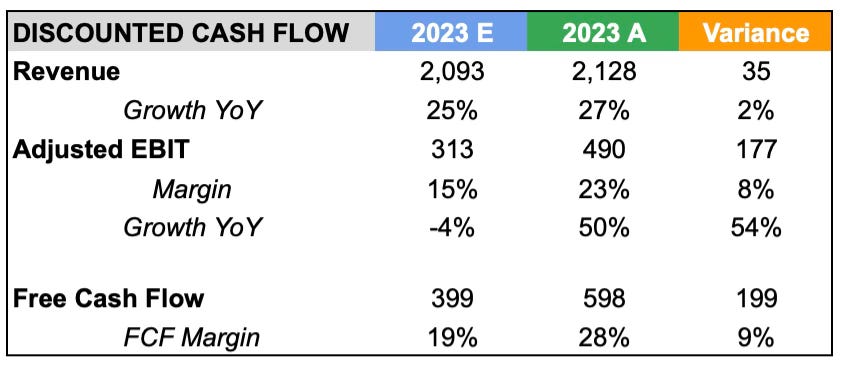

A revenue CAGR of 24% is projected from 2023 to 2028. In 2023, Datadog posted revenue of $2.13 billion, representing 4.2% of the observability TAM, per Gartner. By 2027, I project Datadog’s revenue to reach $5.12 billion, or almost 6.6% of the Gartner TAM, which seems reasonable for the category leader.

The adjusted EBIT margin is forecast to be 24% in 2024, in line with management guidance. As the business continues to scale, an EBIT margin of 27% is assumed by 2028.

The FCF margin is assumed to be 27% in 2024, reaching 30% by 2028. A capital expenditure margin of 3.5% is anticipated for all years, in line with the average of the past few years.

Previous analysis identified significant shareholder dilution in recent years. In 2023, the dilution rate was 3.5% (2022: 1.8%, 2021: 2.5%, 2020: 3%). I have assumed a total dilution rate of 9% over the forecast period.

Based on these assumptions, the fair value of Datadog is approximately $79 per share, indicating a potential downside of -28% compared to the share price on September 11, 2024, which was $110.

Conclusion

Last year’s analysis suggested Datadog was undervalued with a reasonable margin of safety. This proved accurate, as the stock has appreciated significantly since then. The analysis was underpinned by modest expectations, which Datadog ultimately exceeded, particularly in Adjusted EBIT and FCF.

Datadog remains largely the same business today, supported by secular tailwinds as its market opportunity continues to expand. However, the valuation now reflects this. A lot more is priced into the stock than last year. Key changes to my expectations include an increase in the FCF margin from 24% to 30% in year five. However, this is offset by a worsening trend in dilution, which I’ve raised from 6.7% to 9%. As a result, my fair value estimate has only increased by 3% during this period.

The opportunity to deploy new capital into the stock today is far less appealing than it was last year. In fact, the risk of capital loss is material, especially if Datadog’s growth slows, as much of this growth is already priced in. Additionally, Datadog’s Non-GAAP profitability and FCF margin are already quite high and close to management’s long-term targets, leaving limited room for further margin expansion.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Did you check if SBC probably more allocated to R&D instead of Marketing Expenses? That may cause the impact on R&D expenses.