Evolution: 2024 Financial Model and Valuation Update

Analysing the fair value of Evolution AB

Last year, I released my initial investment thesis for Evolution, providing a comprehensive analysis of the business, including a 5-year projected P&L and discounted cash flow valuation. At that time, my analysis indicated that the company was trading 38% below its fair value, and since the report's publication, the stock has returned 28%. The full report is linked below.

In this update, I present a revised financial model and a fair value assessment following the release of the 2023 earnings. Before delving into the financial model, let's review the 2023 earnings.

2023 Earnings Summary

Revenue

Evolution experienced a 23% growth in revenue in 2023, reaching €1.8 billion. Although this growth rate is the slowest since its IPO, it still represents a five-year CAGR of 49%.

Operating Margin

In 2023, Evolution achieved its most profitable year yet, attaining an operating margin of 64%. Personnel expenses, the primary component of operating expenses, accounted for 54% of total operating expenses during the period.

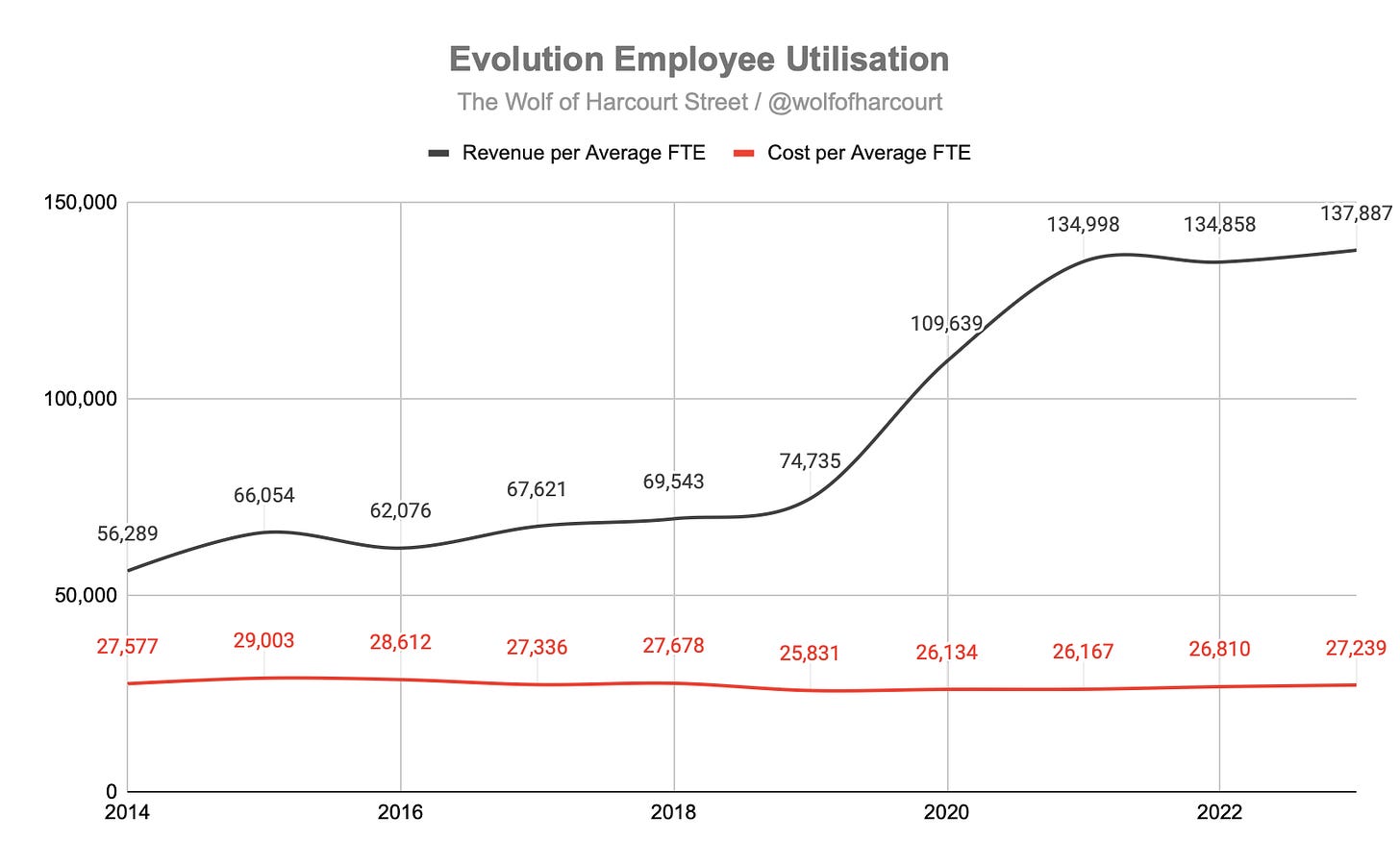

Evolution had an average full-time equivalent (FTE) of 13,044 in 2023, marking a 21% YoY increase. One factor contributing to the expansion of the operating margin was employee utilization. Evolution increased its revenue per average FTE by 2.2% in 2023 to €138k, while the cost per average FTE only rose by 1.6% to €27k. This results in Evolution's revenue per average FTE being 5.1 times greater than its cost per average FTE.

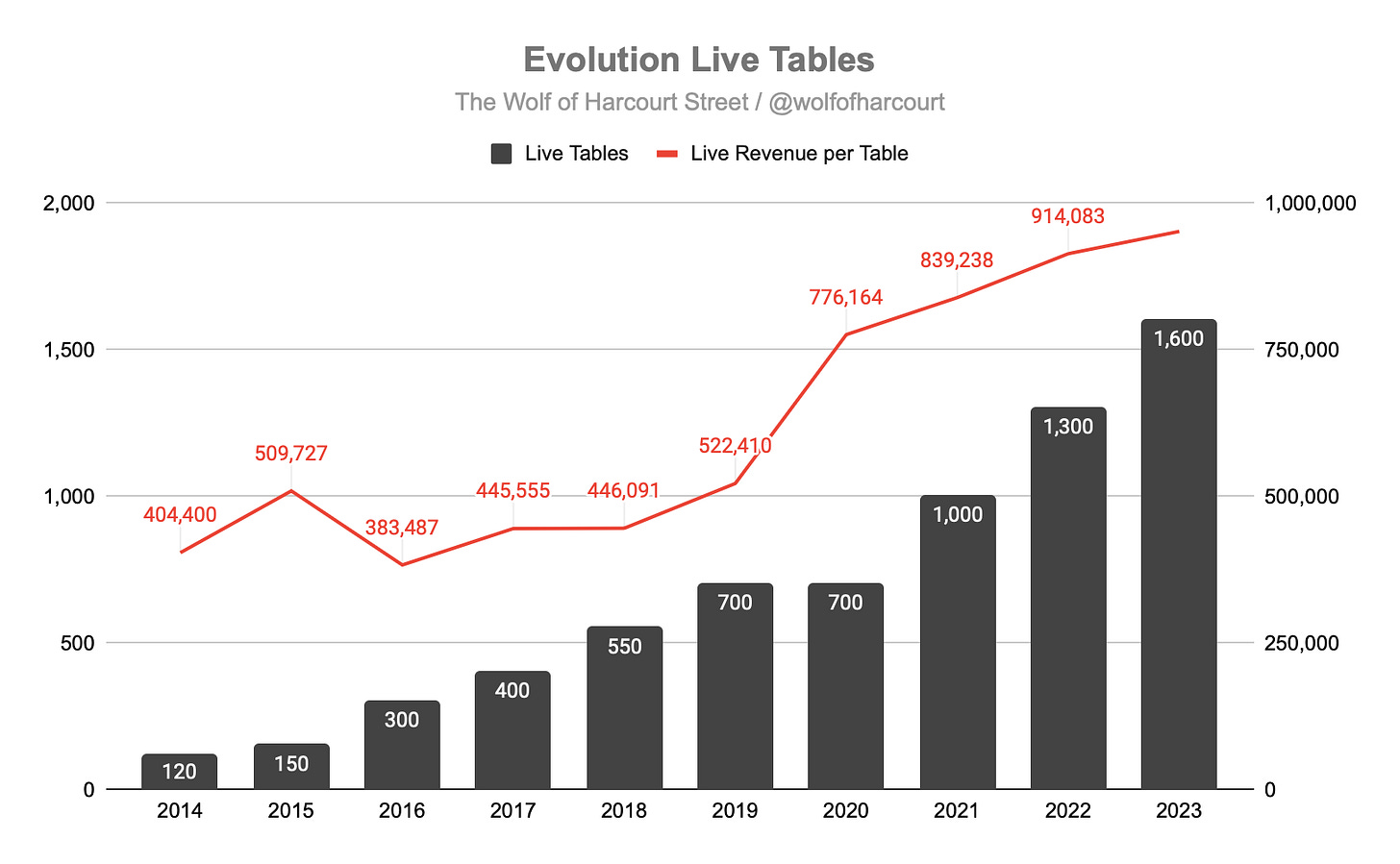

A second driver of margin expansion was Evolution’s increased scale. In 2023, the company concluded the year with 1,600 Live tables, a 23% YoY increase. Simultaneously, Evolution boosted its Live revenue by 28% YoY, resulting in the Live revenue per table increasing from €914k in 2022 to €952k in 2023. Evolution has effectively accommodated more players at a faster rate without needing to add more tables.

Evolution achieved its highest-ever EBITDA margin of 70%. It is noteworthy that this margin is double the 35% objective that management set during the IPO.

Free Cash Flow

Evolution generated over €1 billion of free cash flow (FCF) in 2023, resulting in a record FCF margin of 60%.

A small part of the reason for the record FCF margin was that Evolution failed to meet its CapEx guidance. Management guidance for the year was €120 million, but instead, Evolution invested €94 million. Evolution did not expand as fast as it would have liked in 2023, but it appears to have rectified this at the end of the year with the launch of a new studio in Bulgaria and the initiation of a project to build a second studio in Colombia. Management announced plans to add at least four new studios during 2024 in addition to expansion in existing locations.

Discounted Cash Flow Analysis

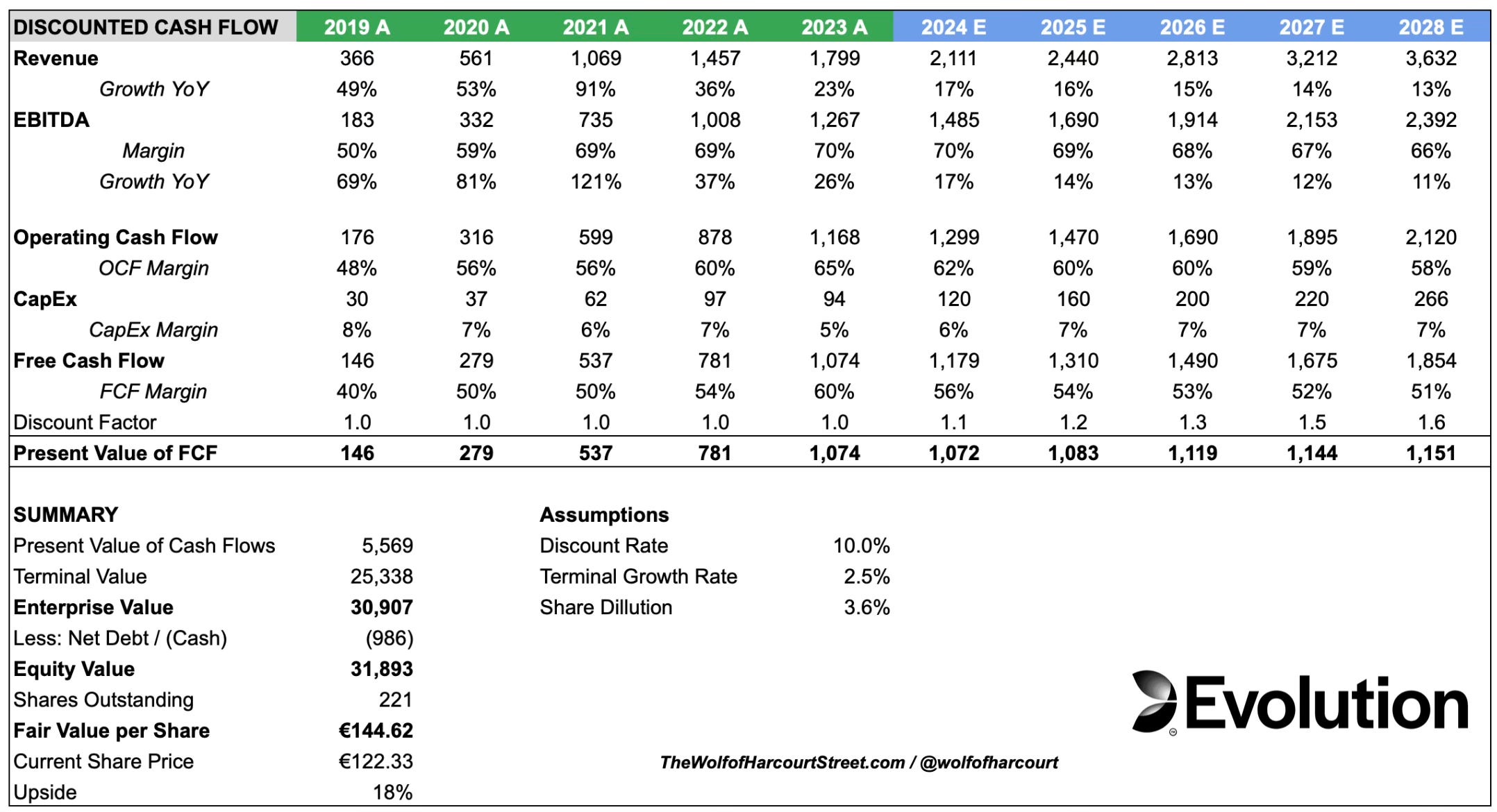

Future cash flows have been projected over five years using a discount rate of 10%. A terminal growth rate of 2.5% has been assumed based on the quality of the underlying business. A conservative approach has been used regarding future assumptions.

A revenue CAGR of 15% is projected from 2023 to 2028. This has been revised downwards from 18% in last year’s model to account for the negative impact foreign exchange (FX) rates are having on Evolution’s revenue. In Q4 2023, Evolution’s revenue was negatively impacted by 8% due to FX growing by 16% instead of 24% in underlying currencies.

The EBITDA margin has been forecast to remain at 70% in 2024, in line with management guidance, before tapering off to 66% over the next five years. This projection includes accounting for the additional studios needed in each U.S. state as part of the global expansion opportunity.

Management set a Capital Expenditure (CapEX) guide of €120 million for 2024, which would equate to a CapEx margin of 6%. This has been increased to 7% from 2025 to 2028 to align with global studio expansion. In last year’s model, I projected a CapEx margin of 8% for the same period, but given that Evolution only spent 5% on CapEx in 2023, the capital requirements appear slightly lower than I anticipated. This results in the FCF margin reaching a peak of 60% in 2023 before leveling off to 51%.

Last year, there was a lot of uncertainty regarding the management incentive plan and the impact on dilution. Thankfully, this has been resolved, and I have reduced the maximum dilution from 5.8% to 3.6%.

Based on these assumptions, the fair value of Evolution is approximately €144.62 per share, indicating a potential upside of 18% compared to the share price on 13 March 2024, which was €122.33. The EVO.ST SEK share price has been converted to EUR using the closing fx rate for that date.

Conclusion

Over the past five years, Evolution has achieved a compounded annual growth rate (CAGR) of 74% in its free cash flow. The DCF analysis assumes a more conservative free cash flow CAGR of 11.5% over the next five years. The 74% growth resulted from a combination of hyper revenue growth and considerable margin expansion. While replicating the same level of growth or margin expansion is not anticipated in the next five years, the 11.5% growth rate incorporates conservative assumptions and offers a high margin of safety. If the FX headwinds that Evolution faced in 2023 reverse, this would present a favourable tailwind for revenue growth. Considering the historical performance and the DCF analysis, the business's prospects suggest that the market's growth assumptions might be too conservative.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

thank you for the update, great job!

Superb insight Wolf. Many thanks. Bought EVO based on a previous post of yours..one of my better decisions!