Evolution: 2025 Financial Model and Valuation Update

What is the fair value of Evolution?

2024 was a year to forget for Evolution, as it faced several negative catalysts, including labour strikes at its Georgian studio, cyber-attacks in Asia, an increased tax rate, and significant foreign exchange headwinds.

After the stock declined by 27% in 2024, what is Evolution’s fair value today, and is it a buy?

In this update, I present a revised financial model and fair value assessment. The starting point for this analysis is the 2024 financial results. I have already shared a detailed Q4 2024 earnings analysis, which can be accessed via the link below.

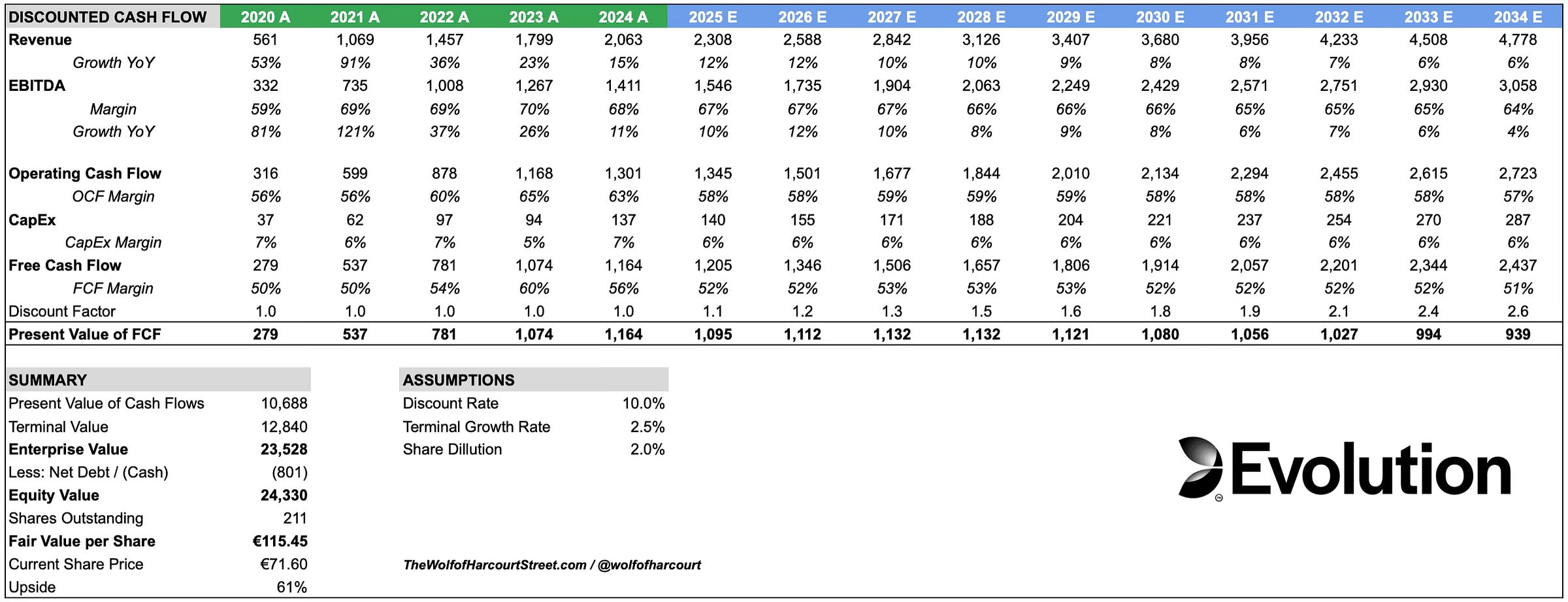

Discounted Cash Flow Analysis

Future cash flows have been projected over ten years using a 10% discount rate. Previous models were based on a five-year period, which resulted in most of the value being attributed to the terminal component. To reduce reliance on this assumption, I have extended the projection period. A terminal growth rate of 2.5% has been applied, reflecting the quality of the underlying business, with a conservative approach taken for future assumptions.

A 9% revenue CAGR is projected from 2024 to 2034, revised downwards from last year’s model to reflect the slowdown in 2024. My projection assumes that the negative impact of foreign exchange rates on Evolution’s revenue will persist. In Q4 2024, Evolution’s revenue was negatively impacted by 4 percentage points due to FX, growing by 12% instead of 16% in underlying currencies.

The EBITDA margin is forecast to be 67% in 2025, in line with management’s guidance range of 66% to 68%, before tapering to 64% over the next ten years. This is largely unchanged from last year’s projections, which factored in the additional studios required in each U.S. state as part of global expansion. I expect Evolution’s incremental margins to decline over time, given management’s clear focus on regulated markets, which generally have lower margins than unregulated counterparts.

Operating cash flow conversion, as a percentage of EBITDA, is projected to fall to 87% in 2025 and 2026 due to Pillar II tax payments. Evolution’s operating cash flow margin of 59% and conversion rate of 92% in 2024 is misleading because, while Evolution has been accruing for this tax, the top-up payments will not commence until 2026. From 2027 onwards, I expect operating cash flow conversion to revert to 89%.

Management has set a Capital Expenditure (CapEx) guide of €140 million for 2025, equating to a CapEx margin of 6%. I have extrapolated this trend across the projection period, as it aligns with the five-year historical average. As a result, the FCF margin, which peaked at 60% in 2023, is expected to level off at 51% in year 10.

Maximum share dilution has been projected at 2%, in line with the company’s share warrant incentive program.

Based on these assumptions, Evolution’s fair value is approximately €115.45 per share, representing a potential upside of 61% compared to the share price of €71.60 on 11 March 2025. The EVO.ST SEK share price has been converted to EUR using the closing FX rate from that date.

Conclusion

I have taken a conservative approach, particularly regarding revenue growth assumptions. Given the secular trend toward iGaming legalisation, particularly in the U.S. and Latin America, it is probable that Evolution could sustain double-digit revenue growth for longer—especially if FX headwinds reverse.

It is also important to note that Evolution’s 15% revenue growth in 2024 occurred despite its largest studio in Georgia operating at 60% capacity for half the year and the cyber-attacks in Asia causing flat sequential revenue growth in Q4.

The analysis suggests that even with conservative assumptions, Evolution presents an asymmetric opportunity given the margin of safety at the current stock price. As Mohnish Pabrai once said:

“Heads I win, tails I don’t lose much.”

If we invert the DCF model and solve for the growth rate embedded in the current stock price, the market is pricing in just 3% annual growth over the next ten years—demonstrating how low expectations currently are.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Thank you for sharing your wonderful work! I am curious how did you account the 2% shares dilution in the DCF model?

Incredibly useful article - thank you.