In this weeks edition, I am going to discuss the importance of financial statements, how to interpret them and a brief case study.

Being an accountant by nature, I have grown up studying and working on financial statements but many business professionals or investors have not. In simple terms, investing in a company without looking at the associated financial statements is comparable to buying a car without looking under the bonnet first to check if everything is OK.

Importance of Financial Statements

Being able to understand the financial health of a company is one of the most vital skills for any investor. By developing this skill, we can better identify investing opportunities while avoiding potential banana skins. Financial statements offer a birds eye view of the health of a company, which can be otherwise difficult to decipher.

A set of financial statements comprises of three key reports: Income Statement, Balance Sheet and Cash Flow Statement.

Income Statement

An income statement, also commonly referred to as a profit and loss (P&L) statement breaks down the revenue a company earns against the expenses involved in its business to provide a bottom line, profit or loss. The document shows financial trends, business activities and comparisons over specific periods. The purpose of an income statement is to show a company’s financial performance over a period.

Income statements typically include the following information:

Revenue: Sale of goods or services

Costs of goods sold: The cost of component parts it takes to make whatever the business sells

Gross profit: Total revenue less cost of goods sold

Expenses: Indirect costs including payroll, marketing and utilities

Operating income: Gross profit less operating expenses

Income before tax: Operating income less other expenses

Net income: Income before tax less tax charge

Earnings per share (EPS): Net income divided by the total number of outstanding shares

Basic analysis of the income statement can involve the calculation of gross profit margin, operating profit margin, and net profit margin which each divide profit by revenue. Profit margin helps to show where company costs are low or high at different points of the operations.

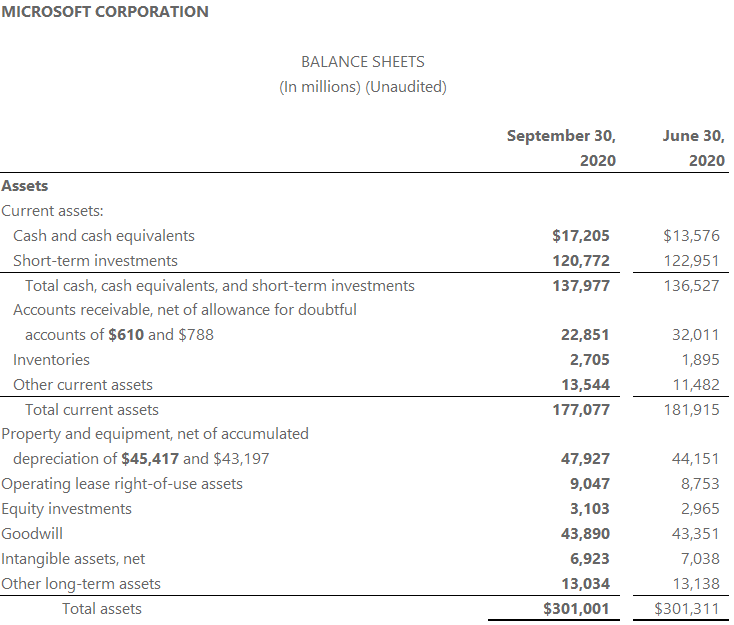

Balance Sheet

A balance sheet is designed to show exactly how much a company is worth also known as its book value. The balance sheet details all of a company’s assets, liabilities, and shareholders’ equity as at a particular date, also referred to as the reporting date.

A balance sheet provides a summary of a business at a given point in time and is a snapshot of the company’s financial position. As the name suggests, a balance sheet must “balance”. The following is the accounting equation: Assets = Liabilities + Shareholders’ Equity

Assets

An asset is anything that is owned by a company and has quantifiable value. An asset is essentially anything that a business could sell if it had to be liquidated.

Examples:

Property, plant & equipment

Cash

Investments

Inventory

Accounts receivable

Patents

Liabilities

A liability is the polar opposite of an asset. While an asset is something a company owns, a liability is something it owes. Liabilities are financial and legal obligations to pay an amount of money to a debtor.

Examples:

Utility bills

Accounts payable

Leases

Loans

Provisions

Deferred income

Shareholders’ Equity

Shareholders' equity refers to anything that belongs to the owners of a business after any liabilities are accounted for. If we were to add up all of the assets a business owns and subtract all of the liabilities a business owes, the remainder is the owners’ equity.

Shareholder’ equity typically includes two key elements:

Money contributed to the business in the form of an investment in exchange for some degree of ownership or shares

Earnings that the company generates over time and retains

Cash Flow Statement

A cash flow statement provides a detailed picture of what happened to a business’s cash during a period. It demonstrates a company’s ability to operate, based on how much cash is flowing into and out of the business. Cash flow statements are broken into three sections: Cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

Operating activities detail cash flow that are generated once the company delivers its goods or services, and includes both revenue and expenses.

Investing activities include cash flow from purchasing or selling assets. Think back to the assets described in the balance sheet.

Financing activities include cash flow from both debt and equity financing.

At this point I would like to draw the readers attention to the difference between cash flow and profit. While cash flow refers to the cash that is flowing in and out of a company, profit refers to what remains after all of a company’s expenses have been deducted from its revenues and are not necessarily cash based. Both are important numbers to know, however while management may be able to manipulate when revenue is recognised and when expenses are accrued, it is very difficult to fudge cash flow. Cash is king as they say.

Recommended reading

This has been a very high level run through of financial statements so if you would like to further develop your knowledge, The Basics of Understanding Financial Statements is a book that is well recommended on this topic.

Case study - Microsoft

I am now going to take a look at the financial statements of Microsoft as part of a brief case study. Microsoft is a company that should be familiar to everyone and for full disclosure is one of my biggest holdings. Every company that is listed on a stock exchange has to make their financial reports available to the public. The easiest way to access them is on the company’s investor relations website.

Income Statement commentary

Revenue increased by 12.4% year-over-year

Gross profit margin increased by 1.9% year-over-year from 68.5% to 70.4%

Net income margin increased by 5.1% year-over-year from 32.3% to 37.4%

The numbers speak for themselves. Being able to increase revenue and margins at the same time is most impressive. This can be attributed to the increase in service related revenue of 23.5% which has a higher margin compared to product revenue

Balance sheet commentary

Almost $138 billion in cash and cash equivalents

Very low inventory levels compared to other companies but not surprising given that much of its business is based on software which can be downloaded

Long-term debt has decreased by $2.5 billion and not increased

Total Liabilities as a % of Total Assets has improved from 60.7% to 59%

Rock solid balance sheet. Financial strength can be demonstrated by having $2.68 in current assets for every $1 in current liabilities

Cash flow statement commentary

Free cash flow (Operating cash flow - capital expenditure) has increased by $3 billion from $10.4 billion to $14.4 billion

Net cash from operations has increased by $5.5 billion or 40%

Microsoft is a cash generating machine and has even increased its dividend paid to shareholders over the period by almost 10%

Summary

Microsoft is a company with a big brand and products and services that many of us use daily. When we look under the hood at its financial health it becomes even more impressive.

If you have found any of the above useful, please hit the subscribe button below if you have not already done so in order to receive the latest content straight to your inbox each week. Please also consider sharing with a friend if you find the content useful.

Happy investing

Wolf of Harcourt Street

Disclaimer: I am not a financial adviser and I am not here to give specific financial advice. The opinions expressed are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. The information is based on personal opinion and experience, it should not be considered professional financial investment advice. There is no substitute for doing your own due diligence and building your own conviction when it comes to investing.