Know What You Own, and Who Else Owns It

Peter Lynch's Wisdom and the Modern-Day Emphasis on Understanding Ownership Dynamics

Welcome back to the Wolf of Harcourt Street Newsletter.

Have you ever wondered why some investors get caught in the frenzy of skyrocketing stock prices only to face significant losses when the momentum fades? The answer lies in a critical aspect of investing that often goes overlooked: knowing what you own and who else owns it.

In this thought-provoking article, I delve into the importance of uncovering the ownership landscape. By exploring the collective ownership of stocks, I shine a light on some invaluable insights into market dynamics, investor sentiment, and potential risks that might elude even the most diligent investors.

Peter Lynch was a legendary investor who managed the Fidelity Magellan Fund from 1977 to 1990. During his tenure, the fund returned an average of 29.2% per year, beating the S&P 500 by an average of 11.4 percentage points per year.

One of Lynch's most famous quotes is:

Know what you own, and why you own it

He believed that investors should only invest in companies that they understand and that they believe in. He also believed that investors should be able to explain why they own a particular stock in simple terms.

In the modern day, Lynch’s adage is frequently emphasized and for good reason. Investors are urged to thoroughly research the fundamentals, financials, and potential risks of the stocks they hold in their portfolios. This process enables investors to make informed decisions, manage their portfolios effectively, and mitigate potential risks.

However, an often overlooked aspect of investment analysis is understanding who else owns the same stock. The identification and evaluation of other stakeholders can provide valuable insights into market dynamics, potential risks, and opportunities.

Know what you own, and who else owns it

- Wolf of Harcourt Street

The Importance of "Who Else Owns It"

While knowing the details of your holdings is crucial, it's equally important to explore the broader landscape and identify other investors who have a stake in the same stock. This information sheds light on market dynamics, investor sentiment, and potential risks that might not be apparent when focusing solely on individual stocks. Here are a few reasons why understanding who else owns an investment matters:

1. Market Sentiment and Influence

The collective ownership of a stock by prominent institutional investors, such as mutual funds, pension funds, or hedge funds, can indicate market sentiment. Large-scale buying or selling by influential investors can impact the asset's price and liquidity. Monitoring the ownership patterns of these market participants can help identify trends, market sentiment shifts, and potential investment opportunities or threats.

Case Study: The Covid Bubble and the Importance of Valuation Awareness

Cloudflare, for example, traded at a price/sales ratio close to 90 during the Covid bubble, a valuation that was hard to justify for any company. The individuals or institutions that were buying shares at these valuations likely never cared about valuation. It is safe to assume that the shareholder base at this point was predominantly momentum investors or traders. This shareholder base cared about the share price at the end of the day or week rather than in five or ten years' time. Unfortunately, when the momentum fizzles out, as it always does, the stock price can come crashing down, leaving investors who bought in November 2021 with significant losses. There were so many other stocks I could have used here as an example but I opted for Cloudflare as it is a stock that I purchased in 2020 and continue to hold.

Warren Buffett's Berkshire Hathaway: A Testament to Conservative Ownership

In contrast, take Berkshire Hathaway, the company managed by Warren Buffett, who is one of the most successful investors in history. Buffett is known for his long-term investment horizon and his focus on value investing. He is also known for his conservative approach to risk management.

As a result of Buffett's management style, Berkshire Hathaway shareholders tend to be more conservative than the average investor. They are less likely to sell their shares during a downturn, and they are more likely to hold on to their shares for the long term. This is because they trust Buffett to make sound investment decisions and to manage their risk effectively.

In 1983, Buffett stated that he wanted to “obtain only high-quality shareholders,” whom he identifies as individuals — not institutions — who choose to entrust their wealth to Berkshire for the long term. In 2021, he declared victory on this goal.

2. Risk Assessment

Knowing who else owns an asset can reveal potential risks associated with concentration and correlation. If a substantial portion of a stock is owned by a few investors, there may be a higher risk of price volatility. Similarly, if multiple investors have significant exposure to the same stocks, a sudden event impacting one could have ripple effects across the market. Understanding these ownership patterns can aid in assessing the overall risk exposure of an investment and diversifying portfolios accordingly.

Case Study: The Quinn Empire and the Perils of Unregulated Ownership

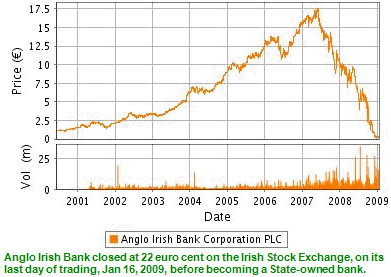

It it not often that I get to reference some Irish businesses but a great (and sad) example of this was when Sean Quinn of the Quinn Group acquired a reported 15% stake in Anglo Irish Bank thorough contract for difference (CFD). As the transactions were spread across almost a dozen brokers, Quinn was not required to disclose its interest due to a loop hole in regulations at the time.

When the share price started to fall in 2008 on the back of the Lehman Brothers collapse, Quinn got margin calls and incredibly ended up taking out loans from Anglo Irish Bank itself to cover the losses. This poured even more petrol on the highly inflammable Anglo Irish Bank and set in motion the worst banking crisis the Irish state and its people ever witnessed. The Irish government ended up nationalising the bank and the tax payer still pays the bill to this day. The documentary “Quinn Country” covers this rise and fall of the Quinn empire and is worth the watch if you have not seen it.

Concluding Remarks

Peter Lynch's timeless advice to "know what you own, and why you own it" holds true in today's investment landscape. Thoroughly understanding the fundamentals of the stocks in your portfolio is essential, but equally important is gaining insights into who else owns those stocks. By exploring the ownership landscape, investors can gauge market sentiment, identify potential risks, and seize opportunities that may not be apparent at first glance.

The examples of Cloudflare and Berkshire Hathaway highlight the stark contrast between momentum investors driven by short-term gains and long-term shareholders who prioritize value and trust in the company's management. Moreover, the cautionary tale of Sean Quinn and the collapse of Anglo Irish Bank demonstrates the potential risks associated with concentration and undisclosed ownership. By incorporating the knowledge of who else owns the stocks we invest in, we can make more informed decisions, effectively manage risk, and navigate the stock market with greater confidence.

Hit subscribe below if you have not already done so in order to receive the latest content straight to your inbox each week.

If you enjoy today’s edition, then feel free to share as it, it really helps.

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com