Welcome back to the Wolf of Harcourt Street Newsletter.

Market Movers is your time-saving guide to crucial stock news, cutting through the noise.

With all that being said, let’s dive into today’s edition!

Todays Agenda

Evolution at NEXT Summit: Valletta

Shopee Probed for Alleged Competition Rule Breaches

More Good News for Nubank

Amazon to Invest Billions in European Data Centre Expansion

The Technological Evolution at MercadoLibre

Wedbush Research on Airbnb

1. Evolution (Ticker: EVO) at NEXT Summit: Valletta

This event is viewed by many as the pinnacle of the iGaming industry, offering insights from 300 industry-leading voices. For those of us who could not make the event, it was live-streamed on YouTube.

The following were my key highlights from the event:

Rapid Industry Growth: The global iGaming market, valued at around $73 billion in 2023, is projected to exceed $127 billion by 2027, driven by technological advancements and increased mobile and internet accessibility.

AI Integration: Artificial Intelligence is gradually being incorporated into iGaming, with the potential to enhance game personalisation, customer service, and operational efficiency. The importance of proactively testing and integrating AI tools was emphasised.

Emerging Markets Focus: There is a notable shift towards emerging markets, especially in Latin America and Asia, due to their growing internet access and untapped potential. Latin American countries are becoming focal points for iGaming expansion. Industry leaders are increasingly focusing on these regions, adapting strategies to align with local cultural and regulatory contexts. This was further reinforced earlier this week when Evolution announced the launch of its portfolio of live casino games with Jugamax in Paraguay.

Friend of the newsletter,

, attended the event. He spent two hours chatting with Evolution’s Chief Product Office, Todd Haushalter. I recommend reading his notes from the event, which are linked below.2. Shopee (Ticker: SE) Probed for Alleged Competition Rule Breaches

Indonesia’s anti-trust agency is investigating local branches of e-commerce platforms Shopee and Lazada for potential anti-competition rule violations. Shopee and Lazada are accused of favoring their own affiliated logistics services over other providers, potentially restricting consumer choice and impacting other logistics partners.

Shopee is suspected of directing users to its affiliated logistics provider, Shopee Xpress, which could unfairly boost Shopee Xpress’s shipping volumes. Indonesia’s anti-trust agency has emphasised the importance of consumer freedom to choose their preferred delivery providers and the need for marketplace platforms to avoid using algorithms to favour their affiliated companies.

Shopee’s legal team will respond to the hearing on 11 June. While no details were given about the possible penalties for Shopee, Lazada is facing fines of up to 50% of its net profit or 10% of its total sales, earned within the market during the period of infringement.

Source: Reuters

My Perspective: Shopee Xpress is integral to Shopee’s operations. In Q1, 70% of Shopee Xpress orders were delivered within three days in Asia, and the cost per order decreased by 15% in Asia and 23% in Brazil. Management has spent considerable resources building out the logistics network, so it will be very interesting to see how this case plays out given the knock-on implications for the e-commerce supply chain.

What I find most interesting about this case is that, for the past few years, the general consensus appeared to be that Shopee did not have any moat and that the e-commerce market in Southeast Asia was fiercely competitive. Now, Shopee is being investigated for anti-competitive practices. So, which is it? Without hearing Shopee's defense, I feel like this is a nothing burger and actually reinforces the competitive position of Shopee.

3. More Good News for Nubank (Ticker: NU)

Nubank Reaches 3 Million Under-18 Accounts

NU has achieved a significant milestone with 3 million users of its under-18 accounts, solidifying its market leadership among 10 to 17-year-olds. The account for young people saw a sixfold increase in customers in 2023, reflecting NU's commitment to early financial education and secure, practical solutions for parents. The account requires a legal guardian, who is also a NU customer, to initiate the account setup.

NU has integrated several parental control features, including real-time transaction notifications, allowing parents to monitor their children’s financial activities while maintaining the child's financial autonomy. The platform offers Gift Cards with exclusive discounts for young users, usable on various popular platforms. These additions enhance the financial tools available to young users and provide further value.

Source: Nubank IR

My Perspective: This cohort increased sixfold in 2023 meaning that it had only half a million under-18 accounts at the end of 2022. This is a staggering growth rate considering NU only began to offer under-18 accounts in July 2022.

Nubank launches NuViagens

NU announced the launch of NuViagens, a travel planning platform for its high-income customers, integrating the convenience of booking air tickets and hotels through the NU app. Key features of NuViagens include:

Best Price Guarantee: If a customer finds a lower price for a flight or hotel within 24 hours of purchase, NU will refund the difference.

Price Monitoring and Alerts: The platform monitors flight prices and recommends the best time to buy. Customers who purchase at the recommended time get automatic reimbursement of up to BRL 500 if the price drops within 30 days.

Flexible Payment Options: Purchases can be made in up to 8 interest-free installments via NuPay, and customers earn 1% cashback that grows at 200% of the CDI.

24/7 Travel Support: Dedicated travel-related support is available through the app’s chat or phone.

Gradual Availability: NuViagens will be rolled out gradually and can be accessed in the Nubank Ultravioleta app under the "Ultravioleta Benefits" and "Travel and Leisure" sections.

Source: Nubank IR

My Perspective: I don’t know about you, but I get the feeling that NU is turning into the everything app—or dare I say it, a super app.

4. Amazon (Ticker: AMZN) to Invest Billions in European Data Centre Expansion

Amazon's cloud computing division, AWS, is it talks with Italy to invest billions to expand its data center operations in the country. AWS launched its first cloud region in Italy in 2020 with a plan to invest €2 billion by 2029.

AWS recently announced a €15.7 billion investment in Spain, significantly increasing from a previous plan of €2.5 billion. In Germany, AWS plans a €7.8 billion investment by 2040.

Source: Reuters

My Perspective: AWS is strategically expanding its cloud infrastructure in Europe, aligning with increasing demand and regulatory requirements to store data within the European Union. To put Amazon’s scale into perspective, the €15.7 billion investment in Spain is equivalent to the GDP of Malta, where the NEXT Summit was held.

5. The Technological Evolution at MercadoLibre (Ticker: MELI)

This week, I came across a great article from Juliano Marcos Martins, a Senior Technology Manager at MELI. It details the technological evolution as MELI transitioned from a monolithic architecture (1999) to a microservices-based infrastructure (2010) called MeliCloud, and finally to the Fury platform (2015). The evolution aimed to address scaling challenges, improve deployment frequency, and enhance developer productivity.

Fury is MELI's Internal Developer Platform (IDP) providing a unified, self-service environment for efficient application creation, deployment, management, and monitoring. It was developed to support the exponential growth and complex ecosystem of MELI, with a focus on scalability, integration, and security.

Source: MercadoLibre Tech

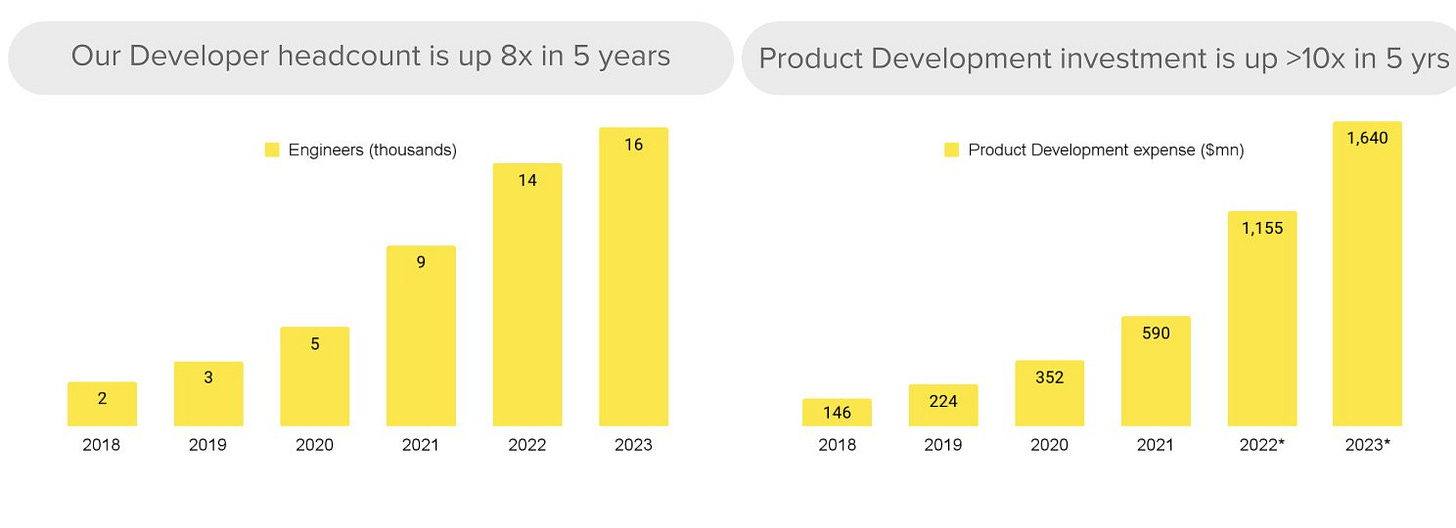

My Perspective: MELI's journey from a monolithic architecture to a sophisticated multicloud platform underscores its commitment to being a technology-first company. A lot of companies make this claim, but few can prove it. In MELI’s case, software engineer headcount has increased 8x in 5 years to more than 16,000 people.

6. Wedbush Research on Airbnb (Ticker: ABNB)

Wedbush sees ABNB as an attractive buying opportunity following its conservative second-quarter guidance, which has contributed to recent stock underperformance. The brokerage upgraded ABNB's stock rating to outperform from neutral and raised the price target to $165 from $160. The analysts suggest that investors should capitalize on the current period of relative weakness, expecting an upside in near-term estimates due to positive travel trends.

Wedbush increased its Q2 revenue forecast slightly to $2.74 billion and EPS target to $0.88. The consensus among analysts is a revenue of $2.72 billion and GAAP EPS of $0.90. For the full year, Wedbush raised its revenue estimate to $11.27 billion from $11.15 billion and its EPS estimate to $4.34 from $4.19. The consensus forecasts for 2024 are $11.17 billion in revenue and $4.52 in GAAP EPS.

Source: MT Newswires

My Perspective: Wedbush’s commentary is consistent with my own analysis after the Q1 earnings, where I wrote that the perceived weakness was not warranted given that the full-year guidance had not been lowered. The upcoming events in Europe, like the Paris Olympics and the Euro 2024 Championships, will boost summer travel. The full analysis of the Q1 earnings is linked below.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com