Welcome back to the Wolf of Harcourt Street Newsletter.

Market Movers is your time-saving guide to crucial stock news, cutting through the noise.

With all that being said, let’s dive into today’s edition!

Todays Agenda

Adyen Partnership with END. Clothing

Nubank Lots and Lots of News

Evolution Commences Buybacks in Earnest

Airbnb Short-term Rentals Surge During Paris Olympics

Sea Limited Shopee Experiences 66% Growth in Vietnam

1. Adyen Partnership with END. Clothing

Adyen has partnered with END. Clothing to provide a unified commerce solution integrating both online and offline payments. This partnership aims to offer a seamless and reliable payment experience, essential for END. Clothing's global expansion. The integration allows END. Clothing to gain a holistic view of their customers, enabling personalized experiences for repeat and loyal shoppers. Adyen's platform, chosen for its cost-effectiveness and operational simplicity, supports multiple local payment methods, ensuring consistent service worldwide.

Source: The Paypers

My Perspective: According to my notes, this is the 22nd partnership that Adyen has achieved in 2024 so far. It’s difficult to get a definitive number because not all partnerships are disclosed on the investor relations website, so this includes partnerships disclosed from other sources too. Still, this run rate equates to three partnerships per month. Not bad, eh?

2. Nubank (NU) Lots and Lots of News

Colombia is the Fastest-Growing Market

Nubank is rapidly expanding in Colombia, attracting 600,000 new clients with a 13% interest-rate savings account. Between April and June, this initiative brought in 900 billion pesos ($220 million) in deposits. Nu Colombia's general manager, Marcela Torres, noted that Colombia is now the company's fastest-growing market. The country's financial sector is concentrated and struggling with low credit demand and high delinquency rates.

Nu Colombia offers competitive interest rates due to its lower operational costs as an online bank, though the sustainability of these rates is uncertain. Nubank has captured a 6.4% market share for credit cards in Colombia with about 1 million clients, although growth is hindered by interest rate caps and limited credit histories among applicants.

Source: Bloomberg

My Perspective: Nubank's expansion in Colombia is already proving successful, driven by its high-yield savings account offering. This rapid growth demonstrates Nubank's ability to disrupt traditional banking in Colombia by providing attractive, digital-first products that meet consumer demands for higher yields and lower fees. We've seen the Brazil playbook indicate what the future might look like in Mexico, and it appears Colombia could be on a similar trajectory.

Cripto Platform Growth

The Nubank Cripto platform saw a 1,500% growth in transaction volume over a one-year period, from March 2023 to March 2024. During this period, there was a 56% increase in the number of customers who used the experience at least once, surpassing the 4.2 million user mark

The evolution of Nubank Cripto also includes advancements in greater operational efficiency – aimed at reducing costs for the end customer – through integration with Talos, a global leader in digital asset trading technology. Through this partnership, there is smart routing to select liquidity providers, optimising the execution of cryptocurrency buy and sell orders in Brazilian reais.

Source: Nubank IR

My Perspective: These developments position Nubank as a major player in the cryptocurrency market in Brazil given its ability to attract and retain users in this rapidly evolving sector.

Government Partnership Exceeds 3 Million Customers Within 3 Months

Nubank is transforming how Brazilians access government digital services through a partnership with gov.br. Since May, over 3.2 million Nubank customers have obtained a silver account on gov.br via the Nu app, allowing access to over 4,200 digital public services.

Currently, about 40,000 new Nubank customers connect to gov.br daily, making Nubank the leading financial institution in user connections to the silver account. The partnership ensures data privacy, with no exchange of bank or government body information between Nubank and gov.br.

Source: Nubank IR

My Perspective: Nubank's partnership with gov.br has significantly transformed how Brazilians access government digital services. This initiative underlines Nubank's role in facilitating digital transformation and improving access to essential public services for millions of Brazilians.

3. Evolution (EVO) Commences Buybacks in Earnest

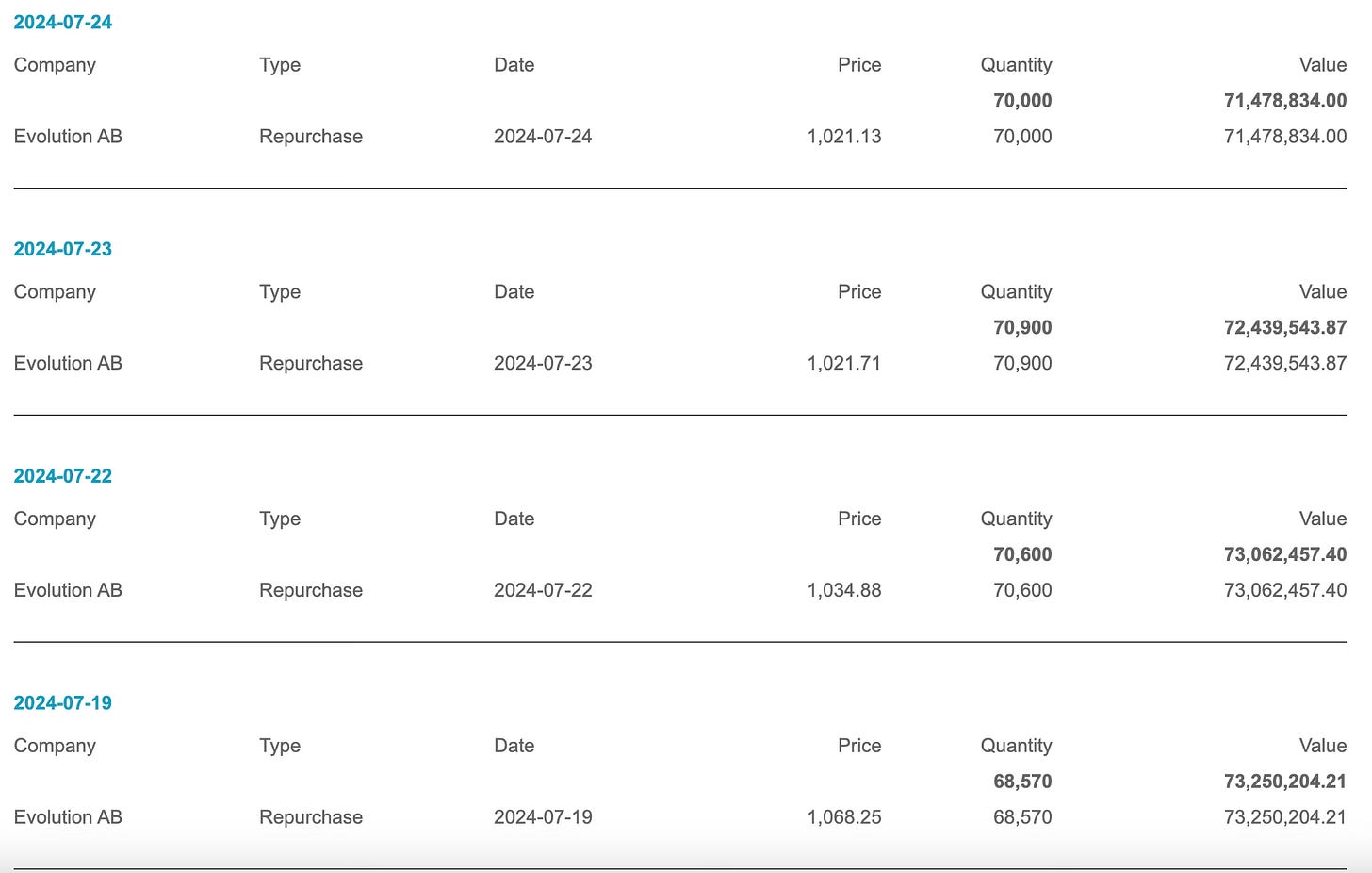

As part of its Q2 2024 earnings release last week, Evolution announced a new capital allocation framework and approved a €400 million share repurchase program. The company wasted no time, starting the buybacks the very next day.

Source: Nasdaq

My Perspective: The new capital allocation framework was the highlight of the Q2 earnings report for me. I’m pleased to see the company take advantage of its low valuation by buying back shares. So far, Evolution has been repurchasing an average of €6 million worth of shares per day. At this rate, the €400 million allocation could be exhausted within three months if the current pace continues.

4. Airbnb (ABNB) Short-term Rentals Surge During Paris Olympics

Millions of visitors are expected in Paris for the Olympic Games, leading to a surge in short-term rental listings, particularly on Airbnb. There are 44% more short-term rentals than last summer, making Paris the fastest-growing short-term rental market in the EU. Airbnb, an official Olympic sponsor, has actively promoted renting homes, resulting in a 40% increase in listings for the Games.

The average Airbnb host in Paris is projected to earn about €2,000 during the Olympics. Despite high demand, the influx of short-term rentals has led to lower occupancy rates compared to last summer. As of mid-July, occupancy was 46%, down from 59% the previous year. However, booking rates have risen, with the average rate reaching $393, a 39% increase since July 1.

The availability of short-term rentals has reduced accommodation costs, impacting hotel prices. Hotel rates have fallen by about 30% in the past three months due to increased rental supply. This situation is challenging for hoteliers, who typically expect to raise prices during such events.

Source: Business Insider

My Perspective: The surge that Airbnb is experiencing as part of the Olympic Games in Paris should come as no surprise to regular newsletter readers as this is something I have spoken about earlier this year as a potential catalyst. The other important point to emphasise is that the availability of Airbnb rentals has actually reduced hotel rates which is a net positive for the consumer. Who would have guessed that additional supply would be good for the overall market? Just a thought but perhaps the cities that have started to ban Airbnb rentals might consider their position given the data shows that limiting supply results in higher prices for the consumer.

5. Sea Limited (SE) Shopee Experiences 66% Growth in Vietnam

In the first half of 2024, Vietnamese consumers spent VND 143.9 trillion ($5.68 billion) on 1.53 million items across five e-commerce platforms, marking a year-on-year increase of 55% in spending and 66% in items purchased, according to Metric.

TikTok Shop and Shopee experienced substantial revenue growth of 151% and 66% respectively. This contrasts with Lazada, Tiki, and Sendo, which saw declines in both revenue and sales volume.

This robust growth highlights the strong e-commerce market in Vietnam and the effectiveness of sellers leveraging online shopping trends. TikTok Shop and Shopee capitalised on livestream shopping trends and saw a 12% increase in the number of shop malls.

Source: The Investor

My Perspective: According to data from Momentum Works, Shopee held a 61% share of the $13.8 billion e-commerce market in Vietnam in 2023. This translates to $8.4 billion in GMV, with a projected growth rate of 66% in 2024. If this growth continues, Shopee's market share in Vietnam by the end of 2024 would exceed the total e-commerce market size of 2023. Wow.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Great update!

Thanks for the update! Looking at the same chart from Momentum Works for 2023 vs 2022, TikTok’s growth is very impressive. I wonder if they can continue taking share from SE, at least in the markets outside of Indonesia.