Welcome back to the Wolf of Harcourt Street Newsletter.

Market Movers is your time-saving guide to crucial stock news, cutting through the noise.

With all that being said, let’s dive into today’s edition!

Todays Agenda

Adyen Industry-Defining Solutions & New Partnerships

Visa Antitrust Lawsuit

Meta Connect 2024 Review

Nubank Payroll Loan Expansion & ETF Launch

Sea Limited Shopee Offers Next-Day Delivery in Brazil

Unlock Premium Insights with Seeking Alpha! 🔎

Seeking Alpha Premium gives you all the tools you need to research and invest with confidence. Trusted by professionals in hedge funds, mutual funds, and investment banks, it provides top-tier stock research, quant ratings, and access to exclusive analysis from leading investors.

Starting September 16th, the price of Seeking Alpha Premium will increase to $299. But Wolf of Harcourt Street subscribers can still lock in the current offer of $214/year until October 1st! Plus, you’ll secure a renewal rate of $239 for next year—saving even more. Don’t wait until the price goes up!

1. Adyen (ADYEN) Industry Defining Solutions & New Partnerships

Industry-Defining Solutions

Adyen has announced significant advancements in its in-person payments (IPP) capabilities, reinforcing its position as a leader in payment technology. Key developments include:

Launch of the SFO1 Terminal: Adyen introduced the SFO1, a proprietary multimedia countertop Android terminal that integrates traditional payment functions with an 8-inch customer-facing screen. This allows merchants to offer customized branding, display rich content, and create dynamic in-store experiences. The terminal aims to transform point-of-sale interactions by integrating seamlessly with POS systems.

Global Integration of Klarna and Alipay+: Adyen became the first global payment service provider (PSP) to launch Klarna’s in-store solution and initiate a worldwide rollout of Alipay+. This integration enhances Adyen’s unified commerce capabilities, catering to the growing "buy now, pay later" (BNPL) market and attracting global customers, especially from Asia.

Expansion of Tap to Pay on Android: Adyen is expanding its Tap to Pay on Android solutions to new regions, including Europe, the UAE, Hong Kong, Malaysia, Australia, and New Zealand. This solution transforms NFC-enabled Android devices into secure payment terminals, reducing hardware costs and offering greater flexibility.

Source: Adyen

My Perspective: The launch of the SFO1 reminds me of Apple product launches under Steve Jobs—slick and polished. One criticism of Adyen in the past was that its POS terminals were, frankly, ugly. But if you put an Apple logo on the SFO1, you’d be forgiven for thinking it’s a genuine Apple product.

Partnership with RMS Cloud

Adyen and RMS Cloud have extended their partnership to deliver enhanced operational efficiencies and cost savings for the hospitality industry. RMS Cloud, a leading Australian cloud-based property management solution, serves over 7,000 properties worldwide with its all-in-one platform, which includes tools for channel management, booking, and process streamlining.

Through this renewed partnership, RMS Cloud users benefit from RMS Pay, an integrated payment solution powered by Adyen, which consolidates payments, reconciliation, and reporting. This integration has resulted in significant cost savings (between $50,000 to $200,000 annually), 6X faster payment processing, and a 93% decrease in disputes. The platform has also improved the user experience by enabling contactless check-ins and providing a unified interface for financial management.

Source: Adyen

Partnership with Cinemark

Adyen has partnered with Cinemark, one of the largest theater chains in the U.S., to provide a unified payment solution across its 300+ locations. This collaboration will streamline payments made through Cinemark's website, mobile app, box offices, kiosks, and concessions, as well as premium amenities like in-theater restaurants and the Movie Club subscription program.

Overall, the partnership aims to reduce friction in the movie-going experience and offer a seamless, omnichannel payment solution for Cinemark’s guests.

Source: Adyen

My Perspective: According to my tracker, Adyen has announced 35 partnerships in 2024 so far, and we’re only at the end of September. Just think about all the future processed volume that is waiting to hit Adyen’s earnings in the coming years.

2. Visa (V) Antitrust Lawsuit

The U.S. Department of Justice has filed an antitrust lawsuit against Visa, alleging that the company unlawfully maintains a monopoly over debit network markets. According to the complaint, Visa controls more than 60% of U.S. debit transactions, generating over $7 billion annually in fees. The lawsuit claims that Visa leverages its dominant position to stifle competition through exclusionary agreements and partnerships that prevent smaller networks or new entrants from gaining a foothold.

Key allegations include:

Exclusionary Practices: Visa imposes agreements on merchants and banks that penalize them for routing transactions to other debit networks, effectively locking in debit volume and insulating itself from competition.

Co-opting Competition: Visa offers monetary incentives or imposes punitive fees to convert would-be competitors into partners, limiting potential innovation and reducing competitive pressure.

Impact on Consumers: The Justice Department argues that Visa’s practices result in higher fees for merchants and banks, which are then passed on to consumers through increased prices or reduced service quality.

The Justice Department is seeking to restore competition in the debit network markets, arguing that Visa’s actions harm not only competitors but also the broader U.S. economy by suppressing innovation and maintaining inflated fees.

Source: U.S. Department of Justice

My Perspective: Visa and Mastercard have been in litigation for nearly two decades over their dominance in the card markets, so this is nothing new. Visa is vowing to vigorously defend itself in court and there are several arguments they could make in their defense:

Other major players like Mastercard also operate in the space.

Visa’s market share is a result of superior products and services.

The widespread acceptance of Visa debit cards provides convenience and flexibility for customers.

Their network's efficiency keeps transaction costs low for merchants, potentially leading to lower prices for consumers.

3. Meta (META) Connect 2024 Review

Meta Connect 2024 showcased Meta's strategy to seamlessly integrate AI, AR, and VR technologies into everyday life. Key announcements included:

AI-Powered Chatbots and Assistants: Meta introduced personalized, AI-driven chatbots for platforms like Instagram and WhatsApp, aimed at enhancing user interactions and generating new revenue streams. These AI assistants will support users in navigating virtual and augmented environments, making experiences more intuitive and engaging.

Llama 3.2 Update: The latest Llama update includes lightweight models optimized for mobile and edge devices, along with advanced vision models for enhanced image reasoning. This update positions Llama as a flexible, privacy-focused AI solution suitable for various platforms.

Ray-Ban Smart Glasses: Meta unveiled an upgraded version of its Ray-Ban smart glasses, featuring an improved camera, enhanced voice controls, and deeper AI integration. These glasses are designed to make AR more accessible and useful in everyday scenarios such as content creation and navigation.

Meta Quest 4: The new VR headset offers enhanced resolution, better ergonomics, and expanded functionality beyond gaming. Positioned as a versatile tool for fitness and productivity, it reflects Meta's ambition to broaden VR’s use cases.

Orion AR Glasses: Meta teased its upcoming Orion AR glasses, promising a fully immersive AR experience. This advanced hardware aims to merge the digital and physical worlds seamlessly, setting the stage for broader AR adoption.

AI in the Metaverse: Meta is embedding AI across its platforms to create smarter virtual environments and responsive assistants. The goal is to make the metaverse a space for learning, work, and personal growth.

Source: Meta

My Perspective: The Orion AR glasses were the event’s biggest surprise. While still a few years away from consumer release, they genuinely feel like Meta’s iPhone moment (second Apple reference this week).

Meta is demonstrating how AI, AR, and VR are converging to create more immersive digital experiences. These innovations are part of Meta’s broader strategy to establish a digital ecosystem that blends the real and virtual worlds. Meta clearly wants to dominate the next computing platform—and it’s evident that they’re willing to go to great lengths to achieve this.

4. Nubank (NU) Payroll Loan Expansion & ETF Launch

Payroll Loan Expansion

Nubank has signed agreements with the states of Rio de Janeiro and Minas Gerais to expand its payroll loan offerings, increasing its total addressable market (TAM) for payroll loans from 50% to 70%. This growth is driven by the addition of these two states to Nubank's existing agreements, which include partnerships with the Brazilian Armed Forces, municipalities such as São Paulo, Rio de Janeiro, and Belo Horizonte, and the state of Paraná. The expanded services will be gradually rolled out through 2025.

Nubank’s fully digital payroll loan service will be accessible to over two million public sector employees, both active and inactive, across Brazil. This expansion targets a significant portion of Brazil’s 11 million public sector workers. Payroll loans have been available to federal employees via SIAPE since March 2023, and the company is also linked with INSS to serve retirees and pensioners.

Source: Nubank

My Perspective: Payroll loans are one of the most attractive lending products for a bank due to their lower risk, as they are backed by the borrower’s salary. This also provides an excellent opportunity for Nubank to cross-sell additional products to these customers.

Launch of ETF

Nu Asset Management, Nubank's investment arm, has launched the Nu Ibovespa B3 BR+ ETF (NBOV11), now available for trading on the B3 stock exchange. This is the first ETF to track the newly developed Ibovespa B3 BR+ index. With a low management fee of 0.10% and T+2 liquidity, the ETF offers cost efficiency and ease of trading. The initial investment starts at R$100.00.

The Ibovespa B3 BR+ index could evolve into a new benchmark for the Brazilian capital market, building on the traditional Ibovespa index. It includes 91 assets and will be rebalanced quarterly. Nubank’s BDR is the second-largest component of the index, with an 8.3% weight.

The launch of NBOV11 aligns with Nu Asset’s commitment to expanding variable income options for investors and developing innovative, transparent, and high-quality investment solutions tailored to market needs.

Source: Nubank

My Perspective: As I’ve mentioned before, Nu Asset Management is allowing Nubank to gradually move up the financial services value chain. Although still relatively small today, with around R$4 billion in assets under management, it has the potential to become a more significant part of the business in the future.

5. Sea Limited (SE) Shopee Offers next-day delivery in Brazil

Shopee has launched same-day and next-day delivery options for São Paulo’s capital and metropolitan region to meet the growing demand for faster shopping experiences. This service covers a wide range of products, including groceries and electronics, and aims to enhance customer satisfaction while supporting local sellers by making their offerings more competitive. Sellers must be located within the covered region and enable the option through Shopee’s Seller Center. Deliveries are handled directly by the sellers.

Logistics remain a critical issue for e-commerce in Brazil, where high costs and slow delivery times in remote areas continue to impact sales. At the E-commerce Brazil Forum 2024, logistics was highlighted as a key factor for improving sales conversion rates and the overall competitiveness of the industry.

Source: Mercado & Consumo

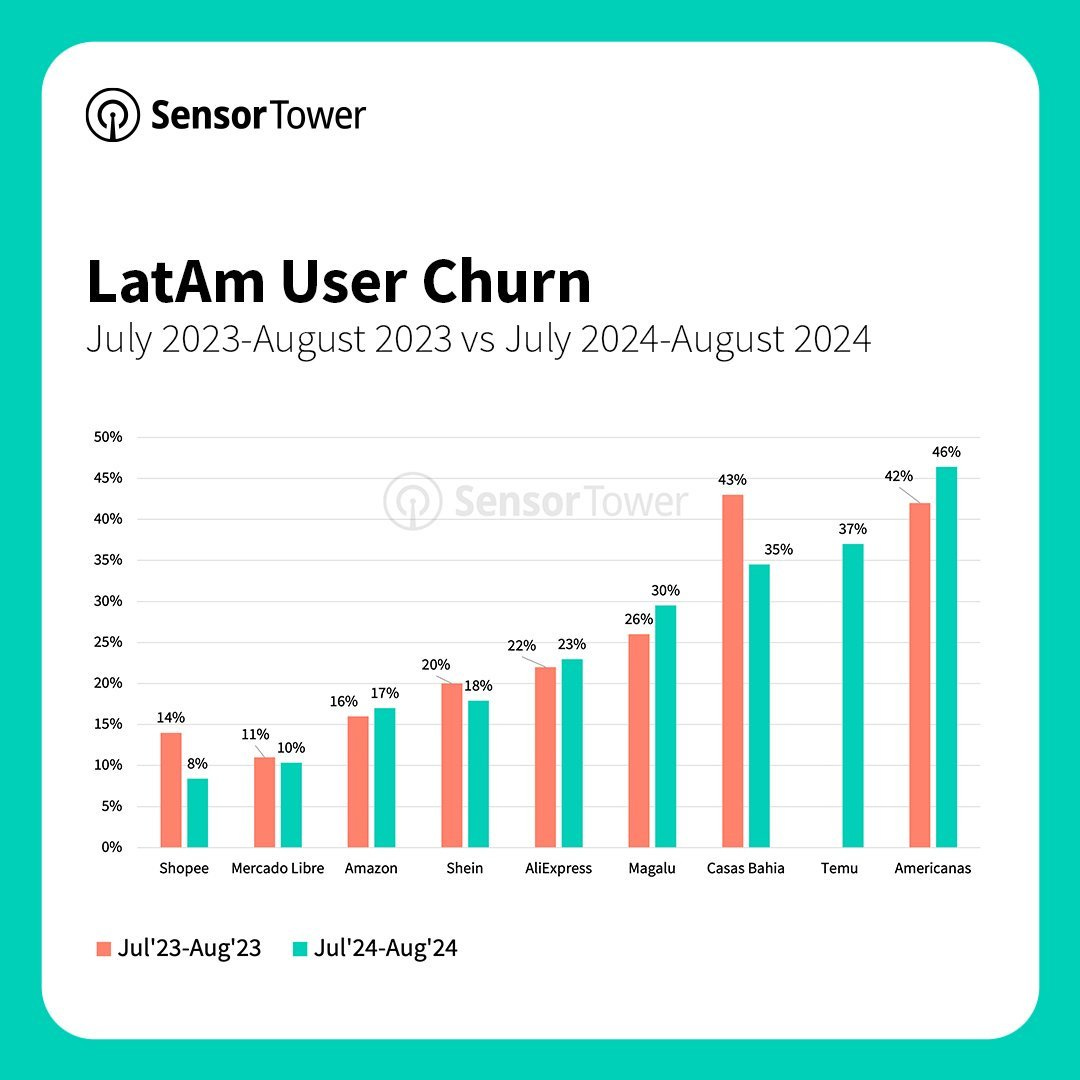

My Perspective: The market is still underestimating Sea Limited despite its stock performance in 2024. Shopee now has the lowest user churn rate across all of Latin America, even lower than Mercado Libre. This improved delivery option should help Shopee maintain its low user churn and further increase its market share.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Thanks for the update, interesting as usual. As for the last chart on churn: could the churn ratio simply be a function of new user addition rate? E.g., Temu is investing in user growth like crazy, getting lots of new users which means many will churn in the short term, while Shopee has moderate user growth rate, leading to low churn?