Mercado Libre’s Journey From Startup to Global Platform

Lessons from the climbers & scalers podcast — Part 2

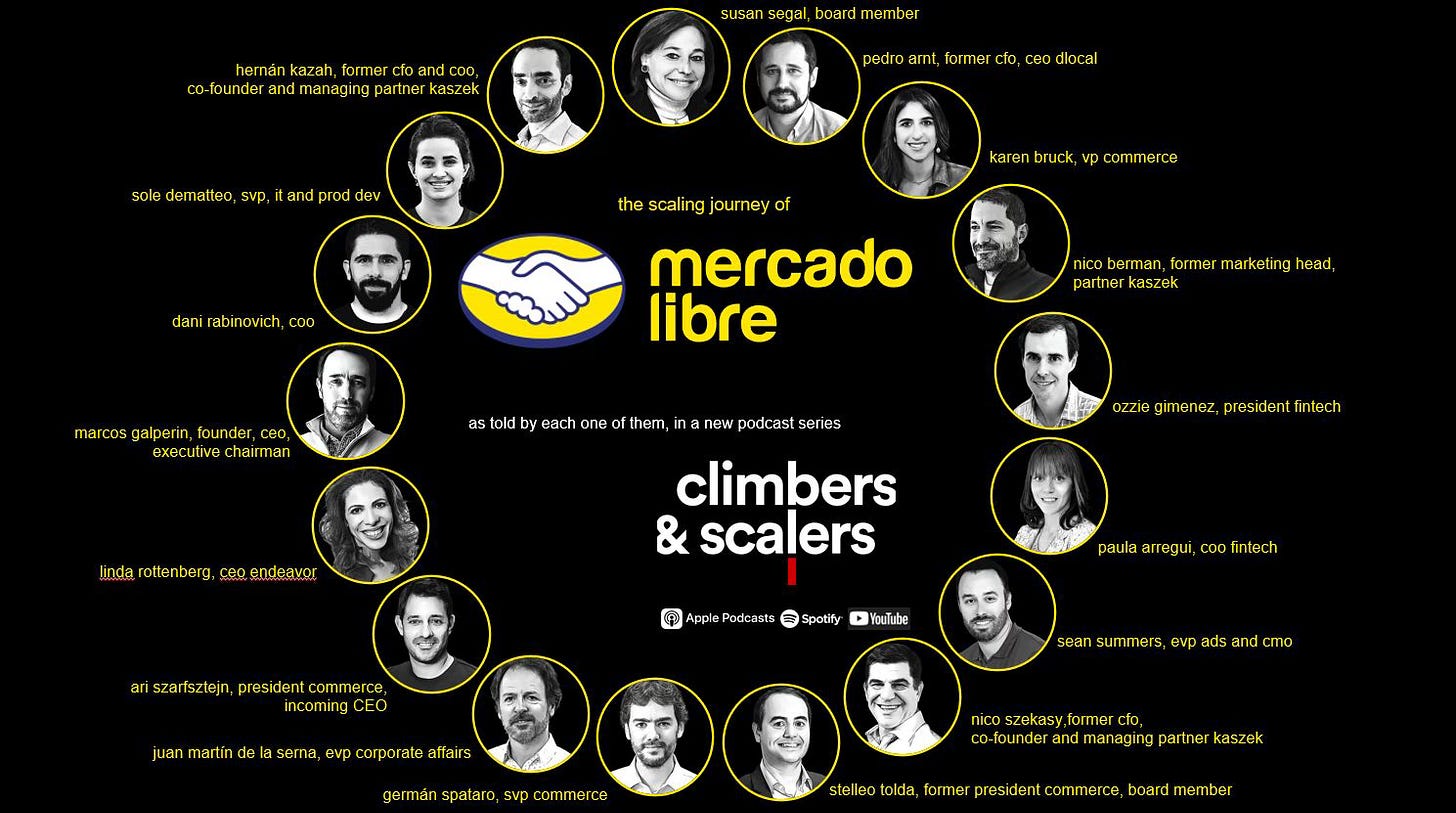

Episodes 10–19 of the climbers & scalers podcast series reveal the most crucial phase of Mercado Libre’s journey, the transition from promising startup to global platform. These conversations highlight the strategic decisions and cultural principles that enabled MELI not only to survive multiple existential crises, but to emerge as the dominant force in Latin American commerce.

If you are new to this newsletter, I recommend checking out Part 1 first, which covers episodes 1–9 and explores MELI’s philosophy and competitive frameworks.

Mercado Libre-Specific Insights

Nuclear Winter Strategy

Nico Szekasy’s account of the dot-com crash provides the clearest window into MELI’s strategic discipline during crisis. When the internet bubble burst in 2001, most companies scrambled for survival. MELI had already implemented what Szekasy calls “nuclear winter” planning, assuming capital markets would remain frozen indefinitely.

The company’s response was surgical: they cut teams in half while preserving $50 million in capital, centralised operations from nine countries into Buenos Aires, and shifted from growth-at-all-costs to a path-to-profitability mindset. This was not just cost-cutting, it was strategic repositioning. By 2005, they achieved profitability with substantial reserves intact, a decisive advantage when acquisition opportunities arose.

This experience created institutional memory around capital efficiency that persists today. Unlike competitors who optimised for favorable conditions, MELI built assuming adversity as the baseline. This explains their current approach to expansion and investment, always maintaining flexibility for the next downturn.

The Inconscience Advantage

The creation of Mercado Pago stands as one of the most successful platform extensions in e-commerce, yet Paula Arregui’s candid reflection on the role of “inconscience” reveals its unlikely origins. She noted, “If we had fully understood the complexity of what we were attempting, we might never have started.”

Her team’s early reality, manually processing transactions, entering card data into spreadsheets, faxing information, even creating physical coupons, illustrates both desperation and grit. This inconscience advantage enabled MELI to act when exhaustive feasibility studies might have paralyzed them.

The breakthrough was not technological but behavioral: solving trust between strangers rather than merely processing payments. By holding funds until buyers confirmed satisfaction and creating reputation systems, MELI turned the biggest barrier to adoption into a competitive moat. From manual processes to neural network fraud detection, this “naive” start enabled sophisticated solutions that perfectionism might have delayed.

70% Pay Reduction Philosophy

Nico Berman’s choice to take a 70% salary cut to join MELI, framing it as “investment in education,” highlights a recruitment philosophy that traditional compensation frameworks miss. His path from spotting a billboard to becoming employee number 8, shows how MELI hired for curiosity and learning capacity rather than narrow expertise.

This model filtered for conviction-driven employees. Significant financial sacrifice meant skin in the game that stock options alone could not match. The fact that many early MELI employees went on to found venture capital firms validates this human capital investment thesis.

Regulatory Arbitrage

Ozzie Giménez’s account of Mercado Pago’s battles with financial incumbents highlights MELI’s regulatory arbitrage playbook. Rather than waiting for permission, they built operations first, forcing regulators to adapt.

Because no regulation existed for businesses like Mercado Pago, MELI shaped new frameworks to its advantage. In markets dominated by monopolistic acquirer networks, they worked with competition authorities to pry open access. This created durable advantages that technology alone could not.

Amazon Counterplay & Global Learning

Germán Spataro’s perspective on Amazon’s entry into Brazil highlights MELI’s most sophisticated competitive analysis. Amazon expanded cautiously through books and categories, but MELI understood the real threat: Amazon’s operational excellence and customer obsession.

MELI responded by accelerating logistics, deepening local integration, and maintaining faster decision cycles. They bet that Amazon’s Seattle-centered approvals would slow local adaptation. As Spataro noted, “Brazil is the main country for Mercado Libre, while for Amazon it is just one of many.”

At the same time, MELI imported models from global peers, particularly Chinese fintech and e-commerce players. By adapting QR payments and money-market funds to Latin America, MELI leapfrogged local financial limitations. Remarkably, QR payment penetration in Argentina surpassed e-commerce usage, evidence of successful adaptation over invention.

Universal Business Principles

Inconscience–Competence

Arregui’s “inconscience” insight frames a broader principle: productive ignorance vs destructive ignorance. Productive ignorance allows teams to attempt the “impossible” without being constrained by industry baggage.

Firms can harness this by creating “ignorance buffers”, leaders articulate bold visions while shielding teams from paralysing detail. Hiring should balance domain expertise with fresh perspectives, avoiding teams that only optimise for known constraints.

Income-for-Learning

Berman’s salary sacrifice illustrates treating career transitions as educational investments rather than financial optimisations. Organisations can apply this by enabling employees to invest in skill-building periods that trade short-term productivity for long-term returns. Periods of reduced current income/productivity in exchange for learning acceleration can create exponential future value.

Scarcity Planning

Planning for scarcity during abundance creates resilience. MELI’s nuclear winter mindset exposed inefficiencies and forced resource discipline. Any organisation can benefit from occasionally planning as if today’s favourable conditions will vanish.

This mental exercise often reveals operational inefficiencies, strategic dependencies, and resource allocation opportunities that aren’t visible during normal conditions. A recent example of this is the ZIRP era which fuelled a startup boom and tech growth but caught many businesses off guard when it ended.

Friction Analysis

MELI’s evolution from marketplace to payments, logistics, and credit reflects systematic friction analysis. Each expansion solved a customer pain point and transformed it into a business opportunity.

This framework applies broadly: every user journey contains friction points that represent either barriers to remove or services to monetize. The strategic choice depends on whether eliminating friction increases platform usage more than monetising it increases revenue.

Competitive Intelligence

Rather than benchmarking, MELI practiced multi-level competitive learning: tactical copying, strategic adaptation, and cultural pattern recognition. This enabled rapid iteration while avoiding costly strategic errors.

Talent Compound Interest

Early hiring choices generated compound returns through talent ecosystems. Former MELI employees became founders and investors, strengthening MELI’s reputation as a “talent factory” and attracting future high-potential hires. Organisations that treat employee development as ecosystem investment rather than pure cost can access better human capital at lower costs than competitors optimising for employee retention alone.

Continuous Beta

MELI operationalised continuous beta, treating everything as permanently improvable. The approach involved structured experimentation, fast testing systems, and institutional learning capture which prevented chaos and turned permanent iteration into a growth engine.

Conclusion

Episodes 10–19 reveal how MELI systematically built organisational capabilities that compound. Talent, regulatory navigation, and global learning created a self-reinforcing system.

MELI’s success lies in shifting from marketplace to platform mindset, treating every challenge as a platform extension opportunity. Payments, logistics, and credit were not side bets but integral expressions of this philosophy.

For investors, the key takeaway is that MELI’s moat extends beyond financials into institutionalised innovation systems. For business leaders, the lesson is to build organisations that convert external shocks into enduring advantages.

This is Part 2 of a three-part series on the climbers & scalers podcast. The final installment will cover MELI’s global expansion philosophy and long-term positioning.

If you’d like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today’s edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com