On 6 June 2025, Mercado Libre (MELI) made its most significant announcement in five years: it slashed the minimum purchase for free shipping in Brazil from R$79 to just R$19.

The move is a direct response to intensifying competition from Asian players. Brazil accounts for over half of MELI’s revenue, and rivals like Shopee and Temu have been rapidly gaining share. MELI’s Brazil chief, Fernando Yunes, put it bluntly: the investment in logistics and subsidies is to “be ready for a war… to keep growing in Brazil” against Shopee, Shein, Temu, and others. By offering zero shipping on virtually the entire site (R$19 covers nearly all purchases), MELI is fighting to defend its e-commerce turf.

MELI’s stock fell 8% in the week following the announcement. Do investors have reason to worry, or has Wall Street misread the move?

Volume and Revenue: Bigger Sales, Smaller Tickets

Wall Street expects this aggressive pricing to boost gross merchandise volume (GMV), even if it puts pressure on per-item economics. Banco Itaú BBA notes that the R$19–79 range already accounts for ~19% of MELI Brazil’s GMV and 53% of items sold. In other words, a large slice of MELI’s order book now gets subsidised delivery.

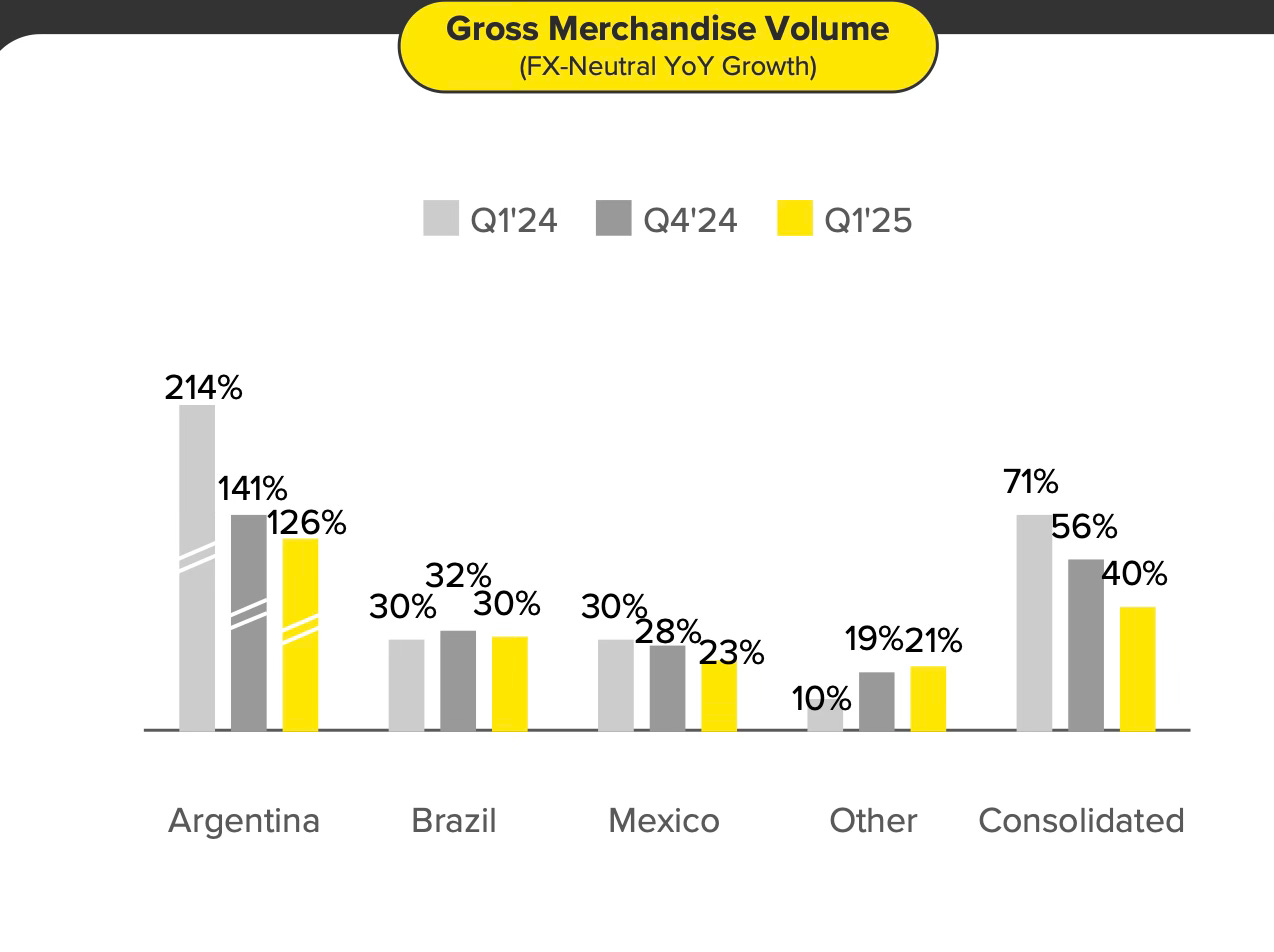

Morgan Stanley agrees, noting that the policy should directly accelerate GMV growth by leveraging MELI’s dominant logistics network. This could drive more frequent purchases and attract new, price-sensitive buyers. Q1 2025 results already showed Brazil GMV up ~30% year-over-year, and the new policy aims to maintain that momentum.

Meanwhile, MELI continues to diversify revenue. 90% of Brazilian sales come from third-party sellers, with income from commissions, logistics, advertising, and fintech services. Notably, logistics revenue is just ~8% of Brazil GMV, so the subsidised shipping has a relatively modest revenue impact. This is more a reallocation of delivery costs than a broad revenue hit, even as order volume climbs.

Margins and Profits: Short-Term Squeeze

The trade-off is profitability. Itaú BBA estimates the new shipping policy could reduce annual pre-tax profit by ~$390 million, or ~10% of full-year 2025 EBIT. Citi Research also warns of a 2 percentage point decline in Brazil’s gross margin. Jefferies and others have downgraded MELI, citing this near-term margin compression.

MELI management emphasises that the R$19 threshold applies only to the slowest delivery tier, deliberately preserving express shipping fees. Itaú notes that this tiered approach allows MELI to expand free delivery without compromising its logistics business, which accounts for only a small share of GMV. Still, the immediate impact is a clear hit to margins, explaining the market’s initial alarm.

Wall Street’s Short-Term Focus vs. Long-Term Strategy

Many analysts are focused on short-term profit impacts. But as noted previously in this newsletter, Wall Street often prioritises near-term metrics, while MELI has consistently played the long game. Throughout its 25-year history, MELI’s upfront investments in logistics, credit, and tech have ultimately translated into long-term gains.

Some analysts echo this view. Exame notes that MELI expects to recover the cost via volume growth, higher order frequency, and network efficiency. Buyers from underserved regions (especially North and Northeast Brazil) who were previously deterred by shipping costs may now become regular users.

An expanding GMV base improves logistics efficiency (lower cost per order) and supports monetisation through more advertising and fintech services. MELI is also introducing new layers such as Mercado Ads, Mercado Play, loyalty programs, and financial products, to offset lower margins in core commerce.

Competition and Moat: Shopee, Amazon, Temu and Friends

Shopee holds ~8% of Brazil’s e-commerce market versus MELI’s ~13%, but it’s growing fast. Shopee’s Brazil GMV hit ~$10 billion last year, about 40% of MELI’s total, with $6 billion added in a single year. Shopee’s ultra-low-price model (average ticket ~$7 vs. MELI’s ~$21) is dominating the bargain segment. Temu, Shein, and quick-commerce players like Rappi are also gaining ground, especially in urban markets.

By lowering the free-shipping threshold, MELI is targeting these rivals’ strongholds. As Itaú analysts put it, MELI is using its scale to block the advance of new entrants at lower price tiers. Most of MELI’s sales are still higher-value, higher-margin goods, so the impact is contained to the bottom end of the catalogue.

Even Shopee now reports profitability in Brazil, as its volume scale dilutes fixed costs. That adds pressure. In response, MELI is leveraging its own assets: 25+ planned in 2025 and an integrated payments and ads ecosystem. If successful, the strategy deepens MELI’s moat, built on logistics, product breadth, and cross-selling to MercadoPago users.

The new policy reinforces MELI’s dominance by deploying its greatest competitive advantage, scale, in a way that competitors cannot easily replicate.

The Bottom Line

This is a classic case of short-term pain for long-term gain. MELI is sacrificing some margin today to secure growth and loyalty tomorrow. Analysts’ early reactions are understandable, but they miss the strategic context.

If the plan works, MELI will emerge with higher GMV, stickier customers, and a stronger competitive moat. The R$19 blitz could ultimately expand MELI’s revenue base, entrench its leadership over Shopee and Temu at the low end, and set up faster growth and better margins down the line.

That’s the kind of investment story long-term investors should focus on.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Wouldn't this imply that Mercado Libre is going for Shopee's Customers in Brazil and push them into a price war, which would eventually lead to Shopee being unprofitable in their biggest market again? How do you access the magnitude and probability of this risk? (I own both)

$6 billion in a year is monumental!