MercadoLibre: 2025 Financial Model and Valuation Update

What is the fair value of MercadoLibre?

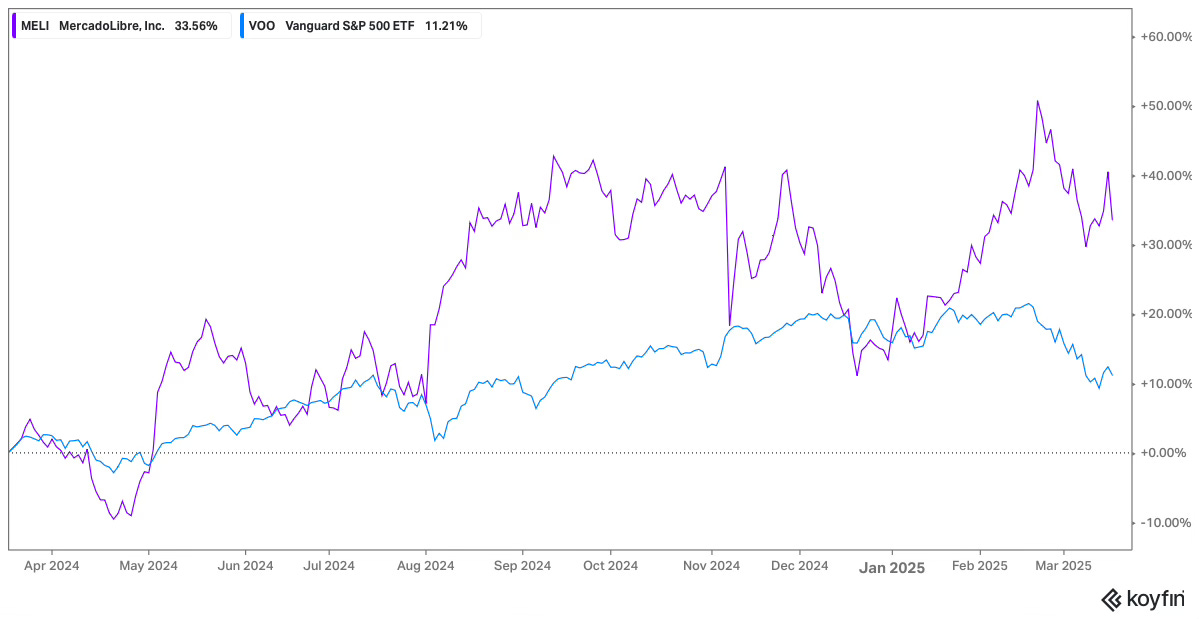

Mercado Libre (MELI) stock has delivered outstanding performance over the past twelve months, returning +34%, compared to just 11% for the market during the same period.

After such a strong rally, what is MELI’s fair value today, and is it still a buy?

In this update, I present a revised financial model and fair value assessment. The starting point for this analysis is the 2024 financial results. I have already shared a detailed Q4 2024 earnings analysis, which can be accessed via the link below.

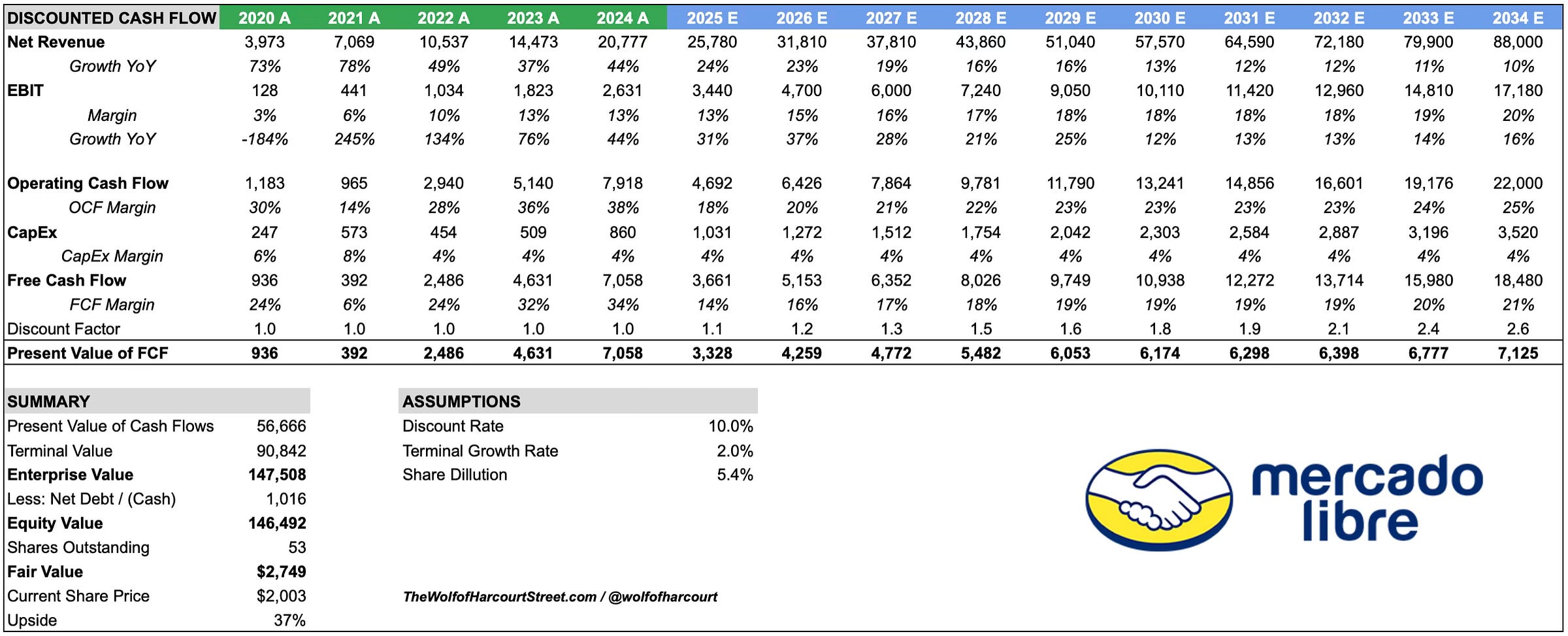

Discounted Cash Flow Analysis

Future cash flows have been projected over ten years using a 10% discount rate. Previous models were based on a five-year period, which resulted in most of the value being attributed to the terminal component. To reduce reliance on this assumption, I have extended the projection period. A terminal growth rate of 2% has been applied—on the lower end of the range, given the currency devaluation inherent in the region where MELI operates.

A 16% revenue CAGR is projected from 2024 to 2034. Between 2018 and 2024, MELI’s revenue grew at a 56% CAGR. As the company matures and its revenue base expands, a gradual deceleration is expected. The forecast reflects revenue growth moderating from 24% in 2025 to 10% by 2034, acknowledging the natural constraints of increasing scale while still outpacing broader market growth. According to PMCI market research, Latin America’s e-commerce market volumes will surpass $1 trillion by 2027, doubling from $507 billion in 2023.

The EBIT margin is projected to remain at 13% in 2025, consistent with 2024 levels. Despite heavy investment in growth, I expect operating leverage to improve over the next decade, with the EBIT margin reaching 20% in year 10. MELI has done an exceptional job of scaling its business, diluting fixed costs, and investing in new opportunities—a trend I expect to continue.

In 2024, MELI reported an operating cash flow (OCF) margin of 38%. However, this figure is misleading, as it is distorted by MELI’s credit business, where cash is both the product and a key operational component.

As shown below, changes in operating assets and liabilities significantly impact OCF, while the provision for doubtful accounts artificially inflates OCF by recording estimated losses before actual cash outflows occur.

To adjust for these distortions, I have revised MELI’s reported OCF from $7.9 billion to $3.8 billion, resulting in an normalised OCF margin of 18% for 2024. Over the next decade, I forecast the normalised OCF margin to scale from 18% in 2025 to 25% in 2034, aligning with EBIT margin expansion.

MELI’s Capital Expenditure (CapEx) margin has averaged 4% over the past three years. For this analysis, I assume a steady 4% CapEx margin over the forecast period. It’s important to note that most of MELI’s logistics spending is classified as operating expenditure (OpEx) rather than CapEx, meaning it flows through the Income Statement rather than being capitalized.

MELI’s share dilution has averaged 0.5% per year over the past four years. Assuming this trend continues, I project maximum shareholder dilution of 5.4% over the forecast period.

Based on these assumptions, MELI’s fair value is approximately $2,749 per share, indicating a potential upside of 37% compared to the share price of $2,003 on 18 March 2025.

Conclusion

The growth runway for MELI remains enormous.

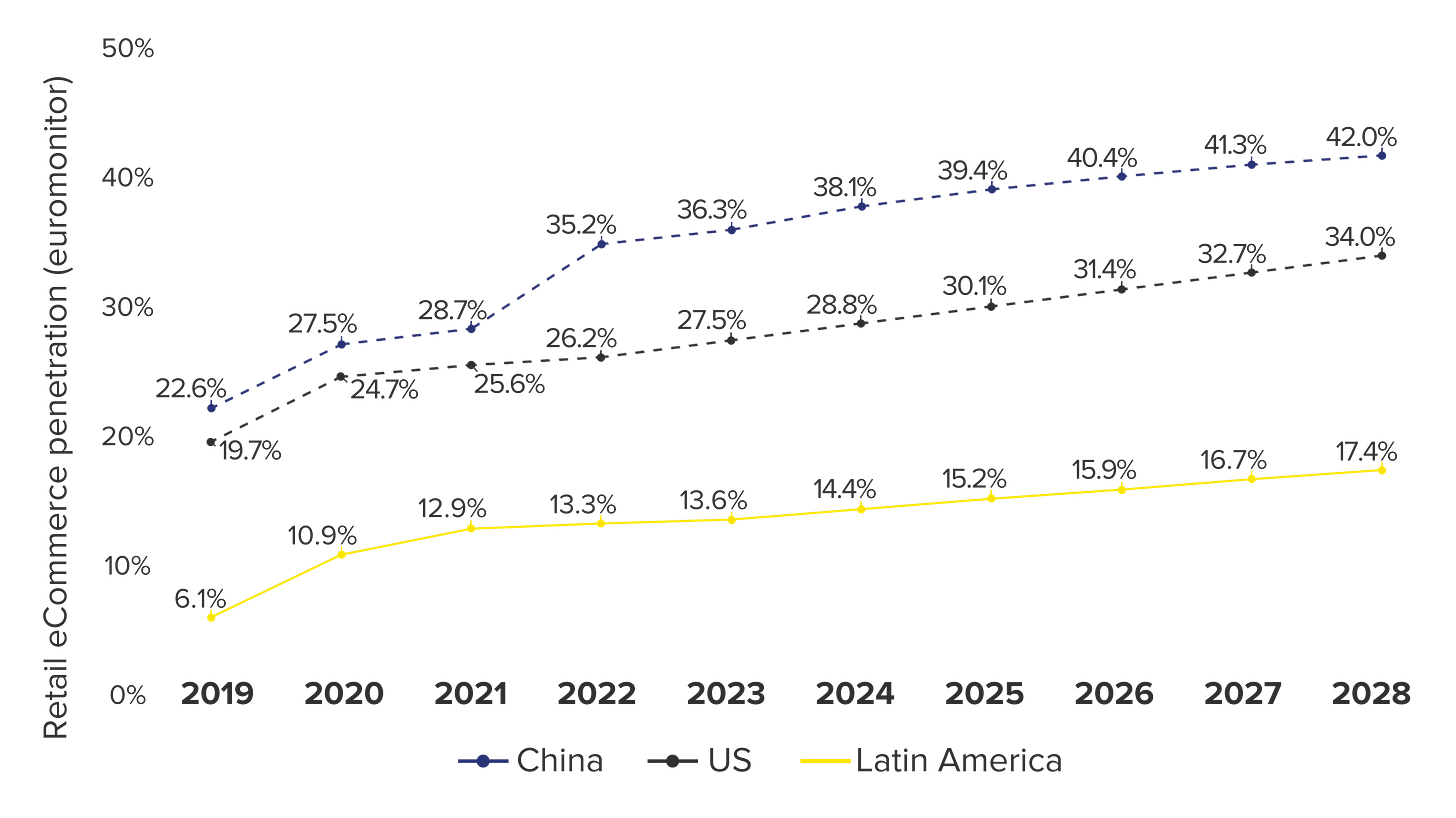

E-commerce penetration in Latin America remains in the mid-teens as a percentage of total retail—almost a decade behind the U.S.

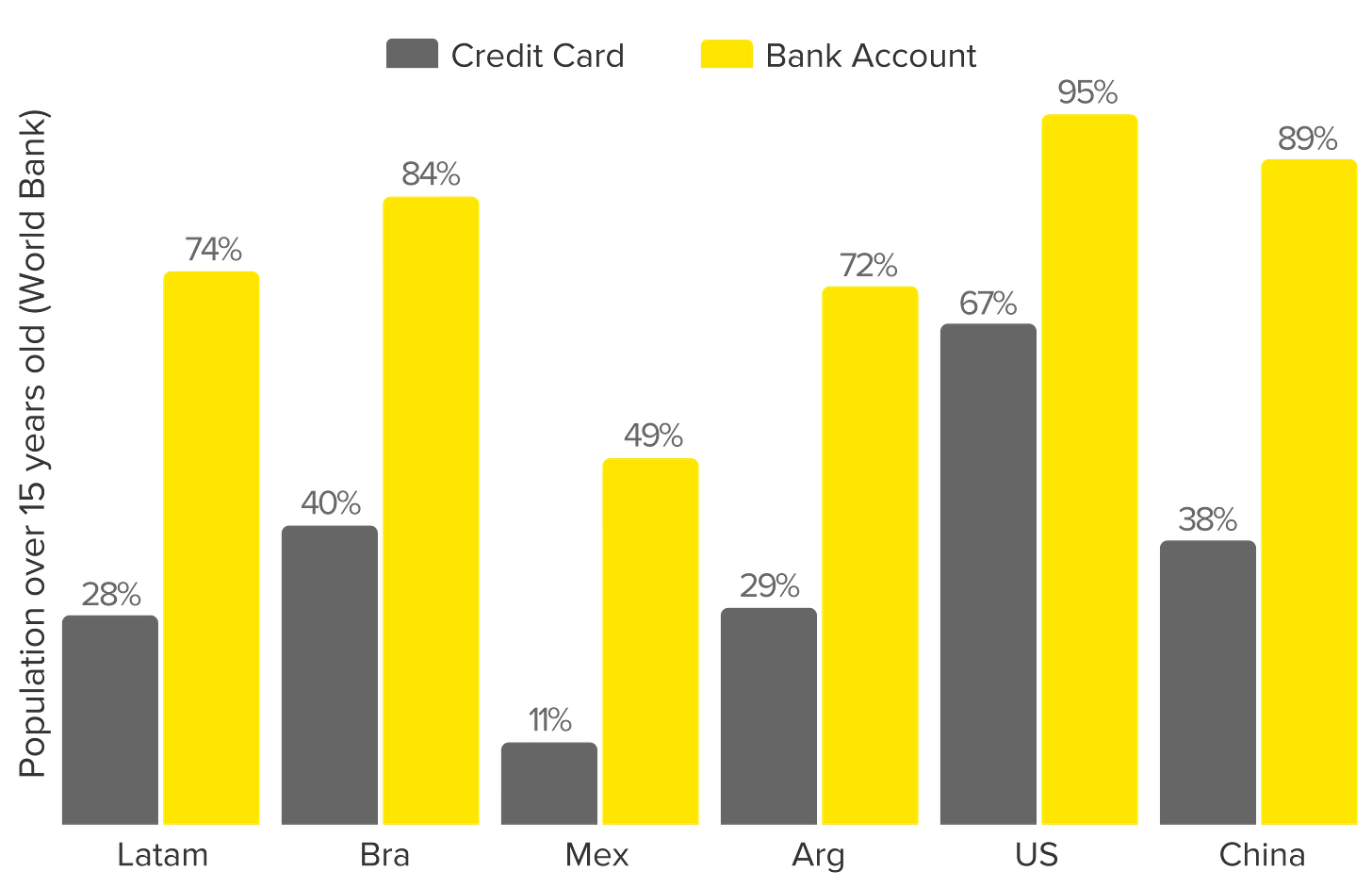

Financial inclusion in Mexico lags behind Brazil by more than a decade, with just 50% of the population having a bank account and less than 20% holding a credit card. In Brazil, four incumbent banks control 59% of credit operations, positioning Mercado Pago for disruption.

This backdrop provides strong confidence that MELI can achieve its forecasted revenue growth with a reasonable degree of certainty.

MELI’s business model is highly complex, making EBIT and FCF margins more challenging to model. I have made several adjustments to establish a normalised FCF margin for 2024 as a starting point.

Given MELI’s 46% gross margin today, an EBIT margin of 20% a decade from now appears conservative—especially considering the company has already achieved a 13% EBIT margin while heavily reinvesting for growth.

Due to the distortion of OCF from the credit business, an EBIT-to-FCF margin multiple of nearly 1:1 also appears reasonable.

Ultimately, MELI’s track record of flawless execution and future growth potential suggest that the market’s growth assumptions are overly conservative at the current valuation.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Clear approach! I like the OCF cleanup. It could be interesting to value separately the ecomm and finance biz as they carry different profiles.

Dziękuję! :)