MercadoLibre: Flat Earnings A Cause For Concern?

MercadoLibre (MELI) Q4 2023 Earnings Analysis

Executive Summary

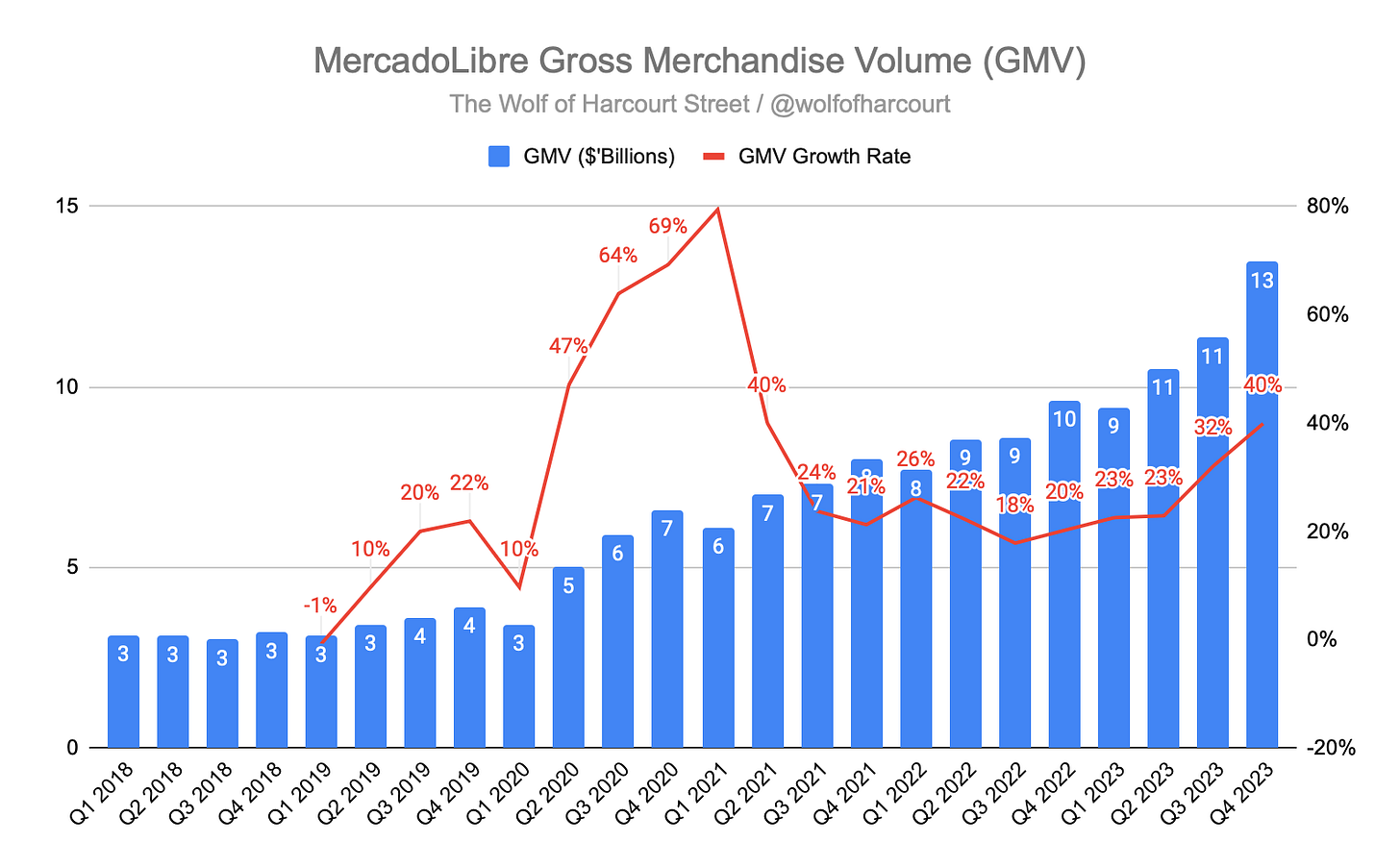

MercadoLibre Marketplace GMV reached $13.5 billion, with a remarkable year-on-year FX-neutral growth of 79%. This marks the second consecutive quarter of accelerated GMV growth, reaching the fastest rate since Q2 2021. The growth was driven by sustained acceleration in item sales and healthy trends in the number of unique buyers. The broad-based growth in Brazil and consistent performance across various metrics highlight the platform's strong position in the market.

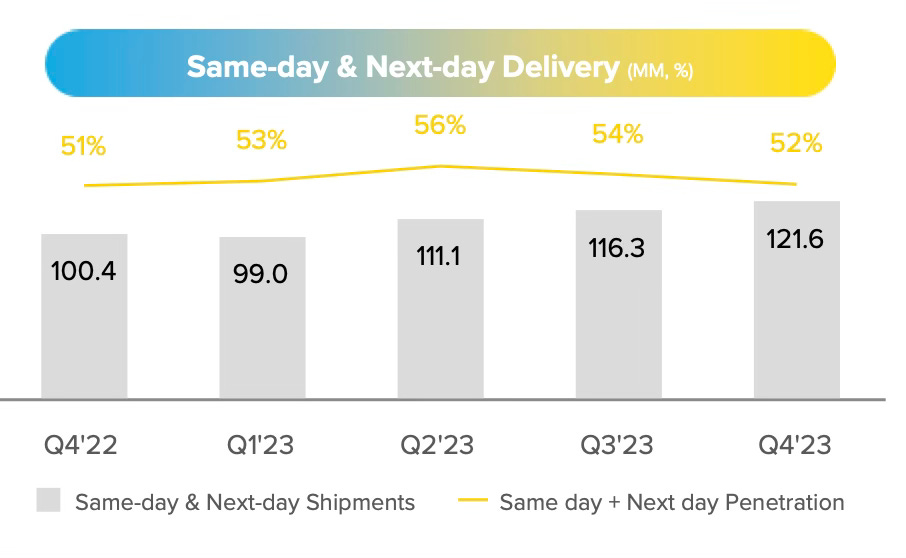

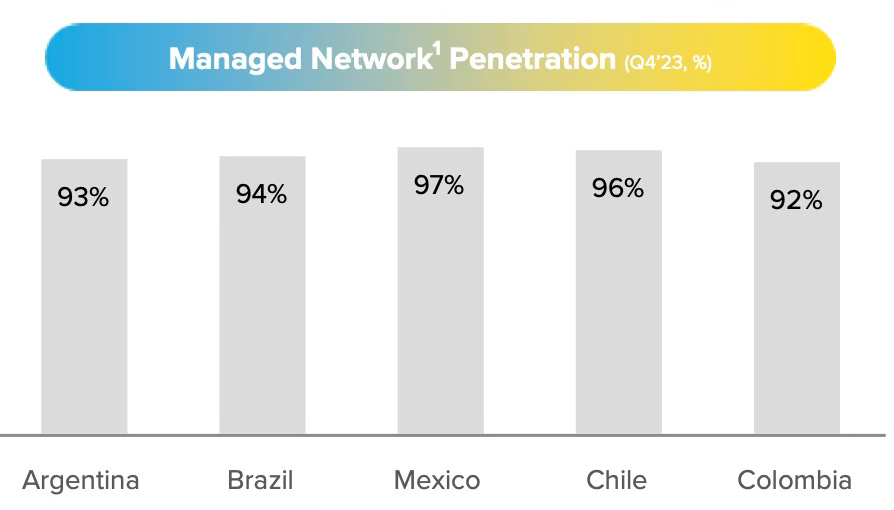

Mercado Envíos achieved a significant milestone by delivering almost 122 million packages on the same or next day, reflecting a substantial 21% year-on-year increase. The expansion of the fulfillment network played a crucial role, accounting for nearly 50% of shipments—a new record. The 94.4% record penetration of the Managed Network and the role of Meli Places highlight the platform's commitment to enhancing efficiency and expanding its logistics capabilities.

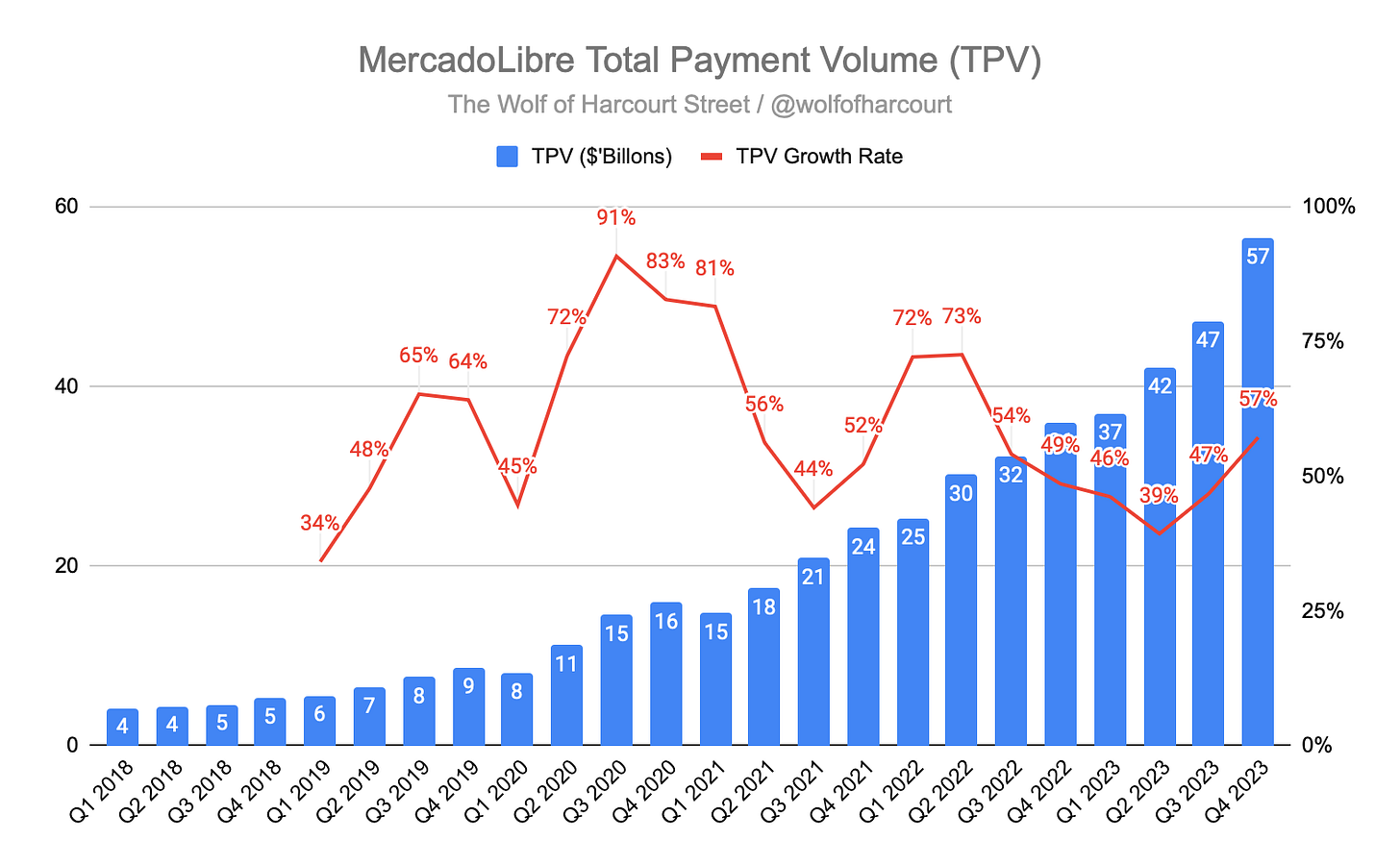

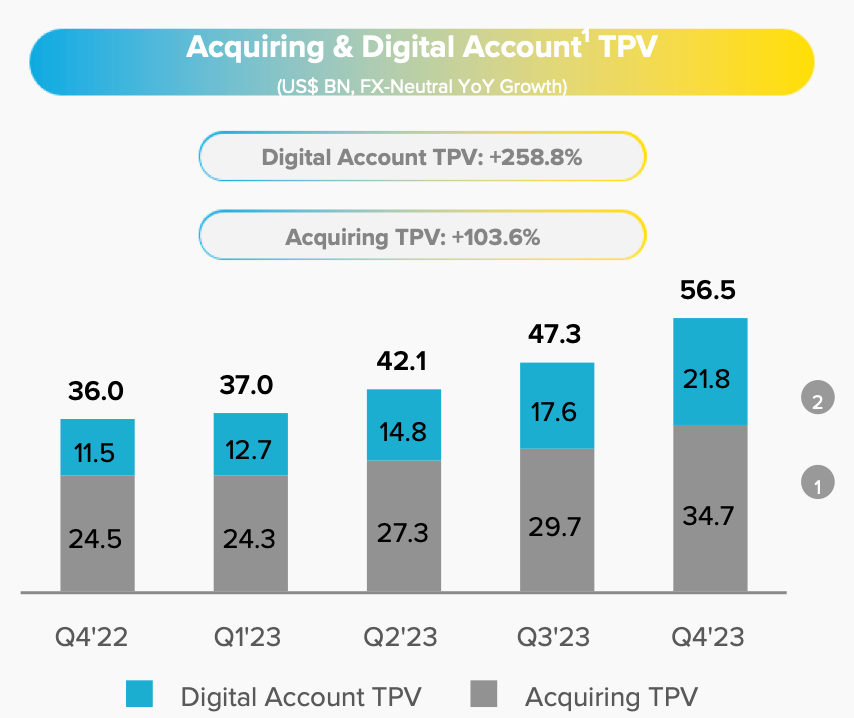

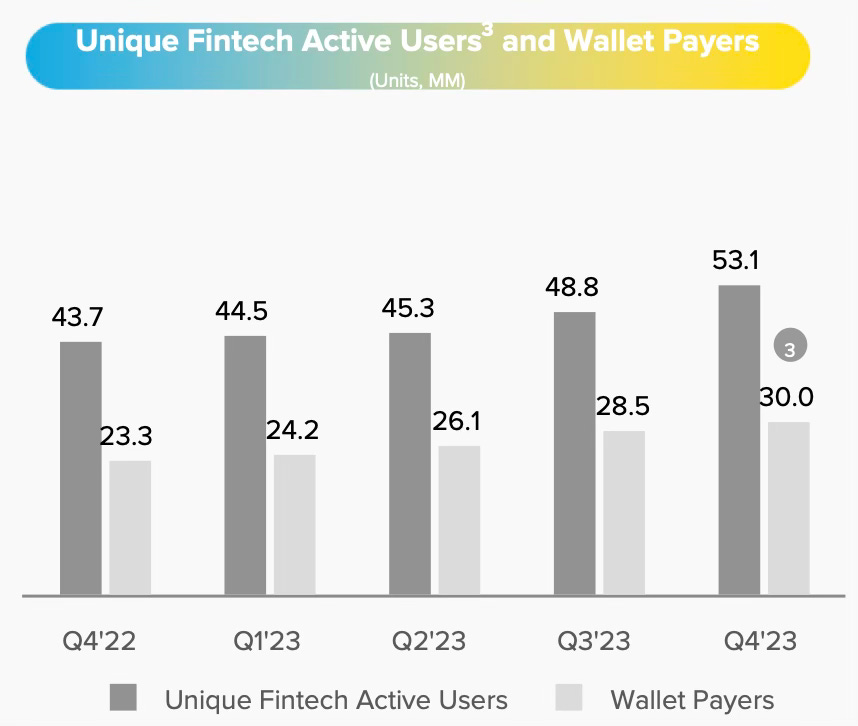

Mercado Pago achieved a Total Payment Volume of $56.5 billion, demonstrating 153% FX-neutral YoY growth. Mercado Pago's performance reflects robust growth across various segments, including acquiring services, mobile payments, online transactions, and the rapid adoption of digital financial solutions, contributing to a record number of active users. Mercado Crédito demonstrated significant portfolio growth, particularly in the Credit Card and Consumer books. The expansion of NIMAL spread and conservative risk management strategies contributes to the platform's success in the credit market.

MELI faced significant one-off expenses in Q4, totaling $350 million. These expenses were associated with contingent tax liabilities related to prior periods, ongoing legal proceedings, and a DIFAL sales tax ruling in Brazil. These expenses caused the gross margin and operating margin to contract by 269 basis points and 600 basis points, respectively. Despite this, when excluding these expenses, the company showed improvement in its operating margin, emphasizing the positive effects of business growth and cost management.

Contents

Financial Highlights

Wall Street Expectations

MercadoLibre Marketplace

Mercado Envíos

Mercado Pago

Mercado Credito

Financial Analysis

Conclusion

1. Financial Highlights

Revenue: $4.261 billion +42% year-over-year (YoY)

Operating Income: $240 million -31% YoY

Net Income: $165 million flat YoY

Earnings per Share: 3.25

2. Wall Street Expectations

Revenue: $4.13 billion (beat by 3%)

Earnings per Share: 6.96 (miss by 53%)

3. MercadoLibre Marketplace

MercadoLibre (MELI) reported a Gross Merchandise Volume (GMV) of $13.5 billion, driven by a year-over-year (YoY) FX-neutral growth of 79%. This marks the second consecutive quarter of accelerated GMV growth and the fastest rate of growth since Q2 2021.

Brazil's growth was broad-based, with most categories contributing to a 35% YoY FX-neutral GMV growth. Argentina experienced faster growth, supported by a pickup in items sold. Mexico's FX-neutral GMV growth remained above 30% for the third consecutive quarter.

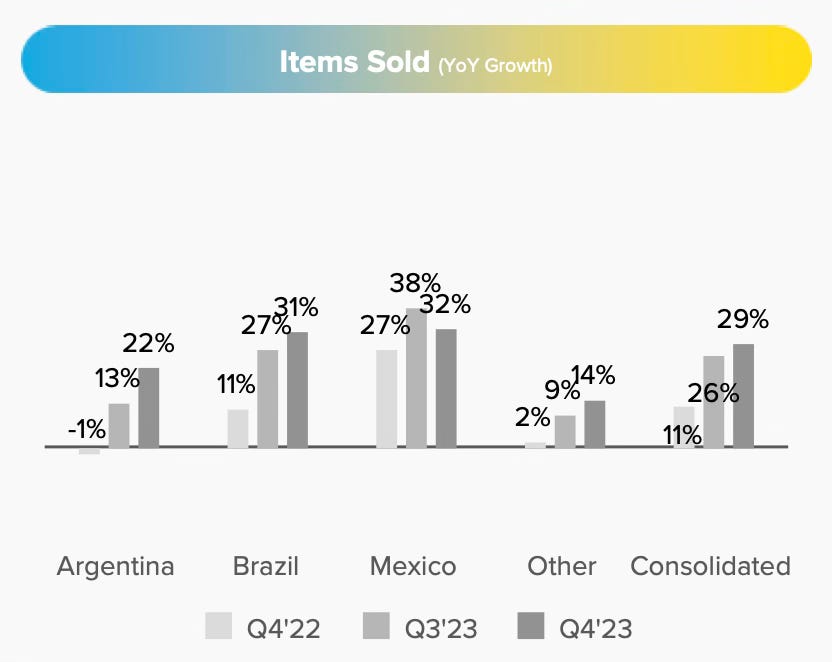

MELI's sales of items continued to accelerate for the fifth consecutive quarter, growing by 29% YoY in Q4. MELI sold an additional 92 million items YoY in Q4, compared to the additional 73 million items sold in Q3 and 50 million in Q2. This growth trend is noteworthy and is the fastest achieved since Q2 2021. Both Brazil and Mexico delivered growth of more than 30% YoY in items sold, while Argentina showed acceleration.

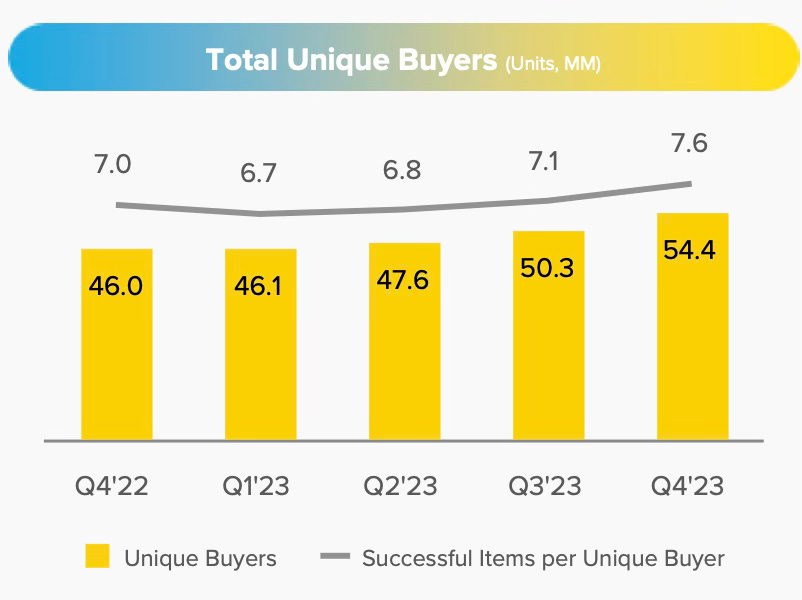

The number of unique buyers grew by nearly 18% YoY, and growth remained at similar levels as the prior quarter, which demonstrated the highest growth since Q2 2021. All segments continue to show healthy trends, with Mexico posting the highest growth.

Items sold per buyer increased, helped in part by Grocery returning to growth after lapping the introduction of higher free shipping thresholds in 2022.

4. Mercado Envíos

MELI achieved a significant milestone by delivering almost 122 million packages on the same day or next day, marking a substantial 21% YoY increase. This accomplishment was supported by the expansion of the fulfillment network, which accounted for nearly 50% of shipments: a new record.

MELI shipped a total of 407 million items in Q4 2023, indicating a strong growth rate of 31% YoY. This growth is the highest since Q3 2021, underscoring the platform's increasing scale and efficiency in handling a larger volume of shipments.

Despite challenges, such as consumers opting for slower delivery options like MELI Delivery Day (a shipping option that enables subscribers of the program to schedule a day of the week on which they can access free shipping on items from approximately $6, compared to the standard free shipping threshold of approximately $15) and increased volumes from more distant regions. The proportion of same-day or next-day deliveries increased by 21% YoY and almost 5% QoQ. Just over 75% of shipments were delivered within 48 hours across Latin America, remaining broadly stable YoY.

The total penetration of the Managed Network reached a record level of 94.4%, showcasing ongoing improvements in most geographic segments. Fulfillment by MELI also reached a record level, constituting almost 50% of shipments. Brazil made significant progress, with a 10-percentage-point increase in penetration YoY.

Meli Places, with over 10,000 partner locations, plays a crucial role in handling more than 50% of returns, as well as serving as first mile and last mile hubs. This indicates a diverse and extensive network, contributing to the efficiency of Mercado Envios.

5. Mercado Pago

Mercado Pago's Total Payment Volume (TPV) reached $56.5 billion, with Acquiring TPV of $34.7 billion growing at an impressive 104% year-over-year (YoY) on an FX-neutral basis. This reflects the platform's robust performance in facilitating transactions.

Off-platform TPV growth accelerated sequentially in key markets, such as Argentina, Brazil, and Chile within the Other segment, which continued to experience strong triple-digit growth rates.

Mercado Pago's Mobile Point of Sale (MPOS) in Mexico showed consistent sequential growth, while a revamped commercial strategy in Brazil yielded promising initial results, indicating successful market engagement. Online Payments experienced robust growth, particularly in Brazil, showcasing the platform's adaptability to evolving digital commerce needs.

The adoption of QR-based payment methods, reflected in QR TPV, continued to accelerate across Mercado Pago's markets. Digital Account TPV exhibited rapid growth in all countries, with triple-digit increases in Mexico and Brazil during Q4, demonstrating heightened user interaction.

Key drivers of stickiness and volume growth within the Mercado Pago ecosystem were credit card adoption, activation, and utilization. Core wallet products played a crucial role in capturing new volume and served as first adoption products for fintech solutions.

The number of Unique Fintech Active Users reached a record high of 53 million, with a strong quarter-over-quarter increase of 4.3 million. This growth was contributed to by all three top geographies.

6. Mercado Credito

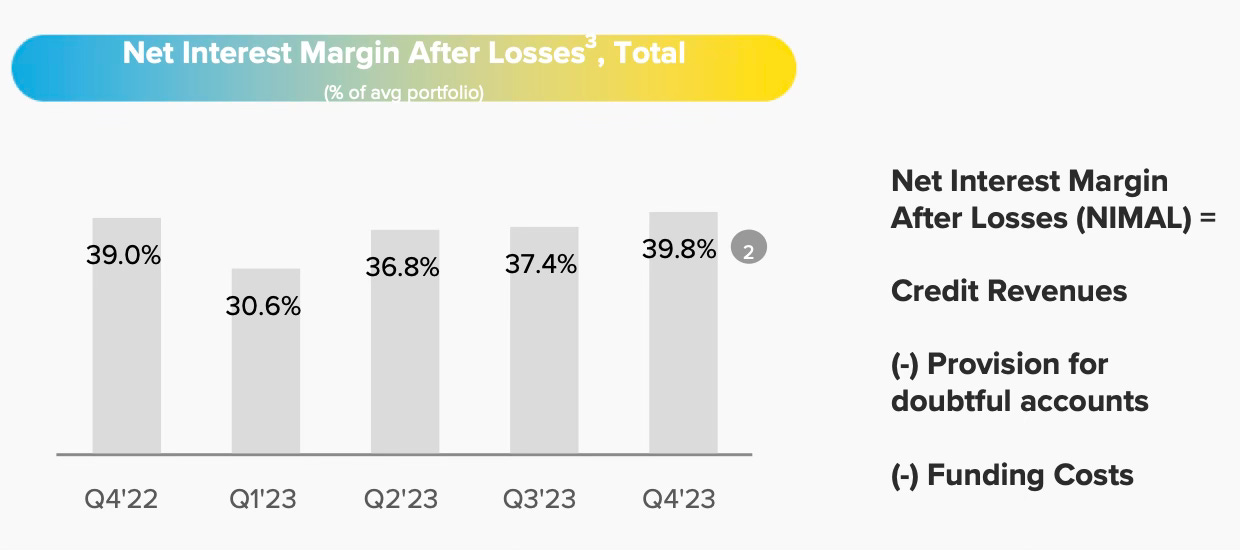

Mercado Crédito's credit portfolio reached nearly $3.8 billion in Q4 2023, reflecting a significant YoY growth of 33%. The main drivers of this growth were the Credit Card and Consumer books. The annualized NIMAL (Net Interest Margin after Loan Loss Provisions) spread increased both YoY and QoQ to 39.8%. This growth underscores Mercado Crédito's ability to accurately price risk and its cautious risk management approach.

The 33% YoY growth in the portfolio and the expansion of NIMAL were influenced by a slight uptick in sequential portfolio growth, particularly in Brazil and Mexico. However, this expansion was partially offset by the sharp contraction in Argentina's portfolio due to FX devaluation.

The credit card segment drove the majority of originations expansion, with Total Payment Volume (TPV) exceeding $1.6 billion in Q4. The total credit card portfolio surpassed the $1 billion mark for the first time, contributing to NIMAL expansion.

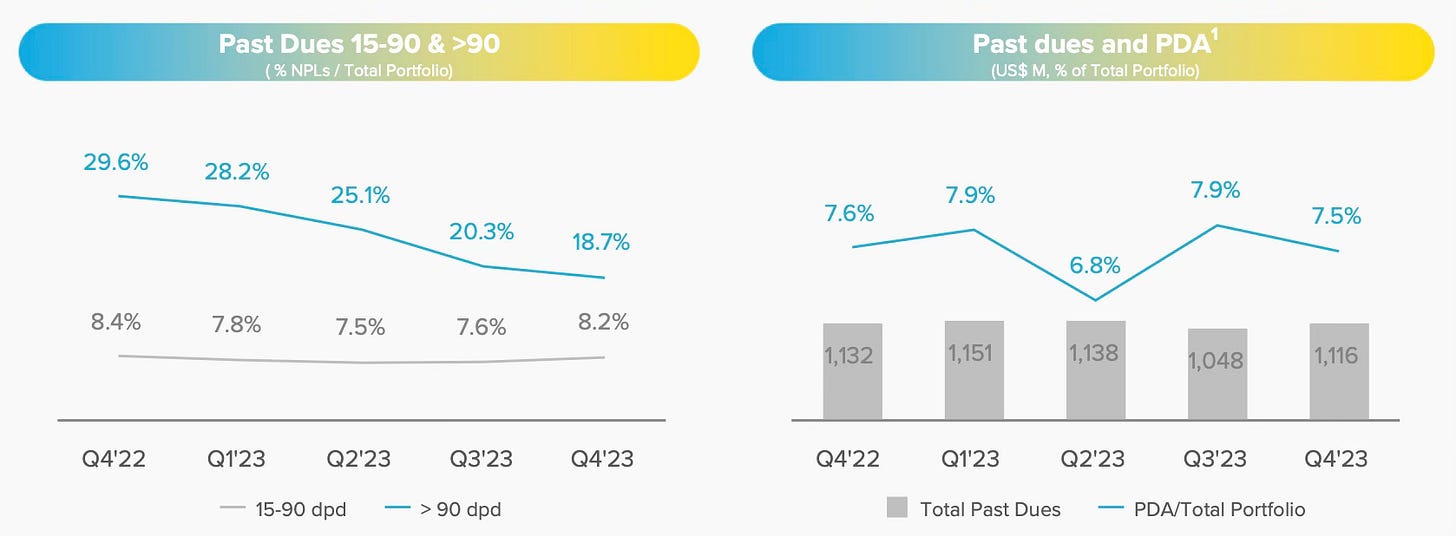

The total Non-Performing Loans (NPLs) exceeded the 30% rate for the first time in over a year, landing at 29.5%. The 15-90-day NPL increased slightly QoQ, influenced by product mix, particularly in Credit Card Brazil. However, Q4 showed an improved roll rate, attributed to higher liquidity available, such as the thirteen salary, impacting better collections and decreasing first payment defaults.

In Q4 2023, the provision was equivalent to 7.5% of the portfolio, reflecting Mercado Crédito's conservative provisioning policy. The decrease in total past dues in dollar terms was attributed to the continued prioritization of asset quality and organic write-off of previous cohorts. This policy ensures high levels of coverage throughout the life of the loan.

7. Financial Analysis

Revenue

MELI recorded net revenue of $4.261 billion in Q4 2023, representing an increase of 42% YoY in US dollars and an 83% increase on an FX-neutral basis. This represents the fastest revenue growth since Q3 2022.

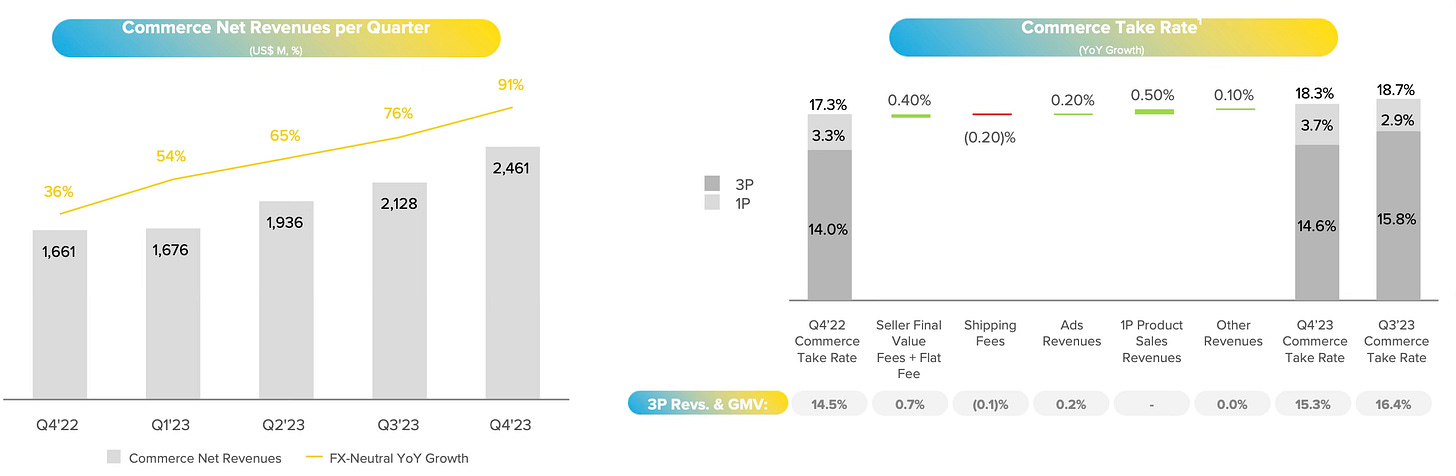

Commerce revenue growth accelerated 91% YoY on an FX-neutral basis to $2.46 billion, driven by a step up in first-party product sales and continued monetisation efforts that drove the take rate higher.

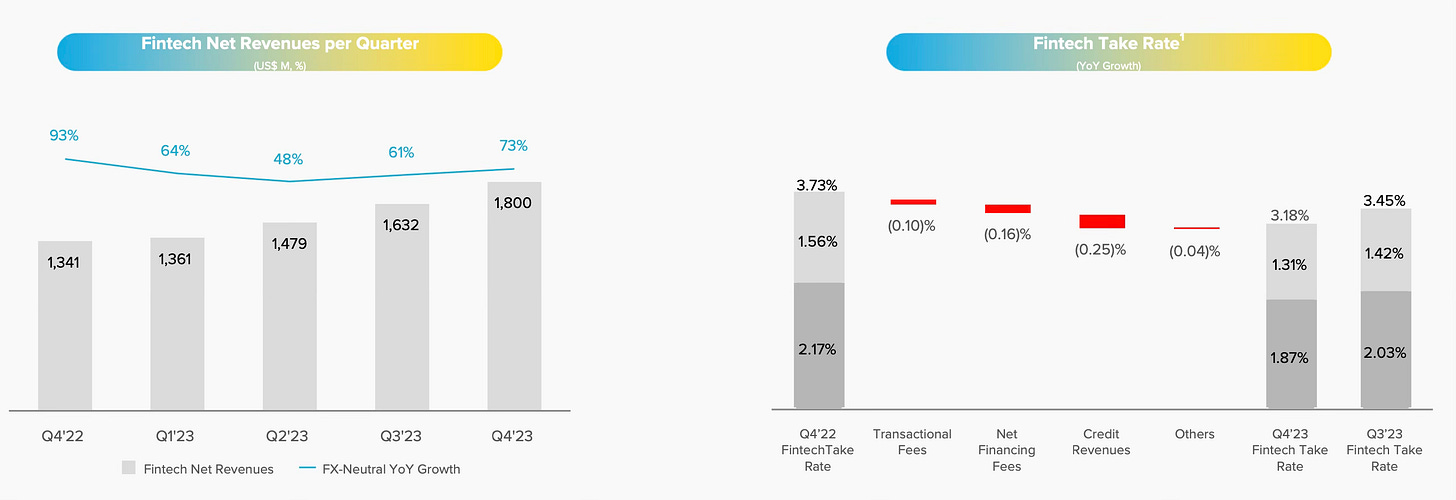

Fintech revenue was $1.8 billion, an increase of 73% YoY on an FX-neutral basis supported by a pick up in credit revenues, despite some pressure on monetization.

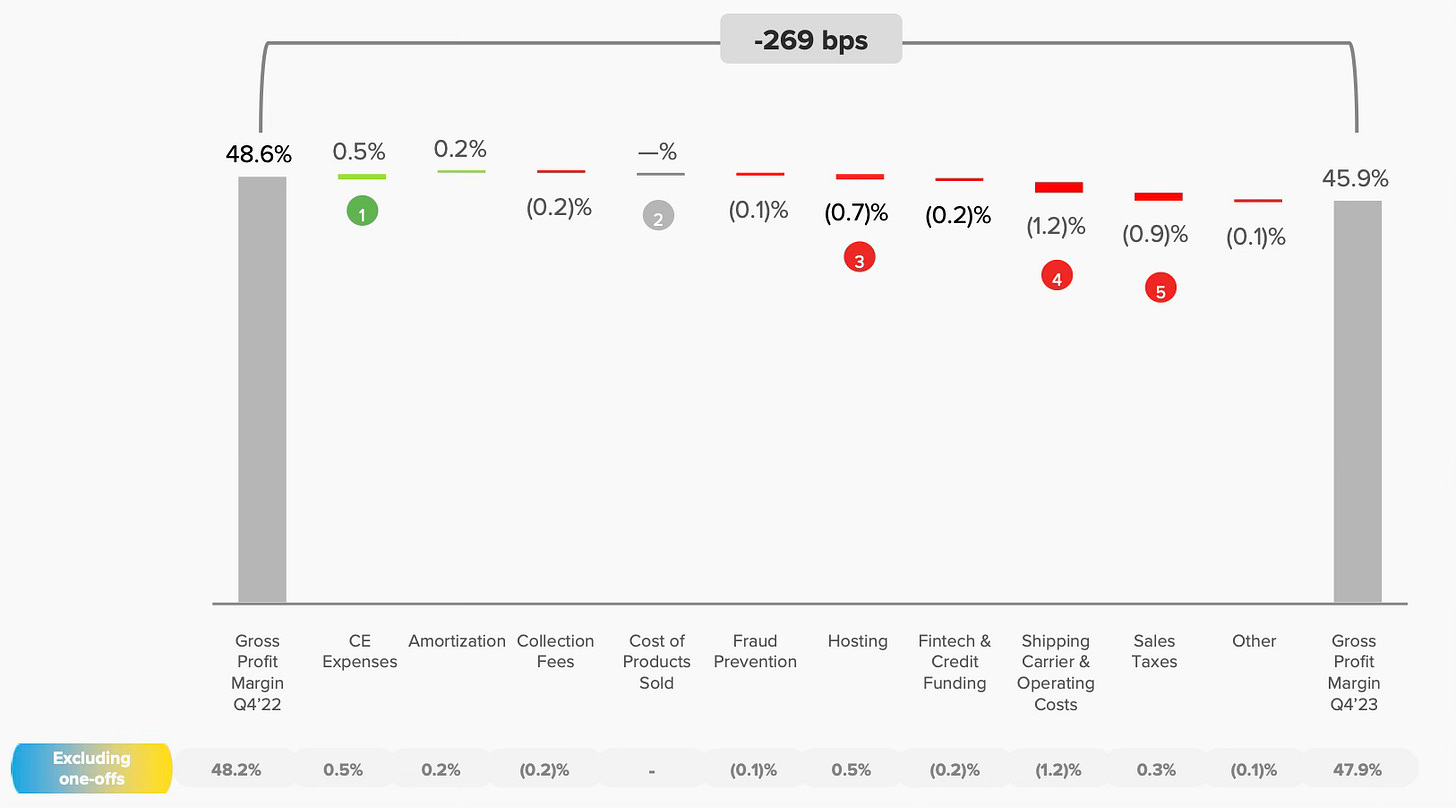

Gross Margin

MELI was impacted by one-off expenses in Q4 which I would like to draw the readers attention to. These expenses were associated with contingent tax liabilities, mainly related to prior periods.

DIFAL Sales Tax: A second one-off expense of $31 million, booked in cost of revenue, is related to a recent ruling from Brazil’s highest court. The ruling states that the DIFAL sales tax must be paid for the period April to December 2022, despite ongoing legal questions about its legality.

Contingent Tax Liabilities Details: The first one-off expense of $320 million is linked to ongoing legal proceedings since 2014. It disputes the Brazilian federal tax authority's ability to charge withholding income tax on payments from Brazilian subsidiaries to the Argentine subsidiary for IT support and services.

The gross margin contracted by 269 basis points (bps) and was adversely affected by one-off expenses, investments in first-party (1P) operations, logistics, and a reduced contribution from credit revenues. This indicates an impact on profitability from additional costs related to customer experience initiatives.

Dilution of Customer Experience Costs

Headwind from Higher Mix of 1P Revenue: A headwind of more than 2 percentage points resulted from a higher mix of first-party (1P) revenue, offset by decreased sales of point-of-sale (POS) devices. This shift in revenue mix had an impact on the overall gross margin.

One-Off Expenses Impact: Almost 1.2 percentage points headwind in the gross margin was attributed to one-off expenses.

Investments in Logistics Network: Investments in the logistics network, including the launch of new fulfillment centers in Brazil and Mexico, contributed to the gross margin impact. Additionally, there was an overall increase in fulfillment penetration, particularly in Brazil, indicating ongoing efforts to enhance the efficiency of the supply chain.

Sales Taxes and One-Off Expense: Sales taxes included a $31 million one-off expense related to the DIFAL sales tax, equivalent to 70 bps.

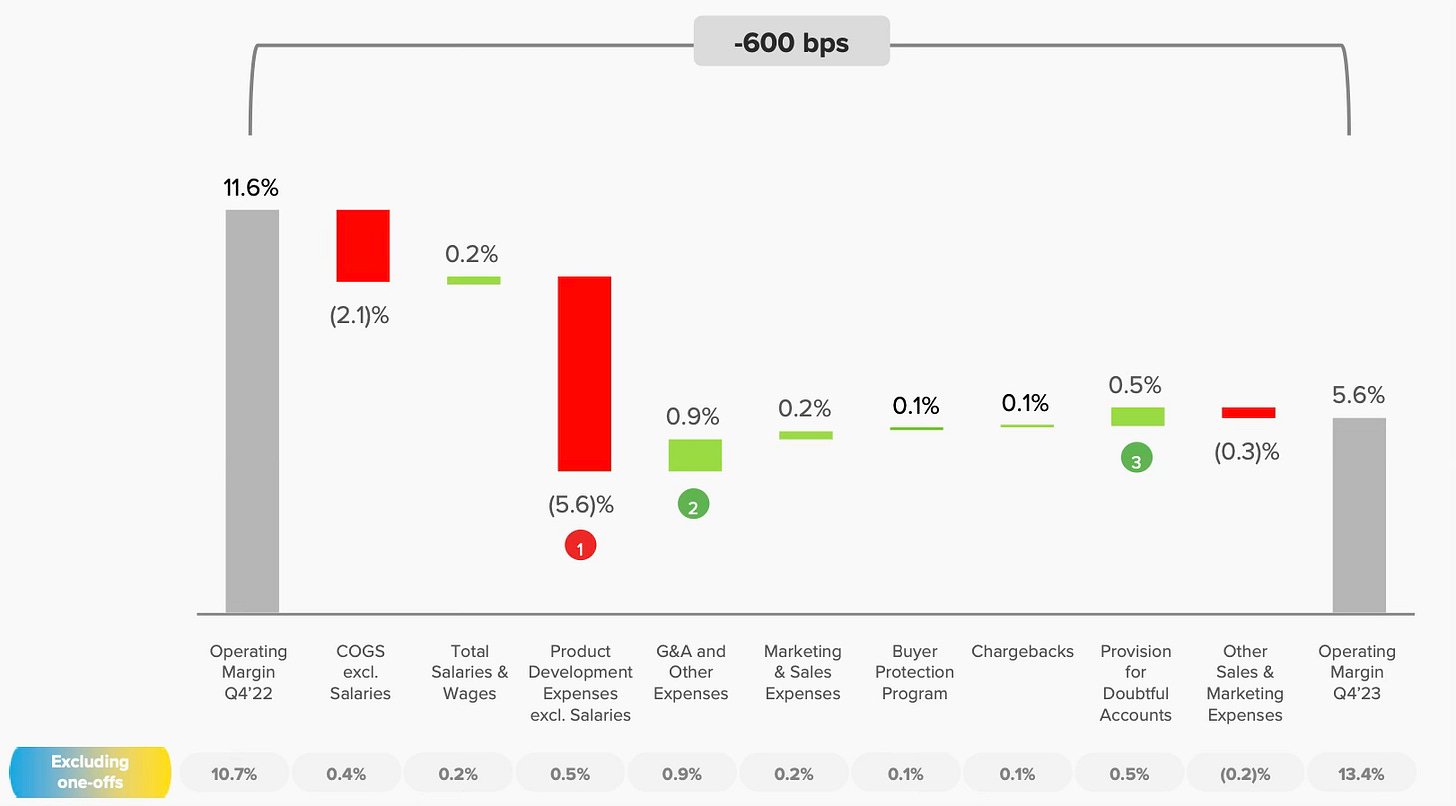

Operating Margin

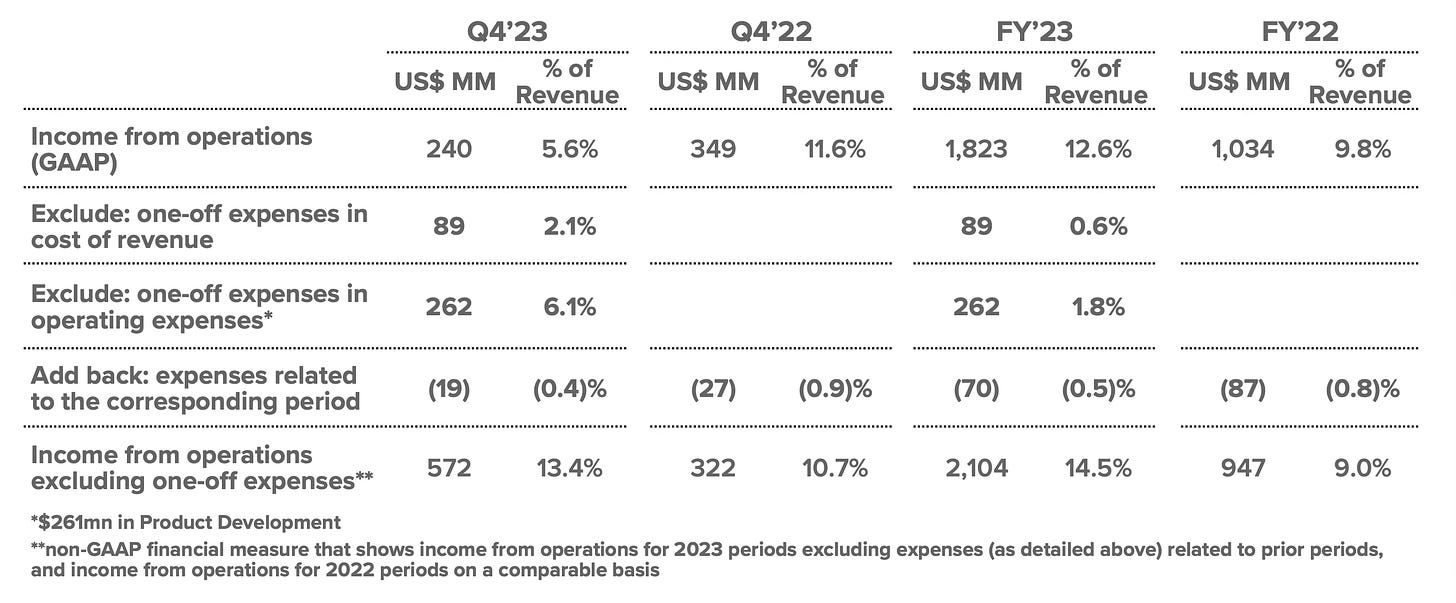

MELI’s operating margin contracted by 600 bps YoY, negatively impacted by one-off expenses.

Significant One-Off Expenses: The Q4 2023 operating margin experienced a negative impact due to one-off expenses equivalent to 8.2 percentage points.

Dilution of Operating Expenses: The dilution reflects increased efficiency in operational activities during the quarter.

Stable Provision Charge as a Percentage of Credit Revenue: The provision charge as a percentage of credit revenue remained broadly stable. The EBIT margin gain was driven by dilution from other company revenue streams that grew at a faster pace than the credit segment, indicating positive performance in non-credit areas.

Cash Flow Analysis

MELI reported $5.14 billion of cash flow from operating activities in 2023 compared to $2.94 billion in 2022. For the same period MELI recorded free cash flow of $4.63 billion compared to $2.49 billion in 2022. This represents a FCF margin of 32% for 2023 compared to 24% for 2022.

Management confirmed that the one-off expenses will not have a material cash impact as most of the values in question were accumulated in judicial accounts and booked as non-current assets during the corresponding periods.

8. Conclusion

First off, let’s address the elephant in the room - the one-off expenses. While the expenses caused a material impact on the results, as someone from an accounting background I was satisfied with management’s explanation. Approximately 6% of the $350 million charge corresponds to this specific quarter. Going forward, the impact is expected to be around $20 million per quarter, and the charge was fully funded through a judiciary account over the past decade.

If we zoom out and exclude the one-off expenses, MELI’s Q4 2023 income from operations margin of 5.6% would have been 13.4%, an improvement on the 10.7% margin from Q4 2022. MELI achieved this improvement by growing the business, diluting fixed costs, and focusing on efficient cost management.

Management provided a very helpful walk from the reported income from operations figure to the income from operations excluding one-off expenses. The impact on the fiscal year 2023 results was relatively minor.

MELI’s continued momentum and top-line growth is beginning to defy the law of large numbers. Despite its size, MELI managed to add an extra $9 billion of TPV in one quarter alone. For context in Q1 2020, MELI’s reported TPV was $8.1 billion. Similarly with GMV, MELI added an incremental $2 billion in one quarter, more than it added from Q1 2023 to Q3 2023 combined.

Another positive for MercadoLibre was the performance of its Ads business, which grew by 72% YoY on an FX-neutral basis. This growth marked the seventh consecutive quarter with growth above 70%, mainly driven by Brazil and Mexico. MercadoLibre added 53,000 new advertisers during the year, showcasing strong interest in the advertising product. The ads tech stack was re-launched with an automated buying platform, enhanced bidding algorithms, and new placements for increased visibility.

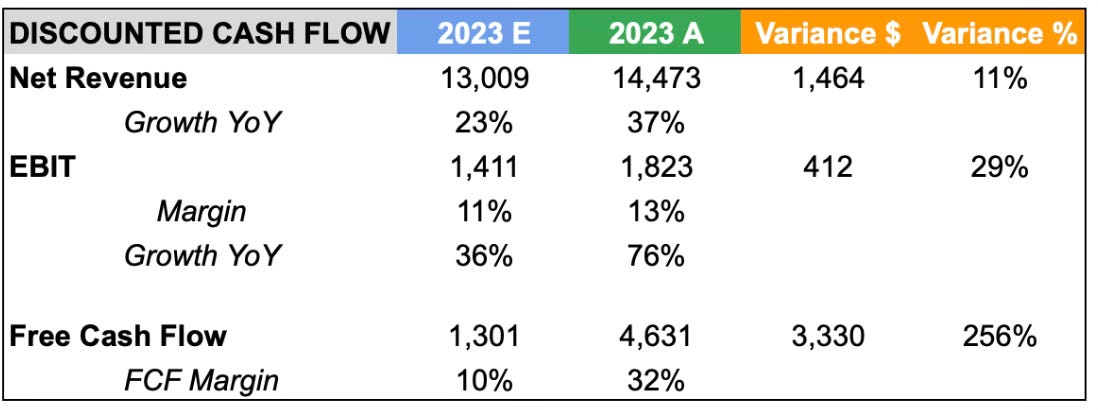

When I shared my initial MercadoLibre Investment Thesis last year, the stock traded at $1,192. At the time of writing, the stock is trading at $1,665 after hours, meaning that the investment has returned 40% in less than 12 months. In light of this, let's revisit the assumptions I made and compare them to the actual results. MELI smashed my expectations for revenue, EBIT and FCF by 11%, 29% and 256% respectively.

While the one-off expenses will grab all of the media attention, long-term investors should zoom out and see that MercadoLibre has completed an exceptional year by anyone’s standards. The long-term thesis continues to play out as the company accelerates growth and increases its market share in most countries.

The full MercadoLibre investment thesis is linked below for new subscribers or anyone that missed it.

Rating: 4 out of 5. Exceeds expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com