MercadoLibre: Profitable Growth Trajectory Continues to Soar

MercadoLibre (MELI) Q1 2023 Earnings Analysis

Executive Summary

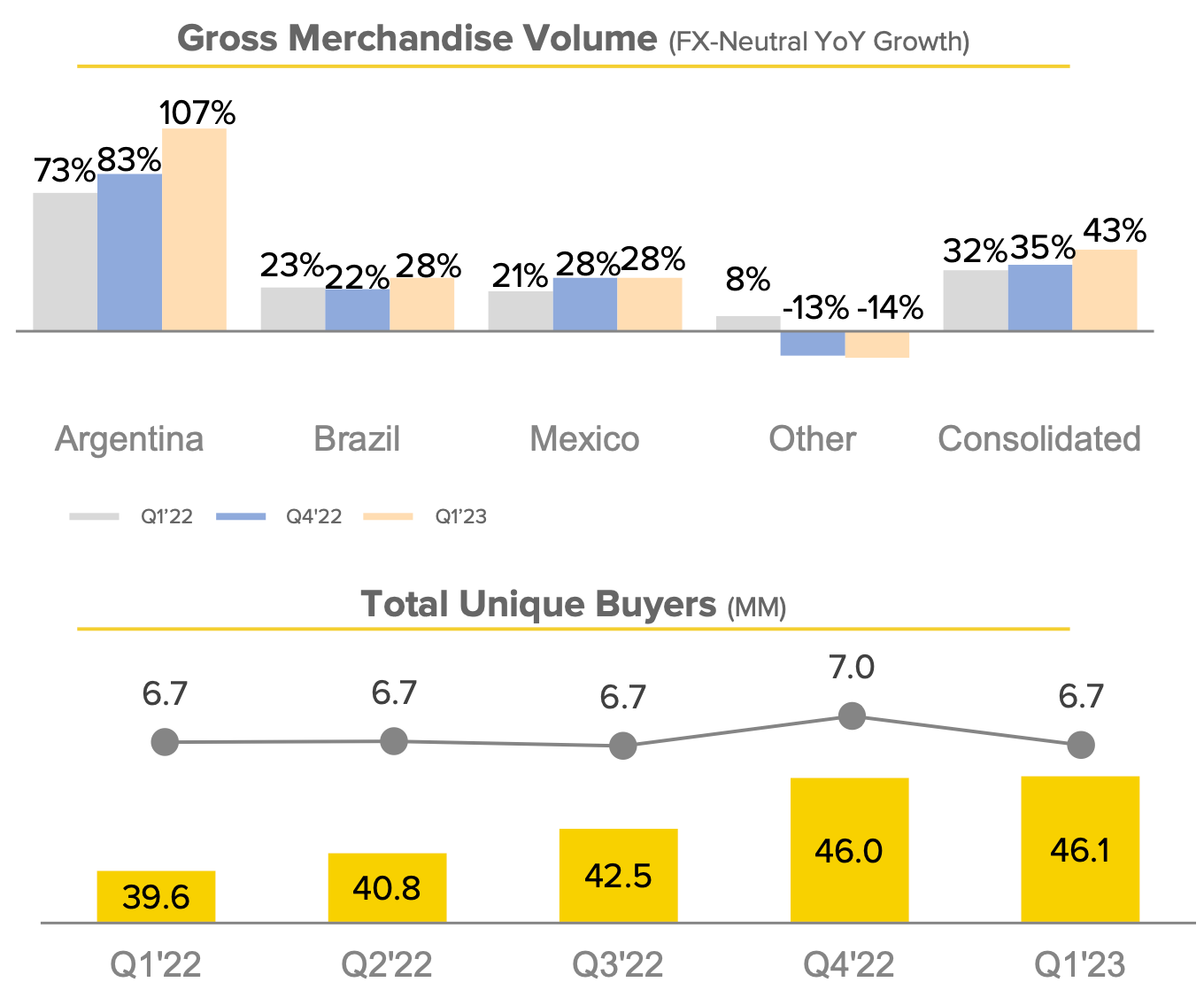

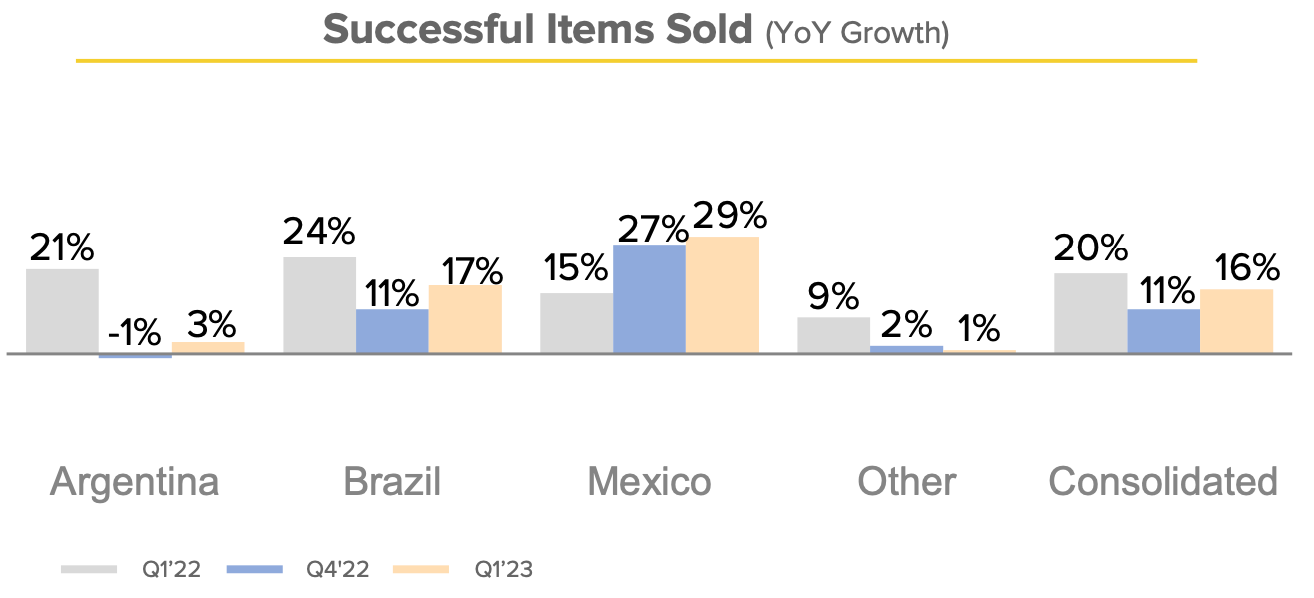

MercadoLibre Marketplace experienced an acceleration in Gross Merchandise Volume (GMV) growth in Q1 2023, with a significant contribution from items sold. Brazil saw a strong acceleration of GMV growth, driven mainly by items sold, while Mexico maintained its strong growth momentum, and Argentina returned to items sold growth.

Mercado Pago's off-platform Total Payment Volume (TPV) continues to drive growth, with triple-digit growth rates in Mexico and Argentina, and Brazil showing good results despite deceleration. Digital Account TPV also grew significantly, with a marketing campaign aimed at developing a deeper relationship with its 44 million quarterly unique active fintech users. Its credit business also delivered a solid performance, with a robust demand and a decreasing non performing loan (NPL) ratio.

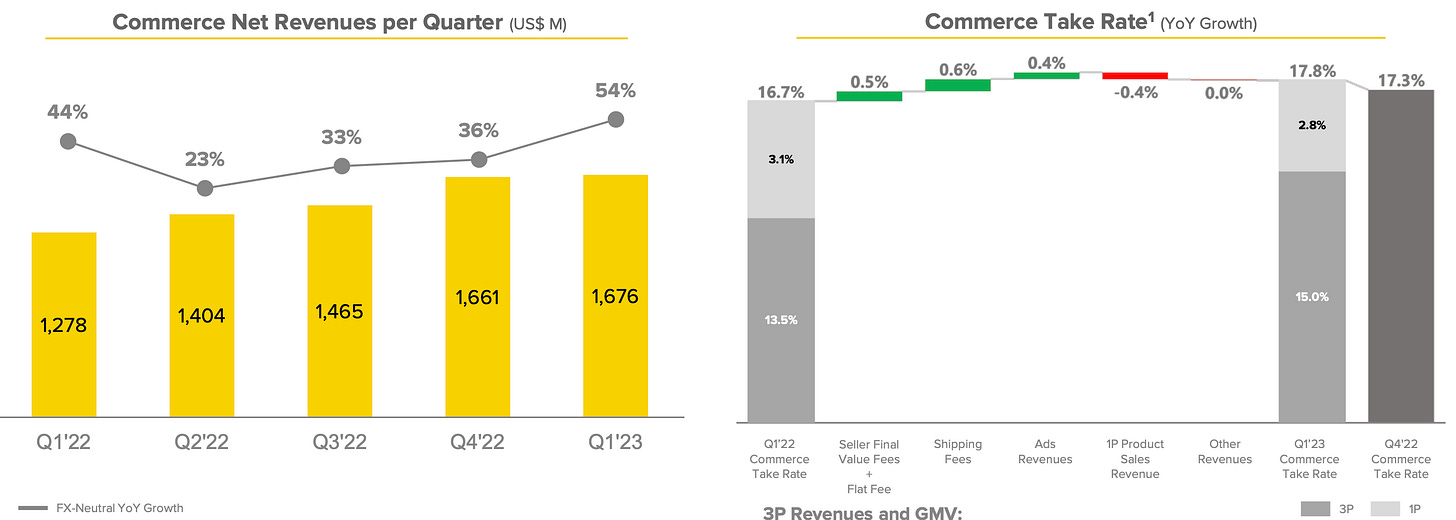

Commerce and Fintech segments both showed strong YoY growth in revenue. The Commerce segment's revenue increase was driven by higher monetisation and faster growth in GMV. Additionally, the growth in Ads and repricing contributed to a higher take rate. While the Fintech segment's revenue continued to grow, the rate slowed compared to the prior year's rapid growth in credit revenues.

Gross profit margin expansion from 47.7% to 50.6% demonstrates that the company is taking steps to improve profitability by reducing costs and improving efficiency, while also focusing on key categories to drive growth. Positive cash flow from operating activities resulting in a free cash flow margin of 25% further underlines the company's commitment to operational efficiency while maintaining high growth rates and managing risks effectively.

Contents

Financial Highlights

Wall Street Expectations

MercadoLibre Marketplace

Mercado Envíos

Mercado Pago

Mercado Credito

Financial Analysis

Conclusion

1. Financial Highlights

Revenue: $3.037 billion +35% year-over-year (YoY)

Service: $2.763 billion +38% YoY

Product: $274 million +9% YoY

Gross Profit: $1.536 billion +43% YoY

Operating Income: $340 million +145% YoY

Net Income: $201 million +209% YoY

Earnings per Share: 3.97

2. Wall Street Expectations

Revenue: $2.88 billion (beat by 5%)

Earnings per Share: 3.04 (beat by 27%)

Source: Zachs

3. MercadoLibre Marketplace

MercadoLibre (MELI) Marketplace experienced significant growth in Q1 2023, with a notable acceleration in Gross Merchandise Volume (GMV) growth. The growth was largely driven by the increase in items sold, especially in Brazil, which saw strong momentum in GMV growth. Mexico also maintained its strong growth momentum, while Argentina returned to items sold growth.

The milestone of surpassing 100 million unique active users across its ecosystem was a significant achievement for MercadoLibre. Unique buyer growth accelerated in all geographies, leading to an acceleration of items sold and GMV growth, resulting in market share gains, particularly in Brazil.

Brazil's momentum continued to strengthen, with a rise in successful sellers and fulfillment penetration playing an important role in driving market share gains. Mexico remained the segment with the highest growth in items sold, while logistics continued to be one of MercadoLibre's strongest competitive advantages in the country. Inflation and a reversal of last year's weakening trend contributed to Argentina's FX-neutral GMV growth.

Growth in MercadoLibre's first party (1P) business accelerated, with adjustments made over the last few quarters aimed at strengthening execution in 1P helping to put the business on a solid footing with higher gross margin, faster inventory turn, and wider use of automatic pricing.

MercadoLibre's advertising business also continued to grow rapidly, with revenue as a percentage of GMV reaching 1.4% in Q1 2023, up 30bps YoY on a much higher GMV base. The launch of the first version of Mercado Ads' Ads Console in a test phase in Q1 2023 will help the company compete for marketing dollars that have historically been difficult to access.

4. Mercado Envíos

MercadoLibre's logistics arm shipped almost 302 million items in Q1 2023, showing an increase of 19% YoY. The company's Total Managed Network penetration reached its highest level at 93.4%, with Chile and Colombia seeing the largest gains.

Logistics played a crucial role in driving market share gains. Fulfillment penetration in Q1 2023 reached a new high of 41%, showing almost a 4ppts YoY increase. Logistics is one of MercadoLibre's strongest competitive advantages in Mexico, where the fulfillment penetration is most advanced, and they continue to have the fastest delivery times in most major urban centers for millions of items.

More than 7,400 Meli Places operated as hubs for sellers and buyers for pick-up, drop-off, and returns, with over 4 million users in Q1 2023. The company's crowdsourcing solution, Mercado Envíos Extra, was also expanded in Brazil, Mexico, and Chile, with Colombia soon to follow.

Over 53% of deliveries were delivered the same or next day, and over 77% of shipments were delivered within 48 hours. Fulfillment by MELI reached a record level of 44%. These statistics indicate that Mercado Envios is making significant progress in providing fast and reliable logistics services to its customers, which is crucial in the highly competitive e-commerce market.

5. Mercado Pago

Mercado Pago's Total Payment Volume (TPV) grew at 96% on an FX-neutral basis in Q1 2023, reaching $37 billion. This growth was mainly driven by off-platform volume, which accounted for $27 billion of the TPV. The off-platform TPV has grown above 100% on an FX-neutral basis for the sixth successive quarter, with Argentina, Brazil, and Mexico showing faster growth rates than Q4 2022.

The Acquiring business of Mercado Pago is performing well across the region. In Brazil, despite decelerating, the move upmarket to serve larger merchants is still showing good results. TPV per device continues to grow nicely, up 26% YoY. In Mexico, Point continues to deliver triple-digit TPV growth, and in Chile, the performance of Redelcom, a business that was acquired at the end of 2021, continues to surpass expectations.

Digital Account TPV, which includes Wallet payments, peer-to-peer transfers within the ecosystem, and transactions using Mercado Pago cards, grew at 164% on an FX-neutral basis in Q1 2023. Brazil and Mexico showed strong double-digit growth rates, while Argentina’s growth was triple-digit and well ahead of inflation.

Mercado Pago launched a marketing campaign to position itself as a full-service digital account with the critical mass of services necessary for users to have their principal financial services relationship with Mercado Pago. The long-term strategy aims to develop a deeper relationship with its 44 million quarterly unique active fintech users.

6. Mercado Credito

Mercado Credito delivered another solid performance in Q1 2023, with the portfolio of $3 billion growing marginally on a sequential basis. The company maintained a cautious approach regarding originations, particularly in Brazil, but even with this cautious approach, it originated $2.7 billion in the quarter.

The Interest Margin After Losses (IMAL) reached 38.8% on an annualized basis, compared to 48.3% in Q4 2022 and 24.7% in Q1 2022. The 1-90 day non-performing loan (NPL) ratio continued to fall, to 9.5%.

Towards the end of the first quarter, Mercado Credito started to slowly accelerate new credit card issuance in Brazil from a low base after several months of improving performance. The credit card was also launched in Mexico in Q1 2023, albeit with limited levels of issuance so far.

7. Financial Analysis

MELI recorded net revenue of $3.037 billion in Q1 2023, representing an increase of 35% YoY in US dollars and a 58% increase on an FX-neutral basis.

The growth in net revenue was broad-based, with double-digit expansion in all segments and all countries.

Commerce revenue was $1.676 billion, an increase of 54% YoY on an FX-neutral basis, driven by higher monetisation and faster GMV growth. Ads growth and repricing also helped drive a higher take rate.

Fintech revenue was $1.361 billion, an increase of 64% YoY on an FX-neutral basis, with growth slowing as the company lapped the prior year's rapid growth in credit revenues. Repricing helped drive a sequentially higher take rate in other fintech revenues.

MercadoLibre's core e-commerce business and Fintech business continue to perform well, and the company is finding ways to improve its monetization and take rate in both segments.

The expansion in gross profit margin of 285 bps is a positive development for the business, as it indicates an improvement in profitability. The dilution of fixed costs suggests that the company has been able to spread its fixed costs over a larger revenue base, which can help to boost profitability. The increase in efficiency in collection fees and shipping costs further adds to this improvement in profitability.

Lowering the 1P mix also contributed to the gross profit margin expansion. This suggests that the company has been focusing on strengthening its execution in 1P, particularly in certain key categories, which is helping to put the business on a solid footing. Additionally, the use of automatic pricing has helped to improve inventory turn and widen the profit margin.

MELI achieved an operating margin expansion of 499bps YoY, driven by lower cost of goods sold, G&A dilution, more efficient marketing spend, and a higher mix of advertising. The expansion of margin was achieved despite sustaining high levels of investment in technology and innovation.

The revenue growth of 35% YoY was higher than the growth rate of cost of net revenues and operating expenses (both growing at 28%). This growth in revenue was driven by a higher mix of advertising and a slightly lower revenue contribution from 1P.

The margin expansion was also driven by improvements in net shipping charges and the dilution of some cost of net revenues and G&A expenses.

The company sustained high levels of investment in technology and innovation, with product and technology development expenses rising 63% year-on-year, albeit deleveraging 200bps as a percentage of sales.

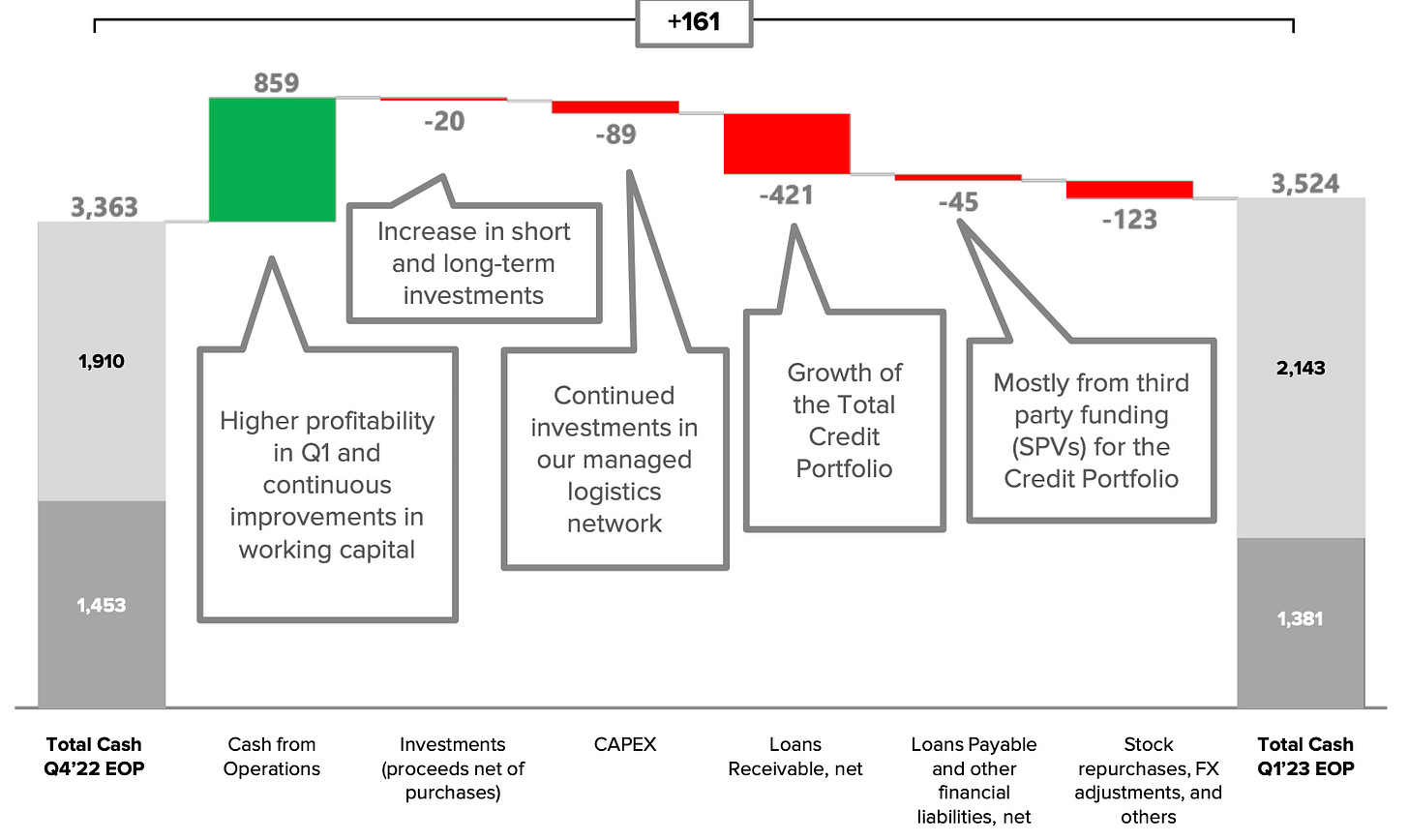

Cash Flow Analysis

During Q1 2023, cash flow from operating activities amounted to $859 million compared to -$233 million during Q1 2022. For the same period MELI recorded free cash flow of $770 million compared to -$370 million in Q1 2022. This represents a FCF margin of 25% for Q1 2023.

Part of the reason for the increased FCF margin was due to CapEx coming in lower than expected. Management explained that there were certain investments in logistics that were initially budgeted for the first quarter but have been pushed back into the second, third, and fourth quarters, indicating an element of phasing to the slowdown in CapEx.

MELI is committed to achieving operational efficiency while maintaining high growth rates and scaling its businesses. The fact that the operating cash flow margin reached 28% is evidence that the company is able to balance growth and profitability while also managing risks effectively. Additionally, the company was able to grow its credit portfolio at a modest pace while maintaining healthy levels of profitability.

8. Conclusion

MELI crushed EPS estimates for the fourth quarter in a row while managing to reaccelerate growth in the Marketplace through items sold and GMV. MELI is proving to be one of the very rare companies that can achieve above average growth whilst also improving profitability metrics.

The earnings call revealed additional insights including:

Ramp-up in monetisation of logistics primarily due to price increases on transportation costs within their network rather than ramping up the monetisation on fulfilment.

Credit models are well-calibrated sorting users in terms of increased risk. Whenever profitability improves, the company expands the segment.

Andean markets (Chile, Colombia, and Peru) opportunity viewed not as a matter of investing more but rather waiting for the market to mature a little bit and for the company to continue to improve execution and product rollouts.

Plans to launch more advertising technology in the next few quarters, hoping it will be adopted by advertisers and increase penetration once again.

MELI’s long-term investment thesis remains as robust as ever. The company is poised to exceed the 23% revenue growth rate estimated earlier this year in a valuation assessment.

Rating: 4 out of 5. Exceeds expectations.

Hit subscribe below if you have not already done so in order to receive the latest content straight to your inbox each week.

If you enjoy today’s edition, then feel free to share as it, it really helps.

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com