MercadoLibre: The Tried and Tested Playbook

MercadoLibre (MELI) Q2 2025 Earnings Analysis

Executive Summary

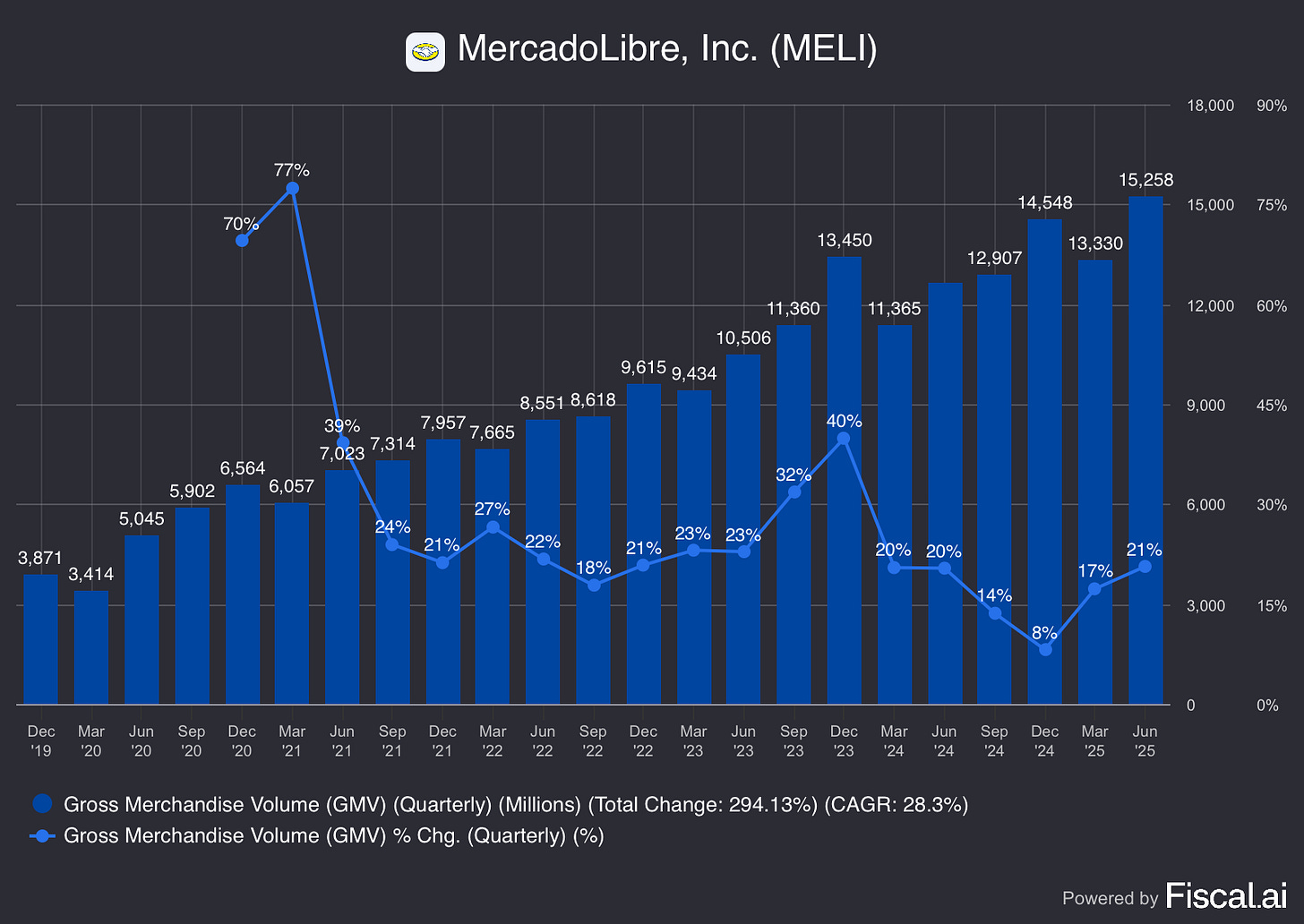

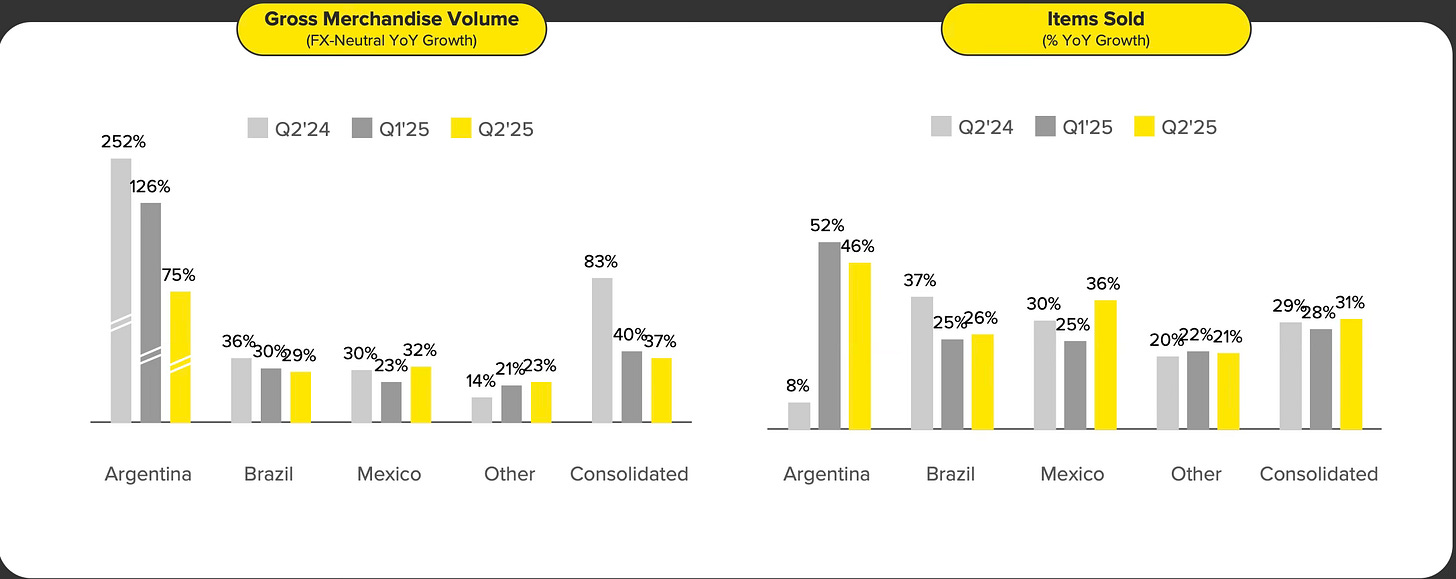

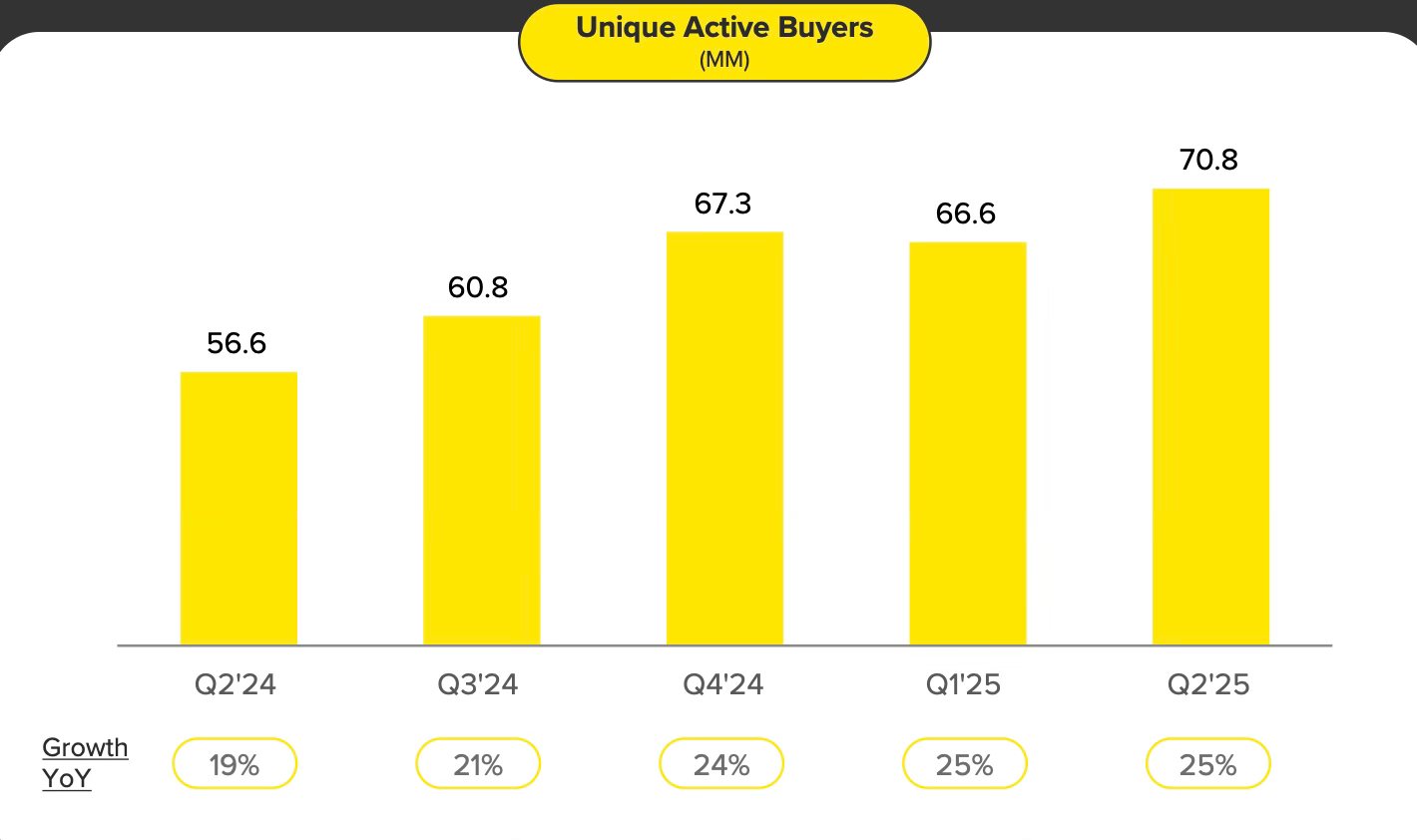

MercadoLibre’s GMV reached $15.3 billion, up 21% YoY and 37% on an FX-neutral basis, marking the second consecutive quarter of growth acceleration and the fastest pace since Q3 2023. Unique buyers grew 25% to 71 million, the highest growth rate since Q1 2021. In Brazil, expanded free shipping eligibility drove higher engagement and a 26% increase in items sold.

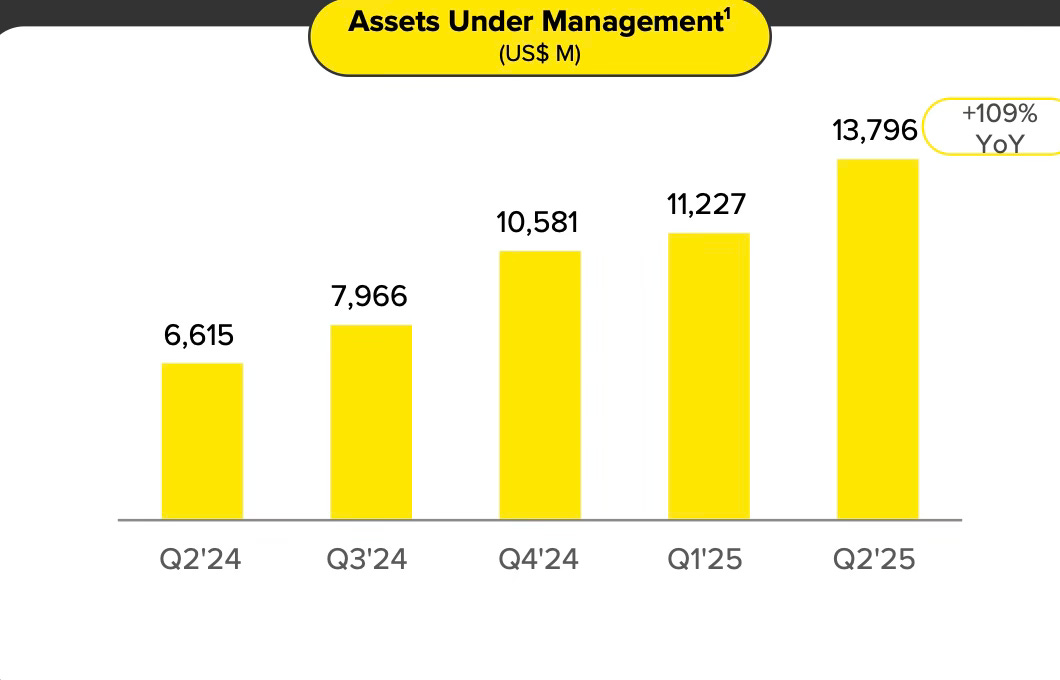

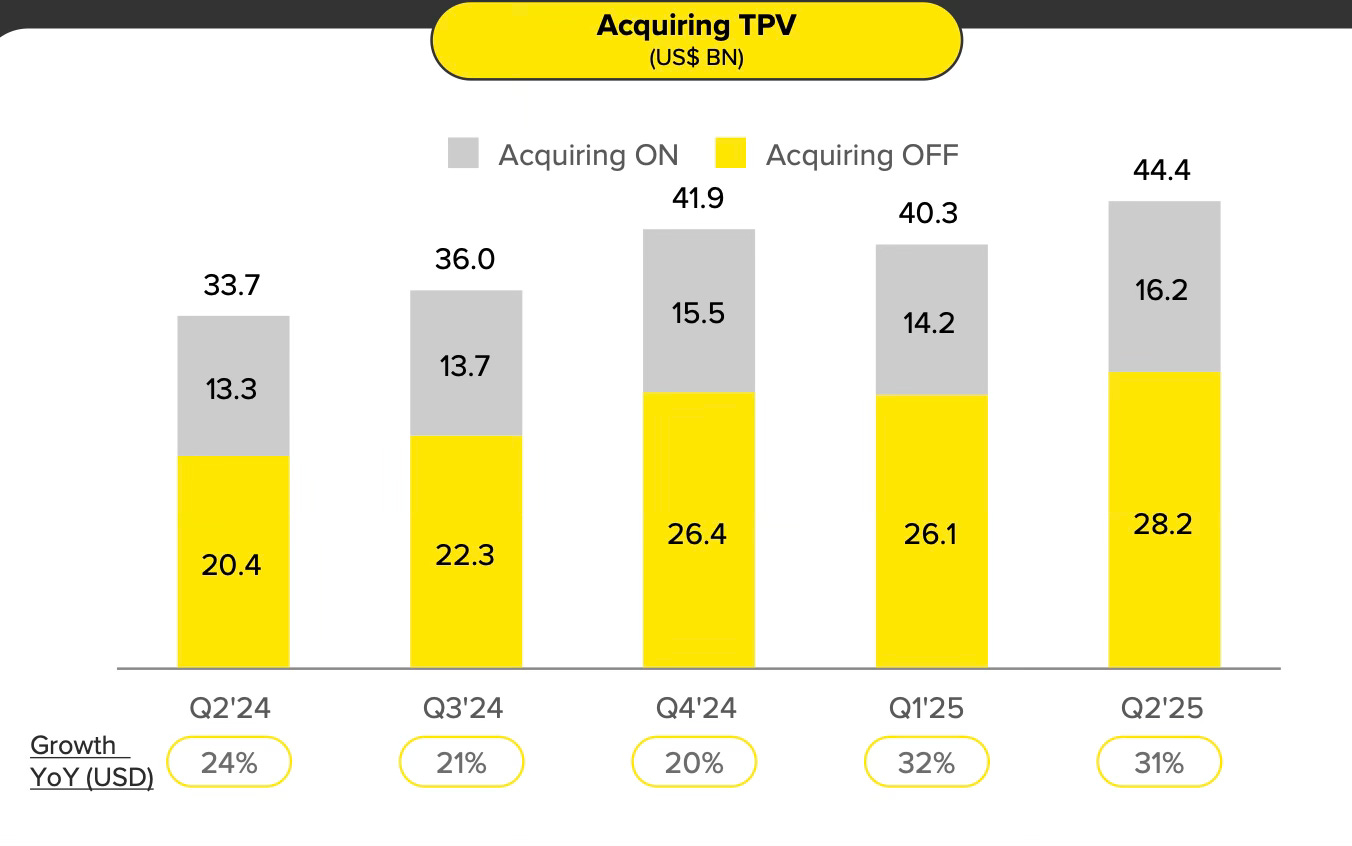

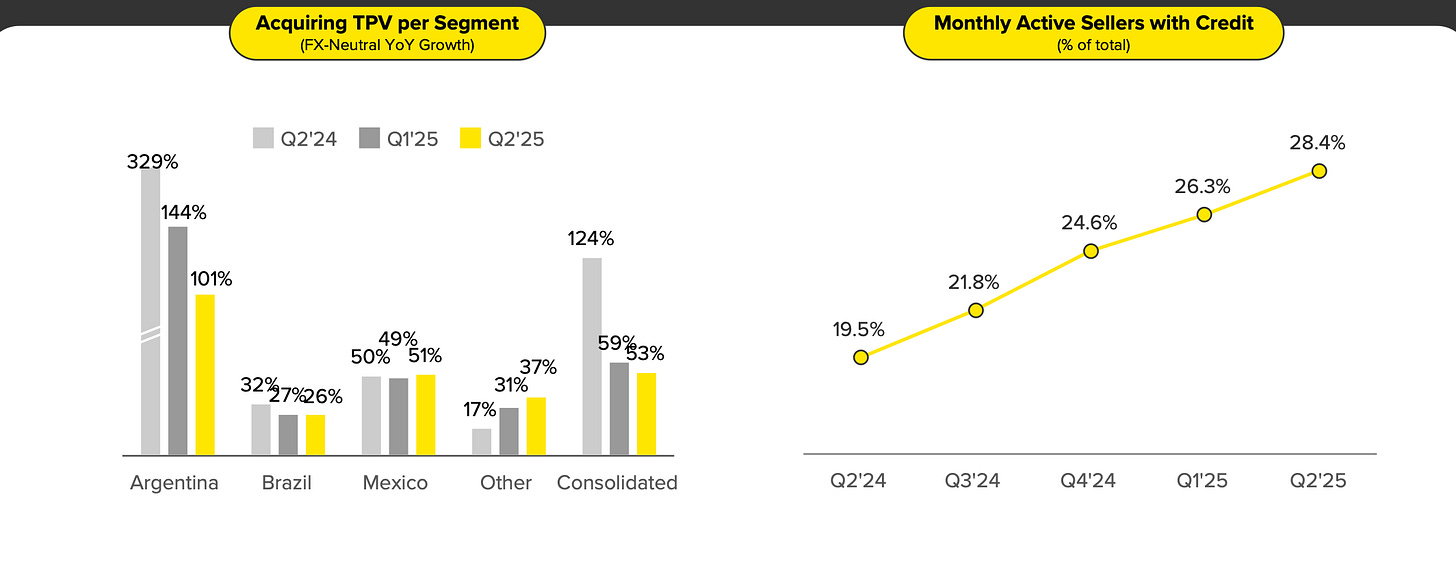

Mercado Pago’s ecosystem continues to scale rapidly, with monthly active users up 30% YoY to 68 million. Assets under management more than doubled YoY to $13.8 billion, representing the platform’s largest sequential increase to date. Acquiring TPV rose 31% YoY to $44.4 billion, with share gains across all major markets.

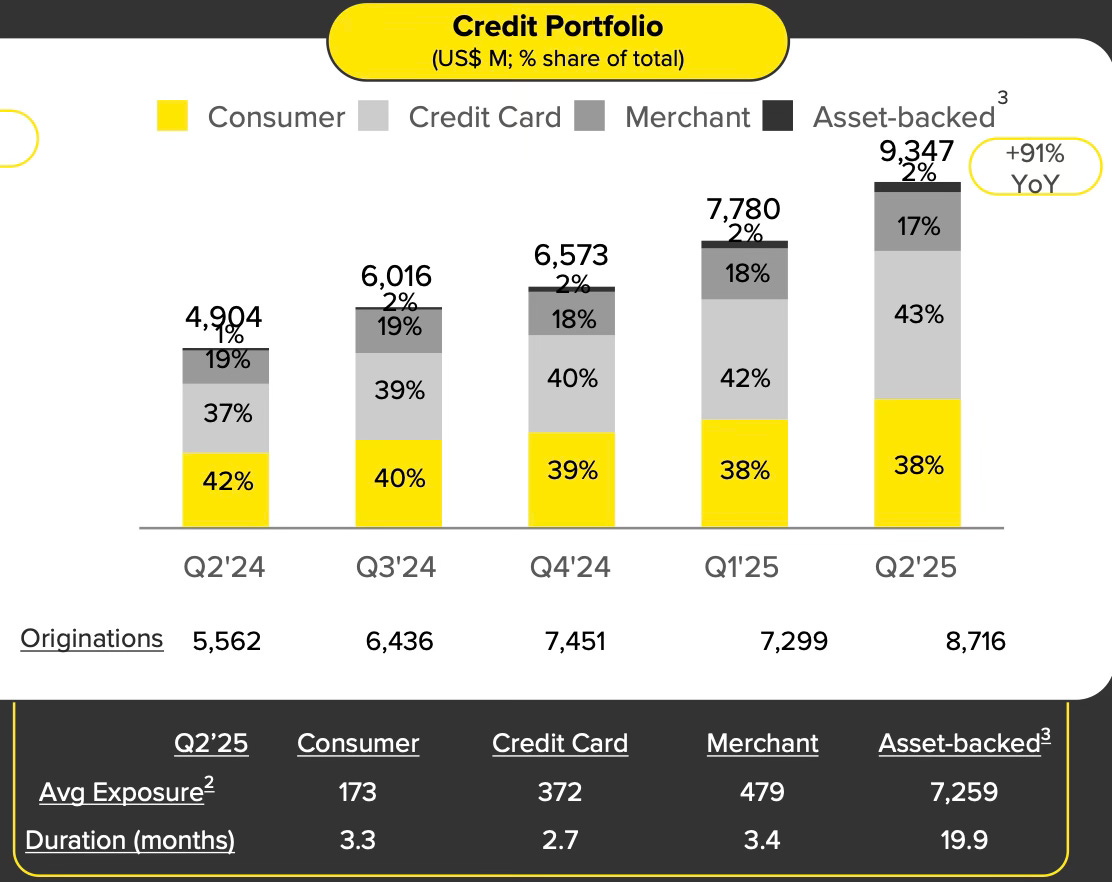

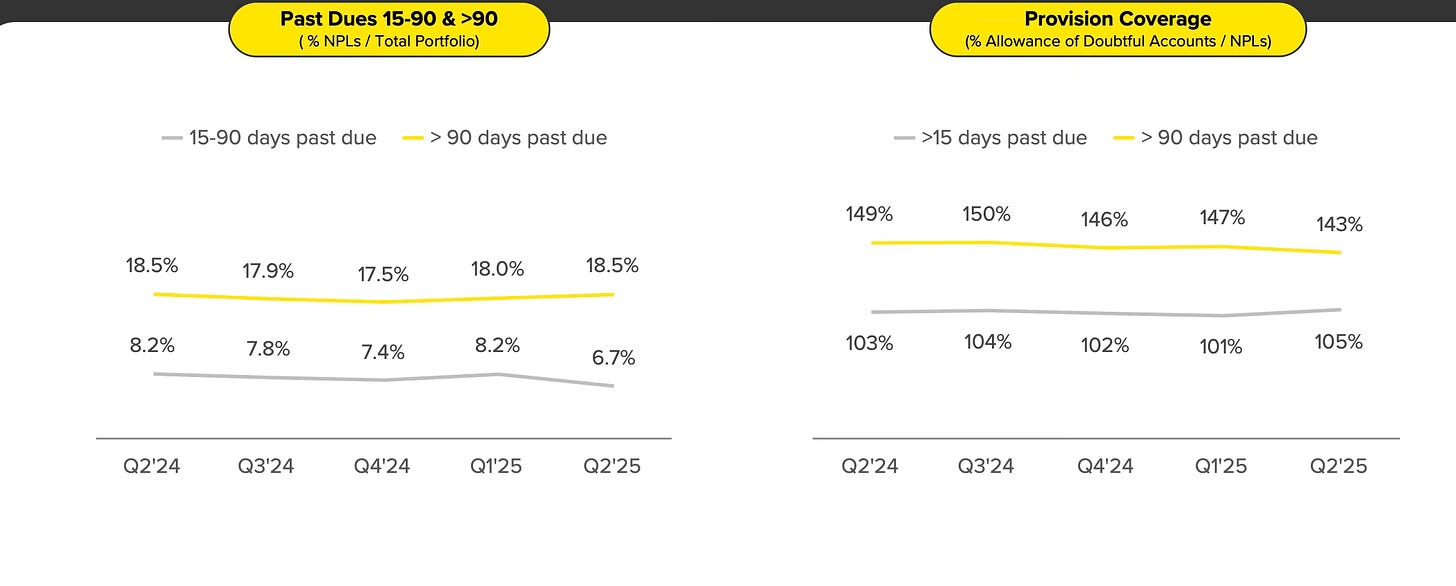

Mercado Crédito’s portfolio grew 91% YoY to $9.3 billion, marking its fastest revenue growth since Q3 2022 and the third consecutive quarter of acceleration. The portfolio has more than tripled since Q3 2022, when it stood at $2.8 billion. Credit cards were a key driver, up 118% YoY to $4.0 billion and now comprising 43% of the credit book, up from 37% a year ago. Asset quality continues to strengthen, with a shift toward lower-risk products. The 15–90 day NPL ratio improved to 6.7%, and provision coverage remained steady at 105%.

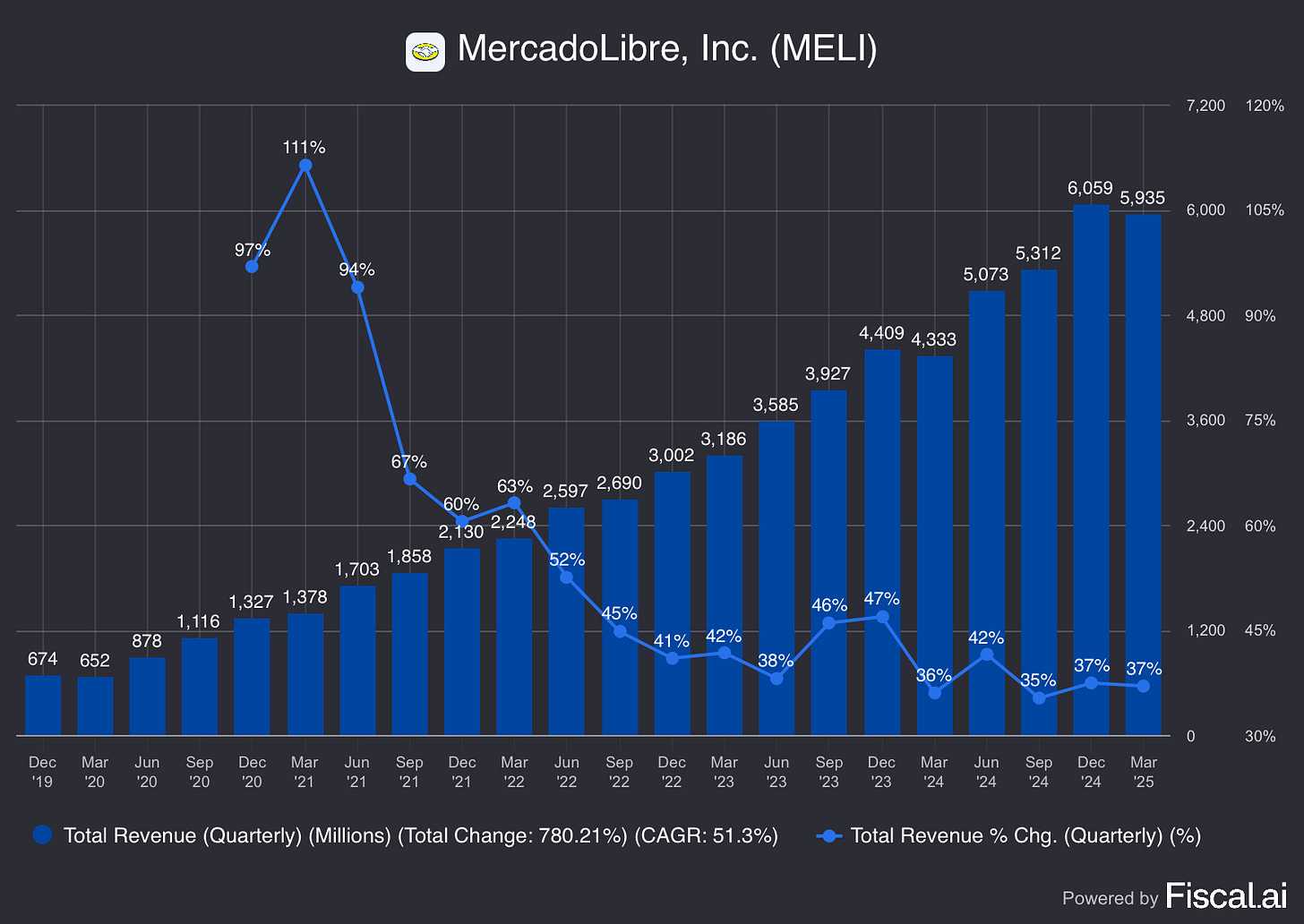

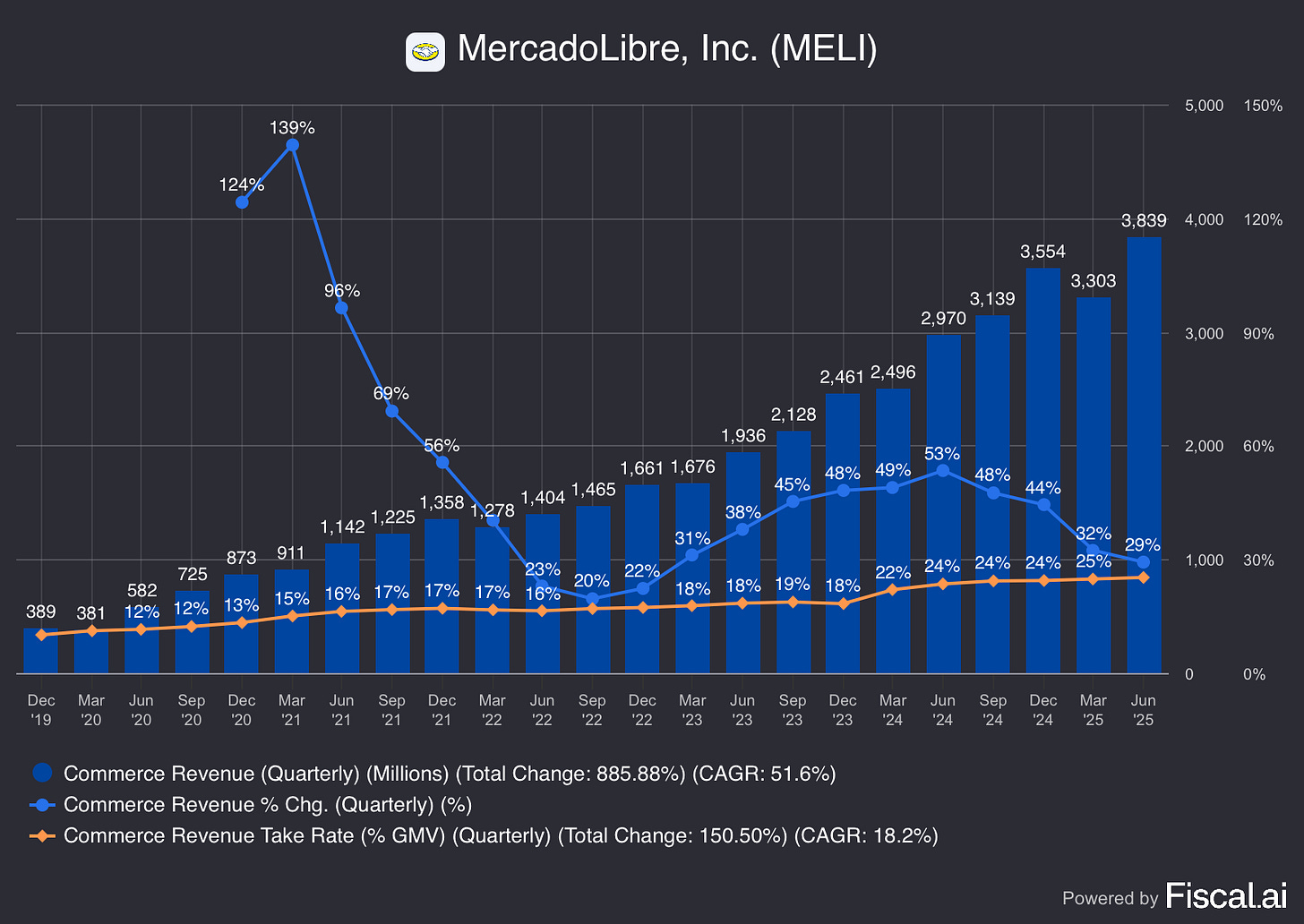

MELI reported net revenue of $6.79 billion, up 34% YoY. Commerce revenue grew 29% YoY to $3.8 billion, supported by a higher 3P take rate of 21.3%. Fintech revenue increased 40% YoY to $3.0 billion, driven by growing credit penetration, although the overall take rate held steady due to a lower mix of financing fees relative to TPV. Gross margin declined 105 basis points to 45.6%, primarily due to strategic investments such as expanded free shipping in Brazil, reduced shipping charges on mid-priced items, and a greater mix of lower-margin 1P sales.

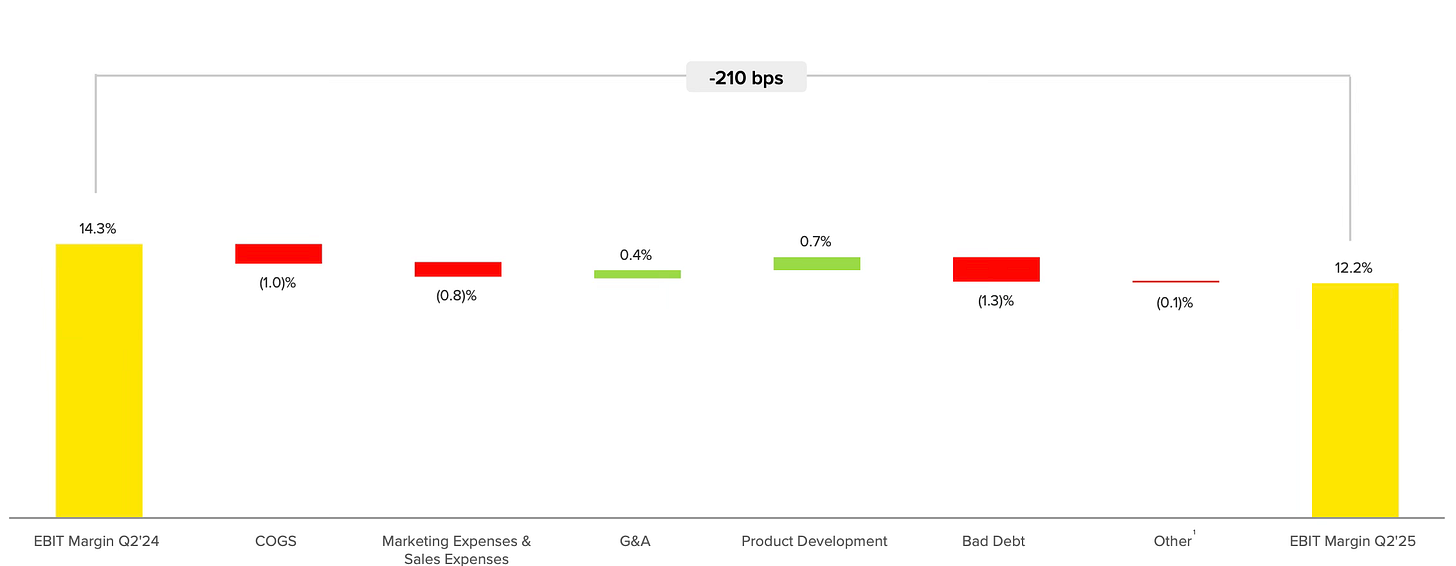

MELI delivered record operating income of $825 million, though the operating margin declined 210 basis points YoY to 12.2%. This margin compression was driven by several factors, including higher sales and marketing spend linked to high-profile campaigns with Neymar and Ronaldo in Brazil, and a rise in provisions for doubtful accounts, reflecting upfront provisioning needs in the fast-growing credit business.

Contents

Financial Highlights

Wall Street Expectations

MercadoLibre Marketplace

Mercado Pago

Mercado Crédito

Financial Analysis

Conclusion

1. Financial Highlights

Revenue: $6.79 billion (+34% YoY)

Operating Income: $825 million (+14% YoY)

Net Income: $523 million (-2% YoY)

2. Wall Street Expectations

Revenue: $6.66 billion (beat by 2%)

EPS: $11.89 (miss by 13%)

3. MercadoLibre Marketplace

MercadoLibre (MELI) reported Gross Merchandise Volume (GMV) of $15.3 billion, up 21% YoY, marking the second consecutive quarter of growth acceleration and the fastest growth rate since Q3 2023. On an FX-neutral basis, underlying GMV growth reached 37%.

Growth was driven by logistics scale, platform enhancements, AI-powered search, and value-added services like instalments and MELI+.

Brazil: MELI expanded its free shipping offer to include millions of items priced from R$19 (previously R$79), boosting engagement and attracting new buyers. These changes, combined with AI-powered search, drove 26% YoY growth in items sold, with June growth accelerating to 34%. FX-neutral GMV rose 29%, maintaining eight straight quarters of ~30% growth despite tougher comps. Its logistics advantage, built on a managed network (since 2017) and more than 30 fulfilment centres, enabled 57% of regional shipments, supporting demand for both fast (paid) and slower (free) delivery options.

Argentina: Buyer growth exceeded 30% for the second quarter in a row, with items sold up 46% and FX-neutral GMV up 75%, aided by premium financing options, rising fulfilment penetration, and record same-day delivery performance.

Mexico: Items sold rose 36% YoY, the strongest growth in two years, driving GMV up 32%. New facilities expanded logistics capacity, pushed fulfillment penetration above 75%, and enabled faster delivery. Improved pricing, financing, and assortment reversed prior weakness in consumer electronics and led to a rebound in first-party (1P) sales.

Unique buyers accelerated to 25% YoY growth, reaching 71 million, the fastest rate since Q1 2021. MELI’s value proposition is resonating more clearly as it brings offline retail online and deepens engagement with its existing base.

MELI's 1P business surpassed $1 billion in GMV for the first time, growing 103% YoY FX-neutral, demonstrating the strategic role of 1P in closing assortment and pricing gaps, especially in underpenetrated categories like consumer electronics.

The company also integrated with Google Ad Manager and AdMob in April, expanding ad reach beyond its ecosystem while leveraging first-party data and campaign attribution to enhance full-funnel performance. Advertising revenue rose 38% YoY (59% FX-neutral), led by strong search growth and nearly doubled Display & Video revenue across markets, narrowing regional gaps.

4. Mercado Pago

Monthly active users (MAU) grew 30% YoY to 68 million. MELI’s Fintech Services continue to gain traction, underpinned by years of focus on user experience and satisfaction, reflected in leading net promoter scores across Brazil, Mexico, Argentina, and Chile.

Mercado Pago launched broad marketing campaigns to promote its yielding accounts and savings products. These offerings, which often outperform traditional deposit rates, have proven effective for user acquisition and engagement, akin to the role free shipping plays in e-commerce. This strategy has helped:

Build the largest retail money market fund in Argentina

Draw capital from Brazil’s large “poupança” market

Accelerate digital payments adoption in Mexico

As a result, assets under management (AUM) posted their largest-ever sequential increase and more than doubled YoY to $13.8 billion.

Acquiring total payment volume (TPV) rose 31% YoY to $44.4 billion (35% FX-neutral), with share gains across all key geographies.

Growth was driven by large merchant solutions, particularly in Argentina, where MELI’s move upmarket outpaced inflation. In Chile, the shift from Redelcom to Mercado Pago devices improved processing speeds and growth. Brazil's Instore segment achieved its fastest TPV growth since Q1 2023, driven by a focus on higher-quality volume. In Mexico, new features like bill payments and dynamic currency conversion supported store traffic and monetisation.

5. Mercado Crédito

Mercado Crédito grew 91% YoY to $9.3 billion, marking the third straight quarter of accelerating revenue growth and the fastest pace since Q3 2022. For context, the portfolio grew 146% to $2.8 billion in Q3 2022, meaning it has more than tripled in less than three years.

The credit card portfolio stood out, up 118% YoY to $4.0 billion, now accounting for 43% of Mercado Pago’s $9.3 billion credit book (up from 37% a year ago). Brazil led growth across credit card, consumer, and merchant segments, while Mexico posted its largest ever quarterly increase in both consumer and credit card portfolios.

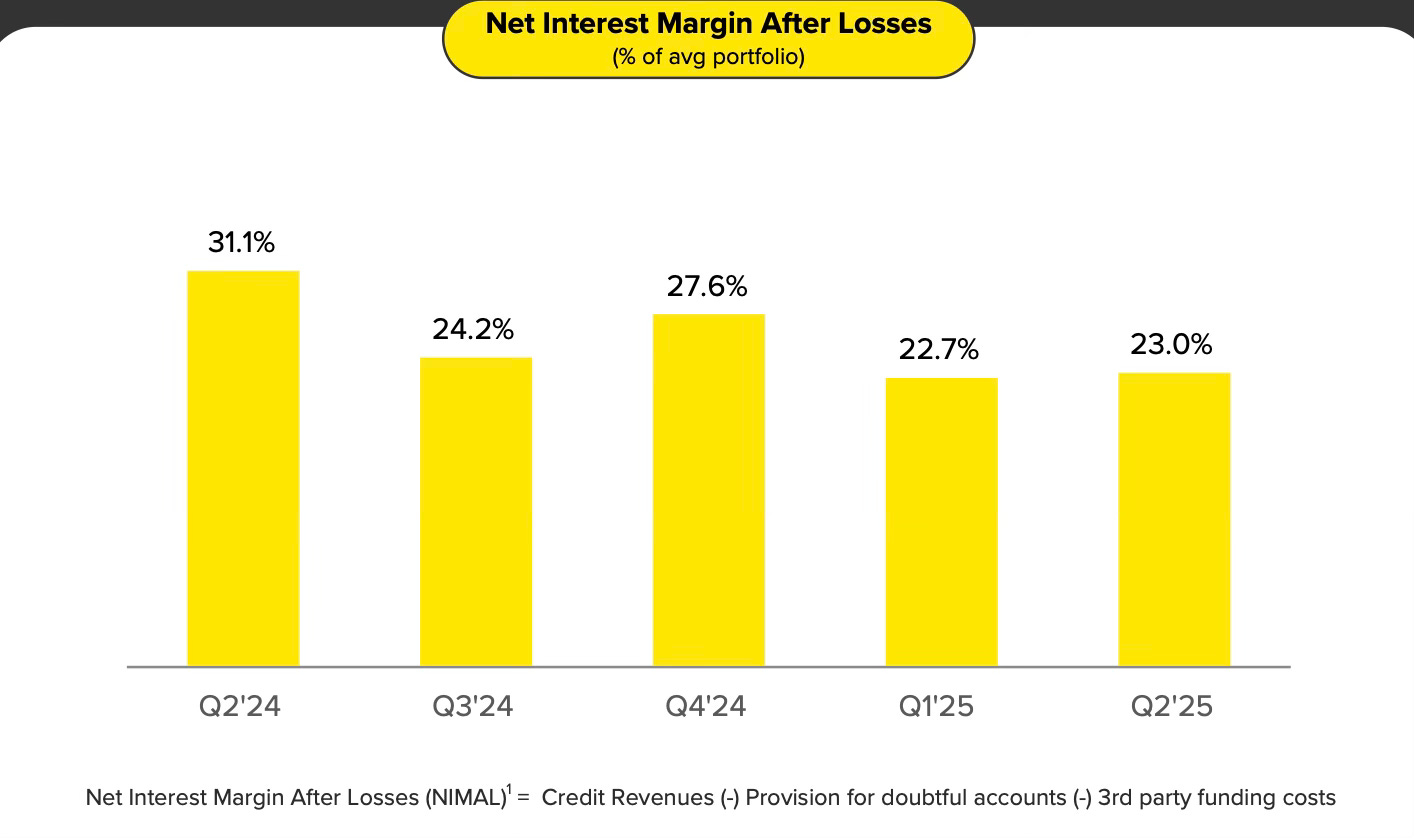

Spreads remained healthy with NIMAL stable at 23%. Profitability continues to improve, particularly in Brazil, where the entire 2023 cohort is now NIMAL positive, consistent with past cohorts that reached this milestone within two years. These profitable cohorts now represent 51% of the Brazilian credit card portfolio, with the larger 2024 cohort also tracking positively.

Asset quality is strengthening as the portfolio expands and shifts toward lower-risk products. The 15–90 day NPL improved both QoQ and YoY to a low of 6.7%, while provision coverage remained stable YoY at 105%.

6. Financial Analysis

Revenue

Net revenue reached $6.79 billion, marking a 34% YoY increase on a reported basis, maintaining strong momentum. On an FX-neutral basis, revenue grew 53% YoY despite lapping shipping reporting updates, incremental investments in free shipping, and reduced shipping charges for sellers.

Commerce revenue grew 29% YoY (or 45% FX-neutral) to $3.8 billion, as the 3P take rate rose to 21.3%. Flat fees, advertising, and loyalty programs helped offset lower shipping revenue as a percentage of GMV.

Fintech revenue reached $3.0 billion, up 40% YoY (63% FX-neutral). The take rate remained broadly flat YoY, with higher credit penetration offset by lower financing fees as a percentage of TPV.

Gross Margin

The reported gross profit margin declined by 105 basis points (1.05%), falling to 45.6% from 46.6% YoY, driven by several strategic investments and business shifts:

Increased Free Shipping: MELI expanded its free shipping offer in Brazil, lowering the threshold from BRL 79 to BRL 19 for millions of items. This "forgone revenue" reduces operating income and margin but is seen as a long-term investment to drive engagement and frequency.

Reduced Seller Fees: MELI also cut shipping charges for sellers in Brazil on items priced between BRL 79 and BRL 200. This eliminated a “cliff edge” in the take rate, encouraging lower prices and greater selection. Most of this reduction was passed through to consumers.

Negative Mix Impact from 1P Business: MELI’s 1P business, where it sells its own inventory, surpassed $1 billion in quarterly GMV for the first time, growing 103% YoY FX-neutral. While strategic for assortment and competitiveness, lower-margin 1P sales diluted the gross margin.

Operating Margin

Operating income hit a new record of $825 million, yet the operating margin declined by 210 basis points to 12.2% from 14.3% YoY.

Key drivers of margin compression:

-1.0 percentage point Higher COGS: Due to the free shipping and 1P mix shift.

-0.8 percentage point Higher Sales & Marketing Expenses: Campaigns across key markets, including celebrity promotions with Neymar and Ronaldo in Brazil, were effective in driving user growth and AUM but pressured short-term margins.

-1.3 percentage point Higher Provisions for Doubtful Accounts: The faster-growing credit business required higher provisions, which are recognized upfront while revenue accrues over time. This creates a temporary mismatch.

Offsetting these pressures, MELI reduced G&A expenses (0.4% margin improvement) and product development costs (0.7% margin improvement).

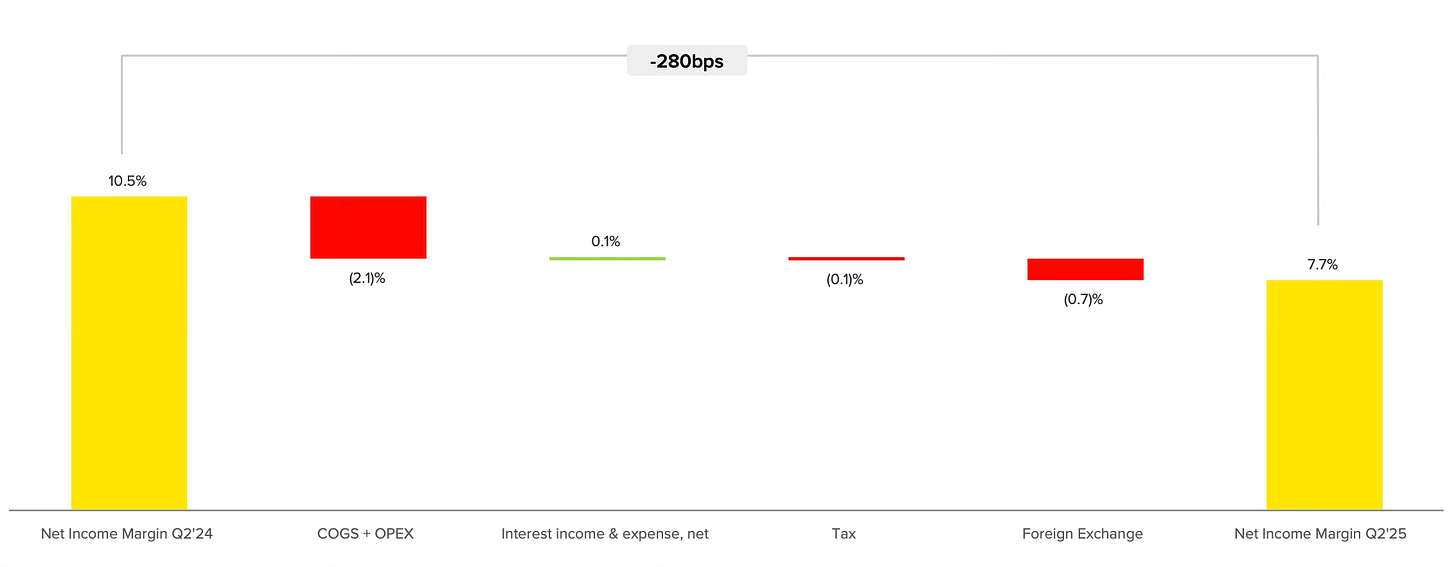

Net Margin

The net margin declined 280 basis points, falling to 7.7% from 10.5% YoY.

Key drivers of contraction:

+2.1 percentage points: Combined effect of higher COGS and operating expenses.

+0.7 percentage points Higher FX Losses: Net FX losses doubled YoY to $117 million, driven by April’s Argentine Peso devaluation. This impact was magnified by MELI’s larger net asset position in Argentina.

+0.1 percentage point Normalised Tax Rate: The effective tax rate increased as prior deductions related to inflation adjustments in Argentina normalised.

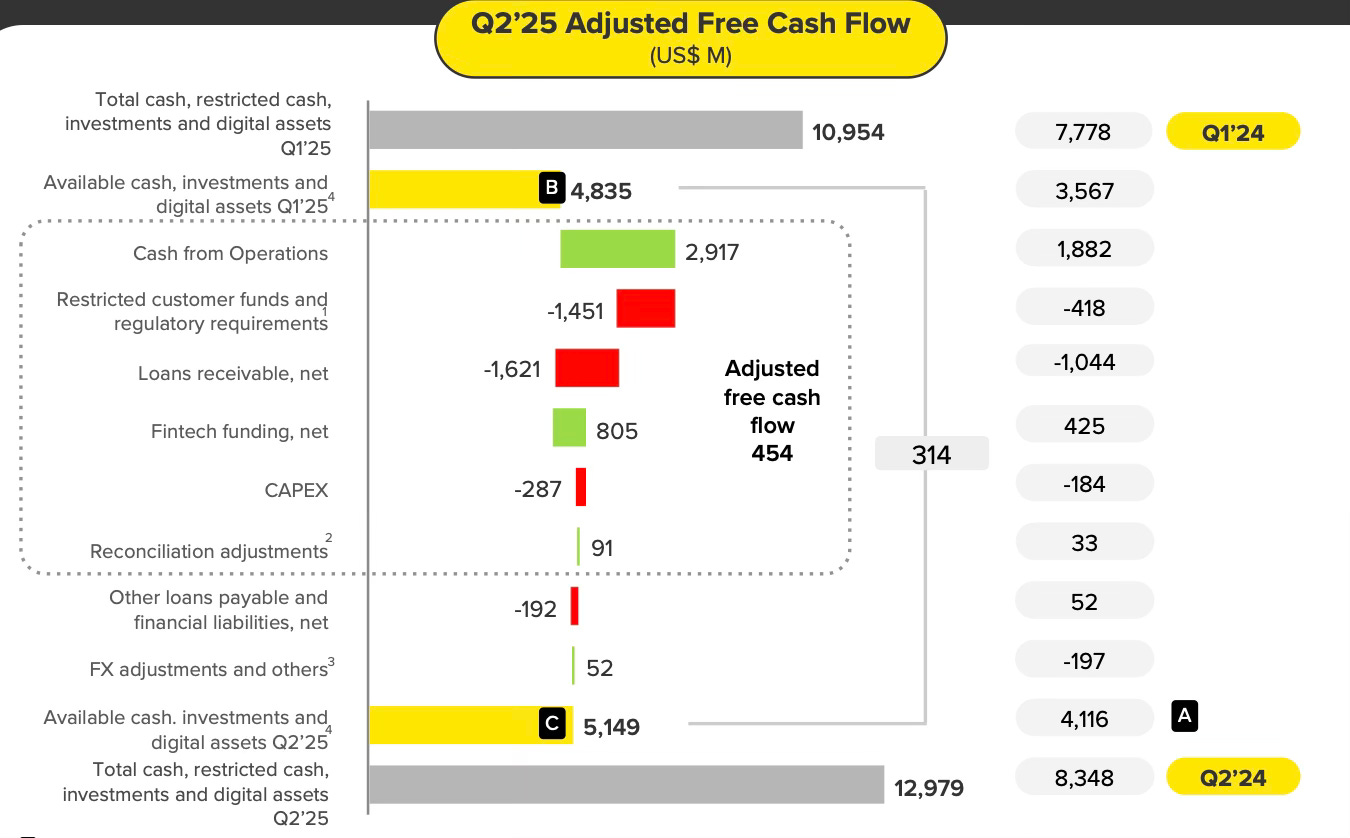

Cash Flow Analysis

MELI reported $454 million in adjusted free cash flow, shaped by:

Net Investment in Fintech Funding: A substantial $816 million was deployed to expand Mercado Pago’s credit portfolio. This lowered the proportion of receivables discounted and increased leverage.

Capital Expenditures (Capex): Capex totaled $287 million in Q2 2025.

Despite these investments, MELI optimized funding by using lower-cost alternatives and discounting fewer receivables in Brazil. This prudent approach led to a credit rating upgrade to investment grade (BBB-) by S&P in July, following Fitch’s similar upgrade last year.

MELI’s balance sheet remains healthy with:

$3.9 billion in cash and restricted cash

$4.6 billion in short-term investments

$3.5 billion in long-term debt

7. Conclusion

This earnings report feels like déjà vu. Once again, MELI has prioritized long-term growth and market leadership over short-term profitability. Several strategic takeaways stand out:

Free Shipping as a Strategic Lever: Lowering the free shipping threshold to BRL 19 is a clear example of forgone revenue that sacrifices short-term profitability for long-term gains. Management views it as essential to drive conversion, retention, and customer satisfaction, similar to successful initiatives dating back to 2017.

Investing in Fintech Reach: High-profile campaigns for Mercado Pago, while costly, have significantly expanded its user base and AUM, with the yielding account strategy described as the "Fintech equivalent of free shipping", removing friction and attracting deposits for long-term engagement.

Scaling the 1P Business: The rapid rise in 1P GMV, despite its lower margins, strengthens MELI’s value proposition in key categories, addressing assortment gaps and price competitiveness.

Disciplined Credit Expansion: Credit issuance is accelerating, but MELI remains focused on quality and profitability. Improved models and successful cohort performance underscore a strategy that balances growth with risk.

MELI is borrowing from Costco’s playbook, choosing to reinvest scale efficiencies into lower prices and better services instead of short-term profit maximization. Whether it is free shipping, market-leading yields, or credit offerings, MELI is doubling down on its value proposition to expand market share and entrench its leadership in Latin America.

This revenue beat and earnings miss was no surprise, I predicted it in the July 2025 Portfolio Review. Having followed MELI for years, I’ve seen how Wall Street repeatedly fails to understand its model well enough to forecast short-term performance.

Take Q3 2024 as an example. MELI missed EPS estimates by 21%, the stock dropped 16%, and then rallied 35% over the next nine months. This quarter, MELI once again focused on the long term and the stock opened down 6% before finishing the day green. This time won’t be different.

Rating: 3 out of 5. Meets expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Makes sense. Thanks again.

Great update - not sure how you turn these so quickly during the week but really appreciate it. Very solid quarter for me - lots of strategic decisions being made to support long term growth & reinforce the moat.