MercadoLibre: Opportunity Meets Execution

MercadoLibre (MELI) Q2 2023 Earnings Analysis

Executive Summary

MercadoLibre Marketplace achieved a significant milestone with quarterly GMV exceeding $10 billion for the first time, driven by strong expansion in Mexico and Brazil. This growth is supported by a consistent rise in items sold per buyer and an increase in unique buyers across major markets. The company's focus on executing successful events and adapting category-specific strategies has also contributed to achieving this milestone.

Mercado Envios continues to invest in improving logistics and delivery efficiency, evident through record high same-day and next-day shipments, growing shipment volume, and expansion of managed network services. The increased penetration of fulfillment solutions and the introduction of innovative solutions like Mercado Envíos Extra contribute to enhancing customer experience and driving the success of Mercado Libre's logistics ecosystem.

Mercado Pago achieved significant growth, with strong TPV and user base expansion. Its consistent growth, strategic partnerships, and innovation reinforce its leadership in the regional fintech landscape. Mercado Crédito demonstrated healthy portfolio growth, profitability, and successful credit card initiatives in Brazil and Mexico. A focus on risk management and asset quality resulted in favorable provisioning and NPL trends.

MELI experienced impressive revenue growth across all geographies and segments. Commerce segment revenue growth surged 65% driven by increased 3P GMV, higher 1P share, and ongoing monetization efforts that elevated the take rate. Gross margin expansion from 49.4% to 50.4% was attributed to multiple factors including cost dilution, efficiency, and strategic adjustments in POS device sales.

MELI’s ability to drive leverage in its financial model is evident from the significant growth in cash flow from operating activities and free cash flow, highlighting its strong overall financial health and cash generation capacity.

Contents

Financial Highlights

Wall Street Expectations

MercadoLibre Marketplace

Mercado Envíos

Mercado Pago

Mercado Credito

Financial Analysis

Conclusion

1. Financial Highlights

Revenue: $3.415 billion +32% year-over-year (YoY)

Operating Income: $558 million +123% YoY

Net Income: $262 million +113% YoY

Earnings per Share: 5.15

2. Wall Street Expectations

Revenue: $3.26 billion (beat by 5%)

Earnings per Share: 4.13 (beat by 25%)

Source: Zachs

3. MercadoLibre Marketplace

MercadoLibre (MELI) Quarterly Gross Merchandise Volume (GMV) exceeded $10 billion for the first time, propelled by a YoY FX-neutral growth of 47%. Mexico's GMV growth accelerated to 34% YoY, while Brazil maintained solid growth at 25% YoY. This suggests significant market share gains, as indicated by third-party data.

Mexico experienced accelerated GMV growth due to a surge in new buyer adoption, supported by a well-executed Hot Sale event. In Brazil, GMV growth remained robust, with all categories contributing to a 25% YoY growth.

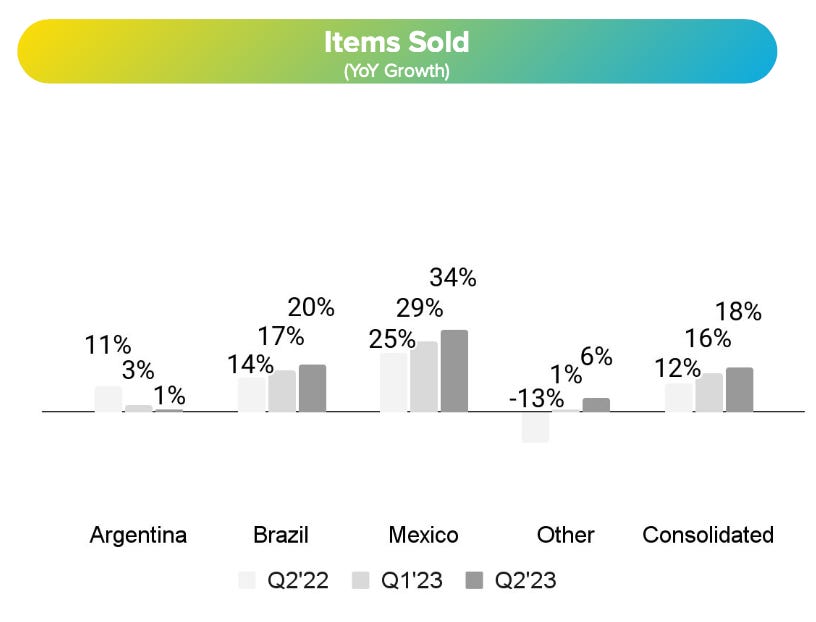

MELI's sales of items continued to accelerate for the third consecutive quarter, growing by 18% YoY in Q2. This growth trend is noteworthy, as it signifies sustained demand and user engagement on the platform.

The number of unique buyers grew by nearly 17% YoY across major markets, particularly in Brazil and Mexico. This expansion highlights the platform's ability to attract and retain new customers, driving overall growth.

The metric of items sold per buyer remained consistent with prior quarters. However, this measure was impacted by lower items sold in the Supermarket category, following adjustments made to the category's free shipping threshold in the previous year.

4. Mercado Envíos

MELI achieved over 100 million same-day and next-day shipments, representing 56% of all deliveries. This marked a historic high for the company, showcasing the positive impact of ongoing logistics investments on delivery speed and reliability.

MELI shipped nearly 319 million items during the quarter, indicating YoY growth of 21%. This growth highlights the increasing demand for the platform's services and products.

Around 80% of shipments were delivered within 48 hours throughout Latin America, underscoring the effectiveness of the logistics network in ensuring timely deliveries across the region.

The Total Managed Network penetration reached a record high of 93.9%, emphasizing the widespread utilization of MELI's managed logistics solutions. Fulfillment by MELI penetration also hit a new record of over 46%, with all markets witnessing increased penetration, particularly Brazil.

Meli Places, a network of partner locations, surpassed 8,000 locations, serving millions of buyers and sellers. This expansion improves convenience and accessibility for customers and sellers alike.

Mercado Envíos Extra, a crowdsourcing solution for last-mile delivery, expanded its operations to four countries: Brazil, Mexico, Chile, and Colombia. The launch in Colombia during Q2 extends the reach of this solution and showcases the company's commitment to innovative logistics solutions.

5. Mercado Pago

Mercado Pago's Total Payment Volume (TPV) exceeded $42 billion, with impressive YoY FX-neutral growth of 97%. This growth was widespread across major regions, highlighting the platform's increasing popularity for transactions.

Off-Platform TPV in Argentina significantly outpaced the country's inflation rate, indicating Mercado Pago's ability to provide value and maintain its competitiveness in the market.

Acquiring TPV experienced continuous growth across geographies and product lines. Argentina and Mexico saw accelerated growth quarter-on-quarter, and Mexico and Chile achieved triple-digit TPV growth in point-of-sale (POS) transactions, surpassing Argentina's POS TPV combined.

Merchant Services and QR TPV exhibited sequential acceleration, compensating for slightly slower yet still robust growth in POS. Digital Account TPV maintained rapid growth, driven by Mexico and Argentina, with the latter's growth exceeding the country's inflation rate.

Debit card volume in Chile increased by half quarter-on-quarter (QoQ), attributed to partnerships with online businesses and transactions during events like CyberDay.

The number of Unique Fintech Active Users reached a new milestone, surpassing 45 million users within a quarter. This increase was largely driven by the rising adoption of remunerated accounts in Brazil.

On the conference call, management shared a detailed view of the fintech operations in Mexico. The following are the key insights to be gleaned:

Mexico is a growing market with a substantial population and lower financial services adoption compared to other Latin American markets. Mercado Pago aims to capitalize on this opportunity and position itself as a leader in digital payments and financial services.

Mexico's remittances (a service used by millions of Mexicans every month) present an opportunity to encourage digital cash transfer into the digital account. Partnerships with established players and a startup, Felix Pago, facilitate these transfers, aiding the shift from cash-based transactions.

Mercado Pago users in Mexico can open a free digital account within minutes, offering interest on stored money, free debit card usage, transfers, and online payments.

6. Mercado Credito

MercadoLibre's credit portfolio grew by 7% QoQ to $3.3 billion. The NIMAL (Net Interest Margin after Loan Loss Provisions) expanded to 36.8% in Q2, driven by consistent low-single digit dollar growth in the total portfolio, primarily fueled by Mexico's consumer and Brazil's credit card portfolios.

Revenue growth was achieved through accelerated originations in the Mexican consumer book and repricing in the Argentinian books. Bad debt decreased due to shifting originations and portfolio growth from Brazil to the lower-risk Mexican consumer book, along with continuous improvement in credit card asset quality.

Mercado Crédito maintained a measured approach to credit card originations, resulting in encouraging Q2 profitability and delinquency results.

<90-day NPLs increased slightly due to the Merchants book, partially offset by credit card improvements. >90-day NPLs showed a downward trend for the second quarter, with improvements seen in the 90 to 300 days past due (dpd) buckets, particularly in Brazil's loans.

The provision in Q2 accounted for 6.8% of the portfolio. Although provisioning policies and accounting practices remained consistent across all books, a decrease in the Provision for Doubtful Accounts (PDA) was due to a focus on improved asset quality in credit risk management. Provision coverage increased sequentially and remained above 100%.

7. Financial Analysis

MELI recorded net revenue of $3.415 billion in Q2 2023, representing an increase of 32% YoY in US dollars and a 57% increase on an FX-neutral basis. On a sequential basis net revenue increased 12% QoQ in US dollars. This represents the largest acceleration in QoQ revenue growth since Q2 2022.

The growth in net revenue was broad-based, all geographic segments delivering revenue growth above 20% YoY in US dollars.

Commerce revenue growth accelerated 65% YoY on an FX-neutral basis to $1.936 billion, driven by 3P GMV growth, a higher share of 1P and continued monetisation efforts that drove the take rate higher.

Fintech revenue was $1.479 billion, an increase of 48% YoY on an FX-neutral basis, with growth slowing as the company lapped the prior year's rapid growth in credit revenues. Repricing helped drive a sequentially higher take rate in other fintech revenues.

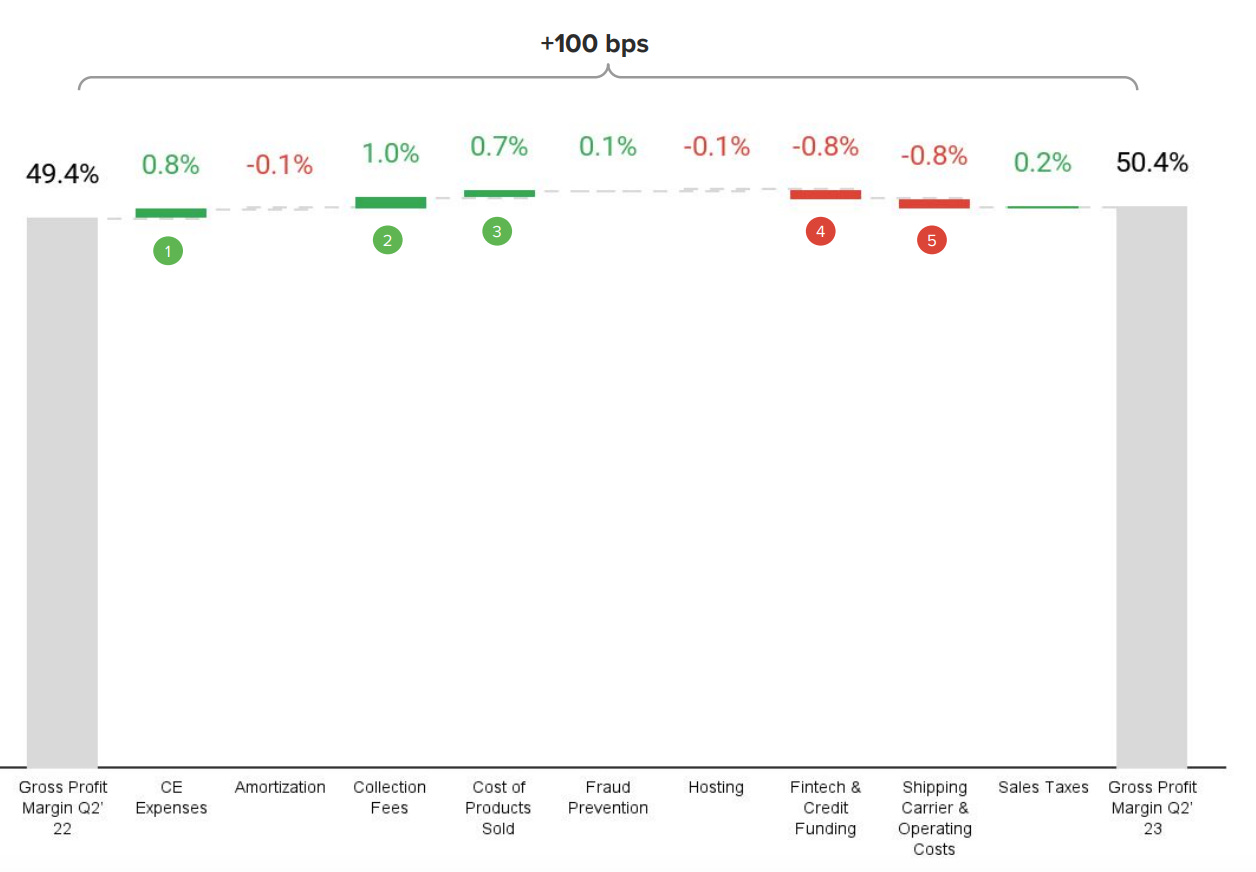

The expansion in gross profit margin of 100 bps was primarily fueled by cost dilution and increased efficiency. Lower point-of-sale (POS) device sales also contributed to this expansion.

Customer Experience Cost Improvement: Dilution of Customer Experience costs positively impacted gross margin by +0.8%, reflecting improved cost management in this area.

Higher Volumes from Own Acquirer: Increased volumes through the company's own acquirer contributed +1.0% to gross margin expansion, indicating improved transaction volumes and processing efficiency.

Positive Impact of Lower POS Device Sales: The gain from lower POS device sales had a positive effect on gross margin (+0.7%), indicating increased profitability due to reduced device-related expenses.

Impact of Higher Funding Costs: Gross margin was negatively impacted by higher funding costs, including Certificates of Deposit (CDBs) related to credit offerings (-0.8%).

Increased Shipping Operations Costs: Higher costs in shipping operations, primarily due to increased fulfillment penetration, had a negative impact on gross margin (-0.8%).

MELI achieved an operating margin expansion of 670bps YoY, driven by lower cost of goods sold, G&A dilution, more efficient marketing spend, and better asset quality.

Impact of Higher Product Development Expenses: A decrease in margin by 1.4% was attributed to higher Product Development expenses, suggesting increased investment in research and development activities to innovate and enhance products.

Dilution of Operating Expenses, Particularly G&A: The margin gain was positively impacted by the dilution of operating expenses, notably General and Administrative (G&A) costs, contributing +1.3% to the margin improvement.

Improved Asset Quality and Limited Credit Growth: The credit business demonstrated better asset quality, coupled with limited growth in loan originations, which positively impacted margins. Additionally, dilution from other revenue streams growing faster than the Credits business added +5.2% to the margin.

MercadoLibre's core e-commerce business and Fintech business continue to perform well, and the company is demonstrating its increasing ability to drive leverage in its financial model.

Cash Flow Analysis

YTD 2023 cash flow from operating activities amounted to $2.27 billion compared to $674 million during the same period in 2022. For the same period MELI recorded free cash flow of $2.07 billion compared to $438 million in 2022. This represents a FCF margin of 38% for Q2 2023 and 32% for YTD 2023.

Koyfin is the tool that I use to screen and analyse stocks. In my opinion, it is the most comprehensive financial data and visualisation tool that makes the research process so much easier for investors. If you would like to try it for yourself, follow the link below to receive a 10% discount.

The increased cash flow from operating activities and free cash flow demonstrates that MELIs profit growth and margin expansion are translating into cash generation.

8. Conclusion

MELI continues its strong momentum with rapid top-line growth and significant margin expansion across geographies and business units. Despite its size, the company maintains high revenue growth combined with operational efficiency, leading to a substantial increase in income from operations margin, which more than doubled YoY, setting a new quarterly record. The results demonstrate the long-term margin and cash potential as the company scales.

What should excite investors most is the enormous market opportunity that exists for MELI. Management discussed the Mexico market opportunity and for good reason. Mexico has the largest unbanked population in the region, surpassing Brazil by over 15 million people. The untapped opportunity is hard to overstate.

Management execution has been absolutely flawless to date. Part of this has been due to the leadership of CFO Pedro Arnt. Subsequent to the earnings release, Arnt announced that he will leave MELI to join dLocal as co-CEO in a shock move. Arnt was replaced by Martin de los Santos, the head of the Mercado Credito segment. While loosing Arnt is no doubt a blow to MELI, Martin de los Santos, who has been with the company since 2008, has been instrumental in launching and scaling the credits division.

MELI is a prime example of a quality business consistently surpassing expectations magnifying the compounding effect. As part of my MELI investment thesis earlier this year (linked below), I projected revenue growth of 23% and $1.3 billion of FCF for 2023 suggesting the stock was 39% undervalued. After two stellar quarters, analysts now forecast 31% revenue growth and $3.2 billion FCF in 2023!

Rating: 4 out of 5. Exceeds expectations.

Hit subscribe below if you have not already done so in order to receive the latest content straight to your inbox each week.

If you enjoy today’s edition, then feel free to share as it, it really helps.

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com