As investors, we spend a lot of time tracking everything we can to measure how well a company is performing. While this is important, we invariably run into the same problem: we want to see all key metrics going up, but we’re not sure which one really moves the needle.

Although it’s tempting to always default to financial KPIs, the best North Star Metrics help businesses understand how customers truly derive value from their products. This focus on customer value is crucial for sustainable growth and helps investors gauge the company's market fit and potential for expansion. While revenue itself shouldn't be the North Star Metric, a properly chosen metric should lead to revenue growth. This connection to financial performance is essential for investors evaluating the company's potential returns.

Let's examine some North Star Metrics for a selection of stocks I follow closely as case studies. Grouping these stocks by sector reveals clear themes.

Marketplace

MercadoLibre

⭐ Gross Merchandise Volume

Gross Merchandise Volume (GMV) represents the total value of all transactions completed through MercadoLibre's marketplace, offering a clear view of its core e-commerce business performance. An increase in GMV typically correlates with higher revenue through marketplace fees, shipping fees, and other ancillary services. By focusing on GMV as a North Star Metric, investors can gauge MercadoLibre's overall growth, market penetration, and the success of its e-commerce platform in Latin America.

Sea Limited

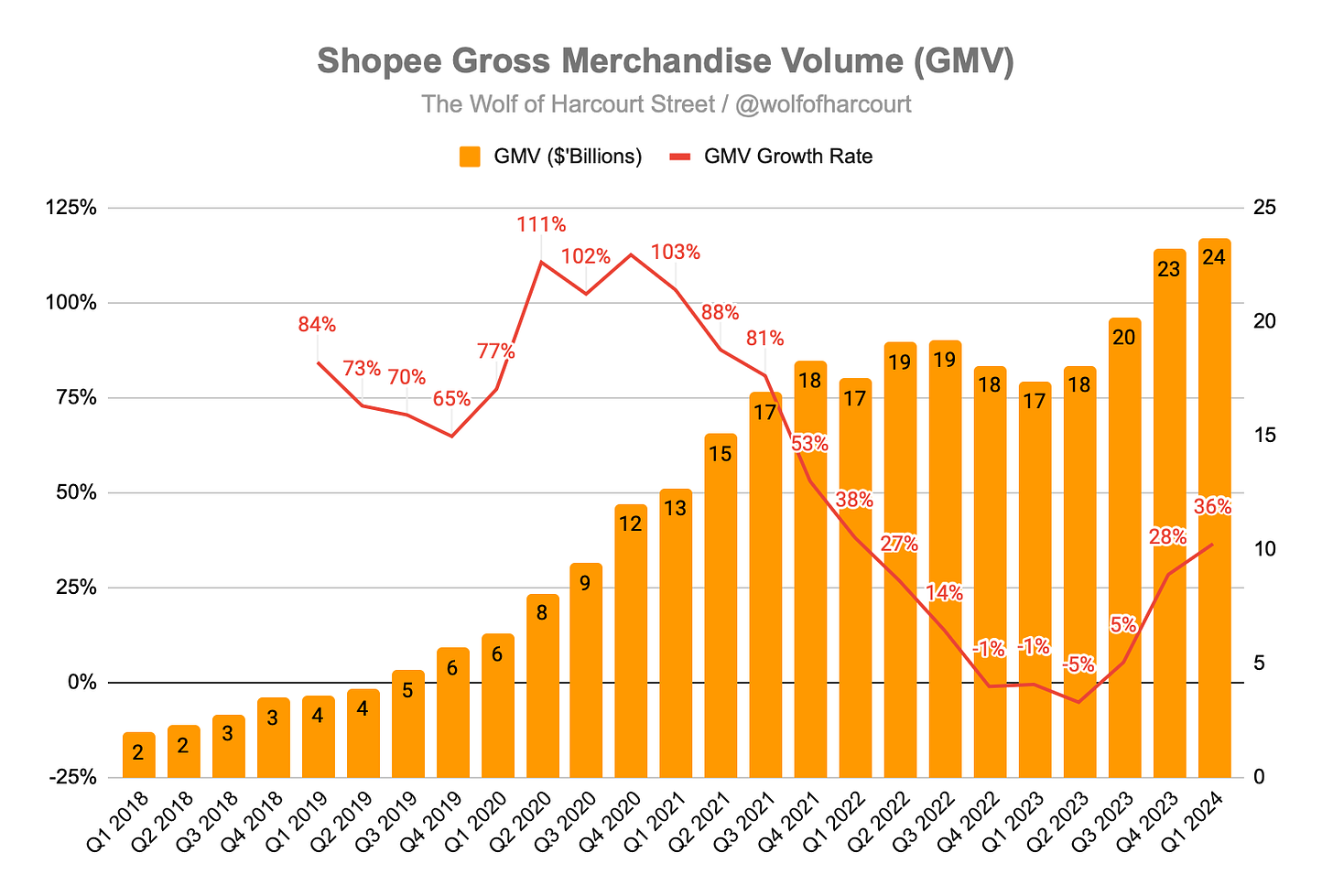

⭐ Gross Merchandise Volume

GMV also serves as a North Star Metric for Sea Limited, measuring the total value of transactions on Sea's e-commerce platform, Shopee. This metric reflects the health and growth of its core e-commerce business. GMV growth indicates Sea Limited's increasing market share in the competitive Southeast Asian e-commerce landscape and suggests a thriving ecosystem of buyers and sellers on Shopee. Focusing on GMV encourages initiatives to increase transaction volume, improve user experience, and expand product selection—key strategic priorities for Sea Limited.

Airbnb

⭐Nights and Experiences Booked

Nights and Experiences Booked measures the primary activity on Airbnb's platform and acts as a robust predictor of future demand. As this metric increases, it typically correlates with higher revenue through service fees and other charges. It demonstrates user engagement and the success of Airbnb in connecting hosts and guests, creating a flywheel effect where more bookings lead to more satisfied customers, attracting more hosts and guests in turn.

Fintech

Adyen

⭐ Processed Volume

Processed Volume measures the total value of transactions Adyen processes, reflecting the health and growth of its core payment processing business. As Processed Volume increases, it typically correlates with higher revenue through transaction fees and other services. This growth can indicate Adyen's increasing market share in the competitive global payments industry and suggests growing adoption of its payment solutions by merchants and consumers. Over 80% of Adyen’s Processed Volume growth comes from expanding existing customer relationships on the platform.

Nubank

⭐ Number of Customers

The number of customers reflects Nubank's ability to attract and retain users, crucial for its growth and market penetration. As the number of customers increases, so does Nubank's revenue potential through transaction fees and interest income. This growth indicates Nubank's increasing market share in the competitive fintech and banking sectors in Latin America and suggests that its financial products meet customer needs. The number of customers is more important than Purchase Volume for Nubank because it disrupts incumbent banks. Without market penetration, there is no monetisation down the line.

PayPal

⭐ Total Payment Volume

Total Payment Volume (TPV) measures the total dollar value of transactions conducted through PayPal's payments platform. As TPV increases, it typically correlates with higher revenue through transaction fees and other services. TPV allows investors to compare PayPal's performance with other payment processors and assess its competitive standing in the market. Recently, PayPal’s management shifted its focus to active customer accounts and payment transactions per active account. Increasing both active accounts and transactions per account can lead to growth in TPV.

Social Network

Meta

⭐ Family daily active people

Family daily active people refers to the number of unique individuals who use at least one of Meta's family of apps (Facebook, Instagram, WhatsApp, Messenger) daily. This metric measures user engagement across Meta's ecosystem. As a social media company, Meta's success relies heavily on active user engagement. Higher daily active users correlate with increased advertising revenue, Meta's primary source of income.

B2B

Datadog

⭐ $100K+ ARR Customers

The number of customers with Annual Recurring Revenue (ARR) of $100,000 or more demonstrates Datadog's ability to attract and retain high-value customers. An increase in $100K+ ARR customers suggests successful upselling and cross-selling of Datadog's products to existing customers and increasing adoption among larger enterprises and organizations with complex needs. Customers with higher ARR are likely to be more stable, contributing to Datadog's overall business stability.

Evolution

⭐ Number of Live Tables

As Evolution provides live casino solutions to online gambling operators, the number of live tables deployed directly impacts earnings potential. More tables mean more capacity to serve players and generate revenue through setup fees, commission fees, and dedicated table fees. An increase in deployed tables indicates that more online casinos are adopting Evolution's solutions, demonstrating market growth. A complementary metric, such as Revenue per Table, showcases the company's operational efficiency and scalability.

Key Takeaways

North Star Metrics should focus on customer value rather than just financial metrics.

Metrics like GMV for MercadoLibre and Sea Limited and Nights and Experiences Booked for Airbnb measure the success of the core business in delivering value to customers.

North Star Metrics should lead to revenue growth, even if revenue itself is not the metric.

Processed Volume for Adyen, Total Payment Volume for PayPal, and Family daily active people for Meta all correlate with revenue growth as the business scales.

North Star Metrics should be measurable, time-bound, and within the company's control.

The Number of Live Tables for Evolution is a clear, actionable metric that demonstrates the company's market growth.

North Star Metrics can vary by business model and stage.

For a fintech like Nubank disrupting retail banking, the Number of Customers is more important than transaction volume. For a B2B company like Datadog, the number of high-value enterprise customers is key.

North Star Metrics should be broken down into sub-metrics to drive alignment and ownership.

Initiatives to increase transactions, improve user experience, and expand selection all feed into GMV growth for e-commerce companies.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Great article: For all my positions I am making a spreadsheet with the north star metrics! Great timing