Executive Summary

Nu added 20.4 million new customers in 2024, bringing its total to 114.2 million and solidifying its position as one of the world’s largest digital financial platforms. While quarterly additions slowed slightly, annual growth outpaced 2023. Brazil remains Nu’s core market, with 58% penetration, while Mexico and Colombia are driving incremental growth. Although initial activity levels in these newer markets are lower, Nu’s expansion strategy is proving successful—particularly in Colombia, where customer growth surged 213% following the launch of Nu Cuenta.

Total deposits grew 55% YoY on an FX-neutral basis to $28.9 billion, fuelled by strong growth across Brazil, Mexico, and Colombia. Brazil led with $23.1 billion in deposits, while Mexico’s deposits quadrupled YoY to $4.5 billion, despite a lower spread over interbank rates. Colombia gained traction rapidly, reaching $1.3 billion just two quarters after launching its checking account. However, Nu’s cost of deposits rose to 89% of the blended interbank rate, suggesting higher costs in Mexico and Colombia.

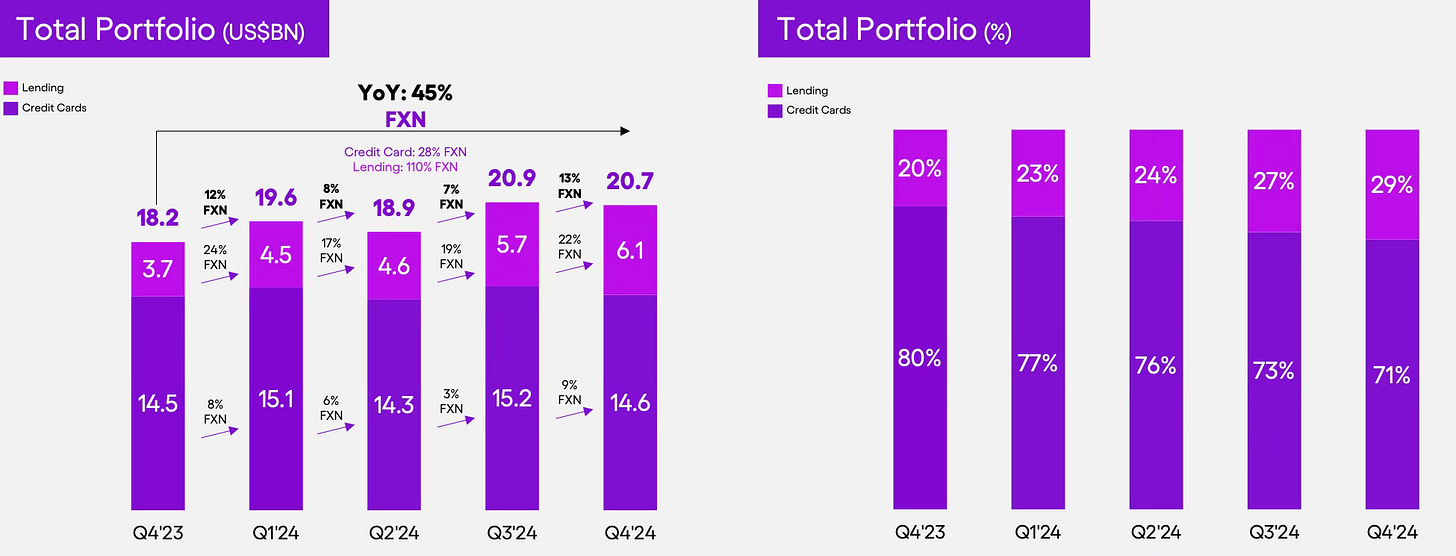

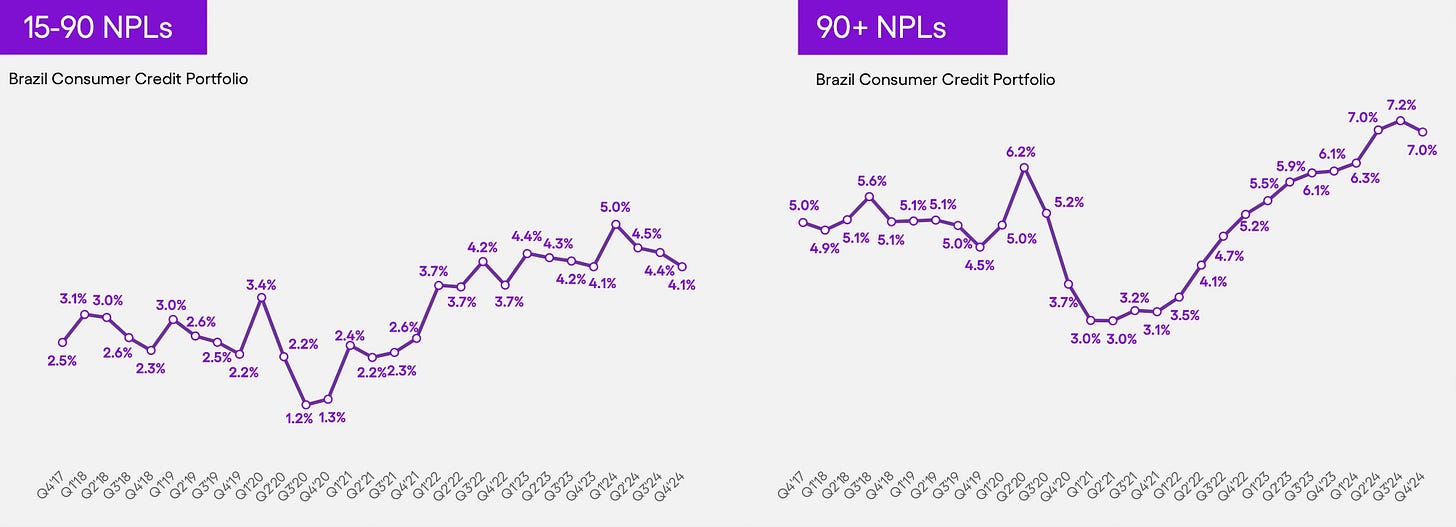

Nu’s consumer finance portfolio expanded 45% YoY FXN to $20.7 billion, with strong growth in both credit cards (+28% YoY) and lending (+110% YoY). Credit card growth was driven by increased wallet share, though interest-earning installments declined slightly as PIX Financing expansion slowed. Lending growth was primarily fueled by secured loans, particularly public payroll loans, which now account for 15% of new originations. Delinquency metrics improved, with 15-90 day NPLs down to 4.1% and 90+ day NPLs declining to 7.0%, reflecting a shift toward lower-risk customers and increased secured lending.

Revenue growth slowed to 25% YoY on a reported basis due to FX headwinds but remained strong at 50% YoY FXN, driven by increased customer activity, cross-selling, and new product launches. Gross profit grew 44% FXN, though margins declined slightly due to higher costs in Mexico and Colombia, where incremental gross margins appear structurally lower than in Brazil.

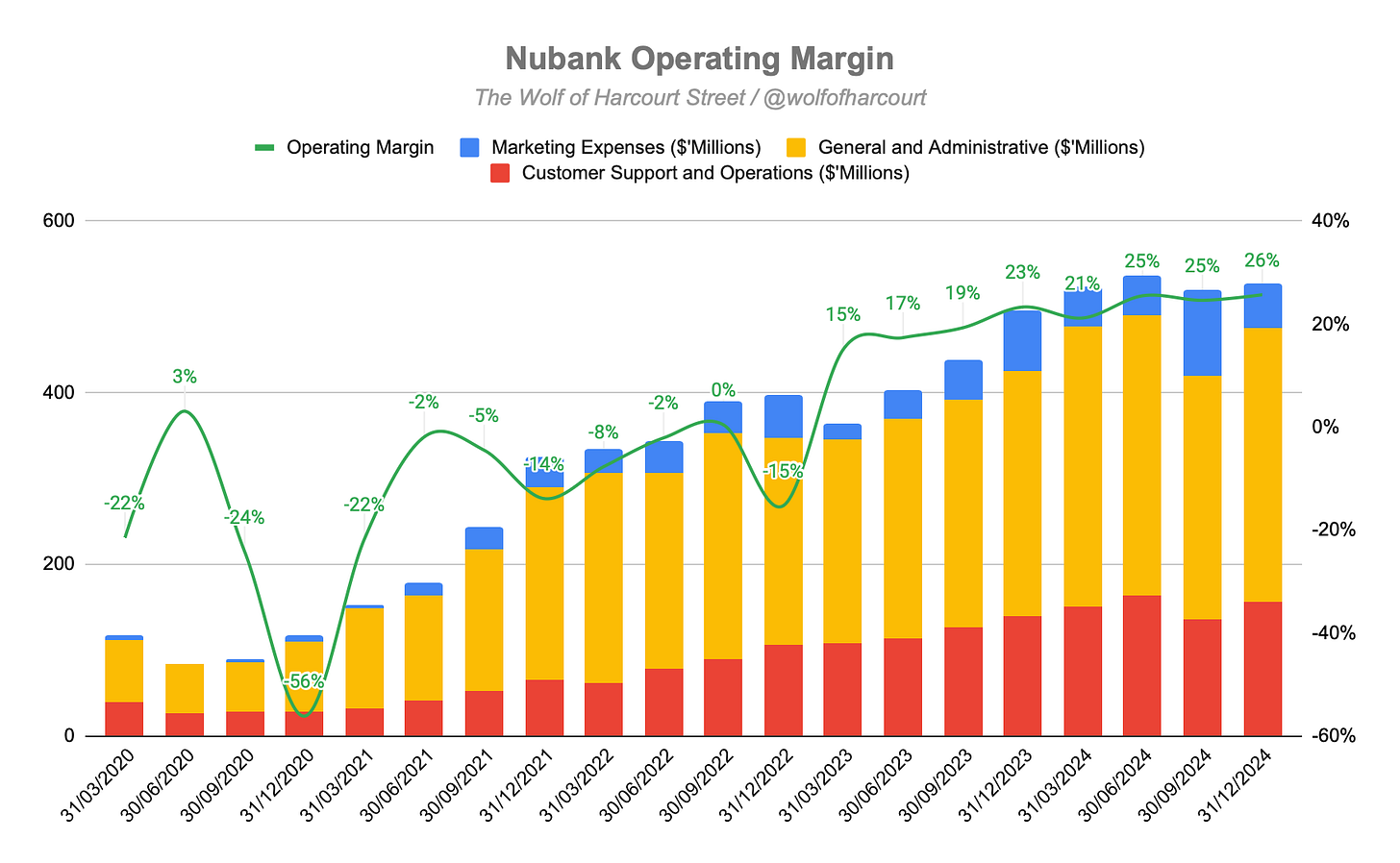

Nu’s operating margin expanded to 26%, benefiting from strong operating leverage as revenue growth outpaced expenses. Despite an 11% YoY FXN increase in costs, Nu kept its average monthly cost-to-serve per active customer under $1. However, risk-adjusted NIM declined 60 bps, with FX accounting for 45% of the drop. Structural factors—such as portfolio shifts and rising deposit costs—contributed to the remainder, raising questions about whether this trend is temporary or more persistent.

Contents

Financial Highlights

Wall Street Expectations

Business Activity

Financial Analysis

Strategic Priorities

Conclusion

1. Financial Highlights

Revenue: $2.99 billion (+24% YoY)

Interest Income: $2.49 billion (+28% YoY)

Fees: $496 million (+9% YoY)

Operating Profit: $767 million (+37% YoY)

Net Profit: $553 million (+53% YoY)

2. Wall Street Expectations

Revenue: $3.17 billion (miss by 6%)

EPS: $0.11 (in line)

3. Business Activity

Customers

Nu’s strong customer growth continues to exceed management’s own expectations, adding 4.5 million new customers in the quarter and 20.4 million for the year, reaching a total of 114.2 million customers. While the 4.5 million new customers added during the quarter was the lowest since Q2 2023, Nu added more customers in 2024 than in 2023 (20.4 million vs. 19.2 million).

This cements Nu’s position as one of the largest and fastest-growing digital financial services platforms globally and one of the largest financial institutions in Latin America by customer count, according to data from the Brazil Central Bank. The customer activity rate remained stable at 83% YoY, resulting in 94.9 million active customers at the end of 2024, though it was down sequentially from 84% in Q3. On the conference call, management noted that while customer growth in Mexico and Colombia outpaced Brazil (as detailed below), initially lower activity levels in these two countries temporarily impacted the consolidated activity rate.

Brazil: The customer base grew 16% YoY to 101.8 million, reaching 58% of the adult population. Despite high penetration, an average of 1 million new customers continue to join each month.

Mexico: The quarter added 1.1 million new customers, bringing the total to 10 million, now covering 12% of the adult population.

Colombia: Growth accelerated for the fourth quarter in a row, up 213%, with the customer base reaching 2.5 million. The positive momentum follows the successful launch of the Nu Cuenta product.

Deposits

Total deposits increased 55% YoY on an FX-neutral (FXN) basis to $28.9 billion, reflecting strong growth across all three markets:

Brazil: Deposits reached $23.1 billion, an 11% sequential increase on an FXN basis.

Mexico: Deposits grew 20%, reaching $4.5 billion, a fourfold increase from 2023, despite a reduced spread over the interbank rate.

Colombia: Deposits increased 55%, reaching $1.3 billion, just two quarters after launching NuColombia’s checking account, placing it among the top 5 financial institutions in Colombia based on individual demand deposits.

The cost of deposits remained at 89% of the blended interbank rate, up from 80% a year ago, meaning that while Nu is attracting significant deposits, it is paying more to do so. This suggests that deposit costs in Mexico and Colombia are higher than in Brazil. Later in the report, we will see the impact on gross margins. The loan-to-deposit ratio decreased slightly to 39% (down from 40% last quarter), indicating that deposit growth outpaced loan growth.

Purchase Volume

On a reported basis, Purchase Volume (PV) decreased 1% YoY to $32.2 billion. However, due to foreign exchange headwinds, PV grew 20% YoY on an FXN basis.

Monthly Average Revenue Per Active Customer (Monthly ARPAC)

On a reported basis, Monthly ARPAC decreased 3% QoQ to $10.70 (from $11.00 in Q3). However, on an FXN basis, ARPAC increased 23% YoY and 5% QoQ. Management noted that ARPAC is affected by Nu’s accelerated customer growth in Mexico and Colombia, where new customers initially engage with the low-revenue Cuenta product. However, Nu remains confident in this strategy, citing similar trends in Brazil over the past decade.

Other key ARPAC metrics:

Primary Bank Account Usage: 61% of active customers now use Nu as their primary bank (up from 60% in Q3).

Products per Customer: Customers hold an average of 4.1 products, slightly up from 4 in Q3, as cross-selling efforts remain strong.

ARPAC by Cohort: Mature customer cohorts generate a significantly higher $25 ARPAC per month, reinforcing a clear path for future ARPAC growth.

Customer Finance Portfolio

Nu’s consumer finance portfolio (credit cards and lending) grew 45% FXN YoY and 13% FXN QoQ, reaching $20.7 billion.

Credit Card Portfolio: Grew 28% YoY and 9% QoQ to $14.6 billion, driven by increased wallet share across customer segments. Interest-earning installments continued to grow QoQ, but their share of the total credit card portfolio declined slightly to 27% from 28%, following a deliberate slowdown in PIX Financing expansion for specific risk bands.

Lending Portfolio: Grew impressively, up 110% YoY and 22% QoQ, reaching $6.1 billion (now 29% of the overall portfolio). Growth was driven by secured lending, including public payroll loans, which now account for 15% of new originations. New collateral agreements expanded eligibility to cover 70% of the addressable market for public payroll loans in Brazil.

Delinquency

Nu’s non-performing loan (NPL) metrics showed improvement:

15-90 Day NPL: Declined 30 bps to 4.1%, helped by a shift towards lower-risk customers and an increasing mix of secured lending.

90+ Day NPL: Declined 20 bps to 7.0%, reflecting a lagging effect from three consecutive quarters of early delinquency improvements. The 90+ NPL ratio behaves more like a stock measure than a flow measure, as it reflects the inventory of accounts transitioning from the 15-90 category in prior quarters.

4. Financial Analysis

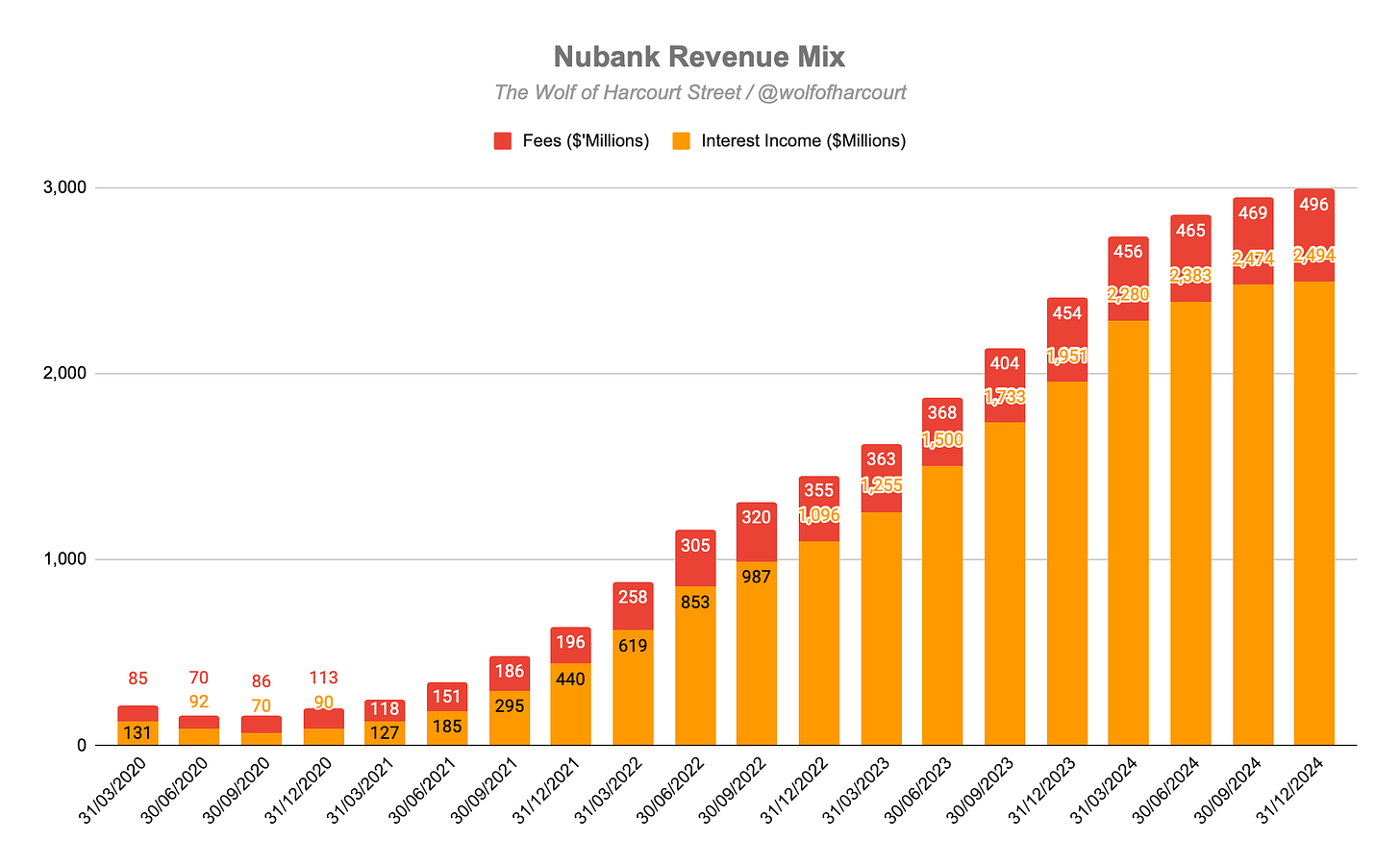

Revenue

On a reported basis, Nu’s quarterly revenue growth rate declined for the third consecutive quarter to 25%, resulting in total revenue of $2.99 billion. The FX headwinds previously referenced were the primary reason Nu’s revenue fell short of consensus estimates. However, on an FXN basis, revenue grew 50% YoY, maintaining the 56% FXN growth in Q3. This growth continues to be driven by a combination of increased active customers, cross-selling and up-selling efforts, and the launch of new products that boosted ARPAC.

Interest income, which accounts for 83% of total revenue, grew by 28% YoY (or 55% on an FXN basis), reaching $2.49 billion. This increase was primarily fueled by:

Sustained high-interest income from the consumer finance portfolio, reflecting the ongoing expansion of credit cards and lending.

A favourable credit mix, with a notable rise in installment-based credit card transactions.

Fees, which make up 17% of total revenue, rose by 9% YoY (or 32% on an FXN basis) to $496 million. This growth was driven by higher interchange fees from increased credit and prepaid card purchase volumes, reflecting the ongoing expansion of Nu’s customer base and activity. Additionally, late fees tied to Nu’s expanding credit portfolio contributed to revenue growth.

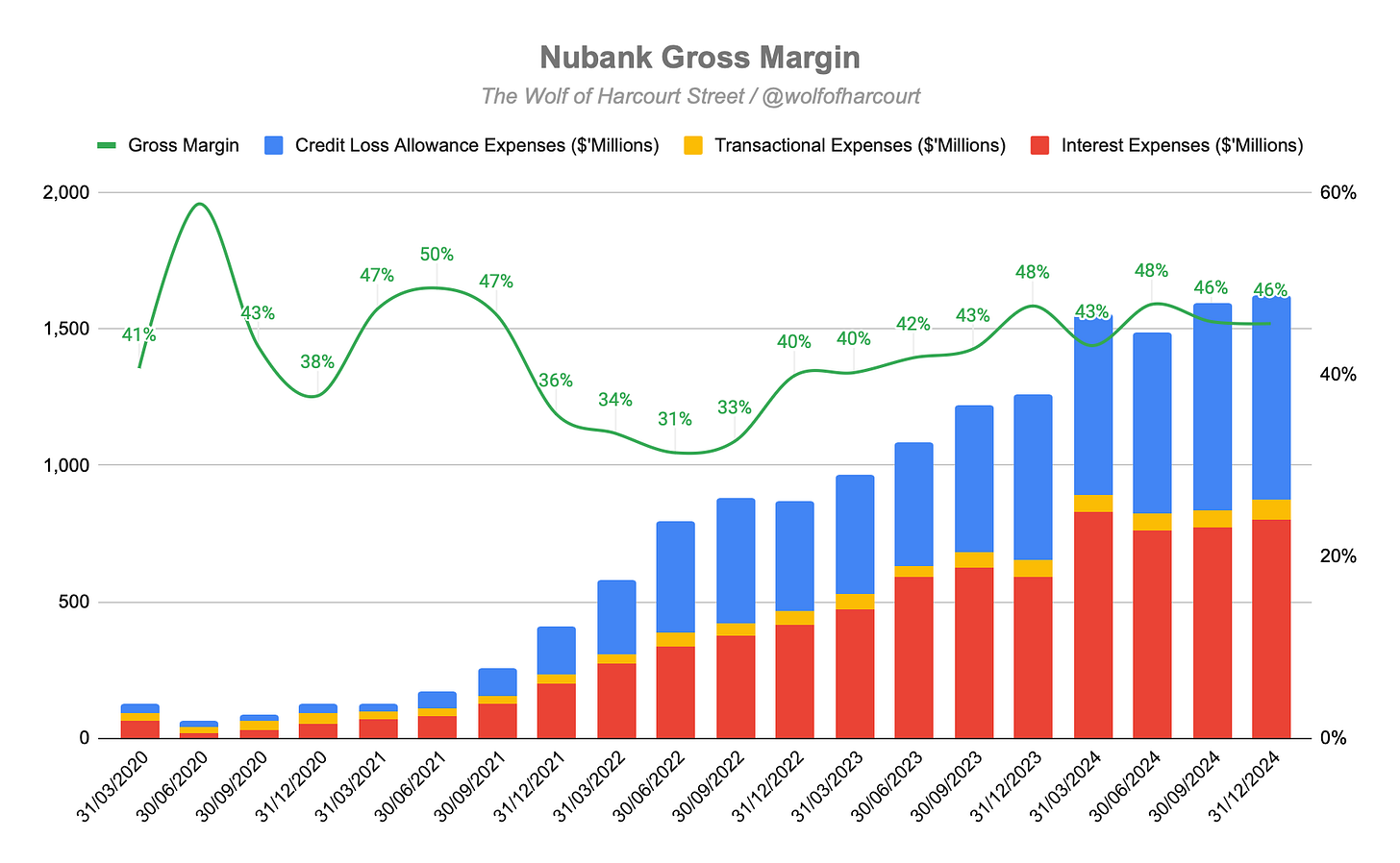

Gross Margin

Nu achieved a gross profit of $1.36 billion, representing FXN growth of 44% YoY. The gross profit margin remained flat at 46% sequentially but contracted from 48% in Q4 2023.

Interest income gross margin fell to 38% (from 39% in Q4 2023).

Fees gross margin declined slightly from 86% to 85%.

The contraction in interest income gross margin was due to higher costs in Mexico and Colombia. As mentioned earlier, incremental gross margins in Mexico and Colombia are lower than in Brazil. The key question is whether this is a permanent structural market difference or a temporary issue due to increased competition. Based on available data, it is prudent to assume that incremental gross margins in Mexico and Colombia will be permanently lower.

Operating Margin

Nu's operating profit reached $767 million, growing 37% YoY, outpacing revenue growth. This led to an operating margin expansion to 26%, up from 23% YoY and 25% sequentially. This operational leverage—a key feature of Nu's business model—continues to strengthen, even amid significant investments in Mexico and Colombia.

As revenue grows, operating expenses are increasing at a slower pace. This is evident in the decline of customer service, marketing, and general & administrative (G&A) expenses as a percentage of revenue, which dropped from 21% in Q4 2023 to 18% in Q4 2024.

Customer Service and G&A expenses increased modestly by 12% YoY, well below revenue growth.

Marketing expenses actually decreased by 27% YoY. A large portion of Nu’s customer acquisition is organic, driven by word-of-mouth and direct referrals, reducing direct marketing expenses.

Nu’s efficient cost management resulted in an average monthly cost-to-serve per active customer of $0.80. This remains under $1 despite an 11% YoY FXN increase, driven by higher data and processing costs.

Risk-Adjusted Net Interest Margin

Risk-Adjusted Net Interest Margin (NIM) reached 9.5%, declining by 60 basis points (bp). This was driven by:

A 70 bp decline in NIM (partially offset by a 10 bp improvement in the cost of risk).

FX impact, which accounted for 45% of the decline.

Portfolio shift & deposit costs accounted for the remaining 55%, with growth in secured lending over unsecured lending in Brazil reducing yields, alongside higher deposit costs in Mexico and Colombia.

Credit loss expenses rose to $804 million, a 12% QoQ FXN increase, aligning with Nu's expanding credit portfolio.

A common argument is that Nu’s challenges this quarter are entirely FX-related and can be disregarded. This is lazy analysis and simply not true. FX only accounted for 45% of the NIM reduction, while the remaining 55% is a more structural issue. This is an important takeaway for investors. The key question remains: Is this temporary or permanent?

5. Strategic Priorities

At the beginning of 2024, Nu outlined four key strategic priorities. In this report, the company demonstrated measurable progress against these priorities. Much like Mercado Libre, Nubank does not provide quarterly guidance, instead focusing on long-term strategic priorities. As a shareholder, I align with this approach, as achieving these priorities will generate significant value creation and shareholder returns.

Looking ahead, management outlined their 2025 strategic priorities, structured as a '3-Act Story':

Act 1: Expanding Retail Banking in Latin America

Goal: Become the largest and most loved retail bank in the region.

Despite strong growth, market share remains below 4%, leaving significant room for expansion.

Priorities include enhancing customer engagement, scaling credit operations, and increasing banking penetration in Brazil, Mexico, and Colombia.

Act 2: Expanding Beyond Financial Services

Nu has already ventured into marketplace, travel, and telecom sectors.

Management believes Nu has earned the right to expand beyond banking, leveraging its strong brand, customer engagement, and data capabilities.

The goal is to build an ecosystem that enhances customer spending and increases the addressable market.

Act 3: AI-Driven Global Digital Banking Model

The long-term vision is to evolve into a global AI-powered banking platform.

2025 will mark foundational steps toward scaling products and services globally.

6. Conclusion

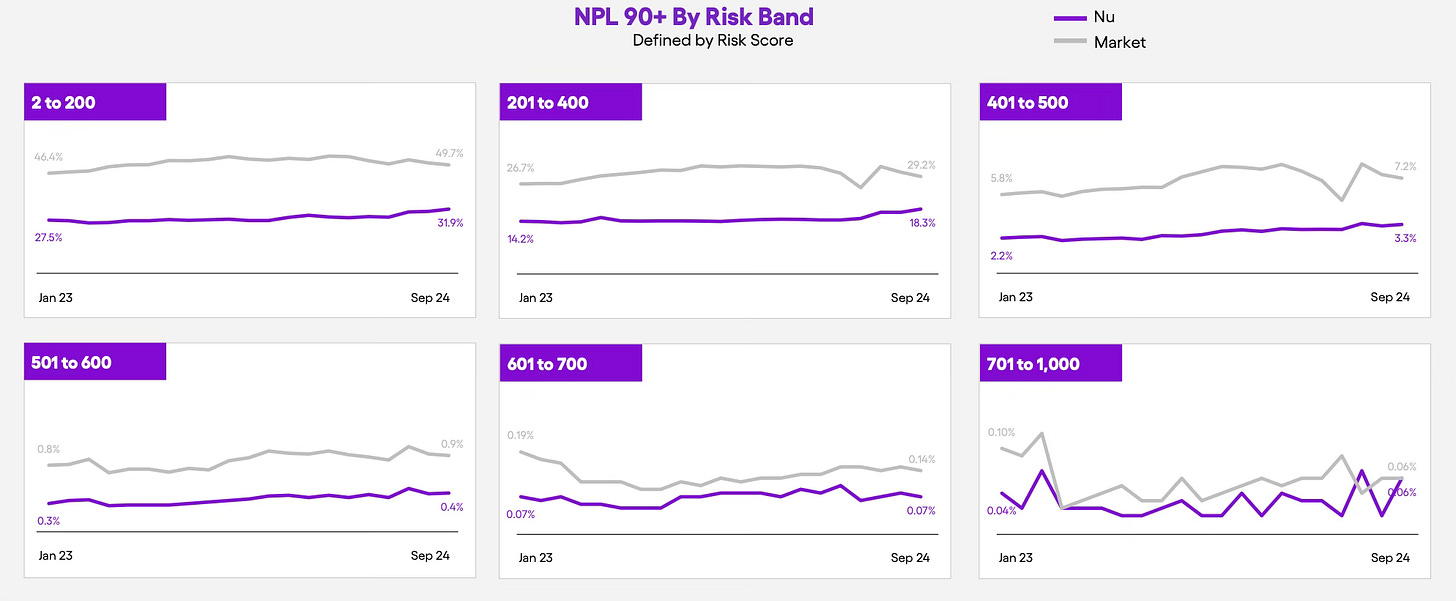

Nu stock declined at the end of 2024 due to concerns about elevated credit risk in Brazil. Given Nu's exposure to this market, this was a key focus for analysts, but management addressed these concerns well.

During the earnings presentation, management revealed that Nu’s credit card portfolio outperforms the broader Brazilian market across all risk bands, exhibiting lower delinquency rates. This is attributed to better risk assessment, optimised credit limits, and a higher share of customers using Nu as their primary financial institution.

Regarding FX headwinds, while this is a legitimate risk, it is not a thesis breaker. As I previously noted in my Nu investment thesis, the Brazilian Real has depreciated significantly against the US dollar over the past decade, impacting profitability. However, in Q1, the Real appreciated by 8%, meaning a potential tailwind if this trend continues.

Beyond FX, two key areas require close monitoring:

NIM Compression: NIM shrank by 70 basis points, and over half of this decline was due to operational pressures—not FX. While still well above the 4%-6% range of incumbent Brazilian banks, further declines could occur if interest rates in Brazil fall from their current 13.25%.

Deliberate Slowdown in PIX Financing: Eligibility criteria for lower-credit bands have been tightened, as second-order impacts (such as negative effects on NPS, customer churn, and engagement) have been observed.

While these issues do not change the long-term investment thesis, they warrant closer attention moving forward. Nu continues to excel in customer acquisition, but increased monetisation and profitability may take longer to materialise. As management takes a more cautious short-term stance, investors should adjust expectations accordingly.

Rating: 3 out of 5. Meets expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Nu's CEO David is very long term focused. The business model is extremely scalable. The company has impressive efficiency compared to any digital banking. It is also very customer focused with a heavy focus on NPS.

I also had a chance to meet one of the technical founders of Hyperplane, the credit underwriting company Nu acquired. He told me that Nu's underwriting technology is second to none compared to any US digital bank he is aware of. Quite an impressive statement. So it also has world leading technology.

NIM & FX pressure are not going to have any fundamental impact on any of these mentioned above. It is just short term headwinds that will be gone over the long term.

I believe Nu will be a winner on the long term, in 10 years time we will look at this as a bump in the road. Management has shown it can steer the ship well in troubled waters. All great companies have had issues, the question is do they keep the company well run? I believe they will. Thanks for another great write up.