Nu Holdings (Ticker: NU) trades on the NYSE having gone public via an initial IPO in December 2021. In May 2024, Nubank became the first bank to reach 100 million customers outside of Asia.

What has been the secret to Nubank becoming the world's largest digital banking platform outside of Asia and is it worth investing in today?

Contents

Executive Summary

Overview

Customer Base

Financial Analysis

Competitive Landscape

Leadership and Incentive Structure

Risks

Opportunities

Valuation

Investment Outlook

1. Executive Summary

Nubank was launched to revolutionize financial services in Latin America by addressing inefficiencies, high costs, and exclusion associated with traditional banks. Operating as a neobank without physical branches, Nubank leverages a mobile-first, cloud-based model to deliver affordable, accessible, and customer-centric financial solutions. By utilising advanced data science for personalised credit decisions, Nubank provides a comprehensive suite of financial services, expanding access to banking for the underbanked and unbanked populations across the region.

Nubank has rapidly grown into one of the world's largest digital banking platforms, serving over 100 million customers across Brazil, Mexico, and Colombia as of May 2024. In Brazil, it covers 55% of the adult population. Key to its success is a member-get-member referral program and a gamified approach to banking that drives high customer engagement and loyalty. Recognized as Brazil's Strongest Brand for two consecutive years, Nubank boasts an NPS of 90 and 83% monthly active customer rate. Its revenue model focuses on seamless user experience, increasing transaction volumes, and diverse product adoption.

Nubank's competitive moat is fortified by its early market entry, efficient scale, modern technological infrastructure, and robust network effects. As the first digital-native bank in Latin America, Nubank has captured significant market share, allowing it to leverage its large customer base to achieve cost efficiencies. Its fully digital platform ensures low operational costs and high customer acquisition efficiency through organic growth and a strong referral program. Nubank's data-driven approach enhances customer experience, loyalty, and financial product development, resulting in superior underwriting, optimized credit limits, and lower delinquency rates, ultimately solidifying its market leadership and profitability.

Nubank faces significant credit and emerging market risks. Its heavy reliance on lending, particularly in a high-default environment like Brazil, poses substantial credit risk. The bank's shift to interest-based revenue increases vulnerability to loan defaults, with recent delinquency rates rising. Additionally, operating in volatile emerging markets like Brazil, Mexico, and Colombia exposes Nubank to economic instability, high borrowing costs, currency fluctuations, and regulatory changes, all of which can impact profitability and operational stability.

Nubank has a substantial growth opportunity by expanding its customer base and increasing average revenue per active customer. With 77.1 million unbanked adults in Brazil, Mexico, and Colombia, and low credit card penetration rates, Nubank can target a vast, untapped market. The adoption of Pix in Brazil and its early integration into Nubank's services further accelerates growth. Additionally, by leveraging cross-selling strategies, enhancing service offerings, and utilising customer data, Nubank can significantly increase its average revenue per active customer and market share in Latin America's financial services market.

2. Introduction

Overview

Nubank was launched to revolutionize financial services for consumers and small businesses in Latin America. By challenging the status quo of incumbent banks, Nubank aimed to address the inefficiencies and high costs associated with traditional banking methods. Nubank made the decision to operate exclusively online, without traditional physical branch networks, which is commonly referred to as a neobank. These legacy banks often utilized uniform underwriting methodologies and lacked a strong focus on customer satisfaction, resulting in exorbitant fees and interest rates that ignored the needs of many consumers and excluded a significant portion of the population from the banking system.

In an era where technology companies are transforming various industries by placing the customer at the centre of their strategies, Nubank leverages a mobile-first and cloud-based model to deliver superior financial services. The company’s strategy revolves around a belief that technology-driven firms can capture market share from traditional providers, expand the size of addressable markets, and operate with enhanced economic efficiencies.

Brazil, characterized by some of the highest banking fees globally, presented an ideal environment for Nubank to introduce its customer-centric financial solutions. The broader Latin American market, encompassing around 650 million people according to World Bank data, represented a significant opportunity. Many individuals in this region are either underbanked, deeply dissatisfied with their traditional banking relationships, or entirely unbanked, highlighting the need for a new, innovative approach to financial services.

What Problem Does Nubank Solve?

Nubank addresses several key problems in the traditional banking sector, particularly in Latin America, including:

Trust Decline: Trust in banks and the broader financial system significantly deteriorated worldwide following the Financial Crisis in 2008. Confidence in financial institutions has remained low, with Gallup Poll data indicating a drop in trust from over 50% pre-Crisis to 33% in 2021 in the U.S., and similar trends observed globally. In Latin America, trust in banks is notably low, averaging 43%, which reflects a broader distrust in financial institutions in emerging markets.

High Fees and Interest Rates: Traditional banks in Latin America, especially in Brazil, often charge exorbitant fees and high interest rates for their services. Regulatory costs imposed on these banks are often passed on to consumers, maintaining high fee structures despite increased capital requirements. Research by De Genaro shows that higher capital requirements do not affect banks' profitability or fee income, as these costs are transferred to customers, indicating a systemic issue of fee exploitation. Nubank offers a more affordable alternative, reducing the financial burden on consumers.

Exclusion from the Banking System: A significant portion of the population in Latin America is either underbanked or completely unbanked. Traditional banks' rigid criteria and high costs often exclude these individuals. Nubank provides accessible financial services to a broader audience, including those previously excluded from the banking system. Traditional banks often provide a narrow range of financial products that do not meet the diverse needs of consumers and small businesses. Nubank offers a comprehensive suite of financial services tailored to various needs.

Poor Customer Experience: Legacy banks in the region tend to lack a strong focus on customer satisfaction, resulting in subpar service and customer support. Nubank prioritizes customer experience, offering user-friendly, convenient, and responsive financial services. Banking with traditional institutions often involves complex processes, bureaucratic hurdles, and inconvenient access to services. Nubank's platform simplifies financial management, making it easier for customers to handle their finances.

Homogeneous Underwriting Methodologies: Traditional banks typically use standardized underwriting methods that do not consider individual customer circumstances, leading to unfair credit decisions. Nubank employs advanced data science and proprietary models to offer more personalized and fair credit solutions.

Product Journey

In 2014, Nubank introduced its first product in Brazil: the Nu Credit Card, a purple Mastercard-branded credit card. This product marked Brazil’s first annual fee-free credit card and was paired with a digital, mobile-first customer experience. This innovative approach not only expanded Nubank's customer base but also provided critical insights for refining their data models.

To manage risk, Nubank approved only 20% of applicants and often assigned low initial spending limits, which were increased based on timely payments. The company continuously innovated its data-driven approach to assess credit risk, even considering the payment history of the referring customer. By focusing initially on credit cards, Nubank aimed to build customer trust, develop proprietary data, and establish a strong market presence.

Starting with credit cards allowed Nubank to establish a foundation for easily introducing new products. Credit card users frequently check their accounts, providing Nubank with a consistent engagement channel. This frequent interaction makes it straightforward for Nubank to introduce new offerings through the app, ensuring easy access and high visibility, thereby facilitating customer adoption and growth.

In 2017, Nubank launched NuAccount, a digital banking solution offering free deposits, transfers, payments, and low-fee cash withdrawals at partner ATMs, along with a competitive-yield savings feature. In 2018, Nubank added a free prepaid card for NuAccount customers, which helped it become the primary bank for many users.

In 2019, Nubank introduced personal loans and a business checking account for micro-businesses in Brazil, catering to nearly 22 million entrepreneurs. Nubank expanded to Mexico and Colombia between 2019 and 2020, launching its flagship credit card.

Between 2020 and 2023, Nubank significantly expanded and diversified its offerings:

2020: Nubank launched NuLife, a life insurance product, and acquired Easynvest, rebranding it as NuInvest. By 2023, NuInvest had 15 million active customers, becoming the largest direct-to-consumer retail investments platform in Brazil.

2021: The company introduced Ultraviolet, a premium metal credit card, and collaborated with Remessa Online for online remittance services. Nubank also launched "Buy Now Pay Later" solutions and NuPay for online purchases within the Nubank app.

2022: Nubank acquired Olivia, a data company specializing in AI and machine learning for retail banking, and launched Money Boxes, an investment platform.

2023: The company expanded its lending products in Brazil to include secured lines like public payroll loans, loans for retirees and pensioners, and FGTS-backed loans.

The Money Platform

Nubank has developed a comprehensive Money Platform that supports users through the 'Five Financial Seasons':

Spending: Nubank offers various spending solutions, including credit and prepaid cards, QR code-based payments, Pix instant payment arrangements, WhatsApp Pay, traditional wire transfers, and a diverse array of options through its marketplace.

Saving: The company provides personal and business accounts to help customers save effectively.

Investing: Nubank’s direct-to-consumer digital investment platform allows customers to manage their investments conveniently.

Borrowing: Nubank offers transparent and easy-to-manage credit cards, along with secured and unsecured loans with limits increasing over time as users build their credit histories.

Protecting: The company also offers insurance solutions to protect its customers.

This platform is designed to seamlessly integrate these aspects to enhance the financial well-being of customers. The company's business model is built on four core principles:

Customer-Centric Culture: A relentless focus on understanding and meeting customer needs.

Human-Centric Design: Prioritizing products, services, and interactions that create extraordinary customer experiences.

Proprietary Technologies: Developing advanced technologies in-house, leveraging top global talent.

Data Science: Utilizing powerful proprietary models to support every aspect of the business.

These principles create a self-reinforcing business model that enables Nubank to effectively serve its ecosystem of customers and partners, driving significant impact for stakeholders and establishing sustainable competitive advantages in the marketplace.

2. Customer Base

Nubank has become one of the world’s largest digital banking platforms and a leading technology company, boasting an impressive customer base of over 100 million across Brazil, Mexico, and Colombia as of May 8, 2024. In Brazil alone, Nubank serves over 92 million customers, representing approximately 55% of the population aged 18 and above. This remarkable growth has outpaced the combined growth of the five largest incumbent banks in Brazil over the past 12 months. Nubank's member-get-member referral program has been instrumental in unlocking this potential and driving its customer acquisition.

Nubank's commitment to delighting its customers has earned it a powerful reputation and a valuable brand, both locally and globally. In 2023, Nubank was recognized as the Strongest Brand in Brazil for the second consecutive year by Design Bridge & Partners, IstoÉ Dinheiro magazine, and TM20 Branding consultancy. Nubank’s customer base is highly engaged and loyal, a testament to the company’s reputation for trustworthiness and reliability. Key factors contributing to this loyalty include:

Organic Growth: A significant portion of Nubank’s customers were acquired organically through word-of-mouth and direct referrals, without incurring direct marketing expenses.

High Net Promoter Score (NPS): Nubank scores an NPS of 90, far exceeding those of incumbent banks and other major local financial technology companies.

Primary Banking Relationship: As of March 31, 2024, Nubank was the primary banking relationship for over 59% of its active customers, meaning these customers had at least 50% of their post-tax monthly income leaving their NuAccount each month.

Nubank's popularity is bolstered by the gamification of its banking and credit platforms. The platform encourages users to build their credit limit by completing game-like "missions" that involve using various features such as its credit card and paying bills through their Nubank account. This gamified approach makes banking activities more exciting, interesting, and enjoyable, increasing customer acceptance, engagement, satisfaction, and ultimately driving the adoption of mobile banking services.

Nubank measures customer engagement and adoption by tracking the number of monthly active customers and their implied activity rate. A monthly active customer is defined as any customer who has generated revenue in the last 30 days of the measurement date. As of March 31, 2024, Nubank had 82.6 million monthly active customers. The activity rate, which is the ratio of monthly active customers to the total number of customers, was 83% at the end of March 2024, up from 82% in 2023.

Revenue Model

Nubank’s revenue model is designed to be customer-centric, leveraging its digital platform to offer a range of financial services at low or no fees.

Nubank generates revenue primarily from two main sources: fees and interest income. These revenue streams enable Nubank to maintain a robust and scalable business model that leverages its digital platform and extensive customer base.

Fees: This revenue stream is closely correlated to product usage and comprised 20% of total revenue in 2023.

Card Transactions: Nubank earns fees and commissions from credit and prepaid card transactions, including interchange fees paid by merchants.

Payments and Loyalty Programs: Revenue is generated from payment services and customer loyalty programs.

Prepaid Mobile Top-Ups: Fees are charged for prepaid mobile phone top-ups, integrated into Nubank’s app for customer convenience.

Marketplace and Financial Products: Nubank earns commissions and fees by operating a marketplace for investments, insurance, and remittance products through partnerships with financial service providers.

Interest Income: This revenue stream is from the interest charged on revolving and refinanced credit card balances, purchased credit card receivables, customer loans, and the interest earned on cash deposits. It comprised 80% of total revenue in 2023.

Credit Card Balances: Nubank generates significant interest income from customers who carry revolving or refinanced credit card balances beyond the due date.

Credit Card Receivables and Loans: By purchasing credit card receivables and offering loans, Nubank earns interest income, crucial for profitability in a high-demand credit market.

Deposits and Government Bonds: Interest from customer deposits and investments in government bonds.

By focusing on seamless user experiences and efficient service delivery, Nubank attracts and retains a large customer base, driving transaction volumes and thereby increasing its fee-based revenues. The interest income complements this by providing a steady stream of revenue from credit-related products, which are in high demand in Latin America.

Key Performance Indicators

Nubank's monetization strategy hinges on a multi-faceted approach that leverages transaction volume growth, organic customer acquisition, and diversified product offerings to maximize revenue. This strategy is built around key metrics such as Purchase Volume (PV) and Monthly Average Revenue Per Active Customer (Monthly ARPAC), illustrating the effectiveness of increasing customer engagement, credit limits, and product adoption.

Purchase Volume: A central element of Nubank's monetization strategy is boosting the transaction volumes through its credit and prepaid cards. This is measured using the metric PV, which reflects the total value of transactions authorized through these cards. In Q1 2024, PV reached $31.1 billion, marking a 33% increase from Q1 2023. This substantial growth underscores Nubank's success in driving higher transaction volumes among its customers.

Monthly Average Revenue Per Active Customer (Monthly ARPAC): Monthly ARPAC is a critical metric that tracks the average monthly revenue per active customer. In Q1 2024, Monthly ARPAC was $11.40, up from $8.80 in Q1 2023. This increase is driven by several factors:

Higher Credit Limits: As customers demonstrate responsible credit usage, their credit limits are increased, leading to higher spending and subsequently higher revenue for Nubank.

Increased Customer Spending: As customers become more familiar with Nubank’s products and services, their overall spending through Nubank’s platform increases.

Adoption of Multiple Products: Over time, customers tend to adopt more of Nubank’s financial products, further boosting their overall engagement and the revenue generated per customer. Historical data shows that customer cohorts generally increase their Monthly ARPAC over time, reaching over $20 between the fourth and fifth years.

4. Financial Analysis

Revenue

Nubank's revenue has been growing like gangbusters for the past several years. In just four years, Nubank’s revenue has increased almost 12 times, growing at a CAGR of 89%.

As mentioned earlier, the majority of Nubank’s revenues now consist of interest income. However, this was not always the case, as up until Q4 2020, the majority of revenue was derived from fees. What has caused this shift in the revenue mix?

There are two crucial drivers:

Rapid growth in loan portfolio and credit products: Nubank has strongly focused on initiatives like payroll lending in Brazil. Since Q4 2020, the interest-earning portfolio has increased from $0.5 billion to $9.5 billion at the end of Q1 2024. As their lending business grows, interest income from loans becomes a larger portion of their revenue.

Increasing customer deposits generating interest income: Nubank reported having $24.3 billion in customer deposits in Q1 2024, up from $5.6 billion in Q4 2020. As their deposit base expands, the interest earned on those deposits becomes a more significant revenue stream.

Gross Margin

Nubank enjoys a very healthy gross margin due to its highly scalable digital platform. The cost of goods sold, or in Nubank's case, the cost of financial and transactional services provided, includes interest expenses, transactional expenses, and credit loss allowance expenses.

The gross margin profile for fees and interest income is quite different. Fee gross profit is derived after incurring transactional expenses and has resulted in a gross margin of 86% in Q1 2024 and above 80% since Q2 2021. This margin profile has increased over time due to the low-cost operating platform, which has resulted in a growing customer base to spread the fixed costs over.

Interest income gross profit is derived after incurring interest expenses and credit loss allowance expenses, equating to a gross margin of 35% in Q1 2024. Nubank front-loads credit loss allowance expenses based on the expected losses for the life of the credit, in accordance with IFRS 9 methodology. During 2023, the credit cards and personal loans portfolios saw an increase in expected losses due to expansions in the risk profile of newer cohorts in these two products. This trend continued through the first quarter of 2024.

Operating Margin

In 2023, Nubank started to reap the benefits of its platform's operating leverage as it posted an operating profit for the first time, despite still being in high-growth mode. This positive trend in operating margin continued in 2024 as Nubank continues to grow its customer base, up-sell and cross-sell products, launch new features, and ramp up operations in Mexico and Colombia, which are still running at a loss.

The major components of Nubank’s operating costs include customer service expenses, marketing expenses, and general & administrative expenses. The chart below reflects each of these costs as a percentage of revenue.

Nubank takes a very different approach to customer service and marketing expenses compared to traditional banks and competitors, which results in considerable operating leverage as the business scales:

Customer service expense ratio: Nubank’s customer service expense ratio has fallen from 19% in Q1 2020 to 6% in Q1 2024, due to the fact that their cost to serve customers is only $0.90, which is estimated to be 85% lower than traditional banks due to being fully digital. Traditional banks tend to have very high customer service costs from maintaining extensive branch networks. While the cost to serve an active customer has decreased over the years, the revenue per active customer has skyrocketed, resulting in continued margin expansion.

Marketing expense ratio: Nubank spent only around 2% of revenue on marketing over the past year, materially below the 7% average for most banks. Instead of paid marketing, Nubank relies heavily on word-of-mouth and customer referrals for acquisition, with 90% of new customers coming from unpaid referral channels. Their excellent customer service, generating an industry-leading NPS, drives this low-cost acquisition model.

While traditional banks spend heavily on both marketing and branch operations, Nubank flips this model. They drastically underinvest in marketing by providing an outstanding customer experience that generates organic referrals. This allows them to reallocate those marketing dollars into further enhancing their customer support operations and service levels, creating a virtuous cycle of low churn (0.2% per month) and more referrals.

Risk-Adjusted Net Interest Margin

Risk-Adjusted Net Interest Margin (NIM) is a key profitability metric for banks that measures the net interest income generated from lending activities after accounting for credit losses. The metric reflects the bank's ability to generate returns from its lending business while factoring in credit risk and loan losses. A higher Risk-Adjusted NIM indicates better profitability and risk management.

In Q1 2024, Nubank's Risk-Adjusted NIM was 9.5%, up 3.2 percentage points from a year ago, though down slightly from Q4 2023 due to higher provisions for loan growth. The expansion in Risk-Adjusted NIM outpaced the increase in the cost of risk, indicating Nubank was able to grow its interest-earning assets faster than non-performing loans.

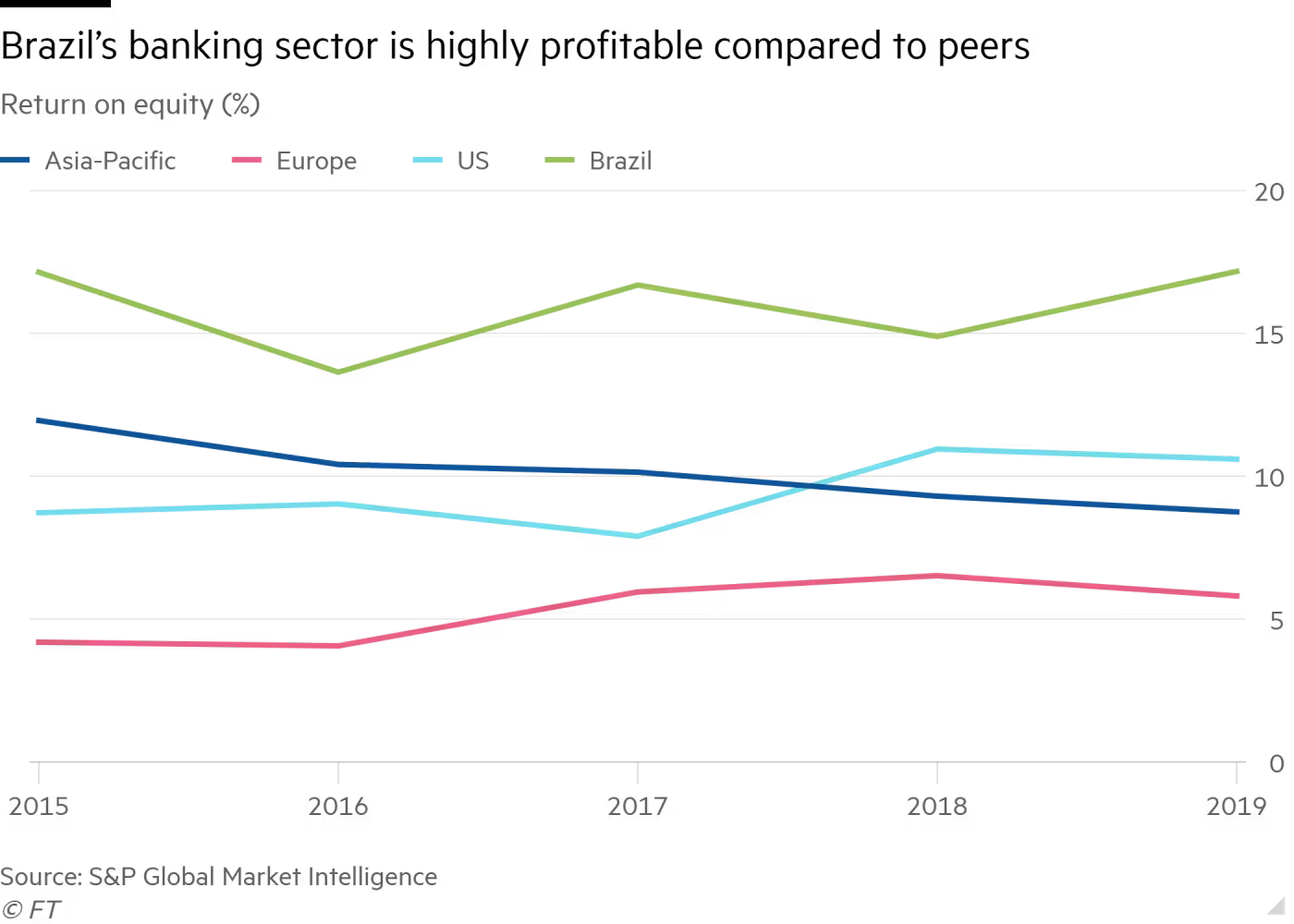

As Nubank expands lending to riskier borrowers, the Risk-Adjusted NIM allows it to measure profitability while accounting for higher expected loan losses from that credit expansion strategy. The Risk-Adjusted NIM for incumbent banks in Brazil ranges between 4% to 6%. Nubank’s industry-leading Risk-Adjusted NIM further highlights its lower cost structure and more efficient risk-pricing models.

Financial Position

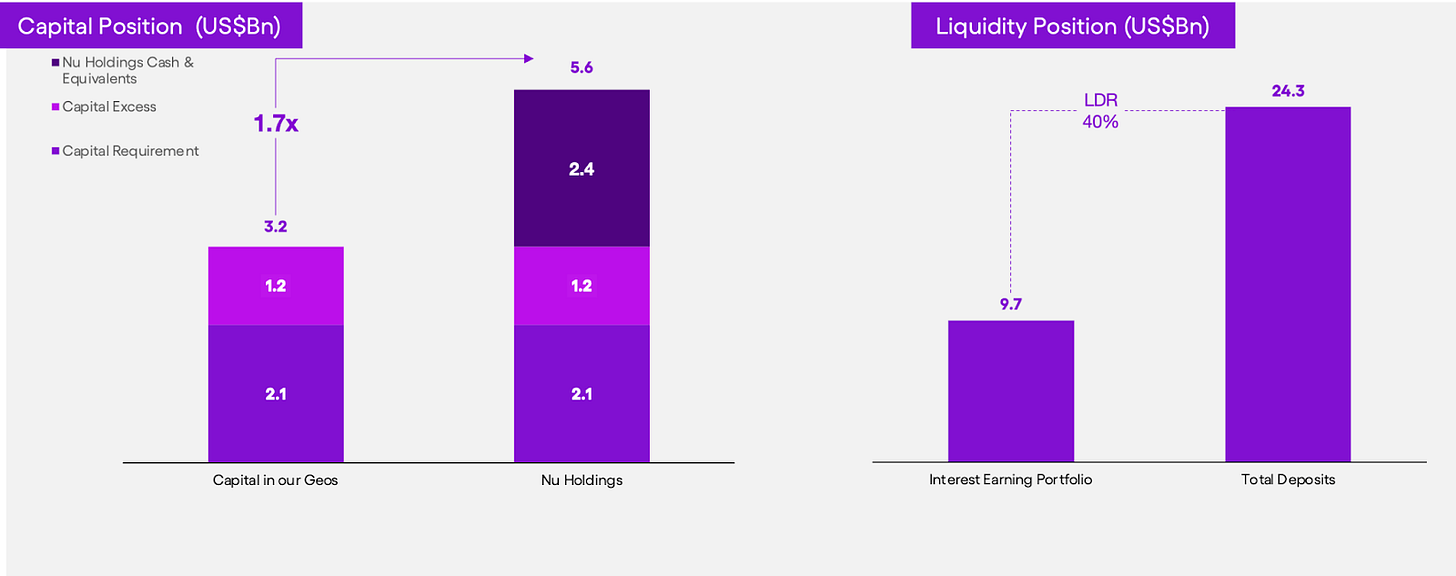

Nubank is one of the best-capitalized players in the region. Its Capital Adequacy Ratios (CARs) have very comfortable margins above the regulatory minimums in all the countries it operates in, even when not including the $2.4 billion excess liquidity held in Nu Holdings.

For anyone not familiar with banking, the CAR is a crucial measure of Nubank's financial health and its ability to meet obligations. It is computed by dividing the bank's capital by its risk-weighted assets. A high CAR indicates a substantial financial cushion, enabling Nubank to absorb losses and avoid insolvency. It is important to focus on the CAR as a measure of its financial strength, but some regular financial position metrics worth highlighting are:

Asset to Equity ratio of 6, which is favorable compared to the industry norm of 12 or more.

40% loan-to-deposit ratio, which is significantly lower than peers.

$6 billion in cash and cash equivalents.

$398 million of Goodwill comprising of less than 1% of total assets related to acquisitions including Cognitect, Easynvest and Olivia AI.

Return on Equity of 21% for the trailing twelve months.

It is reasonable to conclude that Nubank is in a strong financial position with a robust balance sheet, substantial cash reserves, and significant financial flexibility.

Cash Flow

I will not spend much time on the Nubank cash flow statement because banks operate differently from typical businesses. For banks, cash is both the product and a critical component of their operations. As you can see below, changes in operating assets and liabilities distort cash flow from operations as we know it.

Banks like Nubank are focused on growing their balance sheets by increasing the amount of credit and loans they hold. This growth appears as a negative cash flow and does not accurately reflect the company's financial health or operational success. Therefore, evaluating banks based on net income is more appropriate than using free cash flow.

With that being said, let’s move onto share-based compensation (SBC), which is a key item in the cash flow statement. Nubank, like many technology companies, utilizes SBC as part of its employee incentive structure. I will discuss this in detail in section 6, but the financial impact is that shareholders have been diluted by an average of 1.6% per year. SBC is a real cost of doing business, and the dilutive impact on existing shareholders should not be ignored.

5. Competitive Landscape

Nubank operates in a highly competitive landscape, facing challenges from both traditional banks and other fintech companies. Here's an overview of Nubank's competitive environment.

Traditional Banks

Major Brazilian banks like Itaú, Bradesco, Banco do Brasil, Caixa, and Santander have a long-standing presence and a vast customer base. They provide comprehensive financial services and leverage established trust and brand recognition. These incumbents are increasingly investing in digital transformation to compete with fintechs.

In 2016, the Big Five banks lobbied to reduce the merchant payment deadline to two days, arguing it would benefit merchants, but in reality, it was to crush Nubank. Historically, Brazil's credit system allowed issuers like Nubank 30 days to pay merchants, whereas merchants in the U.S. receive funds in two days. This 30-day period worked in Nubank’s favor as consumers typically repaid their balances in 26 days, resulting in a positive cash flow cycle with four days of float.

Nubank highlighted that this change would be catastrophic for them as they did not have the balance sheet strength to manage such a rapid payment turnaround. The Central Bank of Brazil recognized that reducing the deadline would stifle competition and retained the 30-day payment period, supporting Nubank’s ability to continue operations.

The power of the Big Five banks in Brazil is evident from this anecdote and shows that it could have been over for Nubank even before it started if it weren't for the support from the Central Bank of Brazil.

Neobanks and Fintechs

Nubank faces stiff competition from other digital-first banks and fintech startups offering similar services:

Inter: Founded in 1994, Inter started as a traditional bank and transformed into a fully digital neobank in 2014. Some of the services offered include digital accounts, credit cards, loans, investments, and insurance products.

PicPay: Offers a digital wallet app that allows users to send and receive money, pay bills, store loyalty cards, and access other financial services.

Mercado Pago: The fintech arm of the Mercado Libre e-commerce platform, which provides online payment solutions, including a digital wallet, merchant services, and consumer credit products.

PagSeguro: Offers an end-to-end digital payment platform that enables merchants to accept various payment methods, including credit cards, boletos, and its own digital wallet PagBank.

Moat Analysis

A company’s moat refers to its ability to maintain the competitive advantages that are expected to help it fend off competition and maintain profitability into the future. I have analyzed Nubank's moat under the following sources:

1. Efficient Scale

Nubank’s efficient scale competitive advantage is multifaceted, encompassing its early market entry and modern technological infrastructure.

First-Mover Advantage

Nubank's status as the first digital-native banking platform in Latin America has enabled it to capture substantial market share quickly. Its pioneering presence in digital financial services in the region has solidified its leadership, particularly in Brazil, where it has the highest number of customers among digital banks. Nubank's success is not limited to Brazil. In Mexico, within just four years of its 2020 launch, it has become one of the top three credit card issuers, surpassing many traditional financial institutions in terms of the net number of cards issued in 2023.

As a first mover, Nubank has set industry standards for low fees and frictionless services, raising the bar for customer expectations. New neobanks must primarily compete against Nubank, which has already optimized its operations and cost structures. Nubank’s ability to spread fixed costs across its massive customer base of 100 million provides it with substantial scale advantages. This efficient scale makes it challenging for newer entrants to achieve similar cost efficiencies, as they cannot match Nubank’s low cost per customer.

The regulatory environment in financial services often favors established players. Navigating regulatory complexities can be a significant hurdle for smaller, less established companies. Nubank, as a market leader, benefits from its established position and regulatory compliance, making it harder for new entrants to gain traction.

Technological Infrastructure

Being built from the ground up as a digital bank, Nubank benefits from a cohesive and modern technological infrastructure. This is in stark contrast to the fragmented and outdated systems of traditional banks, allowing Nubank to operate more efficiently and effectively.

Leveraging millions of customer data points through AI and machine learning, Nubank continuously enhances its onboarding processes, customer experience, product development, and strategic decision-making. This data-driven approach enables rapid and precise responses to customer needs and market changes, significantly improving the user experience.

Nearly 40% of Nubank’s workforce is dedicated to customer support, combining automated self-service tools with a dedicated team known as Xpeers. This dual approach ensures high-quality, efficient service that is difficult for competitors to replicate, especially new entrants who lack similar scale and infrastructure. Effective customer support reinforces loyalty and satisfaction, key components of Nubank's competitive edge.

2. Network Effect

Nubank's ability to leverage a network effect competitive advantage is evident through its low-cost customer acquisition strategy and organic growth mechanisms.

Low Customer Acquisition Cost (CAC)

In Q1 2024, Nubank’s CAC was $7 per customer, with paid marketing contributing only 29% of this cost. This is consistent with the 2023 CAC, demonstrating Nubank’s ability to maintain low acquisition costs even as it scales. The CAC for retail banks in the U.S. ranges from $300 to $600. This stark difference highlights Nubank’s efficiency and cost-effectiveness in acquiring new customers.

Nubank’s primary driver for low CAC is its effective member-get-member referral program. This program leverages satisfied customers to refer new users, reducing the need for expensive marketing campaigns. Positive customer experiences lead to organic referrals, with satisfied customers acting as brand advocates. This word-of-mouth marketing incurs minimal costs and is highly effective in attracting high-quality, engaged customers.

Nubank ranks in the top 6 for app downloads in Brazil on both iOS and Android, making it the only finance app on the list. The other popular apps on the list include Instagram, TikTok, and WhatsApp, with Nubank ahead of the likes of MercadoLibre and Google. Nubank is operating at a different level compared to the incumbent banks.

Organic Growth Flywheel

As Nubank’s customer base grows, the platform’s value is enhanced, attracting more users. This expansion creates a positive feedback loop where more users lead to greater value and satisfaction, driving further growth. Nubank’s diverse suite of financial products increases customer engagement and satisfaction.

As customers use more products, their overall loyalty and likelihood to refer others increase. Over time, customer cohorts tend to increase their usage of Nubank’s products, contributing to higher PV and ARPAC. This growing engagement within existing cohorts strengthens the network effect, as satisfied customers bring in new users.

Nubank’s focus on exceptional customer experiences fosters trust and loyalty, enhancing the network effect. This customer-centric strategy is reflected in its high NPS, indicating a strong likelihood of customers recommending Nubank to others.

Nubank's strong brand reputation, reinforced by multiple awards and recognitions, further fuels its referral engine. Being recognized as the Strongest Brand in Brazil for the second consecutive year in 2023 and ranking among the top 10 Brands Loved by Brazilians builds trust and credibility, making referrals more effective.

3. Cost Advantage

Nubank’s cost advantage is rooted in its all-digital, cloud-based platform, which drastically reduces operational expenses compared to traditional banks. This model eliminates the need for physical branches and supports a lean organizational structure, leading to significantly lower costs. Nubank estimates that its cost to serve and general administrative expenses per active customer are about 85% lower than those of incumbent financial institutions in Brazil.

Employee-to-Customer Ratio

A key measure of Nubank’s efficiency is its employee-to-customer ratio, which, as of December 2023, stood at approximately 14,900 customers per employee. This is starkly higher than the 1,100 customers per employee ratio seen in traditional banks, demonstrating Nubank’s ability to manage a vast customer base with fewer resources. Incumbent banks in Brazil have vast and expensive branch distribution networks supported by large workforces and legacy systems. As of December 2023, the main incumbents in Brazil are reported to have 2,695 to 3,992 branches, whereas Nubank has zero.

Advantageous Unit Economics

Nubank also boasts advantageous unit economics. The company typically recovers its CAC through cumulative contribution margins within 12 months on average, showcasing its efficiency in customer acquisition and revenue generation. Beyond this period, Nubank continues to expand its revenue and contribution margins, indicating robust long-term profitability.

Customer Acquisition Efficiency

Nubank’s customer acquisition efficiency is evidenced by its Lifetime Value (LTV) to CAC ratio, estimated to be greater than 30x. As discussed earlier, Nubank’s current CAC is $7, meaning that the LTV is at least $210. This high ratio highlights that the revenue generated from each customer over their lifetime substantially exceeds the cost of acquiring them, reinforcing Nubank’s strong economic model and cost advantage.

4. Intangible Assets

Nubank's competitive advantage is significantly bolstered by its strategic use of intangible assets, particularly its proprietary data and the NuX credit engine. These assets enable Nubank to outperform traditional banks in several critical areas.

Enhanced Underwriting

Nubank's extensive data collection allows for refined underwriting processes, enabling accurate assessments of customer risk profiles and creditworthiness. The NuX credit engine uses advanced algorithms to balance expected marginal revenue against expected marginal loss, even factoring in undrawn portions of credit lines under adverse economic conditions. As we have seen earlier, Nubank has an industry-leading Risk Adjusted NIM.

Optimized Credit Limits

Credit limits are customized for each consumer through continuous data analysis. The "low and grow" strategy initially grants lower limits to higher-risk customers, which are selectively increased based on positive usage and repayment behavior. This approach minimizes initial risk exposure while rewarding responsible financial behavior.

Cost of Risk Management

By accurately predicting risk and dynamically adjusting credit limits, Nubank lowers its overall cost of risk. This efficiency allows the company to offer competitive lending rates and superior financial products to its customers. The dynamic risk management ensures a balanced approach between growth and risk exposure.

Superior Delinquency Rates

Nubank's data-driven approach has resulted in impressive delinquency management. As of March 2024, Nubank reported a non-performing loan rate of 5.0% for loans 15-90 days late and 6.1% for loans over 90 days late in Brazil. When adjusted for product and customer income mix, these rates are approximately 15% lower than the market average, according to data from the Central Bank of Brazil. This demonstrates Nubank's superior risk management capabilities.

6. Leadership and Incentive Structure

Founding Story

David Vélez, born in Colombia, experienced a challenging childhood as his family fled to Costa Rica when he was nine to escape the violence from warring drug cartels. Despite these tumultuous early years, Vélez's drive to learn and succeed remained undeterred. He attended a German-language high school before earning an engineering degree at Stanford University. Vélez's career began with valuable stints at Morgan Stanley as an investment analyst and at General Atlantic as a senior associate, followed by a role at the venture capital firm Sequoia Capital. He later returned to Stanford to pursue an MBA, further enriching his expertise in finance and entrepreneurship.

Upon returning to South America, Vélez encountered a highly concentrated banking sector in Brazil, dominated by five banks that controlled 80% of the market. These banks profited massively from high-interest rates and exorbitant fees while delivering poor customer service, resulting in a significant unbanked population and dissatisfaction among consumers. Determined to address this disparity, Vélez envisioned creating a digital bank with minimal fees and accessible banking features. In doing so, the David (Vélez) vs. Goliath story took on a new meaning.

Through an acquaintance, Vélez recruited Cristina Junqueira, a Brazilian engineer with an MBA from Northwestern’s Kellogg School of Management, who had just left her job managing Itaú’s largest credit card division. To develop Nubank's technology, Vélez brought on Edward Wible, an American computer science graduate from Princeton and a former colleague from Sequoia. The trio established Nubank in a rented house in São Paulo, where Wible even lived upstairs.

In August 2014, Nubank secured $15 million in Series A funding led by Sequoia, with Nigel Morris investing through his fintech VC firm, QED. Vélez famously finalized the deal by taking the paperwork to the hospital for Junqueira's signature while she was in labor with her first child. The following month, Nubank launched its first product, the famous purple credit card, and the rest is history.

Management Team

David Vélez is the Chairman of the Board of Directors and the Chief Executive Officer. Vélez is described as structured, disciplined, and intellectual, contributing significantly to Nubank's long-term strategy. His farsightedness and sophisticated vision set him apart, particularly as a first-time founder.

Cristina Junqueira is the Chief Growth Officer. Besides being responsible for the operations and growth strategies in Mexico and Colombia, she also has a global role in leading functions like marketing and communications. Junqueira, known for her action-oriented and deadline-driven approach, acts as a galvanizing force within Nubank.

Edward Wible remains with the company, having served as Chief Technology Officer until 2021 before deciding to stand down to contribute more directly to the company’s systems and infrastructure. Wible was critical to Nubank's operations, driving its tech-centric approach. His leadership ensured that Nubank consistently renovated and improved its technology stack, avoiding the technical debt that plagues traditional banks.

Despite being 10 years old, the company still has all three co-founders involved in the day-to-day running of the business, which is an extremely positive sign.

Ownership

David Vélez is the largest individual shareholder in Nubank, with a 20% stake, while Cristina Junqueira holds 2.5%. After stepping back from executive leadership, Edward Wible does not appear to hold a significant stake in the company based on the disclosure in the 2023 annual report.

The company's largest institutional shareholder is Sequoia Capital, which owns a 6.8% stake. Other major institutional shareholders include Tencent, Baillie Gifford, and more famously, Warren Buffett’s Berkshire Hathaway, which invested $500 million in 2021 before the IPO.

Incentive Program

Nubank's executive compensation structure is designed to balance fixed and variable components, aligning the interests of executives with those of shareholders while maintaining competitive attractiveness to high-quality executives. Nubank explicitly calls out its equity compensation approach as essential to "creating long-term shareholder value" and fostering an "ownership-minded culture." The key components of the incentive structure include:

Fixed Compensation: Executive officers receive a fixed base salary based on the scope of their duties. Fixed compensation provides a stable income, recognizing the value of executive positions and contributing to the retention of the management team.

Profit Sharing: Executives in Brazil participate in a Profit Sharing Program tied to the achievement of pre-established business goals, as per union agreements. This short-term variable remuneration aligns executives' interests with immediate company performance and ensures that executives have a stake in achieving business goals.

Share-Based Compensation: Long-term incentive plans, including options and Restricted Stock Units (RSUs), form a significant part of executive compensation. This aligns executive interests with those of shareholders, encouraging long-term commitment and performance. Share-based compensation is effective in attracting and retaining key executives, aligning their interests with long-term shareholder value.

What is most interesting about Nubank is that it has successfully implemented an ownership-minded culture that has manifested itself in some very distinct ways:

High Employee Ownership: Approximately 95% of our employees owned Nubank shares or held share-based incentive awards as of December 31, 2023. This high level of employee ownership helps foster an ownership mindset and creates a cultural competitive advantage. This is extremely rare to see.

Customer Giveback: Nubank discovered a bug in the system that caused an email reminder about payment due dates to be removed, resulting in customers incurring late fees. Upon discovering this, Nubank chose to restore the email reminder and refund the customers, even though this meant losing the additional revenue from late fees. This decision was guided by their values, particularly their commitment to customer obsession. Contrast this with how most companies might have exploited the bug for profit.

Terminated CEO Equity Award: David Vélez was eligible for a Contingent Share Award (CSA) that would grant him up to 1% of total shares if the stock price reached certain milestones. However, in November 2022, Vélez terminated this 2021 CSA award as part of Nubank's efficiency program, forgoing potential compensation worth $356 million over seven years. Vélez's decision to terminate his CSA demonstrates alignment with shareholders and a focus on long-term value creation over personal compensation. It reinforces Nubank's principle of "thinking and acting like owners, not renters."

Referring back to the SBC discussed earlier in the report, my view is that Nubank's incentive program strongly aligns the interests of employees and management with those of the shareholders, justifying the moderate dilution as a worthwhile tradeoff for sustained high growth and a unique culture.

7. Risks

1. Credit Risk

Credit risk is the most significant risk for Nubank due to its heavy reliance on lending for revenue and the credit profile of its customer base.

Revenue Dependence on Lending Activities

As we have seen earlier, Nubank's product mix has shifted from predominantly fee-based income to 80% interest income. Nubank's revenue model heavily relies on interest income from loans and credit cards, which constitute a substantial portion of its earnings. Any deterioration in credit quality directly impacts this revenue stream. For instance, if Nubank's loan portfolio shows a higher default rate, the interest income would decrease, and the bank would need to set aside more provisions for loan losses, affecting its profitability.

Nubank's COO Youssef Lahrech acknowledged that many banks and fintechs have struggled to execute a successful credit strategy in Latin America. He stated:

We know of a number of banks that tried moving in this direction, but then they had to take a step back because it was just too hard to execute or it just did not produce the results they were expecting.

High Default Rates

Brazil has historically experienced elevated default rates compared to other regions. In January 2024, the delinquency rates in the FinTech FIDC market hit an average of 9.5%. This is due to factors like economic volatility, high inflation, and income inequality. Maintaining the quality of Nubank's loan portfolio, which has grown to nearly $20 billion, is critical in this challenging environment.

Despite the macroeconomic headwinds, Nubank has managed to keep its non-performing loan (NPL) ratios below the industry average. However, in the recent quarter, the firm reported a 90-day delinquency rate of 6.3%, up from 5.5% in the previous year, reflecting the complexities of the Brazilian market.

Nubank's customer base includes many individuals who might be underserved by traditional banks. While this presents growth opportunities, it also means that a significant portion of Nubank's borrowers may have higher credit risk profiles. This segment is more vulnerable to economic stress, thus elevating the overall credit risk for Nubank.

2. Emerging Market Risk

Emerging market risk, the risk associated with economic, political, and social instability in developing countries, is another significant risk for Nubank.

Geographic Concentration

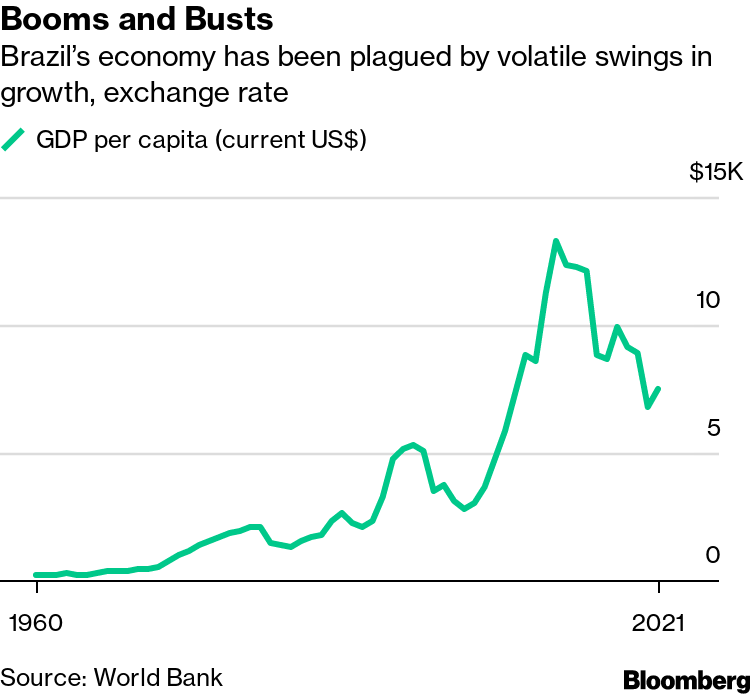

Nubank operates primarily in Brazil, Mexico, and Colombia, all of which are emerging markets. These regions are inherently more volatile than developed markets due to their economic, political, and social environments. For example, Brazil's GDP growth rate has been highly volatile over the past decade, with periods of recession and stagnation. Such economic instability directly impacts consumer spending, loan demand, and repayment capacity.

High Borrowing Costs

Nubank faces higher borrowing costs in emerging markets compared to developed markets. For example, Brazil has historically had higher interest rates compared to developed economies like the United States or European countries. Brazil's benchmark Selic rate of 11% has been significantly higher than the Federal Reserve's target rate in the US.

Currency Risk

Currency fluctuations in emerging markets can impact Nubank's financial performance. Depreciation of local currencies against the US dollar can increase the cost of foreign-denominated debt and affect the company's profitability. For example, the Brazilian Real has depreciated significantly against the US dollar over the past decade, which could increase the cost of Nubank’s dollar-denominated obligations and reduce its profitability when converted to local currency.

Regulatory Risks

In 2023, the Central Bank of Brazil placed a cap on interchange fees charged to 0.7% for prepaid cards. At the time of the announcement, Nubank said that if the changes had been in effect, its revenue would have been affected by 2.9%. This risk could potentially expand to other financial products and place Nubank's revenues at risk.

8. Opportunities

1. Growth of Customer Base

Nubank has a tremendous opportunity to continue expanding its customer base by leveraging the significant pain points faced by consumers in the financial services market, capitalizing on powerful secular trends, and addressing substantial penetration opportunities in the region. The combination of a large unbanked population, low credit card adoption rates, and supportive regulatory environments positions Nubank well to grow its active customer base significantly in the coming years.

Large Unbanked Population

There are 77.1 million unbanked adults in Brazil, Mexico, and Colombia. This represents a vast, untapped market that Nubank can target with its accessible and user-friendly digital financial services. Nubank currently serves around 100 million customers, but the potential market is much larger given the region's population of 650 million. The unbanked population of Latin America as a whole is estimated to be 65%. This implies that Nubank has only penetrated about 15% of the total addressable market, leaving significant room for growth.

Nubank has opportunities for expansion into other geographies and markets, particularly those with substantial unbanked populations. CEO David Vélez has likened their growth strategy to "fishing with dynamite”. By leveraging its technological innovation and understanding local needs, Nubank can aim to replicate its success in Latin America in new regions such as the Hispanic market in the U.S., Africa, and Asia.

There is a lot of room to conquer. We are 100 million and yes, that is impressive. But we must not forget that this only represents 1.25% of the world’s population. We are confident that by doing what is best for our customers, we are winning them over for decades. We optimize long-term value creation, not short-term. It’s an infinite game.

- David Vélez

Pix

In 2020, the Brazilian central bank introduced a digital currency called Pix. Pix is an instant payment system enabling free, fast transactions via QR codes. The volume of Pix transactions has grown rapidly, with usage increasing by 74% in 2023, reaching nearly 42 billion transactions and quickly overtaking credit and debit card usage. According to the Central Bank’s data, 149 million Brazilian users, or 74% of the population, have already made a Pix transaction, and 145 million own an active Pix key as of December 2023. Pix transactions cost retailers an average of 0.22%, compared to over 1% for debit cards and up to 2.2% for credit cards, making it a cheaper alternative.

Nubank was an early adopter of Pix and used it to launch new products like Pix credit, which offers installment payments and additional revenue streams. Nubank ended 2023 with 13.6 million customers using Pix credit, with customers using it growing 166% from a year before. Nubank's market share reached 10% in originations of transfers, and they believe they are the market leader in terms of the number of registered and active Pix keys in Brazil.

Pain Points with Incumbent Banks

Incumbent banks in Brazil, Mexico, and Colombia dominate the market, holding between 70% and 87% of all loans and deposits. These banks charge high fees and generate outsized profits, which presents an opportunity for Nubank to attract customers by offering lower fees and more customer-friendly services. The high fees and perceived lack of customer-centric services from traditional banks create a significant pain point for consumers, making them more likely to switch to alternative providers like Nubank that offer innovative and cost-effective solutions.

Market Penetration

Credit card penetration is low in the region compared to developed markets. For example, credit card adoption rates are 52% in Brazil, 11% in Mexico, and 22.5% in Colombia, compared to 66% in the United States and 62% in the United Kingdom. This indicates significant potential for growth in Nubank's credit card offerings. Household debt as a percentage of GDP is lower in Brazil (34%), Mexico (16%), and Colombia (28%) compared to developed markets (55%-85%). This suggests there is room for growth in consumer lending, as households have the capacity to take on more debt.

Brazil as the Roadmap for Mexico

In 19 quarters since launching in Mexico, Nubank has surpassed Brazil's performance in achieving key KPIs, indicating a faster growth trajectory. Within one year of launching Cuenta Nu, Nubank's customer numbers and checking account holders in Mexico have exceeded those in Brazil at the same point in their respective timelines. Nubank dominates the new credit card issuance market in Mexico with a 29% market share.

Nubank Mexico has over 3 million credit card customers, outpacing some of the top three incumbent banks in the country. The credit card purchase volume has reached $1.6 billion, capturing a 6.1% market share, compared to a 4.3% share in Brazil during the same period. Nubank Mexico has amassed $2.3 billion in retail deposits, more than double the amount at the end of 2023. This represents a 1.2% share of total deposits in Mexico, compared to 0.5% in Brazil at the same stage.

Nubank has a 5.1% market share of customers in Mexico, meaning there is considerable opportunity to increase its market share. If Nubank can replicate its success in Brazil, it could have 45 million customers in Mexico by Q1 2027. This is probable given that only 49% of adults in Mexico have access to a bank account.

2. Growth of Average Revenue per Customer

Nubank has a substantial opportunity to increase its ARPAC by expanding its market presence, leveraging its diverse revenue streams, deepening customer relationships, and employing effective cross-selling strategies. By capturing a larger share of the growing financial services market in Latin America and enhancing its product offerings, Nubank can significantly boost its revenue per active customer over time.

ARPAC Comparison

For the three months ended March 2024, Nubank’s consolidated monthly ARPAC was approximately $11.40. However, for customers active across core products (credit card, NuAccount, personal loans), monthly ARPAC averaged $45. The ARPAC for incumbent banks in Brazil is estimated to be 4.5 times higher than Nubank’s. This gap highlights the potential for Nubank to increase its ARPAC by capturing a greater share of wallet and cross-selling additional products.

The near future for Nubank appears to be promising, driven by its focus on winning over high income individuals in Brazil and expanding its secured lending offerings. Despite having 70% of Brazilians who earn monthly income of more than R$5,000 on the platform, many do not yet use Nubank as their primary bank. This presents a substantial opportunity for the company to deepen engagement and increase wallet share by converting these users into primary account holders. Additionally, Nubank’s expansion into secured lending is poised to bolster its ARPAC, as secured loans typically feature lower non-performing loan (NPL) rates and higher spreads.

Serviceable Addressable Market (SAM)

The SAM for retail financial services in Brazil, Mexico, and Colombia was estimated at $200 billion in 2023. Nubank’s current market share is around 3%, indicating significant room for growth. Increasing its share within this large and growing market can drive substantial revenue gains. By deepening relationships with existing customers through enhanced service offerings and more personalized financial products, Nubank can capture a larger portion of customers' financial activities.

Increasing Share of Customers’ Financial Lives

Nubank's customer base is young, with 64% under 40 years old and an average age of 37. Latin America benefits from a young population with a growing middle class. As these customers accumulate wealth and experience new life milestones, their demand for diversified financial services will grow. This provides Nubank an opportunity to expand its product offerings to meet evolving customer needs.

Nubank can leverage its data to understand customer needs better and recommend suitable products, thereby increasing the number of products per customer. As of March 31, 2024, Nubank averaged four products per active customer, indicating successful cross-selling efforts. Enhancing customer segmentation and credit models can further increase approval rates and product uptake without additional customer acquisition costs.

Creating “Nu” Markets

Nubank has demonstrated a remarkable ability to identify and capitalize on untapped market opportunities in Latin America. Its success in creating an insurance product for previously uninsured customers serves as a prime example of how it can potentially create new markets and drive financial inclusion.

Prior to Nubank's entry, a significant portion of the Brazilian population lacked access to affordable and accessible insurance products. By leveraging its digital platform and customer-centric approach, Nubank introduced innovative insurance offerings tailored to the needs and budgets of this underserved segment. In June 2024, Nubank reached 2 million active insurance policies in Brazil, largely driven by Nubank Vida, a digital insurance product launched in 2020 in partnership with Chubb, which alone has over 1 million active policies.

The key point to emphasize is that Nubank’s opportunity is even larger than the serviceable addressable market, given that uninsured customers wouldn't even be showing up in the existing retail industry data.

9. Valuation

Price to Earnings Ratio

Nubank trades at 25 times forward earnings. Despite having grown into its valuation over the past year, it still trades at a considerable premium to peers such as legacy bank Itaú, which trades at 6 times forward earnings, and neobank Inter, which trades at 14 times forward earnings.

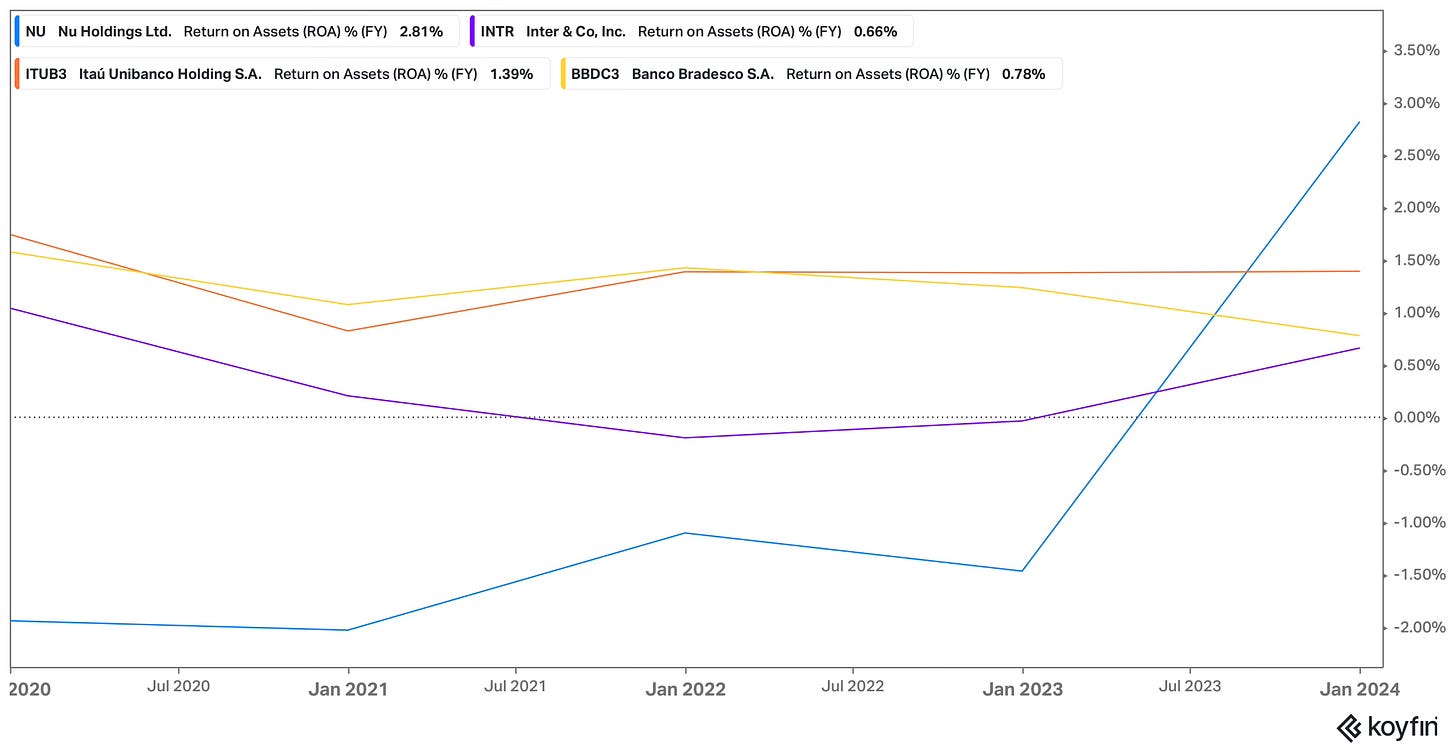

It should not come as a surprise to anyone who has read this far that Nubank trades at a premium to its peers, given its growth prospects and rapid market gains over the past couple of years. But how much more efficient is it with its assets?

Return on Assets

Nubank's Return on Assets (ROA) was almost four times higher than that of legacy banks in 2023. Nubank's digital-first approach, lean cost structure, and strategic focus on high-yield lending products allow it to generate superior returns from its asset base compared to the asset-heavy and operationally complex incumbent banks in Brazil.

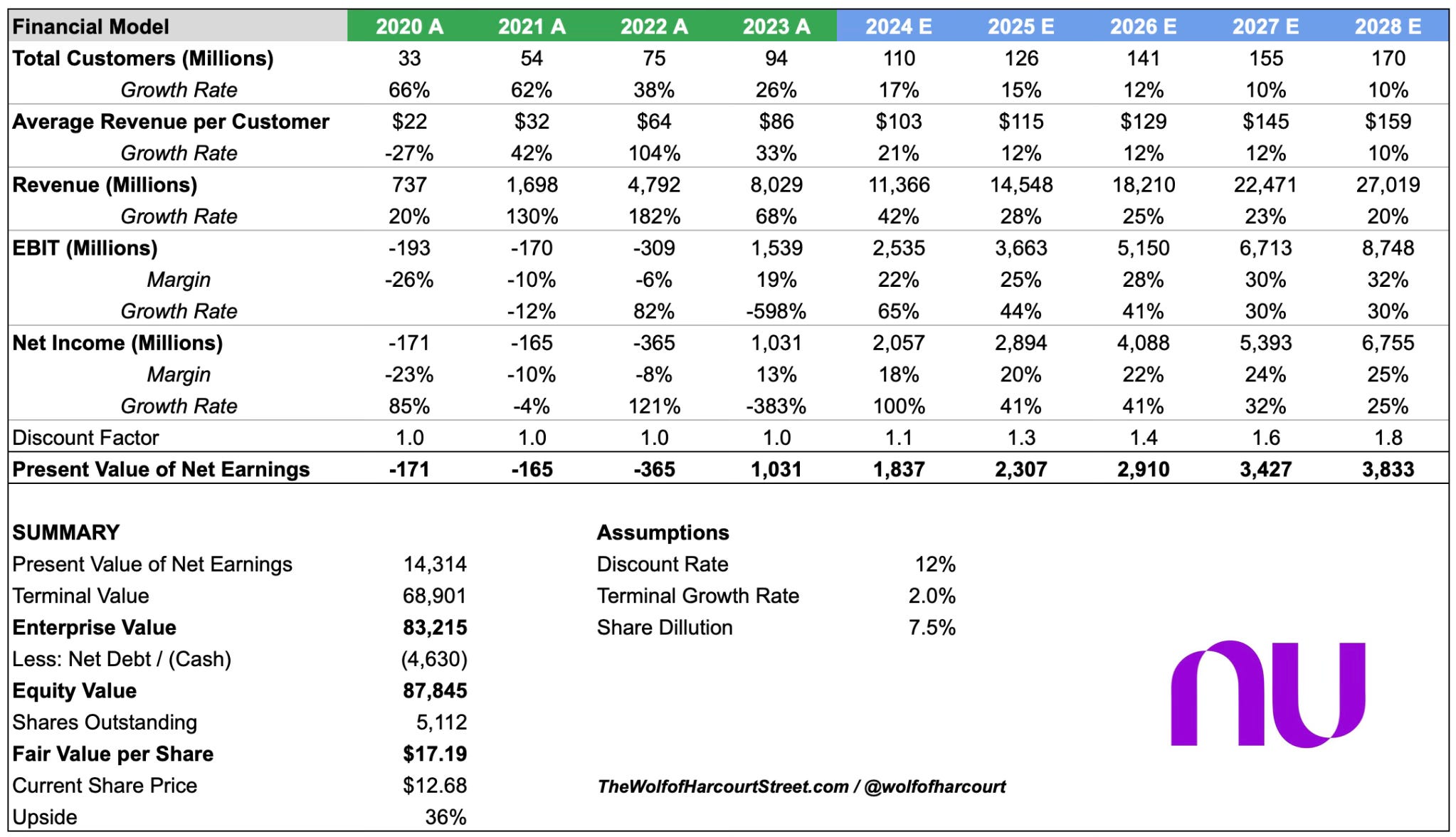

Financial Model

Valuing Nubank from the ground up is challenging due to the complexities inherent in its operations and financial structure. As referenced earlier, Nubank's reported cash flows are distorted because cash serves as both an input and output of the business. Using net income simplifies the modeling process while still capturing the essential profitability and operational efficiency of Nubank. Valuation is an art, not a science, after all.

Future earnings have been projected over five years using a discount rate of 12% and a terminal growth rate of 2%. Given the inherently risky markets that Nubank operates in, a higher discount rate has been assumed.

Between 2019 and 2023, Nubank’s total customers grew at a CAGR of 67%. This analysis assumes that total customers will reach 170 million by 2028, representing a CAGR of 13% during the forecast period. This would result in Nubank’s customers still only accounting for 26% of the total Latin American population.

Nubank’s average revenue per customer is forecast to almost double over the next five years, increasing from $86 in 2023 to $159 in 2028. As noted earlier, the average revenue per customer of incumbent banks in Brazil is estimated to be 4.5 times higher, so there is plenty of scope to capture a greater share of wallet and cross-sell additional products. A revenue CAGR of 27% is projected from 2023 to 2028 based on the total customer and average revenue per customer inputs.

The EBIT margin has been forecast to increase from 19% in 2023 to 32% in 2028 as Nubank benefits from the operating leverage inherent to its unique business model. Similarly, the Net Income margin has been forecast to scale from 13% in 2023 to 25% in 2028. For context, Itaú posted a net income margin of 27% in 2023.

A dilution rate of 1.5% per year has been assumed, in line with the historical average over the past couple of years.

Based on these assumptions, the fair value of Nubank is close to $17.19 per share, suggesting a potential upside of 36% based on the share price on June 26, 2024, of $12.86. The valuation analysis implies that Nubank is undervalued with a reasonable margin of safety. The analysis conservatively assumes Nubank will continue to gain market share but will still lag behind incumbent banks in total customers, average revenue per customer, and industry revenue market share metrics.

10. Investment Outlook

Some important news broke yesterday, June 26, 2024, as Nubank announced the acquisition of Hyperplane, a data intelligence company specializing in AI-driven financial decision-making. This is a significant move towards AI-first banking, as Hyperplane’s AI technology will enhance Nubank’s ability to analyse vast datasets and personalise services on a granular level.

Nubank's investment thesis is centered around disrupting the financial services market in Latin America by leveraging technology and data to create a fundamentally different and superior customer experience. The thesis can be summarized into the following key points:

Low Cost to Acquire: Nubank has built a powerful brand and reputation, acquiring customers primarily through viral word-of-mouth and direct customer referrals. This approach avoids expensive marketing campaigns and incentives, focusing instead on creating strong customer experiences.

Low Cost to Serve: Operating in a fully digital environment without physical branches and simplifying processes have enabled Nubank to serve customers efficiently. This operational model achieves scale efficiencies that benefit both customers and investors.

Low Cost of Risk: Advanced technology and proprietary data science are used to assess and mitigate credit risk effectively. This capability allows Nubank to operate and scale efficiently while offering competitive pricing to customers.

Low Cost of Funding: Nubank's large and growing base of locally sourced deposits exceeds funding needs, enabling increased credit extension to customers. This creates a highly resilient, diversified, and low-cost funding model.

While Nubank may appear overvalued relative to traditional banking peers, this premium is justified as it represents one of the most significant disruptive forces globally. Nubank faces risks, particularly around credit and exposure to emerging markets, which have been present since its founding 10 years ago. However, bottom-up valuation analysis based on conservative assumptions and supported by secular growth trends indicates that Nubank presents an attractive opportunity.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Great report, the results of scale and the network effects are so strong. That chart of Gen&Admin expenses collapsing from 40% to 12% is so indicative of the core thesis. Legacy bank are inefficient dinosaurs.

Great overview