Nu’s Customers Get 34x More Valuable Over Time

A deep dive into ARPAC by cohort and what it means for revenue in 2030

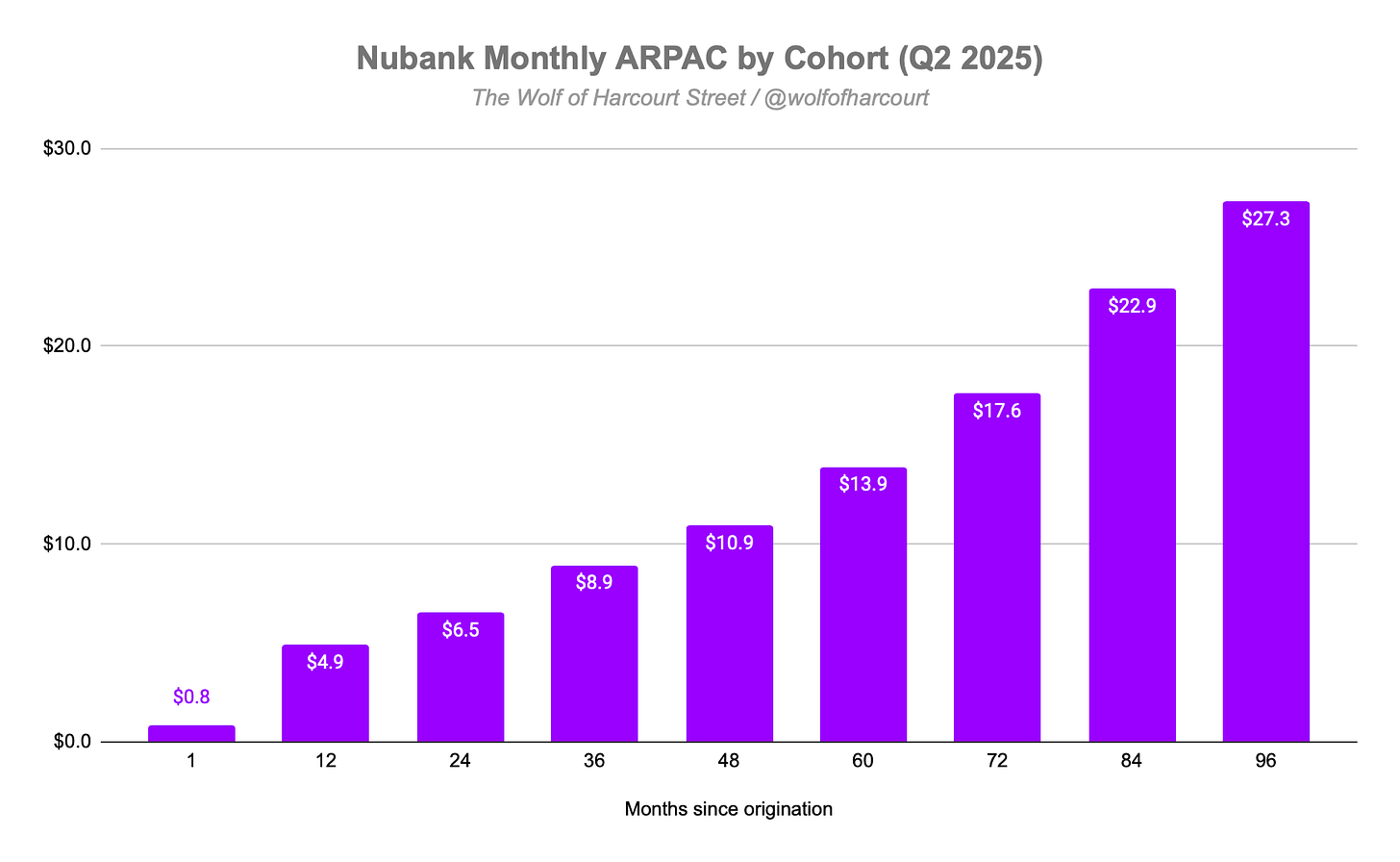

As part of Nu’s quarterly earnings report, the company discloses its monthly average revenue per active customer (ARPAC) by cohort. Based on this data, we know that each customer becomes 34x more valuable over 8 years. In their first month, the average customer generates just $0.80 of revenue, but by year eight this rises to $27.30.

This is an enormous engine for revenue growth, and it got me thinking: What could Nu’s revenue look like in 2030 simply from existing customers maturing, without adding a single new customer?

Customers by Cohort

The starting point for my analysis was Nu’s 123 million customers as of Q2 2025. By reviewing quarterly filings, I calculated the net new customers added each quarter and grouped them into cohorts by months since origination. For example, all customers added in Q1 2025 fall into the 2–12 months since origination bucket.

One thing really stood out: 66% (81 million) of Nu’s customers joined within the past four years or less. This shows not only how young most of Nu’s customer base is, but also how under-monetised it remains. At 48 months since origination, monthly ARPAC is just $10.90.

Annual Revenue by Cohort

Using ARPAC and customer data by cohort, I estimated annual revenue at Q2 2025. It’s no surprise that customers with Nu for less than two years account for just 16% of total revenue despite representing 32% of total customers.

The more interesting point is that cohorts with 60+ months of tenure account for 55% of total revenue while representing only 34% of total customers. The longer a cohort stays, the more valuable it becomes. Nu’s extremely strong retention rate allows it to consistently up-sell and cross-sell, supporting customers as they progress through their financial journey.

The 2030 View

By maturing each cohort five years, we can forecast what the customer mix might look like in 2030. The shift toward late-stage cohorts is glaringly obvious: by 2030, 68% of customers will have been with Nu for 8+ years.

This maturation sets the stage for explosive revenue growth. With 84 million customers on track to generate $27.30 in monthly ARPAC, this group alone could produce $27.4 billion in annual revenue by 2030. In total, today’s 123 million customers could generate $37 billion in 2030 revenue, more than 3x the $11.5 billion reported in 2024.

Conclusion

There are a number of caveats to this analysis that are worth pointing out if not already apparent. The first major one is the assumption that the existing ARPAC by cohort will continue into the future. There is no guarantee of this, as many factors influence this single data point. Conditions outside the company’s control, such as a global recession, could materially impact its ability to grow its credit portfolio, which has been the key driver of revenue growth in recent years.

This assumption also ignores the potential upside of ARPAC increasing for each cohort by 2030. In just one year, the mature ARPAC cohort has risen from $25 in Q2 2024 to $27 in Q2 2025. It is likely this figure will climb further by 2030, even from inflation alone, not to mention Nu’s ongoing launch of new products and services.

Another factor left out of this analysis is the impact of new customers. With a high degree of certainty, Nu’s customer base in 2030 will be larger than it is today. The company is adding roughly 4 million new customers each quarter, and while this growth rate will naturally slow as market penetration increases, it is highly probable that the customer base will keep expanding. The only scenario that could prevent this is an asteroid hitting Earth.

With all that being said, there is a credible path to a 3x increase in revenue by 2030.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

I think this hits the nail on the head for Nu's investment thesis. One additional point is that incremental ARPAC drops almost 100% to the bottom-line as there is no incremental cost to serve. So it should not come as a surprise for earnings to grow at a faster clip on further inflection.