Welcome back to the Wolf of Harcourt Street Newsletter

Every month, I'll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I'll share a recap of the articles you may have missed from the previous month.

Broker Update

Last month, I mentioned that I was in the process of opening a new broker. Currently, I use DEGIRO, but I began to look elsewhere after it raised its fees again, per the latest Fee Schedule.

As a result, I have decided to open a new brokerage account in Trade Republic, a European investment platform. I have been testing the platform for the past few weeks and like it for several reasons:

Market-beating 2% deposit interest on cash deposits. Similar to a deposit bank account, you can deposit cash onto the platform and earn 2% per year, paid monthly. For context, AIB’s rate is 0.25%. This is a great alternative to having cash sitting in a bank account earning next to nothing.

€1 execution fee per trade. The equivalent cost on DEGIRO is nearly €3 comprised of a €1 commission + €1 handling fee + 0.25% FX fee.

Zero fees on “savings plans.” You can set up a recurring investment each month with no trade fee. For example, you could set up a savings plan to buy €500 worth of Microsoft (or any stock or ETF) every month and not incur any fee.

Facilitates fractional shares and comes with both a mobile app and desktop version.

Regulated by the Federal Financial Supervisory Authority (BaFin) in Germany and has a European banking license. This means that it is covered by the EU deposit guarantee scheme up to €100,000.

Finally, it is wise to consider diversifying your investments across multiple brokers, regardless of which one you use. Relying on just one broker may limit your protection, as the EU deposit guarantee scheme typically guarantees up to €100,000. However, by spreading your investments across two or more brokers, you can effectively double your protection to €200,000.

If you’re located in Europe, click here to try Trade Republic for yourself1.

Transactions

I added to my positions in the following:

Airbnb (ABNB)

In the Q1 2023 portfolio review, I mentioned that ABNB was on my buy list. At the beginning of April, The Bear Cave published a short report causing the stock to drop 5%. I felt that the report was lacking any real substance or new information that was not already know to those that follow the company closely so it presented the ideal buying opportunity. In particular, the report argued that Airbnb is facing increased competition from professional hosts who are building their own booking platforms and offering cheaper deals to cut out Airbnb. This is an inherent risk of the business model but Airbnb has made operational improvements and enhancements to counteract this risk. For example, AirCover protection for hosts and guests is included for free with every booking. For hosts to build their own platforms, they will incur all of the fixed costs but without any of the network effects or certainly that Airbnb provides. This competitive advantage will be difficult to erode.

Home Depot (HD)

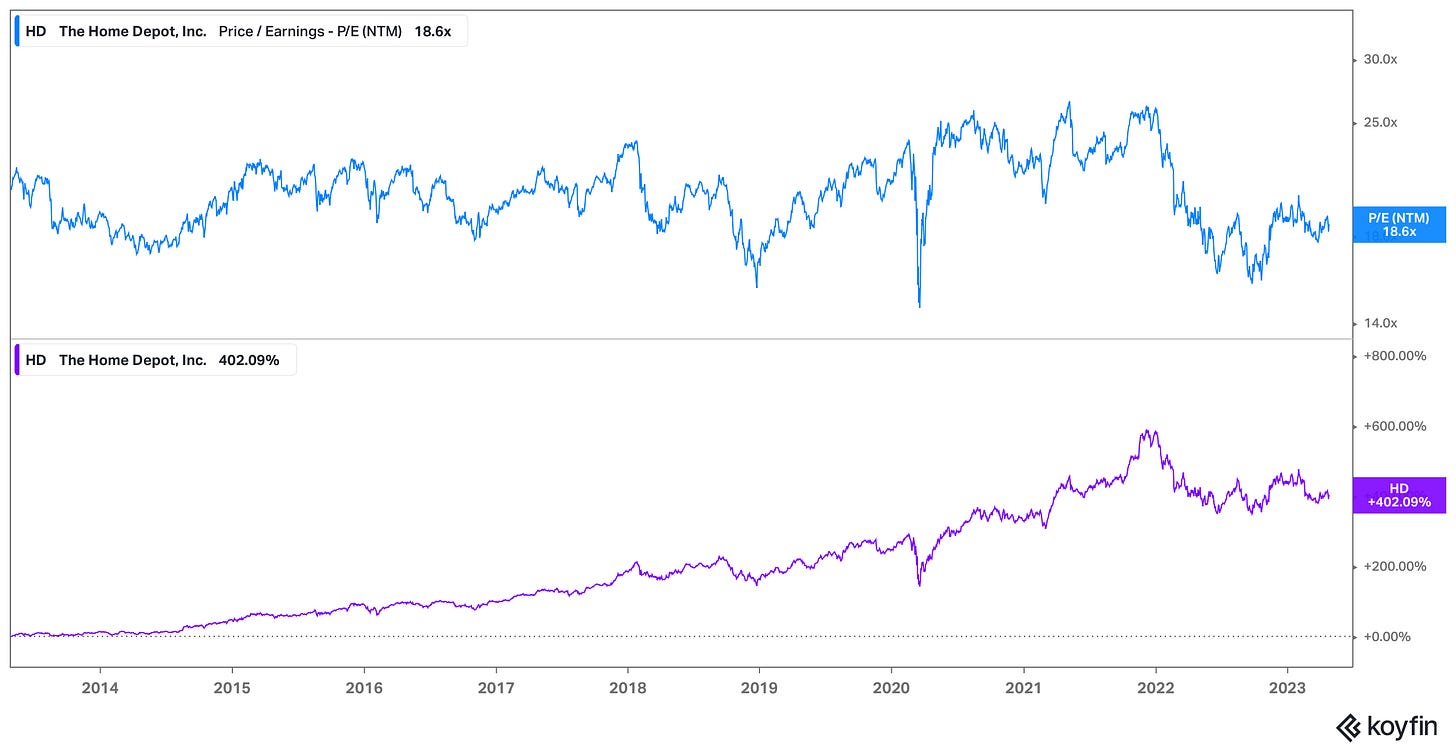

HD is a new position in my portfolio in 2023 and as such I am still building it out in terms of portfolio weight. I continued to accumulate shares under $290 (and will continue to do so if presented with the opportunity). The forward P/E of 18 has proved to be an attractive point to add shares over the past 10 years. What makes HD unique is its ability to generate incredible capital returns from growing sales per store rather than growing the number of stores.

The above chart is from Koyfin which is the tool that I use to screen and analyse stocks. In my opinion, it is the most comprehensive financial data and visualisation tool that makes the research process so much easier for investors. If you would like to try it for yourself, you can click here to sign up and receive a 10% discount.

I didn’t sell or open any new positions during the month.

Allocation

Portseido is the tool that I have been using to track my portfolio for a number of years. I really like the charts that it produces and how it tracks performance. They also added a feature to automatically track dividends too. To top it off, it is effortless to update for new transactions. If you would like to save yourself a tonne of time tracking your own portfolio, click here to sign up.

Buy List

Stocks that are on my radar to add this month:

Amazon (AMZN) - I feel that AMZN is a bit misunderstood at the moment. Short-term profitability has been hit by a massive CapEx cycle to expand their fulfilment capacity. This will reinforce the already strong competitive advantage even further and boost long-term profitability, rewarding shareholders that are patient enough.

Chevron (CVX) - CXC beat Q1 revenue estimates by a casual $3 billion (yes, you read that correctly) and achieved the seventh consecutive quarter with a return of capital employed greater than 12%. Despite posting these numbers the stock is still fairly priced.

PepsiCo (PEP) - PEP had a really solid Q1 earnings and continues to be a safe hedge against inflation. The share price has climbed 12% since I opened my position and is overvalued at the moment. I would need to see a drop in share price to continue increasing my position size.

Texas Instruments (TXN) - TXN is down around 10% over the past month and reported Q1 earnings that were very much “meh”. During the conference call, management expect the outlook for 2023 to be worse than seasonal due to declines in end markets, except for automotive, and a continuing trend of customers reducing inventory. Looking at the long-term, higher semiconductor content growth in industrial and automotive markets is bullish for TXN as it makes up two-thirds of their revenue.

In Case You Missed It

Cloudflare (Ticker: NET) will be the focus of the upcoming deep dive which will be released in the next week or two.

Some of the articles you might have missed during the past month:

Final Words

I am working my way through all of the earnings reports for my holdings with over half still to report in May. This was a low key month for me. I added to a couple of existing positions and that was it. ABNB becomes a Top 5 position for the first time. Keep It Simple, Stupid.

Hit subscribe below if you have not already done so in order to receive the latest content straight to your inbox each week.

If you enjoy today’s edition, then feel free to share as it, it really helps.

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

If you sign up using this link, I receive a modest commission. This helps to support an independent content creator and enables the newsletter to remain free.

I've been with Trade Republic since I started in 2020. Great broker. Regarding the 100,000 € Einlagensicherung in Germany, that is only for your cash deposits. Your shares are not included here, they are not on the balance sheet of Trade Republic but rather with a trustee. Those are two different things.