Welcome back to the Wolf of Harcourt Street Newsletter.

Every month, I'll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I'll share a recap of the articles you may have missed from the previous month.

Unlock Premium Insights with Seeking Alpha! 🔎

Seeking Alpha Premium gives you all the tools you need to research and invest with confidence. Trusted by professionals in hedge funds, mutual funds, and investment banks, it provides top-tier stock research, quant ratings, and access to exclusive analysis from leading investors.

Starting September 16th, the price of Seeking Alpha Premium will increase to $299. But Wolf of Harcourt Street subscribers can still lock in the current offer of $214/year until October 1st! Plus, you’ll secure a renewal rate of $239 for next year—saving even more. Don’t wait until the price goes up!

Transactions

PepsiCo (PEP)

I sold my entire position in PEP at the beginning of the month, which accounted for just under 3% of my portfolio at the time of sale. After reporting Q2 earnings, the stock rose by as much as 8%, which surprised me as I found the earnings unimpressive.

As we know, inflation has been hitting consumers hard, but PEP has benefited by continually raising prices. While revenue in Q2 grew by just 1% YoY, volumes actually decreased by 2%.

This indicates that the revenue growth was purely due to price increases, compensating for declining volumes. My concern with PEP is that it has squeezed so much out of consumers through price hikes that they are reducing their consumption of PEP products. Continually raising prices while volumes fall is not a sustainable strategy, which is why I exited the position. I am not interested in owning a company that only grows in line with inflation.

Visa (V)

I opened a new position in V which is a business we're all familiar with, and many readers probably use it daily. I've always wanted to own this company, but it has typically seemed expensive, especially for a mature business. However, at the beginning of August, the stock dropped to as low as 24 times forward earnings, so I decided to finally initiate a position.

PEP was a low-volatility position in my portfolio that helped balance some of the more volatile holdings. I believe that V, at these levels, presents a much higher return potential than PEP—at least 2x or possibly 3x—while still maintaining relatively low volatility.

Rather than delve deeply into the business's intricacies and its strong, durable competitive advantage, I'll link two podcasts that supplemented my research process.

The first is from Acquired and runs almost four hours long, but it’s a phenomenal piece of work, covering the company in such detail that you'll come away knowing everything you need to know about Visa.

The second is from the team at

. This episode is about an hour long and offers a shorter, summarized version of the business and its history, along with a discussion of the stock from an investment perspective.I added to my position in the following:

Sea Limited (SE)

SE has been a rollercoaster journey since 2020, when I first invested at $102 per share. I rode it up to over $360 in October 2021, only to watch it crash to as low as $34 at the beginning of 2024. I held on through the drawdown and made my most significant addition to the position in November 2023, after the stock dropped 20% following its Q3 earnings report. At the time, the market reacted negatively to SE’s strategy of investing heavily in its live streaming ecosystem and logistics infrastructure. These instances, where the market focuses on short-term concerns rather than the bigger picture, present opportunities for long-term investors to profit.

Fast forward to today: after investing in future growth in 2023, SE is back to growing revenue by over 20%, with the stock price more than doubling as well. When the stock dropped on 'Black Monday' (August 5), I seized the opportunity to buy more shares ahead of the Q2 earnings report the following week. After a strong earnings report, the stock is now up almost 40% since 'Black Monday.' For those who missed it, the full earnings review is linked below.

Amazon (AMZN)

I recently added to my Amazon position for the first time since 2023, when I significantly increased my holding as the stock was trading around $100. At that time, I wrote:

I increased my exposure to AMZN significantly at the start of this month. I mentioned last month that I felt it was being misunderstood by the market. The similarity between free cash flow (FCF) and stock price charts is uncanny. The minute AMZN completes its current cycle of heavy CapEx the stock price could explode in line with FCF.

This is exactly what played out as FCF has exploded and the stock is up +70% since.

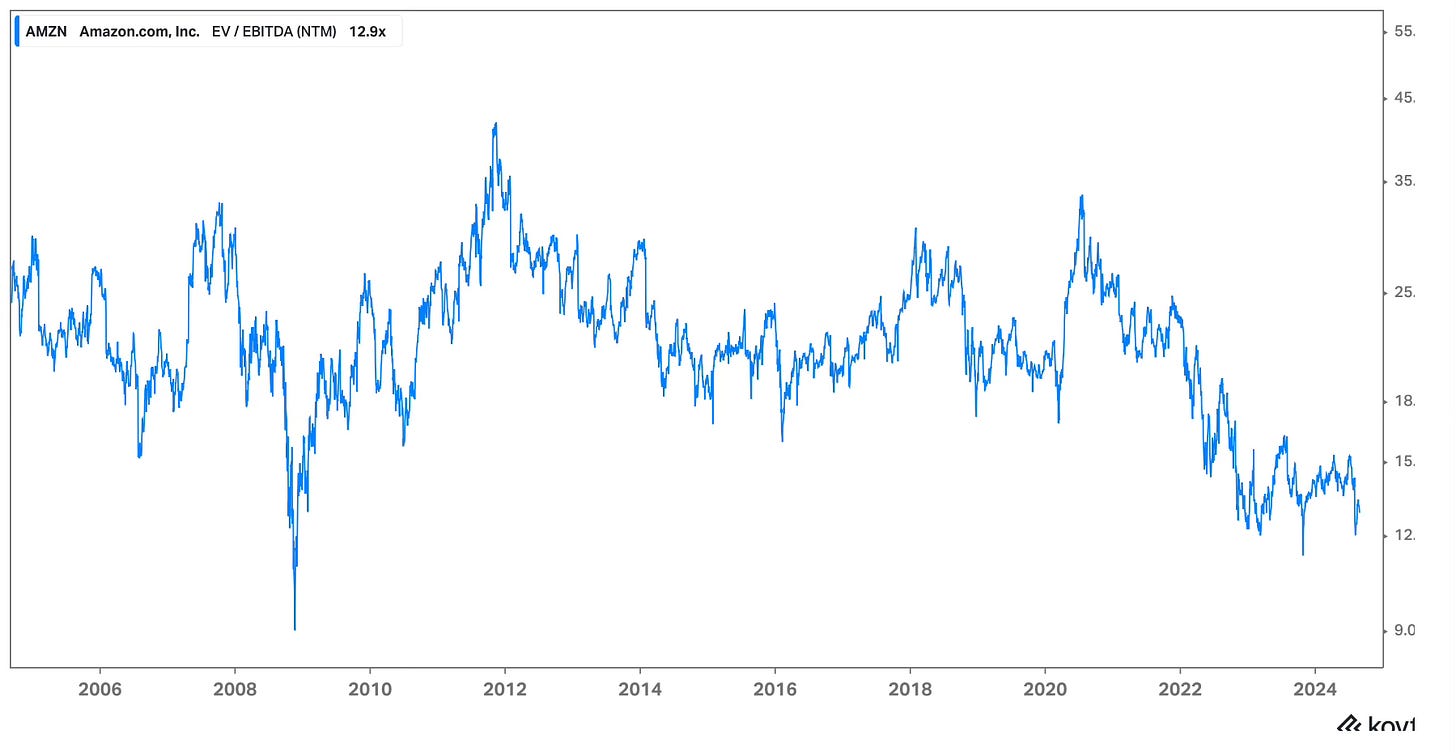

Despite this strong return, I believe AMZN still presents a very attractive opportunity today. The company continues to grow its top line by double digits and is now benefiting from enormous operating leverage following its heavy CapEx investment cycle. The EBIT margin has increased from 2% in 2022 to 9% in 2024. With a forward EV/EBITDA of just 12, AMZN is trading at its cheapest valuation since the financial crisis of 2008.

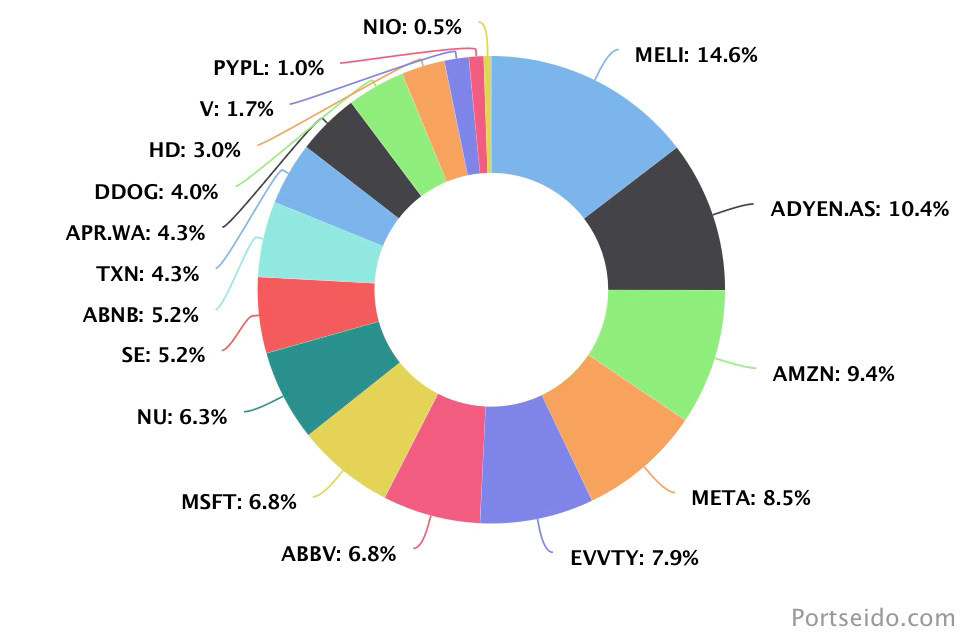

Allocation

Portseido is the tool that I have been using to track my portfolio for a number of years. I really like the charts that it produces and how it tracks performance. They even have a feature to automatically track dividends too. To top it off, it is effortless to update for new transactions. The team have kindly given me an affiliate link so if you would like to sign up you can click here.

Buy List

Stocks that are on my radar to add this month:

Visa (V): This is a new position that I am happy to continue building, especially at the current valuation level. My long-term goal is to have V as a top 10 position by weight.

Auto Partner (APR.WA): I have been holding off on adding to APR until after the Q2 earnings call on September 17. The company provides preliminary monthly sales updates, so we already know that revenue grew by 13% in Q2 and 20% in July. However, I need clarity on two questions before purchasing more shares:

What was the revenue growth split between domestic and export markets? I assume Q2 growth slowed due to export sales, as the company is building a new distribution centre to serve this market.

How have margins evolved in response to the minimum wage increase and FX headwinds? I expect margins to compress, but I want to assess the full extent of the impact.

In Case You Missed It

Some of the articles you might have missed during the past month:

Final Words

July presented some attractive opportunities that continued into August, despite my portfolio experiencing a 9% drawdown on 'Black Monday.' Fortunately—or unfortunately, depending on your perspective—the drawdown was short-lived, and my portfolio rebounded to a new all-time high within two weeks driven by strong earnings moves from MELI, SE, NU and ADYEN in particular.

My investing style and strategy remain consistent, whether the portfolio is at an all-time high or in a drawdown of over 20%, as it was in 2022. However, I sense that we’re entering a market phase where anything you buy seems to go up. This is the time to be most vigilant, ensuring you don’t cut corners on due diligence or stray from your strategy, even when you feel like a genius.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com