Welcome back to the Wolf of Harcourt Street Newsletter.

Every month, I'll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I'll share a recap of the articles you may have missed from the previous month.

Transactions

Brookfield Renewable (BEPC)

I sold my entire position in BEPC, which was a 4% weight at the time of sale. Earlier this year, after careful consideration, I concluded that commodities do not align with my overall investment strategy. Commodity prices are volatile and influenced by various factors such as weather, global demand, and geopolitical events. While I foresee a bright future for renewable energy, many factors outside the control of management make it difficult to appraise the business and its competitive positioning.

In February, I sold my position in Chevron, and after this month’s disposal, I no longer hold any commodity stocks. While I essentially broke even on the sale of BEPC, including the dividends received, it’s worth noting that the stock has significantly underperformed the market over the past four years. Is it capable of outperforming over the next ten years? I’m unsure.

I added to my position in the following:

Adyen (ADYEN)

I invested half the proceeds from BEPC into Adyen. After rising to over €1,500 in March, the stock has fallen by 30% in the past four months. Despite this trend, the company continues to go from strength to strength, as demonstrated by the new partnerships being onboarded almost weekly. These are the sorts of situations that present themselves if you can remain patient enough. Follow the business, not the stock price chart.

Airbnb (ABNB)

ABNB is down over 10% since it reported Q1 earnings back in May. At the time, I mentioned that this was an overreaction to Q2 guidance that appeared light. In reality, this was due to some Q2 revenue being pulled forward into Q1 because of the timing of the Easter holiday, and the guidance for H1 2024 revenue exceeded Wall Street's estimate.

I continue to believe that ABNB remains undervalued, especially considering the surge in demand it is experiencing in Paris for the Olympics, which I referenced in a recent edition of Market Movers. ABNB is uniquely able to capture one-time events because the supply model flexes with demand. Contrast that with hotels, which can’t pop up overnight and often take years to build from start to finish.

Evolution (EVO)

I added more EVO shares after the stock sold off following the Q2 2024 earnings report. While the report itself was rather weak, the company is still growing double digits and maintains market leadership in an ever-expanding global industry. At just 15 times forward earnings, it’s difficult to envisage the floor for EVO being much lower. The new capital allocation framework provides certainty to shareholders, and the €400 million buyback program should further reinforce the share price floor. Since the program was approved, EVO has been buying back an average of €6 million worth of its own shares per day.

I didn’t open any new positions during the month.

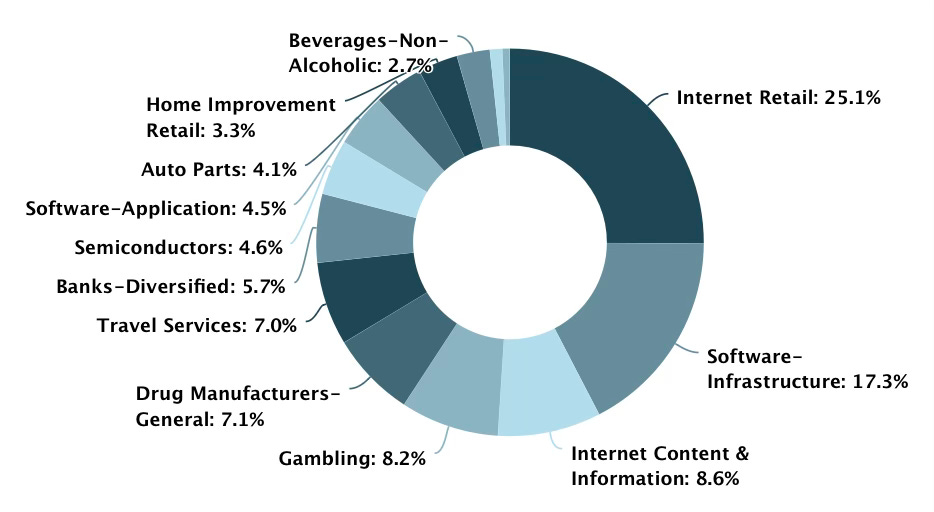

Allocation

Portseido is the tool that I have been using to track my portfolio for a number of years. I really like the charts that it produces and how it tracks performance. They even have a feature to automatically track dividends too. To top it off, it is effortless to update for new transactions. The team have kindly given me an affiliate link so if you would like to sign up you can click here.

Buy List

Stocks that are on my radar to add this month:

Sea Limited (SE) - I last purchased SE in November 2023, and the stock subsequently doubled to $75 by June 2024. The market sentiment in November was very different from today. Back then, the market was fixated on the previous quarter, ignoring the clear signs of a return to growth that were apparent to attentive investors. Fast forward nine months, and SE is growing at over 20%, surpassing my forecast of mid-teen growth. The stock has fallen 13% from its June highs and is very reasonably valued considering the growth and operating leverage yet to be realized.

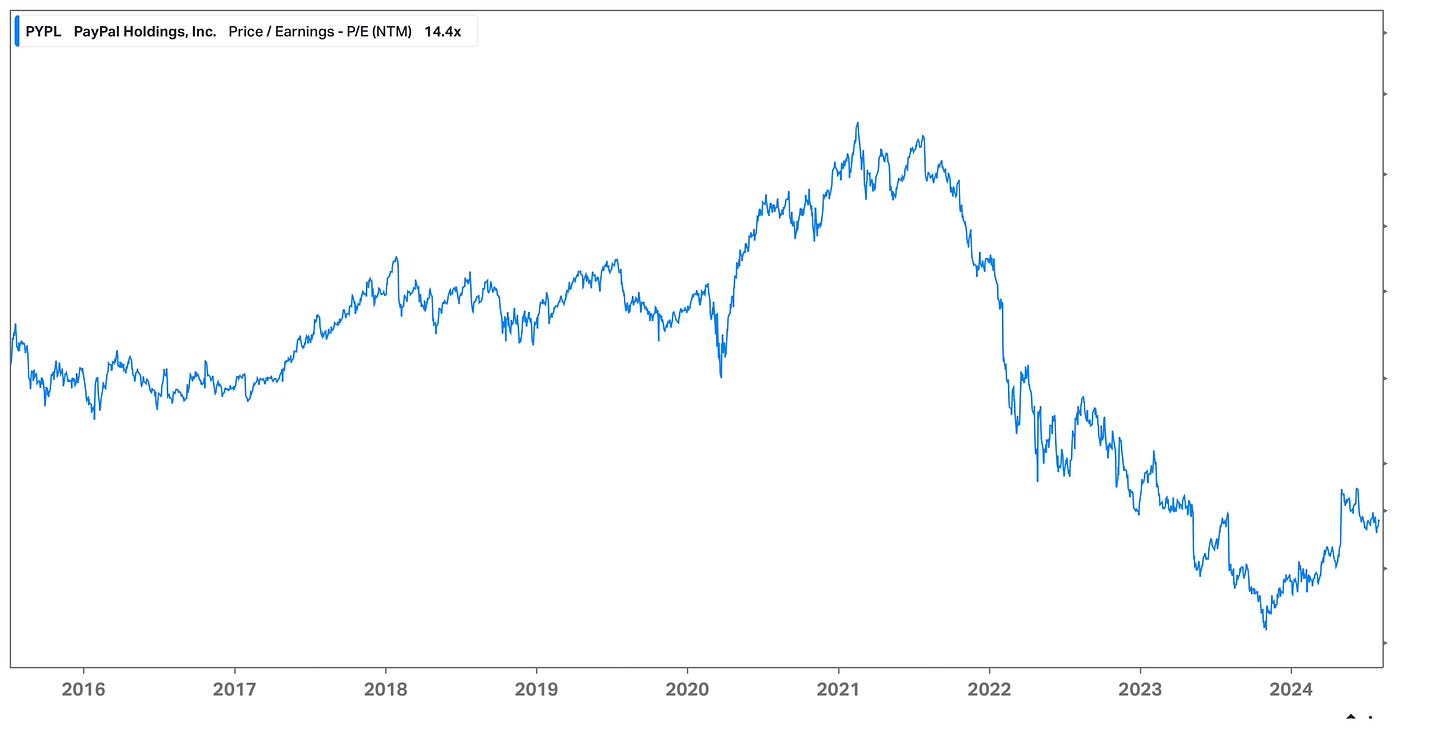

PayPal (PYPL) - PYPL is the second smallest position in my portfolio, with a weight of 1%. It’s a position I have held for many years without adding to it. It has reached a point where I need to increase my position or sell because 1% simply won’t move the needle. The company had a tough couple of years under Dan Schulman before he was replaced as CEO by Alex Chriss in September 2023. Ultimately, I believe PayPal is inferior to competitors like Adyen, which continues to increase its market share. However, I do believe Chriss is starting to make the necessary changes after years of Schulman being asleep at the wheel. In Q2 2024, PYPL reported Total Payment Volume of $417 billion, which grew 11% YoY. The company is far from dying, and trading at just 14 times forward earnings, this could well be a value play.

Visa (V)/ Hermes (RMS) - I’ve included Visa and Hermes together because they are two stocks on my watchlist that I would like to own. Both are extremely high-quality businesses with durable competitive advantages. Visa is part of the global payment rail duopoly, while Hermes is an iconic luxury brand. Both rarely look cheap (Hermes still doesn’t), but at the moment, they are trading towards the lower end of their historic forward earnings multiples

In Case You Missed It

Some of the articles you might have missed during the past month:

Final Words

I was quite active this month, deploying all the proceeds from BEPC across a few different positions. For many months, I have been noting that I see fewer and fewer obvious opportunities. Thankfully, this is changing, and many more attractive opportunities are starting to arise. As a long-term investor, I embrace this because it means I can deploy capital with more favorable risk vs. reward scenarios.

After selling BEPC this month, the portfolio is now down to 17 positions, the lowest number I have held since I started investing. While I do not rule out reducing the number of positions further if I see fit, I am now well-positioned to add some watchlist names to the portfolio if market sentiment continues to react negatively in the short term.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Great update. Are you considering any more Nu now it has pulled back close to $12?

Great post! Hermes is always on my watchlist too, but always too expensive :(