Welcome back to the Wolf of Harcourt Street Newsletter.

Every month, I'll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I'll share a recap of the articles you may have missed from the previous month.

Transactions

New Position

NU Holdings (NU)

I opened a new position in NU after entering 2024 with a cash position of over 3%, a result of some tax harvesting in December. I am extremely bullish on Latin America, as evidenced by my large position in MELI, and I believe that NU is another stock within this region that warrants serious attention.

The backstory to NU is a fascinating one. CEO David Vélez founded the neobank in 2013 after moving to Brazil from Colombia. He became extremely frustrated with the Brazilian banks' fees and service. I recommend checking out the Morgan Stanley interview with David Vélez linked below.

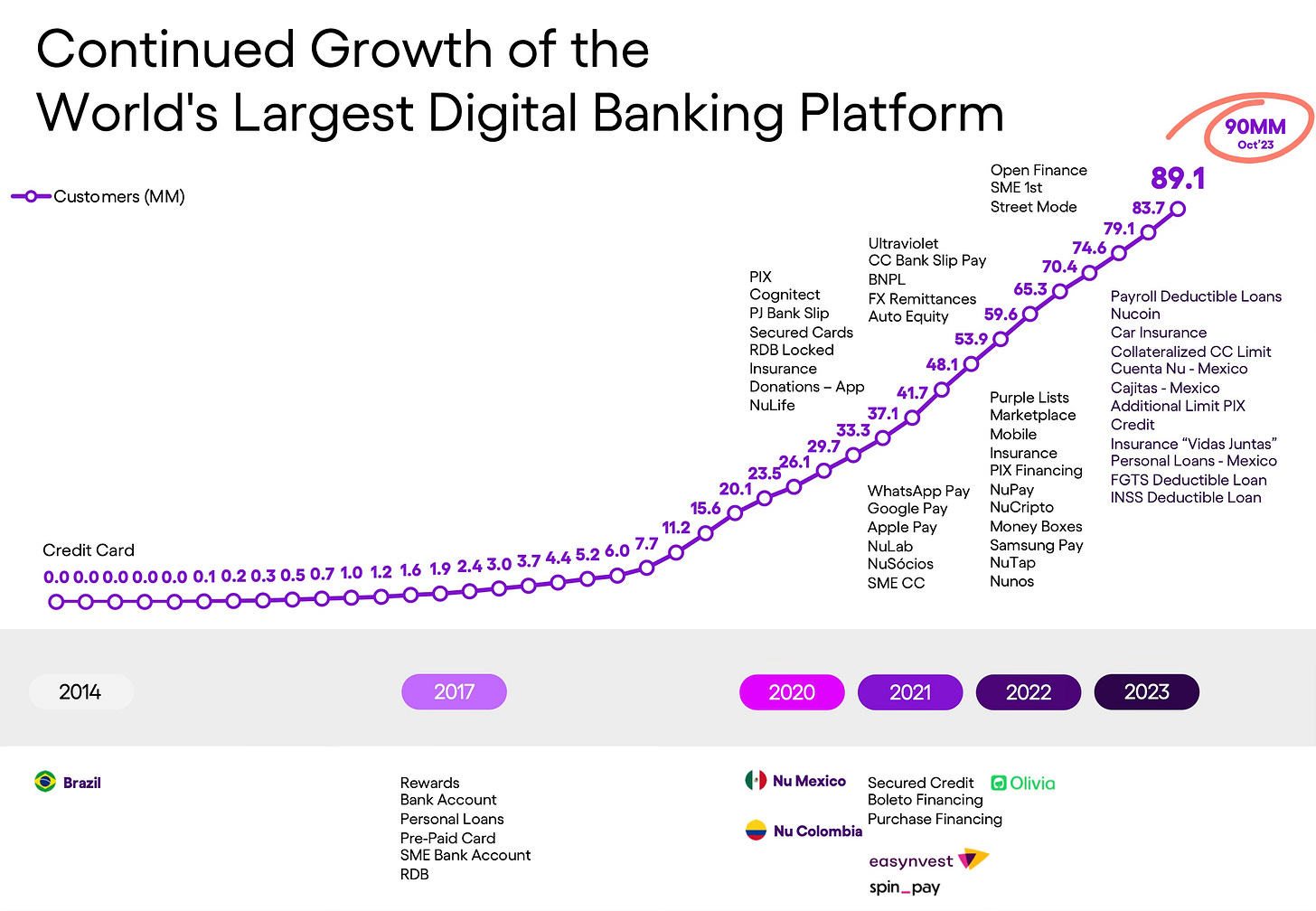

Fast forward ten years, and NU now has more than 90 million customers across Brazil, Mexico, and Colombia. In Brazil, 51% of the adult population has a NU account, which is truly astonishing. I cannot think of any other bank in any country that has this level of penetration.

NU's customer growth has resulted in revenue growing like gangbusters. In just two years, NU has increased revenue from $481 million in Q3 2021 to $2.14 billion in Q3 2023. What's just as impressive is that NU is expected to continue growing revenue by +30% over the next couple of years.

What sets NU apart from the competition is its customer acquisition cost (CAC) of just $5, which is incredibly low. By comparison, the CAC for retail banks in the U.S. is $500. It is estimated that NU's lifetime value for each customer is at least 30 times greater than its CAC. In general, an LTV/CAC of 3x is considered good.

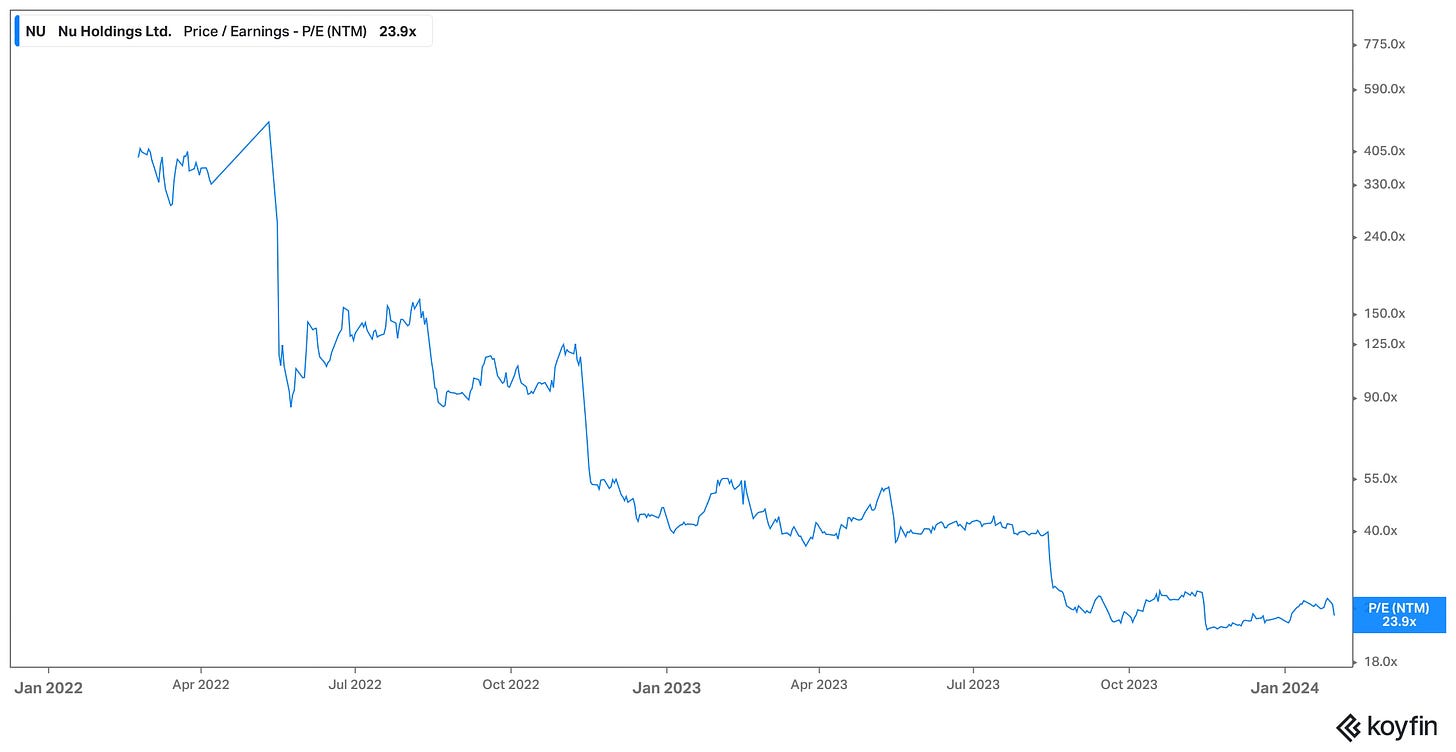

Finally, looking towards valuation, my strategy is to favor growth at a reasonable price (GARP) over growth at any price (GAAP), and I believe that NU certainly fits this description. In January, NU traded for as low as 23 times forward earnings. For a company with a clear structural competitive advantage over its competitors, visionary management, and secular tailwinds supporting future growth, I think this is a very reasonable valuation.

I added to my positions in the following:

Auto Partner (APR.WA)

After reporting preliminary December revenue numbers in January, APR stock fell by 8%. The preliminary numbers implied revenue growth of 14%, which was lower than market expectations. However, what most analysts ignored was the fact that there were two fewer working days in Poland in December 2023 compared to December 2022 due to the arrangement of public holidays. If December 2023 had 21 working days instead of 19, revenue would have grown by 26%, all other things being equal. Despite the shortfall in December, APR achieved revenue growth of 29% in 2023, accelerating from 25% in 2022.

I seized this opportunity to increase my position, especially considering that the sell-off resulted in the stock trading at 12 times forward earnings.

Allocation

Portseido is the tool that I have been using to track my portfolio for a number of years. I really like the charts that it produces and how it tracks performance. They also added a feature to automatically track dividends too. To top it off, it is effortless to update for new transactions. The team have kindly given me an affiliate link so if you would like to sign up you can click here.

Buy List

Stocks that are on my radar to add this month:

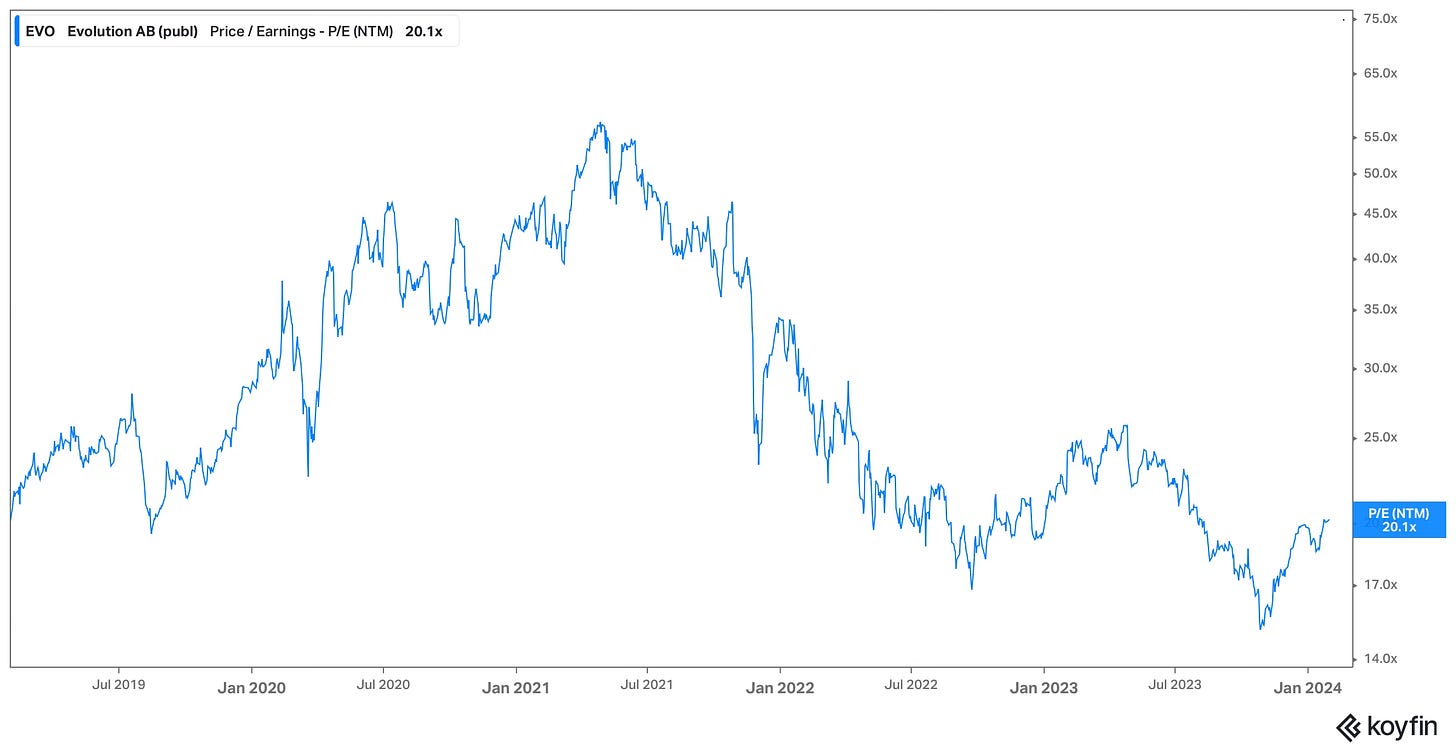

Evolution (EVO.ST) - In anticipation of the Q4 earnings, which will be released today (1 February), I believe that EVO is still quite attractive at 20 times forward earnings. The company has been actively buying back its own shares over the past several months and has exhausted €195 million of the approved €400 million program.

Nu (NU) - I opened a starter position in NU this month, using half of the proceeds from my tax-harvesting strategy. My plan is to gradually build out the position over the next several months, assuming that the current valuation does not fluctuate wildly.

In Case You Missed It

Some of the articles you might have missed during the past month:

Final Words

The stock market made a solid start to 2024, continuing from its strong finish in 2023. As a result, I find that there are fewer obvious opportunities. This does not mean that there are no opportunities; it just means that we have to work a bit harder to find them or be more selective.

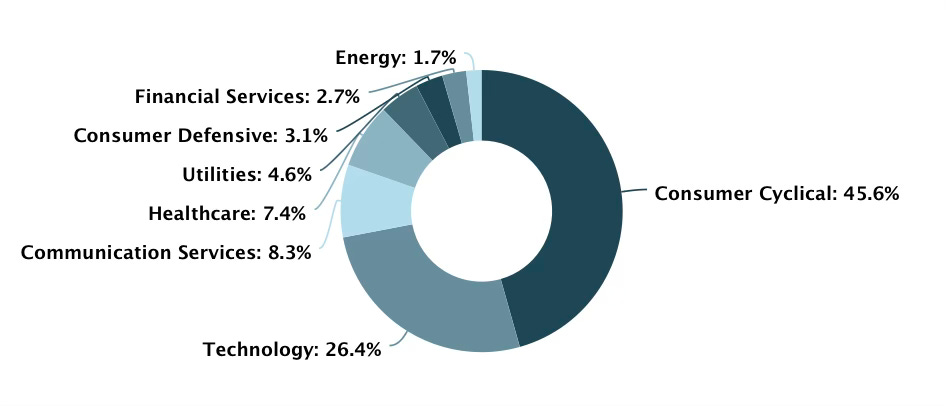

Over the past month, I have been considering my exposure to commodities, particularly energy and utilities. When writing my 2024 Annual Report, I highlighted the importance of not just investing in value for value’s sake. It could be argued that commodities might not fit within my overall strategy and have been used to hedge the portfolio. This is something I will continue to tease out before rushing to any conclusions or decisions. Expect an update on this thought process next month.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com