Portfolio Review - May 2023

AI Investment Strategy: Ignoring the Noise and Staying Focused on Long-Term Goals

Welcome back to the Wolf of Harcourt Street Newsletter

Every month, I'll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I'll share a recap of the articles you may have missed from the previous month.

Transactions

I added to my positions in the following:

Amazon (AMZN)

I increased my exposure to AMZN significantly at the start of this month. I mentioned last month that I felt it was being misunderstood by the market. The similarity between free cash flow (FCF) and stock price charts is uncanny. The minute AMZN completes its current cycle of heavy CapEx the stock price could explode in line with FCF.

The above chart is from Koyfin which is the tool that I use to screen and analyse stocks. In my opinion, it is the most comprehensive financial data and visualisation tool that makes the research process so much easier for investors. If you would like to try it for yourself, you can click here to sign up and receive a 10% discount.

Another positive catalyst for AMZN was Shopify announcing the sale of its logistics and fulfilment operations. Shopify realises that they cannot compete with AMZN in this area and rather than throw more money at it they have decided to sell this part of the business and offer “Buy with Prime” to its merchants. If this does not copper-fasten AMZNs logistics and fulfilment competitive advantage then I don’t know what does.

Chevron (CVX)

CVX posted some mind blowing Q1 results and is swimming in cash at the moment after raking in record profits over the past year. With all of this cash at its disposal, CEO Mike Wirth announced the $6.3 billion acquisition of PDC Energy this month and confirmed that he is open to more deals (Source: Bloomberg). To put some context around this deal, the price paid by CVX is less than its first quarter cash flow from operations. CVX is still a relatively small position for me but I am happy to build out the position at these levels.

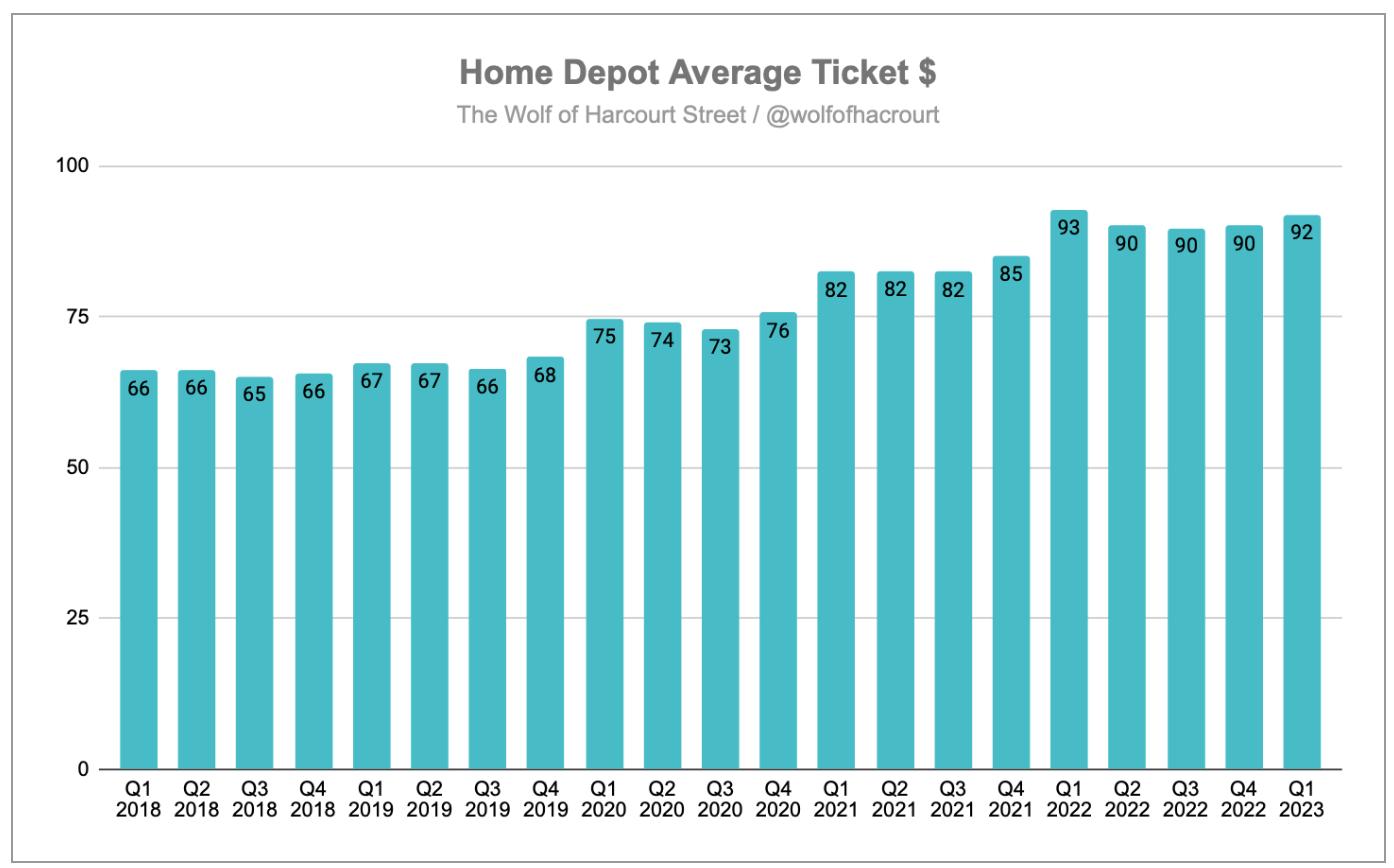

Home Depot (HD)

I have been accumulating HD sub $290 since the start of 2023 and after it dipped below $280 reporting Q1 earnings I added some more. The earnings were in line with my expectations, revenue and net earnings declined 4% and 8% respectively. On the flip side, free cash flow increased 115% to $6.6 billion driven by positive working capital requirements. The market is not expecting revenue or earnings growth in the short-term which presents the ideal opportunity to acquire shares in a high quality business for the long-term.

I didn’t sell or open any new positions during the month.

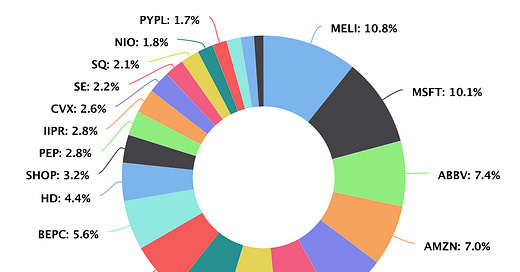

Allocation

Portseido is the tool that I have been using to track my portfolio for a number of years. I really like the charts that it produces and how it tracks performance. They also added a feature to automatically track dividends too. To top it off, it is effortless to update for new transactions. If you would like to save yourself a tonne of time tracking your own portfolio, click here to sign up.

Buy List

Stocks that are on my radar to add this month:

Sea Limited (SE) - Since reporting earnings on 18 May, SE is down over 30%. I felt the earnings were satisfactory particularly given the achievement of a second successive profitable quarter. On the negative side, revenue growth continued to slow to 5% with Digital Entertainment declining 56%. My full review is linked below.

Wall Street analysts expect revenue growth to reaccelerate to 11% in Q2 and if this is the case I think the stock will react very favourable. If (and its a big if) SE can turn Digital Entertainment around as hinted at during the Q1 earnings call, I could envisage revenue growth of close to 20% in 2023.

AbbVie (ABBV) - ABBV is my third largest position but I have not added to the position in almost one year. The main reason being valuation. However, the stock is down 16% since 25 April without any change to the fundamentals. ABBV generates billions of dollars in annual revenue from its aesthetics portfolio where the global market continues to grow double digits. ABBV sells two of the world's leading products - Botox for wrinkles and the Juvederm line of filler products.

Brookfield Renewable Corporation (BEPC) - The least talked about stock on FinTwit. The company grew revenue 15% in Q1 but more importantly funds from operations grew 32%. The recent wave of AI hype has caused semiconductor stocks to rocket. Few seem to realise that an enormous amount of electricity is going to be required to power the data centres that house the AI models. With BEPC already powering Amazon Web Services, I think this stock is well positioned in this regard.

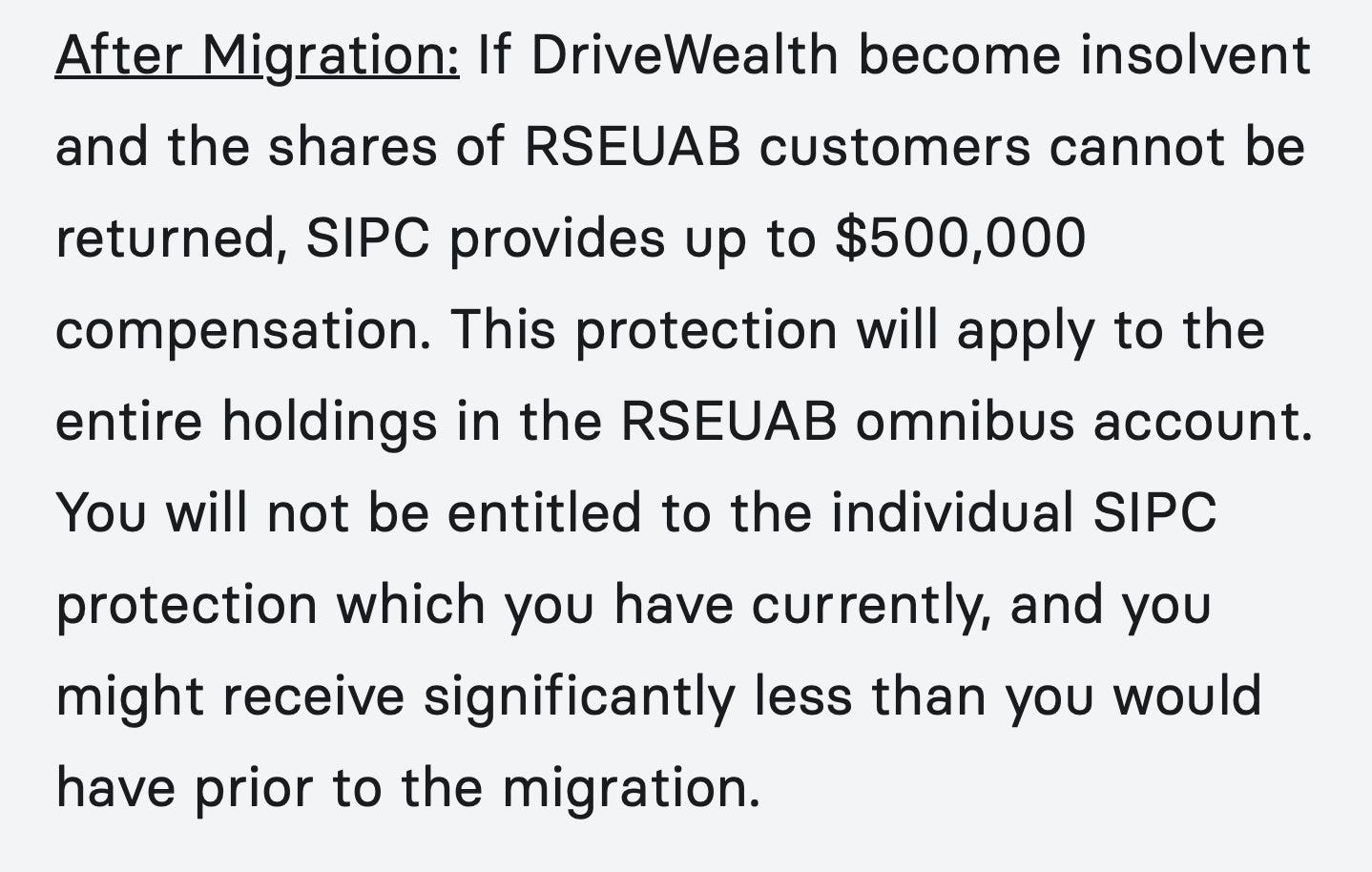

Broker News

Many of my European readers are aware of Revolut, so it's important for me to discuss the latest developments concerning their custodian, Drive Wealth. In a recent update to its terms and conditions, Drive Wealth essentially lowered the level of protection in case of insolvency from $500,000 to zero. This means that customers may not have any financial safeguard if Drive Wealth were to face financial difficulties.

Last month I discussed the importance of diversifying your investments by using multiple brokers instead of relying on just one. I strongly believe it's foolish to keep all your investments on a platform that provides zero protection, especially considering the numerous alternatives available in the market.

One such alternative is Trade Republic. I like the platform because it offers low fees, competitive deposit interest rates, and it's also backed by the EU deposit guarantee scheme.

In Case You Missed It

Adyen (Ticker: ADYEY) will be the focus of the upcoming deep dive which will be released in June.

Some of the articles you might have missed during the past month:

Final Words

The only material change to my top holdings is AMZN which has moved from 10th to 4th. The reason for this is two fold: significant accumulation of more shares and the stock price appreciating 15% during the month.

AI was the flavour of the month in May after Nvidia (Ticker: NVDA) raised Q2 2023 revenue guidance by $3 billion as part of its Q1 earnings release. This was one of the wildest earnings I have ever witnessed. The stock rose 25% in after hours but was actually cheaper due to the forward guidance.

My view is that it is likely that capital will flow to AI stocks on the back of the NVDA move in the coming weeks (perhaps months). This also means that capital will leave other industries in pursuit. Pharma is one example, Johnson & Johnson and AbbVie traded down in May. This could present long-term opportunities in other industries.

Hit subscribe below if you have not already done so in order to receive the latest content straight to your inbox each week.

If you enjoy today’s edition, then feel free to share as it, it really helps.

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

I like the Meli, Msft and Amzn exposure. 28% pretty gutsy.