Welcome back to the Wolf of Harcourt Street Newsletter.

Every month, I'll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I'll share a recap of the articles you may have missed from the previous month.

Transactions

I added to my positions in the following:

Adyen (ADYEN.AS)

Last month, I opened a position in Adyen after it experienced a 50% multiple compression following the release of its H1 2023 earnings. As the stock continued to bleed in September, I increased my position. The stock hit as low as 28 times forward earnings before rebounding over the past week.

While I do not know where the share price will bottom, I have learned through experience the dangers of trying to catch a falling knife. I have been slowing scaling into the position and will continue to do so until I see signs of the stock forming a Stage 1 base.

The full Adyen investment thesis is linked below for anyone that missed it.

Evolution (EVVTY)

After beginning to accumulate shares in Evolution in July at 20 times forward earnings, the stock now trades at 17 times forward earnings which is near its historical low. While we shouldn't draw firm conclusions about the future solely from past data, we do know that Evolution has consistently delivered compelling returns from this entry point

For the past four months, I have been researching Evolution in-depth. Instead of going into too much detail now, make sure you are subscribed to receive a comprehensive Evolution deep dive in the coming weeks.

I didn’t sell or open any new positions during the month.

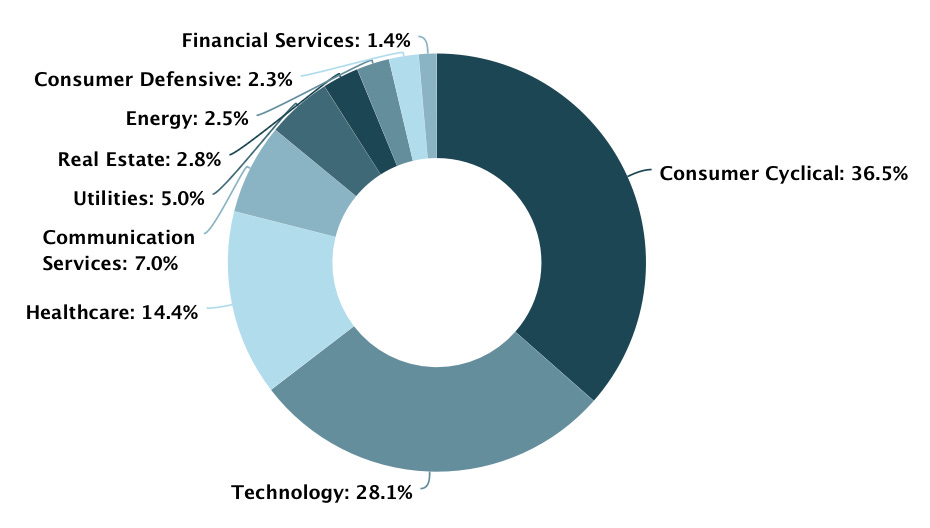

Allocation

Portseido is the tool that I have been using to track my portfolio for a number of years. I really like the charts that it produces and how it tracks performance. They also added a feature to automatically track dividends too. To top it off, it is effortless to update for new transactions. The team have kindly given me an affiliate link so if you would like to sign up you can click here.

Performance

Q3: -3.8% vs S&P -2.0%

YTD: +14.3% vs S&P +11.6%

Broker

Trade Republic is the name of the investment broker that I use. The platforms combination of low fees, accessibility, fractional share options, and regulatory backing make it a reliable choice.

From 1 October, Trade Republic will double its interest on uninvested cash from 2% to 4% per annum, paid monthly. This is one of the most competitive rates on the market for European investors.

Click here to sign up for a free Trade Republic account

Buy List

Stocks that are on my radar to add this month:

PepsiCo (PEP) - PEP remains on my buy list since last month. After starting a position in PEP in February the stock reached all-time highs, preventing me from increasing my position. However, it has recently retreated, currently trading at 21 times forward earnings, lower than the 25x I initially paid in February. This is a desirable situation where the stock price is higher, yet the valuation is lower due to earnings growth.

Texas Instruments (TXN) - In September, TXN increased its dividend to $1.30, marking its 20th consecutive year of dividend growth. This served as a reminder for me that I hadn't added to my position in a while. When I think about TXN, three key principles come to mind: a robust business model, careful capital allocation, and a commitment to enhancing efficiency.

In Case You Missed It

Some of the articles you might have missed during the past month:

Final Words

I began the year with 20 positions in my portfolio, but I've since expanded it to 24 by taking advantage of opportunities presented by the market. However, this means that I've reached the upper limit of what I can effectively manage and analyze. As a result, I plan to consolidate my portfolio back to a maximum of 22 positions by the end of the year. This means that I will be selling positions with the lowest conviction.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Good mix of quality businesses👍

Nice portfolio. Did you used to be fiver recently can’t remember.