Executive Summary

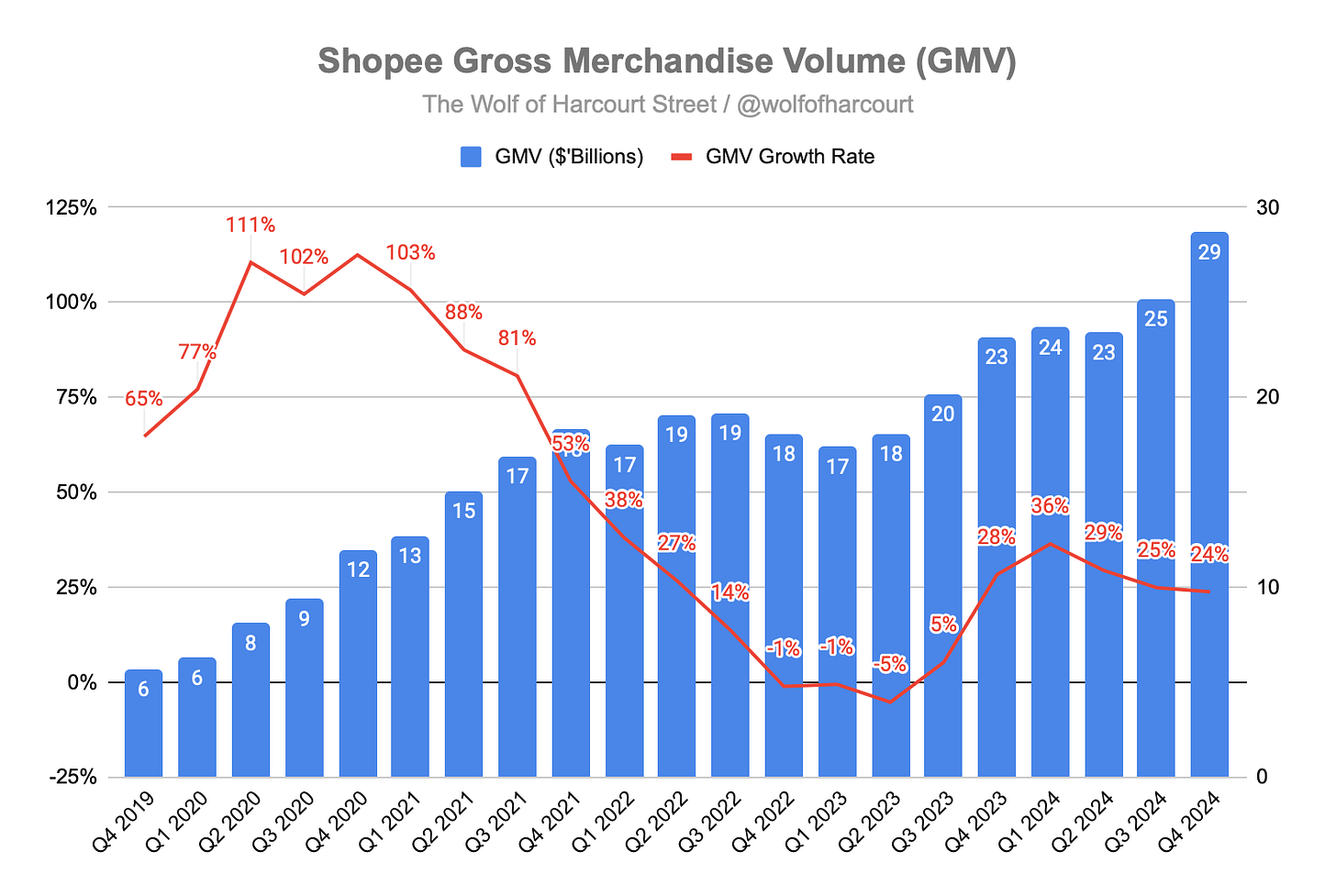

E-Commerce GMV reached $28.6 billion in the quarter, growing 24% YoY, with 2024 surpassing $100 billion. Shopee’s marketplace take rate improved to 11.2% through better monetisation, driven by higher commissions, increased ad adoption (+50% YoY), and a more rational competitive landscape. Cost leadership from SPX Express, AI-driven efficiencies in customer service and search, and a growing live streaming ecosystem further bolstered margins. In Brazil, Shopee gained market share with faster deliveries, broader product categories, and larger basket sizes, contributing to two consecutive quarters of profitability.

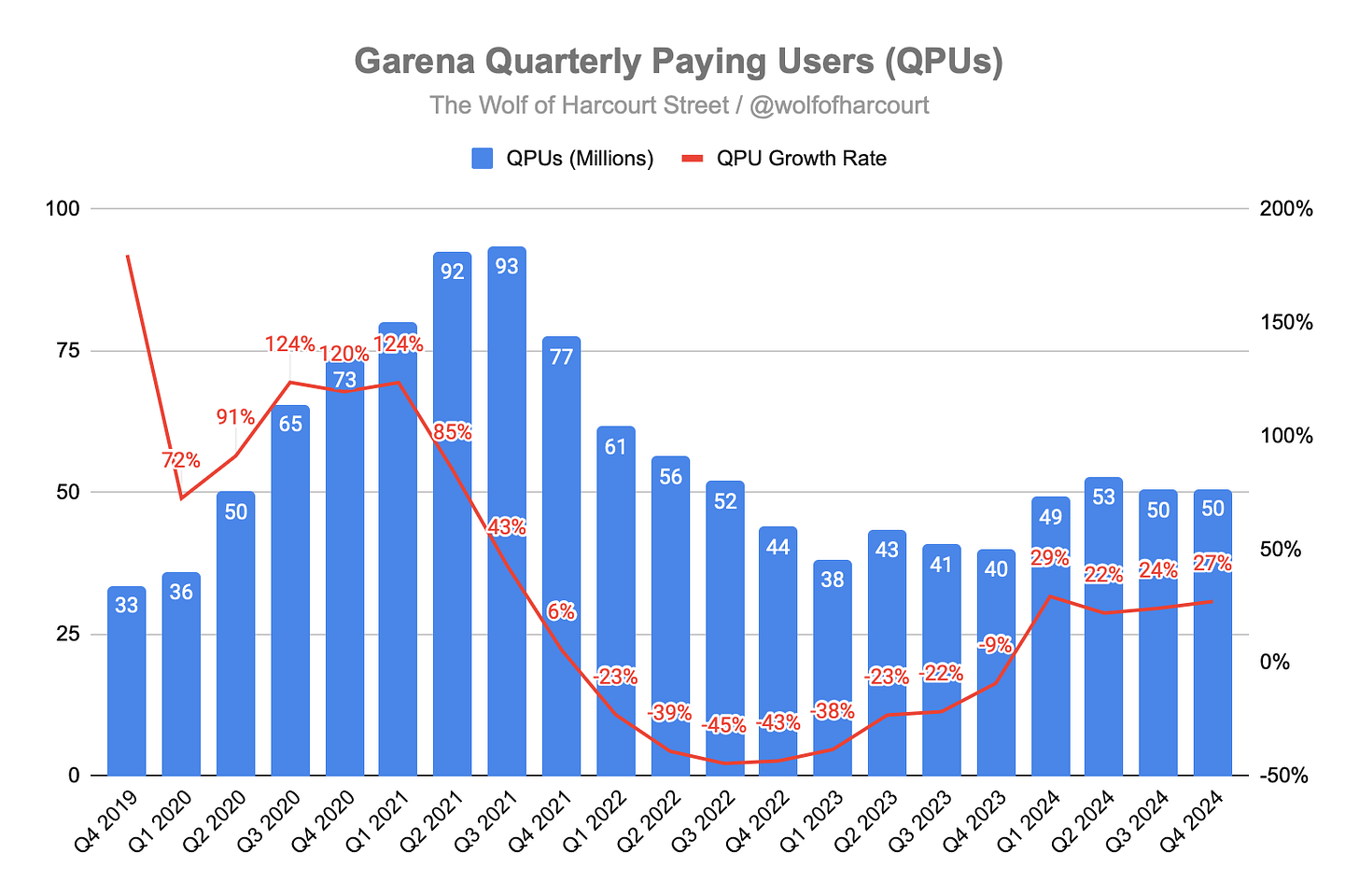

Digital Entertainment's quarterly active users reached 618 million, growing 17% YoY. Free Fire staged a strong recovery in 2024, with user growth and engagement accelerating after two years of decline. Quarterly paying users grew 27% YoY, marking four consecutive quarters of 22%+ growth, while daily active users surpassed 100 million.

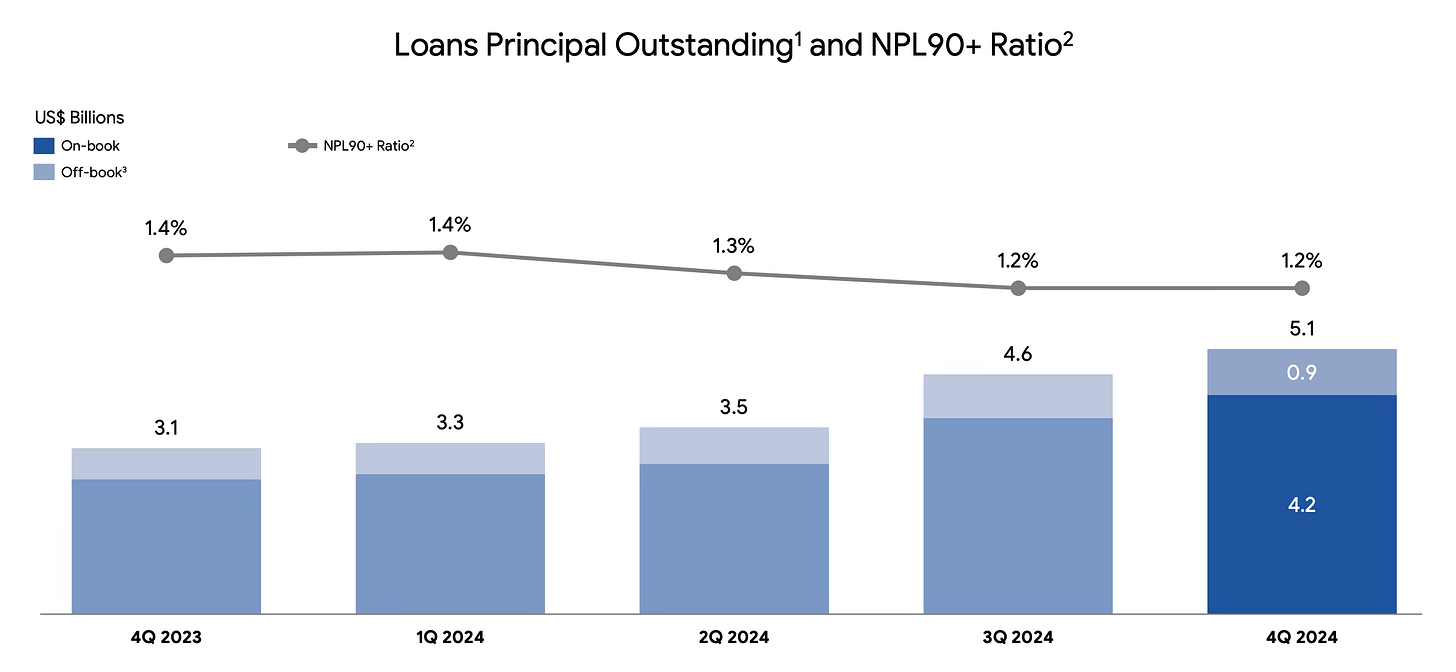

Digital Financial Services' loan book grew 64% YoY to $5.1 billion, with active users rising 50% to 26 million, while maintaining stable credit quality (90-day NPL at 1.2%). By leveraging Shopee's ecosystem and user data, Sea Money follows a "low-and-grow" strategy, starting borrowers with small SPayLater loans before offering larger off-platform loans based on positive credit behaviour. Off-platform loans now represent 50% of the loan book, tapping into Southeast Asia's under-penetrated consumer credit market.

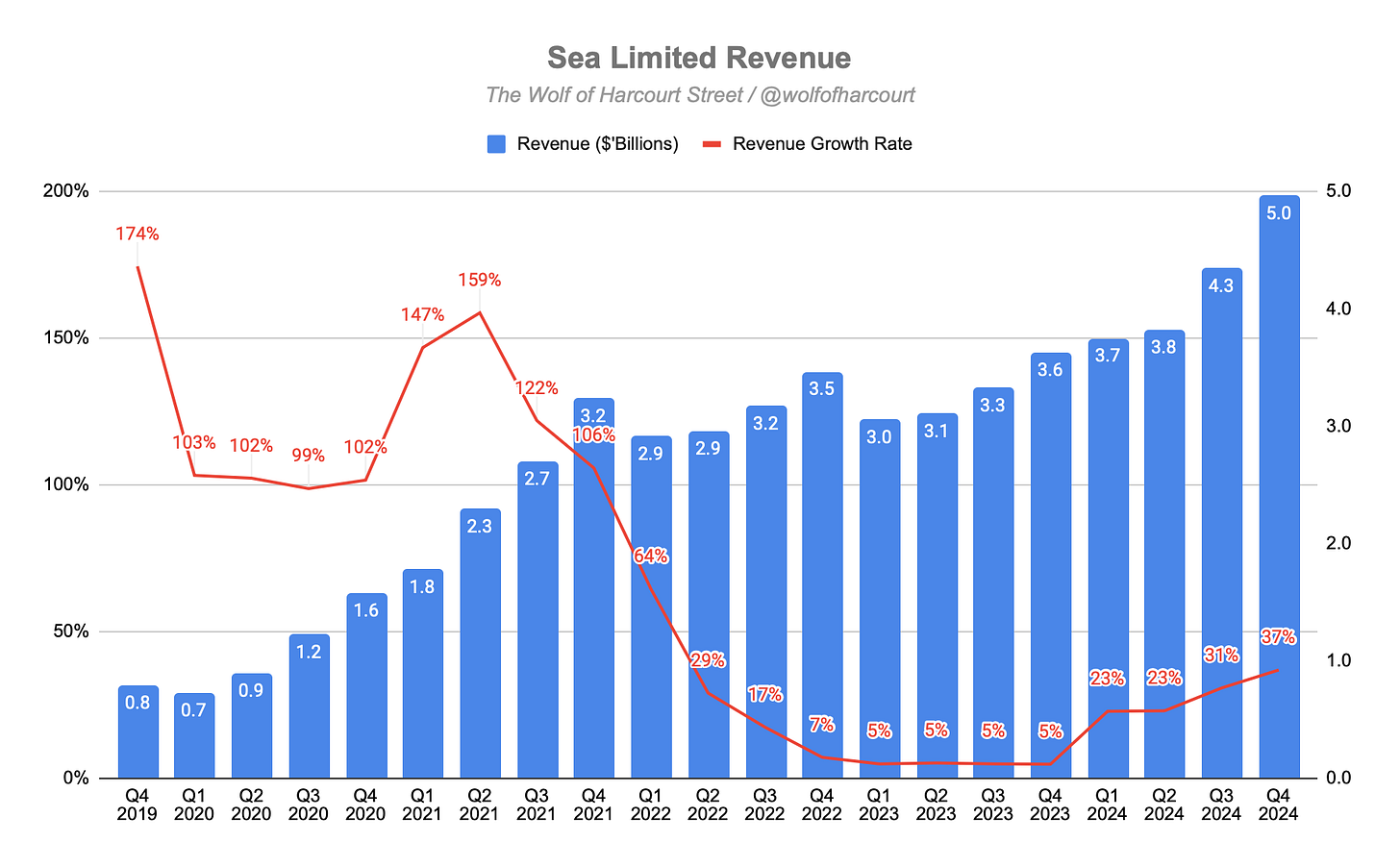

Total revenue grew 37% YoY to $4.95 billion, the fastest rate in nearly three years, driven by strong e-commerce (+41%) and digital financial services (+55%) growth. Gross margin improved to 45%, despite the shrinking contribution from the high-margin digital entertainment segment. E-commerce margins expanded by 500 basis points to 46%, highlighting Shopee's pricing power. Recent commission fee hikes have not dented GMV growth, demonstrating the platform's economic moat.

Sea delivered strong operating leverage in Q4 2024, with operating income reaching $306 million and margins improving to 5% from -2% a year earlier. Revenue growth of 37% outpaced the 20% increase in operating expenses, driven by more efficient Sales & Marketing spending, which generated higher returns due to ad tech improvements and SPX Express enhancements. The overall increase in operating expenses was primarily due to loan book growth in Sea Money, not deteriorating credit quality, and one-off legal settlements, which are unlikely to affect future profitability.

Contents

Financial Highlights

Wall Street Expectations

E-Commerce

Digital Entertainment

Digital Financial Services

Financial Analysis

Guidance

Conclusion

1. Financial Highlights

Revenue: $4.95 billion (+37% YoY)

Digital Entertainment: $519 million (+2% YoY)

E-commerce and Other: $3.96 billion (+43% YoY)

Sale of Goods: $472 million (+41% YoY)

Operating Income: $306 million vs ($57 million) YoY

Net Income: $238 million vs ($112 million) YoY

Adjusted EBITDA: $591 million (+366% YoY)

2. Wall Street Expectations

Revenue: $4.65 billion (beat by 6%)

Earnings per Share: $0.44 (miss by 11%)

3. E-Commerce

Gross Merchandise Volume (GMV) for the quarter reached $28.6 billion, growing 24% YoY, with gross orders totaling 3.0 billion (+20% YoY). For the full year 2024, Shopee's GMV surpassed $100 billion, exceeding management's own guidance with 28% growth and over 10 billion gross orders. 2024 also marked the first full year of adjusted EBITDA profitability, with Asia and Brazil both now profitable.

With GMV at $28.6 billion and marketplace revenue of $3.2 billion, the implied marketplace take rate is 11.2%, up from 10.0% in Q4 2023 — a significant improvement amid rapid GMV and order growth. How did Shopee achieve this?

Improved Monetisation: Higher commission and ad take rates, supported by a more rational market environment and greater adoption of Shopee's ad tech tools. Ad revenue increased by 50% YoY, with take rates up 50 basis points.

Logistics & Cost Leadership: Shopee's logistics arm, SPX Express, enhanced service quality and reduced costs. Almost 50% of orders in Asia were delivered within 2 days, while logistics costs per order fell by $0.05 YoY.

AI Adoption: AI tools improved search accuracy, product listings, and customer service. Upgraded chatbots reduced customer service costs by nearly 30%, while return and refund resolution times in Asia improved by 40%.

Content Ecosystem & Live Streaming: Live streaming accounted for 15% of overall orders in Southeast Asia, with strong growth in streamers and viewers. A YouTube partnership drove significant order growth in Indonesia, with plans to expand into more markets.

In Brazil, Shopee gained market share, with 40% growth in monthly active buyers and positive adjusted EBITDA for two consecutive quarters. Faster deliveries, broader product categories, and larger basket sizes drove the improvement.

4. Digital Entertainment

Quarterly active users (QAUs) reached 618 million (+17% YoY), with the quarterly paying user ratio rising from 7.5% to 8.2% YoY. Quarterly paying users (QPUs) increased by 27% to 50 million. After eight quarters of YoY declines, QPUs have now grown by 22%+ for four consecutive quarters, indicating stabilisation heading into 2025.

Free Fire made a strong recovery in 2024, with 34% YoY growth in bookings and 28% growth in daily active users (DAU) surpassing 100 million. However, average revenue per user (ARPU) declined to $10.80 in Q4 2024 from $11.50 a year ago.

Despite being in its eighth year, Free Fire remains the world's largest mobile game by average DAU and the most downloaded game globally in 2024. Accessibility through lightweight design helped it gain a competitive edge in emerging markets, particularly in Africa, where Nigeria saw 90% growth in active users YoY. Localised content, frequent updates, and collaborations with popular IPs like Demon Slayer, BLUE LOCK, and NARUTO SHIPPUDEN boosted engagement.

Free Fire accumulated 1 trillion+ social media views across TikTok and YouTube, while its eSports World Series in Brazil saw a 43% increase in viewership hours.

5. Digital Financial Services

Sea Money's outstanding loan principal reached $5.1 billion (+64% YoY, +10% QoQ). The platform added 5 million first-time borrowers, with active users reaching 26 million (+50% YoY, +8% QoQ). The 90-day NPL ratio remained stable at 1.2% sequentially, down from 1.4% a year ago — highlighting a disciplined approach to lending.

Sea Money only operates in markets where Shopee has a strong presence, leveraging user data to assess and manage risk. Its two-pillar strategy includes:

On-Shopee SPayLater loans: Entry-level loans for new borrowers.

Off-Shopee loans: Larger loans with longer tenures after establishing credit history.

Following a "low-and-grow" strategy similar to Nubank, Sea Money scales up lending based on positive credit behaviour. Off-platform loans now represent 50% of the loan book, addressing low credit card penetration in Southeast Asia and unlocking a much larger consumer credit market.

6. Financial Analysis

Revenue

Total revenue growth accelerated in Q4, increasing by 37% YoY to reach $4.95 billion, marking the fastest growth rate in eleven quarters. This was primarily driven by growth in GMV within e-commerce and digital financial services.

E-commerce revenue grew by 41% to $3.7 billion, driven by core marketplace and value-added services revenue, both up 41%.

Digital Entertainment revenue grew by 2% to $519 million, driven by a 19% rise in bookings to $543 million, partially offset by lower recognition of accumulated deferred revenue from prior quarters. This was the first quarter of YoY revenue growth since 2021.

Digital Financial Services revenue grew by 55% YoY to $733 million, fueled by growth in both consumer and SME credit businesses.

Gross Margin

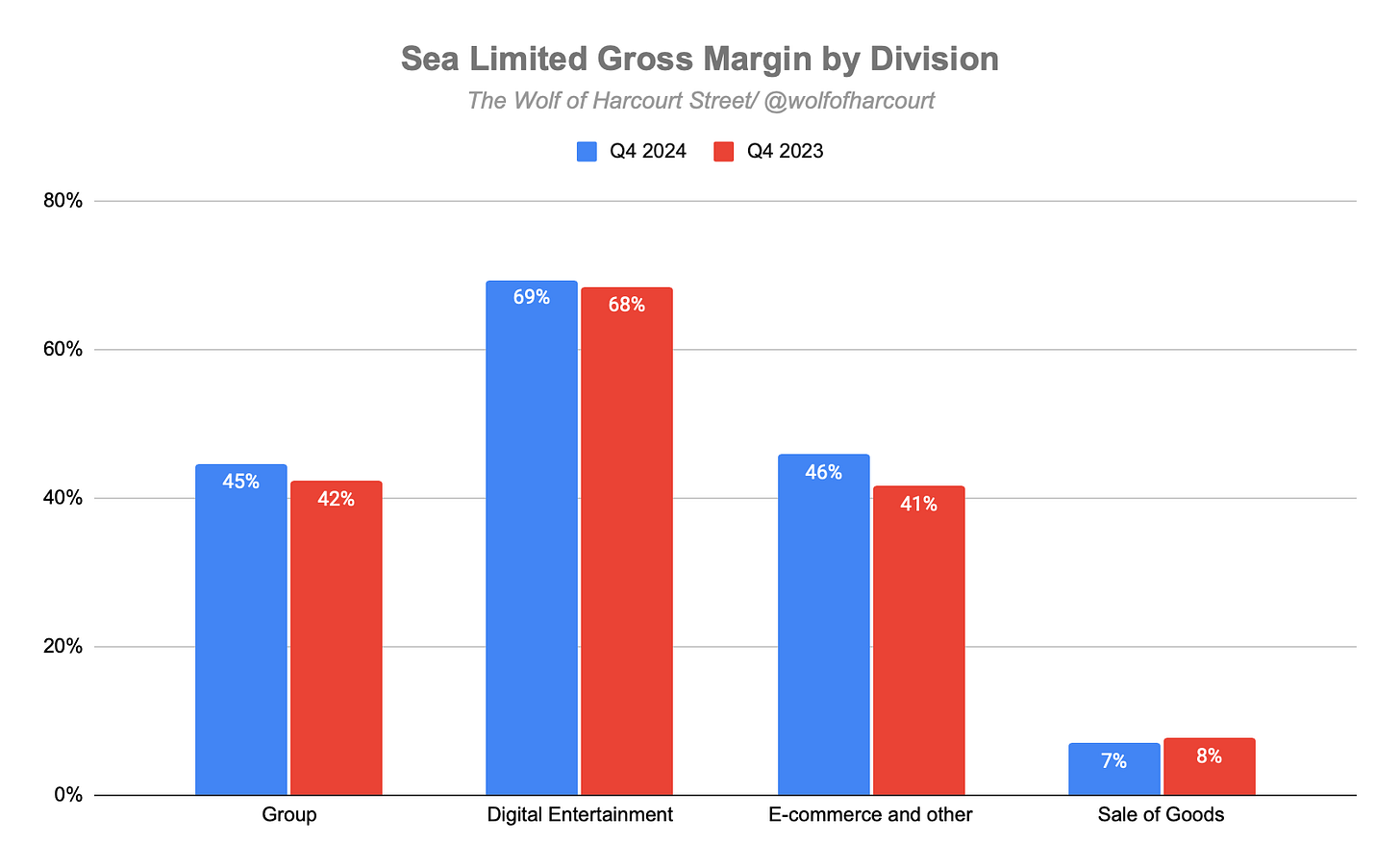

Sea reported its highest gross margin since Q2 2023 at 45%, improving from 42% in the prior year period and 43% in the prior quarter.

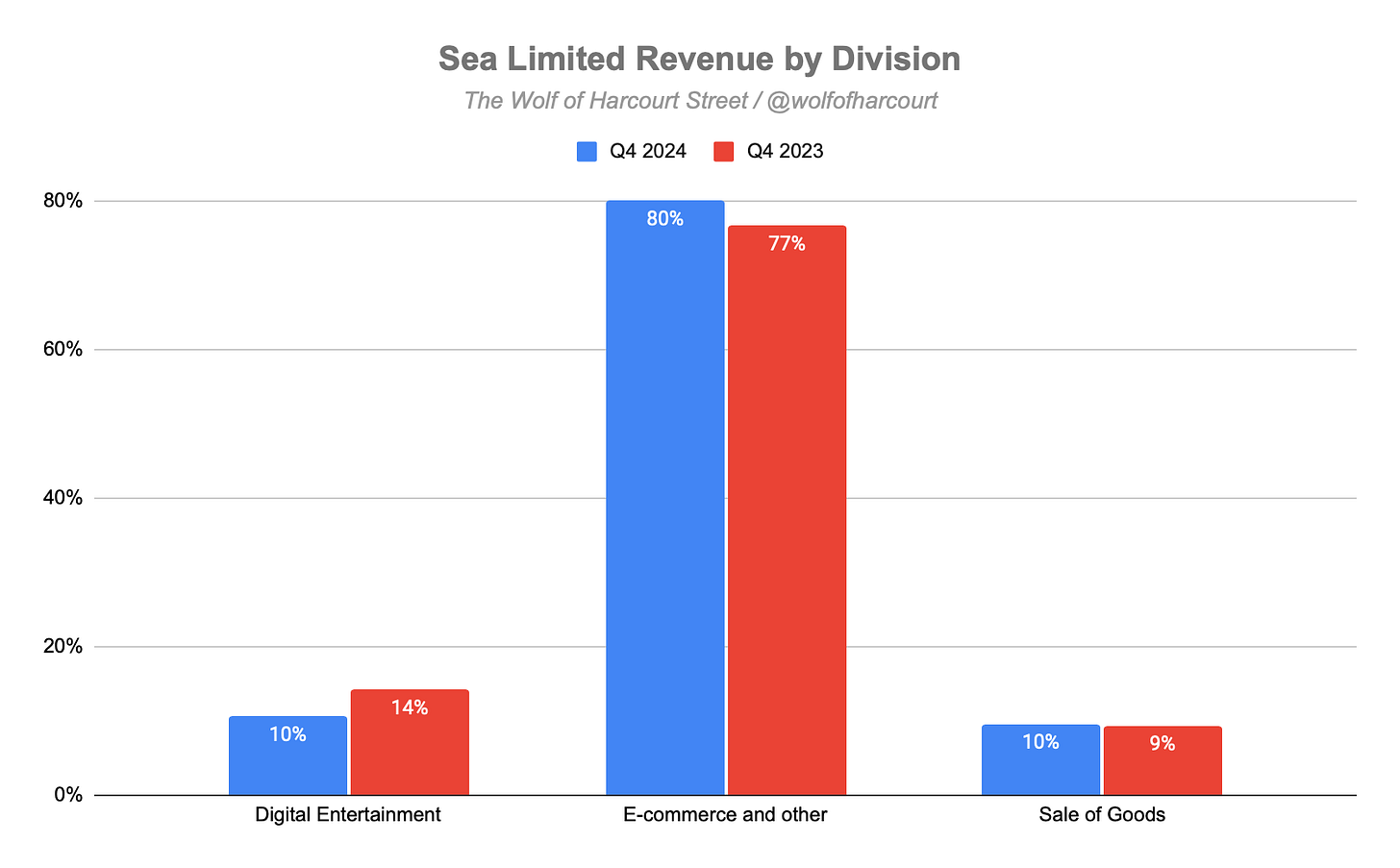

The digital entertainment division, which traditionally enjoyed a gross margin exceeding 70%, continues to shrink as a portion of total revenue, falling from 14% in Q4 2023 to 10% in Q4 2024. Given this business mix change, one might expect overall gross margin to decline, as seen in previous quarters.

However, this was more than offset by improvements in the gross margin of e-commerce and other division which improved by 500 basis points from 41% to 46%, likely due to adjustments in pricing structures and merchant fees.

Since the beginning of 2024, Shopee has raised merchant commission fees by one-third, such as increasing the commission in Thailand from 10% to 13% in July. Despite these price hikes, GMV has continued to grow at a mid-20% rate in the second half of 2024—clear evidence of pricing power and an economic moat.

Operating Margin

Sea reported operating income of $306 million, with the operating margin improving from -2% in Q4 2023 to 5% in Q4 2024.

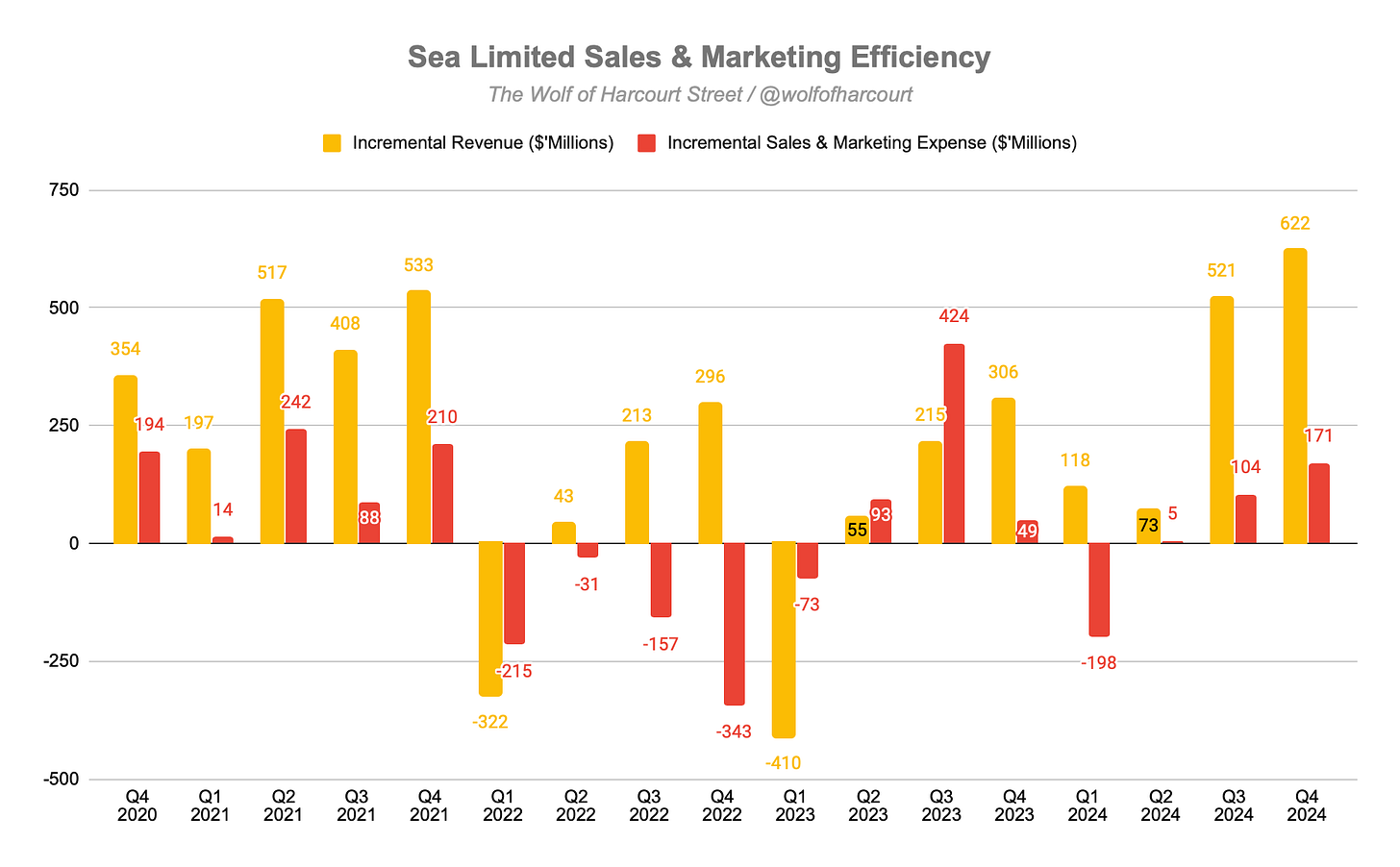

Operating expenses rose by 20% YoY to $1.90 billion, well below the 37% revenue growth—a sign of operating leverage. The largest component, Sales & Marketing (S&M) expenses, accounted for 55% of total operating expenses, increasing by 9% YoY to $1.05 billion. S&M as a percentage of revenue dropped from 27% to 21%, reflecting greater efficiency.

Sea’s refined investment strategies, including ad tech improvements and enhancements to SPX Express, are driving more targeted spending. Each additional dollar spent on S&M is now generating significantly higher revenue—a stark contrast to Q3 2023 when incremental S&M spending outpaced revenue growth.

The rise in operating expenses was also driven by:

Provision for credit losses: Up 48% YoY to $236 million, reflecting the 64% growth in Sea Money’s loan book. However, the NPL ratio remained stable at 1.2%, indicating this increase is purely due to loan book growth rather than deteriorating credit quality.

General & Administrative expenses: Up 58% YoY to $366 million, largely due to one-time expenses related to the settlement of two securities class actions. While the specific cases were not disclosed, they likely relate to allegations from 2022 regarding the company's handling of credit losses and profitability expectations. These settlements are non-recurring and should not impact future profitability.

Cash Flow Analysis

Sea generated $3.2 billion in operating cash flow (OCF) in 2024, including over $1 billion in Q4 alone—likely inflated by the scaling of the credit business.

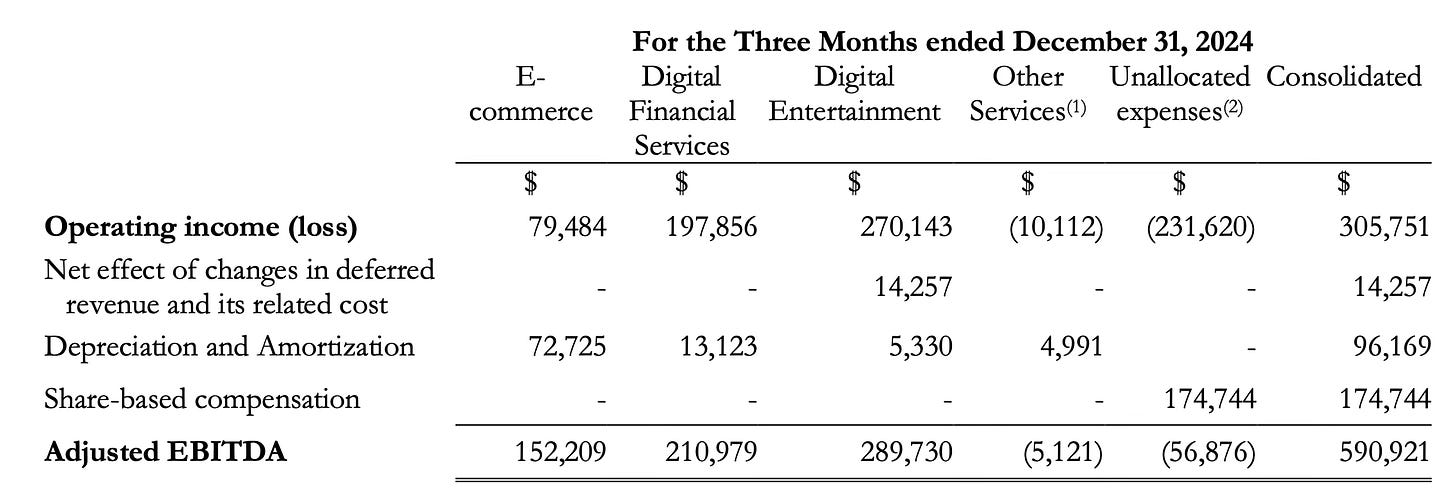

Using Adjusted EBITDA as a proxy for OCF provides the following insights:

Digital Entertainment: Generated $290 million in OCF despite only comprising 10% of revenue, annualizing at over $1.1 billion.

Digital Financial Services: Contributed 36% of total OCF, despite representing only 15% of total revenue.

E-commerce: Achieved breakeven OCF for the second consecutive quarter.

7. Guidance

While management does not provide formal guidance, they disclosed the following expectations for 2025:

Shopee: 20% GMV growth with improving profitability, driven by structural cost advantages, operational excellence, and low e-commerce penetration across its markets.

Garena: Double-digit growth in both user base and bookings, driven by content innovation and community engagement.

Wall Street consensus estimates for 2025 are:

Revenue: $21.15 billion (+26% YoY)

Adjusted EPS: $3.82 (+167% YoY)

Given Sea’s Q4 revenue outperformance, analysts are likely to revise these estimates upward in the coming weeks.

8. Conclusion

This was an excellent end to the year for Sea in what could prove to be a pivotal year for the company.

All three business segments returned to double-digit growth, surpassing management’s guidance. This marked the second consecutive year of positive annual profit, with all segments delivering positive adjusted EBITDA and expected to remain self-sufficient.

2024 marks Sea’s 15th anniversary, during which it built two market-leading businesses—Shopee as the leading e-commerce platform across seven Asian markets and growing in Brazil, while Garena engages over 100 million daily gamers globally. Sea Money could follow suit in the coming years.

While the earnings miss will attract scrutiny, this is not a concern. Backing out the $50 million estimated one-time settlement expense, underlying operating margin could have been 7%, with EPS around $0.48—above consensus estimates.

Ultimately, Sea is not optimized for profitability at this stage but is focused on reinvesting earnings to fuel growth. Less than 18 months ago, the company was growing revenue by 5% while operating at a loss. Today, it is achieving the holy grail of accelerating revenue growth at 37% while being self-sufficient and expanding margins.

Rating: 4 out of 5. Exceeds expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com