Executive Summary

Digital Entertainment revenue increased 12% QoQ. Quarterly active users decreased by 0.1% QoQ but the quarterly paying user ratio deteriorated from 7.9% to 7.5% QoQ. As a result, quarterly paying users decreased by 6% to 40.5 million. However, average bookings per user improved from $0.80 to $0.82 QoQ along with bookings growth QoQ.

E-commerce revenue increased 16% YoY driven by higher transaction-based fees and advertising revenue. The resulting increase in take rates has flowed directly to the bottom line resulting in segment gross margin expansion from 29% to 44%. On a sequential basis, revenue increased 4% QoQ driven by an 11% increase in GMV. The implied take rate is 9.5%, down from 10% in Q4 2022. Gross orders totaled 2.2 billion for the quarter, reflecting a 13% YoY increase and a 24% QoQ increase.

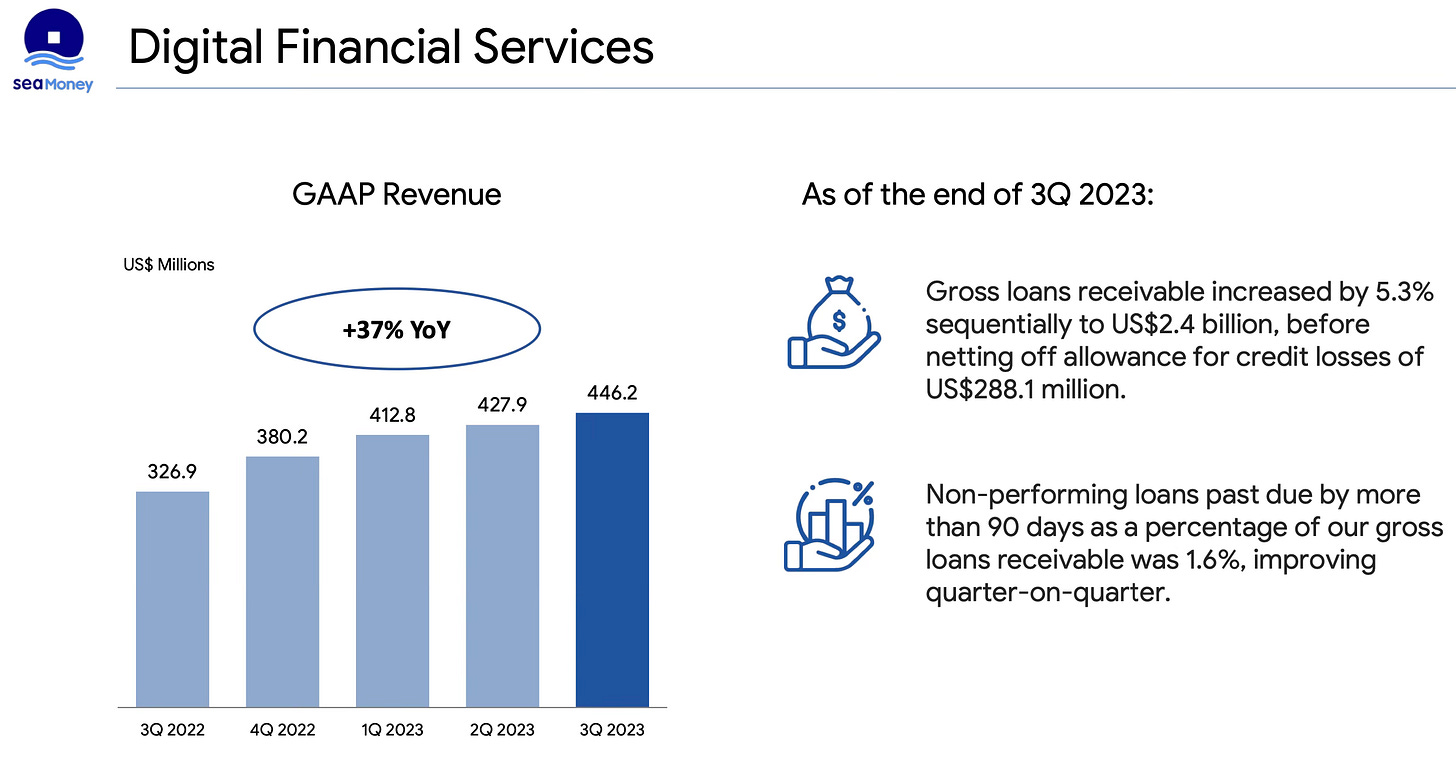

Digital Financial Services revenue reached $446 million, growing 37% YoY driven by the consistent expansion of SeaMoney's credit business, with the credit portfolio reaching $2.9 billion and growing by 5% sequentially. The loan book maintained a healthy quality, with past-due loans improving quarter over quarter.

Contents

Financial Highlights

Wall Street Expectations

Digital Entertainment

E-commerce

Digital Financial Services

Financial Analysis

Guidance

Conclusion

1. Key Highlights

Revenue: $3.31 billion +5% year-over-year (YoY)

Digital Entertainment: $592 million -34% YoY

E-commerce: $2.42 billion +22% YoY

Sale of goods: $301 million +5% YoY

Gross Profit: $1.44 billion +17% YoY

Net Loss: $144 million -75% YoY

Adjusted EBITDA: $35 million compared to a loss of $358 million YoY

2. Wall Street Expectations

Revenue: $3.21 billion (beat by 3%)

Adjusted Earnings per Share: 0.10 (miss by 360%)

3. Digital Entertainment

At the end of Q3 2023, quarterly active users (QAUs) reached 544.1 million, a decrease of 4% YoY. The quarterly paying user ratio also decreased from 9.1% to 7.5% YoY. What this ultimately means is that quarterly paying users (QPUs) fell by 21% from 51.7 million a year ago to 40.5 million for the third quarter of 2023. The total user base and paid user base both continue to shrink YoY.

In the last quarter, the quarter-over-quarter (QoQ) trends showed positivity for both QAUs and QPUs. Unfortunately, for shareholders, this proved to be short-lived as QAUs decreased by 0.1%, and the quarterly paying user ratio dropped from 7.9% to 7.5% QoQ.

When it comes to Digital Entertainment, QPUs stand out as the most crucial metric. As I've emphasized for some time, free users don't contribute to the financial health of the platform. The decrease in the quarterly paying user ratio resulted in a 6% QoQ decline in QPUs, dropping from 43.1 million to 40.5 million. Despite this decline, the number of QPUs remains above the low reported in Q1.

On a positive note, Garena witnessed growth in bookings QoQ, despite the reopening of schools in key markets. During the conference call, management highlighted that Free Fire maintained stability in user and monetization metrics. Successful initiatives aimed at enhancing user experience and engagement, such as reducing loading time and revamping the guild system, contributed to higher user retention and renewed interest from previously churned users. Sensor Tower reported that Free Fire was the most downloaded mobile game globally in Q3. Other published games, like Arena of Valor and Call of Duty: Mobile, experienced increased user engagement and bookings due to the introduction of fresh content and improved gaming experiences.

With the relaunch of Free Fire in India following its ban in 2022, Garena seems poised for a strong finish to the year, as Free Fire has once again become the most downloaded gaming app worldwide in recent weeks.

4. E-commerce

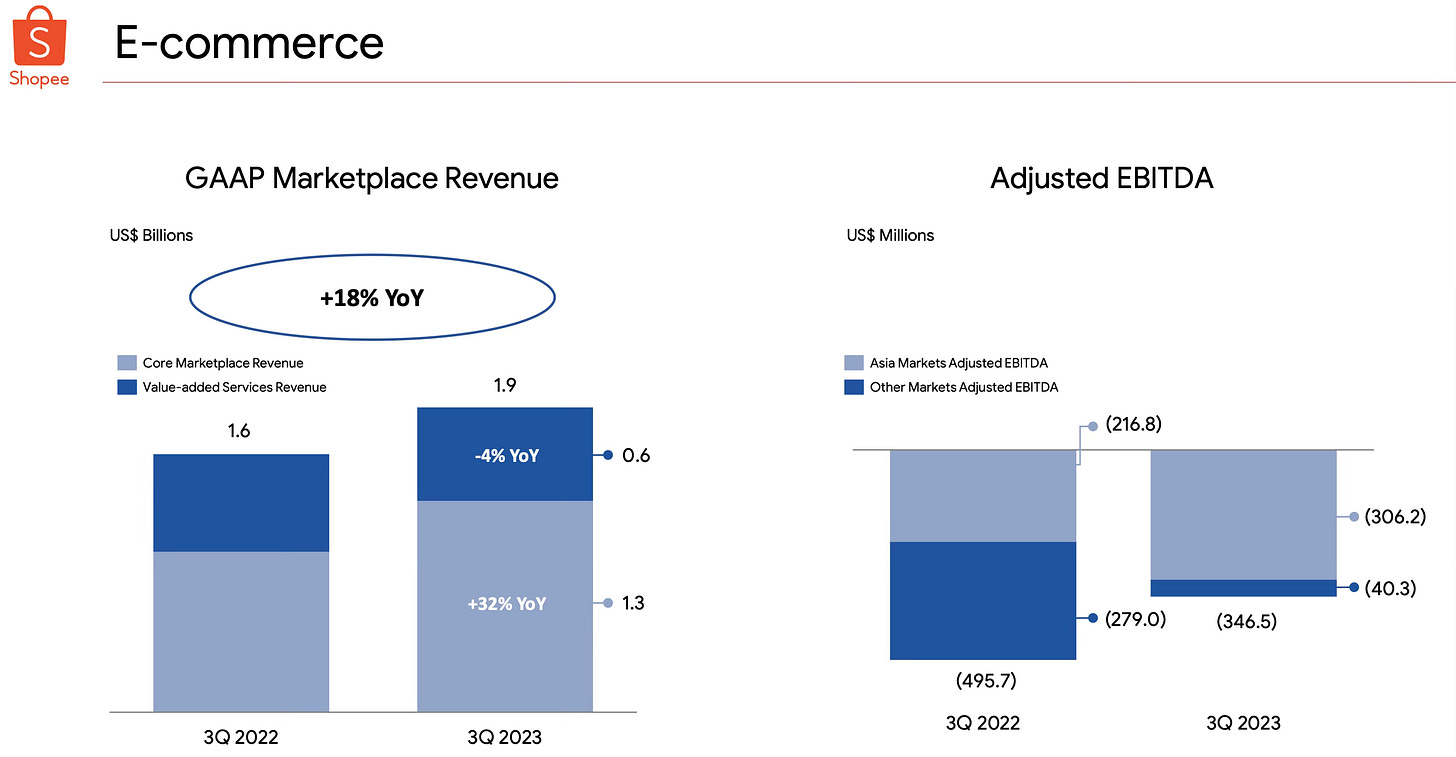

In Q3 2023, revenue experienced a 16% YoY growth, reaching $2.2 billion. Core marketplace revenue saw a 32% increase, reaching $1.3 billion, driven by higher transaction-based fees and advertising revenue. Meanwhile, value-added services revenue declined by 4% to $593 million.

Adjusted EBITDA showed improvement, with a loss of $347 million compared to a loss of $648 million in the previous year. However, on a QoQ basis, adjusted EBITDA deteriorated from the profit of $150 million in Q2.

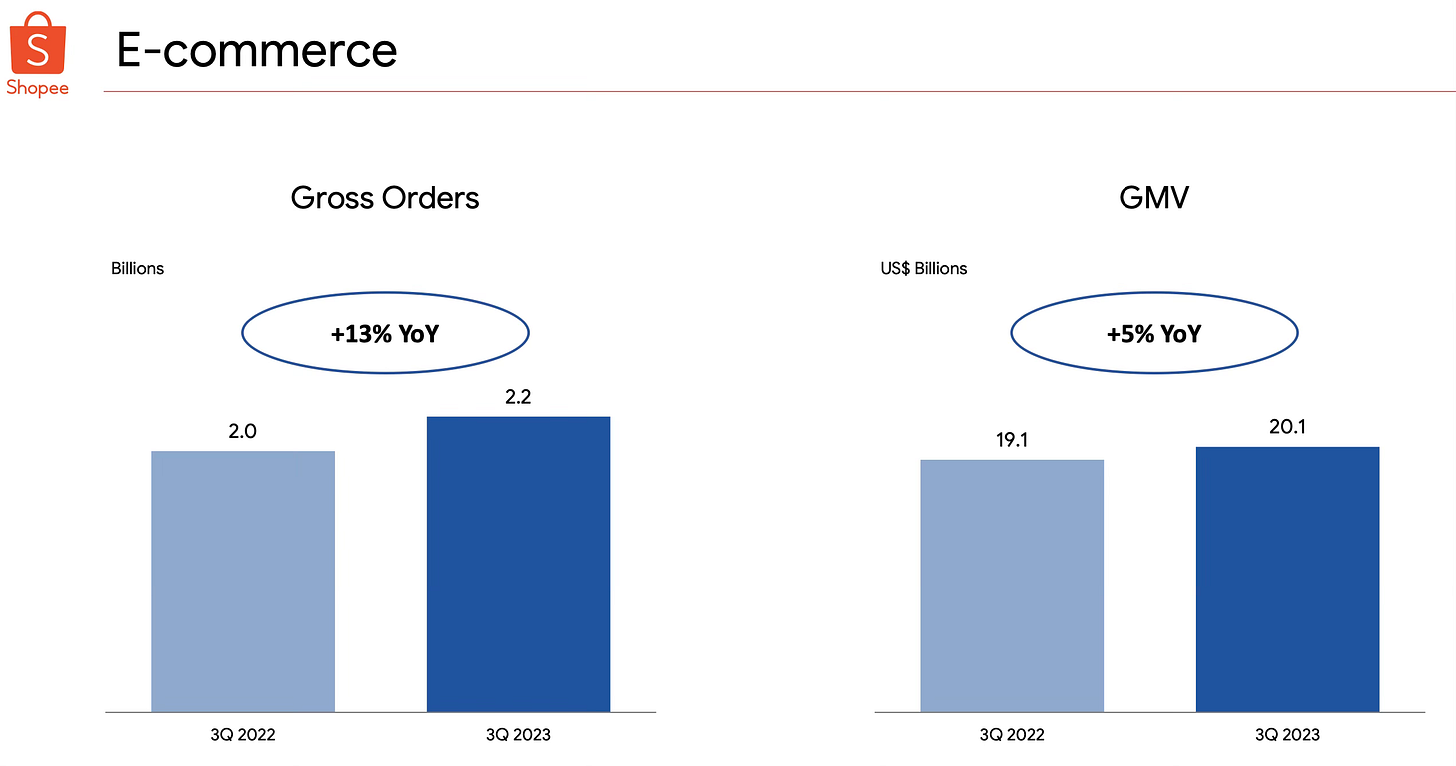

After transitioning to an annual disclosure of Gross Merchandise Volume (GMV) and Gross Orders at the close of 2022, management chose to reveal these metrics in Q3. GMV reached $20.1 billion, marking a 5% YoY increase and an 11% QoQ increase. Gross orders totaled 2.2 billion for the quarter, reflecting a 13% YoY increase and a 24% QoQ increase.

So, why did management choose to reveal these metrics?

The simple answer is that it benefits them, as they are now in a positive position again. Looking at the adjusted EBITDA margin for Q3, which has flipped negative again, it's evident that the Shopee division invested heavily to spur growth after a period of cost-cutting. While Shopee has achieved reasonable QoQ growth, it hasn't been able to do so profitably. I'll delve into this further in section 6. Financial Analysis.

Now, let's turn our attention to the take rate, which we can calculate for the first time since Q4 2022. Based on a GMV of $20.1 billion and marketplace revenue of $1.9 billion, the implied take rate is 9.5%, compared to 10% in Q4 2022. We already know that in January, Shopee increased commissions for local sellers. However, with the implied take rate falling by 0.5% over the past 9 months, it suggests that Shopee may not have been as aggressive with this strategy, or at least has been more lenient with discounts to stimulate growth again.

On the conference call management stated that their focus on market leadership and the strength of their e-commerce content ecosystem has paid off. Shopee's user base, gross orders, and GMV showed significant sequential growth. The success of Shopee Live, with increased collaborations and user engagement, played a crucial role in this growth. Live streaming orders in Southeast Asia accounted for over 10% of the total order volume in October.

They are also making strides in improving investment efficiency and unit economics, aligning with their long-term view that live streaming e-commerce can be both meaningful and profitable. Logistics cost per order decreased by 17% YoY, showcasing their commitment to reducing costs while enhancing the user experience.

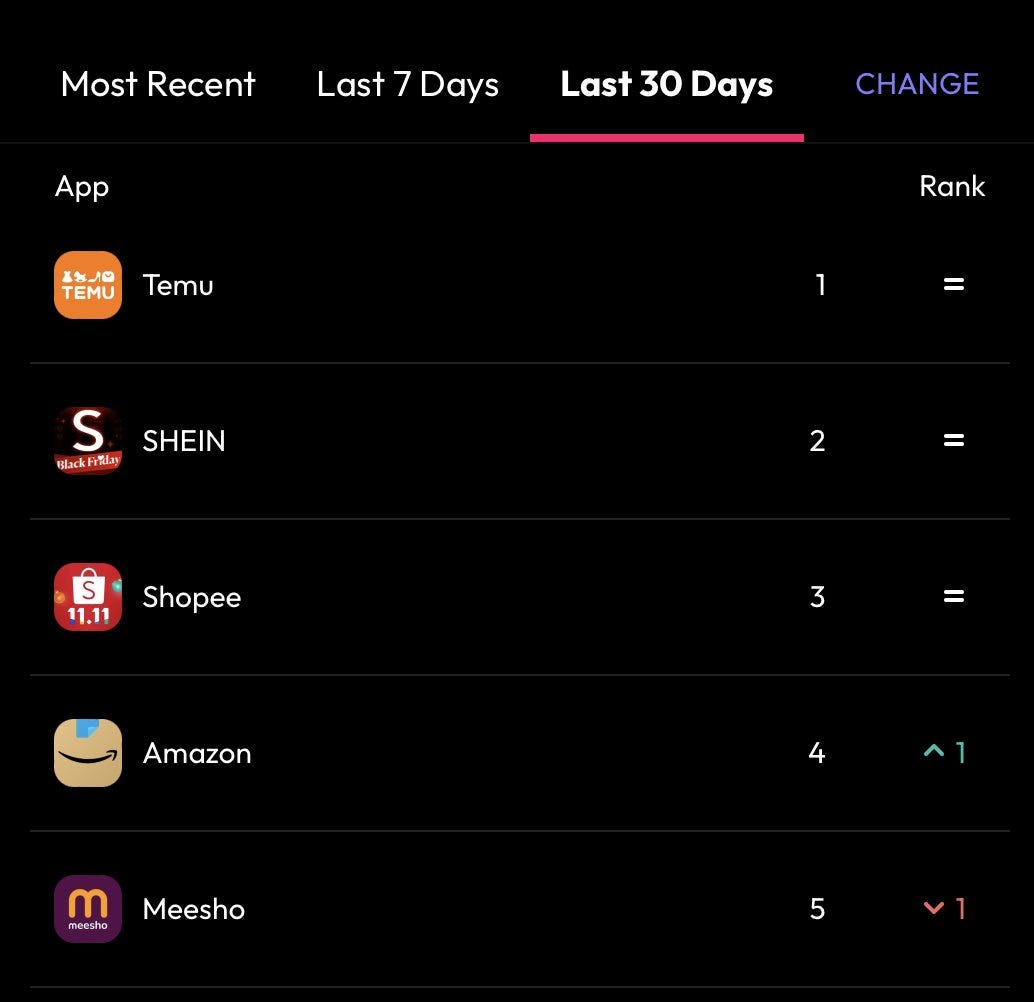

The growth in Brazil has been notable, with improved unit economics. They plan to continue investing in category expansion and user acquisition while maintaining a balance between growth and operational efficiency, especially in logistics. This growth in Brazil is supported by external third party data which shows that Shopee was the 3rd most downloaded shopping app worldwide over the past month—even higher than MercadoLibre in Brazil. Another significant tailwind benefiting Shopee in Q4 is the ban of Tik Tok in Indonesia which had been taking market share from Shopee.

5. Digital Financial Services

SeaMoney's performance in Q3 2023 marked the fastest-growing division. The revenue soared to $446 million, reflecting a 37% increase compared to the previous year but only 4% QoQ. The adjusted EBITDA also saw a substantial improvement, reaching $166 million, a significant turnaround from the $68 million loss recorded in the same period of 2022.

This performance was primarily driven by the consistent expansion of its credit business. The credit portfolio expanded to $2.9 billion, experiencing a sequential growth of 5%. Within this portfolio, $2.4 billion comprised gross loans on the balance sheet, while an additional $0.5 billion came from channeling arrangements. SPayLater consumption loans accounted for $1.4 billion of the portfolio, with the remaining portion allocated to cash loans for Shopee users.

The loan book maintained a healthy quality, with past-due loans improving QoQ. Digital bank offerings, especially direct debit services in Indonesia, the Philippines, and Singapore, saw strong user adoption, enhancing user acquisition and transactional experience on Shopee. SeaMoney has become a vital contributor to overall business performance, with a positive risk profile, strong ecosystem synergies, and a commitment to developing comprehensive financial products and services.

6. Financial Analysis

Sea grew revenue by 5% YoY or 7% QoQ which was more than double the 2% growth Wall Street analysts had forecast. While this is a beat, it is far removed from the triple of double digit growth that was achieved in 2020 and 2021.

Despite revenue only increasing by 5%, gross profit increased by 17% with gross margin improving from 39% to 44% YoY.

E-commerce continues to contribute the majority of revenue of the business as the Digital Entertainment revenue melts away. In just twelve months, Digital Entertainment has decreased from 28% of total revenue to less than 18%.

Despite a 34% YoY decline in Digital Entertainment revenue, there was a 12% QoQ increase, mainly attributed to the rise in average booking per user—from $0.80 in Q2 2023 to $0.82 in Q3 2023. This positive trend indicates stabilization in the quality of paying users after a period of decline.

In contrast, E-commerce revenue saw a 23% YoY increase but only a 4% QoQ rise. I maintain the theory that a significant portion of the YoY revenue surge is driven by price increases rather than volume. This is evident in the Q3 2022 take rate of 8.4%, compared to 9.5% in Q3 2023.

The boost in gross margin from 39% to 44% is primarily a result of a substantial improvement in E-commerce gross margin, soaring from 29% to 44%. While the Sale of Goods gross margin more than halved from 10% to 4%, Digital Entertainment gross margin remained steady at 70%.

E-commerce margins have seen improvement thanks to increased monetization and greater cost efficiencies.

Operating expenses (OpEx) experienced a 9% YoY decrease, amounting to $1.57 billion. However, on a QoQ basis, OpEx increased by 34%. The primary factor behind this increase was Sales and Marketing (S&M) expenses, which rose by 86% QoQ to reach $918 million, aimed at boosting demand. In Q3 2023, Sea allocated 28% of its revenue to S&M expenses, marking the highest percentage since Q4 2022. To provide additional context, an additional $424 million in S&M expenses resulted in an extra $215 million in revenue during Q3 2023. It is reasonable to conclude that Sea subsidized sales in Q3 through discounts in an effort to stimulate GMV and gross orders, both of which were conveniently disclosed again this quarter.

General and administrative expenses and research and development expenses both decreased by 33% YoY but remained relatively consistent QoQ while provision for credit losses decreased 2% YoY.

The increased in S&M expenses during the quarter resulted in an operating loss of $144m compared to a profit of $331 million in Q2 2023.

Cash Flow Analysis

Sea’s operating cash flow is showing rapid improvement. At Q3, year-to-date (YTD) cash flow from operations improved from -$1.38 billion to +$1.8 billion. This represents an operating cash flow margin of 19% which is impressive considering the focus on profitability occurred less than one year ago. What is even more impressive is the fact that despite incurring a net loss of $144m in Q3, Sea still achieve operating cash flow of $600 million. This means that Sea ploughed the cash generated from the digital entertainment and digital financial service divisions back into the e-commerce division to stimulate growth. This is a sustainable long-term growth strategy which does not rely on external sources of funding.

7. Guidance

Management did not give any future guidance. Wall Street analysts are predicting revenue growth of 4.7% for Q4 2023 and adjusted EPS of 0.17.

At this point, I would like highlight that Sea is now entering periods of notably lower comparatives. In Q4 2022, Sea posted $2.23 billion of e-commerce and other service revenue compared to the $2.42 billion already earned in Q3 2023.

Q4 has traditionally been Sea's most substantial quarter in terms of revenue. Management have made it clear that heading into this busy quarter, the focus remains on investing in the holiday shopping season to acquire users, gain market share, and fortify their content ecosystem.

8. Conclusion

On the conference call, management noted that their approach to e-commerce is rooted in a long-term perspective, focusing on maximizing profitability for sustained shareholder returns. They prioritize three operational factors: growth, current profitability, and market share gain. During the pandemic, they initially prioritized rapid growth to meet surging demand, later shifting to immediate profitability when capital became scarce. They claim that their ability to adapt quickly is a strength, and now, with improved cash reserves and operational efficiency, they are investing in the business to increase market share and strengthen leadership.

The quarter of reckoning for Sea is almost upon it. Third-party data obtained for Free Fire and Shopee show that both have been topping charts for downloads worldwide in Q4. Flexing profitability for three quarters caused growth to grind to a halt. It’s not enough to only be able to grow by subsidising sales, you are only renting the customers in that scenario, you don’t own them.

The long-term opportunity presented to Sea is as big as it ever was. As a result, Sea is aggressively investing in live streaming to recreate what Tik Tok had created now that there is a void in the market which should create a greater network effect business and be more profitable. Management recognize the growing popularity of live streaming in their markets and aim to efficiently build an e-commerce content ecosystem to tap into this trend. They also express a commitment to fostering the overall growth of the e-commerce ecosystem in their markets in a healthy and sustainable way.

While the quarter had a mixed bag, the long-term thesis is not broken. This is a multi-year thesis which is supported by management recognising the importance of maintaining a strong cash position, avoiding reliance on external funding, and investing within their means.

Rating: 3 out of 5. Meets expectations.

Disclosure: The author holds a long position in Sea Limited.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com