Sea: Unleashing the 'Holy Grail' of Growth Investing

Sea Limited (SE) Q2 2025 Earnings Analysis

Executive Summary

E-commerce delivered a record-breaking quarter, with GMV reaching $29.8 billion (up 28% YoY) and gross orders exceeding 3.3 billion (up 29% YoY), marking the fastest growth since Q2 2024. The implied take rate rose to 11.1%, driven by improved monetisation, particularly in advertising, where the ad take rate climbed nearly 70 bps YoY as more sellers adopted ad products and increased spending. Technological upgrades, including improved traffic allocation and seller tools like “GMV Max,” lifted purchase conversion rates by 8%, with long-term potential for the ad take rate to double. Shopee also strengthened its logistics capabilities, cutting delivery times and costs in Asia and Brazil.

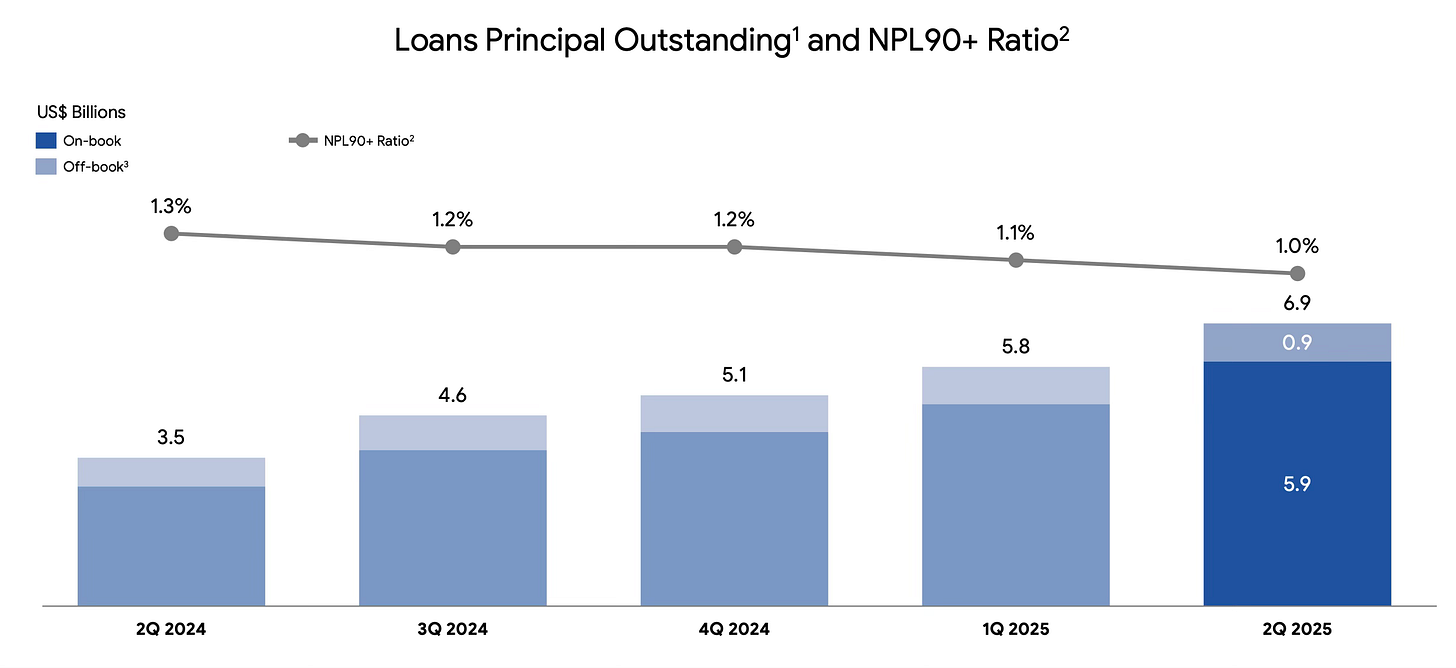

Digital Financial Services saw its loan book grow over 90% YoY to $6.9 billion, supported by rapid customer acquisition as active users passed 30 million (up more than 45% YoY). The 90-day NPL ratio improved slightly to 1.0%, underscoring strong asset quality despite aggressive expansion. Growth is being driven by deeper integration with Shopee, a large and maturing user base, and AI-driven credit models. Malaysia became Monee’s third market to exceed $1 billion in loans, while in Brazil, strong uptake of SPayLater and personal loans doubled both the borrower base and outstanding loans.

Digital Entertainment recorded a 3% YoY increase in quarterly active users to 665 million, the highest level since Q3 2021. The paying user ratio climbed from 8.1% to 9.3%, lifting quarterly paying users 18% to 62 million. This marks six consecutive quarters of growth above 18% following a two-year decline. Free Fire remains the flagship title, maintaining over 100 million average daily active users after eight years, while other titles such as Arena of Valor, EA Sports FC Online, and Call of Duty: Mobile achieved double-digit growth. This pushed bookings up 23% to $661.3 million, and ARPPU to $0.99 from $0.83 a year ago.

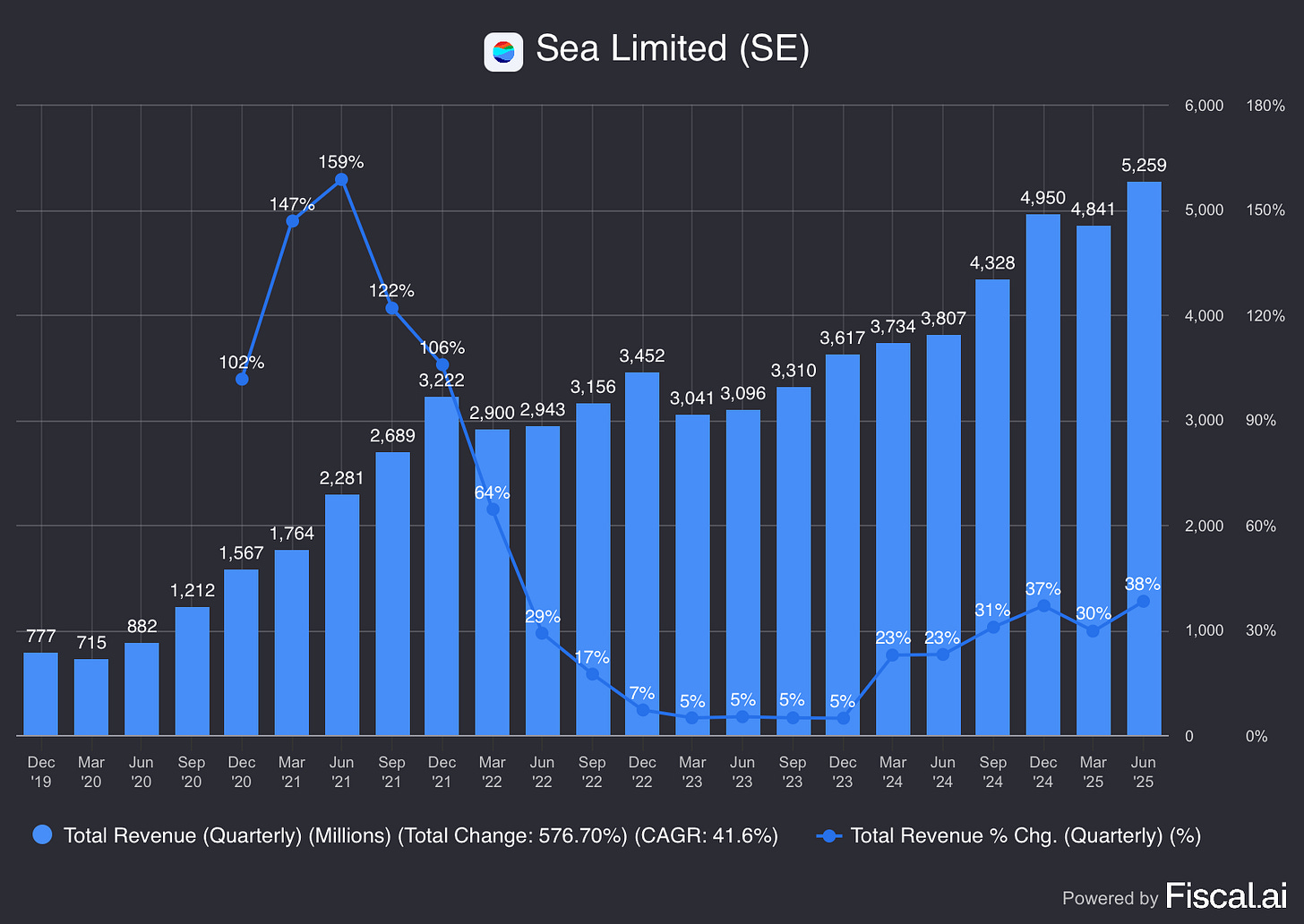

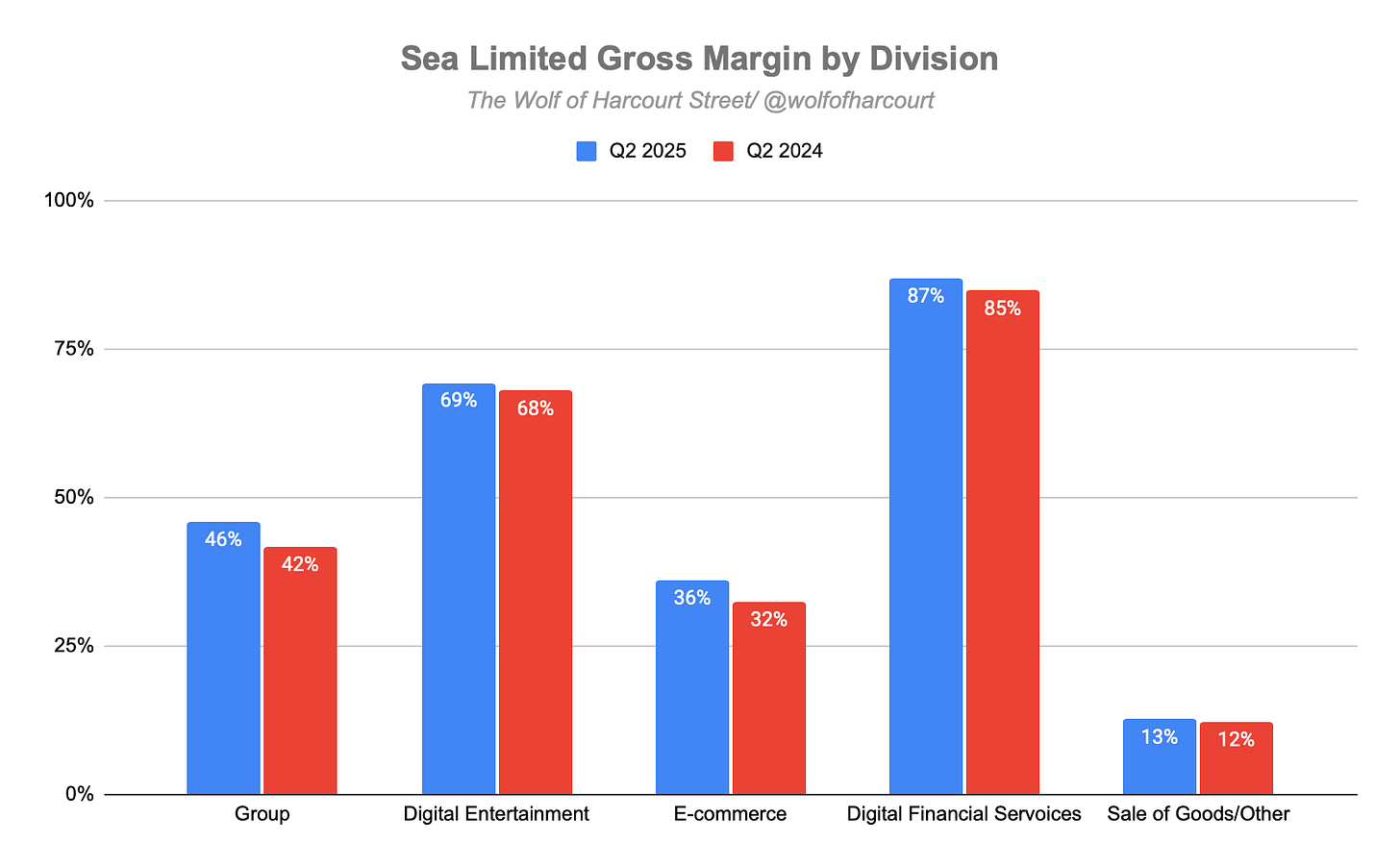

Total revenue accelerated 38% YoY to $5.26 billion, the fastest pace in over three years. Growth was driven by e-commerce (+34%), digital financial services (+70%), and digital entertainment (+28%). Gross margin improved to 46% from 42% a year earlier, with e-commerce margins rising 400 bps to 36%, reflecting Shopee’s pricing power and competitive moat. The growing share of high-margin digital financial services could push overall company margins above 50% in the coming years.

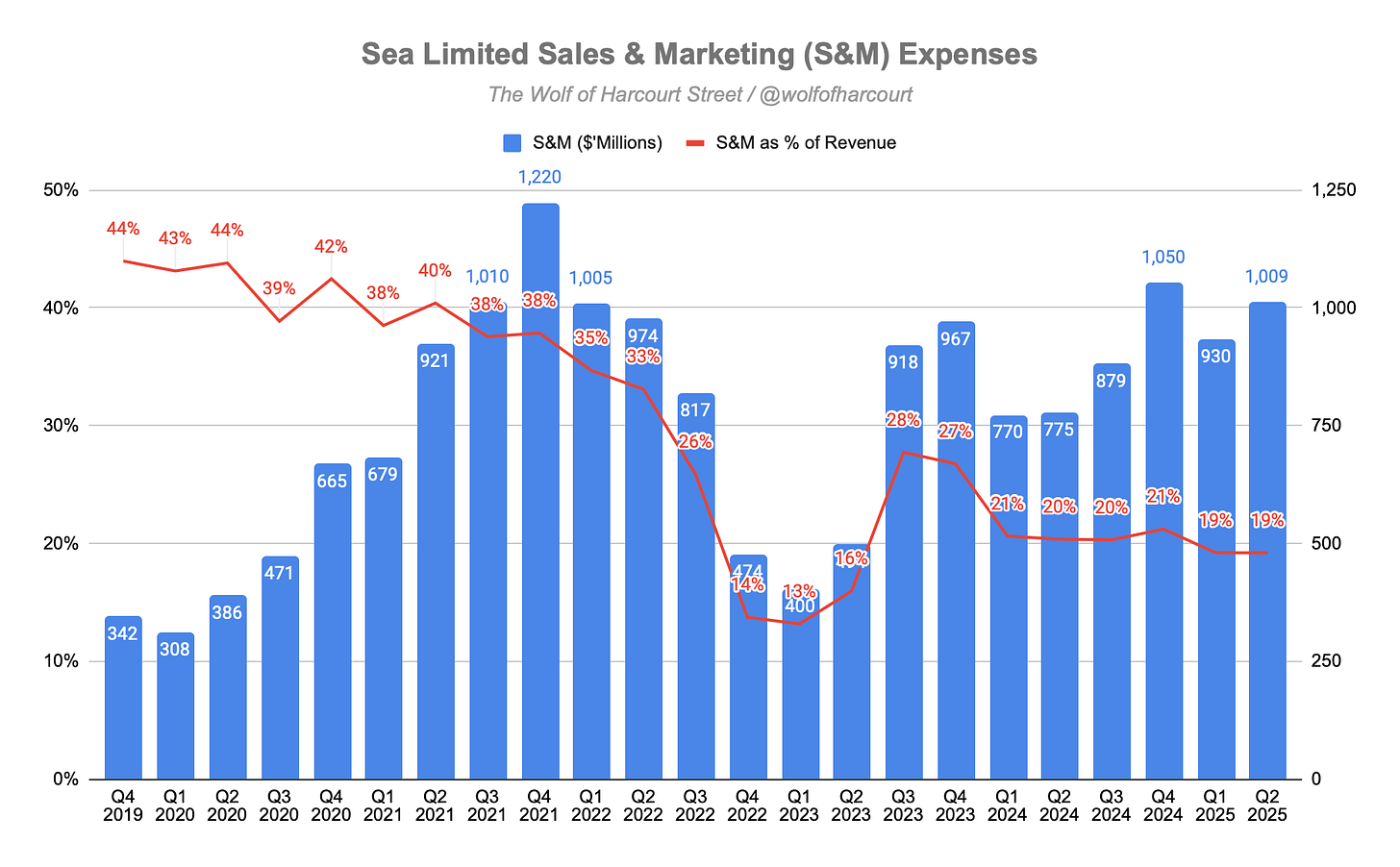

Sea posted record operating income of $488 million, with its operating margin rising to 9% from 2% a year earlier. Revenue growth of 38% outpaced a 28% rise in operating expenses, highlighting strong operating leverage. Sales and Marketing expenses increased 30% in absolute terms but fell to 19% of revenue from 20% a year ago. Notably, an additional $80 million in spending generated $418 million in extra revenue, underscoring improved efficiency.

Contents

Financial Highlights

Wall Street Expectations

E-Commerce

Digital Financial Services

Digital Entertainment

Financial Analysis

Guidance

Conclusion

1. Financial Highlights

Revenue: $5.30 billion (+38% YoY)

E-commerce: $3.31 billion (+34% YoY)

Digital Financial Services: $883 million (+70% YoY)

Digital Entertainment: $559 million (+2% YoY)

Other: $45 million (+52% YoY)

Sale of Goods: $461 million (+34% YoY)

Operating Income: $488 million (+488% YoY)

Net Income: $414 million (+418% YoY)

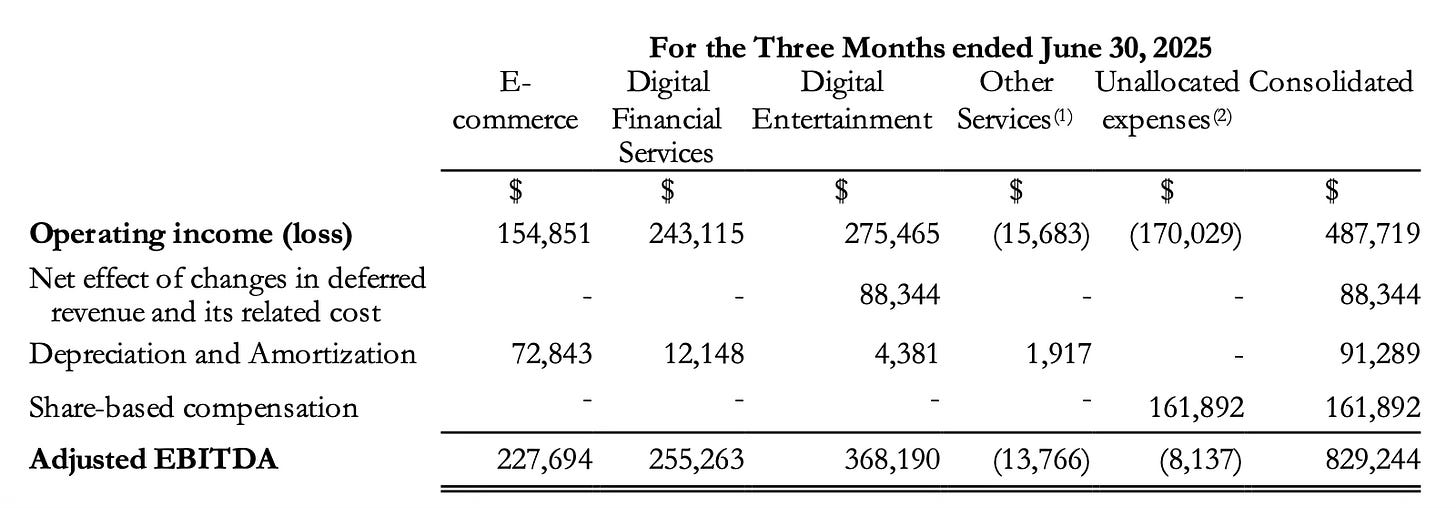

Adjusted EBITDA: $829 million (+85% YoY)

2. Wall Street Expectations

Revenue: $4.97 billion (beat by 7%)

Earnings per Share: $0.73 (miss by 11%)

3. E-Commerce

Shopee delivered a record-breaking quarter with Gross Merchandise Volume (GMV) reaching $29.8 billion, up 28% YoY, the fastest growth rate since Q2 2024. Gross orders exceeded 3.3 billion, up 29% YoY. The platform saw a sustained increase in active buyers and purchase frequency, reinforcing its leadership across all markets and driving improved profitability YoY in Asia and Brazil.

With GMV at $29.8 billion and marketplace revenue of $3.3 billion, the implied take rate was 11.1%, up from 10.7% in Q2 2024, marking a notable improvement amid rapid GMV and order growth. How did Shopee achieve this?

Improved Monetisation

Growth in advertising revenue was the primary driver, with the ad take rate improving by nearly 70 basis points YoY. The number of sellers using ad products rose by around 20%, while ad-paying sellers increased their average quarterly spend by more than 40% YoY. Technological enhancements, such as better traffic allocation algorithms and seller tools like “GMV Max,” lifted purchase conversion rates by 8%. The current ad take rate is about 2%, with significant potential to reach 4% to 5% in the medium to long term as new AI technologies are rolled out.

Logistics and Cost Leadership

Logistics cost and delivery speed improved YoY across Asia and Brazil. In Brazil, delivery speeds are now two days faster than last year and logistics costs are believed to be well below competitors’. Shopee piloted “instant delivery” in Indonesia, enabling delivery in as little as four hours, and has expanded it to Vietnam and Thailand.

Shopee reinforced its price-competitive value proposition with the “Cheaper, Faster at Shopee” campaign. Buyers ranked Shopee as the most price-competitive e-commerce platform in Qualtrics surveys across Asia and Brazil.

VIP Membership Program

In Indonesia, VIP GMV grew nearly 50% QoQ, and monthly purchases rose by around 30% after subscribing. Retention rates were about 20% higher for VIP members. The program has expanded to Thailand and Vietnam, reaching 2 million subscribers by June. Initial investment requirements are not expected to materially affect the cost structure in the medium to long term.

Content Ecosystem and Live Streaming

Shopee’s content ecosystem remains a strong engagement driver. AI tools help sellers create quality video content without large studio setups. In Southeast Asia, over 20% of physical goods orders in Q2 came from live-streaming and short-form videos. Collaboration with YouTube remains strong, with more than 7 million videos featuring Shopee product links by June, up over 60% QoQ.

Brazil

Brazil remains a key growth driver, with monthly active buyers up more than 30% YoY. Logistics costs per order fell 16%, and delivery times dropped by over two days YoY. In São Paulo, one in four parcels arrived next day, and 40% within two days, up sharply from a year ago. Over 100 well-known brands joined the platform, boosting average basket sizes. Despite MercadoLibre’s strong quarter, Shopee’s performance shows both platforms are thriving, with smaller competitors losing share.

4. Digital Financial Services

Monee’s loan book grew over 90% YoY to $6.9 billion ($5.9 billion on-book, $0.9 billion off-book). The company added 4 million first-time borrowers in Q2, taking active users past 30 million, up more than 45% YoY.

The 90-day NPL ratio improved slightly to 1.0%, maintaining high asset quality despite rapid expansion. Key growth drivers include deep integration with Shopee, a large user base with improving credit histories, and AI-enhanced credit models.

Malaysia became Monee’s third market to surpass $1 billion in loans after Indonesia and Thailand. In Brazil, strong adoption of SPayLater and personal cash loans doubled the active borrower base and outstanding loans YoY. The business secured an SE license and initial SCI FI license approval in Brazil, improving future funding options.

Monee’s two-pillar strategy is:

On-Shopee SPayLater loans: Entry-level credit with GMV penetration in the mid-teens. Initiatives like one-month interest-free options, tier-based pricing for prime users, and higher credit limits drove record new borrowers in June.

Off-Shopee loans: Larger, longer-tenure loans for users with established credit histories. In Malaysia, this portfolio grew over 40% QoQ and now accounts for more than 20% of the market’s SPayLater portfolio, helped by integration with the DuitNow QR network. A similar setup was launched in Thailand with PromptPay.

Personal cash loans nearly doubled YoY by targeting reliable SPayLater customers. With penetration still relatively low, both SPayLater and personal loans have significant growth runway.

5. Digital Entertainment

Quarterly active users reached 665 million, up 3% YoY, the highest since Q3 2021. The paying user ratio rose from 8.1% to 9.3%, lifting quarterly paying users by 18% to 62 million. After eight quarters of YoY declines, QPUs have now grown by 18%+ for six consecutive quarters.

Free Fire remains the anchor, sustaining over 100 million average daily active users after eight years. Titles including Arena of Valor, EA Sports FC Online, and Call of Duty: Mobile delivered double-digit growth, driving bookings up 23% YoY to $661.3 million and ARPPU to $0.99 (from $0.83 in Q2 2024).

Free Fire’s 8th anniversary featured the launch of the Solara map during the World Series. The first new map in three years, Solara blends nostalgia (return of the iconic train) with innovation (full-map slide rail). It quickly became the best-performing new map, and a new camera mode quadrupled daily gameplay shares within a month.

Management sees AI as a major growth enabler:

Development: AI accelerates content creation with quality art assets at scale.

Engagement: AI game agents support solo players, improving retention.

Generative content: Early experiments aim to let players create in-game assets for a more immersive experience, with focus on scalability and quality.

6. Financial Analysis

Revenue

Total revenue growth accelerated in Q2, increasing 38% YoY to $5.26 billion, the fastest growth since Q1 2022 (thirteen quarters ago). This was driven primarily by GMV growth in the e-commerce business and continued expansion in digital financial services.

E-commerce revenue grew 34% to $3.8 billion, supported by GMV growth and improved monetisation, largely due to strong advertising revenue gains.

Digital Financial Services revenue jumped 70% YoY to $883 million, driven by credit business expansion and higher lending activity.

Digital Entertainment revenue rose 28% to $559 million, benefiting from a larger active user base and deeper paying user penetration.

Gross Margin

Sea reported a very healthy 46% gross margin for the second consecutive quarter, up from 42% in the prior year.

The digital entertainment division, which historically enjoyed margins above 70%, had been shrinking for several years but held firm at 11% of total revenue this quarter. The standout change came from Digital Financial Services, which rose from 14% to 17%.

Since the business mix remained relatively stable YoY, the overall gross margin improvement was driven by gains across all segments. Most notably, the e-commerce division’s margin rose by 400 basis points, from 32% to 36%, likely reflecting adjustments in pricing structures and merchant fees. Since early 2024, Shopee has raised seller fees, yet GMV growth continued accelerating through 2025, clear evidence of Shopee’s value proposition, pricing power, and economic moat in action.

Of particular note is the Digital Financial Services segment, whose gross margin improved from 85% to 87%. Until the end of 2024, Sea combined this segment’s results with e-commerce, so this standalone disclosure is a positive development that gives investors insight into the future. Given its sky-high gross margins and status as the fastest-growing business area, Digital Financial Services is set to contribute an even greater share of revenue, suggesting overall gross margin will continue to improve. I expect Sea’s overall gross margin to exceed 50% in the coming years.

Operating Margin

Sea delivered record quarterly operating income of $488 million, with the operating margin improving to 9% from 2% a year earlier.

Operating expenses rose 28% YoY to $1.92 billion, well below the 38% revenue growth, a textbook example of operating leverage in action. The largest component, Sales & Marketing (S&M) expenses, increased 30% in absolute terms but grew at a slower rate than revenue, indicating improved efficiency. As a percentage of revenue, S&M expenses declined from 20% in Q2 2024 to about 19% in Q2 2025.

Sea’s targeted and efficient marketing efforts, especially within e-commerce, are becoming more effective at generating revenue per advertising dollar spent. On a sequential basis, Sea invested an additional $80 million in S&M, resulting in $418 million in incremental revenue.

The rise in operating expenses was also driven by:

Provision for credit losses: Up 93% YoY to $324 million, reflecting a 94% expansion in Monee’s loan book.

General & Administrative: Up 6% YoY to $323 million.

Research & Development: Flat YoY at $297 million.

Cash Flow Analysis

Sea generated $2.4 billion in operating cash flow (OCF) in H1 2025, more than doubling from $1.1 billion YoY. However, OCF is increasingly distorted by rapid credit business growth, so Adjusted EBITDA is a better profitability proxy:

Digital Entertainment: $368 million in OCF despite comprising only 11% of revenue, annualising at nearly $1.5 billion. This implies an OCF margin of 66%.

Digital Financial Services: Contributed 31% of total OCF while representing only 17% of total revenue. The implied OCF margin here is already 29%.

E-commerce: Breakeven OCF for the fourth straight quarter, with a 7% margin and improving trend.

7. Guidance

Management does not issue formal guidance but shared the following expectations:

E-commerce: Q3 GMV growth of 25%, in line with H1 2025 and above prior guidance of ~20%.

Digital Financial Services: Loan book growth expected to outpace Shopee’s GMV growth rate.

Digital Entertainment: Full-year bookings growth raised to over 30% YoY.

Wall Street 2025 estimates:

Revenue: $21.42 billion (+27% YoY)

Adjusted EPS: $3.82 (+167% YoY)

Given the Q2 beat, analysts are likely to revise estimates upward, continuing the trend of the past 18 months.

8. Conclusion

This was another superb quarter for Sea, something investors have become accustomed to over the past eighteen months. The company delivered strong, healthy, and profitable growth across all three of its core businesses. These results highlight what I call the holy grail of growth investing: accelerating revenue growth combined with operating leverage. After many years of burning cash, Sea has reached a stage where it can pursue growth opportunities while improving profitability. At the same time, growth is accelerating rather than slowing, as management raised guidance for all three of its core segments.

I added to my position last month, and despite the market’s 20% pop yesterday on earnings, the stock remains attractive given its growing market share, steadily improving margins and long runway for growth.

Rating: 4 out of 5. Exceeds expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Great breakdown Wolf, especially on the financials end, loving the charts!

What do you think of the sequential QoQ decline in operating income for Shopee?